Product Overview

Rubber is hydrocarbon polymer which occurs as milky latex in the sap of the different plants and can also be manufactured synthetically. The main property of the rubber is elasticity which makes it readily available for the application in various industries. The diverse field for the application of the rubber includes transportation, material handling, healthcare and sports activities. The industrial rubber consists of two type namely synthetic and natural rubber. Synthetic rubber is more preferred by the automotive industry on the account of its application in the light weight vehicles.

Market Size and Forecast

The global industrial rubber market is anticipated to grow at a CAGR around 4.8% during 2018-2027. It is expected to reach the market size of USD 45 billion by the 2027. The growing application of the industrial rubber in various end-use industries such as automotive, building & construction, industrial manufacturing, polymer modification, wire & cable, electrical & electronics, coating, sealant & adhesive, and medical & healthcare is anticipated to boost the growth of the global industrial rubber market during the forecast period.

The global industrial rubber market can be segmented on the basis of type, product, application and region. On the basis of type, it is sub-segmented into synthetic rubber and natural rubber. Synthetic rubber is anticipated to be the leading sub-segment for the type segment. The rise in the application of the synthetic rubber in the automotive industries on the account of its abrasion-resistant property is anticipated to major reason leading to the expansion of the sub-segment during the forecast period. On the basis of product, it is sub-segmented into rubber hose, mechanical rubber good, rubber belt, rubber roofing and others. On the basis of application, it is sub-segmented into industrial manufacturing, automotive, wire & cable, building & construction, coating, medical & healthcare and sealant & adhesive. Automotive is anticipated to be the leading sub-segment during the forecast period. The various properties of the rubber such as stiffness and abrasion resistance is replacing the traditional material such as metal, glass, and wood parts which are used in the automotive application.

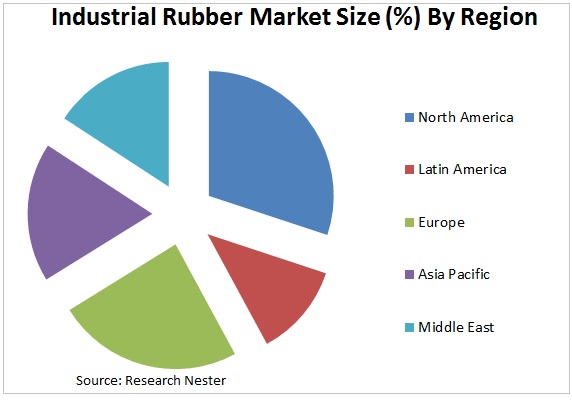

By region, global industrial rubber market is segmented into North America, Asia-Pacific, Latin America, Europe, Middle East and Africa. North America is anticipated to hold the largest market share for the global industrial rubber market during the forecast period. The increasing application of the industrial rubber in the automotive industry and footwear industry in the region is anticipated to be the major reason for the growth of the industrial rubber market in the region. The increasing sales of the car coupled with the rising application of the industrial rubber are anticipated to boost the growth of the global industrial rubber market. According to International Organization of Motor Vehicle Manufacturers, the total commercial vehicle production was 23.8 million in 2017 whereas it was 22.9 million in 2016. Asia-Pacific region is anticipated to be the fastest developing region for the global industrial rubber market. The Asia-Pacific region is witnessing high industrialization which leads to the expansion of various applications industries such as industrial manufacturing, automotive and building & construction. The increasing number of the construction enterprise in China contributes to the high growth of the construction industry in the country. For instance, in 2014 the total number of enterprise were 81,141 which grew to 83,017. Thus, it is contributing to the high growth of the global industrial rubber market.

CLICK TO DOWNLOAD SAMPLE REPORT

Market Segmentation

Our in-depth analysis segmented the global industrial rubber market in the following segments:

By Type:

- Synthetic Rubber

- Natural Rubber

By Product:

- Rubber Hose

- Mechanical Rubber Good

- Rubber Belt

- Rubber Roofing

- Others

By Application:

- Industrial Manufacturing

- Automotive

- Wire & Cable

- Building & Construction

- Coating

- Medical & Healthcare

- Sealant & Adhesive

By Region

Global industrial rubber market is further classified on the basis of region as follows:

- North America (U.S. & Canada) Market size, Y-O-Y growth & Opportunity Analysis

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Market size, Y-O-Y growth & Opportunity Analysis

- Europe (U.K., Germany, France, Italy, Spain, Hungary, BENELUX (Belgium, Netherlands, Luxembourg), NORDIC (Norway, Denmark, Sweden, Finland), Poland, Russia, Rest of Europe), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis.

- Asia-Pacific (China, India, Japan, South Korea, Malaysia, Indonesia, Taiwan, Hong Kong, Australia, New Zealand, Rest of Asia-Pacific), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa) Market size, Y-O-Y growth & Opportunity Analysis.

Growth Drivers and Challenges

The increasing application of the industrial rubber in the various end-use industries such as automotive, building & construction, industrial manufacturing is anticipated to be the major growth driver for the global industrial rubber market during the forecast period. The rising industrialization in the various regions across the globe leads to the high expansion of the various application industries. This is anticipated to boost the growth of the global industrial rubber market. In Asia-Pacific region, automotive industry is expanding rapidly which leads to high application of industrial rubber in the region. Additionally, the rising production of the rubber tire is increasing the application of the rubber which in turn support the growth of the global industrial rubber market. Moreover, the increasing growth witnessed by the rubber market is anticipated to enhance the application of industrial rubber.

The volatile prices of the raw materials coupled with the stringent environmental regulation are anticipated to restrain the growth of the global industrial rubber market.

Top Featured Companies Dominating The Market

- Cooper Standard Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Bridgestone Corporation

- Freudenberg Group

- Continental AG

- HEXPOL AB

- Gates Corporation

- The Goodyear Tire & Rubber Company

- Sumitomo Riko Company Limited

- NOK CORPORATION

- Yokohama Rubber Co., Ltd.

- Eaton

- Myers Industries, Inc.

- Report ID: 668

- Published Date: Feb 10, 2023

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Industrial Rubber Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert