Syphilis Immunoassay Diagnostics Market Outlook:

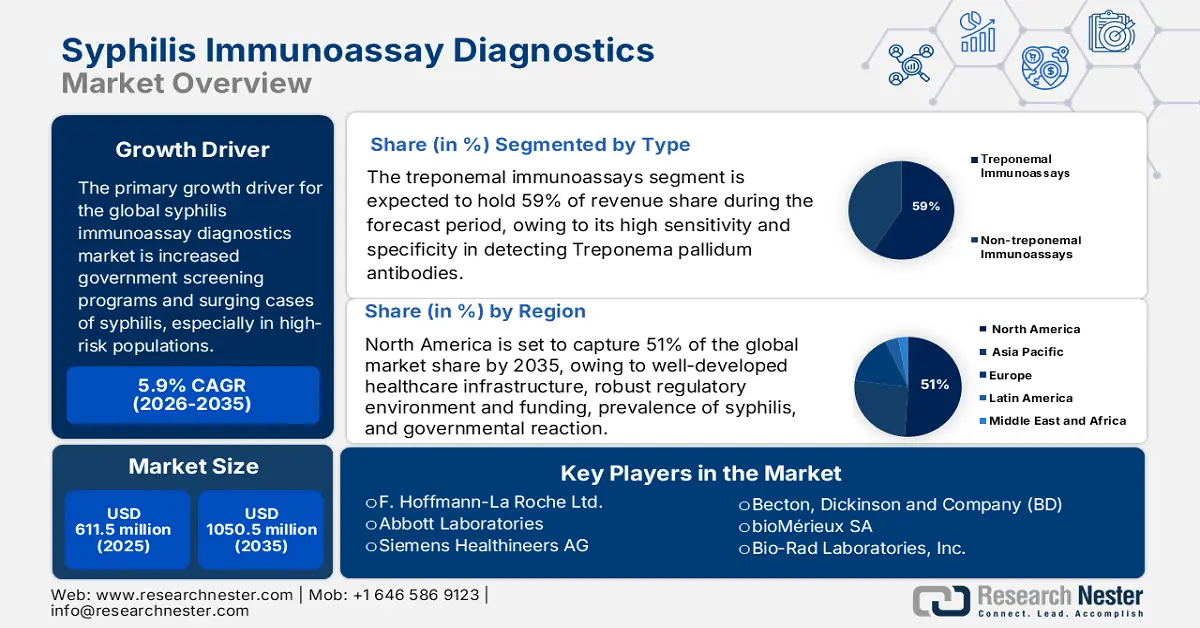

Syphilis Immunoassay Diagnostics Market size was valued at approximately USD 611.5 million in 2025 and is projected to reach around USD 1,050.5 million by the end of 2035, exhibiting a CAGR of 5.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of syphilis immunoassay diagnostics is estimated at USD 644.9 million.

The global market is undergoing significant development during the forecast period, driven by increased government screening programs and surging cases of syphilis, especially in high-risk populations. The use of rapid diagnostic platforms as part of national testing protocols is another major factor. It allows testing to be done quickly and made more accessible to the public. The CDC clinical programs in preventing congenital syphilis and maternal health screenings are opening up more channels for testing individuals for syphilis. According to a report by NLM in August 2024, the global syphilis incidence had increased by 500% between 2011 and 2020, with 661,000 cases reported, which highlights the need to increase efforts in diagnosing and preventing the disease, thereby boosting the market.

Furthermore, investments in development and deployment R&D in the market are driven by the public sector or global health funders focusing on upgrading point-of-care confirmatory assays, mainly for active syphilis detection. As per a report by NLM in August 2024, about 30% to 40% of pregnant cases never go for proper antibiotic treatment even after early diagnosis, plus 2/3rd of patients get lost to follow-up, making it imperative to improve care and outcomes. Trade dynamics concern cross-importation of assay kits and raw antigen materials, as well as the exportation of finished diagnostics to resource-poor settings. The supply chains include assembling in specialized laboratories or manufacturing facilities accredited by international standards of quality.

Key Syphilis Immunoassay Diagnostics Market Insights Summary:

Regional Highlights:

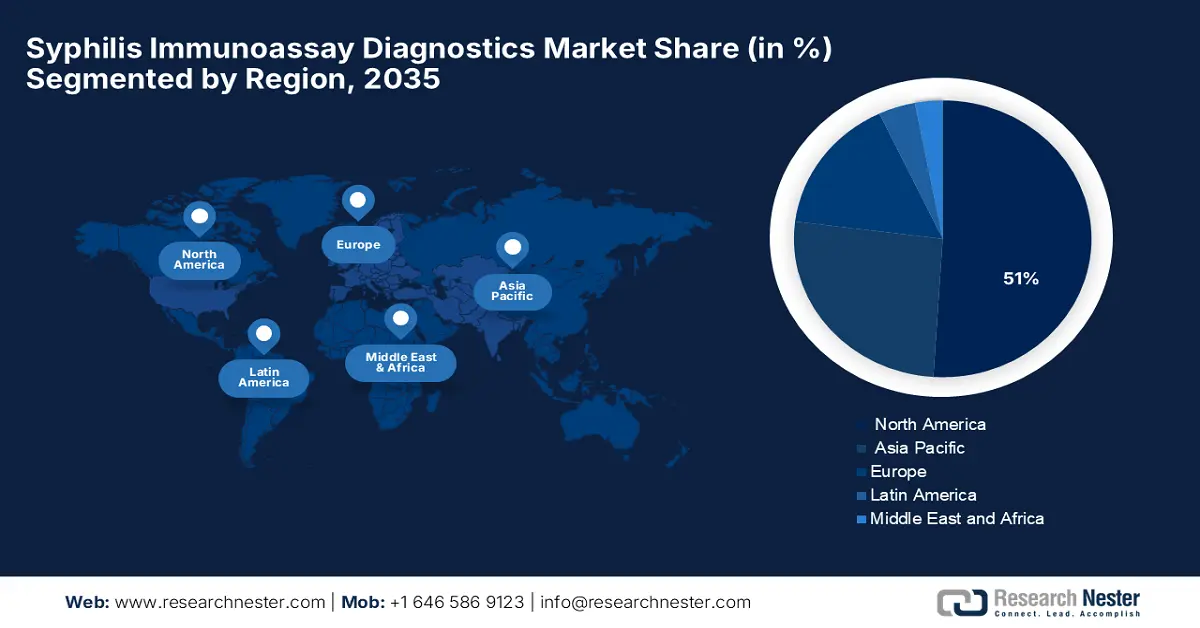

- The North America Syphilis Immunoassay Diagnostics Market is projected to command a 51% share by 2035, attributed to its advanced healthcare infrastructure, stringent regulatory framework, and increased governmental health initiatives.

- Europe is forecast to witness the fastest growth through 2026–2035, owing to the sharp rise in syphilis incidence, robust public health programs, and heightened demand for updated diagnostic technologies.

Segment Insights:

- The treponemal immunoassays segment is projected to account for a 59% share of the Syphilis Immunoassay Diagnostics Market by 2035, propelled by its superior sensitivity and specificity in detecting Treponema pallidum antibodies.

- The healthcare facilities segment is anticipated to dominate the end-user category by 2035, driven by the growing emphasis on early disease detection and the integration of automated immunoassay systems to enhance diagnostic efficiency.

Key Growth Trends:

- Public health mandates and national screening programs

- Shift toward point-of-care and rapid diagnostics

Major Challenges:

- Inadequate access in low-infrastructure settings

- False positives and diagnostic accuracy limitations

Key Players: F. Hoffmann-La Roche Ltd., Abbott Laboratories, Siemens Healthineers AG, Becton, Dickinson and Company (BD), bioMérieux SA, Bio-Rad Laboratories, Inc., Danaher Corporation, QuidelOrtho Corporation, Thermo Fisher Scientific Inc., Trinity Biotech, Shenzhen New Industries Biomedical Engineering, Chembio Diagnostics, Inc., QIAGEN N.V., BioCheck, Inc., SD Biosensor Inc.

