Global Engineering R&D Services Outsourcing Market

- An Outline of the Engineering R&D Services Outsourcing Market

- Market definition

- Market segmentation

- Assumptions and Abbreviations

- Research Methodology

- Research Process

- Primary Research

- Service Providers

- End Users

- Secondary Research

- Market Size Estimation

- Summary of the Report for Key Decision Makers

- Forces of the Market Constituents

- Factors/drivers impacting the growth of the market

- Market trends for better business practices

- Key Market Opportunities for Business Growth

- Based on the type

- Based on the industry vertical

- Based on the end user

- Based on geographical presence

- Major Roadblocks for the Market Growth

- Decarbonization Strategy and Carbon Credit Benefits for Market Players

- Global Government Decarbonization Plans/Goals by Each Country under 2015 Agreement Agreed by 200 Countries

- Measures taken by Countries to Reduce Carbon Footprints

- Carbon Credits and Subsidy Plans/Benefits Rolled out by the Government for Market Players

- Effective Ways to Harness Carbon-Credits and Impact on Profit Margins

- Demand Impact on the Companies Opting for Carbon Credits

- Government Regulation

- Technology Transition and Adoption Analysis

- Industry Risk Analysis

- Global Economic Outlook: Challenges for Global Recovery and its Impact on Global Engineering R&D Services Outsourcing Market

- Ukraine-Russia crisis

- Potential US economic slowdown

- Impact of COVID-19 on Global Engineering R&D Services Outsourcing Market

- Industry Value Chain Analysis

- Regional Demand Analysis

- End-Use Industry Analysis

- Competitive Positioning: Strategies to differentiate a company from its competitors

- Competitive Model: A Detailed Inside View for Investors

- Market share of major companies profiled, 2022

- Business Profiles of Key Enterprises

- Capgemini Engineering

- ALTEN Group

- HCL Technologies Limited

- Siemens

- SOLIZE Corporation

- Bertrandt AG

- Tech Mahindra Limited

- EDAG Engineering Group AG.

- Wipro Ltd.

- Infosys Limited

- Tata Consultancy Services Ltd.

- L&T Technology Services Limited

- Global Engineering R&D Services Outsourcing Outlook & Projections, Opportunity Assessment, 2023 to 2036

- Market Overview

- Market Revenue by Value (USD billion) and Compound Annual Growth Rate (CAGR)

- By Type

- Onshore, Market Value (USD billion), CAGR, 2023-2036F

- Offshore, Market Value (USD billion), CAGR, 2023-2036F

- By Industrial Vertical

- Telecommunication, Market Value (USD billion), CAGR, 2023-2036F

- Automotive, Market Value (USD billion), CAGR, 2022-2023-2036F

- Aerospace, Market Value (USD billion), CAGR, 2023-2036F

- Consumer Electronics, Market Value (USD billion), CAGR, 2023-2036F

- Pharmaceutical, Market Value (USD billion), CAGR, 2023-2036F

- Construction, Market Value (USD billion), CAGR, 2023-2036F

- Semiconductors, Market Value (USD billion), CAGR, 2023-2036F

- Computing System, Market Value (USD billion), CAGR, 2023-2036F

- Others, Market Value (USD billion), CAGR, 2023-2036F

- By Geography

- Market Revenue by Value (USD billion) and Compound Annual Growth Rate (CAGR)

- North America, Market Value (USD billion), CAGR, 2023-2036F

- Europe, Market Value (USD billion), CAGR, 2023-2036F

- Asia Pacific, Market Value (USD billion), CAGR, 2023-2036F

- Latin America, Market Value (USD billion), CAGR, 2023-2036F

- Middle East and Africa, Market Value (USD billion), CAGR, 2023-2036F

- Market Revenue by Value (USD billion) and Compound Annual Growth Rate (CAGR)

- By Type

- North America Engineering R&D Services Outsourcing Outlook & Projections, Opportunity Assessment, 2023 to 2036

- Market Overview

- Market Revenue by Value (USD billion) and Compound Annual Growth Rate (CAGR)

