Electric Vehicle Charging Station Market Outlook:

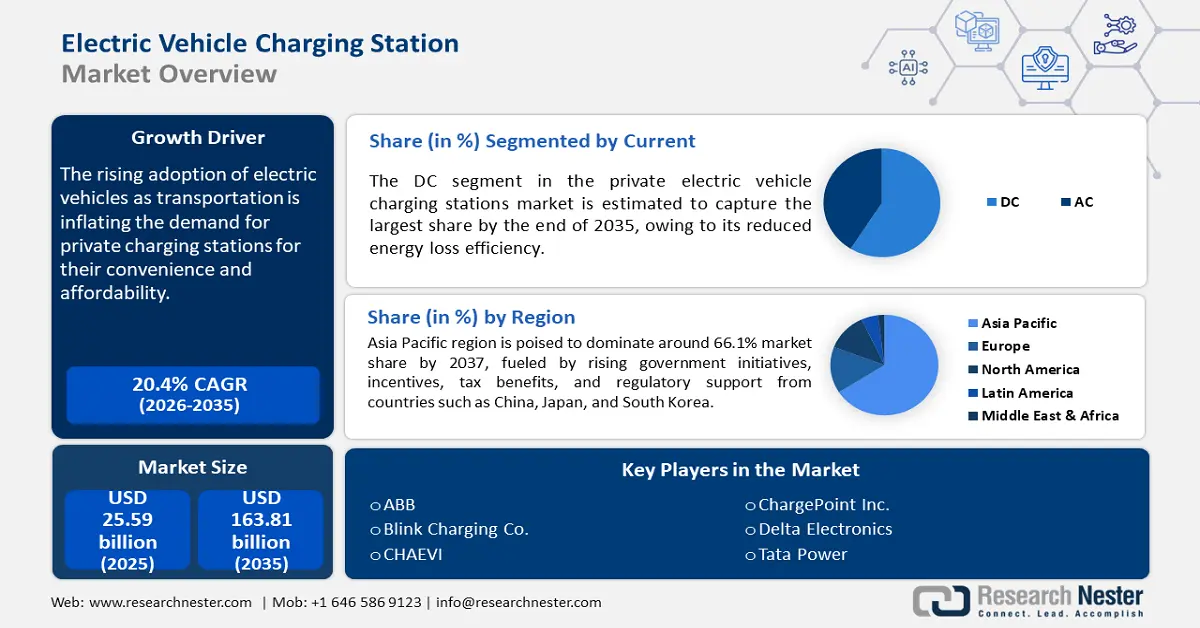

Electric Vehicle Charging Station Market size was over USD 25.59 billion in 2025 and is projected to reach USD 163.81 billion by 2035, growing at around 20.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electric vehicle charging station is assessed at USD 30.29 billion.

The expansion of EV charging infrastructure stands as a crucial strategic objective for government and private corporations that intend to fulfill growing electric vehicle needs and uphold renewable targets. According to a report from the Department for Transport, Government of the UK, the total number of public EV charging devices installed in the country reached 64,632 in July 2024, representing a 47% growth compared to the previous year. The total of 64,632 installed public EV charging devices included 12,474 high-capacity units, which made up 19% of the overall network. A combined total of 54,909 public electric vehicle fast chargers existed in the U.K., with destination chargers taking up 30,921 units and on-street chargers totaling 23,988 units as of July 1, 2024. Such infrastructure developments in the country are delivering stronger, reliable charging services for urban and rural communities.

Strategic alliances between regional governments and private utilities and operators are establishing high-throughput charging stations that operate with DC and AC power systems designed for future commercial vehicle needs and intercity mobility. Grid-balancing technology integration combined with data-driven energy management systems is also enhancing operational efficiency, marking the charging infrastructure as a top strategic investment for B2B mobility operators and real estate developers.

Key Electric Vehicle Charging Station Market Insights Summary:

Regional Highlights:

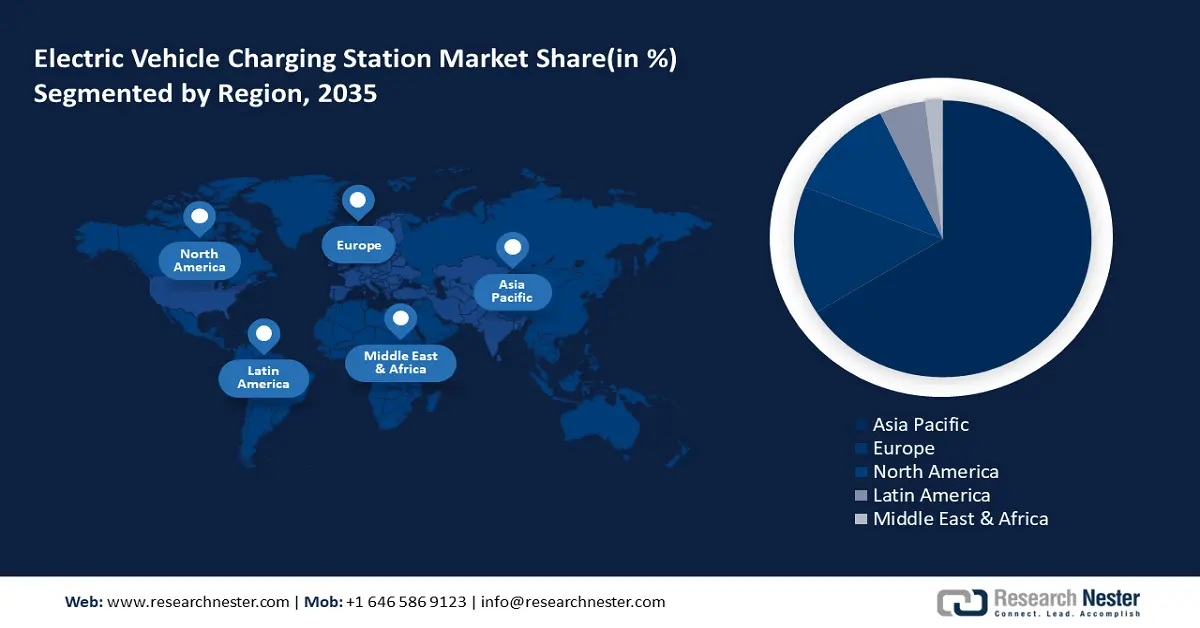

- Asia Pacific electric vehicle charging station market will dominate over 66.1% share by 2035, driven by rising government initiatives, incentives, tax benefits, and regulatory support from countries such as China, Japan, and South Korea.

- Europe market will grow rapidly by 2035, driven by increased awareness of sustainability goals and accelerated EV charging infrastructure development to meet zero-emission vehicle demand.

Segment Insights:

- The private segment in the electric vehicle charging station market is anticipated to secure the largest share by 2035, attributed to integration of private EV chargers with renewable energy systems and smart home networks.

- The level 2 segment in the electric vehicle charging station market is projected to hold the highest market share by 2035, driven by expanding EV infrastructure initiatives supporting clean energy and sustainable transport.

Key Growth Trends:

- Technological advancements

- Environmental and economic factors

Major Challenges:

- Long charging time

Key Players: ABB Group, BYD Motors Inc., Shell Group, ChargePoint, Tesla, Schneider Electric, Blink Charging Co., General Electric Company, Toshiba Corporation, Siemens Aktiengesellschaft.

Global Electric Vehicle Charging Station Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 25.59 billion

- 2026 Market Size: USD 30.29 billion

- Projected Market Size: USD 163.81 billion by 2035

- Growth Forecasts: 20.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (66.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Netherlands, France

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 8 September, 2025

Electric Vehicle Charging Station Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancements: Technological companies focusing on ultra-fast charging systems are developing more efficient methods and solutions for electric vehicle charging systems. In April 2024, Zeekr rolled out its V3 Superchargers that reached 800 kW maximum capability, permitting the Zeekr 001 model to recharge from 10% to 80% in under 12 minutes. The development allows faster EV charging, which extends their use in commercial vehicle fleets and heavy transportation operations. The implementation of ultra-fast charging stations is essential to promote electric vehicle adoption as it offers commercial fleet and long-distance travel users an alternative to traditional vehicles. Faster breakthroughs in charging times are driving the entire EV ecosystem toward increased sustainability, owing to the ongoing focus on fast charging technology.

The integration of Vehicle-to-Grid (V2G) technology by companies and organizations is resulting in the development of significant energy efficiency and stable power grid operations. For instance, in August 2023, Zum deployed a 100% electric school bus fleet in the Oakland Unified School District in California, which started utilizing 74 electric school buses connected to V2G systems. These initiatives improve grid stability by making EVs into mobile power storage devices, which facilitates sustainable smart energy adoption. - Environmental and economic factors: Globally, organizations and governments are providing financial aids that lower electric vehicle costs to reach a wider customer base. According to a report from the Press Information Bureau, the Goods and Services Tax (GST) for electric vehicles was reduced from 12% to 5%, which improved their affordability for consumers in India. The tax deduction comes along with government initiatives aimed at boosting electric vehicle adoption and reducing fossil fuel usage, which accelerates both EV demand and charger infrastructure development. The expanded charging facilities, combined with government incentives, are encouraging more consumers to view EVs as feasible options. These collective initiatives are projected to boost EV charging station market expansion while supporting global efforts for clean, sustainable transportation.

Various other measures are boosting the EV registrations, and subsequently the sales of charging technologies. For instance, India is introducing various subsidies for consumers and manufacturers and maintains an agenda for developing extensive charging facilities. The government's joint initiatives produce a cost-effective EV adoption system that advances India's sustainability goals while decreasing carbon pollution in the country. Such sustained policy support and high adoption of EVs are set to augment the electric vehicle (EV) charging station market growth.

Challenges

- Long charging time: Buyers of electric vehicles are facing a major obstacle due to extended charging times, particularly amongst users who need quick refueling options for their long-distance or commercial requirements. The current infrastructure for ultra-fast charging requires customers to spend a longer time recharging their EVs than conventional petroleum-powered vehicles need for refueling. Extended downtime due to charging requires commercial operators to pay higher operating costs and makes consumers less satisfied, given the sparse availability of charging infrastructure. Mass adoption of EVs remains constrained by the ongoing issue of extended charging periods, as modern charging solutions need to advance faster, and requirement for more widespread charging solutions.

Electric Vehicle Charging Station Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.4% |

|

Base Year Market Size (2025) |

USD 25.59 billion |

|

Forecast Year Market Size (2035) |

USD 163.81 billion |

|

Regional Scope |

|

Electric Vehicle Charging Station Market Segmentation:

Level of Charging Segment Analysis

The level 2 segment is anticipated to hold the highest electric vehicle charging station market share by 2035. The organizations focusing on clean energy, sustainable transportation, and government efforts are continually expanding EV charging infrastructure. According to a report from the California Energy Commission, the state directs substantial investments toward charging infrastructure development for its 2045 carbon neutrality target, which requires 250,000 charging stations by 2025. The regulatory push supports public installations of level 2 chargers and simultaneously stimulates businesses and property owners to install these systems to support EV drivers' accessibility needs. The expanding charging infrastructure initiatives are boosting EV adoption while lowering environmental emissions to help create a sustainable transportation system of the future.

The surging adoption of EVs in commercial fleets is exponentially fueling the level 2 segment growth. Companies are focusing on electric vehicles for their commercial fleets to address their operational requirements. For instance, in August 2023, EVgo and Amazon launched an Alexa-enabled EV charging experience that enables drivers with devices, including Echo Auto or Nissan ARIYA, Ford Mustang Mach-E, and F-150 Lightning models, to search for nearby stations through voice commands. Level 2 EV charging stations are becoming increasingly popular due to rising fleet owner requirements for better charging solutions.

Vehicle Type Segment Analysis

The private segment is set to garner the largest EV charging station market share through 2035, owing to the integration of private EV charging stations with renewable power sources and smart home networks. Homeowners are pairing solar panels, home batteries, with their private EV chargers to charge their vehicles with clean energy and decrease their dependency on the grid and their energy expenses. The new energy system integration is improving EV sustainability while reducing costs for charging. Consumers are focusing on private EV chargers as the efficiency management capabilities of smart home systems make their installation more desirable. The EV charging technologies enhance the efficiency of charging systems and their ease of use, further propelling the segment.

The companies focusing on EV infrastructure expansion are continually innovating to address increasing consumer needs. For instance, in February 2024, Blink Charging Co. introduced 20 IQ 200 chargers into four downtown parking garages throughout Frederick, Maryland's U.S territory. The small and resilient charging equipment supports the development of private charging stations as it can operate effectively in different settings. Such advancements are playing an essential role due to increasing consumer demand for efficient charging solutions, which is driving them to facilitate broader electric vehicle acceptance and convenient access.

Our in-depth analysis of the global electric vehicle charging station market includes the following segments:

|

Charging Point |

|

|

Level of Charging

|

|

|

Vehicle Type |

|

|

Installation Type |

|

|

Connector |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Vehicle Charging Station Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific region is poised to dominate around 66.1% market share by 2035, owing to the rising government initiatives. The EV infrastructure installation is driven by government incentives, tax benefits, and regulatory support from countries such as China, Japan, and South Korea. Government policies that reduce EV prices while building stable client infrastructure are supporting rapid charging station development. The EV charging station market is experiencing strengthened dynamics as the government is prioritizing carbon-neutral targets while implementing the planned internal combustion engine vehicle ban.

The increasing number of EV sales is driving the rapid expansion of charging stations for electric vehicles. The expansion of EV sales in China and India results from growing environmental awareness as people realize the benefits of EVs. The increasing electric vehicles is prompting extensive and reliable charging facilities, which is fueling private and governmental investments to support expanding EV networks.

The China electric vehicle (EV) charging station market is witnessing significant growth. The rise of the urban population is demanding more sustainable transportation options in the country. The growth in electric vehicle adoption is driving the local government to allocate substantial investments for all kinds of EV charging infrastructure throughout residential areas, commercial zones, and public locations. The high demand from densely populated urban regions is fueling the expansion of EV charging networks as these areas are key targets for infrastructure development, accelerating the adoption rates of EVs.

Rising technological innovation in local electric vehicles is boosting the demand for advanced EV charging stations. The country is increasingly investing in developing modern charging systems, including rapid chargers and intelligent charging systems. The charging technology advancements are resulting in improved speed and user convenience, and resolving the issue of prolonged recharging periods. The advancement of battery technology is creating more sustainable charging infrastructure that enables consumer and business EV adoption and stimulates broader expansion of charging networks.

Europe Market Analysis Insights

The electric vehicle charging station market in Europe is projected to grow rapidly throughout the forecast period, due to a rise in awareness regarding the sustainability goals, through which organizations are focusing on converting their vehicle fleets into electric vehicles. EV charging infrastructure development is intensified due to the increasing demand for zero-emission vehicles. Companies operating in logistics and transportation and other sectors are establishing charging stations for their electric fleets to maintain operational readiness, which is directly accelerating the expansion of EV charging networks. The corporate infrastructure initiatives are creating advantages by establishing essential facilities and promoting wider EV applications.

The federal and state governments are implementing tougher emissions control rules, fueling the adoption of electric vehicles. The growth of EV charging infrastructure benefits from government funding initiatives as well as tax breaks for installations. Government policies are reducing the initial expenditure of EV charging station deployment without compromising the infrastructure needed for EVs.

The EV charging station market in the U.K. is all set to hold a high share during the stipulated timeframe, driven by the government and private companies’ focus on growing public EV charging infrastructure, considering the rising demand for electric vehicles. EV charging stations are becoming essential for offering convenient access to electric vehicle owners. Widespread EV adoption depends on the strategic effort to develop public and semi-public charging facilities throughout the country. These networks implement technology to support diverse vehicles, enabling drivers to easily find reliable charging opportunities when traveling.

The integration of EV charging stations with smart grid technology is driving the electric vehicle charging station market growth. This integration enables power distribution to run more efficiently, so charging facilities operate effectively with better control while managing high-demand periods. Smart grids optimize better power distribution through data analytics, providing real-time monitoring for energy consumption and diminished power grid pressure. Through this innovation, the charging infrastructure is enhanced with higher efficiency as well as greater expandability to accommodate the growing number of EVs.

Electric Vehicle Charging Station Market Players:

- ABB Group

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BYD Motors Inc.

- Shell Group

- ChargePoint

- Tesla

- Schneider Electric

- Blink Charging Co.

- General Electric Company

- Toshiba Corporation

- Siemens Aktiengesellschaft

The electric vehicle charging station market is highly competitive, with numerous global and regional players vying for high shares. Major companies are dominating the landscape, offering a wide range of charging solutions for public and private use. Additionally, traditional energy companies such as Shell and BP have entered the electric vehicle (EV) charging station market through acquisitions and partnerships, further intensifying competition. The industry is characterized by rapid technological advancements, with key players focusing on ultra-fast charging stations, smart grid integration, and software solutions to enhance the user experience. Strategic collaborations and government incentives continue to shape the competitive dynamics.

Here are some key players operating in the global electric vehicle (EV) charging station market:

Recent Developments

- In April 2025, the U.K.-based fast-charging battery technology company Nyobolt secured USD 30 million in new funding. The company is to expand its business into autonomous warehouse robots, heavy-duty vehicles, and potentially mainstream electric vehicles.

- In March 2024, Uber and Revel announced a strategic partnership to enhance EV charging accessibility for Uber drivers in New York City. Under this collaboration, Uber drivers gain access to exclusive charging discounts at Revel's network of fast chargers, with discounts varying based on a driver's status in Uber's rewards program, Uber Pro.

- Report ID: 2912

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.