Side View Camera System Market Outlook:

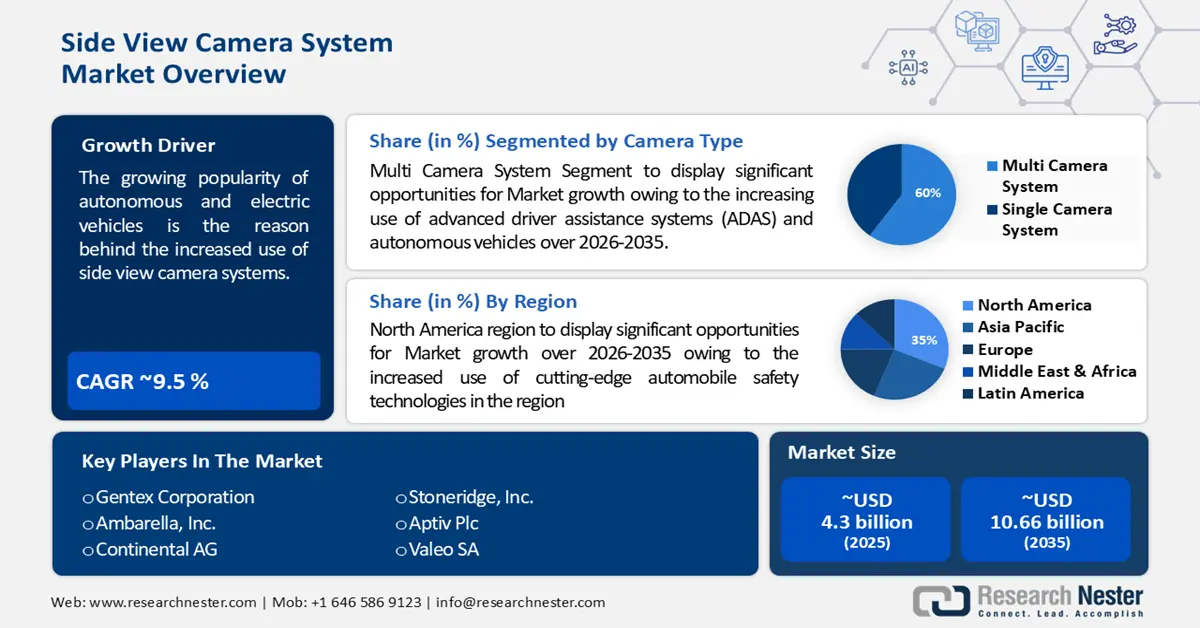

Side View Camera System Market size was over USD 4.3 billion in 2025 and is anticipated to cross USD 10.66 billion by 2035, growing at more than 9.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of side view camera system is assessed at USD 4.67 billion.

The growing popularity of autonomous and electric vehicles is the reason behind the increased demand in the market. In just three years, the percentage of electric vehicles in overall sales has more than tripled, rising from 4% in 2020 to 14% in 2022.

In addition to these, the performance and dependability of mono camera systems have greatly increased because of technological developments. With these advancements, issues with image quality and low-light performance have been resolved, making mono cameras a practical and effective option for use in automobile applications.

Key Side View Camera System Market Insights Summary:

Regional Highlights:

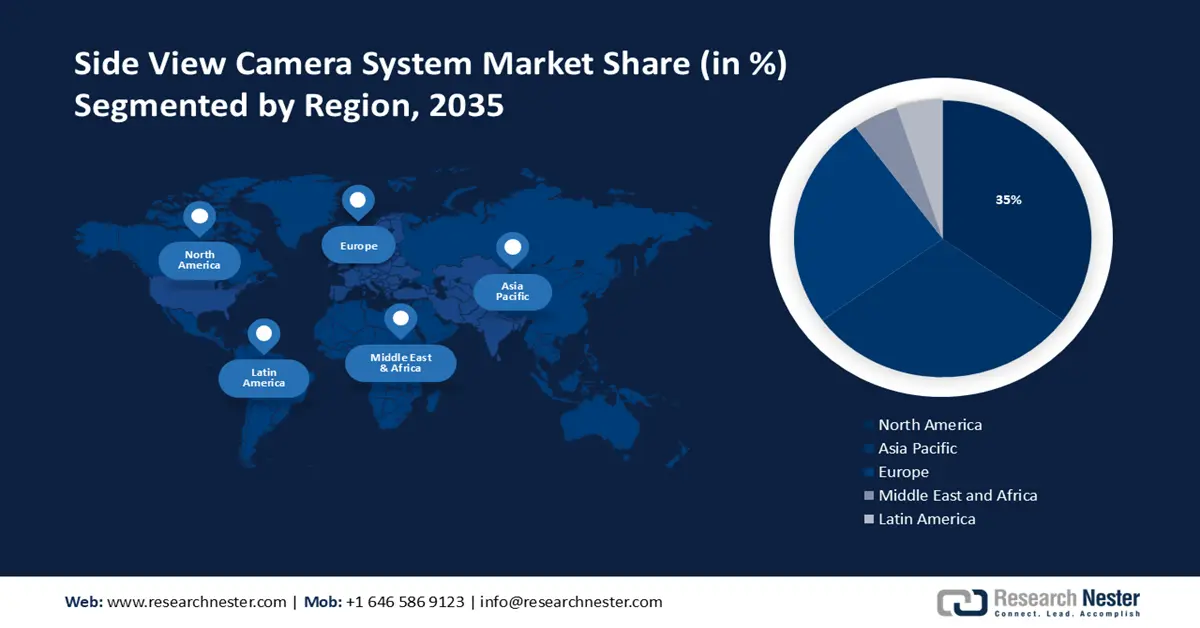

- North America side view camera system market will hold more than 35% share by 2035, driven by stringent safety regulations and adoption of advanced automobile safety technologies.

- Asia Pacific market will achieve a 30% share by 2035, attributed to strengthening capacities in electronic components production and regulatory safety efforts.

Segment Insights:

- The multi camera system segment in the side view camera system market is forecasted to achieve a 60% share by 2035, driven by rising use of ADAS and autonomous vehicles enhancing safety and demand for 360-degree vision.

- The passenger cars segment in the side view camera system market is expected to achieve significant growth through 2035, driven by increasing adoption of side-view camera systems in luxury and safety-focused vehicles.

Key Growth Trends:

- Advanced Driver Assistance Systems (ADAS) are Gaining Popularity

- Regulations for Vehicle Safety and Customer Demand

Major Challenges:

- Advanced Driver Assistance Systems (ADAS) are Gaining Popularity

- Regulations for Vehicle Safety and Customer Demand

Key Players: Ambarella, Inc., Texas Instruments Incorporated, Continental AG, Valeo SA, Stoneridge, Inc., Aptiv PLC, Magna International Inc., ZF Friedrichshafen AG, Robert Bosch GmbH.

Global Side View Camera System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.3 billion

- 2026 Market Size: USD 4.67 billion

- Projected Market Size: USD 10.66 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Japan, China, United States, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 16 September, 2025

Side View Camera System Market Growth Drivers and Challenges:

Growth Drivers

- Advanced Driver Assistance Systems (ADAS) are Gaining Popularity- Side view camera systems are in high demand because of the global interest in ADAS. These technologies are jam-packed with features like blind spot detection, automatic lane change alerts, and parking assistance. Real-time video feeds can be accessed using side view cameras. This helps with several chores. These consist of parking, safe lane switching, and collision avoidance. As automakers continue to incorporate ADAS into their vehicles, side view camera systems will become more and more in demand. Global revenue from advanced driving assistance systems (ADAS) was around 58 billion dollars in 2024.

- Regulations for Vehicle Safety and Customer Demand- Strict regulations have been put in place by governments all over the world to guarantee vehicle safety. As a result, side view camera systems are being used more frequently. These gadgets can increase visibility, which facilitates avoiding blind spots and raises security standards generally. The demand for sophisticated features, such as side view camera systems, has been pushed by consumers. They do this because they want to drive safely and with less chances of accidents.

- An increase in the market for premium and luxury cars- The desire for luxury and premium cars, which come equipped with cutting-edge technology like reverse assistant, blind-spot information systems, and side view cameras, is being driven by an increase in discretionary money. For example, because Germany is the global center for automobile manufacturing, the side view camera system market there is expected to develop at the fastest rate. Renowned automakers like Mercedes-Benz, Audi AG, and BMW AG are all making significant investments in ADAS system research and development. Furthermore, the European Manufacturers Association reports that there is a growing demand for side view camera systems in passenger cars since they increase passenger safety and lower the frequency of traffic accidents.

Challenges

- Challenges with Integration and Compatibility- Installing side view camera systems might be challenging for consumers due to pre-existing vehicle designs and components. Their adoption may be slowed down by their lack of flexibility. The integration of side view camera systems in older vintage cars with limited installation space is an excellent example of this challenging challenge. The ADAS ecosystem's efforts to standardize interfaces and communication protocols may in fact make integration more difficult. Growth in the market may be hampered by this.

- Inconvenient system failures are blamed for impeding side view camera system market expansion.

