Non-Invasive Respiratory Monitoring Market Outlook:

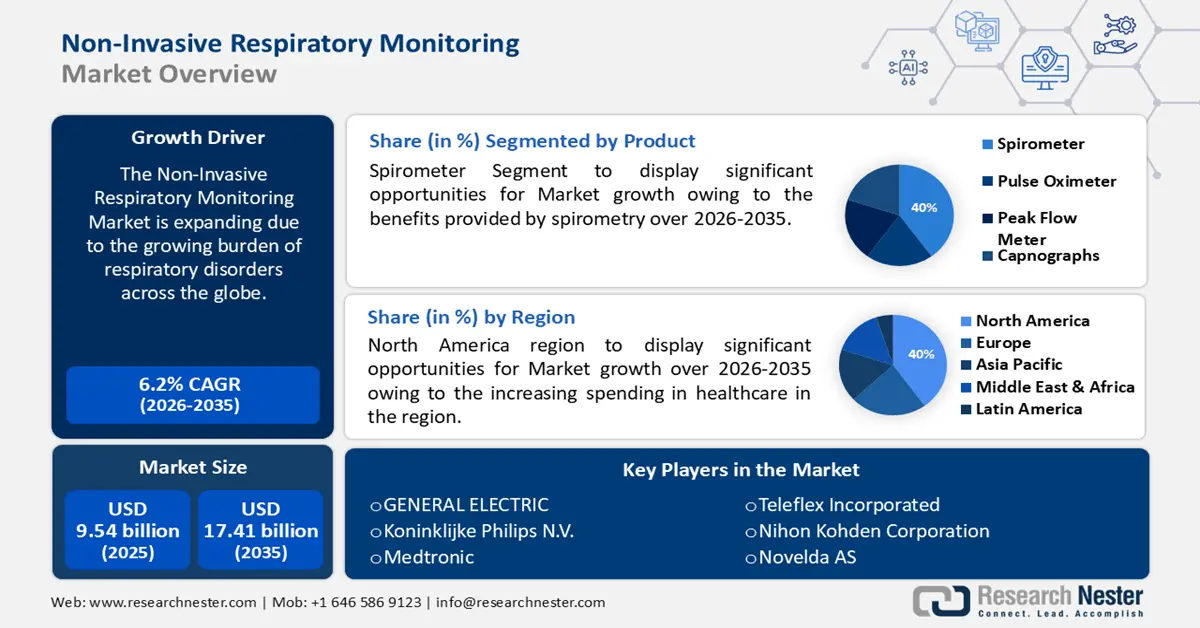

Non-Invasive Respiratory Monitoring Market size was valued at USD 9.54 billion in 2025 and is expected to reach USD 17.41 billion by 2035, expanding at around 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of non-invasive respiratory monitoring is evaluated at USD 10.07 billion.

The reason behind the growth is impelled by the growing burden of respiratory disorders across the globe. The two greatest causes of death in the world are lung cancer and chronic obstructive pulmonary disease driven by growing tobacco smoking, and rising air pollution, dust, and chemicals from the workplace.

For instance, more than 330 million individuals worldwide are thought to be affected by asthma, and the illness is thought to be the cause of around 240,000 annual fatalities.

The growing advancements in noninvasive monitoring of blood gases are believed to fuel the market growth. Improvements in the noninvasive monitoring of arterial and venous blood gases, could all contribute to a significant improvement in respiratory monitoring.

Key Non-Invasive Respiratory Monitoring Market Insights Summary:

Regional Insights:

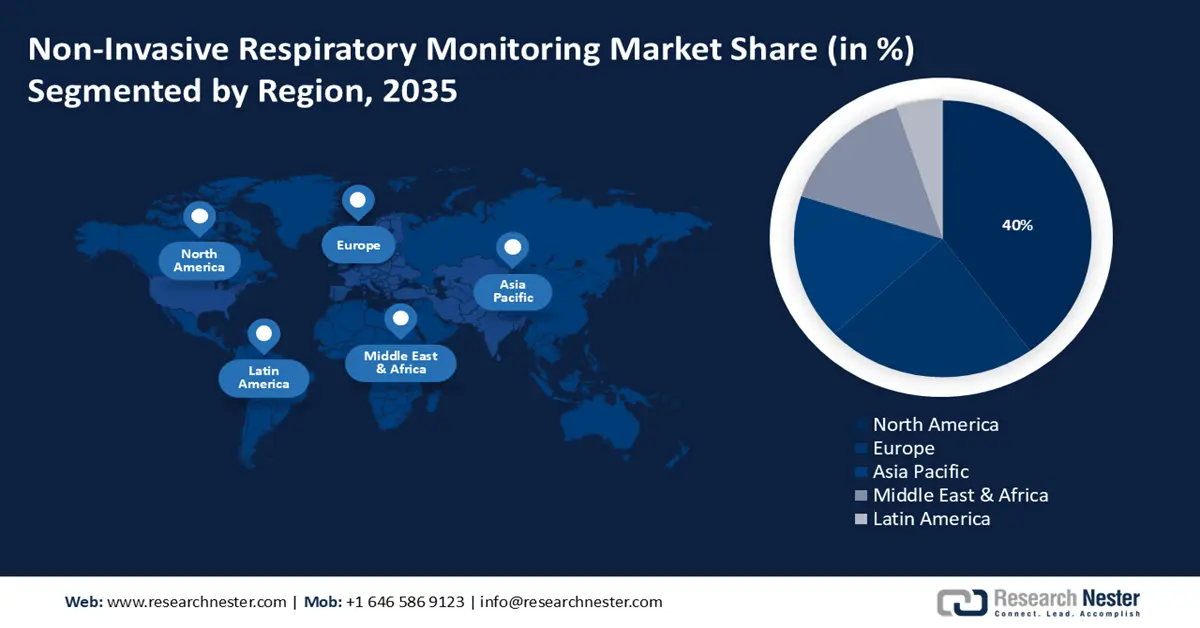

- North America is predicted to command a 40% share of the non-invasive respiratory monitoring market by 2035, bolstered as it is impelled by the increasing spending in healthcare.

- Asia Pacific is poised to secure a significant share by 2035, sustained as it is driven by growing urbanization.

Segment Insights:

- The spirometer segment is projected to capture a 40% share by 2035 in the non-invasive respiratory monitoring market, underpinned owing to the benefits provided by spirometry.

- The hospitals segment is set to garner a notable share by 2035, supported as it is driven by advancements in medical technology and the need for more efficient and comfortable healthcare delivery.

Key Growth Trends:

- Rising Geriatric Population

- Increasing Popularity of Non Invasive Procedures

Major Challenges:

- Lack of awareness and education

- Difficulty associated with ensuring consistent respiratory measurements can limit the adoption

Key Players: Koninklijke Philips N.V., Medtronic, Teleflex Incorporated, Nihon Kohden Corporation, Novelda AS, Welch Allyn, Inc. (Hill-Rom Holdings, Inc.), ResMed, Masimo, COSMED srl, MGC Diagnostics Corporation, OMRON Healthcare.

Global Non-Invasive Respiratory Monitoring Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.54 billion

- 2026 Market Size: USD 10.07 billion

- Projected Market Size: USD 17.41 billion by 2035

- Growth Forecasts: 6.2%

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 28 November, 2025

Non-Invasive Respiratory Monitoring Market - Growth Drivers and Challenges

Growth Drivers

-

Rising Geriatric Population - Elderly patients frequently have acute respiratory failure, which has led to an increase in the adoption of non-invasive respiratory monitoring as a useful substitute for older hospital patients since it causes less discomfort. For instance, more than 770 million individuals worldwide were 65 years of age or older in 2022, making up about 9% of the world's population.

- Increasing Popularity of Non-Invasive Procedures - Their ability to shorten recuperation times, and cost-effectiveness has only served to boost the appeal of non-invasive procedures over time.

Challenges

-

Lack of awareness and education - Many healthcare professionals and individuals in lower economic regions are not aware of non-invasive respiratory monitoring owing to a lack of education arising from the availability of limited resources. As a result, practitioners are less likely to adopt these devices into their practice, which is expected to impede market growth. Moreover, this may also lead to lower funding in research and development of these technologies.

- Difficulty associated with ensuring consistent respiratory measurements can limit the adoption

- Lack of standardization may limit the non-invasive respiratory monitoring market growth

Non-Invasive Respiratory Monitoring Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 9.54 billion |

|

Forecast Year Market Size (2035) |

USD 17.41 billion |

|

Regional Scope |

|

Non-Invasive Respiratory Monitoring Market Segmentation:

Product Segment Analysis

The spirometer segment is predicted to account for 40% share of the global non-invasive respiratory monitoring market in the coming years owing to the benefits provided by spirometry. Spirometry is particularly helpful as a noninvasive respiratory monitoring method of measuring airflow restriction since it is reasonably simple to implement. The most often used technique for tracking breathing is spirometry whereby the patient is required to breathe into a spirometer during the test to gauge how much air they can inhale and expel, which takes a few minutes to complete.

A lung assessment device known as a spirometer counts the amount of air breathed in and out of the lungs every minute and aids in maintaining the health of the lungs by facilitating deep, leisurely breathing. Once trained, spirometry is a simple procedure that may be carried out anywhere and can be carried out by anyone to ascertain the effects of drugs, measure lung damage, track the impacts of occupational and environmental exposures, and detect the existence or absence of lung illness.

In addition, the simple, painless method of determining the blood's oxygen saturation level is pulse oximetry which displays pulse rates and blood oxygen saturation levels with accuracy in less time. They have an LED display, which makes it easier to understand the results, and are often used by sports enthusiasts, cyclists, mountain climbers, and anyone else who wants to swiftly monitor their SpO2 as they are convenient.

Similarly, a peak flow meter is a little, affordable, handheld gadget tool that can help to assess how effectively asthma is controlled, and how well one can expel air from the lungs. The quantity of air that a person can swiftly blast out of their lungs in one breath is known as their peak expiratory flow rate, or PEFR, which is quantified by peak flow meters.

End-User Segment Analysis

The hospitals segment is set to garner a notable share shortly. The demand for non-invasive respiratory monitoring in hospitals is driven by advancements in medical technology and the need for more efficient and comfortable healthcare delivery. Non-invasive techniques, such as pulse oximetry, capnography, and respiratory impedance, allow healthcare providers to monitor respiratory function to detect early signs of respiratory distress and prevent complications.

Furthermore, technological advancements in non-invasive respiratory monitoring devices have led to the expansion of their use across hospitals.

Moreover, non-invasive respiratory monitoring plays a crucial role in enhancing patient safety and comfort during procedures by reducing the risk of adverse events such as hypoxemia, hypoventilation, and respiratory arrest.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Non-Invasive Respiratory Monitoring Market - Regional Analysis

North American Market Insights

Non-Invasive Respiratory Monitoring Market in North America is predicted to account for the largest share of 40% by 2035 impelled by the increasing spending in healthcare. As a result, there is an increasing demand for non-invasive respiratory monitoring technologies in the region which offers several advantages such as reduced patient discomfort. For instance, spending on health care in the United States increased by more than 4% in 2022 to reach around USD 4 trillion.

European Market Insights

The Europe Non-Invasive Respiratory Monitoring Market is estimated to be the second largest, during the forecast timeframe led by growing health awareness. The necessity of maintaining excellent health and well-being has become more widely recognized as a result of the efforts put in place in Europe, which may drive the demand for non-invasive respiratory monitoring.

APAC Market Insights

Also, the market in the Asia Pacific, is poised to hold a significant share by the end of 2035 driven by growing urbanization. This has a significant impact on the nation's air pollution owing to a lack of amenities such as proper roads, efficient transit management, and an unplanned industrial distribution, which has led to several respiratory issues.

For instance, in India, more than 460 million people live in urban areas, and this figure is increasing annually by over 2%.

Non-Invasive Respiratory Monitoring Market Players:

- Smith & Nephew

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GENERAL ELECTRIC

- Koninklijke Philips N.V.

- Medtronic

- Teleflex Incorporated

- Nihon Kohden Corporation

- Novelda AS

- Welch Allyn, Inc. (Hill-Rom Holdings, Inc.)

- ResMed

- Masimo

- COSMED srl

- MGC Diagnostics Corporation

Recent Developments

- Smith & Nephew announced the acquisition of Leaf Healthcare for tracking patient motion and preventing pressure injuries and helps automate and record patients who are at risk of pressure injuries' adherence to turning protocols.

- GENERAL ELECTRIC announced that it has obtained approval from the US Food and Drug Administration (FDA) for a Portrait Mobile gadget that allows for continuous real-time monitoring of a patient's vital signs, including pulse rate, oxygen saturation, and respiration rate, and can notify medical professionals when a patient's condition is about to deteriorate and allow for the required action.

- Report ID: 5938

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Non-Invasive Respiratory Monitoring Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.