Non-Alcoholic Steatohepatitis Treatment Market Outlook:

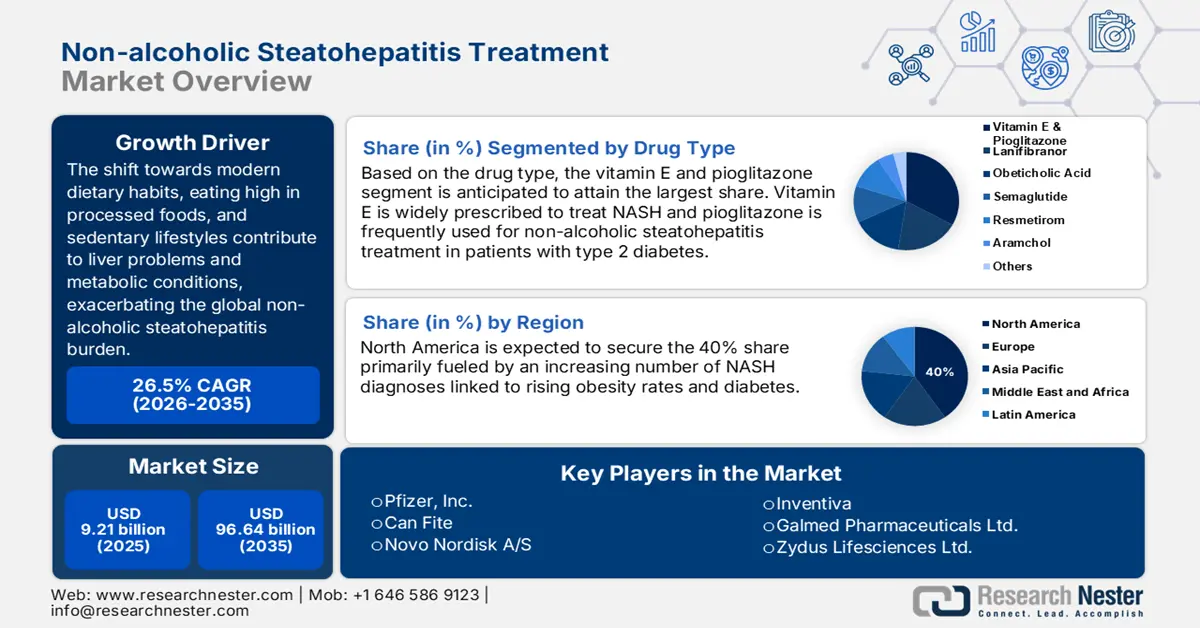

Non-Alcoholic Steatohepatitis Treatment Market size was valued at USD 9.21 billion in 2025 and is likely to cross USD 96.64 billion by 2035, registering more than 26.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of non-alcoholic steatohepatitis treatment is assessed at USD 11.41 billion.

There is a widespread presence of NASH comorbidities such as obesity, nonalcoholic fatty liver disease (NAFLD), type 2 diabetes (T2D), hypertension, high cholesterol, and metabolic syndrome. For instance, in 2022, the worldwide incidence of NAFLD was 47 per 1,000, and prevalence among adults was 32% (NLM). On the other hand, over 890 million people in the world were identified as obese in 2022 (WHO). Another estimation from the Institute of Health Metrics and Evaluation revealed that the diabetic population around the globe was 529 million in 2023, and 96 % of them had T2D. The figure is further projected to reach 1.3 billion by 2050. This demography represents a surge in demand and a large consumer base in the market.

According to a study published by NLM in July 2020, the annual direct medical expenses per patient were USD 1,613 in the U.S. and ranged between USD 402.2 and USD 1321.3 in Europe. This signifies a notable financial exhaustion for patients, making it hard for them to afford advanced solutions from the market. Thus, dedicated organizations in this field are continuously trying to find a cost-effective pathway to mitigate this economic hurdle. On this note, in April 2023, the Institute for Clinical and Economic Review suggested annual payers’ pricing of USD 39,600.0-50,100.0 and USD 32,600.0-40,400.0 for resmetirom and obeticholic acid to meet the cost-effectiveness threshold in treating liver fibrosis.

