Contact Lenses Market Outlook:

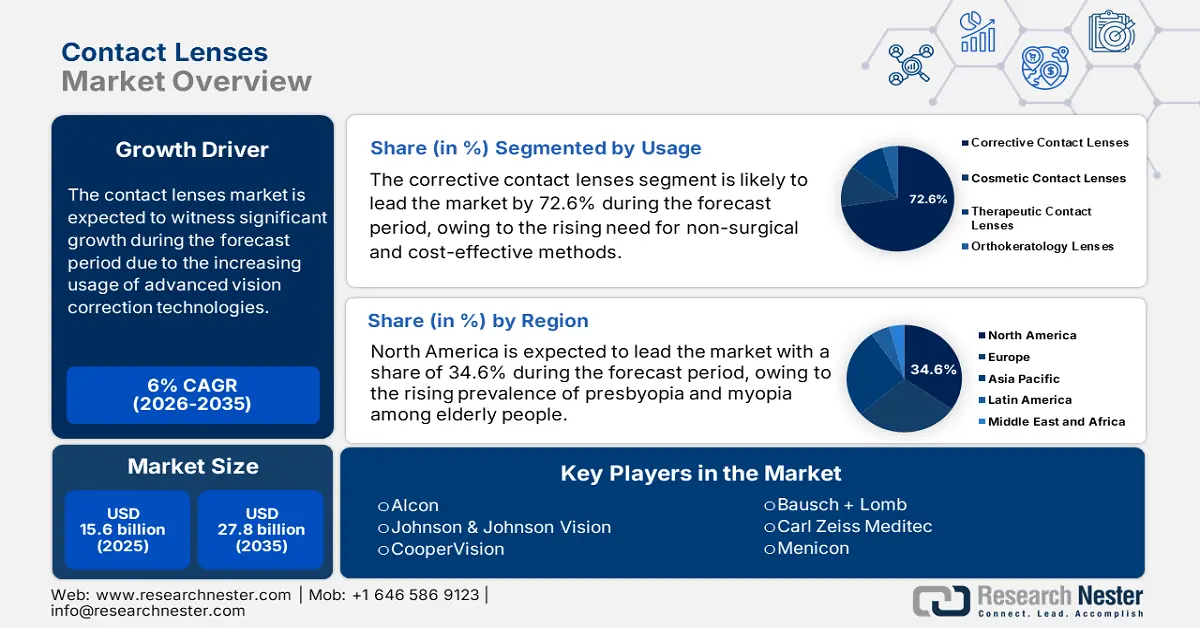

Contact Lenses Market size was valued at USD 15.6 billion in 2025 and is projected to reach USD 27.8 billion by the end of 2035, rising at a CAGR of 6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of contact lenses is estimated at USD 16.5 billion.

The contact lenses market is driven by the increasing usage of advanced vision correction technologies and the increasing prevalence of vision-related issues, such as presbyopia and myopia, as well as consumer interest in aesthetic eye care, leading to the acceptance of contact lenses across both medical and cosmetic sectors. As per the National Eye Institute report published in December 2024, more than 45 million people in the U.S. wear contact lenses. Contact lenses are divided based on their types, such as hybrid, soft, and rigid gas-permeable contact lenses. Further, contact lenses are safe and effective and should be maintained properly.

On the trade side, the contact lenses reached USD 7.02 billion, which is a decrease from 2022, as stated by the OEC report published in 2023. The trade category of contact lenses has witnessed an annual growth rate of 0.53%. Nearly 4644 products were traded in 2023, and contact lenses ranked 528 in the global trade value, reaching 0.031% of the global trade. Further, the product complexity index has stated that the contact lenses were the 501st complex product among 2913 products, holding the PCI value 0.98. The leading exporters of contact lenses are Germany, the U.S., and Ireland. On the other hand, the top three importers are China, Japan, and the U.S.

Key Contact Lenses Market Insights Summary:

Regional Insights:

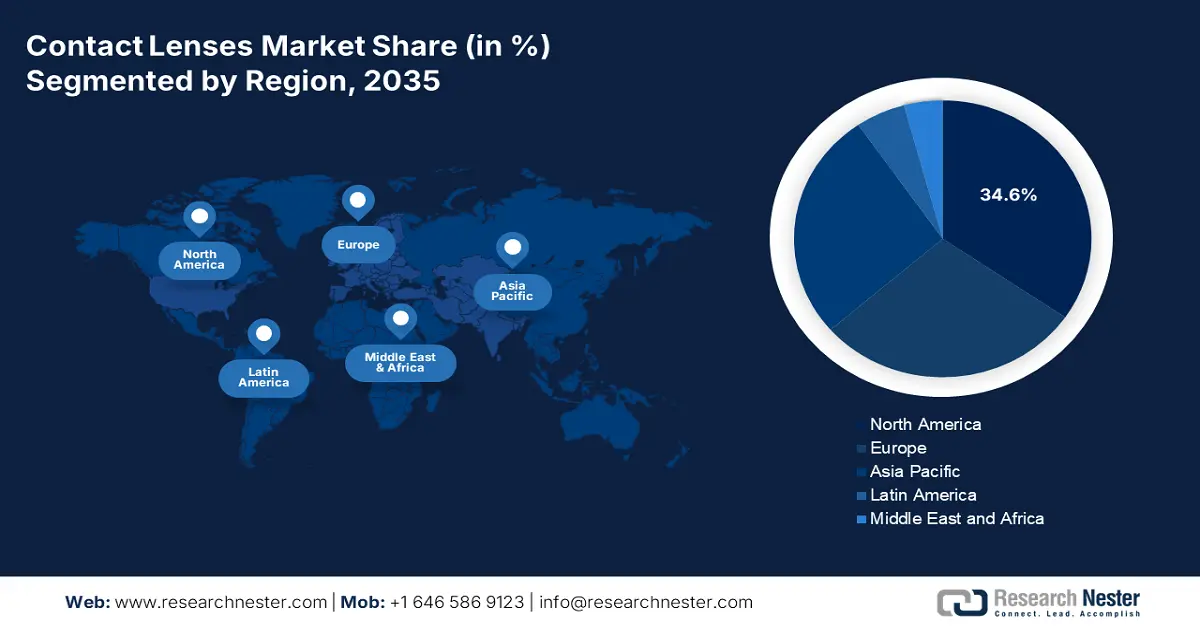

- North America is projected to hold a 34.6% share by 2035, impelled by the rising prevalence of presbyopia and myopia, adoption of disposable lenses, and favorable reimbursement policies.

- Asia Pacific is expected to capture 26.8% share by 2035, fueled by urbanization and increased digital screen exposure.

Segment Insights:

- Corrective Contact Lenses are projected to account for 72.6% share by 2035, propelled by the need for non-surgical and cost-effective methods in both developing and developed markets.

- Adults aged 18–60 are anticipated to hold 65.2% share by 2035, fueled by digital eye strain, vision correction needs, and rising fashion consciousness.

Key Growth Trends:

- Rising rates of myopia and presbyopia

- Increasing e-commerce and online optical retail

Major Challenges:

- Pricing restraints and gaps in reimbursement coverage

Key Players: Alcon (Novartis),Johnson & Johnson Vision,CooperVision (EssilorLuxottica),Bausch + Lomb,Carl Zeiss Meditec,Menicon,Hoya Vision Care,SEED Co. Ltd.,Contamac,BenQ Materials (Hydron),Bescon (Clearlab),UltraVision CLPL,Mark’ennovy,Oculus (Weicon),Gelflex

Global Contact Lenses Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.6 billion

- 2026 Market Size:USD 16.5 billion

- Projected Market Size: USD 27.8 billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, France, United Kingdom

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 13 October, 2025

Contact Lenses Market - Growth Drivers and Challenges

Growth Drivers

- Rising rates of myopia and presbyopia: Myopia and presbyopia are increasing rapidly among the elderly population. Vision correction is starting earlier in life, creating a demand for contact lenses. Countries such as Canada and Germany have witnessed several vision-related disorders over the past few years. Further, the NLM report released in June 2025 has stated that nearly 80% of individuals experience presbyopia with age above 40. Moreover, by 2050, 20% of the world population is expected to get old and demand contact lenses.

- Increasing e-commerce and online optical retail: The rise of digital retail platforms is boosting the distribution channel segment, mainly post-COVID. The U.S. government has relaxed teleoptometry laws, allowing prescriptions via online. Online retailers provide an attractive and transparent discount, hence increasing the compliance and affordability. As per the Vision Council report released in April 2025, the online sales of contact lenses have increased to 39% in Q1 2025, which was 35% in Q4 2024. This shift helps to boost the adoption rate among young consumers who prioritize access and convenience.

- Vision care programs and aging populations: The elderly population with an age above 60 is rising actively and helping to boost the bifocal, toric, and multifocal lenses. Governments are funding vision-related programs for seniors to reduce and prevent injuries and healthcare costs. In North America and the EU, age-related presbyopia programs are provided, including subsidies for lenses offering enhanced vision. this transformation is leading to a stable, recurring market for contact lenses among the elderly population.

