Product Overview

The orthopedic prosthetic devices are the external medical devices. It is a substitute for the missing skeletal part of the body. It is a vital component for the rehabilitation of the injured skeletal system associated with the joints. These devices are primarily used for the elimination of the body appendage and the disability arising from the congenital conditions. It efficiently facilitate the replacement of the missing part of the body. These devices are used for the treatment of the hip, knee, elbow, ankle, leg and others. These devices are associated with the CAD/CAM technology in order to ensure treatment of the diseases.

Market Size and Forecast

The global orthopedic prosthetic devices market is anticipated to expand at CAGR around 5.2% during 2018-2027. It is expected to reach around USD 3.1 billion market size by 2027. The growing ageing population coupled with the increasing rate of the obesity is anticipated to major reason driving the growth of the global orthopedic prosthetic devices market during the forecast period. For instance, according to WHO 39% of women and 39% of men aged 18 and over were overweight.

The global orthopedic prosthetic devices market can be segmented on the basis of device type, technology, end-user and region. On the basis of the device type, it is sub-segmented into lower extremity prosthetics, upper extremity prosthetics, modular components, sockets and liners. The lower extremity prosthetics is anticipated to be the largest sub-segment during the forecast period. The increasing technological development in the lower extremity prosthetics coupled with the rising awareness among the population is anticipated to be major factor driving the growth of the sub-segment. On the basis of technology, it is sub-segmented into conventional, electric powered and hybrid orthopedic prosthetics. Electric powered is anticipated to leading sub-segment during the forecast period. The increasing inclination of the various key manufacturers towards developing electric powered devices is expected to fuel the market growth of the sub-segment. On the basis of end-user, it is sub-segmented into orthopedic clinics, hospitals and ambulatory surgical centers.

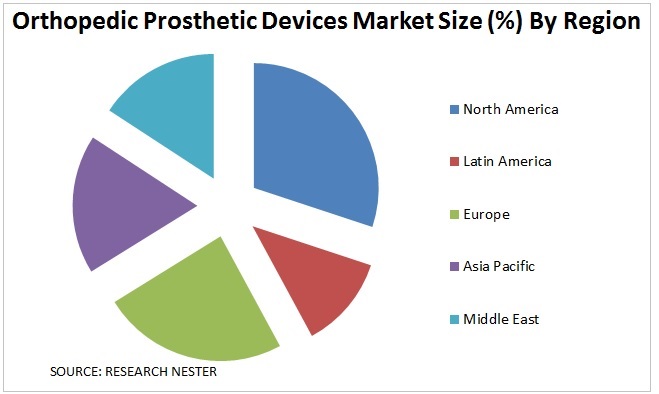

By region, global orthopedic prosthetic devices market is segmented into North America, Asia-Pacific, Latin America, Europe, Middle East and Africa. North America is anticipated to hold the largest market share for the global orthopedic prosthetic devices market during the forecast period. The increasing number of the population suffering from diabetes coupled with the presence of the highly developed machines and devices is expected to be the major factor increasing the growth of the orthopedic prosthetic devices market in the region. For instance according to the U.S. Department of Health and Human Services the total cases estimated suffering from diabetes are 23.1 million every year and in 2015 30.3 Americans had diabetes. Asia-Pacific region is anticipated to be the fastest developing region for the global orthopedic prosthetic devices market. The rising industrial development in the region leads to the development of the enhanced healthcare infrastructure coupled with stringent government policies regarding the healthcare is anticipated to drive the growth of the global orthopedic prosthetic devices market in the region.

CLICK TO DOWNLOAD SAMPLE REPORT

Market Segmentation

Our in-depth analysis segmented the global orthopedic prosthetic devices market in the following segments:

By Device Type:

- Lower Extremity Prosthetics

- Upper Extremity Prosthetics

- Modular Components

- Sockets

- Liners

By Technology:

- Conventional

- Electric Powered

- Hybrid Orthopedic Prosthetics

By End-User:

- Orthopedic Clinics

- Hospitals

- Ambulatory Surgical Centers

By Region

Global orthopedic prosthetic devices market is further classified on the basis of region as follows:

- North America (United States, Canada), Market size, Y-O-Y growth Market size, Y-O-Y growth & Opportunity Analysis, Future forecast & Opportunity Analysis

- Latin America (Brazil, Mexico, Argentina, Rest of LATAM), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Europe (U.K., Germany, France, Italy, Spain, Hungary, BENELUX (Belgium, Netherlands, Luxembourg), NORDIC (Norway, Denmark, Sweden, Finland), Poland, Russia, Rest of Europe), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Asia-Pacific (China, India, Japan, South Korea, Malaysia, Indonesia, Taiwan, Hong Kong, Australia, New Zealand, Rest of Asia-Pacific), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

Growth Drivers and Challenges

The increasing case of the lower limb amputations among diabetic patients is anticipated to be the major growth driver for the global orthopedic prosthetic devices market during the forecast period. According to WHO, 422 million of the adult are suffering from diabetes and 1.6 million deaths are caused by the diabetes every year. The changing lifestyle problems is increasing the cases of the population suffering from the chronic diseases and increasing demand for the technologically advanced devices is anticipated to be a growth driver for the global orthopedic prosthetic devices market. The increasing availability of the minimally invasive technique for the treatment of the diseases is anticipated to increase the demand for the orthopedic prosthetic devices. The rising ageing population across the globe coupled with the increasing number of health conscious population is also driving the global orthopedic prosthetic devices market. For instance according to WHO the total world population is anticipated to grow form 12% to 22% during 2015-2050.

The high cost of the orthopedic prosthetic devices is anticipated restrain the growth of the global orthopedic prosthetic devices market during the forecast period.

Top Featured Companies Dominating The Market

- Zimmer Holdings, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Touch Bionics Inc.

- Exactech, Inc.

- Stryker Corp.

- Otto Bock HealthCare GmbH

- Smith and Nephew plc

- Biomet Inc.

- DePuy, Inc.

- Report ID: 670

- Published Date: Feb 10, 2023

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert