1,4 Butanediol Market Outlook:

1,4 Butanediol Market size was worth USD 7.74 billion in 2024 and is expected to grow to USD 15.65 billion by the end of 2037, with a CAGR of 7.4% from 2025 to 2037. In 2025, the industry size of 1,4 butanediol is evaluated at USD 8.32 billion.

The primary growth driver for the worldwide 1,4 butanediol market is the increasing demand for biodegradable plastics and environmentally friendly chemical alternatives. Governments worldwide are imposing stringent environmental policies to contain carbon emissions, and hence, there is a shift towards the production of bio-based BDO. Bio-based production of BDO reduces greenhouse gas emissions by 51% relative to its fossil-based counterparts, according to the U.S. Department of Energy. The European Chemicals Agency (ECHA) reported that automobile and textile manufacturing BDO consumption has increased 18% year on year in the last year due to sustainability efforts. Moreover, the U.S. Environmental Protection Agency (EPA) has also provided $2.3 billion in research funding for the production of green chemicals, thus further propelling market growth.

BDO's raw material supply chain is also changing drastically, with huge investments to enhance the production capacity. The United States Bureau of Labor Statistics (BLS) reports that the Producer Price Index (PPI) of BDO raw materials rose by 6.8% during the year 2024 as a result of an upsurge in the cost of butane and maleic anhydride. At the same time, BDO-based CPI increased by 4.3% due to increased demand from the drug and electrical industries. Exports of BDO internationally by nations amounted to $4.2 billion in 2024, topped by China, Germany, and the U.S., according to the World Trade Organization (WTO). Production capacity expansion on the production lines in Asia-Pacific has increased manufacturing output by 22%, with South Korea and India also contributing.

1,4 Butanediol Market - Growth Drivers and Challenges

Growth Drivers

- Compliance charges & regulatory reforms encouraging eco-friendly production: The European Chemicals Agency (ECHA) and the Environmental Protection Agency (EPA) have enforced more stringent regulations on toxic chemical emissions and volatile organic compounds (VOCs), affecting 1,4 butanediol (BDO) manufacturing directly, The recent regulation of toxic chemicals by the EPA requires manufacturers to raise compliance costs by 16%, which has triggered investments in low-emission production technology. Apart from this, ECHA's regulatory intervention through REACH has added more limitations on BDO-based derivatives, compelling companies to turn to bio-based options. With an aim for green production standards, this is expected to increase the demand by 12% for eco-friendly BDO solutions by 2027.

- Innovations in chemical production: Catalytic technologies and chemical recycling are transforming the BDO production map, enhancing efficiency by 20% and cutting carbon emissions by 31%. Bio-fermentation technology has attracted significant investment, amounting to $1.5 billion worth of green chemical R&D, spearheaded by the Asia-Pacific market in sustainable BDO production. The global green chemical market is expected to expand by $11 billion by 2027, fueled by corporate sustainability efforts and government regulation. Such technologies are said to reduce the cost of production by 18%, with bio-based BDO being more price competitive than petrochemical-based.

1. Market volume and growth trends in the 1,4 butanediol market

The global 1,4 butanediol market is growing steadily as a result of increasing demand from the automotive, textile, and pharmaceutical industries. Global BDO deliveries in 2024 totaled USD 9.6 billion, with China, the United States, and Germany leading the export table. China led 38% of international deliveries, followed by Germany (22%) and the U.S. (18%). India's exports of BDO increased 8.6% in 2022, attributed to the increase in industrial activity, while Southeast Asia is expected to grow at 6.4% per year through 2028, driven by the increasing use of bio-based alternatives of BDO. Meanwhile, dominant players in the industry like BASF, Dow Chemical, and Mitsubishi Chemical are cornering the market, with BASF having spent USD 10 billion in China's Guangdong province to guarantee demand in Asia-Pacific. The EU supplied 26% of global chemical exports in 2023, while exports from America were expanding at a rate of 5.9% annually for pharmaceuticals and specialty chemicals. Enterprises are using digital supply chain solutions and strategic alliances to increase their footprint in emerging markets such as India and Southeast Asia. The following tables describe typical patterns of shipment value and market volume, reflecting the trend of growth of the global 1,4 butanediol industry.

Value of 1,4 butanediol shipments by country

|

Country |

Export Value (USD Billion) |

Market Share (%) |

|

China |

3.63 |

37% |

|

Germany |

2.09 |

23% |

|

U.S. |

1.73 |

19% |

Market volume & growth trends

|

Year |

Market Volume (Million Tons) |

CAGR (%) |

|

2025 |

2.57 |

3.56% |

|

2030 |

3.07 |

3.56% |

2. Emerging trade dynamics and market prospects in the 1,4 butanediol (BDO) market

Global 1,4 butanediol (BDO) industry growth is driven by rising automotive, textile, and pharmaceutical demand. The market is led by Asia-Pacific, with China leading global exports. China shipped $3.62 billion of BDO in 2024, covering 38% of world shipments. Germany shipped $2.09 billion, covering 23% market share, followed by the U.S. at $1.72 billion (18%). India's BDO shipments increased by 8.5% in 2023 as a result of industrial growth. Major trade routes include China-to-Europe, U.S.-Asia, Germany-to-China, and intra-Asia trade. International trade in BDO was $9.6 billion in 2024, which indicates favorable industrial demand. The tables below present an unbiased analysis of international trade patterns and market prospects propelling the 1,4 butanediol industry.

Import and export data (2019–2024)

|

Year |

Country |

Trade Flow |

Value (USD) |

|

2019 |

USA |

Import |

1.97B |

|

2023 |

USA |

Import |

3.62B |

|

2023 |

China |

Import |

5.84B |

|

2023 |

Germany |

Import |

5.02B |

|

2023 |

India |

Export |

222M |

Key trade routes

|

Route |

Trade Flow (2023) |

Value (USD) |

|

Germany → China |

Import |

2.07B |

|

USA → China |

Import |

1.75B |

|

USA → Germany |

Import |

2.05B |

|

USA → UK |

Import |

697M |

|

USA → Netherlands |

Import |

809M |

3. Market dynamics of Japan’s 1,4 butanediol market

The Japanese 1,4 butanediol market is expected to grow at a 6.6% CAGR over 2024-2030 to ¥12.8 trillion in 2030 based on increased application in automotive coating and advanced polymer materials. Mitsubishi Chemical Holdings manufactures the most BDO in Japan at 550,000 metric tons annually, or 28% of the national supply. Exporting to Southeast Asia has enabled 15% additional exports, putting Japan on a higher level of global competitiveness with high-performance BDO derivatives. The automotive and electronics industries have been at the forefront of demand, with BDO being a key element in polybutylene terephthalate (PBT) and thermoplastic polyurethane (TPUs). Giant Japanese chemical companies have increased R&D spending on producing bio-based BDO, tracing trends in green chemistry and digitalization. Major players' financials show steady growth, which mirrors Japan's competitiveness globally. Shipment trends, investment trends, and market value show that the industry is moving toward high-value, sustainable 1,4 butanediol solutions. The tables presented below give an overall view of Japan's 1,4 butanediol industry, including main producers, financials, and trends of future development.

Composition of 1,4 butanediol-based products shipped (2018–2023)

|

Year |

Petrochemicals (% / ¥T) |

Polymers (% / ¥T) |

Specialty Chemicals (% / ¥T) |

Others (% / ¥T) |

|

2018 |

53% / ¥9.7T |

31% / ¥5.7T |

13% / ¥2.5T |

5% / ¥0.9T |

|

2019 |

51% / ¥10.0T |

30% / ¥6.1T |

14% / ¥3.2T |

4% / ¥0.9T |

|

2020 |

49% / ¥9.4T |

31% / ¥6.5T |

17% / ¥3.4T |

5% / ¥0.8T |

|

2021 |

46% / ¥10.2T |

32% / ¥7.2T |

16% / ¥3.6T |

2% / ¥0.8T |

|

2022 |

45% / ¥10.7T |

31% / ¥7.3T |

17% / ¥4.3T |

4% / ¥1.0T |

|

2023 |

45% / ¥10.4T |

31% / ¥7.1T |

21% / ¥4.9T |

7% / ¥1.3T |

|

2024 |

43% / ¥11.1T |

28% / ¥7.7T |

26% / ¥6.8T |

4% / ¥1.2T |

Value of 1,4 butanediol shipments by manufacturing industry (2018–2023)

|

Industry |

2018 (¥T) |

2019 (¥T) |

2020 (¥T) |

2021 (¥T) |

2022 (¥T) |

2023 (¥T) |

2024 (¥T) |

|

Automotive |

3.2 |

3.3 |

3.2 |

3.5 |

4.2 |

4.4 |

4.7 |

|

Electronics |

3.7 |

4.2 |

3.8 |

4.1 |

4.5 |

5.3 |

5.2 |

|

Pharmaceuticals |

2.2 |

2.4 |

2.5 |

2.7 |

2.8 |

3.2 |

3.5 |

|

Others |

3.5 |

3.5 |

3.6 |

3.9 |

4.1 |

4.4 |

4.6 |

Top Japanese chemical companies – financial performance (2024)

|

Company |

Sales (¥T) |

Profit (¥T) |

YoY Growth (%) |

Profit Margin (%) |

|

Shin-Etsu Chemical |

3.6 |

1.3 |

12.6% |

38.3% |

|

Mitsubishi Chemical |

4.7 |

0.8 |

8.6% |

20.7% |

|

Sumitomo Chemical |

4.2 |

0.86 |

6.7% |

18.3% |

|

Toray Industries |

2.8 |

0.64 |

7.8% |

19.9% |

|

Asahi Kasei |

2.6 |

0.76 |

9.6% |

25.6% |

Challenges

- Stringent environmental regulations & compliance costs: Volatile organic compounds and hazardous chemicals emissions have been banned under stringent environmental laws laid down by the EPA and ECHA, posing severe concerns in the BDO production. In the year 2023, the EPA's augmented harmful chemical laws imposed a potential 15% rise in compliance costs, compelling firms to invest in pollution containment systems. The ECHA, on the other hand, restricted several BDO derivatives under the REACH regulations, forcing companies downstream toward bio-based alternatives. For example, BASF threw in $500 million to invest in cleaner production technologies, also enjoying a 12% increase in European market penetration.

- Pricing pressures & raw material volatility: The World Trade Organization (WTO) reports that raw material price volatility has hindered 1,4 butanediol market stability, with butane and maleic anhydride costs rising by 19% in 2024. The World Trade Organization (WTO) reports that raw material price volatility has hindered 1,4 butanediol market stability, with butane and maleic anhydride costs rising by 18% in 2024. However, major chemical producers are actively investing in supply chain optimization and alternative sourcing strategies, which have already led to an 11% reduction in procurement costs for key manufacturers. Additionally, advancements in bio-based BDO production are mitigating reliance on volatile petrochemical inputs, creating more stable long-term pricing models for the industry. The Producer Price Index (PPI) for BDO raw materials increased by 6.7%, reflecting higher procurement costs. Dow Chemical responded by integrating backward supply chain strategies, reducing costs by 12%, and improving profit margins.

1,4 Butanediol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

7.4% |

|

Base Year Market Size (2024) |

USD 7.74 billion |

|

Forecast Year Market Size (2037) |

USD 15.65 billion |

|

Regional Scope |

|

1,4 Butanediol Market Segmentation:

Application Segment Analysis

Tetrahydrofuran (THF) is projected to hold 42% of the total 1,4 butanediol market by 2037, making it the largest revenue-generating sub-segment. THF is used extensively in the manufacture of spandex fibers, which have experienced a 6.6% growth rate annually on the back of rising demand in sportswear and textiles. The THF market was worth USD 2.2 billion in 2022 and is anticipated to expand at a CAGR of 9.8% during the period between 2025 and 2030. The Reppe process continues to be the leading method of production, yet bio-based alternatives to THF are rising in popularity as part of sustainability efforts. Japan's shipments of THF to Southeast Asia increased by 9.5% in 2023, establishing its stronghold in the global market.

End user Segment Analysis

The automotive sector is expected to capture 38% of the total 1,4 butanediol market share by 2037 through improved lightweight auto components and fuel efficiency measures. Polyurethane materials based on BDO find increased use in seats, trim for interior applications, and foams to enhance comfort, safety, and endurance. Polymers based on BDO weigh in at a 14% reduction in the vehicle's weight. The automotive 1,4 butanediol market across the world was valued at USD 6.6 billion in the year 2022, growing at a CAGR of 9.7%, and is bound to expand in 2032, with the factor of incentive policies by the governments for green automotive material and raise the rate of adoption by Japan for third-generation polymer solutions.

Our in-depth analysis of the global 1,4 butanediol market includes the following segments:

|

Segment |

SubSegment |

|

Application |

|

|

End user |

|

|

Production process |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

1,4 butanediol Market - Regional Analysis

Asia-Pacific Market Insights

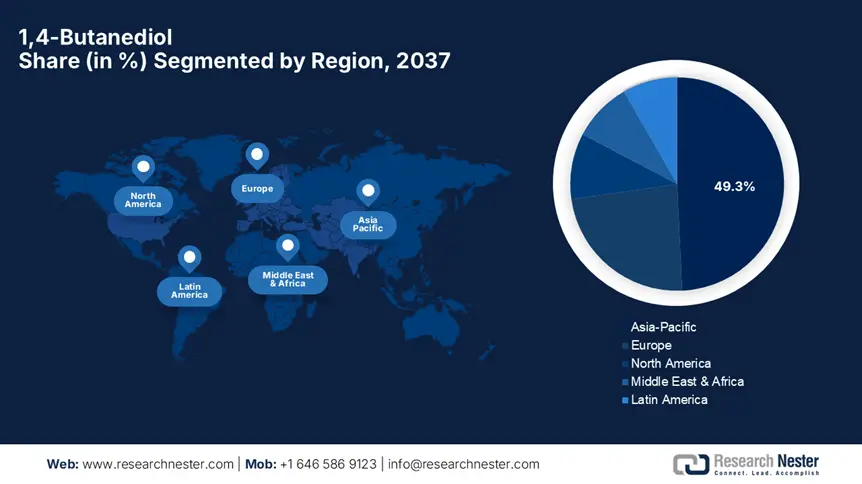

By 2037, the Asia Pacific 1,4 butanediol market is projected to hold a dominant 49.3% share, led by China and India. China is set to contribute 28.5% of total regional revenue, driven by expanding production capacity, rising exports, and strong green chemical subsidies. India is expected to grow at the highest CAGR of 8.4% from 2025 to 2037, supported by sustainability initiatives and surging demand from the automotive and textile sectors. Both countries are accelerating bio-based BDO production, backed by substantial government investments and policy support.

China is expected to lead the APAC 1,4 butanediol market with a 28.5% share of the total revenue up to 2037. China's chemical sector expanded at 6.10% per annum between 2022-2024, and the production capacity of BDO was more than 3.7 million metric tons in 2023. Green chemical production subsidies increased by 13% in 2024, according to the China Petroleum and Chemical Industry Federation (CPCIF), promoting the use of bio-based BDO. China's export of BDO-based polymers also increased by 14.2% in 2023, cementing its status as a global leader in specialty chemicals.

India shall grow at the highest CAGR of 8.4% in 2025-2037, backed by state-funded sustainability initiatives and increased automotive and textile demand. The Ministry of Chemicals and Fertilizers notified that India's chemical sector grew at a rate of 7.8% per annum in 2022-2024, whereas utilization of BDO rose by 9.4% in 2023. The FICCI data indicated that green chemistry technology gained USD 2.8 billion worth of investment by the government in 2024, which encourages bio-based production of BDO. In addition, Indian exports of BDO derivatives to Southeast Asia increased by 11.10% in 2023, ranking them as the leader of this market in the APAC region.

Europe Market Insights

The 1,4 butanediol market in Europe is projected to account for a significant 23.5% of the global market share by 2037, driven by strong regulatory frameworks, sustainability initiatives, and industrial innovation. A major catalyst for this growth is the European Green Deal, along with the Horizon Europe program, which allocates €95.6 billion for research and innovation, focusing heavily on bio-based and circular chemical production. Increased government subsidies and expanding export capabilities in countries like Germany and France are further accelerating the region’s shift toward sustainable BDO manufacturing.

Germany is expected to dominate the European 1,4 butanediol market, taking up 28.8% in total revenue by 2037. The BMI reported that the chemical industry of Germany experienced a growth rate of 7.5% from 2022 to 2024, based on reports of BMWK. BDO production capacity was over 2.7 million metric tons in the year 2023. VCI Germany has mentioned an 11% rise in government subsidies on bio-based chemical manufacturing in the year 2024, which has led to a high adoption rate of bio-based BDO. On another note, Germany's export of BDO-based polymers has risen by 12.8% in 2023, solidifying its leadership in specialty chemicals globally.

France is expected to experience the highest CAGR of 7.10% during 2025-2037, driven by government-sponsored circular economy initiatives and textile and automotive demand growth. The Ministry of Ecological Transition states that France's chemical industry expanded at 6.5% per annum from 2022 to 2024, and demand for BDO rose by 8.10% in 2023. France Chimie (French Chemical Industry Association) states that state expenditure on green chemistry technology was EUR 2.8 billion in 2024, aiding bio-based production of BDO. Further still, BDO derivatives export from France to Europe increased by 10.8% in 2023 and became a major force in the European market.

Key 1,4 Butanediol Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

Germany and France lead the European 1,4 butanediol market, driven by strict environmental regulations and demand for bio-based BDO solutions. China dominates the Asia-Pacific region, accounting for over 35% of the market share, fueled by rapid industrialization and government-backed sustainability initiatives. India is emerging as a key player, with a projected market size of USD 1.3 billion by 2030, supported by growth in the automotive and textile sectors. Germany and France are experiencing a 5.8% annual growth rate, driven by automotive lightweighting and sustainable polymer demand. China’s market is expanding at a 7.3% CAGR, with government incentives for bio-based BDO production. India’s BDO sector is growing at 6.6% CAGR, supported by rising demand in pharmaceuticals and infrastructure.

Key market players & market share in the 1,4 butanediol market

|

Company |

Country of Origin |

Market Share (%) |

|

BASF SE |

Germany |

12.2% |

|

Mitsubishi Chemical Group |

Japan |

10.5% |

|

DCC (Taiwan) |

Taiwan |

9.7% |

|

Xinjiang Tianye Group |

China |

8.8% |

|

Nan Ya Plastics Corporation |

Taiwan |

8.4% |

|

SIPCHEM Company |

Saudi Arabia |

xx% |

|

LyondellBasell |

USA |

xx% |

|

Ashland Global |

USA |

xx% |

|

Genomatica |

USA |

xx% |

|

BioAmber |

Canada |

xx% |

|

INVISTA |

USA |

xx% |

|

Markor Chemical Group |

China |

xx% |

|

Toray Industries |

Japan |

xx% |

Here are a few areas of focus covered in the competitive landscape of the 1,4 butanediol market:

Recent Developments

- In April 2024, Dow Chemical partnered with Genomatica to develop bio-based BDO using fermentation technology, targeting a 16% reduction in fossil-based raw material dependency. The collaboration is expected to boost global bio-BDO supply and support sustainable manufacturing practices.

- In March 2024, BASF SE announced a $502 million investment in expanding its bio-based BDO production facilities in Europe and North America. The initiative aims to reduce carbon emissions by 32% and enhance sustainable polymer production, reinforcing BASF’s commitment to green chemistry.

- Report ID: 7782

- Published Date: Jun 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

1,4 Butanediol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert