Acute Liver Failure Market Outlook:

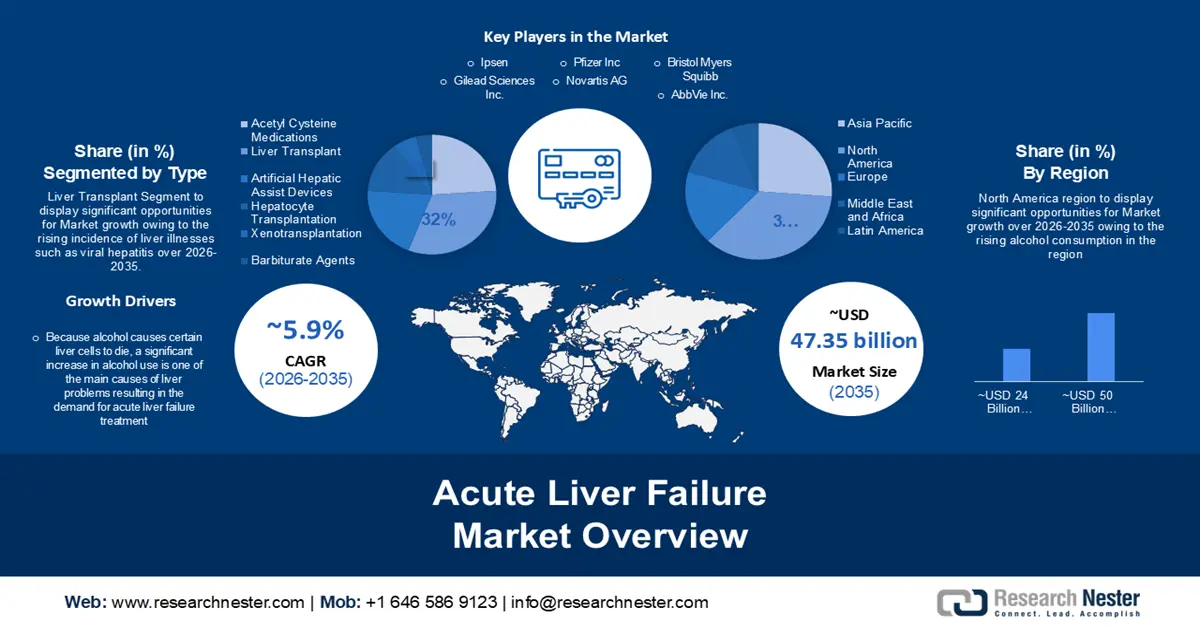

Acute Liver Failure Market size was valued at USD 26.69 billion in 2025 and is likely to cross USD 47.35 billion by 2035, registering more than 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of acute liver failure is assessed at USD 28.11 billion.

There has been a surge in the number of people suffering from liver problems Because alcohol causes certain liver cells to die, a significant increase in alcohol use is one of the main causes of liver problems. As per a report, consuming alcohol results in death and disability at a relatively young age. Approximately 13.5% of all deaths in adults between the ages of 20 and 39 can be linked to alcohol use.

In addition, some treatment approaches, such as supportive medical care and medicines, aim to support liver function and regeneration, which may allow liver function to return to normal. Patients with acute liver failure can also have higher survival rates with prompt and adequate care, particularly if they receive liver transplantation or other sophisticated procedures.

Key Acute Liver Failure Market Insights Summary:

Regional Highlights:

