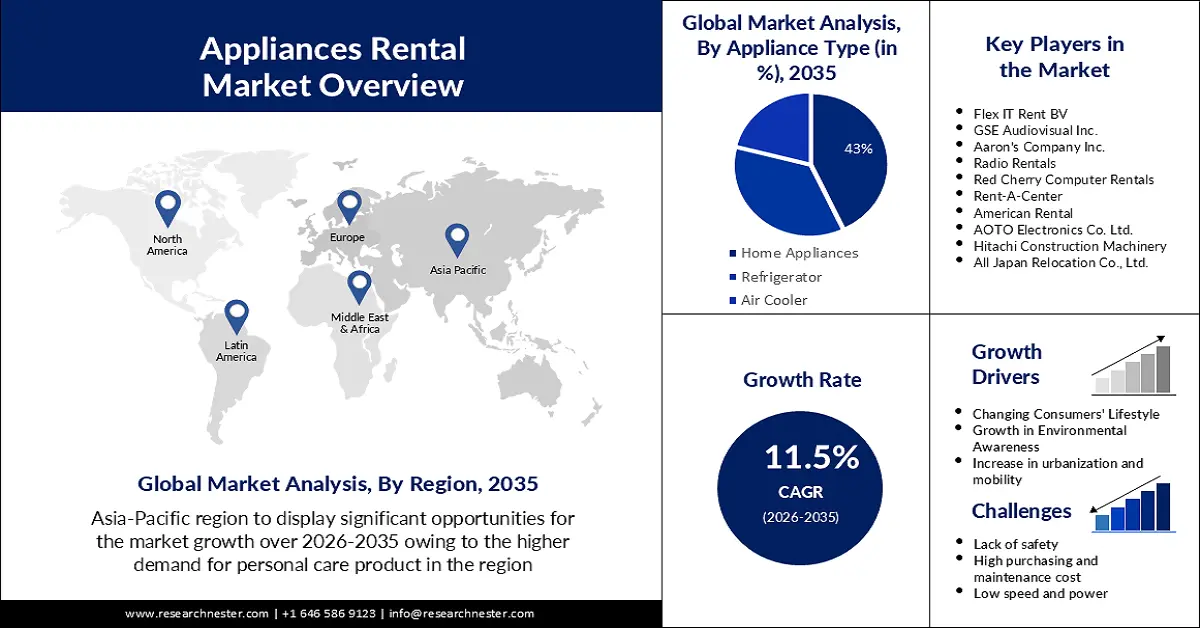

Appliances Rental Market Outlook:

Appliances Rental Market size was valued at USD 79.37 billion in 2025 and is set to exceed USD 235.72 billion by 2035, expanding at over 11.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of appliances rental is estimated at USD 87.58 billion.

Over the past century, the growing demand for affordability, and the growth in the economic conditions, along with the continuously changing consumer lifestyle acts as a major growth driver for the rise in sharing the market. According to the World Economic Outlook, global growth will fall to 2.9% in 2023 but will rise to 3.1% in 2024.

There is an increasing demand for kitchen food processors such as espresso machines, and built-in appliances such as dishwashers or cooktops, according to the United Nations COMTRADE database, in March 2023, a US-based inter-governmental organization, Australia’s electrical equipment exports reached up to 3.6 billion sales in 2022, and this data raised about 87% from 6.6 million in 2014. Such demand and awareness are believed to fuel the appliances rental market growth.

Key Appliances Rental Market Insights Summary:

Regional Highlights:

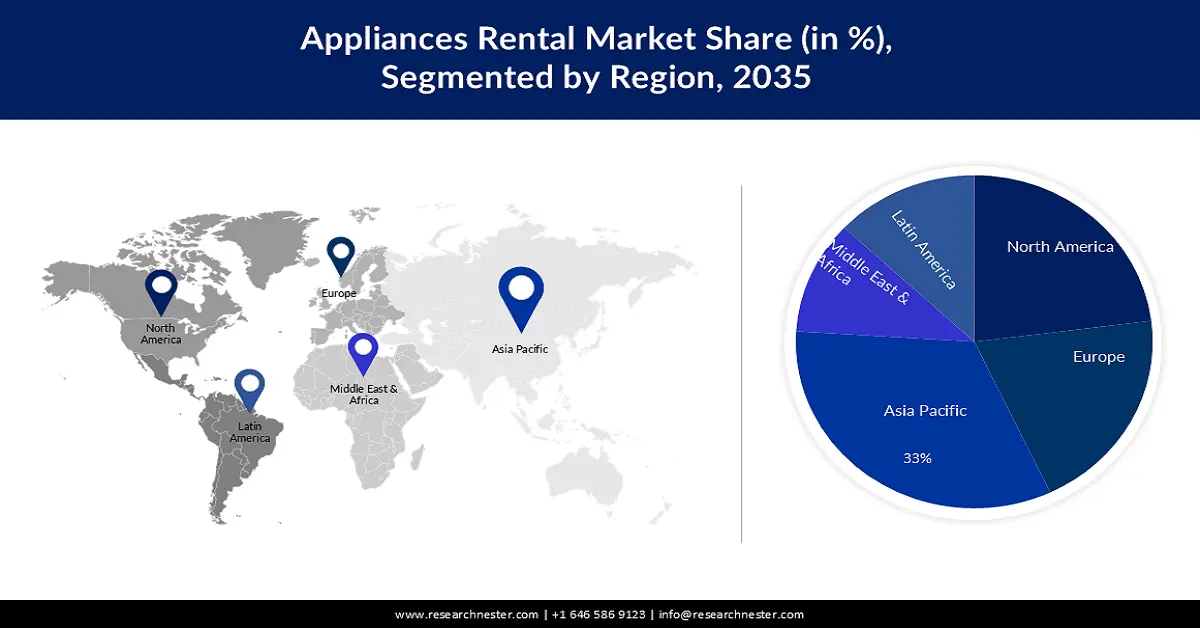

- By 2035, Asia-Pacific in the appliances rental market is anticipated to hold about a 33% share, attributed to the high refundable security amount along with the weekly rental amount deposit.

- Over 2026-2035, North America is expected to remain the second-largest region, reinforced by the higher focus on rising employment opportunities.

Segment Insights:

- By 2035, the home appliances segment in the appliances rental market is projected to capture a 43% share, supported by constantly changing consumer behavior and higher convenience and flexibility.

- By 2035, the personal segment is expected to command the highest share, underpinned by rising demand from lower-income groups and the expanding work-from-home culture.

Key Growth Trends:

- Increase in Urbanization and Mobility

- Growth in Environmental Awareness

Major Challenges:

- Availability of banks and financial loans

- High maintenance and repair costs.

Key Players: SmartSource Inc., Flex IT Rent BV, GSE Audiovisual Inc., Aaron’s Company Inc., Radio Rentals, Red Cherry Computer Rentals, Rent-A-Center, Electro Rent Corp., Cityfurnish, Rent One, American Rental, AOTO Electronics Co. Ltd.

Global Appliances Rental Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 79.37 billion

- 2026 Market Size: USD 87.58 billion

- Projected Market Size: USD 235.72 billion by 2035

- Growth Forecasts: 11.5%

Key Regional Dynamics:

- Largest Region: Asia-Pacific (33% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Japan, United Kingdom

- Emerging Countries: Brazil, Indonesia, Vietnam, Mexico, United Arab Emirates

Last updated on : 19 November, 2025

Appliances Rental Market - Growth Drivers and Challenges

Growth Drivers

- Increase in Urbanization and Mobility- As urbanization grows, so does the demand for home appliances, which in turn, will drive the demand for appliance rental services. More than 4 billion people now live in urban areas and the rates of urbanization have been increasing rapidly across all regions (in 1800, less than 10% of people across all regions lived in urban areas) due to which urbanization is expected to continue to increase with rising incomes and shifts away from employment in agriculture. The rental services provide convenience, flexibility in renting, easy access to appliances, and other advantages, which make it a preferred option amongst customers over purchasing of appliances. Additionally, the rise in urbanization and mobility has led to an increasing number of customers preferring rental services.

- Growth in Environmental Awareness- As environmental concerns grow, so does the demand for sustainable practices, including the use of rental services over traditional ownership of appliances. This is because rental services reduce the use of resources and energy while providing access to appliances, without needing to purchase them. In addition, the adoption of appliances rental services is being driven by the growing awareness and promotion of environmental sustainability.

