Global Protein Expression Technology Market Overview

Global Protein Expression Technology Market is based on the modification and characterization of proteins in cells. This can control over the chronic diseases that occur in human and other living organisms like bacteria, yeasts, algae etc. The change in expressions of proteins can work as a medicine to many diseases and disorders in proteins. The growing technological advancement in R&D of Pharmaceutical labs and Biotechnological labs demands for expansion of the biopharmaceutical industry which has resulted in massive growth of the protein expression market. High chronic disease rate demands for therapeutic proteins such as insulin, hormones, monoclonal antibodies and vaccines. Thus, it is enlarging the protein expression market that propels growth of the market during the forecast period. Many biotechnological and pharmaceutical companies have begun to concentrate on the R&D and manufacturing of latest and advance therapeutic proteins for the treatment of severe chronic diseases such as hemophilia, cancer, infectious diseases, anemia, and many more.

Increasing investment in the R&D by biotechnology and pharmaceutical companies in partnership with government funding is another major factor supporting the Global Protein Expression Technology Market growth. The discovery of newer and advanced technologies to cater the needs of drugs & biologics accessories boosts the adoption of protein expression technology for research and medical applications.

Market Size & Forecast

Many Biotechnological Research Centers and pharmaceutical companies are working to discover better applications by drugs, injections, etc. to achieve the market demand. The rise in chronic diseases has given rise to the market of protein expression technology and will grow throughout the forecast period at a CAGR of 10.1%. The Global Protein Expression Technology market is expected to reach a value of USD 2.9billion at the end of the forecast period.

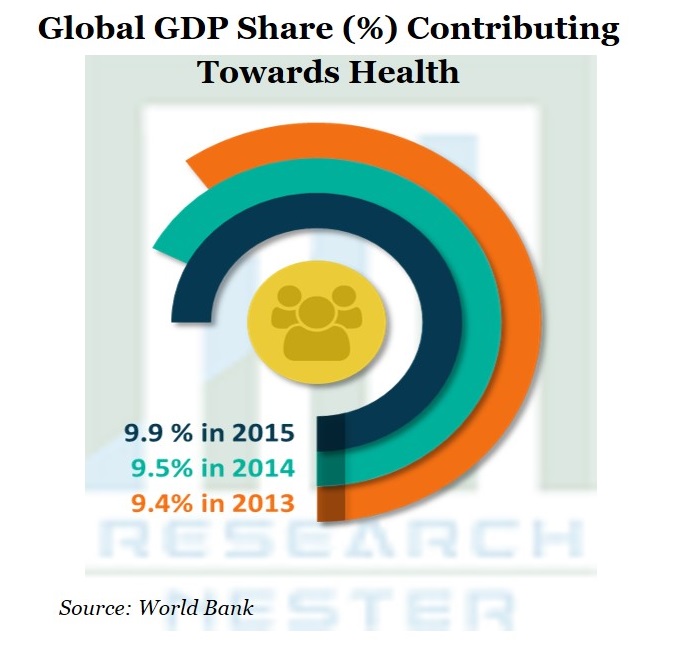

The data from World Bank, shows consequent rise in health investment from world’s GDP share since 2013 to 2015. There have been 9.9% share of GDP in 2015, followed by 9.5% in 2014 and 9.4% in 2013. This rising share in the health segment owing to rise the health awareness and thus in turn driving the protein expression market during the forecast period.

The change in lifestyle and environmental factors have given rise to many diseases to occur at a very early stage of life, thus, increasing the demand for the chronic treatments by drugs and other medical options for protein expression technology. The Global Protein Expression Technology market is observing rapid growth owing to increasing R&D in the academic & research institutes segment which holds the largest revenue share because of rising funding for biological research by private and government organizations.

On the basis of regional platform, global Protein Expression Technology market is segmented into five major regions including North America, Europe, Asia Pacific, Latin America and Middle East & Africa region.

As the trend for advance and innovative treatment is rendering the market, there is an increase in acceptance of therapeutic proteins in the lifestyle of the people all over the world.

Protein Expression Technology market in North America, Western Europe and Asia Pacific excluding Japan with the use of mammalian expression system segment lead the market in terms of expression systems during the forecast period. North America in the protein expression system category will dominate the market with a higher market value as compared to APEJ and Western Europe. Asian Pacific countries will observe a steady growth rate because of lesser complex government rules and regulations and easy availability of skilled professionals.

Market Segmentation

Our-in depth analysis of the global Protein Expression Technology market includes the following segments:

By Expression Type:

- Mammalian

- Insect

- Yeast

- Bacterial

- Algal

- Cell-free

By Product Type:

- Reagents

- Competent cells

- Expression vectors

- Services

- Instruments

By Application Type:

- Cell culture

- Protein purification

- Membrane proteins

- Transfection technologies

By End User Industries:

- Academics

- Pharmaceutical Companies

- Biotechnological Labs

- Others

By Region

Global Protein Expression Technology Market is further classified on the basis of region as follows:

- North America (United States, Canada), Market size, Y-O-Y growth Market size, Y-O-Y growth & Opportunity Analysis, Future forecast & Opportunity Analysis

- Latin America (Brazil, Mexico, Argentina, Rest of LATAM), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Europe (U.K., Germany, France, Italy, Spain, Hungary, BENELUX (Belgium, Netherlands, Luxembourg), NORDIC (Norway, Denmark, Sweden, Finland), Poland, Russia, Rest of Europe), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Asia-Pacific (China, India, Japan, South Korea, Malaysia, Indonesia, Taiwan, Hong Kong, Australia, New Zealand, Rest of Asia-Pacific), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

Growth Drivers

Widespread Application

The rising demand for protein expression technology for its various usefulness in pharmaceutical, biotechnological and other relative industries are expected to drive the market rapidly over the forecast period. On the basis of advancement in R&D and technology, it reflects that Protein Expression Technology will be at the foremost choice of adoption, and will reflect the highest global share.

Rise in Chronic Diseases

High chronic disease rate demands for therapeutic proteins such as insulin, hormones, monoclonal antibodies and vaccines. Thus, it is enlarging the protein expression market that propels growth of the market during the forecast period.

Restraint

Expensive Treatment and Procedure

However, development of protein expression technology incurs huge costs and in-house development which makes this advanced technology out of reach of wide range of population all over the world. Moreover, the technologies have lesser protein production as compared to the costs involved in its development which will anticipate hindering the market growth further over the forecast period.

Top Featured Companies Dominating the Market:

- Merck KGaA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thermo Fisher Scientific Inc.

- QIAGEN N.V.

- Dickinson & Company

- Agilent Technologies, Inc.

- Lucigen Corporation

- Takara Bio Inc.

- Lonza Group Ltd.

- GenScript Biotech Corporation

- Bio-Rad Laboratories, Inc.

- Report ID: 679

- Published Date: Feb 10, 2023

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert