Smart Factory Market Outlook:

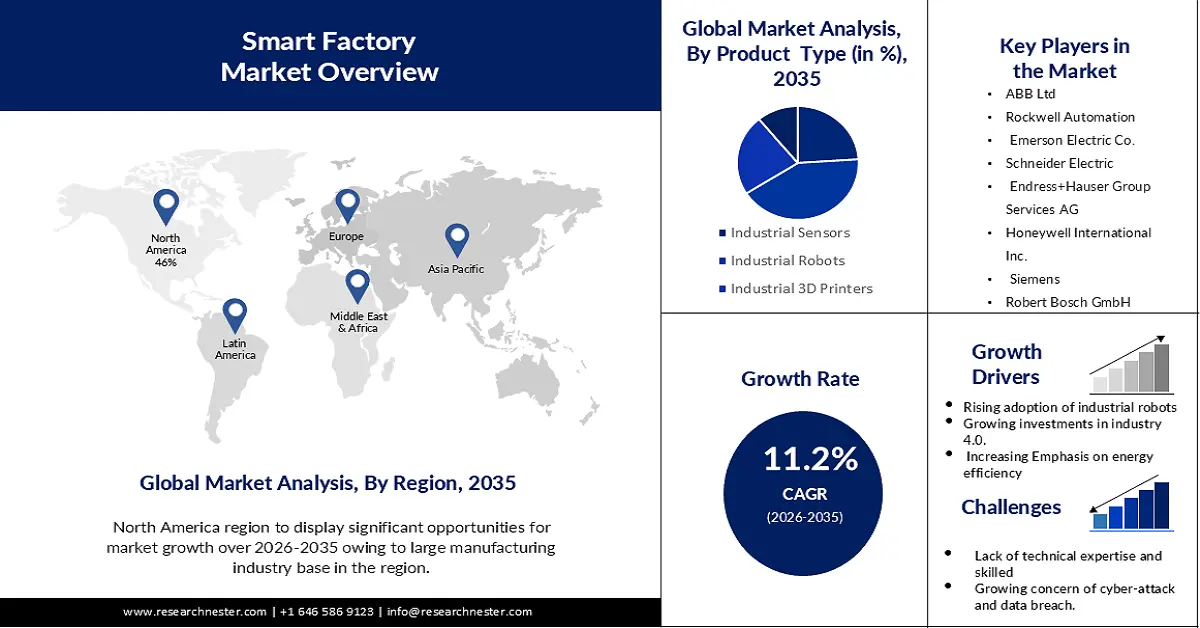

Smart Factory Market size was valued at USD 130.75 billion in 2025 and is expected to reach USD 378 billion by 2035, expanding at around 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart factory is assessed at USD 143.93 billion.

Increasing Adoption of the Industrial Internet of things will fuel the industry growth. In the context of industry, the IIoT is a network of connected machines, sensors, and devices that allows for real-time data gathering, processing, and sharing. Traditional manufacturing processes are revolutionized by this connectivity and data interchange, which also advances the creation of smart factories. As per our analysis, the Industrial Internet of things evaluates an industry figure of USD 544 billion in 2023.

Another significant user of smart factory methods is the semiconductor industry. Rising energy costs, several environmental restrictions, and the general trend toward sustainable manufacturing are anticipated to accelerate the use of items like machine vision systems, robotics, and other technologies, driving up market demand for smart factories.

Key Smart Factory Market Insights Summary:

Regional Highlights:

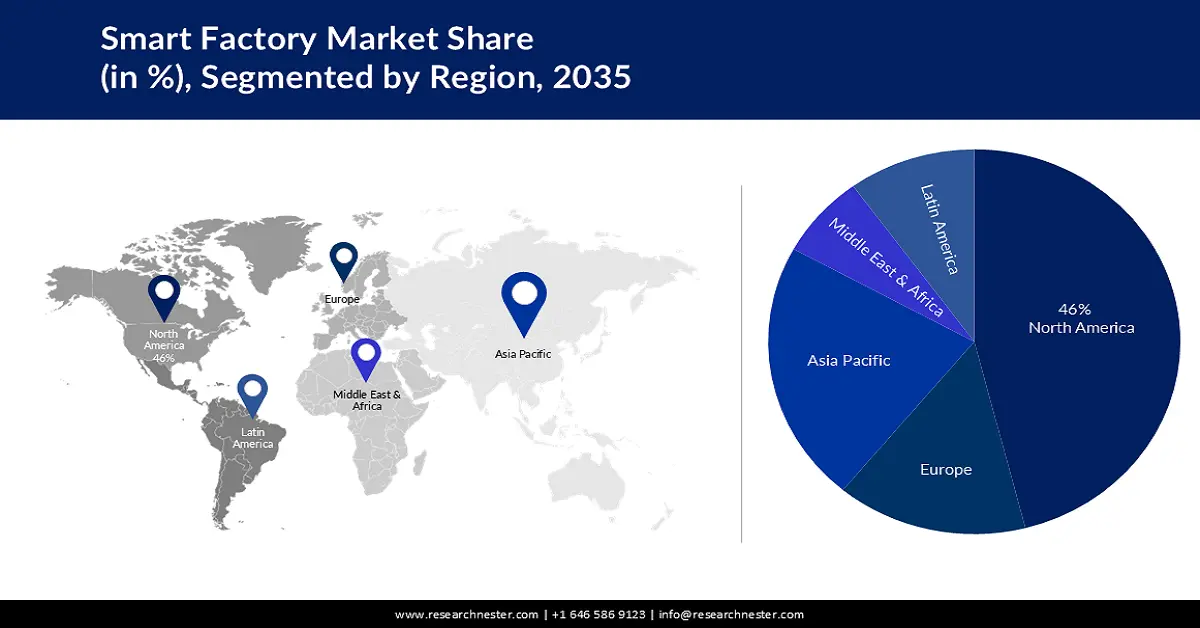

- North America smart factory market will hold around 46% share by 2035, driven by automation adoption and strong tech infrastructure.

- Asia Pacific market projects significant growth during the forecast timeline, driven by government support for industrial automation and R&D investment.

Segment Insights:

- The industrial robots segment in the smart factory market is forecasted to achieve a 42% share by 2035, driven by robotics’ role in improving productivity and reducing errors in production.

- The automotive segment in the smart factory market is anticipated to secure a major market share by 2035, driven by automation needs in response to competition and efficiency goals.

Key Growth Trends:

- Penetration in the Automotive Industry

- Increasing use in Medical devices

Major Challenges:

- Penetration in the Automotive Industry

- Increasing use in Medical devices

Key Players: Rockwell Automation, Emerson Electric Co., Schneider Electric, Endress+Hauser Group Services AG, Siemens, Robert Bosch GmbH, Dassault Systèmes, Yokogawa Corporation, Mitsubishi Electric Corporation.

Global Smart Factory Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 130.75 billion

- 2026 Market Size: USD 143.93 billion

- Projected Market Size: USD 378 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

Smart Factory Market Growth Drivers and Challenges:

Growth Drivers

-

Penetration in the Automotive Industry- The smart factory market is greatly impacted by the growing use of smart factory technologies for producing complex automobiles. Smart factory solutions may successfully solve the challenging production needs in these industries, which call for high levels of precision, quality, and efficiency. In the automotive sector, it is used for seamless integration of automation and it also ensures the production of intricate automotive components. Currently, 30% of car factories are integrating smart factory automation.

-

Increasing use in Medical devices - Medical equipment, implants, and other complex components need to be made using precision manufacturing techniques. Advanced automation, sophisticated quality control, and real-time analytics are all features of smart manufacturing systems, which guarantee the highest levels of accuracy and quality. Additionally, the incorporation of sophisticated traceability and serialization systems in smart factories aids in meeting medical industry regulatory compliance standards. Adopting smart factory solutions in these sectors also increases production effectiveness and empowers businesses to fulfill regulatory and quality criteria that are very strict. As a result, the demand for smart industrial technologies is increasing quickly, fuelling the growth of the market at a steady pace.

- Increasing Network Coverage- There will be a significant increase in the deployment of 5G networks in smart factories. This will accelerate the evolution of the industry's outlook. Several smart owners of factories have been around in recent years. With the aid of 5G technology, there has been a rise in usage of cellular technologies. Further, for the specific use cases, they will be personalized. Integration of sensors into 5G enabled devices equipment enables the data collection from manufacturing networks devoid of Connecting to the machines for efficient real-time optimization. Hence, the excessive deployment of 5G networks in smart manufacturing plants helps in the expansion of the global smart factory market.

- Increased Industrial Robot Adoption - As the need for automation continues to grow in industries, industrial robots are being deployed more and more. As per a survey conducted, there have been an estimated 3 million industrial robots in use across the globe. Growth in Industrial Robots was driven by the expansion of electronics, as well as rising production costs. This is likely to lead to an increase in demand for industrial robots during the study period, while also contributing to market expansion of smart factories.

Challenges

-

Cybersecurity Concerns – Some of the major cybersecurity concerns associated with smart factories are vulnerability in IoT devices, risk of unauthorized access, risk of data breaches, supply chain security threats and others. The manufacturing industry is frequently targeted by cyber-attacks. With smart factories which include industrial internet of things, automation, and integration of cloud computing in record management of manufacturing process, there is an eminent risk of that data getting hacked. As per reports, nearly 25 % of all attacks in the year 2022 have been against manufacturers. Also, the systems' interconnectedness can have a cascading effect that increases the severity of any cyberattack. In light of this, the cybersecurity concerns can be considered as a major setback for the smart factory market.

-

Initial high investment costs, restrain the growth of the market.

- Stringent government Policies, are restricting the industry’s growth.

Smart Factory Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 130.75 billion |

|

Forecast Year Market Size (2035) |

USD 378 billion |

|

Regional Scope |

|

Smart Factory Market Segmentation:

Product Type Segment Analysis

The industrial robots segment is expected to account for 42% share of the global smart factory market by 2035. In driving the growth of the market, industrial robots play a key role. By combining automation, connectivity, and artificial intelligence, these advanced machines are revolutionizing the manufacturing industry. Further, every year, around 400,000 new robots enter the market. Many advantages, such as increased productivity, greater precision, reduced costs, and improved safety, are offered by industrial robots.

Businesses may improve workflows, automate processes, and increase productivity by integrating intelligent robotics into their operations. Industrial robots can complete labor-intensive, repetitive jobs quickly and accurately, removing human error and cutting down on production downtime. Productivity is further increased by their capacity to collaborate with human workers.

End User Segment Analysis

The automotive segment is anticipated to hold a major smart factory market share over the forecast period. Numerous manufacturers are continually concentrating on enhancing productivity, cutting expenses, and boosting efficiency as a result of increasing competition in the automotive business. Due to their ability to assist manufacturers in optimizing their production processes while reducing waste and downtime, smart factory technologies are widely favored in this context. Additionally, the preference for automation technologies to satisfy the booming market for high-quality and dependable products will fuel the market demand.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

End User |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Factory Market Regional Analysis:

North American Market Insights

North America is anticipated to gain the largest smart manufacturing market share of about 46% by 2035. The market growth can be attributed to region's large industry base, advanced technical infrastructure, and a focus on innovation. To improve their effectiveness and competitiveness, North American manufacturers have been pushing for the introduction of automation and digitalization. Market growth has also been driven by the presence of several important automation solution providers and technology companies. In 2021, the manufacturing industry contributed USD 2.3 trillion to the GDP of the United States and accounted for 12.1% of total US GDP.

APAC Market Insights

Asia Pacific smart factory market is expected to record significant growth during the forecast period. This is primarily due to the presence of a strong manufacturing industry base. It has well-established industries that actively utilize smart manufacturing technologies, including the automotive, electronics, and consumer products sectors.

Additionally, the regional governments are aggressively promoting programs to advance digital transformation and industrial automation. To promote the adoption of smart industrial technology, they are making investments in research & development, providing subsidies, and putting supportive regulations in place. The market revenue is further accelerated by the domestic and international investments attracted by this advantageous regulatory environment.

Smart Factory Market Players:

- General Electric Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB Ltd

- Rockwell Automation

- Emerson Electric Co.

- Schneider Electric

- Endress+Hauser Group Services AG

- Honeywell International Inc.

- Siemens

- Robert Bosch GmbH

- Dassault Systèmes

Recent Developments

- ABB Ltd. has been working with Ericsson to develop a flexible wireless automation solution for smart manufacturing plants. This collaboration has been made possible by ABB's industry-leading automation technology with Ericsson's expertise in the field of 5G Wireless, which enables wireless communications to be delivered reliably and effectively within factory settings.

- The Plant web Optics platform has been set up by Emerson Electric Co. The platform is designed to enable Realtime monitoring and optimization of industrial processes by combining advanced Analytics, Digital Twin Technology as well and the Industrial Internet of Things. To increase the operational efficiency, asset performance, and maintenance strategies of smart plants, Plant Web Optics provides actionable insights and predictive Analytics.

- Report ID: 3283

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Factory Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.