Plasma Expressor Machine Market Outlook:

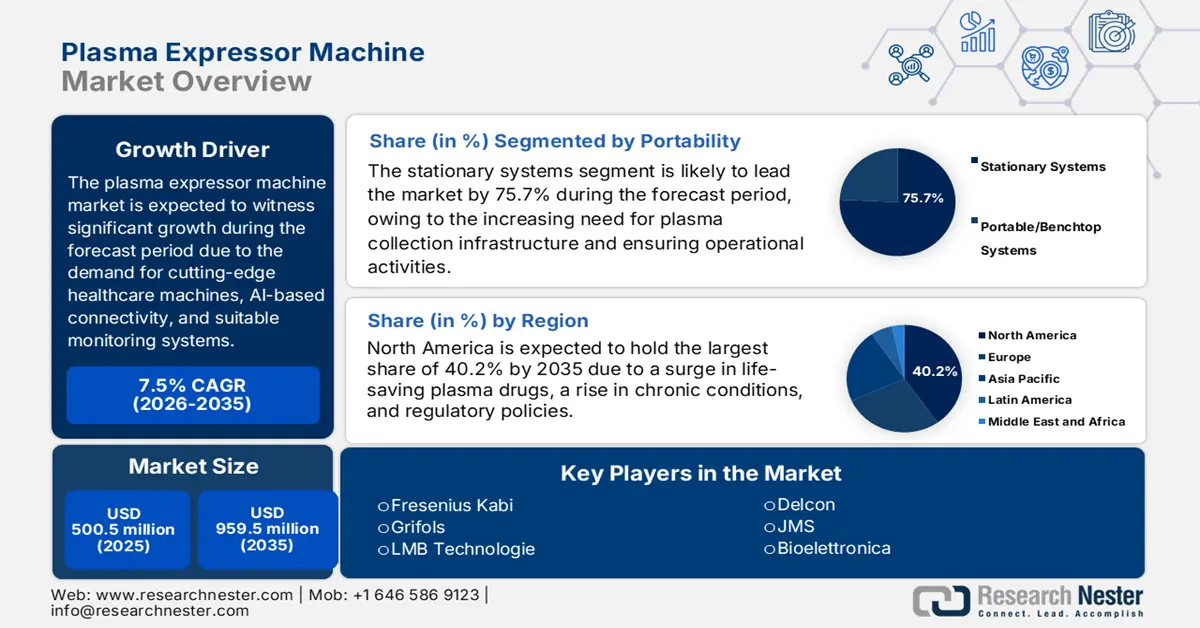

Plasma Expressor Machine Market size was USD 500.5 million in 2025 and is anticipated to reach USD 959.5 million by the end of 2035, increasing at a CAGR of 7.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of plasma expressor machine is assessed at USD 538.0 million.

The worldwide market is readily witnessing a rapid shift from semi-automated to completely automated systems. Based on this aspect, next-generation healthcare machines, such as yield optimization analytics, the Internet of Things (IoT) connectivity, and donor-based design, are readily driving the market across different nations. According to an article published by NLM in October 2022, the development of an intelligent monitoring system has uplifted healthcare systems by an estimated 95% in all medical cases. Besides, a notable information-processing system for IoT-centric health monitoring systems has achieved 97% accuracy, thereby making it suitable for the overall market.

Furthermore, an expansion of the reagent rental business model, strategic focus on emerging economies, and a rise in pathogen reduction technologies are also boosting the market globally. In addition, there has been a surge in both chronic and multiple chronic conditions, which is also uplifting the market worldwide. Regarding this, an article has been published by NLM in April 2025, wherein an estimated 194 million adults in America, 6 in 10 young adults, 8 out of 10 middle-aged adults, and 9 in 10 older people readily suffer from more than one chronic condition. This has created a positive impact for expanding the market not only in America, but in other countries as well.