- The pandemic has also caused a halt to car manufacturing, which has negatively impacted side view camera demand. Furthermore, the pandemic affected the demand for aftermarket side view cameras since government restrictions and lockdown caused the repair and maintenance companies to close. Furthermore, side view cameras are a developing industry that have been hindered by the ongoing pandemic since the epidemic has closed down production and installation in the afflicted nations.

Side View Camera System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 4.3 billion |

|

Forecast Year Market Size (2035) |

USD 10.66 billion |

|

Regional Scope |

|

Side View Camera System Market Segmentation:

Camera Type Segment Analysis

Based on camera type, multi camera system is predicted to account for 60% share of the global side view camera system market during the forecast period. These systems provide a comprehensive view of the surroundings of the vehicle, enhancing driver safety and assisting with lane changes, parking, and navigation. The demand for multi-camera systems has surged due to the increasing use of advanced driver assistance systems (ADAS) and autonomous vehicles. Approximately 31 million automobiles globally were operating with some degree of automation in 2019. Automakers are adding multiple cameras to their automobiles in order to give a 360-degree vision, which is necessary for autonomous driving capabilities. As safety regulations tighten, multi-camera systems are recommended as they offer a comprehensive picture, reducing blind spots and enhancing overall vehicle safety.

Vehicle Type Segment Analysis

Based on vehicle type, passenger cars segment is predicted to account for 52% share of the global side view camera system market during the forecast period. The growth of the segment is because luxury cars like BMW and Audi are increasingly using side-view camera systems. The growing demand for cars with more comfort and safety features is one of the main factors propelling the growth of the side view camera system in this market. As more cars incorporate driver assistance technology to ensure the safety of drivers, passengers, pedestrians, and animals on the road, the side view camera market is anticipated to grow. In 2022, 56 billion passenger cars were sold worldwide, a decrease of 11.7 percent from the year before. In 2022, China emerged as the world's foremost automotive regional market, having sold over 20 billion cars worldwide, or 38.33% of all cars sold worldwide.

Our in-depth analysis of the global market includes the following segments:

|

Camera Type |

|

|

Component |

|

|

Vehicle Type |

|

|

Application |

|

|

Technology |

|

|

Mounting Location |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Side View Camera System Market Regional Analysis:

North American Market Insights

Side view camera system market in North America industry is set to account for largest revenue share of 35% by 2035. Side view camera systems and other ADAS are becoming more and more necessary due to North America's stringent safety regulations. The increased use of cutting-edge automobile safety technologies in cars throughout the US and Canada has also added to the supremacy of this region. Additionally, there are numerous ADAS-focused technological companies based in this area. This, together with the area's booming car sector, has solidified its position as the top player in the market. In 2022, almost 14.8 million automobiles were made in North America.

APAC Market Insights

Side view camera system market in Asia Pacific is attributed to hold second largest revenue share of about 30% share during the forecast period. As nations like China, Taiwan, and India strive to strengthen their capacities for producing electronic components, the market is anticipated to expand. To strengthen their positions in the worldwide ADAS industry, Toyota Motor Corporation, Hyundai Motor Group, and Nissan are all putting in a lot of effort. For instance, in July 2022 Hyundai Mobis developed the first camera monitor system in South Korea using high-performance video sensors to enable dependable autonomous driving. The new regulations aim to protect pedestrians and lower the number of traffic deaths from roughly 6 per 100,000 to 3 per 100,000, as stated in Vision 2022. The expansion of the market is anticipated to be supported by such actions as well as an increase in the number of cars on the road.

Side View Camera System Market Players:

- Gentex Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ambarella, Inc.

- Texas Instruments Incorporated

- Continental AG

- Valeo SA

- Stoneridge, Inc.

- Aptiv PLC

- Magna International Inc.

- ZF Friedrichshafen AG

- Robert Bosch GmbH

Recent Developments

- A digital mirror system was introduced by Robert Bosch GmbH for the new Nikola Two trucks. In addition to the digital mirror, Nikola and Bosch collaborated on the creation of a novel fuel cell drivetrain. These brand-new Nikola trucks will support the double steering system, have mirror cam functionality, and be completely keyless.

- At last, the Federal Motor Carrier Safety Administration (FMCSA) granted Stoneridge certification. After then, MirrorEye was the only CMS in the US to permit the whole removal of conventional mirrors. Initiating MirrorEye's US commercialization was a five-year FMCSA exemption. The company claims that because digital mirrors have better aerodynamics, cars with them can save up to 2.5% on fuel.

- Report ID: 5963

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Side View Camera System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.