Global 1,4-Diisopropylbenzene Market

- An Outline of the Global 1,4-Diisopropylbenzene Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for 1,4-Diisopropylbenzene

- Recent News

- Regional Demand

- Global 1,4-Diisopropylbenzene by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: 1,4-diisopropylbenzene Demand Landscape

- Global 1,4-Diisopropylbenzene Demand Trends Driven by Sustainability, DIPB Grades, Digital Process Optimization (2026-2036)

- Root Cause Analysis (RCA) for discovering problems of the 1,4-Diisopropylbenzene Porter Five Forces

- PESTLE

- Comparative Positioning

- 1,4-Diisopropylbenzene – Key Player Analysis (2036)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2036 (%)

- Business Profile of Key Enterprise

- Eastman Chemical Company

- BASF SE

- Dow Chemical Company

- Evonik Industries AG

- SI Group, Inc

- Goodyear Chemicals

- Tokyo Chemical Industry Co., Ltd

- Kanto Chemical Co., Inc

- SAGECHEM

- Syntechem Co., Ltd.

- Business Profile of Key Enterprise

- Global 1,4-diisopropylbenzene Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Tons), and Compound Annual Growth Rate (CAGR)

- Global Segmentation 1,4-diisopropylbenzene Analysis (2026-2036)

- By Purity Level

- <95%, Market Value (USD Million), and CAGR, 2026-2036F

- 95-98%, Market Value (USD Million), and CAGR, 2026-2036F

- 98-99%, Market Value (USD Million), and CAGR, 2026-2036F

- 99-99.5%, Market Value (USD Million), and CAGR, 2026-2036F

- >99.5%, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Chemical Intermediates, Market Value (USD Million), and CAGR, 2026-2036F

- Surfactants and Cleaning Agents, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical Intermediates, Market Value (USD Million), and CAGR, 2026-2036F

- Agrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Lubricants & Additives, Market Value (USD Million), and CAGR, 2026-2036F

- Polymer Synthesis, Market Value (USD Million), and CAGR, 2026-2036F

- Antioxidants, Market Value (USD Million), and CAGR, 2026-2036F

- Stabilizers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End-Use

- Chemical & Petrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical & Healthcare, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics & Electrical, Market Value (USD Million), and CAGR, 2026-2036F

- Agriculture, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive & Transportation, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Gods, Market Value (USD Million), and CAGR, 2026-2036F

- Paint and Coatings, Market Value (USD Million), and CAGR, 2026-2036F

- Textiles, Market Value (USD Million), and CAGR, 2026-2036F

- Aerospace, Market Value (USD Million), and CAGR, 2026-2036F

- Research and Development, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Factory Automation, Market Value (USD Million), and CAGR, 2026-2036F

- Data Servers, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Electronics, Market Value (USD Million), and CAGR, 2026-2036F

- Mobile Phones, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Regional Synopsis, Value (USD Million), 2026-2036

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Purity Level

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Million), 2026-2036, By

- By Purity Level

- <95%, Market Value (USD Million), and CAGR, 2026-2036F

- 95-98%, Market Value (USD Million), and CAGR, 2026-2036F

- 98-99%, Market Value (USD Million), and CAGR, 2026-2036F

- 99-99.5%, Market Value (USD Million), and CAGR, 2026-2036F

- >99.5%, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Chemical Intermediates, Market Value (USD Million), and CAGR, 2026-2036F

- Surfactants and Cleaning Agents, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical Intermediates, Market Value (USD Million), and CAGR, 2026-2036F

- Agrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Lubricants & Additives, Market Value (USD Million), and CAGR, 2026-2036F

- Polymer Synthesis, Market Value (USD Million), and CAGR, 2026-2036F

- Antioxidants, Market Value (USD Million), and CAGR, 2026-2036F

- Stabilizers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End-Use

- Chemical & Petrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical & Healthcare, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics & Electrical, Market Value (USD Million), and CAGR, 2026-2036F

- Agriculture, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive & Transportation, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Gods, Market Value (USD Million), and CAGR, 2026-2036F

- Paint and Coatings, Market Value (USD Million), and CAGR, 2026-2036F

- Textiles, Market Value (USD Million), and CAGR, 2026-2036F

- Aerospace, Market Value (USD Million), and CAGR, 2026-2036F

- Research and Development, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Purity Level