- Changing Consumers' Lifestyle- As lifestyle changes, so do the consumption dynamics of individuals, which influences the demand for rental services. This is because the consumption patterns of consumers are becoming more focused on convenience, flexibility, and cost-effectiveness, rather than traditional ownership. In addition, the trend of changing consumer lifestyle is also driven by an increasing number of consumers prioritizing experiences over physical possessions.

Challenges

- Availability of banks and financial loans- The availability of financing allows individuals to purchase appliances instead of renting them. When consumers have access to financing, it gives them the power to make decisions based on their financial capabilities, which results in individuals with strong financial capabilities are more likely to purchase appliances rather than renting them. This limits the growth of the appliances rental market, as the availability of financing restrains consumption of rental services.

- High maintenance and repair costs.

- Calculating asset ROI and TCO.

- Difficulty in tracking and managing equipment availability.

Appliances Rental Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.5% |

|

Base Year Market Size (2025) |

USD 79.37 billion |

|

Forecast Year Market Size (2035) |

USD 235.72 billion |

|

Regional Scope |

|

Appliances Rental Market Segmentation:

Appliances Type Segment Analysis

The home appliances segment for appliances rental market is estimated to gain a robust revenue share of 43% in the coming years owing to the constantly changing consumer behavior and higher convenience and flexibility. These appliances have low and sometimes no service and maintenance costs which act as a surge in the market while making them highly affordable. Due to this, the demand for rental services from lower-income groups, who are unable to purchase these appliances is increasing. Additionally, the increase in demand for home appliances including- Freezers, Microwave, Dishwashers, Cookers, Washing Machines, and others is increasing the rentability of these appliances.

Application Segment Analysis

The personal segment for the appliances rental market is expected to hold the highest share during the forecast period increased demand for rental services from lower-income groups and the shift in working culture i.e., work-from-home that has led to a surge in sales of personal home appliances demand and by 2025, the Indian demand for electronic appliances is expected to increase by billions of dollars. The business application segment, i.e., the use of appliance rental for commercial purposes, is also contributing to the growth of the appliances rental market through the increased demand for rental services from small businesses.

Distribution Channel Segment Analysis

The offline distribution channel segment in the appliances rental market held the largest revenue size in 2020 and is also estimated to grow during the forecasted period. The online distribution channel is expected to increase as the transformation of society from offline rentals to offline distribution channels. This transition is mainly attributed to the increase in the millennial population along with the rise of middle-class income families, mainly in developing countries. Apart from these, other factors such as ease of shipments, free coupons, and other maintenance benefits from online distribution channels act as a growth driver for this segment specifically.

Our in-depth analysis of the global appliances rental market includes the following segments:

|

Appliances Type |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Appliances Rental Market - Regional Analysis

APAC Market Insights

The Asia-Pacific appliances rental market is predicted to the largest share of about 33% by 2035 impelled by a high refundable security amount along with the weekly rental amount deposit to the service provider. Asia-Pacific has shown positive growth in the appliance rental industry as the increase in the number of people residing away from their hometowns, leaving them with no option other than renting all these home appliances.

North American Market Insights

The North America appliances rental market is estimated to be the second largest, during the forecast period led by the higher focus on the rising employment opportunities in this particular region, and this has resulted in an increase in the number of more people opting for an independent housing. This had also increased the demand for pocket friendly rental appliances addressing such lifestyle change.

Appliances Rental Market Players:

- SmartSource Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Flex IT Rent BV

- GSE Audiovisual Inc.

- Aaron’s Company Inc.

- Radio Rentals

- Red Cherry Computer Rentals

- Rent-A-Center

- Electro Rent Corp.

- Cityfurnish

- Rent One

- American Rental

- AOTO Electronics Co. Ltd.

Recent Developments

- AOTO Electronics Co. Ltd., launched the “Rental Design LED Panel-SW Series’. It is specially designed for renting purposes and can be used as in indoor or outdoor screen stage for events, theatre, trade shows, and more to provide the perfect visual backdrop.

- Aaron’s Company Inc., an US based company that leases and retail sales of electronics, home appliances, and furniture had acquired BrandsMart USA for 230 million. This strengthens and expands Aaron’s high-quality products at an affordable cost price.

- Report ID: 1801

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Appliances Rental Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.