Acrolein Market Outlook:

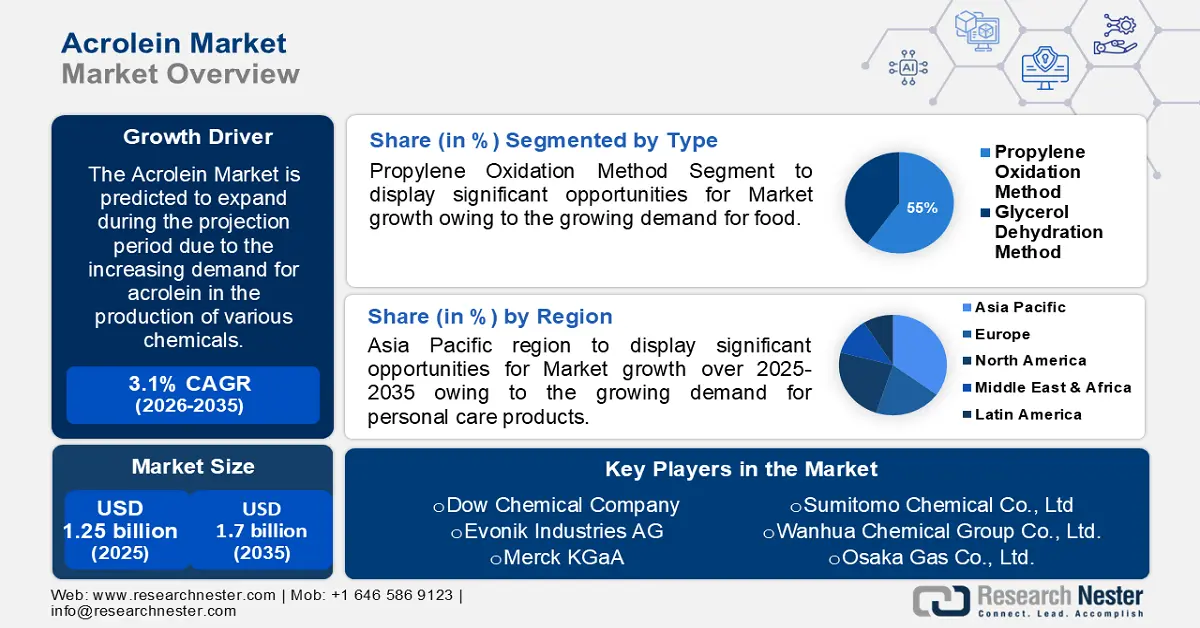

Acrolein Market size was valued at USD 1.25 billion in 2025 and is set to exceed USD 1.7 billion by 2035, registering over 3.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of acrolein is estimated at USD 1.28 billion.

The market growth is mainly owing to the increasing demand for acrolein in the production of various chemicals, particularly in the Asia-Pacific region. Additionally, the growing demand for biocides and herbicides is also expected to drive the demand for acrolein in the coming years. The global industry for herbicides was valued at nearly USD 25 billion in the year 2020. Overall, the growing demand for biocides and herbicides is expected to drive the demand for acrolein, which is used as a key intermediate in the production of these chemicals. However, concerns about the toxic nature of acrolein and the increasing regulatory scrutiny could potentially limit its use in these applications.

In addition to this, according to the Food and Agriculture Organization (FAO) of the United Nations, herbicides account for about 60% of global pesticide use. Herbicide-resistant weeds have become a growing problem in many parts of the world, particularly in countries where herbicide use is high. These weeds have developed genetic mutations that allow them to survive exposure to herbicides, which can lead to reduced crop yields and increased costs for farmers. According to a report, the United States is the largest consumer of herbicides, accounting for about 25% of global consumption. Other major consumers include Brazil, Argentina, China, and India. Acrolein is a highly reactive and toxic organic compound that is used primarily as an intermediate in the production of a range of chemicals, including acrylic acid, methionine, and glutaraldehyde. Acrolein is also used as a biocide, a herbicide, and a fumigant.

