5G Technology Market Outlook:

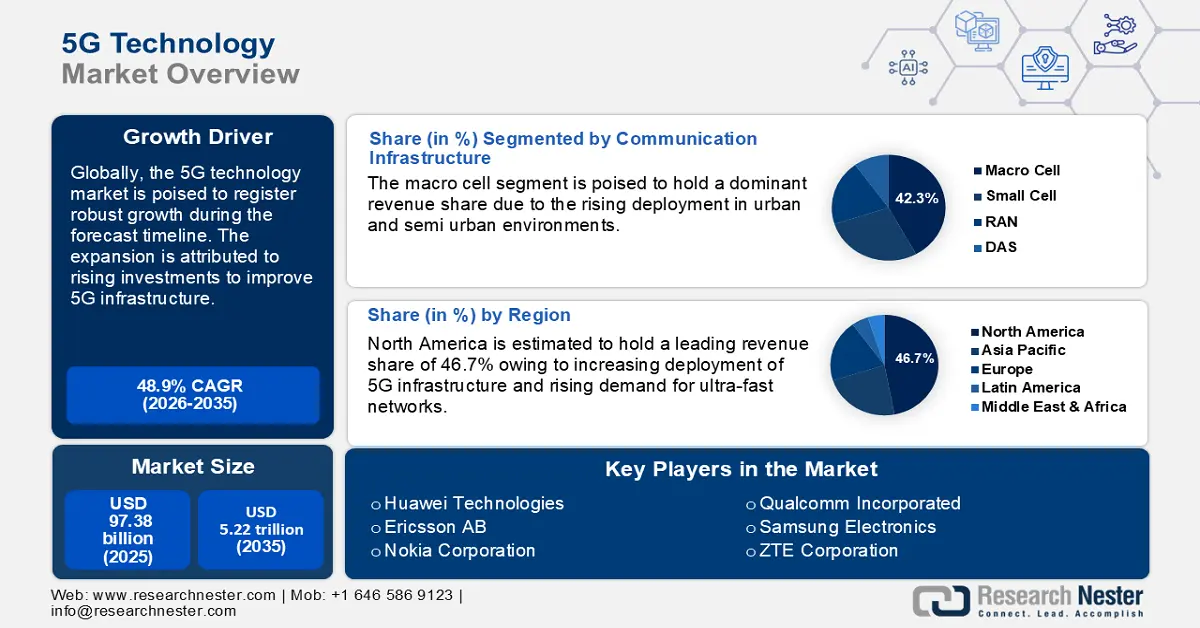

5G Technology Market size was over USD 97.38 billion in 2025 and is poised to exceed USD 5.22 trillion by 2035, witnessing over 48.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 5G technology is evaluated at USD 140.24 billion.

A key driver of the market's expansion is the rapid deployment of 5G globally, as economies seek to improve their nationwide connectivity. The proliferation of smartphones has ensured that the demand for ultra-fast connectivity increases manifold. To ensure connectivity without latency, the requirement for 5G technology is exponential. The table below highlights 5G coverage across different countries as per the OECD Digital Economy Outlook 2024:

|

Country |

5G Coverage (%) (2024) |

|

United States |

68.4 |

|

South Korea |

63 |

|

Finland |

58 |

|

Australia |

57 |

|

Japan |

56 |

Another major market for the market’s growth is the investments made to advance the technology. For instance, in January 2024, the U.S. Department of Commerce's National Telecommunications and Information Administration (NTIA) awarded a significant investment of USD 50 million to establish the Open RAN Center for Integration & Deployment (ORCID) in a bid to hasten the adoption of Open RAN technologies. The table below highlights additional key market indicators highlighting the growth of the 5G technology sector:

|

Indicator |

Value/Status |

|

U.S. 5G Smart Factory Investment |

$100 million (April 2024) |

|

India's Mobile Phone Exports (2023) |

$10.5 billion (FY 2022-2023) |

|

NTIA Grant for Open RAN Center |

$50 million (January 2024) |

|

NIST Funding Request for 5G Standards |

$1.4 million (March 2023) |

Key 5G Technology Market Insights Summary:

Regional Highlights:

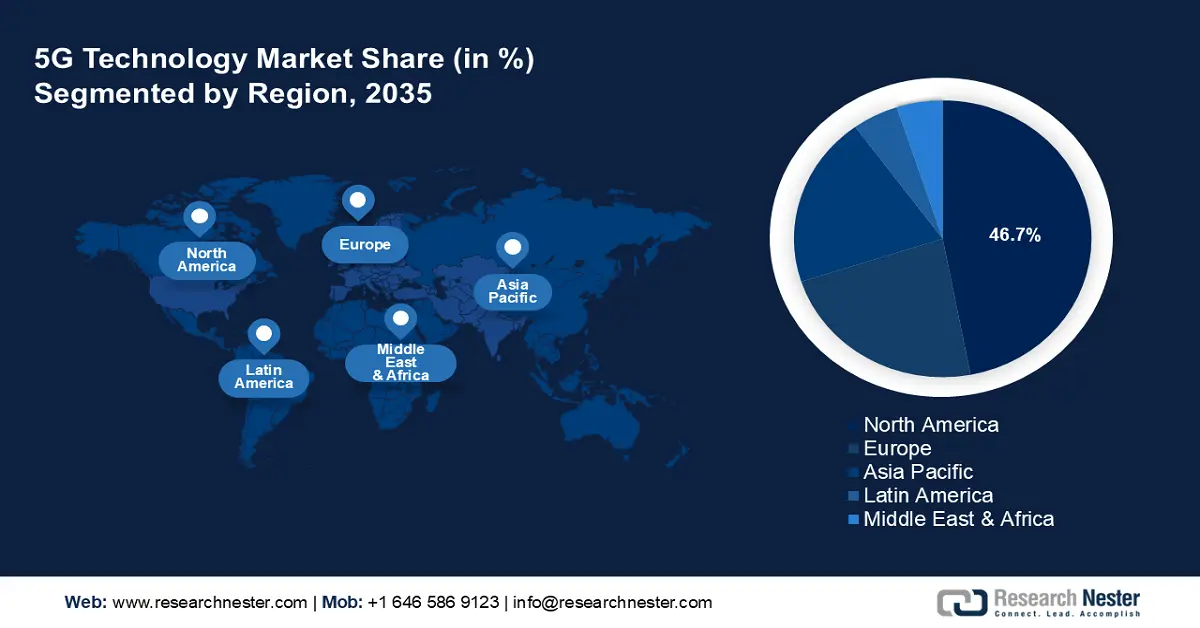

- North America 5G technology market will dominate over 46.70% share by 2035, driven by substantial investments in mmWave 5G infrastructure.

- Asia Pacific market projects significant growth during the forecast timeline, driven by high-average revenue per user 5G services and a large smartphone user base.

Segment Insights:

- The macro cell segment in the 5g technology market is expected to capture a 42.30% share by 2035, attributed to the increasing demand for enhanced mobile broadband services, necessitating macro cell deployment in urban and suburban areas.

- The nfv segment in the 5g technology market is expected to secure a 38.60% share by 2035, driven by the decoupling of network functions from proprietary hardware, reducing operational costs for telecom operators.

Key Growth Trends:

- Government initiatives and infrastructure investments

- Expansion of smart cities and IoT applications

Major Challenges:

- High deployment costs and infrastructure investment

Key Players: Intel Corporation, Deutsche Telekom AG, Telefonaktiebolaget LM Ericsson, Huawei Technologies Co. Ltd., Nokia Corporation, Orange, Qualcomm Technologies, Inc., Telecom Italia, Telstra Corporation Limited, T-Mobile USA, Inc..

Global 5G Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 97.38 billion

- 2026 Market Size: USD 140.24 billion

- Projected Market Size: USD 5.22 trillion by 2035

- Growth Forecasts: 48.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, South Korea, Japan, Germany

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 8 September, 2025

5G Technology Market Growth Drivers and Challenges:

Growth Drivers

- Government initiatives and infrastructure investments: With a surging push to implement 5G across multiple countries worldwide, the opportunities are rife for key players in the market. Additionally, with efforts intensifying to lay the foundation for the advent of 6G, the investments in existing 5G infrastructure is poised to remain high. For instance, more than USD 80 billion has been allocated in the U.S. between 2020 and 2025 for technical training in wireless and broadband. Additional investments are funneled under the aegis of the Infrastructure Investment and Jobs Act. Such proactive investments improve the telecommunications workforce, whilst improving the 5G infrastructure development.

- Expansion of smart cities and IoT applications: The increasing investments in smart city initiatives have favorably impacted the demand for 5G technology. To create an interconnected city manned by smart systems, it is imperative to invest in 5G infrastructure. Additionally, IoT applications require ultra-fast connectivity for seamless functioning. The convergence of these trends, along with the increase in smartphone users, is expected to create a sustained demand for 5G technology throughout the market’s forecast timeline. The table below highlights recent major investments made in smart cities:

Challenges

- High deployment costs and infrastructure investment: The 5G technology market has faced considerable impediments related to the high costs associated with infrastructure deployment. Moreover, the establishment of 5G networks requires considerable investment in small cells, new base stations, and advanced technologies such as beamforming and Massive MIMO. The market analysis reveals that the average cost per base station installation is estimated to be around USD 200,001, which makes it financially challenging for telecom operators. In addition, the shift to 5G requires a dense network of small cells, advanced antennas, and fiber optic cables, which are considerably more expensive than the infrastructure used for the previous generations of wireless networks.

5G Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

48.9% |

|

Base Year Market Size (2025) |

USD 97.38 billion |

|

Forecast Year Market Size (2035) |

USD 5.22 trillion |

|

Regional Scope |

|

5G Technology Market Segmentation:

Communication Infrastructure Segment Analysis

The macro cell segment is poised to hold a leading revenue 5g technology market share of 42.3% throughout the forecast timeline. The macro cells have emerged as an integral part of the 5G networks, especially in urban and suburban deployments. Macro cells solve a key pain point for end users by supporting high user densities, aligning with 5G deployment strategies. The surging demand for enhanced mobile broadband (eMBB) services is impacted by the increasing demand for applications such as augmented reality and high-definition video streaming, necessitating the deployment of macro cells. For instance, in October 2021, the FCC auctioned the mid-band spectrum to accelerate 5G rollout in the U.S., which in turn impacted the macro cell infrastructure expansion.

Network Technology Segment Analysis

The NFV segment is poised to account for 38.6% revenue 5g technology market share by the end of 2035. A key facet is NFV being able to decouple network functions from proprietary hardware, which allows them to run as software on standardized servers. Another factor driving the application of NFV is the surge in data traffic associated with the proliferation of IoT devices. Additionally, the rise in deployment of VFNs by telecom operators in a bid to reduce operational costs boosts the demand for NFVs.

Our in-depth analysis of the global 5G technology market includes the following segments:

|

Communication Infrastructure |

|

|

Network Technology |

|

|

Offering |

|

|

Chipset Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

5G Technology Market Regional Analysis:

North America Market Insights

The North America 5G technology market is poised to account for a dominant revenue share of 46.7% throughout the forecast period. The North America market’s growth curve is attributed to substantial investments in mmWave 5G infrastructure. In February 2024, Verizon deployed over 130,000 0-RAN-capable radios across more than 14,500 virtualized sites. Additionally, in August 2023, Pivotal Commware, a leader in 5G mmWave infrastructure products, announced the closing of a USD 100 million Series D funding round.

The U.S. 5G technology market is projected to maintain its leading share in North America. The U.S. is at the forefront of advancements in 5G technology as well as deployment. The trends are supported by the rising consumer demand for faster data speeds. The U.S. market is also impacted by major investments, such as the Public Wireless Supply Chain Innovation Fund, which allocated USD 1.5 billion to develop open and interoperable networks in August 2022. The table below highlights key stats related to 5G for the U.S. market as highlighted by Ericsson’s report.

|

Metric |

Value |

Date |

|---|---|---|

|

Total Cell Sites (all tech) |

350,100–400,100 |

January 2024 |

|

Estimated 5G-Enabled Sites |

~245,100–280,100 (70% of total) |

January 2024 |

|

Small Cell Installations |

~175,200 |

January 2024 |

|

Low-Band 5G Population Coverage |

~301 million (90% of the U.S. population) |

December 2023 |

|

Mid-Band 5G Coverage |

210–301 million |

December 2023 |

APAC Market Insights

Asia Pacific region is set to witness significant growth till 2035. The growth in APAC is primarily attributed to the explosion of high-average revenue per user (ARPU) 5G services, especially in countries such as China and India with a large volume of users. Additionally, APAC has had the largest smartphone user base, and GSMA projects that there will be over 3 billion smartphone connections by 2030. This is expected to create substantial investments in the market.

The China 5G technology market is estimated to hold a leading revenue share in APAC. GSMA estimates that more than 90% of mobile subscriptions will be on 5G networks in China by 2029. The China 5G technology market’s expansion is further attributed to the massive investments in 5G infrastructure, with the MIIT reporting the deployment of more than 4 million 5G base stations in 2024, with the number expected to increase to 4.5 million by the end of 2025.

5G Technology Market Players:

- Huawei Technologies Co., Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ericsson AB

- Nokia Corporation

- Qualcomm Incorporated

- Samsung Electronics

- ZTE Corporation

- Cisco Systems, Inc.

- NEC Corporation

- Fujitsu Limited

- Tech Mahindra Limited

- Telstra Corporation Ltd.

- Mavenir Systems, Inc.

- Maxis Berhad

- Samsung SDS

- Hitachi, Ltd.

Key players such as Huawei, Qualcomm, Samsung, Nokia, Ericsson, etc. These companies are maintaining leading revenue shares due to the major R&D investments, along with strategic partnerships to improve 5G infrastructure. Key players are focusing on network virtualization and open RAN architecture adoption to further reduce costs and remain competitive against the backdrop of the rising 5G connectivity worldwide. The table below highlights the major players in the 5G technology market:

Recent Developments

- In March 2024, Ericsson announced the launch of the latest 5G Core Network software, aiming to support ultra-reliable low latency communications (URLLC) and massive IoT connectivity. Additionally, as per the NTIA, this release contributed to a more than 10% increase in Ericsson’s revenue from deployments in North America in Q1 2024.

- In January 2024, Qualcomm introduced the Snapdragon X75 Modem-RF System, which supported 5G advanced features. The launch was commercialized in early 2024. Additionally, the FCC reported that the device adoption accelerated by more than 15% in Q1 2024, especially in Europe and North America.

- Report ID: 2257

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

5G Technology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.