- By Type

- Onshore, Market Value (USD billion), CAGR, 2023-2036F

- Offshore, Market Value (USD billion), CAGR, 2023-2036F

- By Industrial Vertical

- Telecommunication, Market Value (USD billion), CAGR, 2023-2036F

- Automotive, Market Value (USD billion), CAGR, 2023-2036F

- Aerospace, Market Value (USD billion), CAGR, 2023-2036F

- Consumer Electronics, Market Value (USD billion), CAGR, 2023-2036F

- Pharmaceutical, Market Value (USD billion), CAGR, 2023-2036F

- Construction, Market Value (USD billion), CAGR, 2023-2036F

- Semiconductors, Market Value (USD billion), CAGR, 2023-2036F

- Computing System, Market Value (USD billion), CAGR, 2023-2036F

- Others, Market Value (USD billion), CAGR, 2023-2036F

- By Country

- US, Market Value (USD billion), CAGR, 2023-2036F

- Canada, Market Value (USD billion), CAGR, 2023-2036F

- By Type

- Europe Engineering R&D Services Outsourcing Outlook & Projections, Opportunity Assessment, 2023 to 2036

- Market Overview

- Market Revenue by Value (USD billion) and Compound Annual Growth Rate (CAGR)

- By Type

- Onshore, Market Value (USD billion), CAGR, 2023-2036F

- Offshore, Market Value (USD billion), CAGR, 2023-2036F

- By Industrial Vertical

- Telecommunication, Market Value (USD billion), CAGR, 2023-2036F

- Automotive, Market Value (USD billion), CAGR, 2023-2036F

- Aerospace, Market Value (USD billion), CAGR, 2023-2036F

- Consumer Electronics, Market Value (USD billion), CAGR, 2023-2036F

- Pharmaceutical, Market Value (USD billion), CAGR, 2023-2036F

- Construction, Market Value (USD billion), CAGR, 2023-2036F

- Semiconductors, Market Value (USD billion), CAGR, 2023-2036F

- Computing System, Market Value (USD billion), CAGR, 2023-2036F

- Others, Market Value (USD billion), CAGR, 2023-2036F

- By Country

- Germany, Market Value (USD billion), CAGR, 2023-2036F

- France, Market Value (USD billion), CAGR, 2023-2036F

- UK, Market Value (USD billion), CAGR, 2023-2036F

- Italy, Market Value (USD billion), CAGR, 2023-2036F

- Spain, Market Value (USD billion), CAGR, 2023-2036F

- Netherlands, Market Value (USD billion), CAGR, 2023-2036F

- Russia, Market Value (USD billion), CAGR, 2023-2036F

- Rest of Europe, Market Value (USD billion), CAGR, 2023-2036F

- By Type

- Asia Pacific Engineering R&D Services Outsourcing Outlook & Projections, Opportunity Assessment, 2023 to 2036

- Market Overview

- Market Revenue by Value (USD billion) and Compound Annual Growth Rate (CAGR)

- By Type

- Onshore, Market Value (USD billion), CAGR, 2023-2036F

- Offshore, Market Value (USD billion), CAGR, 2023-2036F

- By Industrial Vertical

- Telecommunication, Market Value (USD billion), CAGR, 2023-2036F

- Automotive, Market Value (USD billion), CAGR, 2023-2036F

- Aerospace, Market Value (USD billion), CAGR, 2023-2036F

- Consumer Electronics, Market Value (USD billion), CAGR, 2023-2036F

- Pharmaceutical, Market Value (USD billion), CAGR, 2023-2036F

- Construction, Market Value (USD billion), CAGR, 2023-2036F

- Semiconductors, Market Value (USD billion), CAGR, 2023-2036F

- Computing System, Market Value (USD billion), CAGR, 2023-2036F

- Others, Market Value (USD billion), CAGR, 2023-2036F

- By Country

- China, Market Value (USD billion), CAGR, 2023-2036F

- Japan, Market Value (USD billion), CAGR, 2023-2036F

- India, Market Value (USD billion), CAGR, 2023-2036F

- South Korea, Market Value (USD billion), CAGR, 2023-2036F

- Australia, Market Value (USD billion), CAGR, 2023-2036F

- Singapore, Market Value (USD billion), CAGR, 2023-2036F

- Rest of Asia Pacific, Market Value (USD billion), CAGR, 2023-2036F

- By Type

- Latin America Engineering R&D Services Outsourcing Outlook & Projections, Opportunity Assessment, 2023 to 2036

- Market Overview

- Market Revenue by Value (USD billion) and Compound Annual Growth Rate (CAGR)

- By Type

- Onshore, Market Value (USD billion), CAGR, 2023-2036F

- Offshore, Market Value (USD billion), CAGR, 2023-2036F

- By Industrial Vertical

- Telecommunication, Market Value (USD billion), CAGR, 2023-2036F

- Automotive, Market Value (USD billion), CAGR, 2023-2036F

- Aerospace, Market Value (USD billion), CAGR, 2023-2036F

- Consumer Electronics, Market Value (USD billion), CAGR, 2023-2036F

- Pharmaceutical, Market Value (USD billion), CAGR, 2023-2036F

- Construction, Market Value (USD billion), CAGR, 2023-2036F

- Semiconductors, Market Value (USD billion), CAGR, 2023-2036F

- Computing System, Market Value (USD billion), CAGR, 2023-2036F

- Others, Market Value (USD billion), CAGR, 2023-2036F

- By Country

- Brazil, Market Value (USD billion), CAGR, 2023-2036F

- Argentina, Market Value (USD billion), CAGR, 2023-2036F

- Mexico, Market Value (USD billion), CAGR, 2023-2036F

- Rest of Latin America, Market Value (USD billion), CAGR, 2023-2036F

- By Type

- Middle East and Africa Engineering R&D Services Outsourcing Outlook & Projections, Opportunity Assessment, 2023 to 2036

- Market Overview

- Market Revenue by Value (USD billion) and Compound Annual Growth Rate (CAGR)

- By Type

- Onshore, Market Value (USD billion), CAGR, 2023-2036F

- Offshore, Market Value (USD billion), CAGR, 2023-2036F

- By Industrial Vertical

- Telecommunication, Market Value (USD billion), CAGR, 2023-2036F

- Automotive, Market Value (USD billion), CAGR, 2023-2036F

- Aerospace, Market Value (USD billion), CAGR, 2023-2036F

- Consumer Electronics, Market Value (USD billion), CAGR, 2023-2036F

- Pharmaceutical, Market Value (USD billion), CAGR, 2023-2036F

- Construction, Market Value (USD billion), CAGR, 2023-2036F

- Semiconductors, Market Value (USD billion), CAGR, 2023-2036F

- Computing System, Market Value (USD billion), CAGR, 2023-2036F

- Others, Market Value (USD billion), CAGR, 2023-2036F

- By Country

- GCC, Market Value (USD billion), CAGR, 2023-2036F

- Israel, Market Value (USD billion), CAGR, 2023-2036F

- South Africa, Market Value (USD billion), CAGR, 2023-2036F

- Rest of the Middle East and Africa, Market Value (USD billion), CAGR, 2023-2036F

- By Type

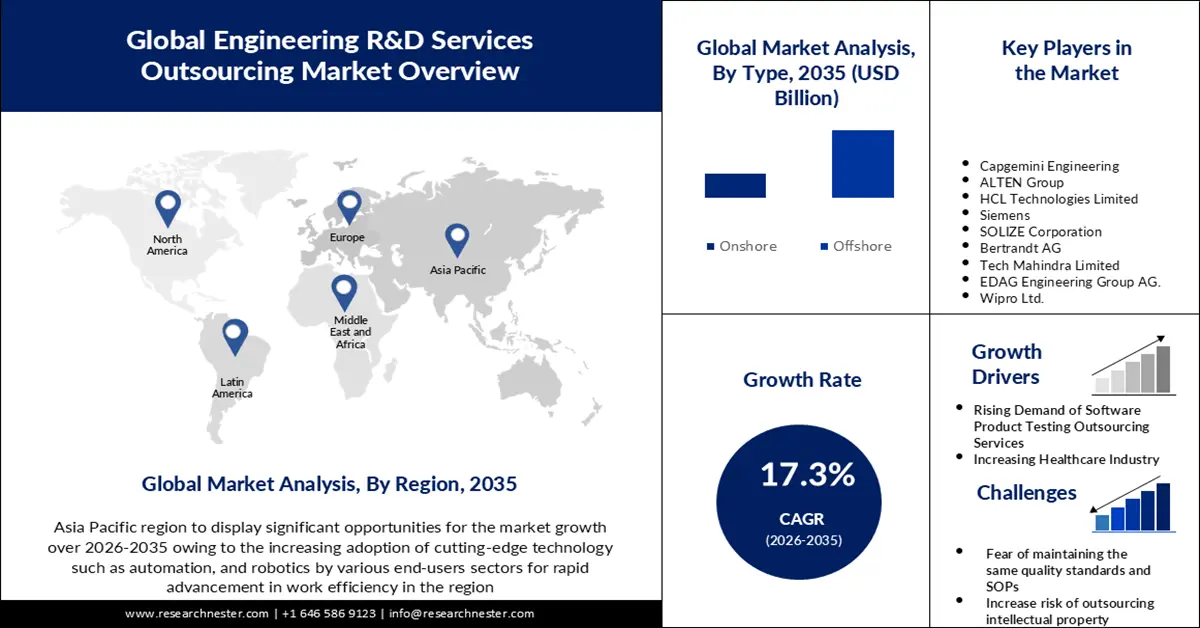

Engineering R&D Services Outsourcing Market Outlook:

Engineering R&D Services Outsourcing Market size was over USD 407.53 billion in 2025 and is anticipated to cross USD 2.01 trillion by 2035, witnessing more than 17.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of engineering R&D services outsourcing is assessed at USD 470.98 billion.

With increasing digitization in almost every country, the competition to attract customers is at an all-time high. With so many options available for consumers, companies need to go out of their way for customer satisfaction to ensure long-term relationships with them. Therefore, the scope for software product testing services is very significant.

Increasing strategic investments by the leading market players are also accelerating the engineering R&D services outsourcing market. For instance, in June 2022, Capgemini announced plans to set up semiconductor design services centers throughout Europe to support Intel's expanded chip manufacturing and ecosystem design services program. This will help enhance the production capacity of next-generation semiconductors in Europe to better support regional enterprises and build resilience in the European semiconductor supply chains, in keeping with the strategic aims of the European Chips Act.

Key Engineering R&D Services Outsourcing Market Insights Summary:

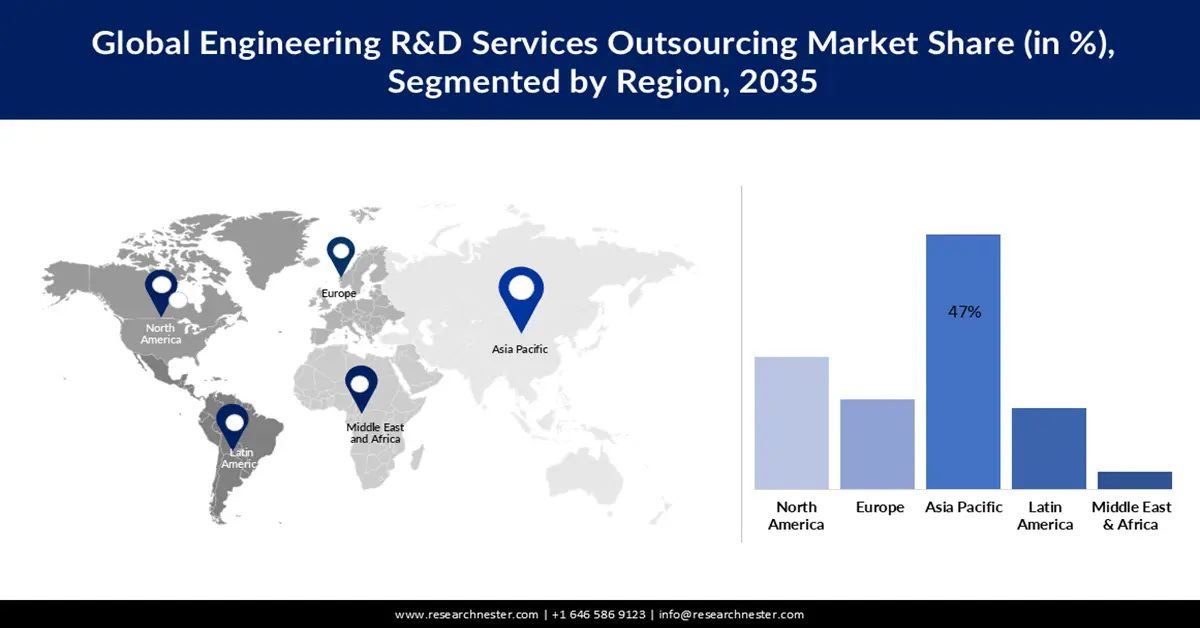

Regional Highlights:

- Asia Pacific industry in the engineering R&D services outsourcing market is projected to secure a 47% share by 2035, owing to the strong presence of engineering R&D service providers and the availability of cost-efficient expertise across the region.

- Europe is anticipated to expand at a CAGR of 15.39% during 2026–2035, underpinned by increasing emphasis on remote product development and the adoption of advanced technologies such as cloud computing, digital twins, analytics, and AI.

Segment Insights:

- The off-shore segment in the engineering R&D services outsourcing market is expected to surpass a 55% share by 2035, propelled by accessibility to affordable skilled professionals and large expert pools that enhance productivity.

- The automotive segment is projected to hold a 28% share by 2035, supported by rising vehicle demand, increased automation adoption, and the growing use of engineering outsourcing to boost efficiency and reduce operational costs.

Key Growth Trends:

- Growing Incorp oration of the Internet of Things (IoT) with Engineering R&D Services

- Increasing Initiative by Engineering Service Providers (ESP)

Major Challenges:

- Fear of Maintaining the Same Quality Standards and SOP

- Absence of Building New Infrastructure in Developing Countries

Key Players: Capgemini Engineering, ALTEN Group, HCL Technologies Limited, Siemens, SOLIZE Corporation, Bertrandt AG, Tech Mahindra Limited, EDAG Engineering Group AG., Wipro Ltd., Infosys Limited, Tata Consultancy Services Ltd., L&T Technology Services Limited.

Global Engineering R&D Services Outsourcing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 407.53 billion

- 2026 Market Size: USD 470.98 billion

- Projected Market Size: USD 2.01 trillion by 2035

- Growth Forecasts: 17.3%

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: Vietnam, Poland, Mexico, Philippines, Brazil

Last updated on : 25 November, 2025

Engineering R&D Services Outsourcing Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Incorp oration of the Internet of Things (IoT) with Engineering R&D Services– The Internet of Things (IoT) gives organizations a real-time view of how their systems operate, providing insights into everything from machine performance to supply chain and logistics operations. During previous years, engineering R&D services coupled with IoT have boosted the healthcare landscape with European innovations. It has helped to reduce and encourage patient engagement and healthcare costs, promote population health, and make healthcare more accessible to consumers.

-

Increasing Initiative by Engineering Service Providers (ESP) – During previous years, it has been observed that there has been a rapid increase in engineering service providers (ESP) who provide services for OEMs. As the ESO delivers and continues to evolve, engineering R&D service providers are setting service delivery standards and a licensing framework that encourages innovation and accelerates market growth. This has further boosted them to increase their respective strategic investments to boost market share. L&T Technology Services Limited announced that it would open its Engineering Research & Development (ER&D) Centre in Toronto, Canada in November 2022, marking its third close-to-shore worldwide engineering facility in two seasons.

-

Rise in the Number of New Businesses- According to US Census Bureau data, 5,044,748 new enterprises will be established in 2022. The lack of adequate infrastructure with new business has compelled them to outsource the R&D team for their company’s operations.

Challenges

-

Fear of Maintaining the Same Quality Standards and SOP - Most organizations fear that the lack of SOPs in the third-party entities may hamper their brand image or their product image, and ultimately, sales. Furthermore, the concern of losing their uniqueness, as well as the fear among companies of not meeting their high standards of quality when functioning through independent entities, is predicted to hamper market expansion.

-

Absence of Building New Infrastructure in Developing Countries

-

High Cost of the Services

Engineering R&D Services Outsourcing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.3% |

|

Base Year Market Size (2025) |

USD 407.53 billion |

|

Forecast Year Market Size (2035) |

USD 2.01 trillion |

|

Regional Scope |

|

Engineering R&D Services Outsourcing Market Segmentation:

Type Segment Analysis

The off-shore segment share in the engineering R&D services outsourcing market is estimated to surpass 55% by 2035. Advantages of offshore engineering R&D services, such as accessibility to cheap and talented professionals from several developing nations worldwide and a large pool of service experts, are expected to benefit the growth of offshore engineering R&D services. This type of outsourcing saves considerable time in training individuals and increases overall productivity.

Industry Verticals Segment Analysis

Engineering R&D services outsourcing market from the automotive segment is expected to garner a significant revenue share of 28% in the year 2035. This can be ascribed to the rising demand for motor vehicles, the expanding desire for industrial robots in the industry of automobiles, and manufacturers' increased emphasis on implementing automation into their production and manufacturing processes as part of their business plan for growth. Engineering services outsourcing in the automotive industry assists in increasing efficiency and reducing overall labor costs and time. As a result, these services are widely employed in commercial, passenger, electric, and hybrid vehicles (EVs/HVs).

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Engineering R&D Services Outsourcing Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 47% by 2035, due to strong presence of engineering R&D services providers in the region. Significant factors in the region include the strong presence of engineering R&D services providers focusing on building a technology ecosystem which will eventually reduce the time taken to market new technologies and meet the uncertainty of capabilities at scale. The availability of cheap engineering R&D services is the primary factor for the growth in the region. The growing population in the area resulted in a surge of demand for innovative and sustainable products across every industry vertical. Manufacturing companies invest heavily in developing connective, creative, and customer-centric products and solutions. This is also one of the crucial traits to aid in regional market growth. Companies in the region are focusing on acquisitions to diversify and increase their global reach to provide onshore outsourcing in developed nations.

For instance, in 2022, HCL Technologies signed a contract to acquire Starschema, a data engineering solutions provider in Budapest, Hungary. This acquisition is expected to boost HCL's capability in digital engineering next-generation offerings. Starschema and HCL is expected to undergo a data-driven revolution with their strategic capabilities. This acquisition is expected to assist HCL in catering to the demand in Central and Eastern Europe engineering R&D outsourcing services.

European Market Insights

The Europe engineering R&D services outsourcing market also shows promising CAGR growth of 15.39% during the forecast period. The market's expansion may be ascribed primarily to the increased emphasis of engineering service providers (ESPs) on preserving basic engineering procedures, as well as the increasing emphasis on activities involving the remote development of goods. Furthermore, tools such as cloud computing, digital twins, analytics, and AI have become available in the region's technological industries, which are projected to propel market growth as these tools are growing as demand grows for cybersecurity, analytics, and automation.

Engineering R&D Services Outsourcing Market Players:

- Capgemini Engineering

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ALTEN Group

- HCL Technologies Limited

- Siemens

- SOLIZE Corporation

- Bertrandt AG

- Tech Mahindra Limited

- EDAG Engineering Group AG.

- Wipro Ltd.

- Infosys Limited

- Tata Consultancy Services Ltd.

- L&T Technology Services Limited

Recent Developments

•HCL Technologies Limited was ranked the No. 1 player in the US in Engineering R&D Services in the annual Zinnov Zones for ER&D 2021 rankings. In addition, the survey recognized HCL Technologies as a leader in worldwide engineering R&D services and digital engineering services.

•Siemens announced the addition of Siemens Xcelerator as a Service (XaaS) along with the launch of Simcenter Cloud HPC. The new service is maintained by Siemens and hosted on AWS (Amazon Web Services), optimized for Simcenter solver technologies, as part of the ongoing partnership between Siemens and AWS.

- Report ID: 5152

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Engineering R&D Services Outsourcing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.