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Million), 2026-2036, By

- By Purity Level

- <95%, Market Value (USD Million), and CAGR, 2026-2036F

- 95-98%, Market Value (USD Million), and CAGR, 2026-2036F

- 98-99%, Market Value (USD Million), and CAGR, 2026-2036F

- 99-99.5%, Market Value (USD Million), and CAGR, 2026-2036F

- >99.5%, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Chemical Intermediates, Market Value (USD Million), and CAGR, 2026-2036F

- Surfactants and Cleaning Agents, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical Intermediates, Market Value (USD Million), and CAGR, 2026-2036F

- Agrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Lubricants & Additives, Market Value (USD Million), and CAGR, 2026-2036F

- Polymer Synthesis, Market Value (USD Million), and CAGR, 2026-2036F

- Antioxidants, Market Value (USD Million), and CAGR, 2026-2036F

- Stabilizers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End-Use

- Chemical & Petrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical & Healthcare, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics & Electrical, Market Value (USD Million), and CAGR, 2026-2036F

- Agriculture, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive & Transportation, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Gods, Market Value (USD Million), and CAGR, 2026-2036F

- Paint and Coatings, Market Value (USD Million), and CAGR, 2026-2036F

- Textiles, Market Value (USD Million), and CAGR, 2026-2036F

- Aerospace, Market Value (USD Million), and CAGR, 2026-2036F

- Research and Development, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Purity Level

- Overview

- Asia Pacific excluding Japan Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Million), 2026-2036, By

- By Purity Level

- <95%, Market Value (USD Million), and CAGR, 2026-2036F

- 95-98%, Market Value (USD Million), and CAGR, 2026-2036F

- 98-99%, Market Value (USD Million), and CAGR, 2026-2036F

- 99-99.5%, Market Value (USD Million), and CAGR, 2026-2036F

- >99.5%, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Chemical Intermediates, Market Value (USD Million), and CAGR, 2026-2036F

- Surfactants and Cleaning Agents, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical Intermediates, Market Value (USD Million), and CAGR, 2026-2036F

- Agrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Lubricants & Additives, Market Value (USD Million), and CAGR, 2026-2036F

- Polymer Synthesis, Market Value (USD Million), and CAGR, 2026-2036F

- Antioxidants, Market Value (USD Million), and CAGR, 2026-2036F

- Stabilizers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End-Use

- Chemical & Petrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical & Healthcare, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics & Electrical, Market Value (USD Million), and CAGR, 2026-2036F

- Agriculture, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive & Transportation, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Gods, Market Value (USD Million), and CAGR, 2026-2036F

- Paint and Coatings, Market Value (USD Million), and CAGR, 2026-2036F

- Textiles, Market Value (USD Million), and CAGR, 2026-2036F

- Aerospace, Market Value (USD Million), and CAGR, 2026-2036F

- Research and Development, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- New Zealand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Purity Level

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2026-2036, By

- By Purity Level

- <95%, Market Value (USD Million), and CAGR, 2026-2036F

- 95-98%, Market Value (USD Million), and CAGR, 2026-2036F

- 98-99%, Market Value (USD Million), and CAGR, 2026-2036F

- 99-99.5%, Market Value (USD Million), and CAGR, 2026-2036F

- >99.5%, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Chemical Intermediates, Market Value (USD Million), and CAGR, 2026-2036F

- Surfactants and Cleaning Agents, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical Intermediates, Market Value (USD Million), and CAGR, 2026-2036F

- Agrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Lubricants & Additives, Market Value (USD Million), and CAGR, 2026-2036F

- Polymer Synthesis, Market Value (USD Million), and CAGR, 2026-2036F

- Antioxidants, Market Value (USD Million), and CAGR, 2026-2036F

- Stabilizers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End-Use

- Chemical & Petrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical & Healthcare, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics & Electrical, Market Value (USD Million), and CAGR, 2026-2036F

- Agriculture, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive & Transportation, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Gods, Market Value (USD Million), and CAGR, 2026-2036F

- Paint and Coatings, Market Value (USD Million), and CAGR, 2026-2036F

- Textiles, Market Value (USD Million), and CAGR, 2026-2036F

- Aerospace, Market Value (USD Million), and CAGR, 2026-2036F

- Research and Development, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Purity Level

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2026-2036, By

- By Purity Level

- <95%, Market Value (USD Million), and CAGR, 2026-2036F

- 95-98%, Market Value (USD Million), and CAGR, 2026-2036F

- 98-99%, Market Value (USD Million), and CAGR, 2026-2036F

- 99-99.5%, Market Value (USD Million), and CAGR, 2026-2036F

- >99.5%, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Chemical Intermediates, Market Value (USD Million), and CAGR, 2026-2036F

- Surfactants and Cleaning Agents, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical Intermediates, Market Value (USD Million), and CAGR, 2026-2036F

- Agrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Lubricants & Additives, Market Value (USD Million), and CAGR, 2026-2036F

- Polymer Synthesis, Market Value (USD Million), and CAGR, 2026-2036F

- Antioxidants, Market Value (USD Million), and CAGR, 2026-2036F

- Stabilizers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End-Use

- Chemical & Petrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical & Healthcare, Market Value (USD Million), and CAGR, 2026-2036F

- Electronics & Electrical, Market Value (USD Million), and CAGR, 2026-2036F

- Agriculture, Market Value (USD Million), and CAGR, 2026-2036F

- Automotive & Transportation, Market Value (USD Million), and CAGR, 2026-2036F

- Consumer Gods, Market Value (USD Million), and CAGR, 2026-2036F

- Paint and Coatings, Market Value (USD Million), and CAGR, 2026-2036F

- Textiles, Market Value (USD Million), and CAGR, 2026-2036F

- Aerospace, Market Value (USD Million), and CAGR, 2026-2036F

- Research and Development, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Purity Level

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

1,4-Diisopropylbenzene Market Outlook:

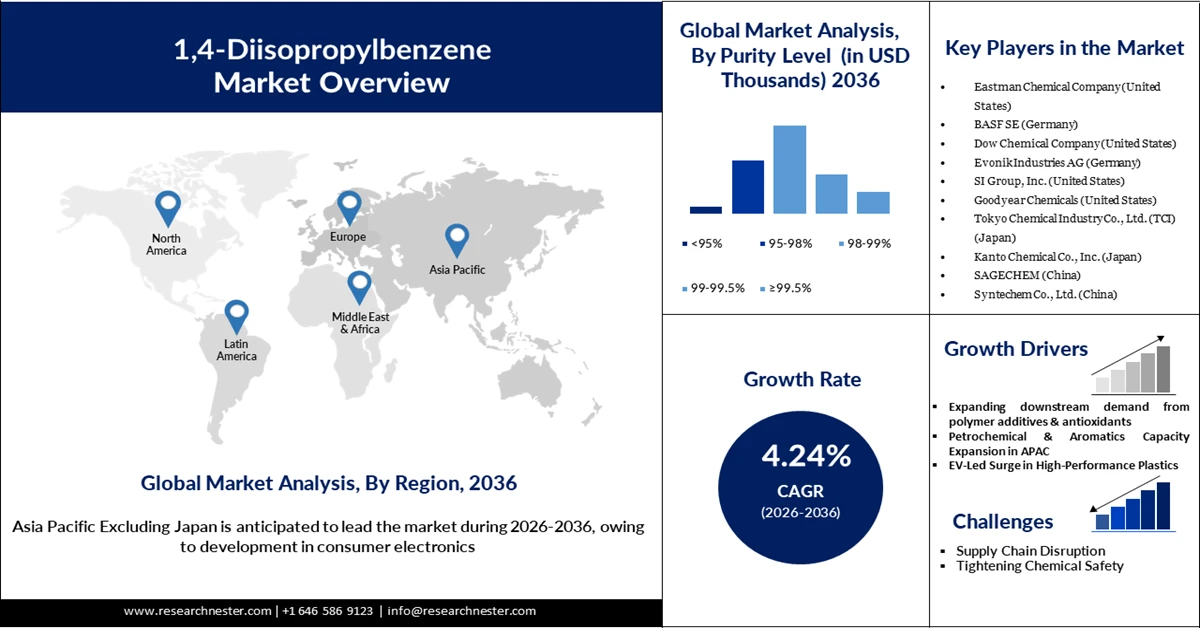

1,4-Diisopropylbenzene Market Size is valued at USD 139.10 million in 2025 and is estimated to reach a size of USD 222.38 million by the end of 2036, registering a CAGR of 4.24% the forecast period, i.e., 2026-2036. In 2026, the industry size of 1,4-diisopropylbenzene is evaluated at USD 146.84 million.

The growing agrochemical industry is a key driver of the 1,4-diisopropylbenzene (DIPB) market, as the compound is widely used as an intermediate in the production of herbicides and pesticides that are essential for securing healthy and high-quality harvests. Agriculture accounted for approximately 4% of global GDP in 2024, highlighting its continued economic significance and the rising dependence on efficient crop production systems. This increasing reliance on agriculture has accelerated the adoption of high-performance agrochemicals, including advanced pesticides and herbicides that enhance crop quality, protect yields, and improve overall farm productivity.

1,4-Diisopropylbenzene is extensively utilized as a chemical building block in the formulation of agrochemical products, supporting the development of more effective and durable crop protection solutions. Regions such as Asia Pacific, which account for the largest share of global agricultural output, exhibit particularly strong demand for agrochemicals due to large cultivated areas and rising food requirements. Moreover, these regions are witnessing rapid adoption of modern and sustainable farming practices, where environmental efficiency and resource optimization are increasingly prioritized. The shift toward sustainable agriculture has further boosted demand for eco-friendly fertilizers and pesticides, thereby significantly strengthening the growth prospects of the 1,4-diisopropylbenzene market.

Key 1,4-Diisopropylbenzene Market Insights Summary:

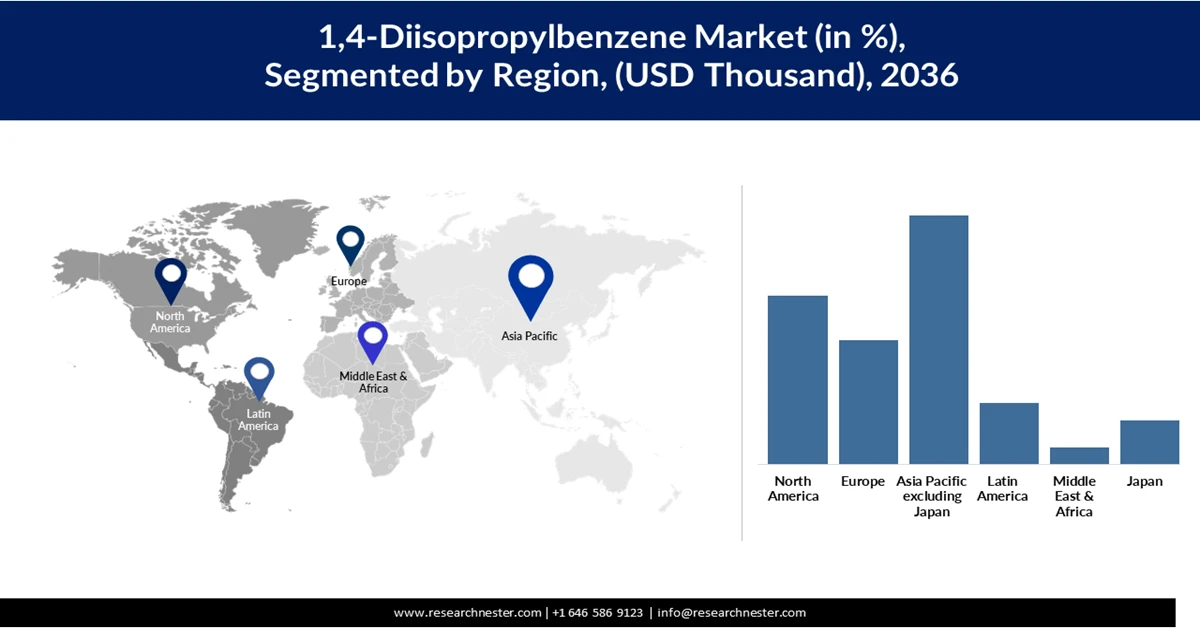

Regional Highlights:

- Asia-Pacific is projected to command 40% share of the global 1,4-diisopropylbenzene market by 2036, supported by surging consumer electronics manufacturing that intensifies the use of polycarbonate and oxidation-based processes requiring DIPB.

- North America is anticipated to secure a 27.19% share of the 1,4-diisopropylbenzene market by 2036, underpinned by rising agrochemical demand alongside strong vehicle aftermarket needs for high-purity polymers and elastomers utilizing DIPB.

Segment Insights:

- The antioxidant segment is projected to dominate the global 1,4-diisopropylbenzene market by 2036 with a 23.04% share, reflecting its extensive application in safeguarding polymers, lubricants, and specialty chemicals through enhanced material stability and reduced degradation.

- The 98–99% segment is anticipated to account for a leading 34.12% share by 2036, supported by its suitability for contamination-free chemical formulations that enable precision manufacturing and cleaner feedstocks.

Key Growth Trends:

- Demand for high-performance plastics in electric vehicles

- Expansion in petrochemical and aromatics in APAC

Major Challenges:

- Supply chain disruption

- Tightening chemical safety

Key Players: Eastman Chemical Company (U.S.), BASF SE (Germany), Dow Chemical Company (U.S.), Evonik Industries AG (Germany), SI Group, Inc. (U.S.), Goodyear Chemicals (U.S.), Tokyo Chemical Industry Co., Ltd. (TCI) (Japan), Kanto Chemical Co., Inc. (Japan), SAGECHEM (China), Syntechem Co., Ltd. (China)

Global 1,4-Diisopropylbenzene Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 139.10 million

- 2026 Market Size: USD 146.84 million

- Projected Market Size: USD 222.38 million by 2036

- Growth Forecasts: 4.24% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Asia-Pacific (40% Share by 2036)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Thailand, Mexico

Last updated on : 4 February, 2026

1,4-Diisopropylbenzene Market - Growth Drivers and Challenges

Growth Drivers

- Demand for high-performance plastics in electric vehicles: The rapid expansion of electric vehicles has increased the demand for lightweight plastics, which makes vehicles more ergonomic. According to data from IEA, China’s electric vehicle sales surged from 0.9 million in 2020 to 6.4 million in 2024. The rapid expansion of vehicle electrification is demanding high-performance plastics that are stable and advancing the growth of the 1,4-diphenylbenzene market. DIPB serves as a core intermediary for performance stabilizers that are used in insulation and wiring. The wide usage of the DIBP in the automotive sector has further increased its growth.

- Expansion in petrochemical and aromatics in APAC: Expansion in aromatic and complex chemical manufacturers is strengthening the regional potential for benzene and propylene, which serve as an essential feedstock for DIPB. As the availability of feedstocks improves, manufacturers of additives and specialty chemicals gain supportive access to DIBP, maintaining consistent growth in automotive and electronics. China, in its 14th 5-year plan, prioritized modernizing the petrochemical chain of the country with a strong focus on integrated refining-chemical complexes. The initiative will strengthen the availability of the feedstock and improve the DIBP production across the region.

- Expanding demand from polymer additives & antioxidants: DIBP acts as a major intermediary in high-performance stabilizers that are employed in automotive and electronics production, which directly increases its consumption. The annual report of 2024 from BASF claims that the Asia Pacific has a high demand for antioxidants and polymer additives, especially from consumer electronics and industrial needs. The business is aiming to expand the additive capacity to meet the rising demand for DIBP.

Challenges

- Supply chain disruption: The rising trade regulations of APAC are limiting the certainty of consistent imports and exports. Approval from customs and transport documents is becoming lengthy and expensive for importers. DIBP moves through a multination supply chain where compliance issues may lead to delayed shipment delivery, leading to increased cost.

- Tightening chemical safety: Asia Pacific governments are tightening the security for hazardous chemicals, including their manufacturing, storage, and logistics. DIBP is a controlled chemical, and its exchange requires stringent compliance, which often leads to increased cost of purchase. Emerging polymer manufacturers may restrict the usage of DIBP and may look for more sustainable and cheaper alternatives.

1,4-Diisopropylbenzene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2036 |

|

CAGR |

4.24% |

|

Base Year Market Size (2025) |

USD 139.10 million |

|

Forecast Year Market Size (2036) |

USD 222.38 million |

|

Regional Scope |

|

1,4-Diisopropylbenzene Market Segmentation:

Application Segment Analysis

The antioxidant segment will hold the most dominating position by 2036 with a share of 23.04% owing to its use in the protection of polymers, lubricants, and specialty chemicals. DIPB supports the stable production of antioxidants by maintaining the integrity of the polymer and reducing the degradation of the chemical, which is driving the growth of high-performance materials and specialty chemicals. The usage of high-purity DIPB ensures effective synthesis of BHT, lubricant oxidants, and polymer stabilizers that ensure high performance across various applications. Antioxidants are equipped in tyres, hoses, and seals that limit overheating and hardening of the materials, which further propels the expansion of global 1,4-Diisopropylbenzene.

Purity Level Segment Analysis

The 98-99% segment will hold the largest share of 34.12% by the end of 2036, as the purity level is considered clean and can be used in a variety of chemical combinations without the risk of contamination. The purity level further supports the growth of performance resins and adhesive modifiers that significantly increase the adoption in different industries. The increasing demand for the purity level is demonstrating the rise in precision manufacturing and cleaner feedstocks. A high level of purity in the 1,4-diisopropylbenzene market ensures better synthesis of industrial and automotive lubricants, enhancing operational efficiency. Countries such as Europe are consistently focusing on high purity levels, which enhances the stability of polymers and industrial lubricants.

End Use Segment Analysis

The chemical and petrochemical segment will hold the dominating position with a share of 23.12%, as it serves as a high-value aromatic intermediate for monomers and additives. Businesses are transitioning towards cleaner and aromatic feedstocks, which is strengthening the adoption of DIPB. As countries are boosting DIPB consumption, efficient reactions and yields are improving. DIPB is highly used in the additives and lubricants, which would significantly increase its adoption and ensure expansion of the 1,4-diisopropylbenzene market. Other segments, such as pharmaceutical and healthcare, will also significant opportunity in the future owing to the use of DIPB in specialty solvents.

Our in-depth analysis of the 1,4-Diisopropylbenzene market includes the following segments:

|

Segments |

Subsegments |

|

Purity Level |

|

|

Application |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

1,4-Diisopropylbenzene Market - Regional Analysis

Asia Pacific Excluding Japan Market Insights

The market in the region is expected to hold 40% of the global 1,4-diisopropylbenzene market share, owing to the increasing manufacturing of consumer electronics, which is significantly enhancing the market potential. Consumer electronics and other smaller components require engineered plastics such as polycarbonate, which is derived through DIPB. Consumer electronics, such as smartphones, laptops, and tablets, further require oxidation, which further elevates the demand for DIPB.

China remains the dominant force in global chemical manufacturing, including intermediates like 1,4-Diisopropylbenzene (DIPB), driven by its massive industrial base and leading role in electronics and specialty chemicals production. China’s chemical industry is the world’s largest, reflecting the country’s broader manufacturing supremacy, and chemical output plays a central role in its economy by supplying raw and intermediate materials for plastics, polymers, and advanced materials. According to WTO and industry data, China accounts for approximately 44 % of the world’s chemical sales, dwarfing other major geographies, with the EU at about 14 % and the U.S. at roughly 11 % of global share. This concentration supports demand for DIPB intermediates used in high-performance polymers and stabilizers, particularly for consumer electronics applications such as smartphones and laptops, where oxidation and high thermal resistance properties are critical. Regional market analysis also suggests that Asia Pacific, led by China, holds the largest share (around 38 %) of the global 1,4-diisopropylbenzene market, driven by rapidly expanding chemical and electronics manufacturing sectors.

India’s chemical and petrochemical sector is growing rapidly as part of a broader strategy to become more self-sufficient and diversify away from import dependence. India is ranked as the sixth-largest chemical producer in the world and the third-largest in Asia, contributing about 7 % to the national GDP. Under initiatives such as the Petroleum, Chemicals and Petrochemicals Investment Regions (PCPIR) policy and Production-Linked Incentive (PLI) schemes, the country is expanding capacity for advanced intermediates, including those related to DIPB and downstream engineered plastics like polycarbonate. The domestic chemicals 1,4-diisopropylbenzene market was valued at around USD 220 billion in 2023 and is projected to grow toward USD 400–450 billion by 2030 under current growth trajectories. While India’s exports of primary polycarbonates were modest, approximately USD 5.2 million in 2024, it reflects the beginning of scaling in value-added materials that use DIPB-derived intermediates for applications in plastics and electronics. Greater investment and policy alignment continue to strengthen India’s capacity to serve both domestic demand and international markets for high-performance polymers and related chemicals.

North America Market Insights

The region is expected to hold a 1,4-diisopropylbenzene market share of 27.19% by the end of 2036, owing to the increasing demand for agrochemical products and crop production. DIPB is used as an intermediate in pesticides and insecticides. The large agricultural sector is driving demand for crop protection using advanced pesticides and fertilisers that would also ensure the healthy growth of crops. Together, these factors are creating demand for 1,4-diisopropylbenzene. The vehicle aftermarket of North America is large, which demands high-purity polymers and elastomers for different needs, which further elevates the need for 1,4-diisopropylbenzene.

The U.S. holds a stable agricultural market, which supports the growth of the 1,4-diisopropylbenzene market. In January 2026, the U.S. Department of Agriculture granted a USD 40 million investment in Town Campbell aimed towards improved water utility systems. These initiatives allow farmers to increase the crop production capacity, enhancing the growth of the market. Furthermore, Canada has recently announced the introduction of interest-free loan limits for farmers under its Advanced Payments Program that will improve the cash flow and help farmers ensure quality production during the growing seasons. Canada’s support to farmers will help them use better composites and manures that will increase the yield and ensure consistent growth of the 1,4-diisopropylbenzene market.

Europe Market Insights

Europe will hold 20.05% of the 1,4-diisopropylbenzene market share by the end of 2036 owing to the large-scale manufacturing of automotive. Popular players such as Land Rover and Mini have shifted their focus to electric vehicles, which is fueling the growth of lightweight components and materials that would enhance the mileage and ergonomics of the vehicle. The petrochemical industry of Europe is rapidly scaling, creating opportunities for DIPB. In Europe, 95% of manufactured goods are based on petrochemicals, demonstrating the segment's rising growth. Complex chemicals such as benzene and propylene are used in the creation of DIPB feedstock, which further boosts the adoption of DIPB.

The UK is a sound manufacturer of automobiles with numerous assembly and manufacturing units across the country, which drives the demand for elastomers and high-end polymers for rubber and door trims. Vehicle lubricants employ DIPB, which ensures effective synthesis between the pistons and the engine and enhances the vehicle's health by keeping components healthy. Germany holds a large number of manufacturing units that work with heavy machinery and equipment. This equipment requires regular servicing, including a lubricant top-up. The dependence on industrial-grade lubricants will fuel the growth of the 1,4-diisopropylbenzene market as the component is used in the synthesis and bonding of the lubricants.

Key 1,4-Diisopropylbenzene Market Players:

- Eastman Chemical Company (U.S.)

- BASF SE (Germany)

- Dow Chemical Company (U.S.)

- Evonik Industries AG (Germany)

- SI Group, Inc. (U.S.)

- Goodyear Chemicals (U.S.)

- Tokyo Chemical Industry Co., Ltd. (TCI) (Japan)

- Kanto Chemical Co., Inc. (Japan)

- SAGECHEM (China)

- Syntechem Co., Ltd. (China)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tokyo Chemical Industry Co., Ltd is based in Japan and is one of the leaders in specialty chemicals. It has a global presence and domination in regions such as Asia, Europe, China, and India. It serves key industries including academic research, life science, and other advanced application studies.

- Kanto Chemical Co., Inc manufactures reagents, electronic materials, and materials. Some of the key industries the business services include are pharmaceutical and life science research. It also has a global footprint with interest in some major regions such as Malaysia, the United States, Singapore, China, and Taiwan.

- SAGECHEM develops pharmaceutical, agrochemical, dyestuff, and organosilicon intermediates. It further holds two major plants in Jiangxi and Zhejiang provinces of China. It has a strong focus on sustainability, resulting in environmentally conscious manufacturing and reducing pollution during the production process.

- Syntechem Co., Ltd a Chinese manufacturer and supplier of industrial and specialty chemicals. The products of the business are used in coatings, polymers, and pharmaceuticals. They serve clients across the globe with domination from international customers.

Below is the list of the key players operating in the global 1,4-diisopropylbenzene market:

The players operating in the global 1,4-diisopropylbenzene market are expected to face intense competition during the forecast timeline. The market is associated with both established key players and new entrants. However, the market is moderately fragmented. New entrants impose immense competition for the existing players, prohibiting them from acquiring the majority of the revenue share. Specialised manufacturers maintain a competitive landscape in the 1,4-diisopropylbenzene market. Key players in the market are significantly supported by the governments for research and innovation.

Competitive Landscape of the Global 1,4-Diisopropylbenzene Market Key Players

Recent Developments

- In August 2025, Eastman Chemical Company partnered with Huafon Chemical to establish a manufacturing facility to produce cellulose acetate yarn in China. The aim is to domesticate production and meet the increasing demand for textile and performance materials. China, being the largest textile hub in the world, demands innovation in yarn to enhance its global dependence.

- In January 2026, BASF successfully started its steam cracker unit in the Verbund site in Zhanjiang, China. The facility is believed to be the first to use 100% renewable energy to power the essential machines, such as turbines and compressors. The business will be supplying ethylene and propylene.

- Report ID: 7528

- Published Date: Feb 04, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

1,4-Diisopropylbenzene Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.