Bleeding Disorders Testing Market Outlook:

Bleeding Disorders Testing Market size was valued at USD 105.79 million in 2025 and is likely to cross USD 218.04 million by 2035, expanding at more than 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bleeding disorders testing is assessed at USD 112.93 million.

Key factors fueling this expansion include rising incidence of bleeding and coagulation disorders along with increased awareness and early diagnosis initiatives for better patient outcomes.

According to a clinical study by NLM in April 2023, hereditary bleeding disorders such as hemophilia A, B, and von Willebrand disease result from clotting protein deficiencies. Hemophilia B, also known as Christmas disease, is an X-linked disorder affecting 1 in 30,000 male births, while Willebrand disease impacts around 1% of the population, with women more likely to show symptoms due to menstrual bleeding. Therefore, the incidence of these disorders encourages the requirement for early testing and accelerates market growth.

Key Bleeding Disorder Testing Market Insights Summary:

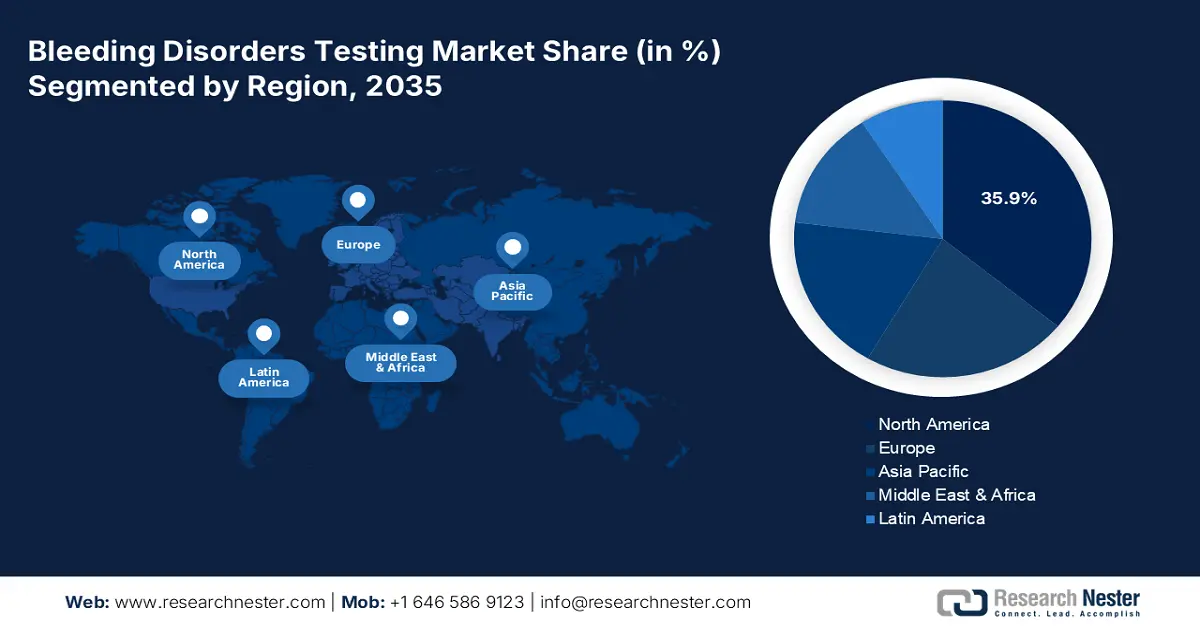

Regional Highlights:

- North America leads the Bleeding Disorders Testing Market with a 35.9% share, propelled by advanced healthcare leaders and strong regulatory frameworks, solidifying its dominance through 2026–2035.

- The Bleeding Disorders Testing Market in Asia Pacific is poised for the fastest growth by 2035, driven by increasing patient populations and government promotion of rare disease diagnostics.

Segment Insights:

- Bleeding Disorders Testing segment is expected to capture a 46.20% share by 2035, driven by increasing focus on advanced diagnostic assays for early hemophilia A detection.

Key Growth Trends:

- Advancements in diagnostic technologies

- Increasing government initiatives

Major Challenges:

- High cost of testing

- Limited awareness

- Key Players: Abbott, Thermo Fisher Scientific Inc., and Gerresheimer AG, Johnson and Johnson.

Global Bleeding Disorder Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 105.79 million

- 2026 Market Size: USD 112.93 million

- Projected Market Size: USD 218.04 million by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, Brazil, Mexico

Last updated on : 12 August, 2025

Bleeding Disorders Testing Market Growth Drivers and Challenges:

Growth Drivers

-

Advancements in diagnostic technologies: The rapid development of advancements in diagnostic technologies is a key driver for the bleeding disorders testing market. Innovations such as highly sensitive assays, next-generation sequencing, and point-of-care diagnostics have increased efficacy in detecting bleeding disorders. For instance, in May 2022, Precision BioLogic Inc. launched the CRYOcheck Chromogenic Factor IX assay in multiple regions to diagnose hemophilia B with enhanced accuracy. Such innovations are advancing the market by improving laboratory efficiency and accessibility in the healthcare sector.

- Increasing government initiatives: The bleeding disorders testing market is majorly driven by government initiatives by promote awareness and accessibility to diagnostic services. The global shift toward early detection leveraging proper health outcomes, i.e. with newborn screenings, funding for research further supports market growth. In February 2024, the WFH Humanitarian Aid Program donated 42 million Ius of factor to India for enhanced hemophilia treatment. It further conducted workshops and collaborations with healthcare institutions to strengthen support. Thus, such initiatives for a better quality of life further encourage market growth during the forecast period.

Challenges

- High cost of testing: It is one of the biggest challenges in the global bleeding disorders testing market. The diagnostic tests involve advanced techniques like genetic testing and chromogenic assays, which limits organizations in developing countries that hesitate to invest. Furthermore, these tests require specialized equipment and trained professionals, making them expensive and often inaccessible. The lack of affordability can lead to delayed or missed diagnoses, impacting patient outcomes and creating barriers to wider bleeding disorders testing adoption.

- Limited awareness: This remains a significant challenge due to the lack of awareness about bleeding disorders and the insufficient diagnostic infrastructure in vast regions. In developing nations, healthcare professionals may have limited training in diagnosing these conditions, probably leading to underdiagnosis or misdiagnosis. Additionally, the absence of specialized laboratories and point-of-care testing facilities in remote areas restricts the ability of industries to fully leverage the benefits of early detection technologies.

Bleeding Disorders Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 105.79 million |

|

Forecast Year Market Size (2035) |

USD 218.04 million |

|

Regional Scope |

|

Bleeding Disorders Testing Market Segmentation:

Indication (Hemophilia A, Hemophilia B, Von Willebrand Disease)

Hemophilia A segment is set to capture around 46.2% bleeding disorders testing market share by the end of 2035. Hemophilia A is highly prevalent and requires early diagnosis to avoid further complications. Moreover, the increasing focus on advanced diagnostic assays is driving demand for hemophilia A testing. For instance, in March 2023, Amrita Hospitals, Kochi, introduced the Factor VIII (F8) gene mutation identification test for the diagnosis of hemophilia. It includes the identification of Intron 22 inversion, which is estimated to affect 45% of severe hemophilia patients. Therefore, efficient diagnostic solutions improve treatment strategies, expanding market growth.

Type (Reagents, Consumables, Instruments)

Based on type, the reagents segment is projected to register considerable growth in the bleeding disorders testing market by 2035. The segment’s domination is poised by its essential role in accurate and reliable diagnostic tests. In February 2021, Gerresheimer AG developed an advanced reagent block with standardized wall thickness for enhanced efficacy and affordability. Their agile development approach is intended to support rapid prototyping and clinical testing. Thus, the innovation is set to improve reagent reliability and efficiency, strengthening bleeding disorders diagnostics.

Our in-depth analysis of the global market includes the following segments:

|

Indication |

|

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bleeding Disorders Testing Market Regional Analysis:

North American Market Analysis

North America bleeding disorders testing market is estimated to hold revenue share of more than 35.9% by 2035. The dominance is majorly due to the presence of advanced global healthcare leaders and the country’s support with regulatory frameworks. Additionally, key market players in the region that support innovative diagnostic solutions further accelerate the market growth significantly during the forecast tenure. Furthermore, insurance coverage and reimbursement policies in the region enhance accessibility to testing services.

U.S. dominates the North America bleeding disorders testing market owing to early adoption of cutting-edge technologies. Government programs such as the Centers for Disease Control and Prevention (CDC) contribute to the demand for accurate testing. For instance, in May 2024, according to a study by the CDC, 33,000 males are estimated to be living with hemophilia in the U.S., diagnosed at a very young age. It further stated that early diagnosis is crucial as severe cases can lead to life-threatening complications. Thus, the study underscores the necessity of early detection and makes the country a hub for diagnostic advancements.

Canada’s bleeding disorders testing market is growing steadily with several collaborative approaches, including public-private partnerships, ensuring a robust disorder testing adoption across key sectors. The country has a strong network of bleeding disorders treatment centres that enhance early detection and management. According to a report published by Queen’s Gazette in, Dr. Paula James secured USD 1.3 million from CIHR’S rare disease research initiative for inherited bleeding disorders, thereby strengthening their ecosystems and positioning Canada for global markets.

APAC Market Statistics

Asia Pacific bleeding disorders testing market is anticipated to grow at the fastest rate during the forecast period. The market is majorly driven by the demand for bleeding disorders testing due to an increasing patient population and vast healthcare infrastructure. Governments in the region actively promote rare disease diagnostics and the expansion of private laboratories to support industry development. Growing investments in diagnostic research, particularly in upward economies, are intended to help the testing solutions sectors embrace early detection with better patient outcomes.

China is a leader in the bleeding disorders testing market, supported by government policies which emphasize bleeding disorders diagnosis and treatment. The country’s biotechnology sector's dominance and integration of AI in diagnostics are improving accuracy and efficiency. For instance, in January 2024, Belief BioMed Group announced that it begun dosing patients in its registrational clinical trial for BBM-H803, China’s first AVV-based therapy for hemophilia A. This milestone underscores China’s growing advancement in bleeding disorders treatment.

India’s bleeding disorders testing market is gaining momentum, fueled by the rising healthcare expenditure and growing focus on early detection of bleeding disorders. In May 2023, Amrita Hospital Kochi and Manchester Hemophilia Treatment Center announced their collaboration to enhance hemophilia care in the country with proper care and accessible treatments. They further stated to introduce diagnostic testing for factor eight and factor nine assays,thus making India a rapidly emerging player in the global market.

Key Bleeding Disorders Testing Market Players:

- F. Hoffmann-La Roche Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent developments

- Regional Presence

- SWOT Analysis

- Siemens Healthcare GmbH

- Abbott

- Thermo Fisher Scientific Inc.

- Gerresheimer AG

- Johnson and Johnson

- Pfizer Inc.

- Novo Nordisk

- Sangamo Therapeutics, Inc.

- Octapharma AG

- Bayer AG

- Baxter International Inc.

Companies in the bleeding disorders testing market are emphasizing coagulation analyzers, molecular diagnostics, and point-of-care testing solutions. Many focus on strategic partnerships and collaborations and geographical expansion to accelerate adoption and expand market presence. For instance, in March 2021, Takeda Pharmaceutical Company Limited announced a partnership with Enzyre BV to accelerate Enzyre’s diagnostic platform for patients with bleeding disorders. Therefore, such strategic integrations are anticipated to showcase lucrative growth opportunities in the forecast period.

Some of the prominent market players are:

Recent Developments

- In December 2024, Sangamo Therapeutics, Inc. regained full rights to its hemophilia A gene therapy program after Pfizer, Inc. decided to cease development. The decision follows positive Phase 3 AFFINE trial results, which met primary and secondary end points.

- In February 2024, Octapharma AG expanded VWDtest.com to enhance the awareness and diagnosis of von Willebrand disease, aiming to improve bleeding disorder management globally. The platform supports early detection and treatment procedures.

- In February 2024, F. Hoffmann-La Roche AG launched three new coagulation tests for Factor Xa inhibitors apixaban, endoxaban, and rivaroxaban in CE-mark-accepting countries, aiding in stroke and thromboembolism prevention.

- Report ID: 7438

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bleeding Disorder Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.