Automotive Lighting Market Outlook:

Automotive Lighting Market was valued at USD 24.5 billion in 2025 and is anticipated to exceed USD 39.3 billion in 2035, expanding at a CAGR of 4.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automotive lighting is assessed at USD 25.5 billion.

The automotive lighting market is growing substantially, driven by the increasing global demand for vehicle production and sales. The electrification and automation of vehicles is propelling the adoption of automotive lighting solutions. The rise in vehicle adoption in both developed and developing economies is anticipated to fuel the revenue of automotive lighting technology manufacturers. For instance, the European Automobile Manufacturers' Association (ACEA) reports that in 2022, approximately 85.4 million motor vehicles were manufactured worldwide. Such developments in vehicle production are opening new opportunities for the market. The progressive demand for vehicles is boosting the automotive lighting sales and is expected to maintain its upward trend during the foreseeable period. Thus, high registrations of vehicles are likely to offer double-digit revenue growth opportunities to automotive lighting manufacturers.

One of the most noticeable evolutions has been the quick abandonment of typical halogen and xenon lamps for more energy-efficient light alternatives, including LED, OLED, and laser-based lighting systems. These new technologies have improved performance, design freedom, and reductions in power consumption, especially relevant for electric vehicle applications. Smart, adaptive lighting systems, including matrix LEDs and adaptive front lighting, are becoming more prominent as these systems can improve safety by changing a vehicle’s beam patterns based on roadway conditions and surrounding vehicles. The customization of interior ambient lighting for the comfort of passengers is becoming common. The lighting industry is also concerned about sustainability, which requires lighting systems to utilize low-power draw options and more recyclable materials.

Key Automotive Lighting Market Insights Summary:

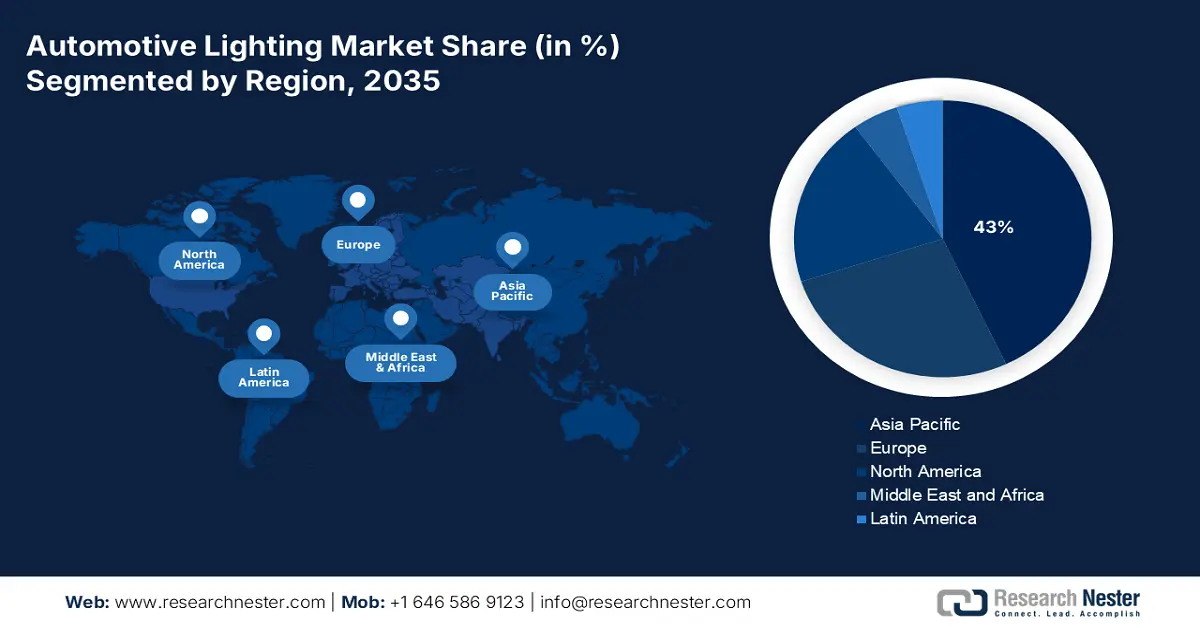

Regional Insights:

- By 2035, the Asia Pacific automotive lighting market is forecast to secure a dominant 43% share, owing to the rapid expansion of strong automotive manufacturing platforms across China, India, and Thailand.

- Europe is projected to maintain a substantial share by 2035 as substantial OEM investments and stringent EU safety regulations bolster the adoption of advanced lighting technologies.

Segment Insights:

- By 2035, the LED segment is projected to command a 47% share in the automotive lighting market, propelled by declining LED production costs.

- The front headlights segment is anticipated to lead from 2026–2035, impelled by rising demand for vehicle design customization.

Key Growth Trends:

- Preference for aesthetic and functional lighting features

- Advancements in lighting materials and design

Major Challenges:

- Battery performance and longevity

- High manufacturing costs and complex integration

Key Players: Ams-OSRAM AG, Marelli Holdings Co., Ltd.,Compagnie Plastic Omnium SE, Koninklijke Philips N.V., Denso Corporation,Stanley Electric Co., Ltd., Hyundai Motor Company, Valeo, Koito Manufacturing Co., Ltd.

Global Automotive Lighting Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 24.5 billion

- 2026 Market Size: USD 25.5 billion

- Projected Market Size: USD 39.3 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: – United States, China, Germany, Japan, South Korea

- Emerging Countries: – India, Mexico, Thailand, Brazil, Turkey

Last updated on : 1 October, 2025

Automotive Lighting Market - Growth Drivers and Challenges

Growth Drivers

- Preference for aesthetic and functional lighting features: Consumers are demanding modern lighting systems that bring design quality with performance needs. This factor is anticipated to boost the demand for advanced automotive lighting technologies in the coming years. Companies are partnering with other players to deliver advanced automotive lighting solutions through high-resolution matrix headlamp systems. For instance, in July 2023, HELLA and Porsche unveiled the SSL | HD as the first high-resolution matrix headlamp system with 32,000 individually manageable LED pixels in each headlamp. Manufacturers are benefitting from emerging lighting innovations, which enhance the need for complicated automotive lighting systems to determine future design and safety specifications of vehicles.

- Advancements in lighting materials and design: Modern developments in automotive lighting materials and advanced design strategies are boosting the function and appearance of vehicle lighting solutions. Various companies are forming collaborations to enable advanced LiDAR technologies in next-gen electric vehicles. For instance, in May 2020, Volvo Cars, along with Luminar Technologies, announced the introduction of a laser-based headlamp system that integrates LiDAR sensors for improved driving condition adaptation, resulting in enhanced visibility and safety features. This innovative lighting technology is set to be installed in the new Volvo ES90. By working together, these companies are improving automotive lighting efficiency and developing road lighting systems to deliver better illumination. Such collaborative moves are estimated to offer lucrative gains to the industry giants.

- Transition from traditional Lighting to LED, OLED, and laser technologies: The integration of light-emitting diodes (LED), organic light-emitting diodes (OLED), and laser-based systems is one of the most sought-after lighting technologies in the automotive sector. The LEDs are gaining prominence as they generate bright illumination through lower energy usage than conventional halogen lamps. The automakers are adopting energy-efficient lighting solutions to address both environmental sustainability and economic needs for automotive components. The development of micro-optics and holographic technologies is enabling innovative materials, allowing manufacturers to create compact aesthetics for their designs and register a double-digit revenue growth in the years ahead.

Vehicle production figures for various regions across 2021 and 2022

|

Region |

2021 Production |

2022 Production |

|

Greater China |

26,411 |

27,222 |

|

Europe |

16,480 |

16,391 |

|

North America |

13,596 |

14,901 |

|

Japan/Korea |

11,065 |

11,334 |

|

South Asia |

8,356 |

10,230 |

|

South America |

2,796 |

3,025 |

|

Middle East/Africa |

2,103 |

2,294 |

Source: European Automobile Manufacturers' Association (ACEA)

Challenges

- Battery performance and longevity: Battery performance and longevity are acting as key challenges for electric vehicles. While advancements are enhancing efficiency and energy density, consumers are still concerned about battery degradation over time. The ability of batteries to retain a charge diminishes with their increasing age, resulting in reduced driving range. The high cost of replacing EV batteries remains a significant barrier, as these components constitute a large part of the vehicle’s overall price. This concern, coupled with the uncertainty surrounding battery lifespan, is discouraging potential buyers from making the switch to electric vehicles, especially for long-term investments.

- High manufacturing costs and complex integration: Lighting methods such as LED, OLED, and laser systems require a significant investment in manufacturing costs. Components for these advanced systems represent significant investments in R&D and precise manufacturing processes. This can impact the vehicle's overall cost. Furthermore, the integration of these complex lighting into vehicles must also consider compatibility with other vehicle electronic components, sensors, and control systems; it can be a significant engineering hurdle, and all this can delay new technology adoption and increase manufacturing timelines.

Automotive Lighting Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 24.5 billion |

|

Forecast Year Market Size (2035) |

USD 39.3 billion |

|

Regional Scope |

|

Automotive Lighting Market Segmentation:

Technology Segment Analysis

The LED segment is expected to capture a high share of 47% throughout the forecast period. LED is an energy-efficient technology that uses less energy and produces more light output, an important factor for electric vehicles. Additionally, LEDs are small and flexible enough to create a range of interesting styling options, which allows an automaker to create their own lighting signature and modify light sources to fit their design or styling. Demand is being further stimulated by more advanced lighting technology. Finally, the price to produce LEDs continues to decline, which will support their usage for vehicles of all types, from entry-level to luxury. Also, regulatory requirements for energy efficiency and environmental sustainability are correlated with the advantages of moving to LEDs, as they consume less energy and produce less heat than standard lighting.

Product Type Segment Analysis

The front headlights segment is anticipated to lead the automotive lighting market from 2026 to 2035. Advanced front-headlighting systems in the automotive industry are undergoing a major transformation due to the integration of matrix LEDs, laser lights, and adaptive lighting technologies. Road safety is becoming advanced through innovations that combine improved illumination systems and reduced glare effects for other drivers on the road. For instance, in January 2023, Nichia Corporation formed a partnership with Infineon Technologies for creating a front illumination system that integrates 16,384 micro-LED matrix solutions. Automotive manufacturers are focusing on enhanced design choices for better performance of the front lighting solutions. The rising demand for vehicle design customization, combined with visual appeal, is also fueling the installation of innovative front lighting technologies.

Distribution Channel Segment Analysis

Original Equipment Manufacturers (OEMs) accounted for the largest revenue share in the automotive lighting market. OEMs manufacture vehicles on a mass scale for both the domestic and international markets. Thus, they are the largest purchasers of automotive lighting components, including LEDs, halogen, xenon, and other advanced lighting systems. The enormous production of vehicles by OEMs creates a constant high demand for lighting systems, and their purchases represent the largest portion of revenue in the lighting market. OEMs drive design trends and consumer preferences in the automotive market, including lighting design. When OEMs invest in unique lighting elements-such as signature LED daytime running lights (DRLs) or dynamic turn signals-they begin to set the pace for the entire market. This continually fuels the need for lighting suppliers to innovate and keep pace with the OEMs they service, strengthening OEMs even further in their ability to capture the greatest revenue share in the marketplace.

Our in-depth analysis of the automotive lighting market includes the following segments:

|

Segments |

Subsegments |

|

Product Type |

|

|

Technology |

|

|

Vehicle Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Lighting Market - Regional Analysis

APAC Market Insights

The Asia Pacific automotive lighting market is projected to hold the largest revenue share of 43% through 2035. There is a rapid expansion of automotive lighting in the region owing to the development of strong manufacturing platforms for automobiles by countries including China, India, and Thailand. Auto manufacturers from around the world are directing their investments to these countries as they benefit from advanced production resources combined with supportive governmental initiatives in the form of policies and schemes. The growing domestic automotive manufacturing is directly stimulating the demand for modern automotive illumination systems throughout different types of vehicles.

The automotive lighting sector in India will witness rapid growth driven by an increase in vehicle production, rapid urbanization, and rising disposable incomes of the growing middle-class population. The demand for two-wheeler and passenger vehicles is substantial, especially in Tier 2 and Tier 3 cities, which in turn fosters both original equipment manufacturer (OEM), and aftermarket, lighting growth. Government policy to support electric vehicle (EV) development, consumer awareness regarding safety regulations and recently implemented safety rule advancement related to DRLs, also contributes to innovation use of lighting technologies. Furthermore, the rising consumer demand for premium fit and finish, coupled with a preference for energy-efficient LEDs, means that there will be considerable growth in demand for the use of LEDs for automotive lighting.

The automotive lighting market in China is expanding as it is the world’s biggest vehicle manufacturer and one of the largest producers of electric vehicles. In addition, there is a noticeable transition towards advanced automotive lighting technologies, as well as growing consumer assessments, government regulations on consumer safety and economic advantages to consumers. New energy vehicles, including autonomous vehicles and connected vehicles are also on the rise and in conjunction with advancements are encouraging intelligent lighting systems. In addition, the Chinese government's commitment of time and resources to the development of NEVs and in electric vehicle charging infrastructure has an indirect impact on the research & development of lighting systems.

Europe Market Insights

Europe is anticipated to occupy a significant share owing to a number of factors. To begin with, Europe is home to some of the world's biggest automotive manufacturers which are making a substantial investment in advanced lighting solutions. Moreover, the transition to electric vehicles (EVs) in the region is driving the demand for energy-efficient lighting solutions in support of the sustainability requirements of these new vehicle designs. In addition, the EU's strict safety requirements, such as the need for adaptable lighting systems and daytime running lights (DRLs) are helping to drive innovation and the need for advanced lighting solutions as a result of EU and national safety regulations.

Strategic financing support from the local government for automotive technology development is creating lucrative avenues for the growth of the U.K. automotive lighting systems. The government's support toward electric vehicle programs and smart transport systems is driving automakers to implement state-of-the-art lighting technologies, including adaptive front lighting and matrix LEDs. Regulatory advancements are accelerating efficient high-performance lighting technologies for the automotive, passenger, and commercial sectors. The consumers who prioritize premium and luxury vehicles are driving the demand for enhanced lighting equipment.

The government of France is actively promoting the adoption of electric and hybrid vehicles as they rapidly capture the market share in the country. Electric vehicle registrations, including plug-in electric vehicles, are on the rise, and the French government is investing in electric vehicle infrastructure (i.e., charging stations), battery manufacturing, and other operations. France is also implementing policies that promote the adoption of energy-efficient technologies, emissions reduction, and sustainability practices in vehicle design and operation.

North America Market Insights

The North America automotive lighting market is set to be driven by the high demand for super and luxury cars. The regional transportation organizations and governments are mandating requirements that enforce adaptive headlights, automatic high-beam systems, and daytime running lights for vehicles. Road visibility improvements and accident reduction at night through compliance requirements are driving system development for intelligent vehicle lighting systems in all car types. The swiftly increasing electric vehicle registrations in the region require advanced, energy-efficient, and attractive lighting systems that meet current consumer demands.

There is an evident shift in consumer preference toward premium vehicles, which is significantly impacting the demand for advanced automotive lighting solutions in the U.S. High-end vehicles often feature sophisticated lighting systems such as matrix LED and laser headlamps, which offer superior performance and design appeal. As automakers compete to enhance aesthetics and brand identity, lighting is becoming a key differentiator. The integration of automotive lighting with smart mobility and connected vehicle technologies is emerging as a vital growth factor in the U.S. market.

Canada is seeing a transition to more efficient energy use and more sophisticated lighting technologies - in particular LED and OLED technologies. These technologies come with many benefits including longer lifetime, lower energy demands, and flexibility in design, which are contributing to increased use and acceptance by both consumers and manufacturers. Additionally, the demand for adaptive lighting systems for improved visibility and safety for drivers is leading to the adoption of new lighting technologies. Furthermore, many of the new heavy vehicle safety legislation in Canada requires the use of advanced lighting systems.

Key Automotive Lighting Market Players:

- Ams-OSRAM AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Marelli Holdings Co., Ltd.

- Compagnie Plastic Omnium SE

- Koninklijke Philips N.V.

- Denso Corporation

- Stanley Electric Co., Ltd.

- Hyundai Motor Company

- Valeo

- Koito Manufacturing Co., Ltd.

The automotive lighting market is highly competitive, featuring a mix of established global players and innovative regional manufacturers. Key companies are dominating the market through continual advancements in LED, laser, and adaptive lighting technologies. These players focus on partnerships, product launches, and R&D investments to strengthen their market presence. Competition is further intensified by emerging startups introducing cutting-edge solutions, especially in the EV and autonomous vehicle segments. The market is defined by rapid technological evolution, cost competitiveness, and increasing demand for energy-efficient, aesthetic lighting systems.

Here is a list of key players operating in the market:

Recent Developments

- In July 2024, HELLA and Audi collaborated on a digital headlamp concept for the Q6 e-tron. The matrix-LED headlamps feature glare-free high beams and customizable daytime running lights, enhancing both safety and personalization for drivers.

- In July 2023, ams-OSRAM AG introduced the EVIYOS 2.0, a groundbreaking multipixel LED for automotive forward lighting and projection. This intelligent LED features 25,600 individually controllable pixels, enabling adaptive and dynamic lighting, including image projection onto the road surface.

- Report ID: 4483

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Lighting Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.