Key Plasma Expressor Machine Market Insights Summary:

Regional Highlights:

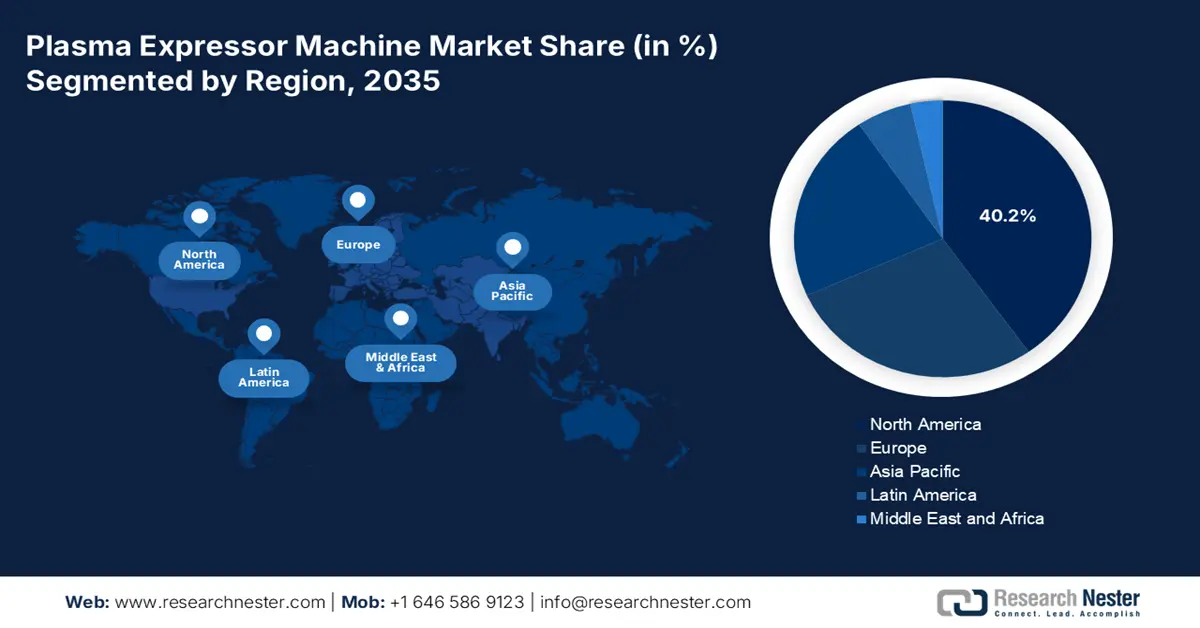

- North America is anticipated to hold a 40.2% share by 2035, owing to the rising need for life-saving plasma-derived drugs, technological integration, and supportive policies.

- Asia Pacific is projected to emerge as the fastest-growing region during the forecast period, propelled by rapid healthcare expansion and increasing plasma therapy demand.

Segment Insights:

- Stationary systems are anticipated to account for the largest share of 75.7% by 2035, driven by high-volume plasma collection requirements and centralized operational efficiency.

- Automated systems are projected to register the second-largest share during the forecast period, owing to enhanced accuracy and productivity in plasma processing.

Key Growth Trends:

- An increase in the demand for plasma-derived therapies

- Surge in blood disorder cases

Major Challenges:

- Absence of regional plasma supply

- Capital investment constraints and public payer coverage gaps

Key Players: Fresenius Kabi, Grifols, LMB Technologie, Delcon, JMS, Bioelettronica, Demophorius Healthcare, Macopharma, BMS K Group, Nigale, BIOBASE, Weigao Group, Meditech Technologies, Labtop Instruments, Suzhou Medical Instrument.

Global Plasma Expressor Machine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 500.5 million

- 2026 Market Size: USD 538.0 million

- Projected Market Size: USD 959.5 million by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 13 October, 2025

Plasma Expressor Machine Market - Growth Drivers and Challenges

Growth Drivers

- An increase in the demand for plasma-derived therapies: These particular therapies are essential for the market since they can aid rare diseases, such as immunodeficiency and hemophilia diseases, by offering crucial antibodies, clotting factors, and proteins. According to an article published by NLM in October 2023, the overall success rate of platelet-rich plasma (PRP) is considered 54.8% and it has been successful for relieving more than 50% of patients globally, thus making it appropriate for the market’s successful growth.

- Surge in blood disorder cases: The aspect of an increase in these diseases that demand plasma-centric therapeutic solutions, including lymphoma, leukemia, hemophilia, and autoimmune disorders, has readily spurred the requirement for the market internationally. As per an article published by the World Health Organization (WHO) in 2025, approximately 40% of children between 6 to 59 months, 37% of pregnant women, and 30% of women between 15 to 49 years are affected with anaemia. Therefore, this has denoted a huge growth opportunity and increased demand for the overall market globally.

- Government strategies for plasma self-sufficiency: This driver is essential for the market to effectively guarantee national health security solutions by offering continuous and timely accessibility to crucial plasma-based medical products. These are suitable for patients, depending on them for successfully aiding illnesses, such as bleeding disorders and immune-based deficiencies. As stated in the 2024 Directorate General of Health Services data report, Blood Transfusion Services effectively supports 1,131 blood banks in India, and based on this, currently there are 4,263 licensed blood facilities, which are positively impacting the market.

Tool Plates 2023 Export and Import Data Uplifting the Plasma Expressor Machine Market

|

Components/Countries |

Export |

Import |

|

Germany |

USD 1.0 billion |

USD 778 million |

|

Japan |

USD 874 million |

- |

|

China |

USD 695 million |

- |

|

U.S. |

- |

USD 972 million |

|

Netherlands |

- |

USD 355 million |

|

Global Trade |

USD 6.1 billion |

|

|

Global Trade Share |

0.027% |

|

|

Product Complexity |

1.36 |

|

Source: OEC

Challenges

- Absence of regional plasma supply: The market is experiencing minimal hindrance, since a few countries are successfully processing plasma at home, and the majority of nations are effectively dependent on plasma imports. The lack of a significant regional supply of plasma indicates that there is reduced economic, strategic, and operational pressure to retain or procure plasma expressor machines. This has readily resulted in poorly utilized equipment, thereby creating a shrink regarding incentive for investing and developing infrastructure, which are essential for building capacity.

- Capital investment constraints and public payer coverage gaps: The market demands extended infrastructure, which includes educated staff members, safety monitoring, and refrigerators. The government has stated that across low- and middle-income countries, budget constraints have massively diminished the capability of health centers to purchase capital equipment. Besides, purchasing plasma expressor machines has been limited due to a lack of direct funding initiatives through the presence of the public system for either the machinery or the equipment consulting devices.

Plasma Expressor Machine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 500.5 million |

|

Forecast Year Market Size (2035) |

USD 959.5 million |

|

Regional Scope |

|

Plasma Expressor Machine Market Segmentation:

Portability Segment Analysis

Based on portability, the stationary systems segment is anticipated to garner the largest share of 75.7% by the end of 2035. The segment’s growth is driven by the operational demand for high-volume plasma collection facilities, which form the crucial aspect of the international supply chain. These facilities have readily prioritized the aspect of integration, reliability, and throughput over mobility. Besides, stationary systems are effectively engineered for ongoing and high-capacity operational activities, frequently focusing on strong components, seamless connectivity, and massive onboard reagent capacities with centralized data management systems.

Product Type Segment Analysis

Based on the product type, the automated systems segment is projected to account for the second-largest share during the forecast duration. The segment’s upliftment is attributed to its importance for effectively bolstering accuracy and productivity, which enables the development of complicated parts with consistency and high quality. According to an article published by NLM in March 2025, the adoption of ultrasonic-based robotic cutting can significantly reduce the mean error cut percentage to 4.4%, with deviations usually ranging from 0.1 to 0.2 degrees for the bevel angle, and 14.2% with deviations ranging from 0.02 to 0.05 mm, particularly for root face deviations.

Technology Segment Analysis

Based on the technology, the centrifugation systems segment is predicted to cater to the third-largest share by the end of the projected timeline. The segment’s development is fueled by its pivotal role in separating overall blood into its usable and individual components. As stated in the October 2023 NLM article, an estimated 20 minutes of centrifugation, almost 15% of platelets remain in plasma layers, and 65% in RBC layers. This particular process is extremely essential for different medical and health applications, from therapeutic treatments to diagnostic evaluation, thereby making it suitable for the overall segment.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Portability |

|

|

Product Type |

|

|

Technology |

|

|

Application |

|

|

End user |

|

|

Business Mode |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plasma Expressor Machine Market - Regional Analysis

North America Market Insights

North America market is expected to garner the largest share of 40.2% by the end of 2035. The market’s upliftment in the region is highly attributed to the inelastic and escalating need for life-saving plasma-derived drugs for aiding rare and chronic diseases, technological integration and automation, administrative policies, and generous funding. According to an article published by NLM in July 2023, whole-exome sequencing (WES) caters to an estimated 1% to 2% of the overall genome, and is considered a suitable sequencing approach that usually focuses on achieving the protein-coding regions of the genome, thus making it suitable for the market in the region.

The plasma expressor machine market in the U.S. is growing significantly, owing to the robust trend towards technological and consolidation integration. In addition, the presence of notable collection centers that are adopting completely connected and automated systems to expand plasma yield and ensure administrative compliance is also uplifting the market in the country. Besides, as per an article published by the Annals of Blood in March 2024, the aspect of plasma blood management is increasingly evident and results in suitable cost-savings, ranging from USD 50 per patient to USD 3,000 per patient. This includes different activities, such as reducing unnecessary transfusions, peri-operative blood conservation, and pre-operative anemia management, thus suitable for boosting the market in the country.

The plasma expressor machine market in Canada is also growing due to the tactical push for national self-sufficiency in the plasma supply, which has led to a surge in public investment, especially in regional plasma collection facilities to diminish dependency on imported plasma. Besides, as per an article published by NLM in June 2022, the country readily depends on paid donations in the U.S. to successfully supply over 80% of plasma, which is also utilized to create plasma-based products to aid different illnesses. Additionally, Canada-based Blood Services (CBS) unveiled the latest plasma collection facilities, with 12 to 16 beds, which is bolstering the market’s exposure.

Medical Factors Driving the Market in North America (2024)

|

Components |

Cost Rate |

Cost Amount |

|

Labor |

56% |

USD 890 billion |

|

Other |

22% |

USD 352 billion |

|

Suppliers |

13% |

USD 202 billion |

|

Drugs |

9% |

USD 144 billion |

Source: AHA

APAC Market Insights

Asia Pacific market is expected to emerge as the fastest-growing region during the projected timeline. The market’s upliftment in the overall region is highly subject to the rapid expansion in the healthcare facility, a rise in government and private investment in ensuring blood safety, along with the aspect of a growing patient population needing plasma-driven therapies for chronic diseases, immunodeficiencies, and bleeding disorders. Meanwhile, the May 2024 WHO data report indicated that Indonesia witnessed an upsurge in dengue incidence, with 88,593 confirmed incidences and 621 deaths, thereby enhancing the market’s demand in the overall region.

The plasma expressor machine market in China is gaining increased traction, owing to the government’s increased focus on the Healthy China 2030 initiative, which has readily prioritized the creation of a regional plasma fractionation sector. Additionally, the National Medical Products Administration (NMPA) has successfully cleared an increase in the number of plasma collection facilities. Besides, as per an article published by LabMed Discovery in September 2024, hemophilia is extremely common in the country, accounting for almost 2.7 per 100,000 to 3.0 per 100,000, which is also uplifting the market’s demand.

