Global Sleep Apnea Devices Market

- An Outline of the Global Sleep Apnea Devices Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

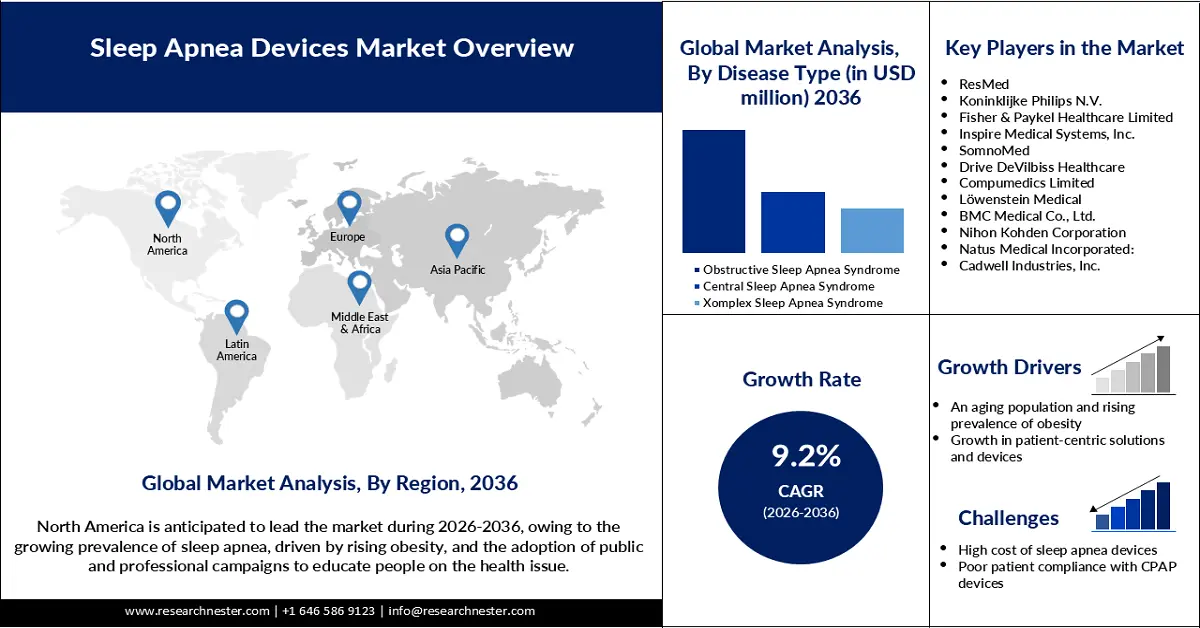

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Sleep Apnea Devices

- Recent News

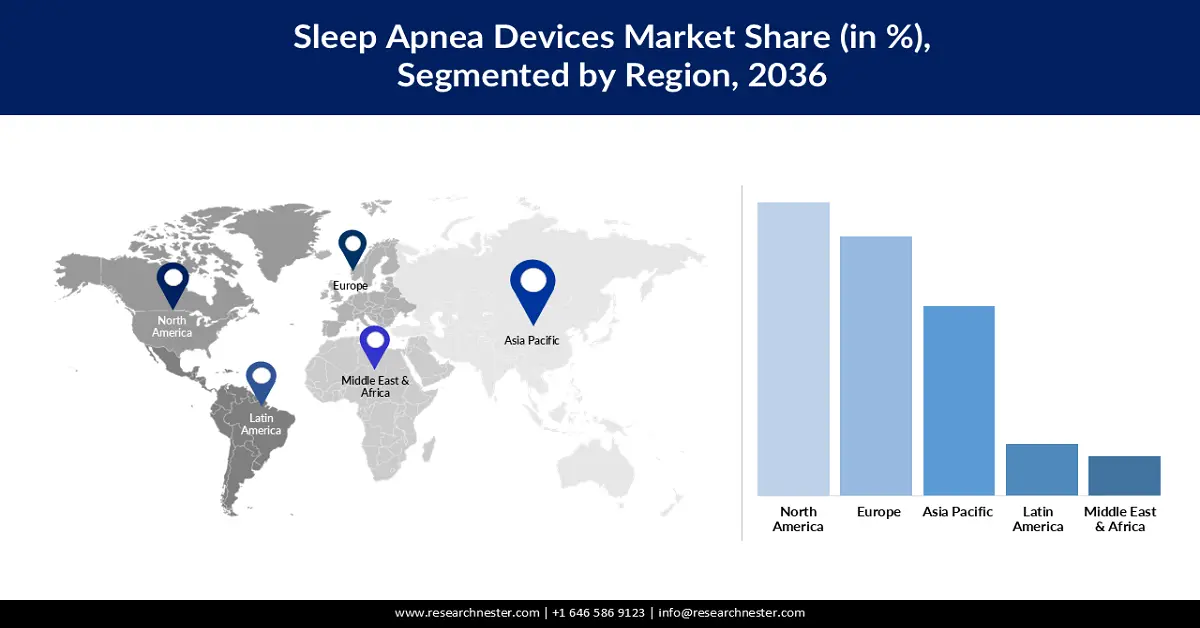

- Regional Demand

- Sleep Apnea Devices Market by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Sleep Apnea Devices Demand Landscape

- Sleep Apnea Devices Demand Trends Driven by Electrification, Downsizing, and Lightweighting (2026-2036)

- Root Cause Analysis (RCA) for discovering problems of the Sleep Apnea Devices Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Global Sleep Apnea Devices Market – Key Player Analysis (2024)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2024 (%)

- Business Profile of Key Enterprise

- ResMed

- Koninklijke Philips N.V.

- Fisher & Paykel Healthcare Limited

- Inspire Medical Systems, Inc.

- SomnoMed

- Drive DeVilbiss Healthcare

- Compumedics Limited

- Löwenstein Medical

- BMC Medical Co., Ltd.

- Nihon Kohden Corporation

- Natus Medical Incorporated:

- Cadwell Industries, Inc.

- Braebon Medical Corporation

- Medtronic

- LivaNova PLCMarket Overview

- Business Profile of Key Enterprise

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Sleep Apnea Devices Market Segmentation Analysis (2026-2036)

- By Product

- Diagnostic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- PSG Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Home Sleep Testing Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Oximeters, Market Value (USD Million), and CAGR, 2026-2036F

- Actigraphs, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Therapeutic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- PAP Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Oral Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Accessories, Market Value (USD Million), and CAGR, 2026-2036F

- Nasal Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Sleep Apnea Masks, Market Value (USD Million), and CAGR, 2026-2036F

- Diagnostic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- By Age Group

- Pediatric, Market Value (USD Million), and CAGR, 2026-2036F

- Below 40 years, Market Value (USD Million), and CAGR, 2026-2036F

- 40 to 60 years, Market Value (USD Million), and CAGR, 2026-2036F

- Above 60 years, Market Value (USD Million), and CAGR, 2026-2036F

- By Disease type

- Obstructive Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- Central Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- Complex Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- By End Use

- Hospitals, Market Value (USD Million), and CAGR, 2026-2036F

- Home Care Settings, Market Value (USD Million), and CAGR, 2026-2036F

- Sleep Clinics, Market Value (USD Million), and CAGR, 2026-2036F

- Ambulatory Care Centers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Regional Synopsis, Value (USD Million), 2026-2036

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Product

- Sleep Apnea Devices Market Segmentation Analysis (2026-2036)

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036,

- By Product

- Diagnostic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- PSG Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Home Sleep Testing Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Oximeters, Market Value (USD Million), and CAGR, 2026-2036F

- Actigraphs, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Therapeutic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- PAP Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Oral Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Accessories, Market Value (USD Million), and CAGR, 2026-2036F

- Nasal Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Sleep Apnea Masks, Market Value (USD Million), and CAGR, 2026-2036F

- Diagnostic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- By Age Group

- Pediatric, Market Value (USD Million), and CAGR, 2026-2036F

- Below 40 years, Market Value (USD Million), and CAGR, 2026-2036F

- 40 to 60 years, Market Value (USD Million), and CAGR, 2026-2036F

- Above 60 years, Market Value (USD Million), and CAGR, 2026-2036F

- By Disease type

- Obstructive Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- Central Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- Complex Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- By End Use

- Hospitals, Market Value (USD Million), and CAGR, 2026-2036F

- Home Care Settings, Market Value (USD Million), and CAGR, 2026-2036F

- Sleep Clinics, Market Value (USD Million), and CAGR, 2026-2036F

- Ambulatory Care Centers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Product

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036,

- By Product

- Diagnostic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- PSG Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Home Sleep Testing Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Oximeters, Market Value (USD Million), and CAGR, 2026-2036F

- Actigraphs, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Therapeutic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- PAP Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Oral Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Accessories, Market Value (USD Million), and CAGR, 2026-2036F

- Nasal Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Sleep Apnea Masks, Market Value (USD Million), and CAGR, 2026-2036F

- Diagnostic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- By Age Group

- Pediatric, Market Value (USD Million), and CAGR, 2026-2036F

- Below 40 years, Market Value (USD Million), and CAGR, 2026-2036F

- 40 to 60 years, Market Value (USD Million), and CAGR, 2026-2036F

- Above 60 years, Market Value (USD Million), and CAGR, 2026-2036F

- By Disease type

- Obstructive Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- Central Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- Complex Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- By End Use

- Hospitals, Market Value (USD Million), and CAGR, 2026-2036F

- Home Care Settings, Market Value (USD Million), and CAGR, 2026-2036F

- Sleep Clinics, Market Value (USD Million), and CAGR, 2026-2036F

- Ambulatory Care Centers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Product

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036,

- By Product

- Diagnostic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- PSG Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Home Sleep Testing Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Oximeters, Market Value (USD Million), and CAGR, 2026-2036F

- Actigraphs, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Therapeutic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- PAP Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Oral Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Accessories, Market Value (USD Million), and CAGR, 2026-2036F

- Nasal Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Sleep Apnea Masks, Market Value (USD Million), and CAGR, 2026-2036F

- Diagnostic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- By Age Group

- Pediatric, Market Value (USD Million), and CAGR, 2026-2036F

- Below 40 years, Market Value (USD Million), and CAGR, 2026-2036F

- 40 to 60 years, Market Value (USD Million), and CAGR, 2026-2036F

- Above 60 years, Market Value (USD Million), and CAGR, 2026-2036F

- By Disease type

- Obstructive Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- Central Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- Complex Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- By End Use

- Hospitals, Market Value (USD Million), and CAGR, 2026-2036F

- Home Care Settings, Market Value (USD Million), and CAGR, 2026-2036F

- Sleep Clinics, Market Value (USD Million), and CAGR, 2026-2036F

- Ambulatory Care Centers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Product

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- By Product

- Diagnostic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- PSG Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Home Sleep Testing Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Oximeters, Market Value (USD Million), and CAGR, 2026-2036F

- Actigraphs, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Therapeutic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- PAP Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Oral Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Accessories, Market Value (USD Million), and CAGR, 2026-2036F

- Nasal Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Sleep Apnea Masks, Market Value (USD Million), and CAGR, 2026-2036F

- Diagnostic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- By Age Group

- Pediatric, Market Value (USD Million), and CAGR, 2026-2036F

- Below 40 years, Market Value (USD Million), and CAGR, 2026-2036F

- 40 to 60 years, Market Value (USD Million), and CAGR, 2026-2036F

- Above 60 years, Market Value (USD Million), and CAGR, 2026-2036F

- By Disease type

- Obstructive Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- Central Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- Complex Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- By End Use

- Hospitals, Market Value (USD Million), and CAGR, 2026-2036F

- Home Care Settings, Market Value (USD Million), and CAGR, 2026-2036F

- Sleep Clinics, Market Value (USD Million), and CAGR, 2026-2036F

- Ambulatory Care Centers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Product

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- By Product

- Diagnostic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- PSG Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Home Sleep Testing Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Oximeters, Market Value (USD Million), and CAGR, 2026-2036F

- Actigraphs, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Therapeutic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- PAP Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Oral Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Accessories, Market Value (USD Million), and CAGR, 2026-2036F

- Nasal Devices, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Sleep Apnea Masks, Market Value (USD Million), and CAGR, 2026-2036F

- Diagnostic Devices, Market Value (USD Million), and CAGR, 2026-2036F

- By Age Group

- Pediatric, Market Value (USD Million), and CAGR, 2026-2036F

- Below 40 years, Market Value (USD Million), and CAGR, 2026-2036F

- 40 to 60 years, Market Value (USD Million), and CAGR, 2026-2036F

- Above 60 years, Market Value (USD Million), and CAGR, 2026-2036F

- By Disease type

- Obstructive Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- Central Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- Complex Sleep Apnea Syndrome, Market Value (USD Million), and CAGR, 2026-2036F

- By End Use

- Hospitals, Market Value (USD Million), and CAGR, 2026-2036F

- Home Care Settings, Market Value (USD Million), and CAGR, 2026-2036F

- Sleep Clinics, Market Value (USD Million), and CAGR, 2026-2036F

- Ambulatory Care Centers, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Product

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Sleep Apnea Devices Market Outlook:

Sleep Apnea Devices Market size was valued at USD 8.9 billion in 2025 and is expected to reach USD 21.4 billion by the end of 2036, registering a CAGR of 9.2% during the forecast period, i.e., 2026-2036. In 2026, the industry size of sleep apnea devices is evaluated at USD 9.7 billion.

The rising prevalence of sleep apnea globally, influenced by factors such as obesity, an aging population, comorbidities, and others, is expected to fuel the market growth. As reported by the National Institutes of Health (NIH) in April 2025, the prevalence of obstructive sleep apnea OSA ranges from 9% to 38% among adults. With the rising prevalence of sleep apnea, the demand for sleep apnea devices, such as CPAP, BiPAP, MADs, and TRDs, is likely to increase in the coming years. Hospitals and other healthcare centers are focusing on adopting modern sleep apnea devices to cater to the increasing number of patient admissions.

Continuous innovation in the industry is leading to the development of increasingly compact and user-friendly sleep apnea devices. Patient outcomes have started improving due to features, such as auto-adjusting pressure, heated humidification, and others, in the newly developed sleep apnea devices. In March 2024, ResMed launched the AirFit F40, a full-face and ultra-compact mask, providing the comfort of smaller masks while helping to improve sleep apnea therapy compliance. The device has features, such as a personal therapy assistant and care check-in, engineered for the provision of personalized assistance to the users of PAP.

Key Sleep Apnea Devices Market Insights Summary:

Regional Highlights:

- North America is projected to hold a 46.7% revenue share in the sleep apnea devices market by 2036, driven by the presence of leading companies, rising prevalence of sleep apnea, and awareness campaigns targeting women athletes.

- Europe is expected to capture a significant revenue share by 2036, supported by government initiatives promoting sleep hygiene, public awareness programs, and rising obesity rates.

Segment Insights:

- In the route of administration segment, therapeutic devices are forecast to secure the largest share of 76.2% by 2036, propelled by growing awareness of sleep apnea health consequences and investment in accessible treatment devices.

- Within the age group segment, individuals aged 40 to 60 are set to hold a significant share by 2036, reinforced by higher prevalence of sleep apnea and vulnerability to obesity.

Key Growth Trends:

- Growth in patient-centric solutions and devices

- Rising awareness and early diagnosis

Major Challenges:

- High cost of sleep apnea devices

- Poor patient compliance with continuous positive airway pressure (CPAP) devices

Key Players: Koninklijke Philips N.V., Fisher & Paykel Healthcare Limited, Inspire Medical Systems, Inc., SomnoMed, Drive DeVilbiss Healthcare, Compumedics Limited, Löwenstein Medical, BMC Medical Co., Ltd., Nihon Kohden Corporation, Natus Medical Incorporated, Cadwell Industries, Inc., Braebon Medical Corporation, Medtronic, LivaNova PLC.

Global Sleep Apnea Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest region: North America (46.7% share by 2036)

- Fastest growing region: Asia-Pacific

- Dominating countries: United States, Germany, Japan, United Kingdom, France

- Emerging countries: China, Australia, South Korea, India, Canada

Last updated on : 29 September, 2025

Sleep Apnea Devices Market - Growth Drivers and Challenges

Growth Drivers

- An aging population and rising prevalence of obesity: With an aging population, the demand for sleep apnea devices is likely to increase as a higher prevalence of sleep apnea is noticed among older people. As per the report by the WHO, the count of individuals aged 60 and older is expected to surge to 1.4 billion by 2030 from 1.1 billion in 2023. Along with an aging population, people with obesity are at high risk of suffering from sleep apnea. As per the report of the World Obesity Federation, 1.13 billion people are expected to live with obesity by 2030. Therefore, the rising prevalence of obesity worldwide is expected to accelerate the demand for sleep apnea devices.

- Growth in patient-centric solutions and devices: The demand for wearable, connected, and portable sleep apnea devices is expected to increase due to the rising availability of patient-centric solutions and devices that value the needs and comfort of users. Companies are also investing in the development of the discussed types of patient-centric sleep apnea devices. As per the report by the American Academy of Sleep Medicine, published in September 2024, Huxley Medical received FDA approval for SANSA in July 2024. SANSA is a chest-worn sleep apnea diagnostic patch, offering comfortable and personalized therapeutic and diagnostic experiences for sleep apnea.

- Rising awareness and early diagnosis: The rising awareness of the health consequences of sleep apnea is leading people to earlier diagnosis. Several initiatives, including plans to organize relevant programs and implement suitable policies, have been taken by regulatory bodies globally to increase awareness of sleep apnea. In March 2024, several global players in the sleep apnea market initiated the French Federation of Associations and Friends of Patients, Insufficient of Disabled Respiratory. The campaign aims to raise awareness of sleep apnea among the population and the Ministries of Health across all continents, reducing stigma associated with the health issue, and establishing a global alliance encompassing relevant stakeholders. The promotion of the health issue is likely to influence a rise in purchases of sleep apnea devices for early diagnosis.

Challenges

- High cost of sleep apnea devices: Sleep apnea devices are costly in the majority of countries due to the high prices of the advanced technologies, recurring accessories, skilled labor, and research and development required in the development phase. This is reducing the affordability of sleep apnea devices in low-income countries. The high costs of producing sleep apnea devices influence high initial investment to establish relevant businesses. This is obstructing the entry of new players in the market and hampering the overall market growth.

- Poor patient compliance with continuous positive airway pressure (CPAP) devices: Patients using CPAP are not able to comply with CPAP devices, hampering the overall effectiveness of the treatment that includes the use of sleep apnea devices. Patients are often under stress and discomfort during using certain sleep apnea devices. CPAP devices are often proven ineffective caused to poor handling. Failure of devices to function properly is also taking place, caused by a lack of maintenance. Poor compatibility of the CPAP devices is another factor hampering the market growth.

Sleep Apnea Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 8.9 billion |

|

Forecast Year Market Size (2036) |

USD 21.4 billion |

|

Regional Scope |

|

Sleep Apnea Devices Market Segmentation:

Product Segment Analysis

The therapeutic devices segment is expected to account for a remarkable market share of 76.2% by the end of 2036, owing to growing awareness of the health consequences of sleep apnea, which is leading people to seek early diagnosis and treatment. Companies are also investing in increasing the market accessibility of the therapeutic sleep apnea devices, including PAP, oral, nasal, and other devices. For example, in October 2023, Fisher & Paykel Healthcare Corporation launched the F&P Solo mask in Australia and New Zealand. The product was the very first nasal and pillow mask globally, simplifying the setup process in the treatment of sleep apnea.

Age Group Segmentation Analysis

The 40 to 60 years segment is poised to acquire a significant share by the end of 2036, on account of the higher sleep apnea prevalence. People of this age category are also vulnerable to obesity. As reported in a 2024 report by the National Center for Health Statistics, the prevalence of obesity was higher among adults aged between 40 and 59 from August 2021 to August 2023, compared to people aged 20 to 39 and 60 and over. These facts indicate that individuals from the mentioned age category are highly vulnerable to sleep apnea due to obesity.

End Use Segment Analysis

The home care settings segment is anticipated to witness significant growth, acquiring a revenue share of 54.2% by the end of 2036, due to the growing demand among patients for personalized treatment options. The continuous launches of the portable, connected, and wearable sleep apnea devices are also influencing the domination of the home care settings segment, allowing users to treat sleep apnea at their own residences. The push by governments, even in developing economies, to accelerate the penetration of digital health is also promoting the use of sleep apnea devices in home-care settings. As reported by the Press Information Bureau in January 2025, through the initiation of campaigns, such as the Ayushman Bharat Digital Mission (ABDM) and the Digital Health Incentive Scheme (DHIS), the government is expected to make the healthcare sector undergo a drastic digital transformation.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Product |

|

|

Age Group |

|

|

Disease Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sleep Apnea Devices Market - Regional Analysis

North America Market Insights

North America sleep apnea devices market is anticipated to acquire a revenue share of 46.7% by the end of 2036, owing to presence of leading companies and growing prevalence of sleep apnea, especially among women athletes. As revealed by the American College of Cardiology in June 2025, sleep apnea is likely to become more prevalent among younger women athletes undergoing higher levels of training, impacting around 18 million of the population in total. Public and professional campaigns are also organized across the region to educate people on the health issue, contributing to increasing the attractiveness of sleep apnea devices.

The U.S. sleep apnea devices market is expected to register a rapid CAGR during the forecast period, due to the continuous development of smart sleep apnea devices. Companies based in the U.S. are driving the development of smart sleep apnea devices. Strategic public-private partnerships are also taking place for the advancement of sleep apnea treatment. For example, in June 2025, Tampa General Hospital reported that it collaborated with the USF Health Morsani College of Medicine to participate in the launch of the Inspire V therapy developed by Inspire Medical Systems. Inspire V is a next-generation neurostimulation device used in the treatment of sleep apnea.

Sleep Apnea Research Initiatives by the National Heart, Lung, and Blood Institute in the U.S. as of January 2025

|

Research initiatives |

Research findings |

|

Support in the Apnea Positive Pressure Long-term Efficacy Study (APPLES) |

Discovery of CPAP as an effective treatment for sleep apnea and establishment of CPAP as a leading treatment option |

|

Partnership with the National Institute of Diabetes and Digestive and Kidney Diseases |

The discovery of the fact that 80% of the population with obesity and type 2 diabetes are vulnerable to sleep apnea, and the suitability of weight loss for the reduction of sleep apnea |

|

Funding for the Childhood Adenotonsillectomy Trial (CHAT) |

Awareness of the potential of tonsil surgery to improve sleep, certain behaviors, and general life quality |

Source: NIH

The market in Canada is projected to experience a robust expansion at a high CAGR between 2036 and 2036, as a consequence of increasing vulnerability of younger people with obesity to sleep apnea. As reported by Statistics Canada in March 2024, 25% of adults aged between 18 and 34 had obesity in 2022 in Canada. In addition, the prevalence of obesity among people aged 50 to 64 peaked at 35%. Thus, the demand for sleep apnea devices is likely to increase with the rising prevalence of obesity. The growing popularity of wearable healthcare devices is increasing the scope of wider use of wearable sleep apnea devices.

Europe Market Insights

Europe sleep apnea devices market is anticipated to account for a significant revenue share by the end of 2036, owing to favorable government initiatives increasing the awareness of the seriousness of the health issue and treatment for the same. For instance, in March 2025, the European Sleep Research Society revealed its involvement in organizing a program, Sleep Awareness Month. The organization also unveiled its plan to promote sleep hygiene among adolescents and children, contributing to increasing the demand for sleep apnea devices. Growing obesity across Europe is another factor influencing a surge in the need for sleep apnea devices. As reported by the European Commission in July 2024, around 50.6% of the population aged 16 and older within the region were overweight and obese in 2022.

The sleep apnea devices market in the UK is expected to witness a robust CAGR during the forecast period, as a consequence of the rapid outbreak of risk factors that include an aging population and rising obesity levels. As per the National Health Service in February 2023, a forecasted 1 in every 4 adults and 1 in every 5 children aged between 10 and 11 were living with obesity. In terms of rapid advancement, the market is growing in the UK. In May 2023, Acurable disclosed its plan to launch AcuPebble device in the U.S. for the diagnosis of OSA, following a successful exposure in Europe. The NHS used the advanced sleep apnea device, enabling earlier detection, quicker treatment, and improved management of sleep apnea.

Germany sleep apnea devices market is projected to grow rapidly throughout the forecast period with the rapid expansion of neurostimulation systems. Such an expansion is driven by various domestic and international players supplying sleep apnea devices. For instance, in September 2023, Nyxoah initiated a collaboration with ResMed Germany with the motive of increasing the market for the Genio system. The organizations worked closely to increase awareness of OSA and therapy penetration across Germany, attracting patients resistant to CPAP therapy. Strong healthcare infrastructure across the country is expected to influence increased accessibility of the sleep apnea devices.

Asia Pacific Market Insights

By the end of 2036, the sleep apnea devices market in the Asia Pacific is projected to acquire a significant revenue share, on account of the demographic shifts, including an aging population, rising awareness of sleep disorders, and increasing obesity, notably in countries such as China and Australia. Government support in the improvement of the healthcare infrastructure is also likely to accelerate the adoption of sleep apnea devices. As per the report by the Australian Institute of Health and Welfare in November 2024, published in November 2024, the government raised funds worth USD 178.7 billion in the development of healthcare infrastructure.

The People's Republic of China is the second-largest market for medical devices in the world, as per the International Trade Administration report. China’s medical device imports, including sleep apnea devices, in 2021 were USD 5.62 billion and are expected to reach USD 160 billion by the end of 2038. The market in China is predicted to undergo a rapid expansion between 2026 and 2036, with the surging poor lifestyle of people, leading to sleep disorders among young adults. As a result, the demand for sleep apnea devices can increase among young adults with rising consciousness about sleep apnea among them. The development of AI-embedded sleep apnea devices is also taking place in China, boosting the technological growth of the market. For example, in April 2025, RingConn unveiled RingConn Gen 2. The device is AI-incorporated and capable enough to track sleep patterns and sync with an intuitive application that enables monitoring of sleep apnea.

India sleep apnea devices market is poised to expand at a fast pace during the forecast period, owing to the presence of a large pool of patients suffering from OSA. A projected 82% of men and 92% of women in India are suffering from undiagnosed severe sleep apnea, indicating a surging use of sleep apnea devices for therapeutic purposes. The growing prevalence of comorbidities, including type 2 diabetes, obesity, cardiovascular diseases, cancer, and others, is expected to increase the risk of sleep apnea, influencing a surging demand for sleep apnea devices. Moreover, rising investments by public and private sectors to improve the healthcare infrastructure and increasing imports of medical devices, including sleep apnea devices is expected to fuel the market growth going ahead. For instance, as per ITA reports, the U.S. medical device exports to India rose by nearly 66.3% in FY24, reaching USD 1.45 billion.

Sleep Apnea Devices Market Players:

- ResMed

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Koninklijke Philips N.V.

- Fisher & Paykel Healthcare Limited

- Inspire Medical Systems, Inc.

- SomnoMed

- Drive DeVilbiss Healthcare

- Compumedics Limited

- Löwenstein Medical

- BMC Medical Co., Ltd.

- Nihon Kohden Corporation

- Natus Medical Incorporated:

- Cadwell Industries, Inc.

- Braebon Medical Corporation

- Medtronic

- LivaNova PLC

The market is witnessing a high intensity of competition and is anticipated to continue to do so in the near future. The revenue share of the global sleep apnea devices market is vastly distributed, which makes the industry highly fragmented. As a result, the scope of new entrants increases. Product innovation is the common area of focus of all the small and large key players associated with the market. The key players in the market not only conduct research and development on their own, but also take assistance from professional bodies, including industry experts and research institutions, for the advancement of sleep apnea devices.

The following is the list of the key players dominating the global sleep apnea devices market:

Recent Developments

- In September 2025, Samsung displayed the Sleep Apnea2 feature in its newly developed Galaxy Watch8 series, designed for users aged 22 and over. The product was launched in July 2025 and has features that improve sleep tracking and coaching.

- In April 2025, ResMed announced the availability of NightOwl in the U.S. The device is FDA-approved and offers healthcare service providers a simplified, appropriate, and efficient way of diagnosing OSA.

- In September 2024, ResMed launched AirTouch N30i. It is a tube-up nasal mask for CPAP, designed to provide patients suffering from sleep apnea with a natural and comfortable experience of sleeping.

- Report ID: 183

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sleep Apnea Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.