Luxury Hotel Market Outlook:

Luxury Hotel Market size was valued at USD 112.4 billion in 2025 and is projected to reach USD 219.1 billion by the end of 2035, rising at a CAGR of 7.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of luxury hotel is estimated at USD 121 billion.

The luxury hotel market is poised for exceptional growth, mainly driven by rising global affluence, increasing demand for premium travel experiences, and a strong shift toward experiential and personalized hospitality. In this context, UNTO reported that international tourism reached 99% of pre-pandemic levels in 2024, with an estimated 1.4 billion international tourist arrivals, which marks an 11% increase when compared to 2023. Several regions surpassed 2019 levels, which were led by the Middle East +32%, Africa +7%, and Europe +1%, whereas the Americas recovered 97% and Asia Pacific 87% of pre-pandemic arrivals. Global tourism receipts totaled approximately USD 1.6 trillion in 2024, up 3% year-over-year and 4% above 2019 levels, with total tourism export revenues reaching a record USD 1.9 trillion, hence increasing the market potential.

Furthermore, the aspects of sustainability, cultural authenticity, and wellness-focused concepts are becoming highly essential for the brand positioning, reshaping the future direction of the market. In December 2025, Hyatt Hotels Corporation announced a major step in its global luxury growth strategy with the appointment of Tamara Lohan as global brand leader - luxury and the preview of an extensive pipeline of luxury openings through 2026. The company’s luxury portfolio now includes nearly 125 hotels and more than 21,000 rooms across the world, with continued expansion planned across key global destinations. Moreover, a highlight of this growth is the opening of Miraval the Red Sea in early 2026, marking the brand’s first international resort and reflecting rising demand for personalized, wellness-focused luxury travel, positively impacting market growth.

Key Luxury Hotel Market Insights Summary:

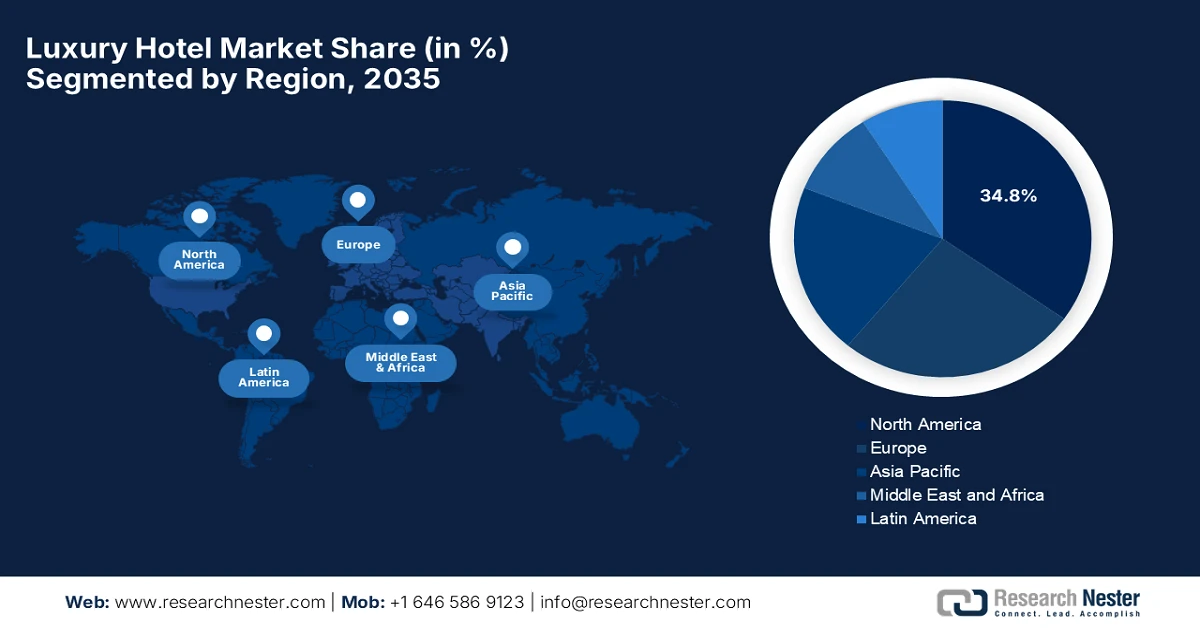

Regional Highlights:

- North America is expected to command around 34.8% share by 2035 in the luxury hotel market, underpinned by robust domestic and international travel flows alongside well-established corporate and leisure hospitality infrastructure.