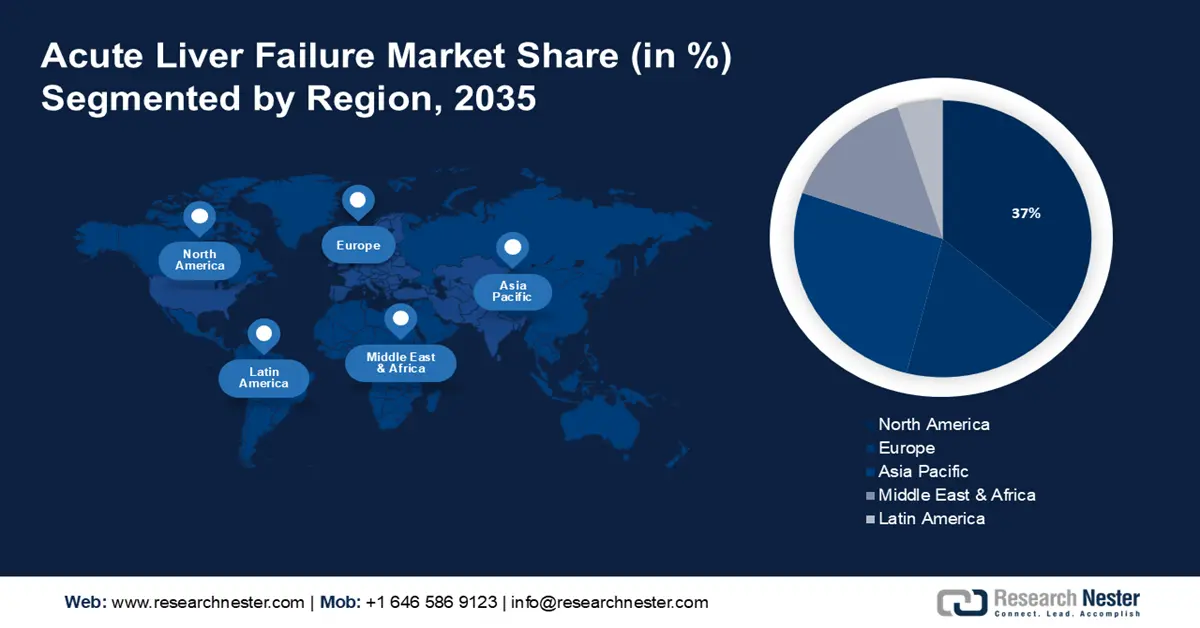

- By 2035, North America in the acute liver failure market is projected to command a 37% share, supported by an unhealthy lifestyle causing obesity.

- Asia Pacific is expected to secure a 27% share during 2026–2035, propelled by the rising incidence of liver diseases and hepatitis B and C.

Segment Insights:

- During 2026–2035, the Liver Transplant segment in the acute liver failure market is anticipated to capture a 32% share, underpinned by the rising incidence of liver diseases.

- The Non-alcoholic Fatty Liver Disease segment is set to hold a 28% share by 2035, fueled by sedentary lifestyle–linked weight gain and metabolic dysfunction.

Key Growth Trends:

- Growing Prevalence of Obesity

- Increased Geriatric Population Globally

Major Challenges:

- High Costs of the Treatment

- Inadequate Healthcare Infrastructure in Developing Countries may Hamper Market Growth

Key Players: Ipsen, Gilead Sciences, Inc., Pfizer Inc., Novartis AG, Bristol Myers Squibb, AbbVie Inc., Johnson & Johnson Services Inc., F. Hoffmann-La Roche Ltd., Abbott Laboratories, Zydus Pharmaceuticals Inc.

Global Acute Liver Failure Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 26.69 billion

- 2026 Market Size: USD 28.11 billion

- Projected Market Size: USD 47.35 billion by 2035

- Growth Forecasts: 5.9%

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Saudi Arabia

Last updated on : 27 November, 2025

Acute Liver Failure Market - Growth Drivers and Challenges

Growth Drivers

- Growing Prevalence of Obesity - Improper lifestyle choices and poor eating habits contribute to weight growth, which ultimately results in obesity. In adults, obesity is the primary cause of fatty liver disease, followed by alcoholism. As per a report in 2020, 38% of people worldwide who were five years of age or older were overweight or obese. This percentage is predicted to increase to 51% by 2035. Being overweight or obese causes fat to build up in the liver. This results in persistent inflammation, commonly referred to as cirrhosis, and liver scarring. Fatty liver disease that is not alcoholic is intimately linked to obesity. Excess fat contributes to inflammatory signaling and insulin resistance. Patients with high blood pressure, high cholesterol, obesity, diabetes, or insulin resistance are at an increased risk of developing fatty liver disease. Therefore, the growing incidences of obesity will escalate the growth of the acute liver failure market.

- Increased Geriatric Population Globally – The number of older people at risk of acute liver failure is rising due to global population aging, which is increasing the need for therapies and interventions specific to this population. Chronic liver illnesses, such as non-alcoholic fatty liver disease, are more common in the senior population and can lead to abrupt liver failure if neglected or inadequately managed. Adults also frequently take many drugs to treat different medical issues, which raises the possibility of drug-induced liver damage and possible side effects that could result in abrupt liver failure.

- Increased Technological Advancements in Liver Disease Diagnosis - Technological developments in liver disease detection, such as imaging methods, liver function tests, and digital biomarker-based diagnostics are driving the growth of the acute liver failure market. The accurate assessment and early identification of liver illnesses have improved due to these technological developments. The creation of novel treatment choices that can offer more varied and efficient care, such as immune suppressants, liver transplantation procedures, antiviral medications, and targeted therapies is driving the growth of the market. For instance, Aycan Medical Systems, a provider of radiology informatics, has released Liver Surface Nodularity (LSN), a novel software plugin that diagnoses and stages chronic liver disease. The software, created by Imaging Biometrics, a business partner of Aycan, enables radiologists to anticipate future liver events, assess liver surface nodularity, identify liver illness from normal abdominal CT images, and create a liver score without requiring liver biopsies.

Challenges

- High Costs of the Treatment – Healthcare systems are severely impacted financially by the high expense of the treatment, especially in nations where the healthcare system is publicly funded. Budgets for healthcare may be strained, and resources for other healthcare objectives may be reduced as a result. Lack of insurance coverage may make it financially difficult for individuals to receive acute liver failure therapy, even in nations with developed healthcare systems. Therefore, the high cost of the treatment may hinder the growth of the acute liver failure market.

- Inadequate Healthcare Infrastructure in Developing Countries may Hamper Market Growth

- The Complex Nature of Liver Transplantation may Impede market Growth

Acute Liver Failure Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 26.69 billion |

|

Forecast Year Market Size (2035) |

USD 47.35 billion |

|

Regional Scope |

|

Acute Liver Failure Market Segmentation:

Type (Acetyl Cysteine Medications, Liver Transplant, Artificial Hepatic Assist Devices, Hepatocyte Transplantation, Xenotransplantation, Barbiturate Agents)

Liver transplant segment in the acute liver failure market is anticipated to grow majorly with a share of 32% during the forecast period. Liver transplantation is becoming more and more popular as a result of the rising incidence of liver illnesses such as viral hepatitis, non-alcoholic fatty liver disease, alcoholic liver disease, and liver cancer. As per a report, more than 1.34 million people worldwide lose their lives to viral hepatitis each year, a mortality toll that is equivalent to that of AIDS and tuberculosis. In addition to this, chronic hepatitis is the cause of 78% of cases of liver cancer. Additionally, more areas now have access to liver transplant services due to the development of the healthcare infrastructure, which includes specialist transplant centers, multidisciplinary transplant teams, and critical care units. Additionally, the success rates of liver transplantation have grown due to advancements in immunosuppressive medications, minimally invasive procedures, and improved surgical techniques, including organ preservation measures.

Indications (Encephalopathy and Cerebral Edema, Intracranial Hypertension, Non-Alcoholic Fatty Liver Disease, Acetaminophen Toxicity, Clotting Abnormalities, Renal Failure, Hemorrhage, Metabolic Imbalances)

Non-alcoholic fatty liver disease segment in the acute liver failure market is poised to hold a share of 28% by the end of 2035. Along with the global rise in obesity rates, non-alcoholic fatty liver disease has also become more common. Low levels of physical activity associated with a sedentary lifestyle leads to weight gain and metabolic dysfunction, which are the two main factors propelling the growth of the non-alcoholic fatty liver disease market. Additionally, the segment's expansion is being accelerated by the aging population's increasing predominance. In addition, eating habits have changed as a result of urbanization and globalization, and sedentary behavior has grown. These factors, along with the prevalence of obesity and metabolic diseases, have added to the mounting burden of non-alcoholic fatty liver disease.

Our in-depth analysis of the global acute liver failure market includes the following segments:

|

Type |

|

|

Indications |

|

|

End-Users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acute Liver Failure Market - Regional Analysis

North American Market Forecast

North America industry is anticipated to hold largest revenue share of 37% by 2035. The growth can be attributed to an unhealthy lifestyle that causes obesity and weight gain, the presence of key players, and rising healthcare costs in the region. Furthermore, the region has a well-developed healthcare infrastructure, including specialized liver transplant centers, advanced diagnostic capabilities, and access to innovative treatments and therapies. For instance, to assist the biotech company in navigating a novel and potentially challenging launch in nonalcoholic steatohepatitis (NASH), Madrigal Pharmaceuticals has appointed Carole Huntsman as its new chief commercial officer.

APAC Market Statistics

Acute liver failure market in Asia Pacific is anticipated to hold a share of 27% during the forecast period. Governments in the region are implementing public health programs and initiatives to address liver diseases, including hepatitis B, screening programs for liver cancer, and awareness campaigns to promote healthy lifestyles and reduce alcohol consumption. As per a report, around 44% of deaths are caused by liver cancer in Asia Pacific. Also, the region is experiencing a rising incidence of liver diseases and hepatitis B and C, which is accelerating the acute liver failure market growth.

Acute Liver Failure Market Players:

- Ipsen

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Gilead Sciences, Inc.

- Pfizer Inc.

- Novartis AG

- Bristol Myers Squibb

- AbbVie Inc.

- Johnson & Johnson Services Inc.

- F. Hoffmann-La Roche Ltd.

- Abbott Laboratories

- Zydus Pharmaceuticals Inc.

Recent Developments

- Ipsen (Euronext: IPN; ADR: IPSEY) and GENFIT announced that the New Drug Application (NDA) for investigational elafibranor has been accepted by the U.S. Food and Drug Administration (FDA). Elafibranor, an experimental oral once-daily dual peroxisome activated receptor alpha/delta (PPAR α,δ) agonist, may represent the first novel second-line treatment for the uncommon cholestatic liver disease PBC in almost ten years. June 10, 2024, is the target FDA PDUFA date that is being reviewed in priority.

- Gilead Sciences, Inc. (Nasdaq: GILD) announced that the FDA in the United States authorized a supplemental new drug application (sNDA) for the use of Remdesivir, or Veklury®, to treat COVID-19 in patients with mild, moderate, and severe hepatic impairment. The FDA approved the sNDA without requiring dose modifications. The safety profile of Veklury, the first and only antiviral COVID-19 therapy licensed for use across all stages of liver disease, is further supported by this approval.

- Report ID: 5770

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acute Liver Failure Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.