Global Syphilis Immunoassay Diagnostics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 611.5 million

- 2026 Market Size: USD 644.9 million

- Projected Market Size: USD 1,050.5 million by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (51% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 8 September, 2025

Syphilis Immunoassay Diagnostics Market - Growth Drivers and Challenges

Growth Drivers

- Public health mandates and national screening programs: Syphilis testing is the major intervention employed by national and regional health authorities for their STI control strategies, thus driving the syphilis immunoassay diagnostics market globally. A study by the WHO in 2025 estimated 700,000 congenital syphilis cases and 390,000 global adverse birth outcomes. To control this, Government programs have instituted routine syphilis screening in settings of prenatal care, correctional facilities, and community health settings. Public health laboratories, through the Association of Public Health Laboratories (APHL) partnerships and beyond, are scaling up test implementation and working to standardize diagnostic quality between regions.

- Shift toward point-of-care and rapid diagnostics: As the demand rises for decentralized testing and delivery of results within a day, POC syphilis immunoassays are increasingly being adopted in low-resource and remote settings. The turnaround time and access to testing have increased thanks to the R&D investments of the NIH and other global health initiatives. The newer dual HIV/syphilis test formats encourage use within integrated disease control program frameworks. These coordinated efforts aim to ensure early detection and treatment, ultimately reducing the burden of syphilis transmission and improving maternal and neonatal health outcomes worldwide, thus suitable for the syphilis immunoassay diagnostics market.

- Increased global funding and public-private R&D collaborations: In the syphilis immunoassay diagnostics market, much funding for innovation continues to pour in from international health organizations, government agencies, and private foundations. As per a report by JPEDHC in June 2025, there was an 80% increase in syphilis cases and a 32% rise in congenital syphilis, affecting 3,700 infants. Many more cases are growing, showing the ongoing need for investment in innovative diagnostic technologies. Partnerships through organizations such as the National Institutes of Health (NIH), United States Agency for International Development (USAID), and other global health alliances design new platforms for working on improving test sensitivity and field deployment.

Rising congenital syphilis cases trend

|

Year |

Rate of Infectious Syphilis per 100,000 Females 15-39 |

Rate of Confirmed Early Congenital Syphilis per 100,000 Live Births |

|

AB |

SK |

|

|

2020 |

120.0 |

238.4 |

|

2021 |

162.2 |

485.8 |

|

2022 |

168.1 |

560.1 |

Source: NLM January 2025

Challenges

- Inadequate access in low-infrastructure settings: Poor laboratory capacity and inadequate supply availability of trained personnel, coupled with unstable supply chains, present significant hurdles to the effective utilization of syphilis immunoassay diagnostics market in low-resource settings. The majority of rural or underserved settings cannot access testing that requires equipment, thereby delaying early diagnosis and treatment. Limited access slows down disease control, weakening national screening programs and limiting market growth for diagnostic companies positioned for emerging markets.

- False positives and diagnostic accuracy limitations: Syphilis immunoassays, particularly non-treponemal immunoassays, can give false-positive results caused by cross-reactivity with other infections or autoimmune disorders. The ensuing diagnostic uncertainty may sometimes lead to inappropriate treatment, hence increased anxiety among patients; also, clinicians begin losing confidence in rapid test results. This leads to lowered adoption of particular immunoassay formats by health care workers, inhibiting scale-up of point-of-care programs and further delaying commercial acceptance of newer diagnostic platforms, thus causing a hindrance in the syphilis immunoassay diagnostics market.

Syphilis Immunoassay Diagnostics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 611.5 million |

|

Forecast Year Market Size (2035) |

USD 1,050.5 million |

|

Regional Scope |

|

Syphilis Immunoassay Diagnostics Market Segmentation:

Type Segment Analysis

The treponemal immunoassays subsegment of the type segment is expected to hold the highest market share of 59% in the syphilis immunoassay diagnostics market within the forecast period due to its high sensitivity and specificity in detecting Treponema pallidum antibodies. According to a study by the CDC in February 2024, the test result is usually shown as a signal-to-cutoff ratio (S/CO), which measures how strongly the test reacts, and S/CO values correspond from 91% to 100% of the time with those from other positive confirmatory tests. The reliability of these tests is all the greater when it comes to verifying infections in their later stages.

End user Segment Analysis

Healthcare facilities are expected to hold the highest revenue subsegment in the end user category for the syphilis immunoassay diagnostics market. Syphilis testing is regularly performed by hospitals, clinics, and specialized diagnostic centers as part of regular health check-ups, prenatal care, and blood donation safety protocols. These facilities require timely diagnosis and treatment, as well as diagnostic tests that are both accurate and efficient, leading to a consistent demand for immunoassay tests. This sustained demand is further driven by the growing emphasis on early disease detection and the integration of automated immunoassay systems to enhance testing capacity and reliability.

Technology Segment Analysis

The enzyme-linked immunosorbent assay (ELISA) dominates the technology segment in syphilis immunoassay diagnostics market due to its accuracy and reliability. ELISA belongs to the technology division in syphilis immunoassay diagnostics and is considered the gold standard because of its accuracy and reliability. ELISA is used widely for the detection of antibodies for syphilis and is thus also trusted in clinical and laboratory uses. The capability of processing large volumes of samples allows for a wide range of screening programs. Besides, its compatibility with automation-based processes and reasonable cost further strengthens its adoption. ELISA also gives reproducible results, thus enabling the timely diagnosis and treatment of the disease.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Sub-segments |

|

Type |

|

|

Technology |

|

|

Application |

|

|

End user |

|

|

Sample Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Syphilis Immunoassay Diagnostics Market - Regional Analysis

North America Market Insights

The North America syphilis immunoassay diagnostics market is anticipated to maintain the largest market share of 51% during the forecast period due to well-developed healthcare infrastructure, robust regulatory environment and funding, prevalence of syphilis, and governmental reaction. As per a study by the CDC in November 2024, North America is still at the top of the list of syphilis infections, with the U.S. alone recording more than 209,253 cases in 2023, which has been increasing since last 5 years, with drastic increases being reported in South Dakota, New Mexico, and Mississippi states. Recovering, government health authorities increased monitoring, testing programs, and public health spending.

The U.S syphilis immunoassay diagnostics market is expanding as a result of booming syphilis incidence and Federal investment in diagnostic modernization. As per a report by NLM August 2024, syphilis incidence in the U.S. has increased rapidly from 2019 to 2022 and approximately 207,255 new cases were reported in 2022 alone. The rapid upsurge has led to increasing federal and state efforts in the shape of increased surveillance, educational campaigns, and FDA approval of the first over-the-counter home syphilis test to support better early detection.

The Canada syphilis immunoassay diagnostics market is growing. The market is rising as a result of the increasing incidence of syphilis and high government support. According to a July 2024 NLM study, the market demand for syphilis immunoassay diagnostics has increased by a 393.1% increase in syphilis cases from 2013 to 2022, compounded by incidence rates jumping from 5.1 to 36.1 per 100,000 population against the national level between last ten years till 2022. These results correlate with ineffective prevention and educational activities, thereby putting a premium on strong diagnostics. Consequently, this leads to an increased rate of congenital syphilis cases and an increase in testing needs throughout all of the provinces and territories.

2023 Syphilis Cases and Rates per 100,000 Population

|

State/Territory |

2023 Cases |

2023 Rate (per 100,000) |

5-Year Growth (2019-2023) |

Diagnostics Market Implication |

|

South Dakota |

2,105 |

229.0 |

↑ 2,347% |

Very high testing needs due to the outbreak |

|

New Mexico |

2,867 |

135.6 |

↑ 122% |

Strong demand for rapid diagnostics |

|

District of Columbia |

1,134 |

167.0 |

↑ 8.6% |

Dense urban testing programs, an ongoing need |

|

Nevada |

3,317 |

103.8 |

↑ 35.7% |

Expanding urban STI clinics and outreach |

|

Mississippi |

3,401 |

115.7 |

↑ 69.6% |

Underserved rural areas need improved diagnostics |

|

Arizona |

7,961 |

107.1 |

↑ 97.8% |

Large-scale testing demand; strong growth |

|

Louisiana |

4,607 |

100.7 |

↑ 67.9% |

High prevalence, public health investment |

Source: CDC, November 2024

Europe Market Insights

The Europe syphilis immunoassay diagnostics market is expected to emerge as the fastest-growing region during the forecast period because of rising cases of syphilis, government initiatives, strong healthcare infrastructure, and increased public health spending. A report by NLM in August 2024 highlighted that the European Centre for Disease Prevention and Control published nearly 33,000 confirmed syphilis cases in the European Union in 2022 at a rate of nearly 8.5 per 100,000 population. This was up by 34% from the year 2021, showing a rising rate of syphilis in Europe. Higher numbers of cases are creating the need for more up-to-date syphilis immunoassay tests.

The UK syphilis immunoassay diagnostics market is growing due to increasing cases of syphilis and national health campaigns. As per a report by the UK Government report June 2023, in 2022, infectious syphilis diagnoses in the UK rose to 8,692, a 15.2% increase from 2021 and the highest annual number since 1948. The 15 to 24 age group remains the most vulnerable, which is an average number in more than 400 cases diagnosed per day. As the cases have increased in number, the demand for syphilis immunoassay diagnostics has also risen, following the UKHSA initiatives that promote testing regularly and testing early enough to avoid serious complications.

The German syphilis immunoassay diagnostics market is growing due to syphilis infections' increased awareness and early detection. The well-established healthcare infrastructure and strong regulatory environment support the adoption of advanced diagnostics. Other thrusts include government-run STI prevention and screening programs, which also provide impetus for market growth. Increased incidents of syphilis, especially amongst the high-risk population, have shaped the demand for more sensitive and rapid diagnostic methods.

Asia Pacific Market Insights

The Asia Pacific syphilis immunoassay diagnostics market is projected to account for the considerable market with a nominal share during the forecast period due to rising prevalence, awareness, and screening for syphilis, improving healthcare infrastructure, and diagnostic laboratories. As per a report by Heliyon, published in March 2023, the Asia Pacific region exhibits high syphilis prevalence rates, ranging from 0.9% to 30.9% in urban areas between 2000 and 2019. Specifically, China shows rates from 2.2% to 30%, while China reports between 2.62% and 17.5%.

The syphilis immunoassay diagnostics market in China is rising with the high prevalence of syphilis, government initiatives, regulatory scenario, and expansion of healthcare units. A study by NLM in August 2023 found a combined detection rate of 154.6 cases per 100,000 cases of syphilis among entry-exit staff at Shanghai port, where the cases have been declining year by year over the last 10 years. Males aged under 39 with high prevalence and prevalence of sexual transmission, especially male-to-male, are generating demand in China for improved syphilis immunoassay diagnosis and specific healthcare intervention.

The India syphilis immunoassay diagnostics market is growing due to the growing rate of syphilis among urban as well as rural people, government initiatives such as the national aids control program, improved access to low-cost diagnostic kits, and enhanced healthcare services. As per the March 2023 Heliyon report, scanning a series of reports placed syphilis prevalence in India at 5.2%, HIV prevalence at 3.5%, and HIV-syphilis co-infection at 0.4%. These statistics highlight the increasing requirement for syphilis immunoassay diagnosis and special health programs to treat and control the infection in India.

Key Syphilis Immunoassay Diagnostics Market Players:

- F. Hoffmann-La Roche Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- Siemens Healthineers AG

- Becton, Dickinson and Company (BD)

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- QuidelOrtho Corporation

- Thermo Fisher Scientific Inc.

- Trinity Biotech

- Shenzhen New Industries Biomedical Engineering

- Chembio Diagnostics, Inc.

- QIAGEN N.V.

- BioCheck, Inc.

- SD Biosensor Inc.

The syphilis immunoassay diagnostics market is highly competitive, with established multinational companies and new regional players. Leading firms like F. Hoffmann-La Roche Ltd., Abbott Laboratories, and Siemens Healthineers AG hold the largest market share by focusing on innovation, broad product ranges, and acquisitions. For example, Roche acquired LumiraDx in 2024 to boost its point-of-care testing. Companies are also offering over-the-counter and rapid tests for easier access. New players provide affordable options for low-resource areas. This competition encourages innovation and improves global access to diagnostics.

Here is a list of key players operating in the global market:

Recent Developments

- In October 2024, NOWDiagnostics and Labcorp collaborated to expand the access to the only FDA-marketing authorized over-the-counter syphilis test in the U.S.

- In December 2023, Roche entered into a definitive agreement to acquire LumiraDx's Point of Care technology, combining multiple diagnostic modalities on a single platform.

- Report ID: 8078

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.