Key Acrolein Market Insights Summary:

Regional Highlights:

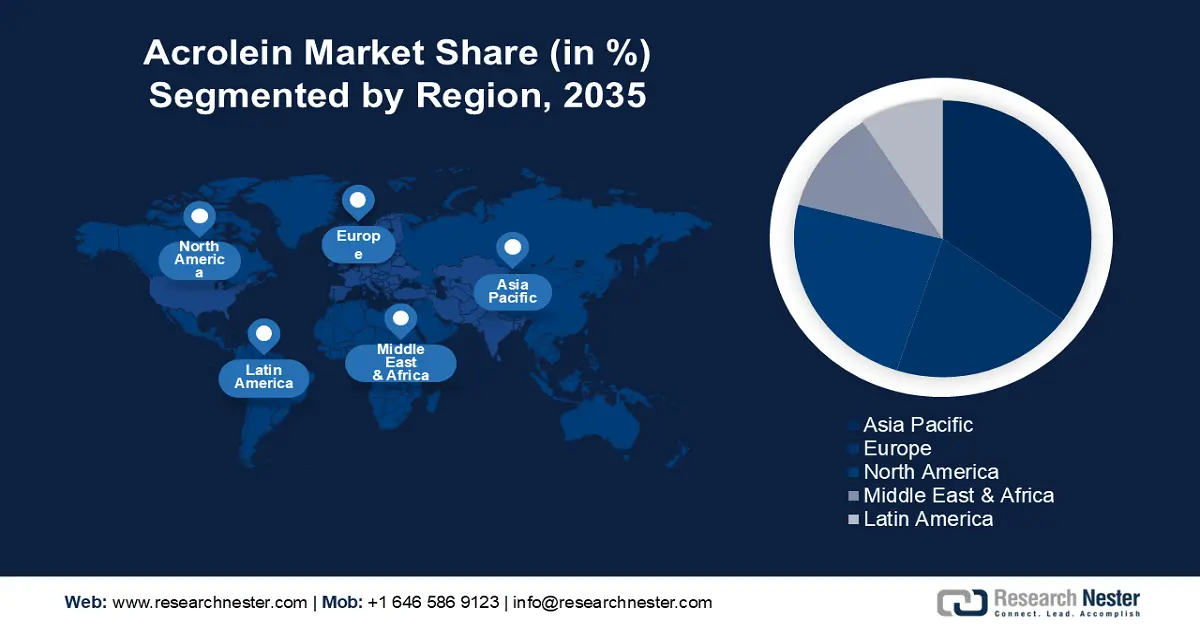

- Asia Pacific acrolein market will hold over 35% share by 2035, driven by growing demand for personal care products and agricultural uses of acrolein.

- North America market will attain a 24% share by 2035, driven by increasing demand for plasticizers, personal care products, and agricultural chemicals.

Segment Insights:

- The propylene oxidation method segment in the acrolein market is anticipated to hold a 60% share by 2035, attributed to increasing demand for acrylic acid used in adhesives, coatings, and textiles.

- The pesticide application segment in the acrolein market is expected to achieve a 35% share by 2035, driven by growing food demand due to increasing global population and dietary changes.

Key Growth Trends:

- Growing Demand for Acrylic Acid and its Derivatives

- Increasing Demand for Personal Care Products

Major Challenges:

- Availability of alternative compounds

- Fluctuations in raw material prices

Key Players: Dow Chemical Company, Evonik Industries AG, Merck KGaA, Sumitomo Chemical Co., Ltd., Wanhua Chemical Group Co., Ltd., Beijing Eastern Petrochemical Co. Ltd., Jiangsu Baichuan High-Tech New Materials Co., Ltd., Osaka Gas Co., Ltd., SEKAB Biofuels & Chemicals AB, Yixing Xinyu Chemical Co., Ltd.

Global Acrolein Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.25 billion

- 2026 Market Size: USD 1.28 billion

- Projected Market Size: USD 1.7 billion by 2035

- Growth Forecasts: 3.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Acrolein Market Growth Drivers and Challenges:

Growth Drivers

- Growing Demand for Acrylic Acid and its Derivatives: Acrolein is used in the production of acrylic acid and its derivatives such as acrylic esters and superabsorbent polymers. The demand for these products is increasing owing to their widespread usage in various industries such as adhesives, coatings, and textiles. According to a report, the global industry for acrylic acid and its derivatives accounted for nearly USD 9.8 billion in the year 2020.

- Increasing Demand for Personal Care Products: Acrolein is used in the production of personal care products such as perfumes, deodorants, and hair sprays. The demand for personal care products is increasing owing to rising consumer awareness about personal hygiene and grooming, particularly in emerging economies. According to a report, the global beauty and personal care industry accounted for nearly USD 500 billion in the year 2020.

- Growing Demand for Biocides and Herbicides: Acrolein is used as a key intermediate in the production of biocides and herbicides, which are widely used in agriculture and water treatment. According to a report, there are now over 600 confirmed cases of herbicide-resistant weeds worldwide, with the highest number of cases reported in the United States, Australia, and Brazil.

- Growing Demand for Food Preservatives: Acrolein is used as a food preservative owing to its antimicrobial properties. The demand for food preservatives is increasing owing to the growing demand for processed foods, changing dietary habits, and increasing concerns about food safety. According to a report by the World Health Organization, the consumption of processed food has increased in both developed and developing countries, with processed food accounting for up to 60% of daily caloric intake in some countries.

- Rise in Research Spending – Growth in the global market during the forecast period can be further attributed to increased investment in research and development activities to continuously find more viable solutions for acrolein. Research reports show that global R&D spending has more than tripled in real terms since 2000, rising from about USD 680 billion to more than USD 2.5 trillion in the year 2019.

Challenges

- Health concerns associated with acrolein: Acrolein is a highly toxic and volatile compound that can cause irritation to the eyes, skin, and respiratory system. Exposure to acrolein has also been linked to various health concerns such as cancer, respiratory diseases, and cardiovascular diseases. These health concerns could lead to regulatory challenges and could impact the demand for acrolein in certain end-use industries.

- Availability of alternative compounds

- Fluctuations in raw material prices

Acrolein Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.1% |

|

Base Year Market Size (2025) |

USD 1.25 billion |

|

Forecast Year Market Size (2035) |

USD 1.7 billion |

|

Regional Scope |

|

Acrolein Market Segmentation:

Application Segment Analysis

The pesticide segment is estimated to gain the largest market share of about 35% in the year 2035. The growth of the segment can be accredited to the growing demand for food. The increasing global population and changing dietary habits are driving the demand for food, which is in turn driving the demand for pesticides. According to the United Nations, the world's population is projected to reach 9.7 billion by 2050, which is expected to lead to a significant increase in food demand. Farmers need to produce high crop yields to meet the growing demand for food, and pesticides play a key role in achieving this. Pesticides help to control pests, weeds, and diseases that can reduce crop yields. There is growing interest in using biopesticides, which are derived from natural sources, as an alternative to conventional pesticides. Biopesticides are considered to be safer for the environment and human health compared to conventional pesticides. Integrated pest management is an approach to pest control that combines various methods, including the use of pesticides, to manage pests in a sustainable and environmentally friendly way. The adoption of IPM is increasing globally, and this is expected to impact the demand for pesticides.

Type Segment Analysis

The propylene oxidation method segment is expected to garner a significant share of around 60% in the year 2035. The growth of the segment can be accredited to the growing demand for acrylic acid. Acrolein is an important intermediate in the production of acrylic acid, which is used in a wide range of applications such as adhesives, coatings, and textiles. The propylene oxidation method is one of the most widely used methods for the production of acrolein, and the growing demand for acrylic acid is expected to drive the growth of this segment. Acrolein is used in the production of several plasticizers such as glycidyl methacrylate, which are used in the manufacture of various types of plastics. The demand for plastics is increasing due to their versatility, durability, and low cost, and this is expected to drive the growth of the propylene oxidation method segment. The propylene oxidation method has undergone several technological advancements in recent years, which have improved the efficiency and sustainability of the process. For instance, the development of catalysts with improved selectivity and the use of renewable energy sources in the process has led to reduced environmental impact and lower production costs.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acrolein Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is anticipated to dominate majority revenue share of 35% by 2035, owing to rising demand for personal care products in the region.The regional growth can majorly be attributed to the growing demand for personal care products. Acrolein is used in the production of several cosmetic and personal care products such as fragrances, lotions, and shampoos. The growing demand for personal care products in the region is expected to drive the demand for acrolein. The Asia Pacific region is the largest consumer of personal care products in the world, accounting for over 30% of the global consumption. The Asia Pacific region is home to some of the world's largest agricultural producers, such as China and India. Acrolein is used as a pesticide in agriculture to control pests, weeds, and diseases that can reduce crop yields. The increasing demand for agricultural products in the region is expected to drive the demand for acrolein. The Asia Pacific region has witnessed significant technological advancements in recent years, particularly in the field of chemical manufacturing. The development of innovative processes for the production of acrolein, such as the use of renewable energy sources and the development of new catalysts, is expected to drive the growth of the acrolein in the region.

North American Market Insights

The acrolein market in the North America, amongst the market in all the other regions, is projected to hold the second largest share of about 24% during the forecast period. The growth of the market in this region can primarily be attributed to increasing demand for plasticizers. Acrolein is a key intermediate in the production of plasticizers, which are widely used in the manufacture of plastics. The demand for plasticizers is increasing in North America owing to the growth of industries such as automotive, construction, and packaging. This is expected to drive the demand for acrolein in the region. Acrolein is used in the production of several personal care and cosmetic products such as shampoos, lotions, and fragrances. The demand for these products is increasing in North America due to the growing focus on personal grooming and hygiene. This is expected to drive the demand for acrolein in the region. Acrolein is widely used as a key ingredient in the production of herbicides and insecticides, which are used extensively in agriculture to control pests and weeds. The demand for these products is increasing in North America due to the growth of the agriculture industry. This is expected to drive the demand for acrolein in the region.

Europe Market Insights

Europe region is anticipated to register substantial growth through 2035. The growth of the market can be attributed majorly to the technological advancements. Europe is home to several leading chemical companies that are investing heavily in R&D to develop innovative processes for the production of acrolein. The development of new and more efficient processes, such as the use of renewable energy sources, is expected to drive the growth of the acrolein market in the region. Europe has some of the strictest regulations in the world for the use of chemicals in various industries. The regulations aim to ensure the safety and health of workers and consumers. The demand for acrolein is expected to increase in Europe as companies comply with these regulations and adopt safer and more sustainable production methods. Acrolein is widely used as a key ingredient in the production of herbicides and insecticides, which are used extensively in agriculture to control pests and weeds. The demand for these products is increasing in Europe due to the growth of the agriculture industry. This is expected to drive the demand for acrolein in the region.

Acrolein Market Players:

- Dow Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik Industries AG

- Merck KGaA

- Sumitomo Chemical Co., Ltd.

- Wanhua Chemical Group Co., Ltd.

- Beijing Eastern Petrochemical Co. Ltd.

- Jiangsu Baichuan High-Tech New Materials Co., Ltd.

- Osaka Gas Co., Ltd.

- SEKAB Biofuels & Chemicals AB

- Yixing Xinyu Chemical Co., Ltd.

Recent Developments

- Dow Chemical Company: Dow announced its plans to build a new high-performance material plant in India. The plant will produce advanced materials for industries such as automotive, consumer goods, and infrastructure. This move is part of Dow's strategy to expand its presence in high-growth markets and support the transition to a more sustainable economy.

- Evonik Industries AG: Evonik announced that it had completed the acquisition of Porphyrio NV, a Belgian technology start-up that specializes in data analytics and digitalization solutions for the poultry industry. The acquisition is expected to strengthen Evonik's position in the animal nutrition market and support its sustainability goals by helping to improve animal welfare and reduce resource consumption in the poultry industry.

- Report ID: 4872

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acrolein Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.