Key Non-Alcoholic Steatohepatitis Treatment Market Insights Summary:

Regional Highlights:

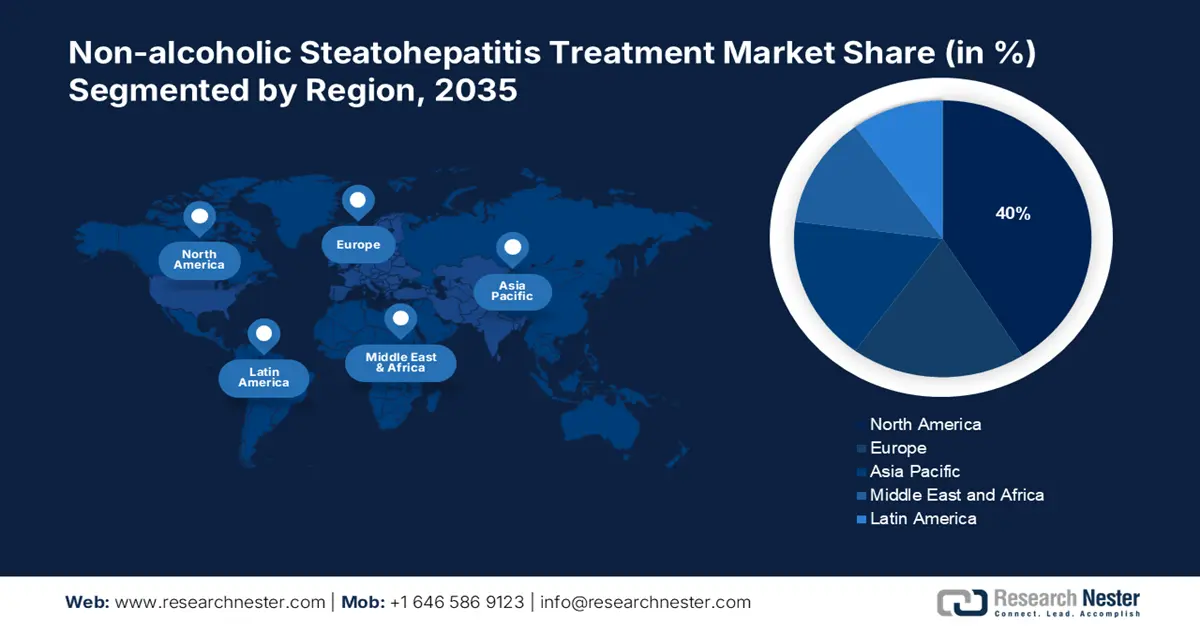

- North America non-alcoholic steatohepatitis treatment market is predicted to capture 40% share by 2035, driven by rising NASH prevalence, increasing obesity rates, and proactive regulatory approvals for new therapeutics.

- Asia Pacific market will achieve notable growth during the forecast timeline, driven by large patient volumes, advances in biopharmaceuticals, and increasing focus from medicine developers.

Segment Insights:

- The vitamin e and pioglitazone segment in the non-alcoholic steatohepatitis treatment market is projected to secure the largest share by 2035, fueled by its global therapeutic effectiveness in reducing NASH-related symptoms.

- The retail & specialty pharmacies segment in the non-alcoholic steatohepatitis treatment market is poised for noteworthy growth during 2026-2035, fueled by stable demand for continuous NASH drug therapy and retail accessibility.

Key Growth Trends:

- Ongoing clinical research and trials

- Advancements in therapeutics development

Major Challenges:

- Difficulties in formulation of the drugs

Key Players: Intercept Pharmaceuticals, Inc., Pfizer, Inc., Inventiva, Galmed Pharmaceuticals Ltd., Novo Nordisk A/S, Madrigal Pharmaceuticals, Galectin Therapeutics, NGM Biopharmaceuticals, Brsitol-Myers Squibb Company, Can Fite, Zydus Lifesciences Ltd., Mitsubishi Chemical Group Corporation.

Global Non-Alcoholic Steatohepatitis Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.21 billion

- 2026 Market Size: USD 11.41 billion

- Projected Market Size: USD 96.64 billion by 2035

- Growth Forecasts: 26.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, China

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 10 September, 2025

Non-Alcoholic Steatohepatitis Treatment Market Growth Drivers and Challenges:

Growth Drivers

-

Ongoing clinical research and trials: R&D initiatives from both governmental, industrial, and academic institutions are evolving the existing pathways in the market. They are discovering new targets and diagnostic methods to bring better precision and efficacy in medications. On this note, in January 2023, researchers at Mount Sinai identified 68 unique interaction pairs in scarred liver cells of candidates with NAFLD. Further, with the use of single-nuclear sequencing and 3D glass imaging, they established promising results from NTF3-NTRK3 blocking molecules in combating NASH fibrosis. Moreover, such deep explorations are helping the sector expand its product portfolio.

-

Advancements in therapeutics development: As consumers shift towards personalized therapies, the cohort of drug development in the market is gaining traction. This is fuelling the emergence of novel medicines with better response rates and safety profiles. For instance, in November 2023, Ipsen, in collaboration with GENFIT, achieved a milestone in a novel, first-in-class, dual PPAR α, δ agonist for treating primary biliary cholangitis (PBC) and preventing NASH. The results from the phase III ELATIVE trial proved the efficacy and safety of investigational elafibranor in attaining a 51% biochemical response, 47% higher than placebo.

Challenges

-

Difficulties in formulation of the drugs: The development of drugs in the market is tedious since liver fibrosis develops slowly and gradually over many years or decades. The level of benefit from lifetime treatment must be weighed against the drug's long-term safety profile, which may cause a delay in regulatory approvals. In addition, NASH patients are susceptible to other illnesses, creating a risk of developing cardiovascular disease, hyperlipidemia, metabolic disease, and diabetes from therapies. Thus, it becomes a complicated and elongated process, increasing financial and commercial pressure on manufacturers.

Non-Alcoholic Steatohepatitis Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

26.5% |

|

Base Year Market Size (2025) |

USD 9.21 billion |

|

Forecast Year Market Size (2035) |

USD 96.64 billion |

|

Regional Scope |

|

Non-Alcoholic Steatohepatitis Treatment Market Segmentation:

Drug Type Segment Analysis

The vitamin E and pioglitazone segment in the non-alcoholic steatohepatitis treatment market is estimated to gain the largest revenue share by 2035. The growth of the segment is notably attributed to its worldwide use, backed by the effectiveness of its therapeutic kinetics. On this note, a study was published by the NLM in August 2023, demonstrating a significant reduction in steatosis, inflammation, ballooning, and liver markers in patients with NAFLD. The results were determined from a combination of randomized controll trials (RCTs), traditional reviews, systematic reviews, meta-analyses, and observational studies. The segment’s leadership is also testified by the worldwide trade of unmixed vitamin E derivatives, which accounted for USD 2.1 billion in 2023, with an annual growth rate of 3.8% in the past 5 years (OEC).

Distribution Channel Segment Analysis

The retail & specialty pharmacies segment is expected to garner a noteworthy revenue from the non-alcoholic steatohepatitis treatment market over the assessed timeline. The importance of a continuous course of drugs in treating NASH is securing a stable flow of business in this segment. In this regard, a 2024 NLM study concluded that the mean annual pharmaceutical spendings by each Medicare beneficiary were USD 4539, USD 6556 , and USD 6427, for non, compensated, and decompensated cirrhotic NASH candidates, respectively. The same was USD 9133, and USD 7348 for hepatocellular carcinoma and liver transplant. On the other hand, the connection between homecare facilities and retail pharmacies boosts the demand for off-label drugs, solidifying the segment’s significance in this sector.

Our in-depth analysis of the global non-alcoholic steatohepatitis treatment market includes the following segments:

|

Distribution Channel |

|

|

Drug Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Non-Alcoholic Steatohepatitis Treatment Market Regional Analysis:

North American Market Insights

The non-alcoholic steatohepatitis treatment market in North America is projected to hold the largest market share of 40% by the end of 2035. In 2022, the prevalence of NAFLD in this region was 47.8%, where the estimated patient population in the U.S. and Canada is 100 million and 9.3 million by 2030, respectively (NLM). This represents an enlarging consumer base for this sector, solidifying the region’s proprietorship. Additionally, the rising expenditure on the treatment of NASH is expected to boost the global presence of North America. This attracting more pharma pioneers to participate in this landscape. On this note, Pfizer consolidated its position in this category by attaining fast-track designation approval from the FDA for its combination therapy of ervogastat and clesacostat in May 2022.