- Asia Pacific is forecast to expand rapidly over 2026–2035, capturing a notable market share as rising affluence and increasing regional travel accelerate demand for culturally rich and premium lodging experiences.

Segment Insights:

- The chain luxury hotel category is projected to account for a dominant 64.6% revenue share by 2035 in the luxury hotel market, bolstered by strong brand recognition, expansive global distribution, and loyalty programs stimulating repeat and business travel demand.

- The business hotels segment is anticipated to register a considerable share during 2026–2035, supported by high-profile corporate travelers seeking accommodations that balance luxury with functional convenience.

Key Growth Trends:

- Rising disposable income and affluence

- Recovery and growth in global travel & tourism

Major Challenges:

- Economic sensitivity

- Intense competition

Key Players: Four Seasons Hotels and Resorts (Canada), Marriott International, Inc. (U.S.), The Ritz‑Carlton Hotel Company (U.S.), Hyatt Hotels Corporation (U.S.), Hilton Worldwide Holdings Inc. (U.S.), InterContinental Hotels Group PLC (UK), Accor S.A. (France), Mandarin Oriental Hotel Group (Hong Kong/China), Rosewood Hotel Group (Hong Kong), Aman Resorts (Singapore), Banyan Tree Holdings Limited (Singapore), Raffles Hotels & Resorts (Singapore), Kempinski Hotels S.A. (Switzerland), The Peninsula Hotels (Hong Kong), Dorchester Collection (UK), Shangri-La Hotels & Resorts (Hong Kong), Taj Hotels (The Indian Hotels Company Limited) (India).

Global Luxury Hotel Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 112.4 billion

- 2026 Market Size: USD 121 billion

- Projected Market Size: USD 219.1 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, France, Japan

- Emerging Countries: India, United Arab Emirates, Indonesia, Vietnam, Thailand

Last updated on : 30 January, 2026

Luxury Hotel Market - Growth Drivers and Challenges

Growth Drivers

- Rising disposable income and affluence: This is the main driver of growth in the luxury hotel market, as increasing wealth among high-net-worth individuals and upper-middle-class travelers boosts demand for premium luxury stays. In June 2025, Hilton announced that it had officially opened its 1,000th luxury and lifestyle hotel worldwide, with recent openings in cities such as Paris, Cape Town, Dallas, Osaka, Costa Rica, and Jordan. The company has nearly 500 additional luxury and lifestyle hotels in development, including the recently announced NoMad Detroit in partnership with Ford Motor Company, highlighting ongoing expansion in this sector. Additionally, the company emphasized that these portfolios are central to Hilton’s strategy, which plans to open three new luxury and lifestyle hotels each week in 2025, demonstrating strong demand from affluent travelers.

- Recovery and growth in global travel & tourism: International tourism is rebounding to pre-pandemic levels, which is prompting a profitable business environment in the market, especially in major destinations and new luxury hubs. In this context, Marriott International in 2024 reported a record 123,000 gross room openings and 6.8% net room growth, reflecting the strong rebound in global travel and tourism. The company also mentioned that its luxury portfolio expanded with 61 new deals, bringing brands such as St. Regis, W Hotels, The Luxury Collection, and JW Marriott to major destinations worldwide. In addition, notable openings included The St. Regis Shanghai, W Prague, and The Jeddah EDITION, while the Ritz-Carlton Yacht Collection launched its second superyacht in the Mediterranean, hence boosting demand for luxury accommodations across key global markets.

- Experiential & personalized travel preferences: These are reshaping the growth dynamics in the luxury hotel market, as travelers prioritize unique cultural experiences and exclusive activities when compared to traditional luxury amenities. Besides the heightened demand for local experiences, cultural immersion, and bespoke stays, differentiating luxury hotel boosts bookings, driving consistent business in the market. In November 2025, Four Seasons announced that it had launched Insider Itineraries, which is a collection of curated, multi-property travel experiences across Bali, Spain, and Mexico, and is designed to offer authentic cultural discovery and personalized service. Each itinerary is crafted by Four Seasons’ local teams by combining private cultural immersions, wellness rituals, and exclusive activities into a perfect journey from pre-arrival to post-stay, hence indicating a positive market outlook.

Challenges

- Economic sensitivity: The luxury hotel market is sensitive to macroeconomic conditions, consumer confidence, and global disposable income. Also, the aspects of economic downturns, inflation, or currency volatility can reduce the spending in terms of travel and these luxury stays. The business travel cutbacks during recessions also negatively impact the urban luxury hotel, wherein the travelers may postpone international trips. Emerging markets may partially offset losses, but global interdependence means that a slowdown in major economies such as the U.S., Europe, or China significantly affects occupancy and revenue. Therefore, hotels must adapt pricing, promotions, and marketing strategies even more dynamically to address these economic shocks.

- Intense competition: The market is intensely competitive, in which the global chains, boutique properties, and lifestyle hotels are constantly vying for the same affluent client base. Also, the established players such as Four Seasons, Marriott, and Ritz-Carlton compete in terms of brand reputation, whereas the boutique hotels are making differentiation through local experiences and personalized services. New entrants, niche operators, and short-term luxury rental platforms are also fragmenting the market. This competition drives pressure on pricing, occupancy rates, and loyalty program effectiveness. Therefore, maintaining brand distinctiveness while also offering compelling experiences is a constant challenge, negatively impacting market growth in the upcoming years.

Luxury Hotel Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 112.4 billion |

|

Forecast Year Market Size (2035) |

USD 219.1 billion |

|

Regional Scope |

|

Luxury Hotel Market Segmentation:

Category Segment Analysis

The chain luxury hotel in terms of category is anticipated to gain the largest revenue share of 64.6% in the market during the discussed timeframe. Brand recognition, global distribution, and loyalty programs drive business travel demand in this segment. In this regard, Hyatt Hotels Corporation in November 2025 reported that it had expanded its collaboration with Chase to enhance the World of Hyatt loyalty program, which had grown to more than 60 million members, reflecting nearly 30% annual growth over the last decade. Besides, the program drives significant engagement, wherein the loyalty members spend more, stay more, and book through direct channels more frequently than non-members. In addition, Hyatt’s luxury brands, including Park Hyatt and Alila, benefit from this increased repeat and business travel demand, supported by co-branded credit card offerings and exclusive member rewards, hence denoting a wider segment scope.

Type Segment Analysis

The business hotels segment is projected to grow with a considerable market share over the forecasted years. The subtype’s growth is mainly propelled by high-profile business travelers looking for accommodations that combine luxury with practicality. In this context, the OECD Tourism Trends and Policies 2024 report highlighted the critical role of tourism businesses in economic recovery, noting that enterprises face challenges in terms of workforce shortages, rising costs, and adapting to new technologies. Therefore, governments across the globe are encouraged to support businesses through policy measures, infrastructure investment, and training programs to improve competitiveness, sustainability, and resilience. Additionally, strengthening collaboration between the private sector, education providers, and policymakers is highly essential in fostering innovation, meeting changing demand, and ensuring tourism businesses thrive in a post-pandemic environment.

Booking Mode Segment Analysis

The direct booking segment is expected to grab a significant market share by the end of 2035. The subsegments' revenue is mainly propelled by the luxury wellness segment since it enables hotels to provide personalized services, such as customized wellness programs and exclusive room upgrades. Also, the affluent travelers prefer booking directly to ensure their specific needs and preferences are fully met. In addition, the aspect of direct bookings helps hotels save on commission fees, thereby allowing them to reinvest in enhancing the overall guest experience. Besides, this trend is also supported by loyalty programs and exclusive member benefits, which incentivize repeat bookings. Furthermore, technological advancements, such as mobile apps and AI-driven personalization, are also boosting direct booking adoption, hence benefiting the overall market growth.

Our in-depth analysis of the luxury hotel market includes the following segments:

|

Segment |

Subsegments |

|

Category |

|

|

Type |

|

|

Booking Mode |

|

|

Service Type |

|

|

Room Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Luxury Hotel Market - Regional Analysis

North America Market Insights

The North America luxury hotel market is projected to dominate the entire global dynamics, accounting for approximately 34.8% of the total revenue share by 2035. The region’s dominance in this field is supported by strong domestic and international travel, corporate and leisure hospitality infrastructure, and high luxury spending. In April 2025, Marriott International announced that it had acquired the lifestyle brand citizenM for an amount of USD 355 million, aiming to expand its select-service and lifestyle hotel offerings. citizenM is best known for tech-savvy, design-focused accommodations and currently operates 36 hotels across the major regions, with three more under construction. Hence, this acquisition strengthens Marriott’s portfolio, enhances Marriott Bonvoy member options, and positions the company to capture growing demand from modern, experience-driven travelers.

The market for U.S. in luxury hotel benefits from diverse geographic appeal, spanning coastal resorts, metropolitan icons, and historic boutique properties. Major cities in the country serve as hubs for luxury stays with a focus on art, fashion, and culinary excellence. Meanwhile, the aspect of technology-driven convenience, from digital concierges to smart rooms, is being incorporated to meet modern expectations, encouraging more players to establish their footprint in the country. In April 2024, The Ritz-Carlton, Denver, partnered with Noventri to install advanced digital signage throughout its property to enhance guest communication and experience. The cloud-powered system integrates with the hotel’s management software to update lobby and event displays automatically, remarkably reducing staff workload and improving service efficiency. Lobby and door displays are designed with ADA-compliant tactile lettering and braille, while color-matched enclosures complement the hotel’s décor, setting a standard for efficiency and guest satisfaction in the luxury segment.

Canada luxury hotel market is growing due to its integration with natural landscapes, offering premium lodges and urban luxury experiences. Properties in the country are mostly focused on sustainability and eco-conscious design, while also providing unique outdoor activities, such as skiing, wildlife excursions, and lakefront retreats. In October 2023, The Hazelton Hotel in Toronto reported that it was recognized by Condé Nast Traveler as the #1 hotel in Canada and #5 in the world, which reflects its status as the country’s premier Forbes five-star independent luxury boutique property. Besides, the hotel combines lavish rooms, an exclusive spa, fine dining at ONE restaurant, and curated cultural experiences such as the Norman Jewison Cinema. Therefore, this recognition elevates the luxury hotel industry by showcasing its ability to deliver the best experiences and boosting the country’s global hospitality reputation.

APAC Market Insights

The Asia Pacific luxury hotel market is set to grow at a rapid pace, primarily fueled by the rising affluence and increased regional travel. International brands coexist with boutique and heritage properties, making it suitable for different tastes. Countries in this region are focused on both business travelers and leisure tourists, leveraging the region’s rich cultural diversity. Forinstance in May 2024, Hyatt Hotels Corporation and Kiraku, Inc. announced the launch of ATONA, which is a luxury hot spring ryokan brand, with properties planned in Yufu, Yakushima, and Hakone by 2026. It is backed by the Atona Impact Fund, which secured 10 billion yen (USD 64 million) in initial funding, and the brand combines traditional Japanese ryokan culture with modern luxury design and personalized experiences for international and domestic travelers, hence indicating a positive market outlook.

China luxury hotel market is a blend of global standards with local cultural elements, which makes it appealing to domestic and international high-end travelers. Urban centers in the country consist of skyscraper hotels with panoramic city views, whereas resorts emphasize relaxation and holistic wellness. In October 2025, Hilton celebrated surpassing 888 hotels in Greater China and Mongolia with the opening of Waldorf Astoria Shanghai Qiantan, marking Shanghai as the third city worldwide with two Waldorf Astoria properties. It also stated that the hotel features 204 rooms with panoramic river views, high-end dining experiences, and luxury amenities, reflecting Hilton’s focus on sophisticated design as well as personalized service. Therefore, this instance underscores Hilton’s growth strategy in the country, which also has plans to double its presence and expand its luxury and lifestyle portfolio across the region in the upcoming years.