Cost Analysis of Specialty, Corneal, and Scleral Contact Lenses (2025)

|

Lens Type |

Median Cost per Patient (INR) |

Median Cost per Patient (USD) |

IQR (INR) |

Cost per QALY Gained (INR) |

Cost per QALY Gained (USD) |

|

Any Specialty |

₹57,878 |

$693 |

₹89,567 |

– |

– |

|

Corneal Lenses |

₹21,907 |

$262 |

₹20,420 |

₹1,35,899 |

$1,628 |

|

Scleral Lenses |

₹1,10,316 |

$1,321 |

₹69,514 |

₹1,56,440 |

$1,874 |

Source: NLM

Eligibility Criteria for Smart Contact Lenses

|

Criteria |

Patients with Stargardt Disease |

Healthy Volunteers |

|

Age Range |

18 – 70 years |

18 – 70 years |

|

Disease Condition |

Juvenile Stargardt’s disease with decreased visual acuity |

None (must be healthy) |

|

Visual Acuity (Binocular) |

≥ 20/400 |

10/10 or better |

|

MMSE Score |

≥ 20/25 (excluding visual items) |

≥ 25/30 (including visual items) |

|

Ocular Surface Condition |

Suitable for scleral lens wear (including palpebral opening & appendages) |

Suitable for scleral lens wear (including palpebral opening & appendages) |

|

Language Requirement |

Sufficient knowledge of the French language |

Sufficient knowledge of the French language |

|

Consent Ability |

Express, free, informed consent (in-person) |

Express, free, informed consent (written) |

|

Protocol Compliance Ability |

Required |

Required |

|

Health Insurance Coverage |

Must be covered |

Must be covered |

|

Matching Requirement |

Not applicable |

Age- and sex-matched to patients (± 5 years) |

Source: Clinical Trials, May 2025

Challenges

- Pricing restraints and gaps in reimbursement coverage: Manufacturers face challenges with the reimbursement mainly in public healthcare systems. Government payers limit the coverage for contact lenses and consider them as elective rather than essential. Hence, this minimizes the insurance reimbursement and limits public procurement. Further, the suppliers have improved the access by providing a cost-effective product based on the pricing model, and resulting in expanded insurance inclusion. Regulatory approval delays further complicate the entry to market in some countries with standard medical device classification standards.

Contact Lenses Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 15.6 billion |

|

Forecast Year Market Size (2035) |

USD 27.8 billion |

|

Regional Scope |

|

Contact Lenses Market Segmentation:

Usage Segment Analysis

Corrective contact lenses lead the segment and are poised to hold the share value of 72.6% by 2035. The segment is driven by the need for non-surgical and cost-effective methods in both developing and developed markets. Moreover, campaigns by public health organizations are supporting early eye screening, which is one of the reasons for boosting adoption. As per the WHO report published in August 2023, nearly 2.2 billion people have near and distant vision impairment, and nearly 1 billion people have been addressed in various ways, such as using contact lenses.

End user Segment Analysis

Adults aged between 18 and 60 lead the end user segment and is anticipated to hold the share value of 65.2% by 2035. The segment is driven by the digital eye strain, vision correction needs and rising fashion consciousness. This age group people have high rate of adoption due to willingness to invest in the premium lenses and lifestyle compatibility. Some latest innovations in the lenses are silicon hydrogel and daily disposables making the people to get attracted with the innovations and dominate the market. The growing preference for aesthetic and convenience-based solutions, along with increased awareness through online platforms and optometrist recommendations.

Type Segment Analysis

Soft contact lenses lead the type segment and is poised to hold the share value of 68% by 2035. As per the CooperVision company’s data published in May 2023, the sales of soft contact lenses have raised to 76%. Soft contact lenses are the most common used on daily routine. They are made up of a flexible polymer material which is used to provide a clear and comfortable vision. These lenses are available in various colors and mainly used to correct presbyopia. Further, the segment is benefitted from the innovations such as oxygen permeable designs and UV blocking.

Our in-depth analysis of the global contact lenses market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Usage |

|

|

Material |

|

|

Design |

|

|

Wear Duration |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Contact Lenses Market - Regional Analysis

North America Market Insights

North America contact lenses market is poised to dominate 34.6% share by 2035. The region is driven by the rising prevalence of presbyopia and myopia among elderly people, rising adoption of disposable lenses, advancements in technology, and favorable reimbursement policies. Many dominating players in the market are from North America, and Alcon, such a leader, has introduced TOTOAL30, the multifocal contact lens with proven precision profile design contributing to a 96% fitting success. Further, the Taylor and Francis report published in January 2025 states that most of the lenses manufactured in the region are based on the silicon hygrogel material, which was 20% over the past five years and increased to 96% by 2024 due to the growing demand.

The U.S. contact lenses market is one of the largest shareholders in the North America region and is driven by the rising vision impairment cases and the adoption of new technology. According to The Vision Council report announced in January 2024, nearly USD 65.6 billion of eye exams and eye care products, including contact lenses, were purchased in the U.S. Further, the contact lens market value in 2022 was revised to USD 10.94 billion. Furthermore, e-commerce platforms are expanding the accessibility of lenses, and manufacturers are offering various subscription models to boost compliance and affordability. Innovations, including smart lenses and antimicrobial coatings, are gaining traction.

Top Countries Exporting Contact Lenses

|

Country |

Partner |

Trade Value 1000 USD |

Quantity (Item) |

Year |

|

U.S. |

Ireland |

277,891.86 |

318,422,000 |

2023 |

|

U.S. |

Germany |

259,755.84 |

515,817,000 |

2023 |

|

Canada |

Ireland |

22,167.52 |

17,971,700 |

2022 |

|

Canada |

Germany |

18,152.74 |

1,016,360 |

2022 |

Source: WITS

APAC Market Insights

The Asia Pacific is the fastest-growing region and is expected to hold the market share of 26.8% by 2035. The region is driven by the rising urbanization and digital screen exposure. Countries such as Japan, China, and South Korea have a rising myopia and presbyopia cases, demanding the contact lenses market mainly among the population in school grade children and elderly people. As per the Roche survey report in April 2023, nearly 28% of the people in the region do regular eye checkups. Further, 90% of the vision-related issues are treatable and preventable, stated by the NLM report in April 2024. Many multinational companies are expanding their market in the APAC region.

With the invention of contact lenses, South Korea has made a significant advance in the material and design of contact lenses. Many people have eyesight issues such as refractive errors and some cosmetic issues, and these are addressed by contact lenses. The country witnesses a rise in myopia occurrence among the younger population, and the use of contact lenses is becoming common. As per the NLM article announced in March 2024, 70.36% of women use contact lenses for a long period compared to men. Further, Korea’s medical device market rose from USD 8.0 billion in 2021 to USD 9.2 billion in 2023 including contact lenses due to rising regional manufacturers, as per the International Trade Administration report published in December 2023.

Import and Export Data by Country

|

Year |

Country |

Export to |

Import to |

Trade Value |

Quantity |

|

2021 |

India |

- |

United Kingdom |

3,820.01 |

851,367 |

|

2023 |

Japan |

China |

- |

28,318.51 |

4,894,100 |

|

2023 |

Malaysia |

Australia |

- |

55.64 |

7,687 |

|

2023 |

China |

- |

Ireland |

102,682.92 |

302,790,000 |

Source: WITS

Europe Market Insights

Europe is experiencing a significant growth in the contact lenses market and is driven by the aging population, demand for vision correction, and digital exposure. Technology advancements in contact lenses, such as silicon hydrogel lenses, monthly and daily disposables lenses improves the comfort and boost the adoption. As per the EuromContact report published in May 2025, the soft contact lenses industry has raised to 7.14%. Further, the silicon hydrogel is the leading material holding 60.9%share in th daily disposable lenses. Sweden leads the adoption rate by 13.8% of population aged between 15 and 64.

Germany holds 4.5% of contact lens adoption rate in the Europe region, as per the EuromContact report published in May 2025. The nation is surged by the insurance coverage, adoption of digital healthcare, and advanced manufacturing facilities. The market is aided by the favorable reimbursement schemes and established optometry network. further, the trend towards lenses and solutions is driven by the e-commerce sector and reshaping consumer behavior. This shift prompts manufacturers to invest in local distribution.

Key Contact Lenses Market Players:

-

- Alcon (Novartis)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson Vision

- CooperVision (EssilorLuxottica)

- Bausch + Lomb

- Carl Zeiss Meditec

- Menicon

- Hoya Vision Care

- SEED Co. Ltd.

- Contamac

- BenQ Materials (Hydron)

- Bescon (Clearlab)

- UltraVision CLPL

- Mark’ennovy

- Oculus (Weicon)

- Gelflex

- Alcon (Novartis)

The global contact lenses market is led by key players such as Alcon, J&J Vision, and CooperVision. These leading player together is expected to hold a 65% share. These manufacturers invest significantly in silicone hydrogel lenses, daily disposables, and myopia management products. Regional players such as SEED (Korea) and Rohto (Japan) have hydration and cosmetic lenses as their priorities, and European companies (Zeiss, Contamac) are seen to prioritize customization and material science. Sustainability is becoming a prominent trend, with players such as Mark'ennovy launching environmentally friendly packaging. Mergers and direct-to-consumer approaches are altering rivalry. Asia-Pacific's increasing demand fuels color lenses and ortho-k solution innovation, with greater competition among mid-range players.

Some of the key players in contact lenses market:

Recent Developments

- In June 2025, Johnson & Johnson has launched ACUVUE OASYS MAX 1-Day MULTIFOCAL for ASTIGMATISM, the first and only daily disposable contact lens for people with both astigmatism and presbyopia.

- In July 2024, Alcon has announced PRECISION7 which is a one week replacement contact lenses providing 16 hours of comfortability and precise vision for the whole week.

- Report ID: 223

- Published Date: Oct 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Contact Lenses Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.