Crystalware and Glassware Market Outlook:

Crystalware and Glassware Market size was over USD 12.04 billion in 2025 and is projected to reach USD 31.51 billion by 2035, growing at around 10.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of crystalware and glassware is evaluated at USD 13.13 billion.

The growth of the market is primarily attributed to the growing craze for fine dining as of its sophistication. For instance, fine dining is a highly expensive dining experience that typically includes multi-course with a prix fixe menu choice. Crystalware and glassware are referred to products that are made up of glass and crystals. It is a variety of glass with different chemical compositions and crystalline structures. Crystalware and glassware products are usually made up of three types of glasses which are soda lime glass, lead glass, and heat-resistant glass. Crystalware and glassware products have a higher refractive index and lower working temperature and viscosity. These products are also used in ornament and have decorative applications globally increasing count of hotels and restaurants is anticipated to lead the growth of the crystal ware and glassware market over the forecast period. For instance, as of 2018, the count of hotels had increased to nearly 187,300 across the globe.

Key Crystalware and Glassware Market Insights Summary:

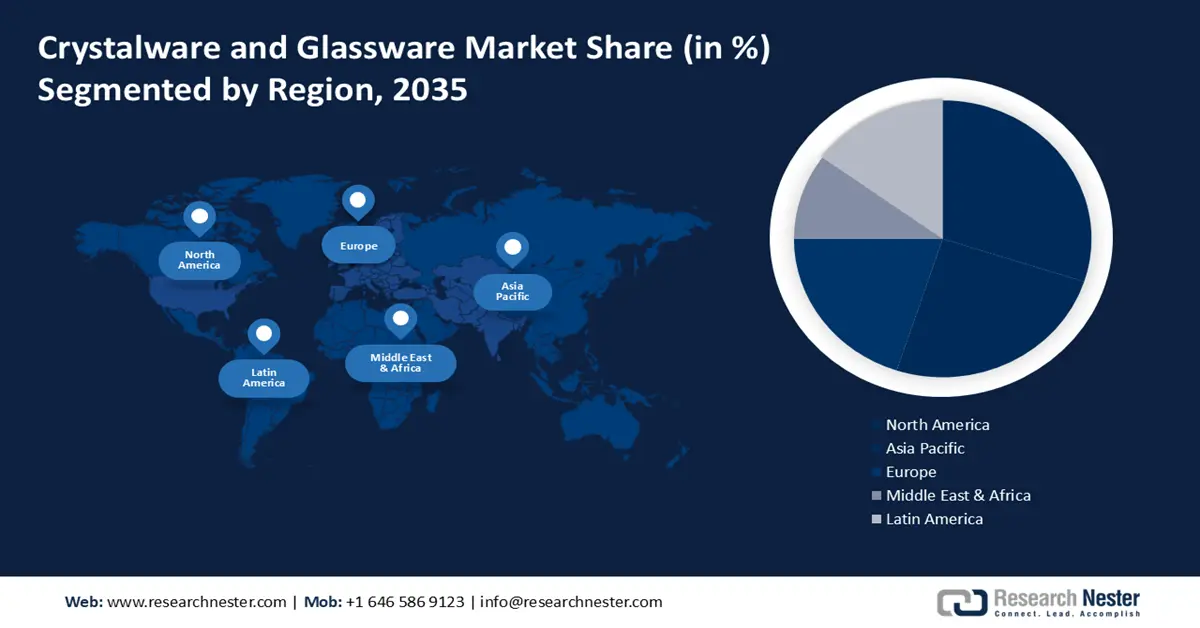

Regional Highlights:

- By 2035, North America is projected to secure the majority revenue share in the crystalware and glassware market, supported by rising per-capita income levels and the strong presence of major manufacturers in the region owing to outstanding lifestyle standards.

Segment Insights:

- By 2035, the soda lime glass segment in the crystalware and glassware market is expected to capture a leading share, propelled by its cost-effectiveness, chemical stability, and high visible-light transmission.

Key Growth Trends:

- Worldwide Growing Inclination of Eating Out

- Escalating the Number of Bars Worldwide

Major Challenges:

- Rise in Penetration of Plastic and Ceramic Products

- Availability of Cheap products

Key Players: Villeroy & Boch AG, Noritake Co., Limited, Lifetime Brands, Inc., Lenox Corporation, Libbey Glass LLC, FUSO Glass India Pvt Ltd., Bormioli Rocco S.p.A., Shandong Hikingpac Co., Ltd, Fiskars Group, Stölzle Lausitz GmbH.