India’s market leverages cultural richness, heritage properties, and palace-style accommodations to create unique experiences. Gastronomy plays a key role in the country’s market, highlighting local and international cuisines, whereas the luxury properties incorporate modern amenities with traditional hospitality principles. In April 2025 Ministry of Tourism announced that the country continues to classify hotels under its star rating system through the NIDHI+ portal, ranging from one star to five-star deluxe, thereby ensuring standardized quality and service across the country. The classification is conducted by the Hotel & Restaurant Approval & Classification Committee, comprising members from the Ministry, industry associations, hotel management institutes, and state/UT administrations. Therefore, this system provides travelers with reliable guidance on hotel standards by promoting transparency and encouraging the growth of high-quality luxury accommodations across India.

Europe Market Insights

Europe luxury hotel market is poised for exceptional progress owing to its historical legacy, art, and architectural grandeur. Heritage properties in the region are being revitalized to offer contemporary amenities by preserving their vintage properties, creating unique experiences that combine tradition with comfort. In this context, IHG Hotels & Resorts in February 2025 announced that it had acquired the Ruby brand from Ruby SARL for €110.5 million (USD 115.03 million) by adding its 20th brand to the portfolio and targeting rapid global expansion. Ruby is a premium urban lifestyle brand with 20 hotels across Europe and 10 more in the pipeline. Besides, it offers a lean luxury concept combining space-efficient design, self-service technology, and culturally rooted experiences for modern city travelers. The brand is leveraging IHG’s distribution, technology systems, and loyalty program, and further aims to expand to over 120 hotels in the next decade.

Germany market is progressing at a notable pace owing to the presence of well-equipped facilities, whereas the leisure tourists are attracted to wellness-focused retreats and spa destinations. The country’s market also benefits from cultural programming, such as local music and art, and proximity to historic sites, which enhance the luxury experience, making it suitable for global tourists. In January 2026, Radisson Individuals announced that it had expanded in southern Germany with the opening of HARBR. Hotel Konstanz and HARBR. Hotel Heilbronn, joining HARBR. Hotel Ludwigsburg is set to offer three distinctive lifestyle stays in Baden-Württemberg. These hotels also consist of modern design, digitally enhanced guest experiences, wherein amenities include long-stay apartments, EV charging, wellness facilities, and meeting spaces. Hence, these additions strengthen Radisson’s presence in Germany, providing both leisure and business travelers with stylish, culturally connected accommodations in lakeside, wine-region, and city-center settings.

The UK luxury hotel market is growing exponentially, owing to the presence of iconic city hotels in London and Edinburgh that blend heritage architecture with modern amenities, whereas countryside estates, coastal retreats, and boutique properties that offer privacy as well as scenic escapes. The country’s market also benefits from culinary excellence, wellness offerings, and cultural experiences, which play a pivotal role, with most of the hotels partnering with Michelin-starred chefs and local artisans. In this context, in September 2025, Radisson Hotels reported that it had become the official hotel partner of Co-op Live in Manchester, which is one of the country’s one of the largest live entertainment arenas, thereby enhancing access to concerts and premium experiences for guests. Furthermore, the partnership coincides with the upcoming Radisson Blu on the Etihad Campus that is set to open in 2026 with 401 rooms, offering a unique stay within an entertainment and sports hub.

Key Luxury Hotel Market Players:

- Four Seasons Hotels and Resorts (Canada)

- Marriott International, Inc. (U.S.)

- The Ritz‑Carlton Hotel Company (U.S.)

- Hyatt Hotels Corporation (U.S.)

- Hilton Worldwide Holdings Inc. (U.S.)

- InterContinental Hotels Group PLC (UK)

- Accor S.A. (France)

- Mandarin Oriental Hotel Group (Hong Kong/China)

- Rosewood Hotel Group (Hong Kong)

- Aman Resorts (Singapore)

- Banyan Tree Holdings Limited (Singapore)

- Raffles Hotels & Resorts (Singapore)

- Kempinski Hotels S.A. (Switzerland)

- The Peninsula Hotels (Hong Kong)

- Dorchester Collection (UK)

- Shangri-La Hotels & Resorts (Hong Kong)

- Taj Hotels (The Indian Hotels Company Limited) (India)

- The Oberoi Group (India)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Marriott International, Inc. is the largest global hospitality company, which operates and franchises more than 9,400 properties across more than 140 countries and territories under 30+ brands. The company’s luxury portfolio consists of the Ritz‑Carlton, St. Regis, Bulgari, Edition, and Luxury Collection, serving affluent travelers across the globe. Further, Marriott’s strategy focuses on portfolio diversification, loyalty expansion through Marriott Bonvoy, and global market penetration.

- Four Seasons Hotels and Resorts is yet another dominant force in this market, which is a privately held luxury hotel and resort with over 120 properties in 44+ countries. It is best known for exceptional personalized service and an independent luxury ethos, wherein the brand is expanding its global footprint through iconic city and resort destinations. Four Seasons also innovates with residences, private jet and yacht experiences, thereby solidifying its position among the world’s most prestigious hospitality brands.

- The Ritz-Carlton Hotel Company is a luxury subsidiary of Marriott International, which efficiently operates 100+ luxury hotel and resorts globally and is synonymous with elevated service standards and timeless elegance. Besides, it continues to expand through both hotel and residential projects, which include exclusive Ritz‑Carlton Reserve sanctuaries and a luxury yacht collection.

- Hilton Worldwide Holdings Inc. is a popular brand name and has its presence in 100+ countries through 20+ brands. Its luxury segment includes Waldorf Astoria, Conrad, and LXR Hotels & Resorts, which are well known for premium experiences and bespoke services. Hilton’s competitive strategy emphasizes loyalty growth through Hilton Honors, tech-driven personalization, and sustainable initiatives to attract global luxury travelers.

- Hyatt Hotels Corporation is a hospitality corporation that efficiently manages and franchises more than 1,300 properties across the globe, with luxury brands such as Park Hyatt and Andaz. The company’s strategy is a blend of intimate luxury experiences with local cultural immersion, and it continues enhancing its global footprint and loyalty engagement through targeted acquisitions and strengthening its brand portfolio.

Below is the list of some prominent players operating in the global market:

The luxury hotel market is witnessing intense competition wherein the global chains emphasize brand differentiation, curated guest experiences, and strategic expansion into key destinations. Major players in this field are making investments in brand portfolio diversification and premium loyalty programs to retain affluent travelers, whereas the boutique luxury groups are focused on unique experiential stays and personalized service. In this context, Indian Hotels Company Limited (IHCL) in January 2026 reported that it had signed definitive agreements to acquire a 51% stake in Brij Hospitality, gaining control of the boutique experiential leisure brand Brij to expand its presence in India’s leisure tourism segment. Besides, this acquisition strengthens IHCL’s portfolio by adding 22 Brij properties and 11 in the pipeline across culturally and spiritually significant destinations such as Jaipur, Varanasi, Ranthambore, and Goa, thereby positioning the company as a frontrunner in the market.

Corporate Landscape of the Luxury Hotel Market:

Recent Developments

- In December 2025, Four Seasons, in partnership with Gruppo Statuto, reported that it will transform Berlin’s Hotel de Rome into a luxury Four Seasons property in which the hotel will feature approximately 140 reimagined rooms and suites, restaurants, and bars.

- In November 2025, The Oberoi Group inaugurated the Oberoi Rajgarh Palace, Khajuraho, which is a 350-year-old restored palace on a 76-acre estate near Panna National Park and UNESCO temples. It offers 65 luxurious rooms and suites, fine dining, banquet spaces, and immersive experiences.

- Report ID: 8374

- Published Date: Jan 30, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Luxury Hotel Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.