Electric Vehicle Market Outlook:

Electric Vehicle Market size was valued at USD 763.97 billion in 2025 and is expected to secure a valuation of USD 2777.77 billion in 2035, expanding at a CAGR of 13.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of electric vehicle is assessed at USD 869.66 billion.

The electric vehicle sales are registering substantial growth due to the growing battery production capacity across the world. The battery supply chain manufacturing capacity is rising owing to rapid and extensive developments in EV production. According to the International Energy Agency (IEA), in 2024, China is the leading manufacturer of over three-quarters of the global batteries, and the prices of batteries in the country recorded a fall of 30%, which represents a surge of more than twice. This development results in the affordable prices of electric vehicles in the country, creating lucrative opportunities for market growth.

Additionally, the IEA forecasts the demand for EV batteries will increase by 40% to over 750 GWh in 2023. Consumer-affordable EV pricing stems from the fast-growing number of gigafactories alongside improved battery cell manufacturing productivity. The industrial growth is resulting in a reduction in the price disparity between internal combustion engine vehicles and electric vehicles. The EV market expands into different consumer segments as batteries are becoming accessible at new, affordable price points. Further, this is strengthening the global demand.

Key Electric Vehicle Market Insights Summary:

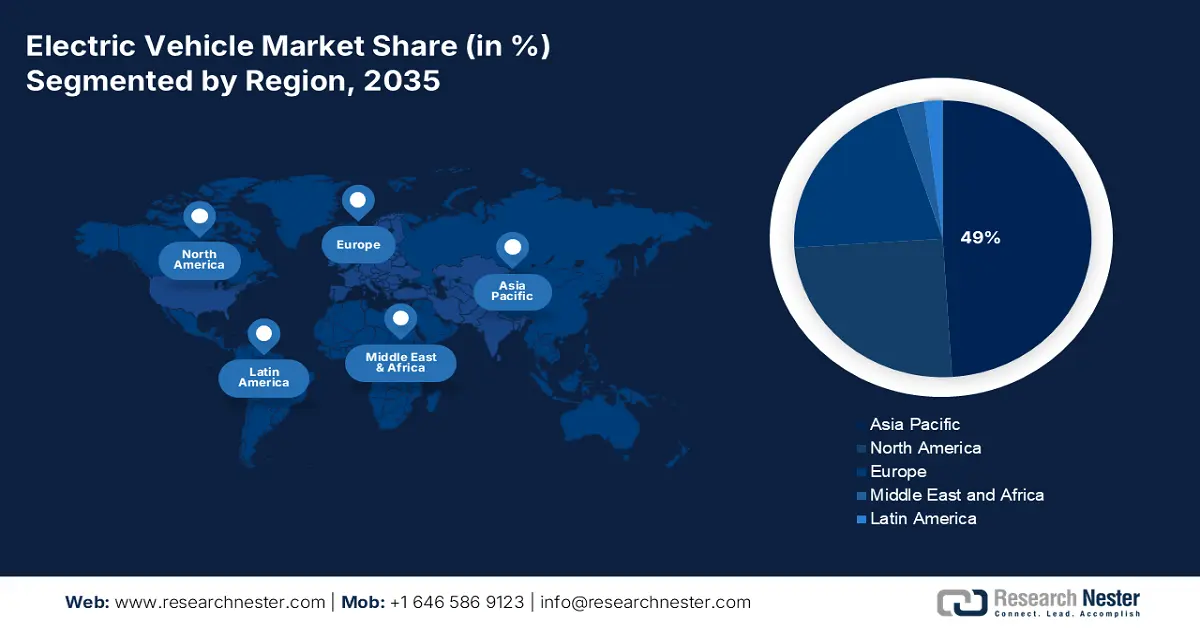

Regional Insights:

- By 2035, the Asia Pacific electric vehicle market is projected to command a dominant 49% share, underpinned by supportive government policies and long-term regulatory frameworks.

- The North America electric vehicle market is set for accelerated expansion through 2035, fueled by rising domestic EV manufacturing facilities and strengthening supply-chain capabilities.

Segment Insights:

- By 2035, the passenger cars segment is anticipated to secure an 88% share of the electric vehicle market, bolstered by the availability of affordable electric passenger models that enhance consumer accessibility.

- Across 2026–2035, the BEV segment is expected to attain a substantial market share, amplified by global government initiatives to integrate BEVs into public fleets to reduce emissions.

Key Growth Trends:

- Expansion of charging infrastructure

- Zero-emission goals

Major Challenges:

- High upfront costs

- Limited charging infrastructure

Key Players: BYD Motors Inc., Mercedes-Benz Group AG, Ford Motor Company, General Motors, Nissan Group, Tesla, Inc., Volkswagen AG, Renault Group, Hino Motors, Ltd.

Global Electric Vehicle Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 763.97 billion

- 2026 Market Size: USD 869.66 billion

- Projected Market Size: USD 2777.77 billion by 2035

- Growth Forecasts: 13.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Indonesia, Mexico, United Kingdom

Last updated on : 1 October, 2025

Electric Vehicle Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of charging infrastructure: Some regions are actively working to build an extensive public charging infrastructure, as it acts as a fundamental requirement for electric vehicle adoption. According to the European Alternative Fuels Observatory, the EU operated 632,423 public charging points by 2023 to support approximately 3 million battery electric vehicles. The European Commission targets 3.5 million chargers by 2030, yet additional installations of 2.9 million devices are required to reach this goal, which translates to 410,000 annual installations. Such innovations are expected to create immense opportunities for the market. Moreover, reliable expansion of charging infrastructure is critical for overcoming anxiety about vehicle range enhancement as well as boosting user convenience to push EV market growth throughout Europe.

- Zero-emission goals: The trend towards zero-emission electric vehicles is creating a great deal of momentum around the world. The UN states that in 2023, global greenhouse gas emissions spiked to an all-time high of 57.1 gigatons of CO₂, a 1.2% increase from the previous year. This is leading both consumers and business enterprises to move towards cleaner alternatives. Environmental concerns are driving consumers towards electric vehicles. Additionally, regulatory efforts are taking off, and government investment is needed in clean mobility. This collaborative effort is driving innovation in the field of electric vehicle development as well, ranging anywhere from the development of batteries with longer ranges to more public charging options in urban settings, making EV vehicles achievable and accessible modes of twenty-first century transportation.

- Rising fuel prices and economic operating costs: Given the volatility of oil prices around the world and a general trajectory upward in fuel pricing, electric vehicles are far less expensive in operate. Electric vehicles have much lower energy costs per mile compared to gasoline or diesel. Maintenance costs are also lower because of fewer moving parts, no oil changes, and regenerative braking. Individuals as well as fleets of vehicles are more attracted to electric vehicles for lower costs in the long run. As long as fuel remains volatile, especially in oil-importing countries, the economic decision to transition fleets to electrics will remain a major incentive across all vehicles and segments including two-wheelers, cars, and commercial vehicles.

Development of natural gas prices for household consumers in the EU, 2014-2024

|

Year |

Half |

Total Taxes and Levies |

Prices Including Taxes |

Prices Excluding Taxes |

|

2014 |

S1 |

2.0 |

6.9 |

5.0 |

|

2014 |

S2 |

2.1 |

7.5 |

5.4 |

|

2015 |

S1 |

2.0 |

6.8 |

4.9 |

|

2015 |

S2 |

2.1 |

7.3 |

5.3 |

|

2016 |

S1 |

2.0 |

6.5 |

4.6 |

|

2016 |

S2 |

2.1 |

6.8 |

4.7 |

|

2017 |

S1 |

1.9 |

6.2 |

4.3 |

|

2017 |

S2 |

2.0 |

6.8 |

4.8 |

|

2018 |

S1 |

2.0 |

6.3 |

4.4 |

|

2018 |

S2 |

2.2 |

7.2 |

5.0 |

|

2019 |

S1 |

2.2 |

6.7 |

4.5 |

|

2019 |

S2 |

2.3 |

7.2 |

5.0 |

|

2020 |

S1 |

2.3 |

6.4 |

4.1 |

|

2020 |

S2 |

2.4 |

6.9 |

4.7 |

|

2021 |

S1 |

1.7 |

7.9 |

6.2 |

|

2021 |

S2 |

2.7 |

8.6 |

6.4 |

|

2022 |

S1 |

2.4 |

11.5 |

9.9 |

|

2022 |

S2 |

3.2 |

11.9 |

9.2 |

|

2023 |

S1 |

3.1 |

11.4 |

8.9 |

|

2023 |

S2 |

3.7 |

12.4 |

8.7 |

|

2024 |

S1 |

3.6 |

11.4 |

8.0 |

|

2024 |

S2 |

4.0 |

12.4 |

8.7 |

Source: European Commission

Global Electric Car Sales from 2014 to 2024 (in millions)

