Polymer Concrete Market Outlook:

Polymer Concrete Market size was valued at USD 655.8 billion in 2025 and is projected to reach USD 1.21 trillion by the end of 2035, rising at a CAGR of 6.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of polymer concrete is estimated at USD 697.7 billion.

The public sector infrastructure investment and asset rehabilitation programs are the primary growth drivers of the polymer concrete market across various sectors, such as water transport and industrial facilities. Further, the factors such as chemical resistance and superior durability, reducing long-term maintenance costs, are driving the adoption of the polymer concretes. According to the U.S. Department of Transportation data in February 2023, USD 550 billion was allocated in new federal spending, including USD 110 billion for roads and bridges, with a significant share allocated to repair, resurfacing, and structural rehabilitation rather than new builds. Besides, the Alliance for Innovation and Infrastructure report in June 2024 shows that nearly 42% of the U.S. bridges are 50 years old, and 7.5% bridges are structurally deficient, driving demand for rapid-setting, corrosion-resistant repair materials used in deck overlays, joint repairs, drainage components, and precast systems.

Similarly, the World Institute Resource data in May 2022 indicates that the Bipartisan Infrastructure Law has roughly allocated investment in bridges, transit, roads, and rail, with surface transportation valued USD 600 billion of the roughly USD 1 trillion authorized. This data indicates a sustained procurement of durable repair materials within federally funded programs rather than cyclical private construction demand. Moreover, the wastewater and industrial corrosion control represent a second structurally resilient demand pillar. As stated in the U.S. Environmental Protection Agency's May 2024 report, nearly USD 630 billion is required over 20 years to maintain and upgrade drinking water and wastewater infrastructure, including treatment plants, pump station and sewer networks. Collectively, these data indicate direct support for the specification and adoption of polymer concrete for new builds and repairs.

Key Polymer Concrete Market Insights Summary:

Regional Highlights:

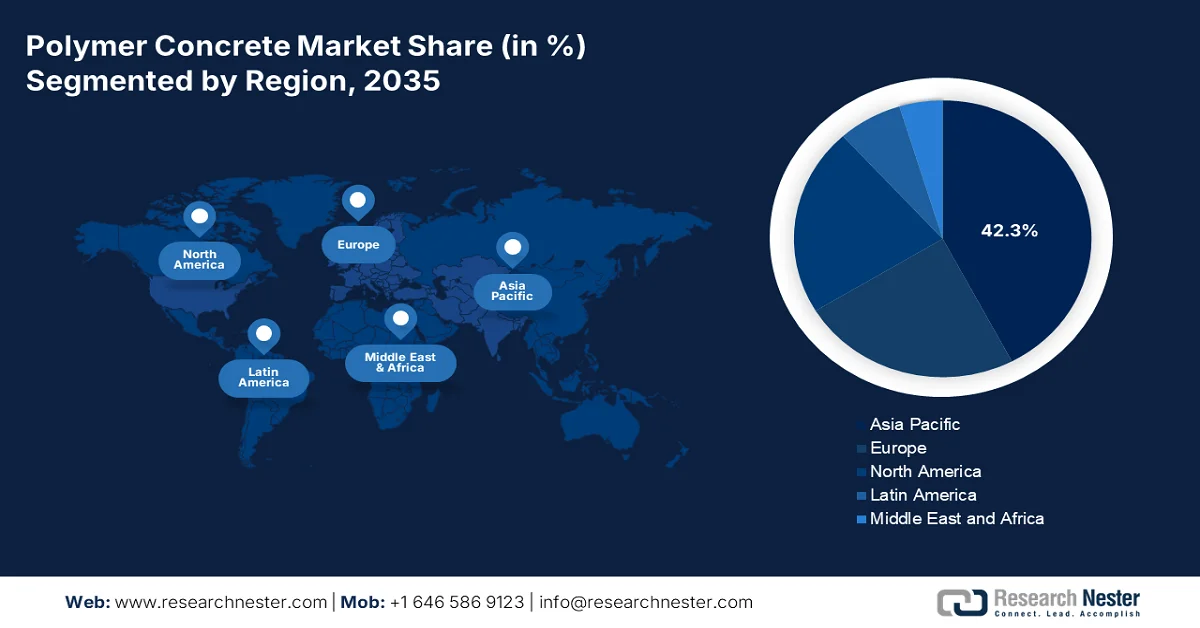

- Asia Pacific is expected to command 42.3% revenue share by 2035 in the polymer concrete market, reflecting strong regional dominance supported by large-scale urbanization and public infrastructure expansion underpinned by government-led infrastructure modernization mandates.

- North America continues to demonstrate stable adoption momentum through the forecast period, with sustained demand across transportation and water infrastructure upgrades anchored in stringent environmental compliance requirements.

Segment Insights:

- Pre-cast Manufacturing Process Segment is projected to account for over 60.5% share by 2035 in the polymer concrete market, supported by superior factory-controlled quality, faster installation, and reduced project timelines driven by demand for efficient high-quality infrastructure solutions.

- Polymer Concrete Class Segment is expected to hold a significant share by 2035, reflecting its high chemical resistance, rapid curing, and extended service life in demanding applications reinforced by government-backed infrastructure modernization.

Key Growth Trends:

- Government water and wastewater infrastructure funding

- Government led industrial corrosion mitigation initiatives

Major Challenges:

- High raw material volatility and cost

- Competition from established substitute materials

Key Players: BASF SE (Germany), Dow Inc. (U.S.), Sika AG (Switzerland), Mapei S.p.A. (Italy), Fosroc International Ltd. (UK), Wacker Chemie AG (Germany), Dudick Inc. (U.S.), Kwik Bond Polymers LLC (U.S.), Forte Composites Inc. (U.S.), ACO Group (Germany), Sauereisen (U.S.), Citadel Flooring (UK), Simplex Chemical Resins Co. (India), Hexion Inc. (U.S.), Ulma - Architectural Solutions (Spain), Armorock (U.S.), Hankon Co., Ltd. (South Korea), Toagosei Co., Ltd. (Japan), Civacon (Australia), Cormix Construction Chemicals (Malaysia).

Global Polymer Concrete Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 655.8 billion

- 2026 Market Size: USD 697.7 billion

- Projected Market Size: USD 1.21 trillion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: India, Vietnam, Indonesia, Brazil, Mexico

Last updated on : 5 February, 2026

Polymer Concrete Market - Growth Drivers and Challenges

Growth Drivers

- Government water and wastewater infrastructure funding: The U.S. federal investment in drinking water, wastewater, and stormwater systems is a direct growth driver for the polymer concrete market due to the scale, duration, and material requirements of EPA-funded projects. According to the U.S. EPA May 2024 data, President Biden’s Bipartisan Infrastructure Law commits USD 50 billion to water infrastructure upgrades, including nearly USD 13 billion for wastewater and stormwater management, while the clean water state revolving fund financed over USD 160 billion in infrastructure projects. These funds are deployed in municipally owned sewer networks, pumping station and treatment plans where corrosion resistance and long service life are prioritized to reduce the lifecycle maintenance costs. As utilities increasingly align procurement decisions with durability and asset-longevity objectives under federal funding frameworks, polymer concrete adoption benefits from predictable, multi-year public capital expenditure rather than short-term construction cycles.

- Government led industrial corrosion mitigation initiatives: Corrosion-related asset dehydration drives the public and quasi-public procurement of polymer concrete market in industrial and utility settings. As per the IOP Science 2022 data, the cost of corrosion worldwide increased to over USD 2.5 trillion, with wastewater energy and transport infrastructure among the most affected public assets. Governments increasingly integrate corrosion reduction into the capital planning for industrial zones, ports, and publicly owned utilities. The U.S. Department of Energy also highlights corrosion control as a priority in energy infrastructure resilience planning. Moreover, the demand for the industrial polymer concrete is increasingly policy-driven rather than discretionary, tied to public ownership of assets and government-backed industrial resilience programs.

Global Cost of Corrosion Regional Based

|

Economic regions

|

Agriculture CoC USD billion |

Industry CoC USD billion |

Services CoC USD billion |

Total CoC USD billion |

Total GDP USD billion |

CoC % GDP |

|

U.S. |

2.0 |

303.2 |

146.0 |

451.3 |

16,720 |

2.7% |

|

India |

17.7 |

20.3 |

32.3 |

70.3 |

1,670 |

4.2% |

|

European region |

3.5 |

401 |

297 |

701.5 |

18,331 |

3.8% |

|

Arab world |

13.3 |

34.2 |

92.6 |

140.1 |

2,789 |

5.0% |

|

China |

56.2 |

192.5 |

146.2 |

394.9 |

9,330 |

4.2% |

|

Russia |

5.4 |

37.2 |

41.9 |

84.5 |

2,113 |

4.0% |

|

Japan |

0.6 |

45.9 |

5.1 |

51.6 |

5,002 |

1.0% |

|

Four Asian Tigers+Macau |

1.5 |

29.9 |

27.3 |

58.6 |

2,302 |

2.5% |

|

Others |

52.4 |

382.5 |

117.6 |

552.5 |

16,057 |

3.4% |

|

Global |

152.7 |

1446.7 |

906.0 |

2505.4 |

74,314 |

3.4% |

Source: IOP Science 2022

- Growth in public transportation and urban mobility projects: The urban transit expansion and modernization programs drive the polymer concrete demand in station platforms, cable trenches, and drainage systems. According to the Streets Blog USA in September 2025 data, the National Highway Performance Program contracts for USD 30 billion annually to public transportation via formula and capital investment grants. Additionally, the WHO 2026 report shows that nearly 68% of the global population will live in urban areas by 2050, pressuring governments to invest in durable urban transport infrastructure. These projects prioritize fast construction schedules and low-disruption materials in dense urban environments. Furthermore, this sustained funding pipeline reinforces long-term demand across transit-linked concrete applications.

Challenges

- High raw material volatility and cost: The cost of key petrochemical-derived resins is highly volatile, tied to the crude oil prices and supply chain disruptions. This makes the production cost forecasting and competitive pricing difficult for new entrants in the polymer concrete market. The major players reduce this via long-term supplier contracts and vertical integration, producing their own resin precursors. Further, the resin prices are fluctuating and squeezing the margins of the manufacturers.

- Competition from established substitute materials: Polymer concrete market players compete with well-entrenched lower-cost materials such as Portland cement, concrete, steel, and fiberglass. Convincing engineers and specifiers to switch requires demonstrable lifecycle cost advantages. Top players tackle this by providing extensive free technical support and the lifecycle cost analysis software to engineers, proving long-term savings from durability and reduced maintenance.

Polymer Concrete Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 655.8 billion |

|

Forecast Year Market Size (2035) |

USD 1.21 trillion |

|

Regional Scope |

|

Polymer Concrete Market Segmentation:

Manufacturing Process Segment Analysis

The pre-cast segment is projected to hold over 60.5% polymer concrete market share by the end of 2035. The dominance is due to the superior quality control, faster on-site installation, and precise engineering achievable in a controlled factory environment. The pre-cast polymer concrete components, such as trench drains, manholes, and architectural panels, are manufactured off-site and then shipped for rapid assembly, reducing the project timelines and labor costs. The demand for efficient high-quality infrastructure solutions supports this trend. According to the Maine.gov June 2023 report, the NAICS code 327390 related to the other concrete manufacturing which include the pre cast concrete has generated USD 46.47 million in total purchases, of which USD 29.82 million (64.2%) were sourced in-state and USD 16.65 million (35.8%) were imported, indicating moderate local manufacturing capacity but a clear opportunity to substitute imports through expanded specialty and precast concrete production.

Class Segment Analysis

The polymer concrete is leading and is poised to hold a significant share value in the polymer concrete market. The polymer concrete uses a polymer resin as a sole binder, completely replacing the traditional Portland cement, which results in exceptional chemical resistance, very high strength, and rapid curing. These properties make it the material of choice for the most demanding applications in corrosive industrial and wastewater environments. Its growth is directly tied to infrastructure renewal. Besides the NLM study, June 2021 highlights that the polymer concrete improves the mechanical strength by 25%. Moreover, reduced maintenance cycles and extended service life make polymer concrete economically favorable for asset owners facing rising lifecycle costs. On the other hand, the government-backed infrastructure modernization reinforces the long-term adoption across the developed infrastructure market.

Resin Type Segment Analysis

The epoxy is leading the resin type segment in the polymer concrete market, both in value and volume. The epoxy-based polymer concrete is favored for its superior mechanical properties, including excellent adhesion, high compressive and tensile strength, and outstanding resistance to a wide range of chemicals and solvents. This makes it the premier choice for critical infrastructure, industrial flooring, and containment applications. The growth is driven by the environmental regulations. Besides the NLM study, December 2022 shows that the epoxy resin-based polymer concrete or composite formulations, where epoxy (EP/ER 430 series) acts as the primary binder, and performance is tuned using sonication, microsilica, and carbon nanotube additives to enhance the mechanical strength and dispersion efficiency.

Epoxy Recipes Research Series

|

Series |

Resin Type |

Type of Additive/Modification |

Amount of Filler (%) |

Amount of Hardener (%) |

|

EP430 |

epoxy |

— |

— |

3 |

|

ER430/US |

sonication |

— |

3 |

|

|

ER430/US/MS |

sonication + microsilica |

0.5 |

3 |

|

|

EP430/US/NT |

sonication + carbon nanotubes |

0.1 |

3 |

Source: NLM December 2022

Our in-depth analysis of the polymer concrete market includes the following segments:

|

Segment |

Subsegments |

|

Resin Type |

|

|

Class |

|

|

Manufacturing Process |

|

|

Grade |

|

|

Application |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polymer Concrete Market - Regional Analysis

APAC Market Insights

The Asia Pacific polymer concrete market is dominating and is poised to hold the regional revenue share of 42.3% by 2035. The dominance is due to the government-led infrastructure development, rapid urbanization, and urgent urban utility upgrades. The massive national initiatives create a sustained demand for durable, low-maintenance construction materials. A primary driver is the region’s focus on building new water treatment, industrial processing, and transportation infrastructure, where polymer concrete’s corrosion resistance and fast installations are vital. The trend is strongly toward using polymer concrete components to meet the aggressive project timelines. Moreover, stringent new environmental regulations aimed at controlling industrial pollution are also mandating the use of advanced containment and treatment systems, further embedding polymer concrete in public and private sector specifications.

The polymer concrete market in India is driven by the sustained central and state government investment in transportation, urban infrastructure, and water systems under multi-year public spending programs. According to the PIB January 2025 report, India’s national highway network expanded over 146,000 kilometers by 2023, with annual capital outlays exceeding a trillion, a portion of which is allocated to asset upgrading and rehabilitation. Moreover, the Current World Environment Journal has published a study on the management of urban water resources in July 2025. The study shows that nearly 145 lakh sewer connections and 39 lakh water tap connections were installed in the chosen 500 cities under the AMRUT Mission. These expansions increase the demand for corrosion resistant low maintenance construction materials. This further boosts the adoption of polymer concrete, creating a positive impact on the market.

The massive and continuous expansion of road, rail, and urban transport networks drives the sustained demand for the polymer concrete market in China. These concrete materials are durable, low-maintenance construction materials. As per the People’s Republic of China, October 2024 data, with 5.4 million kilometers of roads, 160,000 kilometers of railways, and over 10,000 kilometers of urban rail lines, there is an ongoing rehabilitation, expansion, and modernization of transport infrastructure. The rural road expansion, which is 4.6 million kilometers, and high urbanization further increase the requirements for drainage systems, cable trenches, platforms, and bridges, where corrosion resistance, high durability, and rapid installations are significant. the government backed modernization and urban mobility programs create a stable demand for polymer concrete and thus proliferate the market’s growth.

North America Market Insights

The polymer concrete market demand in North America is driven by the aging infrastructure renewal and stringent environmental regulations. The market growth is reliant on the regulation-driven compliance-focused industry with demand anchored in large-scale public infrastructure renewal and stringent environmental mandates. The critical need for durable, long-life repair materials in transportation and water systems is directly demanding the polymer concrete market. further the investments in the corrosion-resistant construction material for industrial and municipal wastewater infrastructure, making polymer concrete a specified material for containment and treatment projects. This creates a stable non-discretionary demand landscape where product specification is based on total lifecycle cost and regulatory adherence rather than initial price, with a pronounced trend toward prefabricated polymer concrete components for efficiency in both public works and heavy industry applications.

The U.S. polymer concrete market is strongly supported by the federal infrastructure spending mainly in transportation and water systems, where durability and lifecycle performance are procurement priorities. According to the U.S. Federal Highway Administration, January 2022 data, nearly 46,000 bridges in the U.S. are classified as in poor condition, driving the modernization-focused material demand. Besides, the U.S. Department of Transportation 2025 report depicts that the federal aid highway obligations and emergency relief funding totaling USD 72.3 billion are highly used in highway infrastructure program projects, bridge rehabilitation, drainage systems, and so on. These categories are the primary application areas for the polymer concrete, prioritizing durability, reduced maintenance frequency, and rapid construction timelines.

Federal Highway Administration Budget (2025)

|

Parameter |

Request |

Supplemental |

Total Budget |

|

FEDERAL-AID HIGHWAYS (OBLIM) |

62,114,171 |

|

62,114,171 |

|

Exempt Obligations |

602,577 |

|

602,577 |

|

Emergency Relief |

94,300 |

|

94,300 |

|

Highway Infrastructure Program |

|

9,454,400 |

9,454,400 |

|

Total |

62,811,048 |

9,454,400 |

72,265,448 |

Source: U.S. Department of Transportation 2025

The polymer concrete market in Canada is primarily supported by the sustained federal and provincial investment in transportation, water, and climate-resilient infrastructure. According to the Government of Canada, January 2025 data, under the Investing in Canada Infrastructure Program, USD 33 billion is delivered towards the funding for public transit, green infrastructure, and community infrastructure, with a part of the share allocated for the rehabilitation of roads, bridges, and municipal assets. Besides, the 2025 Association of Manitoba Municipalities data depicts that 60% of public infrastructure assets, many of which are aging and require corrosion-resistant and low-maintenance construction materials. Further, the federally supported programs create a stable demand for durable concrete solutions and support long-term polymer concrete adoption by prioritizing lifecycle performance over upfront construction costs.

Europe Market Insights

The polymer concrete market in Europe is expanding rapidly and is driven by the stringent EU-wide environmental regulations and significant funding for infrastructure cohesion and modernization. The core demand stems from the need to rehabilitate aging wastewater treatment plants and transportation networks to comply with the directives, such as the EU urban wastewater treatment directive, which is undergoing a major revision to enforce the higher standards. Further, the funding from the EU recovery and resilience facility prioritizes the green transition and digital infrastructure, creating direct opportunities for durable materials in public works. A key trend is the strong shift toward circular economy principles pushing manufacturers to develop formulations with higher recycled content and lower carbon footprints to meet both regulatory demands and public procurement criteria focused on sustainability.

The polymer concrete market in Germany is underpinned by the sustained federal investment in transport infrastructure renewal, municipal utilities, and climate-resilient construction under the federal transport infrastructure plan and related funding frameworks. The growth is further supported by the scale and continuous modernization of one of the world’s most extensive transport infrastructures. According to the Federal Ministry of Research, Technology, and Space report in July 2023, the country operates around 830,000 kilometers of road, including 13,000 kilometers of motorways, alongside 38,400 kilometers of rail networks, all of which require regular rehabilitation to maintain performance and safety standards. These rehabilitation-led programs prioritize durable, low-maintenance materials to reduce the lifecycle costs and traffic disruption across high-utilization corridors. This results in the adoption of polymer concrete in drainage systems, cable trenches, and precast transport components funded via federal and State budgets.

The UK polymer concrete market is supported by the sustained government investment in transport infrastructure, renewal of water utilities, and climate-resilient urban development. According to the Network Rail Center May 2023 report, the government has invested 44 billion euros in rail infrastructure, including the major programs such as Network Rail’s control period 7, which highlights the maintenance and renewal of existing assets rather than network expansion. Moreover, the report from National Highways, June 2022, depicts that the national highways manage and operate more than 4,500 miles of strategic road network, much of which requires ongoing rehabilitation to address asset aging and traffic growth. These publicly funded programs prioritize durable, low-maintenance materials, reinforcing stable demand for polymer concrete in rehabilitation-focused transport projects.

Key Polymer Concrete Market Players:

- BASF SE (Germany)

- Dow Inc. (U.S.)

- Sika AG (Switzerland)

- Mapei S.p.A. (Italy)

- Fosroc International Ltd. (UK)

- Wacker Chemie AG (Germany)

- Dudick Inc. (U.S.)

- Kwik Bond Polymers LLC (U.S.)

- Forte Composites Inc. (U.S.)

- ACO Group (Germany)

- Sauereisen (U.S.)

- Citadel Flooring (UK)

- Simplex Chemical Resins Co. (India)

- Hexion Inc. (U.S.)

- Ulma - Architectural Solutions (Spain)

- Armorock (U.S.)

- Hankon Co., Ltd. (South Korea)

- Toagosei Co., Ltd. (Japan)

- Civacon (Australia)

- Cormix Construction Chemicals (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE is a foundational player in the polymer concrete market, using its vast chemical expertise to innovate advanced resin systems such as epoxy and vinyl ester. Their strategic initiatives focus on developing sustainable low-VOC formulations and providing complete systems solutions that combine high-performance binders with technical support. According to the 2024 annual report, the company has made sales of 15.9 billion euros in the Asia Pacific region.

- Dow Inc uses its leadership in polymer chemistry to drive the expansion in the polymer concrete market via advanced epoxy and polyurethane resin technologies. The key strategies include high R&D to enhance product durability and chemical resistance, and forming strategic partnerships with construction chemical distributors and precast manufacturers. The company’s annual income in 2024 accounted for USD 1,201 billion.

- Sika AG pursues aggressive growth in the polymer concrete market via its dual strategy of innovation and acquisition. The company develops specialized mortars and grouts for rapid repair and corrosion protection, directly targeting the wastewater and transportation sectors.

- Mapei S.p.A has positioned itself as a leader in the polymer concrete market via a deep specialization in high-performance repair and flooring systems. The company’s strategy revolves around controlling production from raw material to finished goods, vertical integration, and ensuring quality and supply chain efficiency.

- Fosroc International Ltd competes actively in the polymer concrete market by focusing on engineered solutions for niche demanding applications in mining, energy, and heavy industry. Their strategic initiative is to provide complete certified systems, including binders, aggregates, and installation expertise that guarantee performance in extreme conditions.

Here is a list of key players operating in the global polymer concrete market:

The global polymer concrete market features a competitive mix of established international players and strong regional specialists. The key players from the U.S. and Europe dominate via extensive R&D, global distribution networks, and product portfolios. Strategic initiatives aim at expanding the production capacity, developing eco-friendly formulations, and pursuing strategic mergers and acquisitions to enter new regional markets. In April 2024, Sika acquired Kwik Bond Polymers, LLC, for the refurbishment of concrete infrastructure. The business complements Sika’s high-value-added systems for the refurbishment of concrete structures. Companies are also heavily investing in technical support and customized solutions for critical end-use sectors such as wastewater management, chemicals, and civil infrastructure to build long term client partnerships and secure large-scale projects.

Corporate Landscape of the Polymer Concrete Market:

Recent Developments

- In October 2025, Arclin, a leading material science company, announced that it has completed the purchase of Polymer Solutions Group, a manufacturer of proprietary and custom polymer additives, dispersions and release agents for the rubber, plastic and engineered wood industries.

- In October 2024, Vebro Polymers, in partnership with Thermax Chemical Solutions Private Limited, a wholly owned subsidiary of Thermax announced its collaboration to form Thermax Vebro Polymers India Private Limited. This partnership will see the two companies dive headfirst into the growing Indian industrial and commercial flooring market.

- In July 2024, Master Builders Solutions has announced the launch of MasterGlenium SKY 925, which is a superplasticizer based on a unique blend of state-of-the-art polymers. MasterGlenium SKY 925 is specially engineered for ready-mix concrete.

- Report ID: 3431

- Published Date: Feb 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polymer Concrete Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.