The plasma expressor machine market in India is also developing due to the government’s strategy to introduce standard and suitable health and medical schemes, such as Ayushman Bharat, along with an increase in budget to ensure blood safety optimization. As per the October 2025 Observer Research Foundation article, the country’s yearly blood demand is approximately 14.6 million units, and between 2024 and 2025, the country successfully collected 14,601,147 units. This denotes a 15% increase over 12,695,363 units in previous years. In addition, nearly 70% of the supply originated from non-remunerated and voluntary donors, thereby boosting the market’s growth.

Europe Market Insights

Europe market is expected to experience steady growth by the end of the predicted timeline. The market’s growth in the overall region is highly fueled by the existence of strict regulatory oversight, a robust push for plasma self-sufficiency, as well as technological modernization. According to an article published by the JPAC in March 2024, the Commission Directive 2002/98/EC and the Commission Directive 2004/33/EC of the region, since their initiation in February 2005, have readily set suitable standards for successfully collecting and evaluating human blood, along with blood components, thereby suitable for uplifting the market.

The plasma expressor machine market in Germany is gaining increased exposure, owing to the presence of the Federal Ministry of Health, which readily supports a strong environment for plasma collection, along with governmental agencies for biomedicines and vaccines. As per the March 2025 MDPI article, the pediatric-based vaccine coverage rate has been 74% as of 2023 for children of 2 years, while it is 23.3% for adults between the age range of 60 to 74 years. Therefore, this has created a huge growth opportunity for the overall market to grow and gain more acceptance in the country.

The plasma expressor machine market in France is also developing due to increased guidance by the French National Authority for Health, which has emphasized self-sufficiency for plasma-specific drugs. In addition, the regional initiative for blood has effectively dictated tactical investments, which is also fueling the overall market in the country. In this regard, the French Blood Establishment has successfully and publicly put forward plans to enhance plasma collection through apheresis over the years. This is considered an objective that has effectively necessitated suitable capital investment in automated expressor machines, thereby positively influencing the domestic health expenditure for this particular technology.

Key Plasma Expressor Machine Market Players:

- Terumo BCT

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Fresenius Kabi

- Grifols

- LMB Technologie

- Delcon

- JMS

- Bioelettronica

- Demophorius Healthcare

- Macopharma

- BMS K Group

- Nigale

- BIOBASE

- Weigao Group

- Meditech Technologies

- Labtop Instruments

- Suzhou Medical Instrument

The international market has been readily characterized by tactical advancement and regional diversity. In general, large-scale organizations, including Grifols and Haemonetics, readily dominate with newly incorporated plasma management systems. Besides, distinguished players in the market, such as Fresenius Kabi and Terumo, have successfully focused on highly automated efficacies. In addition, other players from emerging nations, including SNJ Medical (Malaysia) and Medion Healthcare (India), are extremely concerned about specific customization, along with customer priorities for domestic cost-effectiveness, thus bolstering the market globally.

Here is a list of key players operating in the global market:

Recent Developments

· In March 2025, NTT Corporation, along with the National Institutes for Quantum and Science and Technology, successfully established an AI-based prediction method, which can be applied to plasma confinement magnetic fields for large-scale fusion devices.

· In March 2025, General Fusion declared that its Magnetized Target Fusion (MTF) demonstration has deliberately developed a magnetized plasma, particularly in the machine’s target chamber.

· In January 2025, Fresenius Kabi notified that the U.S. FDA has readily granted the 510(k) approval for its Adaptive Nomogram, which is an alternative algorithm that will be effectively available in the Aurora Xi Plasmapheresis System, designed to improve plasma efficacy and collection.

- Report ID: 3991

- Published Date: Oct 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Plasma Expressor Machine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.