Global Crystalware and Glassware Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.04 billion

- 2026 Market Size: USD 13.13 billion

- Projected Market Size: USD 31.51 billion by 2035

- Growth Forecasts: 10.1%

Key Regional Dynamics:

- Largest Region: North America (Majority Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, Indonesia, Mexico, South Korea

Last updated on : 19 November, 2025

Crystalware and Glassware Market - Growth Drivers and Challenges

Growth Drivers

- Worldwide Growing Inclination of Eating Out – As a result of changing lifestyles and an increase in the working-people ratio, the trend of eating out in a restaurant or hotel has been increasing. Moreover, now people prefer to relish other countries’ cuisines as well, which led them to go out for taking dinners, and lunch in some hotels, where crystalware and glassware are being used majorly. For instance, a staggering ratio of around 43% of people eats out multiple times per week, with another 23% eating out once every week.

- Escalating the Number of Bars Worldwide – For instance, the number of bars in Longrewrown was around 3240 in 2020.

- Worldwide Surge in Travel & Tourism Industry – For instance, international tourism exhibited significant signs of improvement in the first 7 months of 2022, with the number of visitors reaching approximately 55% of pre-pandemic levels which denotes, over the period, an approximated 470 million tourists traveled globally, compared to 172 million during the same months of 2021.

- Upsurge in Food and Beverage Industry – For instance, the food and beverage industry in the United States garnered approximately USD 996 billion in 2020.

- Increasing Ratio of Urbanization - As per the statistics of the World Bank, currently, more than 50% of the world's population lives in cities. The count of people living in urban areas is projected to increase more than double to 6 billion by 2045.

Challenges

-

Rise in Penetration of Plastic and Ceramic Products - Plastic resins of many types are used to make packaging products. Nearly 2 million tonnes, or 13.6% of the total amount of plastic containers and packaging produced in 2018, were recycled. As per recent data, Additionally, 16.9% of the garbage produced from plastic containers and packaging was burned with energy recovery, with the remaining (more than 69%) being landfilled.

- Availability of Cheap products

- Surging Demand for Paper Based and Steel Drinkware

Crystalware and Glassware Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.1% |

|

Base Year Market Size (2025) |

USD 12.04 billion |

|

Forecast Year Market Size (2035) |

USD 31.51 billion |

|

Regional Scope |

|

Crystalware and Glassware Market Segmentation:

Product Segment Analysis

The global crystalware and glassware market is segmented and analyzed for demand and supply by product into the lead glass, soda lime glass, and heat-resistant glass. Out of these, the soda lime glass segment is anticipated to significantly grow over the forecast period owing to its most commonly produced variant glass, less expensiveness, chemical stability, and notable ability to transmit visible light which makes it a very ideal material to use in several kinds of industries. For instance, since atoms in soda lime glass have strong intermolecular bonds and are strongly integrated, other compounds are not able to influence its structure and cause corrosion to the glass. This makes it appropriate for use in chemical environments. It has a hardness of 5-7 on the Mohs scale and a refractive index of about 1.5, which means that only about 4% of the light that strikes it is reflected. The remainder passes through, making it a great substance for applications requiring high-light transmission.

Our in-depth analysis of the global crystalware and glassware market includes the following segments:

|

By Type |

|

|

By Product |

|

|

By Application |

|

|

By Price |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Crystalware and Glassware Market - Regional Analysis

North America Market Insights

North America industry is likely to dominate majority revenue share by 2035 backed by outstanding lifestyle standards, escalating per capita income, and the existence of large manufacturers of crystalware and glassware in the region. According to the statistics provided by the Bureau of Economic Analysis, by March 2022, personal income and disposable personal income (DPI) in the United States have expanded by USD 107.2 billion and USD 89.7 billion, respectively.

Crystalware and Glassware Market Players:

- Villeroy & Boch AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Noritake Co., Limited

- Lifetime Brands, Inc.

- Lenox Corporation

- Libbey Glass LLC

- FUSO Glass India Pvt Ltd.

- Bormioli Rocco S.p.A.

- Shandong Hikingpac Co., Ltd

- Fiskars Group

- Stölzle Lausitz GmbH

Recent Developments

- Stölzle Lausitz GmbH received the prestigious Tableware International Award of Excellence 2021, for its new series titled NEW YORK BAR glasses collection since of their two decorative cuts "Manhattan" and "Club".

- Lifetime Brands, Inc. has acquired S’well, who is a global wholesaler, designer, and retailer of reusable, vacuum-insulated products.

- Report ID: 320

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Crystalware and Glassware Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.