Posted Date : 15 October 2025

Posted by : Akshay Pardeshi

The financial sector is rapidly transforming, and at the core of this major evolution is electronic trading, the use of computer systems and networks to facilitate the trading of financial products. Over the last decade, two groundbreaking technologies, i.e., blockchain and AI, have revolutionized the way electronic trading works, promising greater efficiency, transparency, and profitability.

According to a BME Study 2023, approximately 80% of equity trading in the U.S. was implemented electronically in 2023, and this figure is predicted to grow as automation becomes more deeply embedded into trading infrastructures. With blockchain providing a secure and immutable ledger system and AI offering data-driven insights and predictive capabilities, the synergy between these technologies is reshaping capital markets across the globe.

What is Electronic Trading?

Electronic trading refers to the use of computer-based systems for placing orders to buy or sell financial instruments. These systems consist of web-based trading platforms for retail investors to high-frequency trading (HFT) systems used by institutional traders. There are three main components of electronic trading:

- Execution Management Systems (EMS) for executing trades.

- Order Management Systems (OMS) for controlling and routing orders.

- Algorithmic Trading using predefined rules and AI to automate trading decisions.

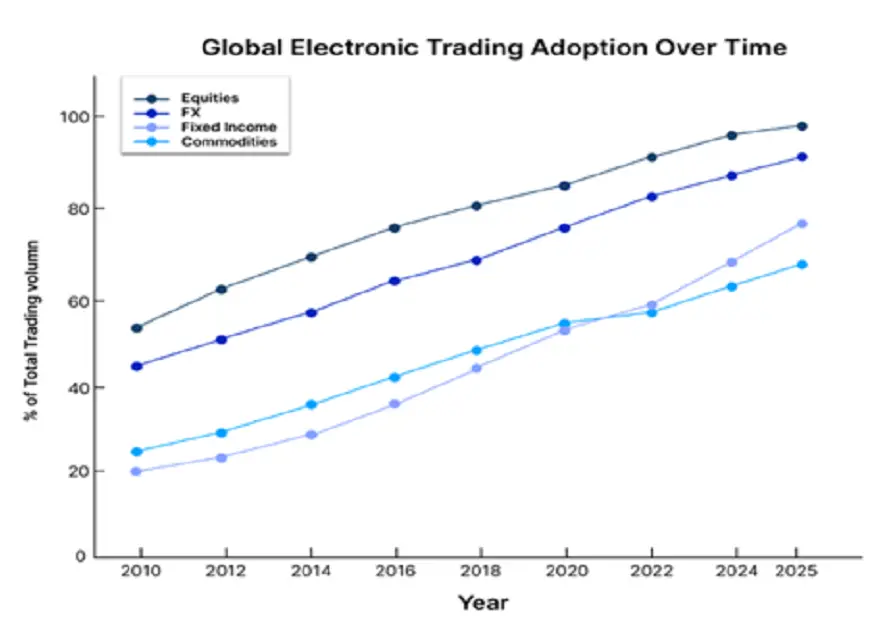

According to the Bank for International Settlements (BIS), electronic trading now leads not only equities but also FX, bonds, and derivatives markets. Here is a graph depicting electronic trading adoption over time.

Source: BIS

The Role of Blockchain in Electronic Trading

- Immutable and Transparent Ledger: Blockchain technology supports the recording of trade transactions in a decentralized, tamper-proof ledger. This transparency decreases the risk of fraud, ensures auditability, and speeds up post-trade settlements. The World Economic Forum expects that up to 10% of global GDP will be stored on blockchain by 2027.

- Smart Contracts for Trade Automation: Smart contracts, i.e., self-executing agreements embedded on a blockchain, automate the settlement process, compliance checks, and margin calls, lowering the need for intermediaries. For instance, Axoni, a blockchain startup, has collaborated with top finance firms such as JPMorgan and Goldman Sachs to optimize after-trade data management in the credit derivatives arena.

- Tokenization of Assets: Blockchain supports the tokenization of financial assets, allowing fractional ownership, better liquidity, and 24/7 trading.

- BCG predicts the tokenized asset market could reach $16 trillion by 2030.

- Digital assets like security tokens are becoming more common, with exchanges like tZERO and INX already operational.

Real-World Use Cases of Electronic Trading

- Nasdaq’s Use of Technology: Nasdaq has combined blockchain into its Nasdaq Linq platform to optimize private securities trading. It also uses advanced analytics to monitor market behavior and recognize unusual trading activity, helping maintain market integrity.

- Santander’s Blockchain-Based Bond Issuance: In 2019, Santander became the first bank to release a bond entirely through blockchain. This innovation lowered both time and cost related to traditional bond issuance and settlement, completing the process in minutes rather than days.

- Goldman Sachs’ Predictive Trading Systems: Goldman Sachs has developed internal trading platforms that use data-driven models to anticipate market movements and execute trades efficiently, enhancing speed and decision accuracy.

- ING Bank’s Privacy Innovation: ING is seriously working on privacy-preserving technologies such as zero-knowledge proofs. These solutions enable financial data to be validated without revealing confidential information, enabling secure, private transactions.

Key Benefits of Integrating Blockchain and Automation in Trading

1. Faster Execution and Settlements

- Automated systems can evaluate and respond to market conditions in milliseconds.

- Blockchain technology allows near-instantaneous clearing and settlement, reducing delays associated with traditional intermediaries.

2. Improved Security and Risk Detection

- Analytical tools are capable of identifying inconsistencies or suspicious activity quickly.

- The decentralized structure of blockchain assures data cannot be changed retroactively, reducing the risk of tampering or fraud.

3. Lower Operational Costs

- According to Research Nester, embracing blockchain could reduce infrastructure costs in capital markets by up to 32%.

- Automated platforms remove many manual procedures, lowering staffing and operational expenses.

4. Greater Access for All Investors

- Asset tokenization allows individuals to invest in traditionally inaccessible markets, such as private equity or real estate, through fractional ownership.

- Digital platforms allow broader participation, improving liquidity and diversification opportunities.

5. Stronger Compliance Capabilities

- Blockchain provides a transparent and traceable ledger that supports regulatory oversight and audit readiness.

- Automated systems can assist with ongoing monitoring, reporting obligations, and financial crime prevention, such as anti-money laundering (AML).

Looking Ahead: What's Next?

By the end of this decade, much of the trading ecosystem is predicted to be fully digital and largely self-operating.

- Decentralized exchanges like Uniswap are facing significant adoption, with monthly trading volumes crossing $40 billion in 2024.

- Central banks are actively exploring digital currencies, which could form the foundation for large-scale blockchain-based settlement systems in public markets.

As financial markets evolve, human-led trading will increasingly pave the way to machine-driven execution and autonomous systems. These systems will interact in real-time across decentralized platforms, balancing portfolios, implementing trades, and managing risk without any manual assistance.

Contact Us