Automotive Exhaust System Market Outlook:

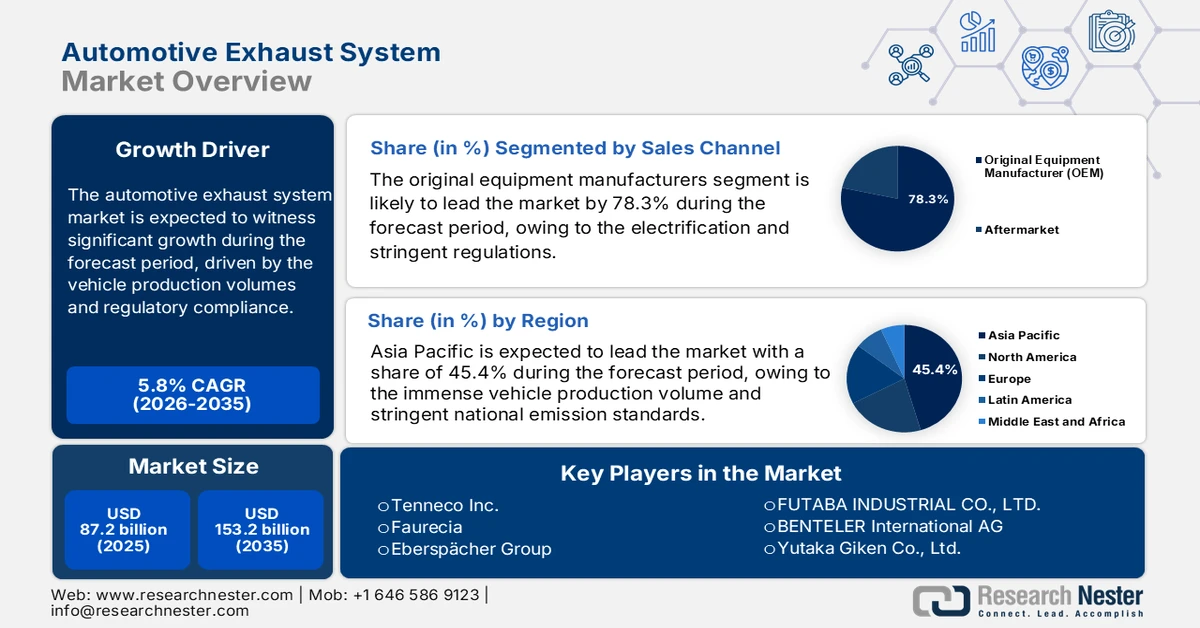

Automotive Exhaust System Market size was valued at USD 87.2 billion in 2025 and is projected to reach USD 153.2 billion by the end of 2035, rising at a CAGR of 5.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automotive exhaust system is evaluated at USD 92.2 billion.

The global demand for automotive exhaust systems is directly tied to vehicle production volumes and regulatory compliance requirements across major automotive manufacturing regions. The report from the International Organization of Motor Vehicle Manufacturers in March 2025 states that the global car sales reached 74.6 million units in 2024, with passenger cars exceeding 3 million units in South America, sustaining baseline demand for exhaust components across internal combustion and hybrid platforms. Regulatory pressure remains a primary demand driver. The U.S. Environmental Protection Agency in March 2025 reports that transportation contributes nearly 29% of the total U.S. greenhouse gas emissions, with light-duty vehicles being the largest source, reinforcing the sustained regulatory oversight on exhaust emissions control systems.

From a regional investment and policy perspective, public sector initiatives aimed at fuel efficiency and emissions reduction continue to shape supplier economics and production planning. The Climate and Clean Air Coalition estimates that the fuel economy improvements and emissions control technologies have reduced the per-vehicle emissions of regulated pollutants by over 99%, despite growth in vehicle miles traveled, highlighting the increasing technical complexity embedded in exhaust systems. Federal funding for advanced vehicle technologies and manufacturing efficiency programs continues to support the domestic supply chains for emissions-critical components in the market. Further, the state-level adoption of the stricter vehicle emissions standards aligned with the California Air Resources Board frameworks increases the compliance costs while reinforcing long term demand for high-performance exhaust solutions.

Key Automotive Exhaust System Market Insights Summary:

Regional Highlights:

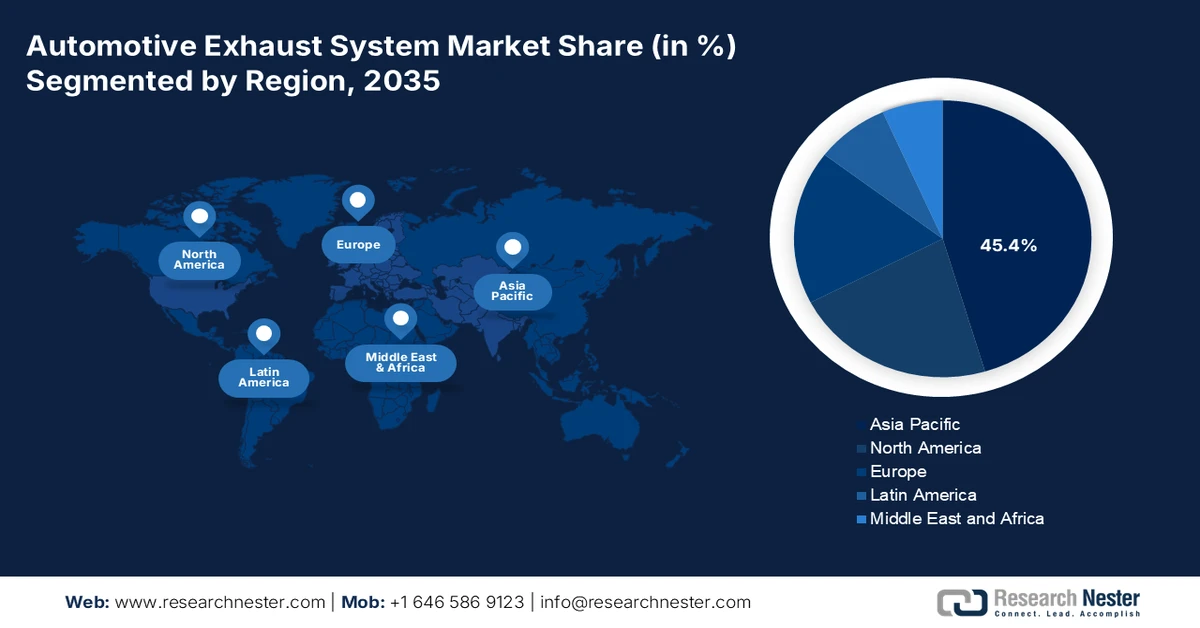

- Asia Pacific in the automotive exhaust system market is forecast to capture a 45.4% revenue share by 2035, underpinned by massive vehicle production volumes and the enforcement of advanced emission frameworks such as China 6, India BS-VI, and Japan’s Post-Post New Long Term Regulations mandating sophisticated after-treatment technologies.

- North America is projected to emerge as the fastest-growing region during 2026–2035, expanding at a CAGR of 6.3% as evolving EPA and Environment and Climate Change Canada standards accelerate the adoption of advanced exhaust after-treatment systems for light- and heavy-duty vehicles.

Segment Insights:

- The original equipment manufacturers segment under the sales channel in the automotive exhaust system market is projected to account for a 78.3% share by 2035, strengthened by deep OEM partnerships required for integrated exhaust and after-treatment engineering amid tightening emission regulations and electrification trends.

- The passenger cars sub-segment within the vehicle type category is anticipated to retain its leading share by 2035, supported by high global production volumes and regulatory mandates accelerating the uptake of advanced catalytic converters and gasoline particulate filters.

Key Growth Trends:

- Continued dominance of internal combustion and hybrid vehicle fleets

- Public support for hybrid vehicles as a transitional technology

Major Challenges:

- High capital intensity and economies of scale

- Complex OEM qualification and long lead times

Key Players: Tenneco Inc., Faurecia, Eberspächer Group, FUTABA INDUSTRIAL CO., LTD., BENTELER International AG, Yutaka Giken Co., Ltd., Sejong Industrial Co., Ltd., Friedrich Boysen GmbH & Co. KG, BOSAL International NV, SANGO Co., Ltd., Katcon Global, Grand Rock Co., Ltd., SHANGHAI LANGXING, UNIPRES Corporation, Harbin Airui Automotive Exhaust System Co., Ltd., Tata AutoComp Systems, AP Exhaust Products, SPMC, MagnaFlow, Walkinshaw Performance.

Global Automotive Exhaust System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 87.2 billion

- 2026 Market Size: USD 92.2 billion

- Projected Market Size: USD 153.2 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: South Korea, Mexico, Brazil, Thailand, Indonesia

Last updated on : 28 January, 2026

Automotive Exhaust System Market - Growth Drivers and Challenges

Growth Drivers

- Continued dominance of internal combustion and hybrid vehicle fleets: Despite the electrification momentum, government fleet data confirms the persistence of ICE and hybrid vehicles. The International Energy Agency reports that the majority vehicle in use around the globe continue to depend on internal combustion engines or hybrid systems. This is reinforced by the public transportation statistics showing slow fleet turnover in the emerging and mature automotive exhaust system market. The U.S. BTS 2024 report indicates that the average vehicle age reached 12.5 years in 2024, sustaining the long-term exhaust replacement demand. Government policy increasingly supports the hybrids as a transition technology, particularly in Asia and Europe, extending exhaust system relevance. The global automotive production is expected to remain high, where the charging infrastructure spending lags vehicle demand.

- Public support for hybrid vehicles as a transitional technology: Governments increasingly position hybrids as a pragmatic emissions reduction pathway, sustaining the market relevance. The International Energy Agency notes that the hybrids receive policy support in Europe, Japan, and Asia due to the infrastructure constraints. The government inventive programs often classify hybrid vehicles separately from the full EVs, maintaining compliance obligations for exhaust systems. Japan’s Ministry of Economy, Trade, and Industry continues to fund hybrid efficiency improvements. The report from the U.S. BTS in April 2024 indicates that the sales of hybrid vehicles are surging, and in 2024, the sales reached 1,609,035. For exhaust suppliers, hybrids represent a stable medium-term demand segment with higher technical content than conventional ICE platforms.

- Regulatory stringency and direct government R&D funding: The new emission standards are the key drivers in the market. Beyond setting rules, the governments directly fund the advanced R&D required for compliance. For instance, the U.S. Department of Energy allocates millions annually via its Vehicle Technologies Office for projects aimed at improving emission control and reducing the cost of after-treatment technologies for diesel and gasoline engines. This public investment drives innovation for suppliers, accelerating the commercialization of systems needed to meet the standards, such as the EPA’s proposed Heavy Duty Phase 3 rules. This creates a direct funding pathway for the next-gen exhaust technologies.

Challenges

- High capital intensity and economies of scale: The automotive exhaust system market demands massive capital for precision manufacturing testing facilities and catalytic converter coating lines. Achieving cost competitiveness is impossible without the scale of incumbents. A single automated production line can cost millions. Even though the market is expected to grow, the profit margins are squeezed, making recouping large initial investments slow and risky for new players without existing volume.

- Complex OEM qualification and long lead times: Securing an OEM contract involves a multi-year qualification process, testing durability performance, and just-in-time delivery capability. Suppliers must often co-design systems for specific vehicle platforms. Futaba Industrial solidified its role as a key Toyota supplier via decades of integrated partnerships. A new entrant lacks this track record. Further, the average age of the lightweight vehicles is a decade, underscoring the durability standards OEMs demand, which are proven over years of testing.

Automotive Exhaust System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 87.2 billion |

|

Forecast Year Market Size (2035) |

USD 153.2 billion |

|

Regional Scope |

|

Automotive Exhaust System Market Segmentation:

Sales Channel Segment Analysis

Under the sales channel, the original equipment manufacturers segment is dominating and is projected to hold the share value of 78.3% by 2035 in the automotive exhaust system market. This dominance is due to the integrated systems-level engineering required for modern exhaust after-treatment, which is best achieved via direct long-term partnerships with vehicle makers. The shift toward electrification and stringent regulations further cements the OEM integration as exhaust systems become a core part of the vehicle’s thermal and emission management architecture. The growth of this channel is supported by the strong vehicle production, for instance, the report from the Auto Innovators in April 2025, the North America production of light-duty vehicles reached over 15,972,369 in 2024, creating a direct demand for the OEM integrated systems.

North America Production of Light Duty Vehicles

|

Year |

Production Value |

|

2024 full year |

15,972,369 |

|

January 2025 |

1,194,682 |

|

February 2025 |

1,290,302 |

|

March 2025 |

1,424,691 |

Source: Auto Innovators April 2025

Vehicle Type Segment Analysis

The passenger cars sub segment leads the vehicle type segment in the market. This share is driven by the sheer global volume of passenger car production and the rapid adoption of complex after-treatment technologies such as gasoline particulate filters and advanced catalytic converters in this segment. Strict emission standards worldwide, such as China 6 and India’s BS-VI mandate these technologies for new passenger vehicles. The report from the U.S. BTS in December 2023 shows that the new passenger car sales in 2023 reached 2,640 thousand underscoring the massive installed base for exhaust systems. further the segment's leadership is reinforced by the global transition toward hybrid electric vehicles, which require advanced exhaust systems to manage intermittent internal combustion engine operation.

Material Segment Analysis

Within the material segment, the stainless-steel sub-segment is leading and is expected to hold a significant share value in the market. The dominance is due to its optimal balance of corrosion resistance durability, and cost effectiveness in high temperature exhaust environments. Its dominance is being reinforced by the need for longevity to match extended vehicle warranty periods for emission components, and its suitability for manufacturing complex after-treatment device housings. According to the American Iron and Steel Institute's January 2025 report, the U.S. imported 2,082,000 net tons of steel in December 2023, indicating its critical industrial role. Furthermore, the push toward lightweighting to improve fuel efficiency is driving the adoption of advanced, thinner-gauge ferritic and austenitic stainless steel grades, which maintain strength while reducing overall system weight.

U.S. Steel Imports by Country

|

Country |

Volume (000 NT) |

Change vs. November |

|

Canada |

539 |

Up 1% |

|

Brazil |

335 |

Down 12% |

|

Mexico |

291 |

Up 18% |

|

South Korea |

269 |

Up 91% |

|

Germany |

106 |

Up 103% |

Source: American Iron and Steel Institute's January 2025

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Fuel Type |

|

|

Vehicle Type |

|

|

After Treatment Device |

|

|

Sales Channel |

|

|

Material |

|

|

Propulsion |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Exhaust System Market - Regional Analysis

APAC Market Insights

The Asia Pacific automotive exhaust system market is dominating and is expected to hold a revenue share of 45.4% by 2035. The market is driven by the immense vehicle production volume and stringent national emission standards. The primary demand driver is the implementation of the advanced regulations, such as the China 6 India BS-VI and Japan’s Post-Post New Long Term Regulations, which mandate advanced after-treatment, such as the Gasoline Particulate Filters and enhanced selective catalytic reduction systems. A major trend is the rapid concurrent growth of hybrid electric vehicles and internal combustion engine production, creating a dual demand stream. China leads in electric vehicle adoption; its sheer scale of ICE production is growing, and the vehicle parc ensures sustained exhaust system demand. The aggressive EV policies are pushing the suppliers to adapt products for hybrid platforms and invest in components for electrified powertrains.

China automotive exhaust system market is undergoing a structural transition as EV penetration is projected to reach 90% by 2030, significantly reducing the long term exhaust demand from new vehicle sales. However, near to medium term demand remains supported by the existing internal combustion and hybrid vehicle parc and China’s dominant position across the automotive material value chains. According to the World Economic Forum's January 2025 report, China accounts for over 50% of the global downstream steel consumption, 57.5% of aluminum consumption, and 56% of global tyre consumption, underscoring its scale in conventional vehicle manufacturing. While the battery electric vehicles are accelerating, the sheer size of China’s installed ICE fleet sustains aftermarket exhaust demand. For suppliers, China remains strategically important for volume-driven production material sourcing and transitional platform programs despite declining long term exhaust intensity in new vehicles.

EV Sales Volume and Penetration

|

Year |

Sales (10,000 units) |

Penetration Rate |

|

2019 |

121 |

5% |

|

2020 |

137 |

5% |

|

2021 |

352 |

13% |

|

2022 |

689 |

26% |

|

2023 |

950 |

32% |

|

2030 |

3,200 |

90% |

Source: World Economic Forum January 2025

A vast active vehicle base and regulatory enforcement mechanisms are supporting the India market. As per the PIB December 2024 report, approximately 38.41 crore motor vehicles were registered under the Vahan 4.0 system, creating a substantial installed base requiring emissions-compliant exhaust systems. Regulatory oversight is reinforced via the Pollution Under Control Certificate regime, with over 53.4 million valid PUCCs issued, directly linking vehicle operation to exhaust performance. While battery-operated vehicles are newly registered vehicles, the majority of in-use internal combustion vehicles remain subject to compliance. Additionally, over 175 million insured vehicles indicate sustained on-road usage supporting replacement and maintenance demand. These dynamics position India as a volume-driven market where exhaust demand remains robust despite gradual electrification.

North America Market Insights

The North America automotive exhaust system market is the fastest-growing and is expected to grow at a CAGR of 6.3% during the forecast period, 2026 to 2035. The market is driven by the evolving federal emission standards from the U.S. Environmental Protection Agency and Environment and Climate Change Canada, particularly for heavy-duty vehicles. The EPA’s Clean Trucks Plan Phase 3 rule will necessitate advanced after-treatment systems, sustaining OEM demand. The key trend is the integration of exhaust systems with hybrid electric powertrains, as supported by U.S. Department of Energy investments in vehicle technologies prolonging ICE relevance. The government spending via programs such as Canada’s Zero Emission Vehicle incentive indirectly supports hybrid adoption, while U.S. infrastructure law funding for the clean school buses directly fuels the demand for modern diesel exhaust systems.

The U.S. is shaped by regulatory enforcement and targeted federal spending. The EPA’s finalized Heavy Duty Phase 3 rules will drastically lower the NOx limits, compelling the adoption of the next-gen selective catalytic reduction and enhanced thermal management systems starting in the model year. This regulatory push is amplified by direct federal procurement, notably the USD 5 billion Clean School Bus Program in the EPA in January 2026, which replaces the old diesel buses with the new compliant models, creating immediate OEM demand. Furthermore, the Department of Energy’s sustained R&D funding for advanced combustion and emission control, through its Vehicle Technologies Office, addresses the dual challenge of meeting stricter standards while improving the efficiency of both conventional and hybrid powertrains. This maintains the technological evolution of exhaust components despite a shifting powertrain landscape.

Canada automotive exhaust system market represents a stable and policy-aligned market supported by the sustained vehicle parc size, aftermarket activity, and cross-border supply integration. The Canada automotive aftermarket is valued at over USD 16 billion annually and remained relatively stable through 2022, indicating a consistent replacement demand for the emissions-related components. Although domestic vehicle manufacturing recovered to pre-pandemic levels in 2022, automotive parts and component imports totaled USD 15.4 billion, reflecting continued reliance on external suppliers. Passenger vehicle imports rose 12% to USD 31 billion in 2022, based on the ITA November 2023 report, reinforcing the integrated exhaust system sourcing. With 84% of the new light vehicle sales classified as light trucks and SUVs, per vehicle exhaust content remains structurally higher. Canada’s regulatory framework is closely harmonized with U.S. emissions and safety standards, supporting platform commonality and stable OEM demand.

Europe Market Insights

The Europe automotive exhaust system market is defined by the impending Euro 7 regulation setting the strictest ever real driving emission limits for pollutants such as NOx and particulate matter from both cars and vans for new types. This framework compels OEMs to integrate more advanced durable ad integrated after treatment solutions including advanced GPFs and electrically heater catalysts, sustaining the R&D and production demand. A parallel dominant trend is the accelarated transition to battery electric vehicles which erodess the long term addressable market for traditional exhausts. Consequently suppliers are strategically pivoting to components for electrified platforms such as thermal management systems and acoustic devices while the aftermarket remains robust due to the Europe aging vehicle fleet.

The Germany market is driven by its status as Europe’s premium vehicle manufacturing hub and the technical demands of the forthcoming Euro 7 regulation. This necessitates high-value complex after-treatment solutions from domestic suppliers serving OEMs like Volkswagen, BMW, and Mercedes-Benz. A key trend is the strategic pivot toward developing exhaust components for high-performance hybrid vehicles and hydrogen combustion engines, aligning with federal hydrogen strategy funding. According to the KBA 2023 data, the total passenger car registration in 2023 reached 2.84 million, and the registration of new gasoline content accounted for 34.4%, which requires advanced systems such as gasoline particulate filters, demonstrating the sustained volume for advanced exhaust technologies despite the rise of BEVs.

The continuous support by the dominant presence of internal combustion and hybrid vehicles is driving the UK automotive exhaust system market. The data from the UK Parliament in June 2025 depicts that as of June 2024, only 3% of the total UK car parc, which is 1.09 million vehicle was battery electric, while 8% were hybrid electric, indicating that over 89% of the vehicles in operation still relied on petrol or diesel powertrains. The petrol vehicles accounted for 57% of the parc and diesel for 32%, sustaining substantial installed base demand for exhaust systems and aftermarket replacements. Although battery electric vehicles represented 19% of new car registrations, fleet turnover remains gradual, preserving medium term OEM and aftermarket exhaust demand. This slow transition supports continued sourcing of compliant exhaust systems aligned with the UK and EU emissions regulations.

Key Automotive Exhaust System Market Players:

- Tenneco Inc. (U.S.)

- Faurecia (France)

- Eberspächer Group (Germany)

- FUTABA INDUSTRIAL CO., LTD. (Japan)

- BENTELER International AG (Austria)

- Yutaka Giken Co., Ltd. (Japan)

- Sejong Industrial Co., Ltd. (South Korea)

- Friedrich Boysen GmbH & Co. KG (Germany)

- BOSAL International NV (Belgium)

- SANGO Co., Ltd. (Japan)

- Katcon Global (U.S.)

- Grand Rock Co., Ltd. (Taiwan)

- SHANGHAI LANGXING (China)

- UNIPRES Corporation (Japan)

- Harbin Airui Automotive Exhaust System Co., Ltd. (China)

- Tata AutoComp Systems (India)

- AP Exhaust Products (U.S.)

- SPMC (Malaysia)

- MagnaFlow (U.S.)

- Walkinshaw Performance (Australia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tenneco Inc is a dominant player in the global automotive exhaust system market, renowned for its ride performance and the clean air divisions. Its strategic focuses on developing advanced emission control and the after treatment technologies, including selective catalytic reduction and gasoline particulate filters, to meet the robust global regulations. Key initiatives involve using its acquisition to integrate powertrain expertise and expanding its portfolio to ensure future relevance. According to the 2024 annual report, the company’s income from operations reached 22,367.55 INR million.

- Faurecia is a top-tier player in the market via its deep expertise in emissions control technologies and vehicle interiors. Its strategic vision revolves around the sustainability, mobility, and cockpit of the future, heavily investing in hydrogen storage and fuel cell systems as a long-term alternative to traditional exhausts. The major initiative was its landmark acquisition of Germany's rival Hella, creating advanced exhaust after-treatment solutions. In 2024, the company made sales of € 26,974.2 million.

- The Eberspacher Group is a leading specialist in the automotive exhaust systems market, mainly for its advanced thermal management systems and exhaust technology. Its strategy is built on innovation in energy-efficient heating, cooling, and emission control components. Key initiatives include a strong pivot towards developing exhaust systems and thermal solutions for hybrid and electric vehicles.

- Futaba Industrial Co., Ltd is a key Japan supplier and a significant global competitor in the automotive exhaust system market with core strength in exhaust systems and body stamping components. Its strategy emphasizes high-quality precision manufacturing and cost efficiency to serve major OEM players worldwide. Strategic initiatives focus on expanding its overseas production footprint to allow OEM into growth markets.

- Benteler International AG is a major engineering group with a powerful presence in the automotive exhaust system market via its automotive division. Its strategy uses its core competencies in metal forming, welding, and system integration to produce the complex exhaust manifolds, pipes, and after-treatment housing. A central strategic initiative is the development of innovative and cost effective solution for global platforms.

Here is a list of key players operating in the global market:

The global automotive exhaust system market is highly consolidated, with the major players from Europe, Japan, and the U.S. dominating via technological scale and extensive OEM relationships. The competitive landscape is defined by the stringent push towards global emission regulations, which drives the relentless R&D in lightweight materials, advanced after-treatment, and electrification-compatible solutions. The key strategic initiatives include geographic expansion into high-growth Asia markets, strategic joint ventures for local production, and significant investment in sustained technologies such as hydrogen fuel cell systems and exhaust energy recovery to stay relevant in the evolving powertrain mix. For example, in June 2024, Team Allied Distribution officially acquired Gator Products, Inc., a Missouri-based undercar exhaust warehouse distributor.

Corporate Landscape of the Automotive Exhaust System Market:

Recent Developments

- In January 2025, Knorr-Bremse is actively advancing its portfolio optimization with a clear focus on strategic fit and performance. The company has completed the sale of its subsidiary GT Emissions Systems to Rcapital Partners, a private equity fund from the UK.

- In July 2024, SMP has announced the acquisition of European aftermarket supplier Nissens Automotive. The purchase price of USD 388 million represents approximately 7.5x EBITDA multiple inclusive of estimated run-rate cost synergies.

- In July 2024, REMUS Holding, a leading Tier 1 supplier of exhaust systems for the automotive, motorbike, and aftermarket industries, announced the acquisition of the Italian GLM Group based in Pescara. The signing marks a significant milestone in REMUS's inorganic growth strategy.

- Report ID: 4482

- Published Date: Jan 28, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Exhaust System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.