Smart Infrastructure Market Outlook:

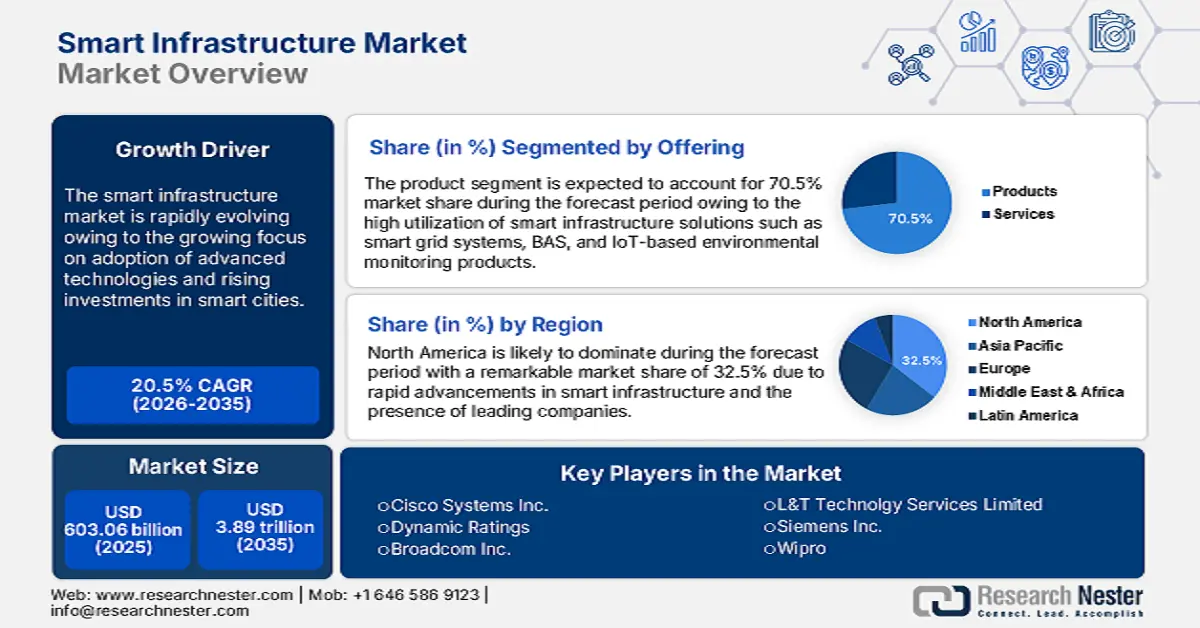

Smart Infrastructure Market size was valued at USD 603.06 billion in 2025 and is likely to cross USD 3.89 trillion by 2035, registering more than 20.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart infrastructure is assessed at USD 714.32 billion.

The smart infrastructure market is poised for notable growth during the forecast period owing to the increasing focus on urbanization using smart technologies for more efficient, sustainable, and optimal infrastructure solutions. Smart infrastructure enables the integration of advanced technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), data analytics, and Information and Communication Technologies (ICT) into a physical framework to create sustainable, comprehensive, and state-of-the-art infrastructure.

Smart infrastructure systems provide key benefits such as improved public services, enhanced transportation systems, better citizen management, and increased energy efficiency, promoting locality toward environmental sustainability and better functionality. The key players contribute to market growth through funding and initiatives to develop a smart and high-tech infrastructure. This financial support and strategic focus contribute to the optimistic market expansion outlook.

Key Smart Infrastructure Market Insights Summary:

Regional Highlights:

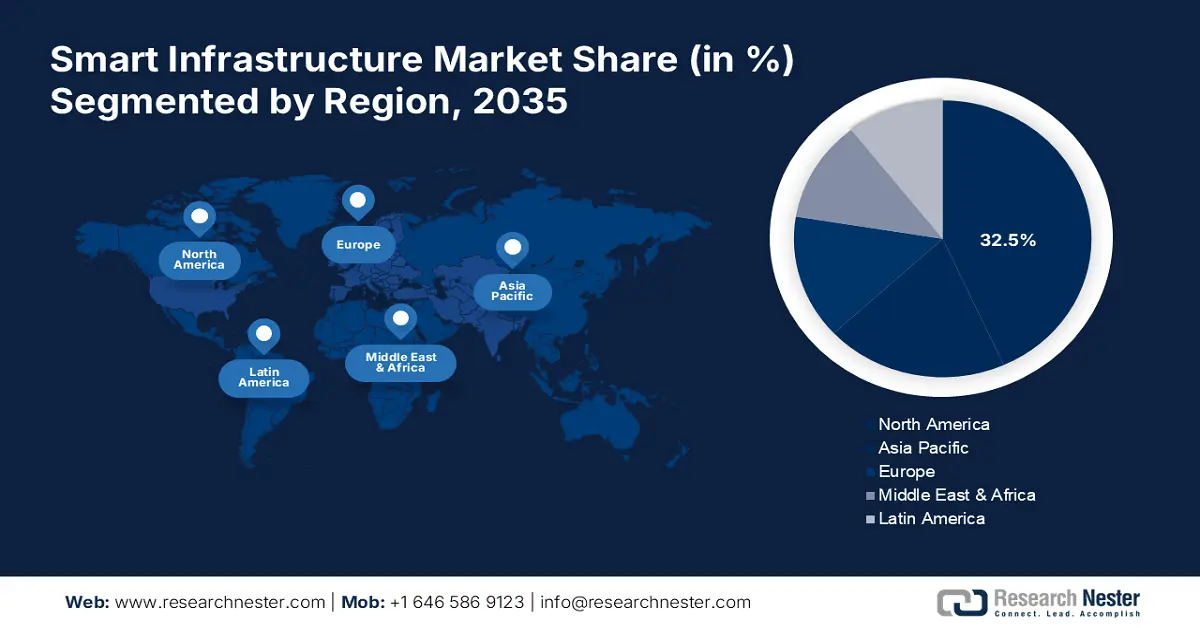

- North America smart infrastructure market is anticipated to capture 32.50% share by 2035, driven by strong economic environment and the presence of tech giants driving innovation.

Segment Insights:

- The product segment in the smart infrastructure market is anticipated to see substantial growth till 2035, driven by the adoption of smart technologies like smart grids and IoT-based monitoring products.

- The non-residential segment in the smart infrastructure market is projected to capture the largest share by 2035, driven by the demand for advanced systems to boost operational efficiency and productivity.

Key Growth Trends:

- Implementation of telecommunication network

- Increase in adoption in non-residential sectors

Major Challenges:

- Rising concerns about data privacy

- High upfront costs

Key Players: Aclara Technologies LLC (Hubbell Incorporated), Broadcom, Inc. (VMware), Cisco Systems, Inc., Dynamic Ratings, Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., International Business Machines Corporation, L&T Technology Services Limited.

Global Smart Infrastructure Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 603.06 billion

- 2026 Market Size: USD 714.32 billion

- Projected Market Size: USD 3.89 trillion by 2035

- Growth Forecasts: 20.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Smart Infrastructure Market Growth Drivers and Challenges:

Growth Drivers

-

Implementation of telecommunication network: The endeavor of developing smart infrastructures is based on high-speed, effective, and secured communication through telecommunication networks such as fiber optic cables, cell towers, switches, routers, and data centers. Technologies to be integrated with the network include 5G, IoT, cloud computing, and AI for optimization through systematic network planning, infrastructure deployment, configuration, security, testing, and maintenance to obtain high-speed data transmission, improvement in customer experience, and operational efficiency. A well-planned telecommunication network would facilitate various applications in a smart city; hence, living conditions and sustainability would be improved in the locality.

- Increase in adoption in non-residential sectors: A growing influx of smart infrastructure within non-residential settings such as commercial buildings, industrial facilities, healthcare, education, and government frameworks, associated with the adoption of BMS, EMS, security and surveillance systems, network infrastructure Wi-Fi, IoT, data analytics, and insights are driving market growth. This assists in fulfilling the demand for energy and operational efficiency, improved security, occupant experience, and sustainability. As the non-residential sector continues to evolve, smart infrastructure will increasingly play its role in shaping the future of buildings and facilities.

- Favorable government policies and initiatives: Governments across the world initiate different programs to develop sustainable, efficient, and resilient urban ecosystems. Incentives for developing smart infrastructure solutions with energy-efficient buildings, and data analytics platforms through funding, policies, and regulations are being facilitated by governments. This can stimulate economic growth and job opportunities while improving the quality of life and advancing innovation.

Challenges

-

Rising concerns about data privacy: Data privacy is a paramount concern in smart infrastructure, owing to the vast range of personal and sensitive data being generated through connected devices and sensors. Furthermore, the threat of maintenance of confidentiality, integrity, easy availability of data, stringent control over individual rights, cyberattacks, and protection of personal information prevails.

- High upfront costs: Smart infrastructure solutions require a high upfront investment cost that includes designing, procuring, and deploying advanced technologies. Moreover, hardware and software costs involved in integration and testing require the training and support of highly skilled personnel. As a result, owing to the financial burden organizations would deter themselves from pursuing smart infrastructure projects despite its long-term benefits hindering the growth of the market.

Smart Infrastructure Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.5% |

|

Base Year Market Size (2025) |

USD 603.06 billion |

|

Forecast Year Market Size (2035) |

USD 3.89 trillion |

|

Regional Scope |

|

Smart Infrastructure Market Segmentation:

Offering Segment Analysis

Product segment is predicted to dominate over 70.5% smart infrastructure market share by 2035, attributable to the adoption of smart technologies such as smart grid systems, BAS, and IoT-based environmental monitoring products. Smart grids optimize the operation of electrical services effectively concerning reliability over its components such as smart meters and advanced distribution management systems. The segment is driven by rapid urbanization, high focus on sustainability goals, and technological advancements. For instance, in February 2024, NEC Corporation India unveiled Advanced Smart City Tech Products such as NEC Mi-Command, NEC Mi-City, NEC Mi-Eye, and NEC Mi-WareSync setting the stage for global expansion.

Type Segment Analysis

The Smart Transportation System (STS) segment is expected to register a staggering revenue CAGR during the forecast period owing to the increasing need for transportation solutions to obtain efficiency, safety, and sustainability. STS is rapidly evolving with the integration of advanced technologies such as AI, IoT, and data analytics. Government transportation authorities and private firms are pooling investments to support and enhance the sustainable transportation ecosystem.

End user Segment Analysis

The non-residential segment has emerged as a dominant sector in the smart infrastructure market, comprising commercial, industrial, and institutional users. The demand for advanced technologies, such as smart energy management, intelligent transportation systems, and data analytics platforms is surging, to enhance operational efficiency, decrease costs, and improve customer experience. The investments in smart infrastructure is likely to ensure optimum use of energy consumption, ease of maintenance, and safety and security by non-residential users while increasing productivity and competitiveness. The sector is expected to continue playing a leading role in driving the growth of the market and account for the largest share of total revenue within it.

The residential area is poised to grow significantly during the forecast period due to increasing demand for smart home technologies and appliances. For example, India approved 12 new industrial smart cities along with other infrastructure projects to boost India’s manufacturing ecosystem. The smart city projects under the National Industrial Corridor Development Programme (NICDP) will entail an investment of USD 3.41 billion.

Our in-depth analysis of the market includes the following segments:

|

Offering |

|

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Infrastructure Market Regional Analysis:

North America Market Insights

North America industry is estimated to dominate majority revenue share of 32.5% by 2035. The key drivers that stimulate the demand are its strong economic environment, the high adoption rate of smart technology, public-private partnerships, and the presence of high-tech companies such as Google, Microsoft, and Cisco which drive innovation and advancement in the field.

Canada is considered a hub for smart city initiatives, with comprehensive planning and rising innovations. The country focuses on sustainability and environmental protection practices driving smart infrastructure solutions. In June 2024, Schneider Electric announced the launch of SMART Building Division in Canada to expand its sustainable building innovation.

Asia Pacific Market Insights

The driving forces such as rapid urbanization, increasing investments in digital transformation, and government initiatives on smart city development, Asia Pacific emerged as the fast-growing market for smart infrastructure. China, Japan, and South Korea are some of the largest revenue-generating countries in this region.

India owing to huge investments in smart transportation, energy management systems, and building management systems holds a significant contribution to the market growth. The large population of the country together with a growing middle-class population and increased demand for sustainable and efficient solutions for infrastructure is further boosting market growth. The country is poised to continue leading the global smart infrastructure market in the next few years.

Smart Infrastructure Market Players:

- Honeywell International Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aclara Technologies LLC

- Broadcom, Inc.

- Cisco Systems, Inc.

- Dynamic Ratings

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation

- L&T Technology Services Limited

- Panamax Infotech

- Schneider Electric

- Siemens

- Wipro

The smart infrastructure market is highly competitive and rapidly evolving with the integration of advanced technologies such as AI, data analytics, and IoT and sustainability initiatives. The market consists of key players operating at global and regional levels, focused on adopting several strategies such as mergers and acquisitions, partnerships, joint ventures, and product launches. Leading companies shaping the forthcoming years of the market by offering smart infrastructure solutions, advanced technological expertise, and efficient methods include:

Recent Developments

- In February 2024, Cisco at the Mobile World Congress, empowered Global Service Providers with AI-ready infrastructure to Win the Enterprise with Innovative Business Services.

- In April 2024, Siemens launched Electrification X (the latest SaaS and IoT portfolio) to strengthen the Siemens Xcelerator portfolio across buildings, electrification, and grids.

- Report ID: 6430

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Infrastructure Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.