Bactericides Market Outlook:

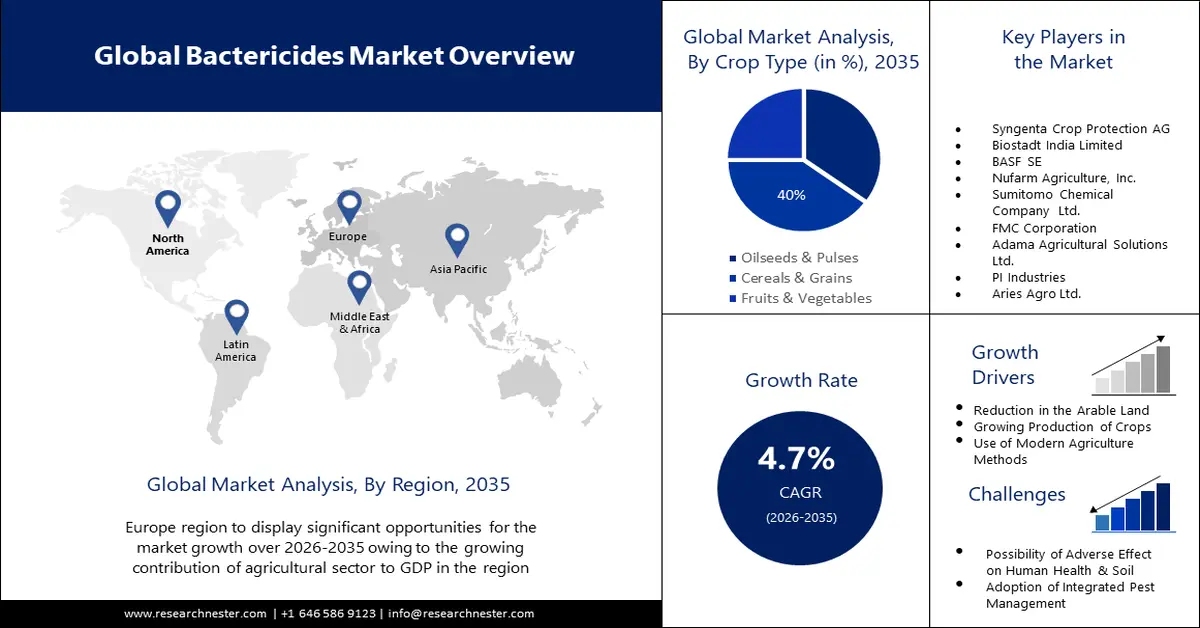

Bactericides Market size was valued at USD 10.38 billion in 2025 and is likely to cross USD 16.43 billion by 2035, registering more than 4.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bactericides is assessed at USD 10.82 billion.

The rising cases of crop wastage due to bacterial infestation instill the need for effective measures to control and manage bacterial disease in agriculture. Bacterial infection can cause significant damage to crops, leading to yield losses, reduced quality, and economic hardships for farmers. According to the Food and Agriculture Organization of the United Nations in 2022, every year, 40% of the crop production worldwide is lost due to diseases and pests.

Besides this, there are rising efforts by regulatory bodies to ensure food safety are significantly contributing to the growth of the market. The World Food Security Outlook stated that more than 950 million people could remain at risk of witnessing severe food insecurity. Bactericides play a crucial role in ensuring food security by protecting crops from damage and streamlining a smooth supply chain.

Key Bactericides Market Insights Summary:

Regional Highlights:

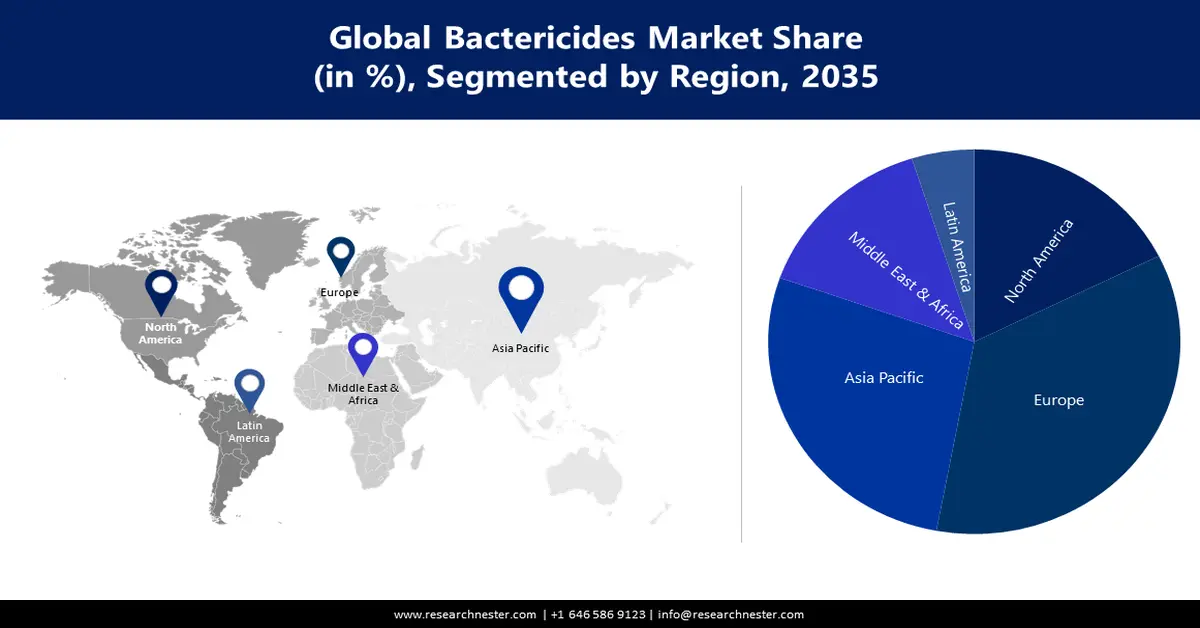

- The Europe bactericides market is projected to capture the maximum share by 2035, driven by the strong contribution of agriculture to GDP and high pesticide sales in the region.

Segment Insights:

- The foliar spray segment in the bactericides market is expected to hold a 60% share by 2035, attributed to the high efficiency and ease of use of foliar spray.

- The cereals & grains segment in the bactericides market is anticipated to capture a 40% share by 2035, driven by growing production and use of cereals and grains.

Key Growth Trends:

- Increasing occurrence of bacterial diseases in plants

- Thriving chemical industry

Major Challenges:

- Environmental concerns

- Resistance development over time

Key Players: Bayer Crop Science AG, Syngenta Crop Protection AG, Biostadt India Limited, BASF SE, Nufarm Agriculture, Inc., Sumitomo Chemical Company Ltd., FMC Corporation, Adama Agricultural Solutions Ltd., PI Industries, Aries Agro Ltd.

Global Bactericides Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.38 billion

- 2026 Market Size: USD 10.82 billion

- Projected Market Size: USD 16.43 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, India, Japan

- Emerging Countries: China, India, Brazil, Mexico, Turkey

Last updated on : 11 September, 2025

Bactericides Market Growth Drivers and Challenges:

Growth Drivers

- Increasing occurrence of bacterial diseases in plants: Farmers are adopting modern practices such as precision farming, hydroponics, agroforestry, etc. However, bacterial diseases are creating a menace during crop production and emerging as a threat to farmers. Majorly, bacterial diseases are of 4 types based on the damage they cause to the tissue of the plant, which may include soft rot, tumors, vascular wilt, and necrosis. Climate change is altering the behavior of the bacteria, bolstering the generation of extracellular polysaccharides by bacteria in warmer temperatures. Various bacteria, such as Burkholderia glumea, are heat-adapted and emerging as a hazard as the temperature rises. According to NASA, the overall temperature of Earth was about 2.6 degrees Fahrenheit warmer in 2024, in comparison with the last century. These factors are propelling the market growth during the forecasted period.

- Thriving chemical industry: The agriculture sector directly depends on the chemical industry to protect crops from harmful organisms. With the rise in the chemical sector, pesticides, bactericides, etc., are easily available to farmers. According to the American Chemical Society, the 50 largest companies across the world have combined sales of chemicals that reached USD 1.2 trillion in 2022. The agrochemical sector is a subset of the chemical industry and is poised to fuel the growth of the market as a surge in advancements in bio-based solutions.

- Rising government subsidies: Governments across the world are giving explicit subsidies in the form of fertilizer, irrigation, credit, and crop insurance. According to the Food and Agriculture Organization, the government spending on the agriculture sector reached an all-time high that is USD 701 billion. Also, according to the USDA Foreign Agriculture Service, fertilizer prices account for nearly one-fifth of the United States farm cash costs. Globally, farmers are applying nutrients on their fields in the form of bactericides and other forms of fertilizers.

Challenges

- Environmental concerns: The main concern with using bactericide is the possibility of poisoning humans or animals and contamination of livestock products. Sometimes, these bactericides remain in the food chain as they remain in the plants eaten by the herbivores. Further, herbivores are eaten by carnivores, and the entire food chain gets affected.

- Resistance development over time: Bacterial pathogens and insects can develop resistance to bactericides over time. Regular and indiscriminate use of bactericides can lead to the development of resistant strains, rendering certain bactericides less effective. This necessitates the development of new and innovative bactericides through the integration of alternative control strategies to manage resistant bacteria effectively.

Bactericides Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 10.38 billion |

|

Forecast Year Market Size (2035) |

USD 16.43 billion |

|

Regional Scope |

|

Bactericides Market Segmentation:

Mode of Application Segment Analysis

The foliar spray segment is estimated to hold 60% share of the global bactericides market by 2035. Foliar spray is the most commonly used technique for spreading bactericides due to its high efficiency and ease of use. According to research conducted by Washington State University the foliar feeding is 20 times more effective than traditional soil application. Some of the benefits of foliar spray are the treatment of nutrient deficiency and plant stage development. By the use of foliar spray, the bactericides can be directly applied on the leaves or the whole plant, which damages the quality of the soil.

Crop Type Segment Analysis

The cereals & grains segment in the bactericides market is expected to be responsible for around 40% in the year 2035. The growth of the segment is primarily attributed to the growing production and use of cereals and grains. According to the Food and Agriculture Organization, worldwide grain consumption in 2023/24 is expected to reach around 2,803 million tonnes, gaining 0.9 percent from 2022/23 levels. Bactericides are utilized in cereal and grains to control bacterial diseases that can negatively impact crop health and yield. The bacterial disease can infect various parts of cereal and grain crops, including the leaves, stems, heads, and kernels. Bactericides are used to suppress or manage bacterial pathogens, minimizing the damage caused by these diseases.

Our in-depth analysis of the global bactericides market includes the following segments:

|

Type |

|

|

Mode of Application |

|

|

Crop Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bactericides Market Regional Analysis:

Asia Pacific Insights

The Asia Pacific region bactericides market is projected to register a remarkable revenue share between 2026 and 2035 due to rising efforts for crop protection. In the Asia Pacific region, bacterial blight has been a cause of concern for the farmers, affecting crops such as rice, most types of beans and walnuts, apples, pears, etc. According to data published by the U.S. Department of Agriculture, the top rice-producing countries in the world are India and China, with a share of 147 million metric tons and 145.28 million metric tons, respectively, in 2024/2025. The surging production of rice instills the requirement for applying bactericides, further augmenting the market growth in the region.

Europe Market Insights

The market in Europe is expected to expand at a substantial CAGR and will cover the maximum share by the end of 2035. The higher contribution of the agriculture sector to European GDP is the main factor driving the market growth in the region. According to data published by the European Government in 2023, agriculture contributed 1.3% to the European Union’s GDP. In the region, the “bactericide and fungicide” category continued to be the most sold variety of the pesticides, registering for almost 43% of the sales in 2022.

Bactericides Market Players:

- Bayer Crop Science AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Syngenta Crop Protection AG

- Biostadt India Limited

- BASF SE

- Nufarm Agriculture, Inc.

- Sumitomo Chemical Company Ltd.

- FMC Corporation

- Adama Agricultural Solutions Ltd.

- PI Industries

- Aries Agro Ltd.

The competitive landscape of the bactericide market is rapidly evolving as established key players, agrochemical giants, and new entrants are investing in developing solutions. Key players in the market are focused on fabricating new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In March 2024, Sym-Agro declared that the U.S. EPA has approved the expanded crop uses of Instill Bactericide and Fungicide. As a result of this, Instill is now registered to use on coffee, potato, hazelnut, and sugar beet for the management of the various diseases.

- In January 2022, Syngenta Crop Protection acquired 2 next-generation bioinsecticides, Unipore and NemaTridnet. The company is aiming to combat increasing resistance among pests and insects across horticulture.

- Report ID: 5085

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bactericides Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.