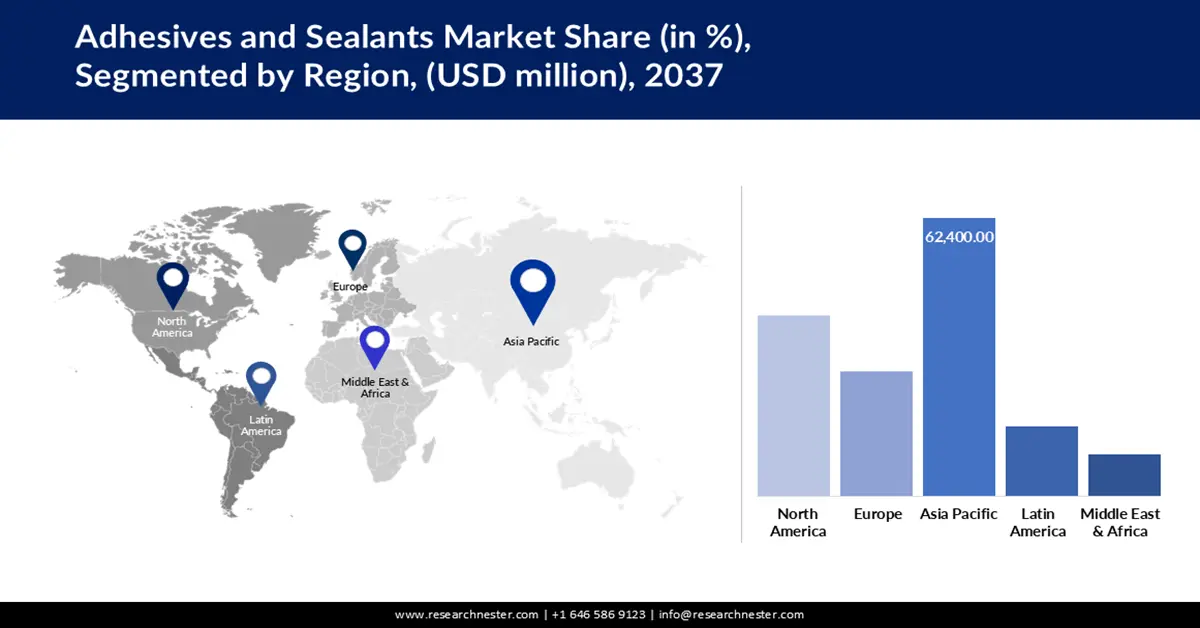

Adhesives and Sealants Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific adhesives and sealants market is expected to hold more than 40.2% revenue share by 2037, attributed to the growth in the infrastructure and manufacturing sectors. In December 2023, Arkema completed the divestment of its adhesives business through the sale of Arc Building Products in Europe, which allowed for more focus on Asia. China, India, and Southeast Asia are the key end-use segments for construction and automotive adhesives in the region. Currently, governments are developing and adopting energy efficiency and green building policies. The interest in sealing solutions is driven by the global trends in urbanization and the introduction of smart city concepts. High production demands in industries continue to drive the consumption of adhesives in various industries.

China has continued to be the leading producer and consumer of adhesives in the world, owing to industrialization. In September 2024, the government revised the industrial policies to embrace adhesive innovation for material security. The demand is in construction, electronics, packaging, automotive industries, and many more. The high-tech adhesive manufacturing is one of the industries that have been encouraged by China’s Made in China 2025” plan. Adhesive manufacturers that target the export adhesives and sealants market capitalize on the increasing consumer demand for low-VOC and environmentally friendly products. Environmental laws and policies are becoming stringent, hence forcing industry to develop environmentally friendly products. The country’s domestic modernization and export competitiveness guarantee its market leadership.

The market in India is expanding due to industrialization, urbanization, and green construction trends. In October 2024, Pidilite forayed into a joint venture to launch superior stone-fixing adhesives in the focused construction segment. Infrastructure development, particularly in affordable housing and commercial business spaces, is one of the main agents of growth. The automotive and electronics industries are the two major industries that have been witnessing high demand for specialty adhesives. Government reforms like Make in India support local manufacturing expansion. Environmental consciousness is on the rise, thus propelling the waterborne adhesive market. The adhesive industry in Asia is expected to grow at a steady pace, and India, with its growing middle class and export orientation, will remain a key driver.

North America Market Insights

North America adhesives and sealants market is set to witness a high growth rate till 2037, attributed to innovations and infrastructural growth. In December 2024, H.B. Fuller made strategic acquisitions to boost its healthcare adhesive portfolio and increase its presence in North America. There is a growing demand in electronics, automotive, and healthcare industries that is driving the research and development spending. The construction adhesives industry is expected to benefit from the U.S. Inflation Reduction Act through increased demand for energy-efficient products. Environmental concerns are also driving more sustainable adhesive solutions and pushing forward water-based and bio-based adhesives. Strategic reshoring initiatives are geared towards ensuring that there is an expansion of local production. North America is the leader in innovation, which contributes to its stable position in the global market.

The growth of the U.S. adhesive market is being driven by technology leadership and end-user segments. In November 2024, DuPont officially opened a new adhesives manufacturing facility to address the increasing needs of the automotive and electronics industries. The construction industry in the U.S., including retrofitting of residential structures, is also driving the need for enhanced sealing solutions. Consumer goods and flexible packaging industries are the two industries that are embracing eco-friendly adhesives at the highest rate. Other government programs related to the reinforcement of manufacturing industries also offer further growth incentives. Businesses are now focusing on automation and smart manufacturing, a trend that has been evident in recent developments. Robust IP protection and innovation environments are critical to sustaining America’s leadership in adhesive technologies and global market power.

The adhesives and sealants market in Canada continues to expand owing to the green building initiatives and industrialization processes. In September 2024, Unitech North America is putting up its first manufacturing facility in Canada to support regional supply chains. There is are increasing demand for adhesive products in construction, transportation, and renewable energy industries. The consumer is increasingly demanding products that are eco-certified and have low-emission adhesives. Trade with the U.S. and Mexico increases product output and technology transfer across borders. Bio-based and specialty forms of adhesives are also the key strategic focus of firms to meet customer needs. Increased spending on research facilities and a qualified workforce is enhancing the competitiveness of the market in Canada.

Europe Market Insights

Europe is expected to expand at a robust CAGR between 2026 and 2037, owing to increasing initiatives to establish battery factories across the region. One such example is the establishment of the very first LFP battery factory of Europe in April 2023 in Serbia by ElevenES. EIT InnoEnergy is a clean energy investor that can be integrated across applications, such as electric cars, trucks, energy storage, and others. For effective thermal management, strong structural bonds and sealing elements within packs of batteries, adhesives, and sealants are crucial. In addition, pressure from the regulatory bodies to manufacture sustainable adhesives and sealants fosters the market growth.

Germany adhesives and sealants market is expected to register rapid growth by the end of 2037 due to the presence of a vast number of exporters, who supply adhesives and sealants globally. Updated regulations for adhesives and sealants also fuel the market growth. For instance, in June 2025, two new laws were added to the list of restrictions that of EU’s REACH imposes on the use of N, N-dimethylacetamide (DMAC) and 1-ethylpyrrolidin-2-one (NEP) in the production of adhesives and sealants. Restrictions on the use of such substances drive the companies towards innovation and growth.

France market is expanding steadily due to the demand for novel adhesive solutions influenced by the advancements in packaging and preference for energy efficiency. Companies based in France are also engaged in the production of sustainable packaging using proper adhesives. In November 2024, the French packaging solutions supplier Amcor revealed its five years of engagement in manufacturing products, including sustainable packaging solutions by using high-performance Tyek adhesives, such as CR27 and SBP2000 heat seal coatings.