Posted Date : 15 October 2025

Posted by : Parul Atri

The paints and coatings market is a dynamic and rapidly evolving sector, driven by innovation, sustainability, and increasing demand across different sectors. As urbanization accelerates, infrastructure development rises, and consumer preferences move toward eco-friendly and high-performance products, this market is set for notable growth. This blog highlights the opportunities within the paints and coatings industry and highlights the key trends, challenges, and future opportunities.

Market Overview: A Surging Industry

The global paints and coatings market is a cornerstone of multiple industries, including construction, automotive, aerospace, marine, and industrial manufacturing. According to a 2024 report by Research Nester, the global paints and coatings market was valued at approximately USD 162.2 billion in 2023 and is projected to expand at a CAGR of 4.5% from 2024 to 2030. This growth is fueled by increasing construction activities, rising automotive production, and a growing emphasis on protective and decorative coatings.

The market is broadly segmented by product type, i.e., waterborne, solvent-borne, powder, and others, application, such as architectural, industrial, and specialty, and region. Architectural coatings, which include paints for residential and commercial buildings, account for the largest market share due to booming construction in emerging economies. Industrial coatings, mostly used in automotive, marine, and machinery applications, are also facing high demand due to their protective properties.

Key Drivers of Market Growth

- Urbanization and Infrastructure Development: Fast urbanization, particularly in Asia-Pacific, Latin America, and Africa, is a significant driver of the paints and coatings industry. According to the United Nations, by 2050, around 68% of the global population is predicted to live in urban areas, a rise from 55% in 2018. This trend is fueling the construction of new homes, offices, and commercial spaces, which increases the need for architectural paints. Countries such as India and China are heavily investing in building projects, including smart city development projects and affordable housing programs, creating continuous demand for strong and high-performance coatings.

- Automotive and Industrial Applications: The automotive sector is another major contributor to the paints and coatings market. In 2023, global vehicle production hit 80.1 million units, with Asia manufacturing more than half of that total, according to the International Organization of Motor Vehicle Manufacturers (OICA). Coatings used in vehicles are needed not only for their visual appeal but also for protecting against rust and wear. Beyond automobiles, industrial sectors are increasingly using coatings to safeguard equipment like machinery, pipelines, and ships, ensuring longer service life and reducing maintenance needs. As industries focus more on durability and asset protection, the need for high-performance coatings continues to grow.

- Shift Toward Sustainability: Both consumers and regulatory bodies are encouraging to opt of greener alternatives, especially those with low emissions of volatile organic compounds (VOCs). Water-based coatings, which are less damaging to the environment than traditional solvent-based options, are gaining momentum and are anticipated to grow at the fastest pace, with a projected CAGR of 5.3% between 2024 and 2030, according to Research Nester. To comply with environmental goals and regulations, many companies are also investing in bio-based coatings, using renewable sources like plant-derived resins to create more sustainable products.

- Technological Advancements: One notable advancement is the introduction of self-healing coatings, which can automatically fix surface scratches and small damages, a feature especially needed in the automotive and aerospace industries. In parallel, nano technology-based coatings are gaining ground due to their high durability and resistance to extreme conditions, making them ideal for demanding industrial applications. These technological strides not only improve the functionality and lifespan of coatings but also give manufacturers a chance to stand out in an increasingly competitive market.

Regional Overview

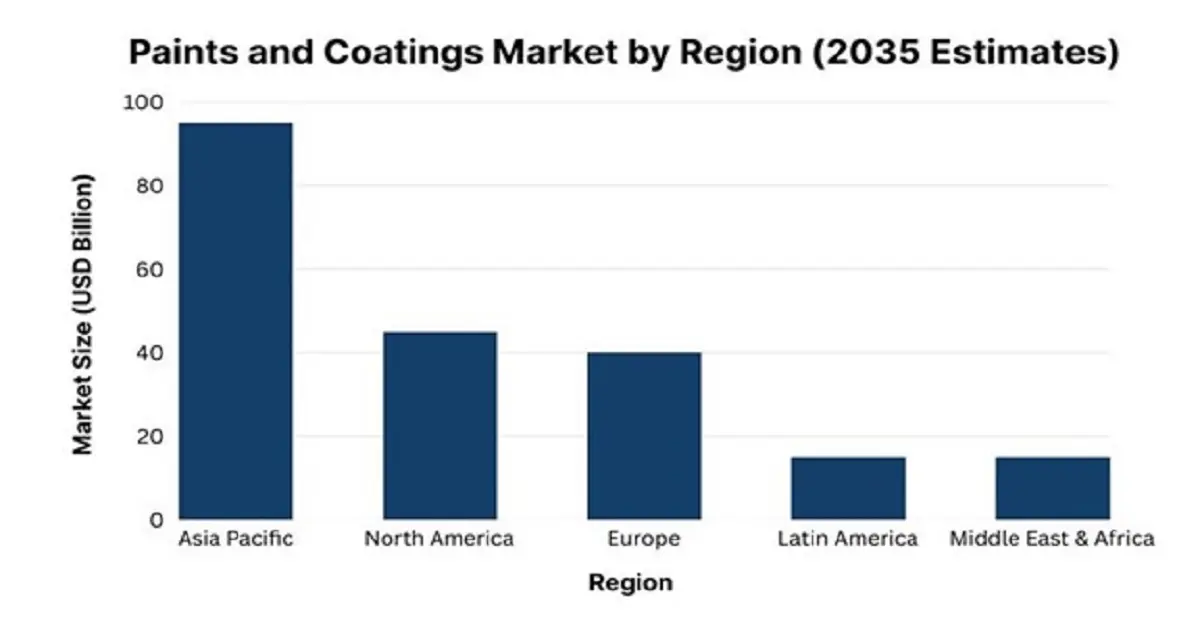

- Asia-Pacific: This region dominates the global paints and coatings industry, contributing to more than 40% of total market revenue in 2025, according to Research Nester. This growth can be attributed to rising industrial activities, rapidly expanding cities, and a rising middle class with profitable disposable income. China, India, and Southeast Asian countries are the leading markets, with China alone using over 20 million tons of coatings every year. In addition, the construction sector in India is supported by government programs, including the Pradhan Mantri Awas Yojana (PMAY), which is expected to fuel the demand for architectural paints and coatings in the coming years.

- North America and Europe: North America and Europe are well-established markets with a focus on innovation and sustainability. North America captured about 26% share in 2023, owing to high demand for high-performance industrial coatings and eco-friendly architectural paints. The U.S. leads the market due to rising implementation of green building standards, including LEED certification, which allows the usage of low-VOC and sustainable coatings. Similarly, in Europe, strict regulations like the EU’s REACH framework in Europe are pushing manufacturers to develop eco-friendly products.

- Emerging Countries: Latin America, the Middle East and Africa provide untapped opportunities due to increasing construction activities and industrial growth. For instance, the Middle East’s large-scale initiatives, such as Saudi Arabia’s NEOM city, are pushing demand for specialty coatings.

Challenges Faced By the Paintings and Coatings Market

Despite its unwavering high market capabilities, the paints and coatings industry experiences several challenges. Raw material price fluctuations are a major issue, as main ingredients like titanium dioxide, resins, and pigments are subjected to supply chain disruptions and geopolitical factors. For example, in 2022, the Russia-Ukraine war disrupted the global supply of titanium dioxide, a critical component in paint production, leading to price hikes. Environmental regulations also give rise to new challenges, particularly for manufacturers who rely on solvent-borne coatings. Compliance with VOC emission regulations needs a significant investment in research and development, which can put pressure on small emerging players. Moreover, top international companies namely PPG Industries, Sherwin-Williams, AkzoNobel, and Asian Paints face intense competition, making current innovation and efficient cost management essential for staying competitive.

Key Trends Shaping the Future of the Market

- Smart Coatings: These respond to environmental stimuli like temperature, light, or pressure, are gaining popularity. For instance, thermochromic coatings, which change color with temperature, are being used in architectural and automotive applications for better energy efficiency. According to a 2024 study by Research Nester, the smart coatings market is expected to reach USD 12.8 billion by 2028, rising at a CAGR of 24.7% from 2023.

- Digitalization and E-Commerce: The rise of e-commerce is changing how paints and coatings are marketed and sold. Online platforms enable consumers to explore a wide variety of products, compare prices, and access DIY painting solutions. Companies like Sherwin-Williams and Asian Paints have introduced digital tools, including color visualizers and virtual consultations, to improve customer engagement.

- Circular Economy Initiatives: The industry is increasingly adopting circular economy principles like recycling paint waste and creating reusable packaging. For instance, some manufacturers are experimenting with take-back programs to recycle leftover paint, lowering environmental impact and appealing to eco-conscious consumers.

Conclusion

The paints and coatings market is a pool of opportunities, driven by urbanization, technological advancements, and a global push for sustainability. With a predicted market value of over USD 200 billion by 2030, the industry provides immense potential for growth and innovation. However, stakeholders must confront challenges of raw material fluctuations and regulatory compliance to capitalize on these opportunities. By investing in eco-friendly products, adopting technological innovations, and targeting high-growth regions, businesses can sustain themselves in this highly expanding market. Whether you are an investor, manufacturer, or consumer, the paints and coatings industry is expanding with countless possibilities. As the world continues to build, protect, and beautify, this market will remain a cornerstone of progress and innovation.

Contact Us