The exponentially growing obese population in the U.S. is propelling demand in the market. As per the 2024 CDC report, the number of adults in this country with obesity surpassed 100 million, and 22 million of them were severely affected by this chronic condition. This indicates the possible widespread occurrence of NASH in the coming years, creating a surge in this field. Furthermore, the nation’s regulatory framework is proactively approving new therapeutics, which is fostering an accepting atmosphere for this merchandise. For instance, in March 2024, the FDA gave clearance to the first and only medication for NASH, Rezdiffra (resmetirom), developed by Madrigal Pharmaceuticals.

APAC Market Insights

Asia Pacific is predicted to register a notable CAGR in the non-alcoholic steatohepatitis treatment market over the analyzed timeframe. The region represents both the key drivers: enormous patient volume and biological innovations. On this note, NLM identified China as encompassing the highest count of NAFLD-afflicted individuals in the world, with a projection of reaching 314.5 million by 2030. Simultaneously, JETRO reported that the domestic biopharmaceutical and regenerative medicine industry in Japan is poised to reach USD 22 billion by 2030 from USD 10 billion in 2020. This testifies to the increasing focus of both international and local medicine developers on Pacific countries, ensuring the region’s fast progression in this field.

2030 Country-wise Projections of NAFLD-afflicted Population

|

Country |

Number of NAFLD patients (in million) |

|

Japan |

22.7 |

|

South Korea |

11.6 |

|

Australia |

7 |

|

Singapore |

1.8 |

Source: NLM

India is emerging as a drug innovation hub for the market with its recent advances in biotechnology and pharmacology. In addition, the country’s governing bodies are proactively spreading awareness about associated diseases to avail early diagnosis, prevention, and intervention. Following this goal, in April 2024, Apollo Hospital inaugurated its Apollo Fatty Liver Clinic at the Liver Diseases and Transplantation Institute in Chennai. The cutting-edge facility is equipped with advanced diagnostic tools and the latest pharmacological solutions, such as FibroScan Expert 630. Such infrastructural developments are garnering new business opportunities for both domestic and foreign pioneers.

Non-Alcoholic Steatohepatitis Treatment Market Players:

- Intercept Pharmaceuticals, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer, Inc.

- Inventiva

- Galmed Pharmaceuticals Ltd.

- Novo Nordisk A/S

- Madrigal Pharmaceuticals

- Galectin Therapeutics

- NGM Biopharmaceuticals

- Bristol-Myers Squibb Company

- Can Fite

- Zydus Lifesciences Ltd.

- Mitsubishi Chemical Group Corporation

- Shilpa Medicare Ltd.

- Hepion Pharmaceuticals, Inc.

Key players in the non-alcoholic steatohepatitis treatment market are evolving their dynamics with the introduction of new therapeutics and preventive medicines. As the trend of identifying and treating the root cause grows, companies are increasingly focusing on developing targeted therapies for individual needs. For instance, in October 2024, Boehringer Ingelheim accomplished Breakthrough Therapy designation for its dual glucagon/GLP-1 receptor agonist, survodutide, from the FDA. This results from the phase II clinical trials demonstrated significant improvement in adults with non-cirrhotic metabolic dysfunction-associated steatohepatitis (MASH) and moderate or advanced fibrosis. The company further commenced the phase III trial for testing the drug’s ability in treating MASH and cirrhosis. Such key innovators are:

Recent Developments

- In March 2025, Shilpa Medicare attained investigational new drug (IND) approval from the Central Drugs Standard Control Organisation (CDSCO) in India for its Nor Ursodeoxycholic Acid (Nor UDCA) Tablets 500 mg. This marketing authorization boosted the company’s debut in the non-alcoholic fatty liver disease portfolio.

- In January 2025, Hepion Pharmaceuticals launched a 'best efforts' public offering, worth USD 9 million, with 27,692,310 shares of common stock. The company is dedicated to developing a treatment for non-alcoholic steatohepatitis, hepatocellular carcinoma, and other chronic liver diseases.

- Report ID: 4695

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Non-Alcoholic Steatohepatitis Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.