Luxury Car Market Outlook:

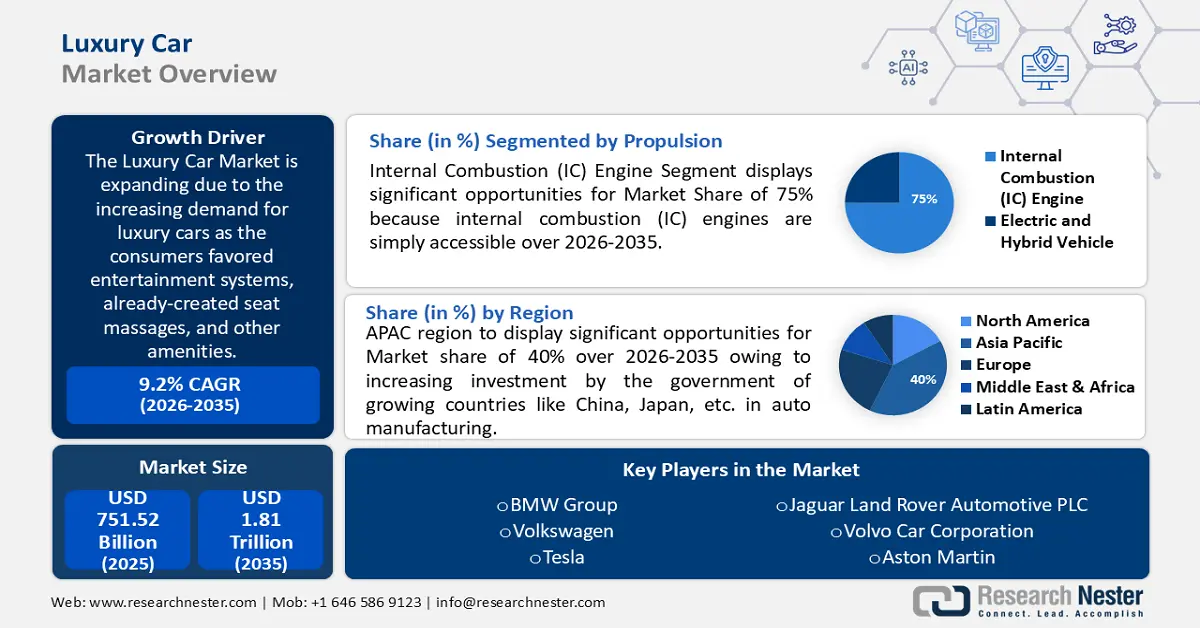

Luxury Car Market size was over USD 751.52 billion in 2025 and is anticipated to cross USD 1.81 trillion by 2035, growing at more than 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of luxury car is assessed at USD 813.75 billion.

The increasing demand for luxury cars as the consumers favored entertainment systems, already created seat massages and other amenities will exponentially help the market to grow in the expected CAGR. Luxury automobiles are a desirable investment for auto aficionados since they frequently hold their value better than mass-market automobiles. Classic luxury vehicles and limited-edition models have the potential to increase in value over time, providing a return on investment. For instance, the Ferrari 250 GTO is valued at tens of millions of dollars, making it one of the most valuable vehicles in the world.

Another reason to propel the luxury car market by the end of 2036 is the current global economic blast. Moreover, according to market research following a 3.1 percent growth rate in the previous year, the global economy is expected to contract significantly in 2023 to 2.1 percent due to further tightening of monetary policy to contain excessive inflation. There will then be a mild recovery to 2.4 percent in 2024. It is anticipated that the resilience shown by global economic activity early this year will diminish. With China's economy recovering more quickly than anticipated and the United States' consumption remaining robust, growth in many major economies was greater than anticipated at the start of the year.

Key Luxury Car Market Insights Summary:

Regional Highlights:

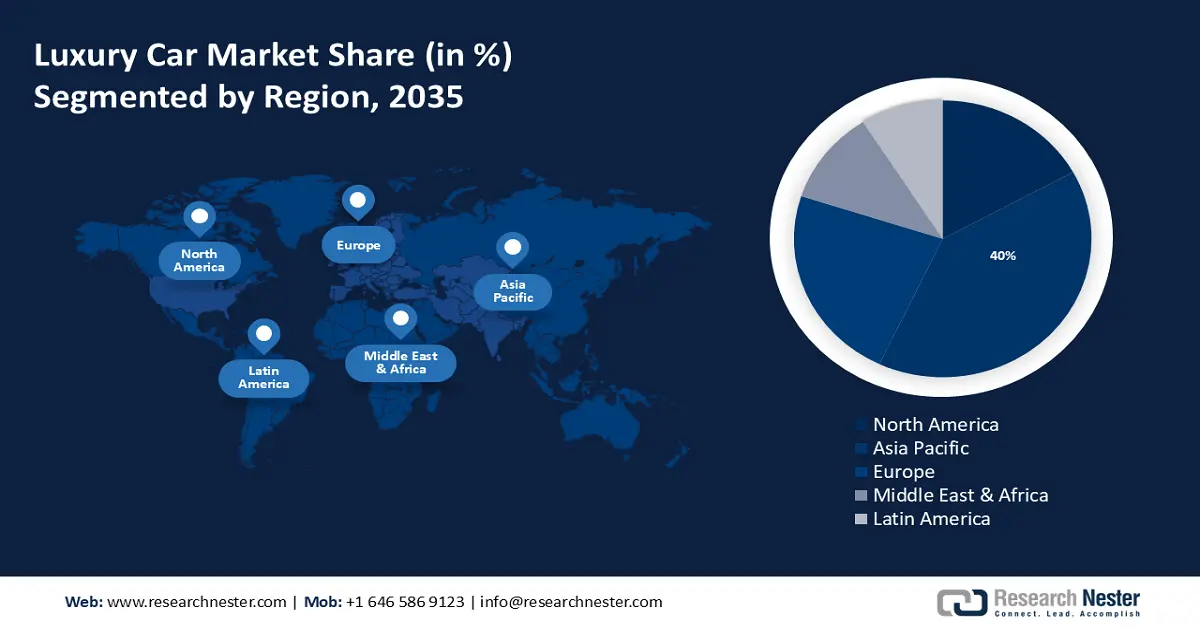

- Asia Pacific luxury car market will dominate around 40% share by 2035, driven by government investment in auto manufacturing in countries like China and Japan.

- Europe market will exhibit huge growth from 2026 to 2035, driven by increasing awareness of sustainability among European consumers.

Segment Insights:

- The internal combustion engine segment in the luxury car market is projected to maintain significant growth over the forecast period 2026-2035, driven by the accessibility of internal combustion engines.

- The sports utility vehicle segment in the luxury car market is expected to achieve a 57% share by 2035, driven by the intensive demand for sports utility vehicles across the world.

Key Growth Trends:

- The Rising Number of Mega-High-Net-Worth of Peoples Across the World

- Rising Involvement of Younger Generation

Major Challenges:

- The High-End Costs of Luxury Cars

- Uncertainty in the Future Purchasing

Key Players: Mercedes-Benz Group AG, Business PlanningMain Product OfferingsFinancial ExecutionMain Performance IndicatorsBMW Group, Volkswagen, Tesla, Jaguar Land Rover Automotive PLC, Volvo Car Corporation, Aston Martin, AUDI AG, Ford Motor Company, Hyundai Motor Company.

Global Luxury Car Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 751.52 billion

- 2026 Market Size: USD 813.75 billion

- Projected Market Size: USD 1.81 trillion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, United States, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Luxury Car Market Growth Drivers and Challenges:

Growth Drivers

- The Rising Number of Mega-High-Net-Worth of Peoples Across the World - Although there is no specific legal definition for a mega-high-net-worth individual (UHNWI), people with assets of at least USD 30 million are frequently considered to be UHNWIs. Importantly, this money has to be invested in assets that can be gained from them. Although there are comparable individuals, the most prevalent of which is the high-net-worth individual, mega-high-net-worth individuals belong to a different class altogether. The millionaires must have a net worth of at least USD 1.5 million and USD 750,000 in investable assets to qualify for this group. It's crucial to remember that investable assets must be net of obligations to meet either of these criteria. Therefore, people who have large debt loads and ambitious investment goals might not be able to attain their desired tier.

- Rising Involvement of Younger Generation - The market for luxury goods, for instance, luxury footwear, dresses, and cars, is driven by the growing involvement of female and younger consumers. Their consuming habits are also driving the market's evolution, offering companies in the market new chances as well as difficulties. BMWs are the most common first car among Gen Z, with nearly one in six of them having owned one. Additionally, 1 in 12 respondents stated that their first car was an Audi.

- The Increasing Buying Power of Women Across the World - "She Power" is becoming increasingly important in the economy. In 2020, a survey curated and found that 89% of women worldwide reported being in control of or sharing daily buying requirements, compared to 41% of men. In 2019, women accounted for nearly USD 31.8 trillion in global consumer spending. There is a growing trend of female consumers participating in the automotive market. An American poll indicates that 65% of new car purchases are made by women. According to a Chinese survey, women spent more on cars in 2020 than men did. Moreover, a sizable portion of purchases in the luxury car market are made by women. According to a premium automobile manufacturer, in China in 2021, 20% of its new cars were bought by women.

Challenges

- The High-End Costs of Luxury Cars - On account of their luxurious and avant-garde characteristics, luxury cars are costly. The cost of producing cars with luxurious amenities and extras is far more than the cost of producing the cars itself. Luxury automobile sales are extremely low because a significant portion of the proceeds from sales goes toward funding the cars' advancement, making them costlier. Thus, it is anticipated that the high price of luxury cars will impede market expansion.

- Uncertainty in the Future Purchasing

- Lack of Technicians Who can Repair the Luxury Cars

Luxury Car Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 751.52 billion |

|

Forecast Year Market Size (2035) |

USD 1.81 trillion |

|

Regional Scope |

|

Luxury Car Market Segmentation:

Vehicle Type (Hatchback, Sedan, Sports Utility Vehicle, Multi-Purpose Vehicle)

The sports utility vehicle segment is expected to hold 57% share of the global luxury car market during the forecast period because of the intensive demand for sports utility vehicles across the world. For instance, in America, Sedan sales now account for just 22.1% of the market, with a new sector capturing 47.4% of all automobile sales, despite decades of popularity for cars like the Honda Civic and Toyota Camry. For many years, SUVs have been more and more popular than sedans. In 2023, they surpassed sedans in market share, and it is expected that this trend will continue in the years to come. SUVs consume more gas and release more CO2 into the atmosphere than sedans because they are heavier and less fuel-efficient.

Fuel Type (Gasoline, Petrol or Diesel, Electric)

The petrol or diesel segment in the luxury car market is projected to account for 45% of the revenue share by 2035, owing to the increasing customer inclination towards petrol despite the prevalence of electric substitutes globally. For instance, in Austria, cars powered by gasoline or diesel are the preferred choice for all age categories (50% of car purchasers under 30, 50% of persons over 65, and 48% of individuals between the ages of 30-64 would buy one).

Propulsion (Internal Combustion (IC) Engine, Electric & Hybrid Vehicle)

The internal combustion (IC) engine segment will have superior growth during the forecast period and will hold around 75% of the revenue share of the luxury car market because internal combustion (IC) engines are simply accessible. About 25% of the world's power comes from internal combustion (IC) engines running on fossil fuel oil (about 3,000 out of 13,000 million tons of oil equivalent annually), and in the process, they generate 10% of global greenhouse gas (GHG) emissions.

Our in-depth analysis of the global market includes the following segments:

|

Vehicle Type |

|

|

Fuel Type |

|

|

Propulsion |

|

|

Vehicle Class |

|

|

Price Category |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Luxury Car Market Regional Analysis:

APAC Market Statistics

The luxury cars market in the APAC region will have the biggest growth during the forecast period with a revenue share of around 40%. This growth will be noticed owing to increasing investment by the government of growing countries like China, Japan, etc. in auto manufacturing. For instance, according to luxury cars market research, China launched "Made in China 2025," a long-term industrial strategy, in 2015 to make the country a global leader in vehicle manufacture by the year 2025. A target of 20% of all new automobile sales will be electric and other new-energy cars by 2022, according to the policy.

European Market Analysis

The luxury car market in the Europe region will also encounter huge growth during the forecast period and will hold the second position owing to the increasing awareness of European people for sustainability. Living well within planetary limitations is the EU's long-term objective for 2050, which is reaffirmed in the 8th Environment Action Programme (8EAP). It lays forth the key goals for 2030 together with the prerequisites for achieving them. The EU might not satisfy the majority of the monitoring objectives listed in the European Commission's eighth EAP Monitoring Communication, according to the European Environment Agency's (EEA) first monitoring report on the Program.

Luxury Car Market Players:

- Mercedes-Benz Group AG

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BMW Group

- Volkswagen

- Tesla

- Jaguar Land Rover Automotive PLC

- Volvo Car Corporation

- Aston Martin

- AUDI AG

- Ford Motor Company

- Hyundai Motor Company

Recent Developments

- IONNA, the joint enterprise to create a high-powered EV charging network around North America, has been accepted by regulatory authorities, and is now authoritatively starting operations. IONNA is a joint enterprise of seven of the world's leading automakers: BMW, General Motors, Honda, Hyundai, Kia, Mercedes-Benz, and Stellantis.

- Mercedes-Benz constantly gripped an all-electric perspective, giving customers a steady charging and payment feel through its charging service, Mercedes Me Charge. In January, a substantial breakthrough was accomplished: the Mercedes Me Charge network currently baled over 1.5 million charging points globally from more than 1,300 charge point operators.

- Report ID: 6003

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Luxury Car Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.