|

Year |

Total Electric Car Sales (Million) |

|

2014 |

0.3 |

|

2015 |

0.6 |

|

2016 |

0.9 |

|

2017 |

1.3 |

|

2018 |

2.0 |

|

2019 |

2.1 |

|

2020 |

2.9 |

|

2021 |

6.5 |

|

2022 |

10.1 |

|

2023 |

13.8 |

|

2024 |

17.3 |

Source: IEA

Global Electric Car Sales by Region and Type (2014-2024) (in Million)

|

Year |

China BEV |

China PHEV |

Europe BEV |

Europe PHEV |

US BEV |

US PHEV |

Rest of World BEV |

Rest of World PHEV |

Total (approx.) |

|

2014 |

0.1 |

0.03 |

0.05 |

0.02 |

0.02 |

0.01 |

0.01 |

0.01 |

0.25 |

|

2015 |

0.2 |

0.04 |

0.08 |

0.03 |

0.03 |

0.02 |

0.02 |

0.02 |

0.44 |

|

2016 |

0.3 |

0.06 |

0.12 |

0.04 |

0.04 |

0.03 |

0.03 |

0.02 |

0.56 |

|

2017 |

0.4 |

0.08 |

0.15 |

0.06 |

0.06 |

0.04 |

0.04 |

0.03 |

0.70 |

|

2018 |

0.6 |

0.12 |

0.25 |

0.07 |

0.08 |

0.05 |

0.06 |

0.04 |

1.13 |

|

2019 |

0.7 |

0.15 |

0.28 |

0.10 |

0.10 |

0.06 |

0.07 |

0.05 |

1.41 |

|

2020 |

1.3 |

0.23 |

0.45 |

0.12 |

0.15 |

0.08 |

0.09 |

0.06 |

2.47 |

|

2021 |

2.7 |

0.46 |

0.85 |

0.20 |

0.30 |

0.10 |

0.15 |

0.10 |

4.86 |

|

2022 |

4.5 |

0.80 |

1.15 |

0.33 |

0.45 |

0.15 |

0.20 |

0.13 |

7.71 |

|

2023 |

5.0 |

1.20 |

1.80 |

0.50 |

0.60 |

0.20 |

0.30 |

0.15 |

9.75 |

|

2024 |

6.5 |

2.10 |

2.30 |

0.80 |

0.85 |

0.30 |

0.50 |

0.25 |

13.60 |

Source: World Economic Forum

Challenges

- High upfront costs: High upfront costs are expected to be a major barrier to the broad adoption of electric vehicles. While battery prices have lowered over the years, it is still evident that EVs are more costly than internal combustion engine (ICE) vehicles, as they are still expensive due to the high cost of batteries. This problem is especially prevalent in developing markets where consumers may have lower disposable income and fewer avenues to finance the purchase of EVs. However, government subsidies, tax incentives, and rebates are expected to cut battery prices and promote the adoption of zero-emission vehicles.

- Limited charging infrastructure: The accessibility to charging infrastructure continues to be a significant barrier in the uptake of EVs. In contrast to gasoline stations, which are visible and considered the normal infrastructure, public EV charging stations are limited, especially in rural and less developed settings. Given the widespread perception of slow charging speeds, battery types, and different charging standards for EVs, this fear is known as "range anxiety". Also, the other factors involved in charging that can create have been cited as potential hurdles to the user experience.

Electric Vehicle Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.6% |

|

Base Year Market Size (2025) |

USD 763.97 billion |

|

Forecast Year Market Size (2035) |

USD 2777.77 billion |

|

Regional Scope |

|

Electric Vehicle Market Segmentation:

Vehicle Type Segment Analysis

The passenger cars segment is expected to garner a robust electric vehicle market share of 88% by 2035. Affordable electric passenger vehicle models extend accessible electric transportation to more consumers, resulting in increasing electric vehicle adoption. More cost-effective electric vehicle options are entering the market, that is aimed at bringing electric driving within reach of greater numbers of consumers. By taking this strategic step, manufacturing companies are expanding the production of electric passenger vehicles to attract new consumer segments. The advancements in electric battery cells, alongside better recharging facilities, are helping resolve essential issues, which are prompting consumers to choose electric vehicles as their primary transportation.

Propulsion Segment Analysis

The BEV segment is expected to capture a high market share between 2026 to 2035. Governments across the world are prioritizing BEV implementation in public fleets to decrease emissions and establish standard benchmarks, which is accelerating their sales growth. Procurement policies develop market consistency for BEVs while they simultaneously create positive consumer preference, driving their adoption in private settings. The establishment of BEV technology through such government programs is creating a lucrative environment for key market players. Battery swapping technologies are playing a major role in driving battery electric vehicle sales. Companies are leading these technological advancements by creating substantial battery swap stations throughout their networks.

Vehicle Class Segment Analysis

The electric vehicles market by vehicle class is dominated by the low-price electric vehicle (EV) segment. Low-price electric vehicles are accessible to price-sensitive consumers in emerging markets or to a significant share of the population. The upfront cost of low-price electric vehicles appeals to middle-income consumers or those who do not wish to spend on premium or luxury electric vehicles. Therefore, the lower price for an electric vehicle drives total sales into higher volumes and broader market penetration.

Our in-depth analysis of the electric vehicle market includes the following segments:

|

Segment |

Subsegment |

|

Propulsion |

|

|

Component

|

|

|

Vehicle Class |

|

|

Speed |

|

|

Drive Type |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Vehicle Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific electric vehicle market is projected to hold a dominant global revenue share 0f 49% through 2035. Supportive government policies and long-term regulatory frameworks act as key drivers for electric vehicle adoption. The tax exemptions and subsidies for EV acquisitions and supportive importing regulations are driving producers and consumers toward electric mobility transitions. China and India are leading the EV production and sales, while Japan and South Korea are set to drive innovations in the coming years. The local manufacturers are increasing their electric vehicle production capacity owing to rising consumer demands. The public-private investments are significantly aiding in expanding electric vehicle manufacturing facilities, battery plants, and technological advancements. Local development initiatives are creating affordable EV purchasing options, driving economic growth, and providing employment opportunities.

The China electric vehicle market is developing significantly, owing to industrial policies that support companies. Manufacturers and consumers benefit from government-sponsored incentives comprising purchase subsidies, license plate preferences, and lowered road tax requirements. The measures implemented by the government are dramatically reducing barriers to EV adoption and driving the overall market growth. The local automotive manufacturers are contributing to the EV sales growth through their technological innovations. Research and development by key companies are promoting advancements in electric car models by decreasing their expenses and delivering better performance alongside desirable characteristics. The country’s position in the global landscape is continually intensifying through continuous technological improvements and market competitiveness.

The electric vehicle (EV) sector in India has experienced remarkable growth due to support from the government and policy, increased environmental consciousness, and a need to reduce dependence on purchased fossil fuels. The Indian Government has implemented some bold initiatives, especially the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) program, which offers financial incentives to consumers and manufacturers. The states also offer incentives, tax waivers, and subsidize the development of electric-vehicle infrastructure to support shared goals. With cities rapidly urbanizing and air pollution accumulating in the larger cities, there is an increased demand for both cleaner and more sustainable mobility from the political system and from citizens.

North America Market Insights

The North America electric vehicle market is witnessing rapid growth as manufacturers are establishing new electric vehicle production facilities. Companies are reinforcing the production of electric vehicles domestically, with rising demand, aimed at reducing their supply dependencies. The rise of manufacturing facilities strengthens supply chain performance while establishing new employment opportunities and stimulating local economic growth. Rising consumer awareness regarding environmental sustainability, the presence of tech-savvy consumers, and cost benefits are accelerating EV sales. The climatic commitments are also driving consumers to choose electric alternatives to reduce carbon footprints, lower fuel and maintenance costs.

The sales of electric vehicles are increasing in the U.S. owing to growing investments from various automakers for the development of next-gen electric vehicles. This trend is encouraging consumer adoption as the demand for sustainable vehicles continues to grow. The U.S. Energy Information Administration (EIA) states that both electric and hybrid vehicles are gaining traction in the country. The U.S. government has provided significant subsidies and tax credits as part of its efforts, under policies like the Inflation Reduction Act, to not only assist electric vehicle (EV) buyers but also domestic manufacturing of the EVs. In addition to this assistance, a growing charging infrastructure network, fueled by public and private investment, has made it easier than ever to own an EV.

The electric vehicle (EV) market in Canada is rapidly growing due to the financial incentives of provincial and federal government support, as well as environmental policies. The federal and provincial government supports the purchase of EVs by providing financial incentives and rebates to consumers who purchase EVs, especially in British Columbia and Quebec. Canada has also announced a ban on internal combustion engine (ICE) vehicles in 2035 to establish a clear long-term framework for automakers and consumers. Considering internal Canadian natural resources such as lithium and nickel, Canada is also positioning itself as a supplier to the global EV battery supply chain. A growing network of charging stations and an increased number of model offerings are also growing conditions for the EV market in Canada.

Europe Market Insights

The electric vehicle (EV) sector in Europe is increasing rapidly as a function of multiple converging forces: policy support and regulatory drivers; environmental imperatives; technological advancements; and changing consumer preferences. The EU has set forth some ambitious climate policies, such as the Fit for 55 packages, which also include proposals to ban the sale of all new petrol and diesel cars by 2035, all of which have accelerated the development and adoption of EVs in EU member states.

The electric vehicle (EV) sector in France is growing rapidly due to large government incentives and a solid environmental policy framework. The government has launched large subsidies for EV purchasers through bonus-malus schemes and scrappage schemes, which have made EV entry costs more accessible for consumers. In addition to these financial incentives, urban clean air and restrictions on usage of older combustion vehicles - especially in Paris and other urban environments - have removed many barriers for consumer EV adoption. In addition, large French vehicle manufacturers such as Renault and Peugeot invested meaningfully in the development of EV products and are starting to offer a wider range of cars that are designed for different mobility needs in urban and rural contexts.

Germany's electric vehicle (EV) market is undergoing a dynamic development process with support from government commitments, strong manufacturers, and the country's commitment to energy transition. The government has implemented programs like the environmental bonus (Umweltbonus) to stimulate direct EV purchases, while also investing in charging infrastructure development on highways and in cities to improve the convenience of being an EV owner. Germany has the world's top automakers, Volkswagen, BMW, and Mercedes-Benz, and we see rising product innovation and production capability for EVs.

Key Electric Vehicle Market Players:

- Toyota Motor Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BYD Motors Inc.

- Mercedes-Benz Group AG

- Ford Motor Company

- General Motors

- Nissan Group

- Tesla, Inc.

- Volkswagen AG

- Renault Group

- Hino Motors, Ltd.

The competitive landscape of the electric vehicle (EV) market is rapidly evolving, driven by both traditional automotive giants and emerging EV startups. Key players are expanding their electric portfolios, while newcomers such as Rivian and Lucid Motors are disrupting the market with innovative designs and technologies. Increasing investments in EV production, battery technology, and charging infrastructure are intensifying competition. Additionally, partnerships between automakers and tech companies, alongside government incentives, are promoting innovation. As the market matures, competition will focus on range, affordability, performance, and access to charging infrastructure.

Recent Developments

- In April 2025, Lexus rolled out its next-generation ES at the Shanghai Motor Show. The new electric vehicle combines HEV as well as battery technology, and offers a spacious rear-seat package along with a comfortable cabin experience.

- In March 2025, Tata.ev and its partner Allied Motors unveiled the new EV portfolio, including Nexon.ev, Tiago.ev, and Punch.ev in Mauritius. The vehicles are designed with advanced high-voltage architectures and offer features such as best-in-class safety and superior terrain response.

- Report ID: 4476

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Vehicle Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.