Rapid Influenza Diagnostics Market Outlook:

Rapid Influenza Diagnostics Market size is valued at USD 1.5 billion in 2025 and is projected to reach USD 2.9 billion by the end of 2035, rising at a CAGR of approximately 8.7% during the forecast period, from, 2026-2035. In 2026, the industry size of rapid influenza diagnostics is estimated at USD 1.8 billion.

The primary growth drivers of the market are the growing need for timely and accurate detection of influenza infections to minimize transmission and patient treatment in clinical and institutional settings. Government-driven initiatives for increasing testing capabilities and improving outbreak management continue to provide impetus for investments in R&D and strengthening of the supply chain. However, as per a report by CDC September 2024, while RIDTs have the advantages of quick diagnosis and convenience, sensitivities are generally low, mostly ranging between 50% to 70% and reported at anywhere between 10% and 80% against viral culture or RT-PCR. The specificities are generally high, approximately 90% to 95% (with an 85% to 100% range), meaning that false negatives are more frequent than false positives.

Moreover, such a profile of performance necessitates continuous innovation and training towards the proper clinical application and interpretation, thereby suitable for the market. Besides, the supply chain involves sourcing reagents and raw materials and assembling diagnostic devices by FDA-approved manufacturers, using regulated import and export channels to maintain steady availability. Government efforts support the development of advanced molecular assays with improved sensitivity to enable rapid deployment across healthcare systems nationwide. This coordinated ecosystem supports market resilience and growth potential. Continued investment in domestic manufacturing is expected to reduce reliance on the global supply chain and improve readiness for seasonal or pandemic outbreaks.

Key Rapid Influenza Diagnostics Market Insights Summary:

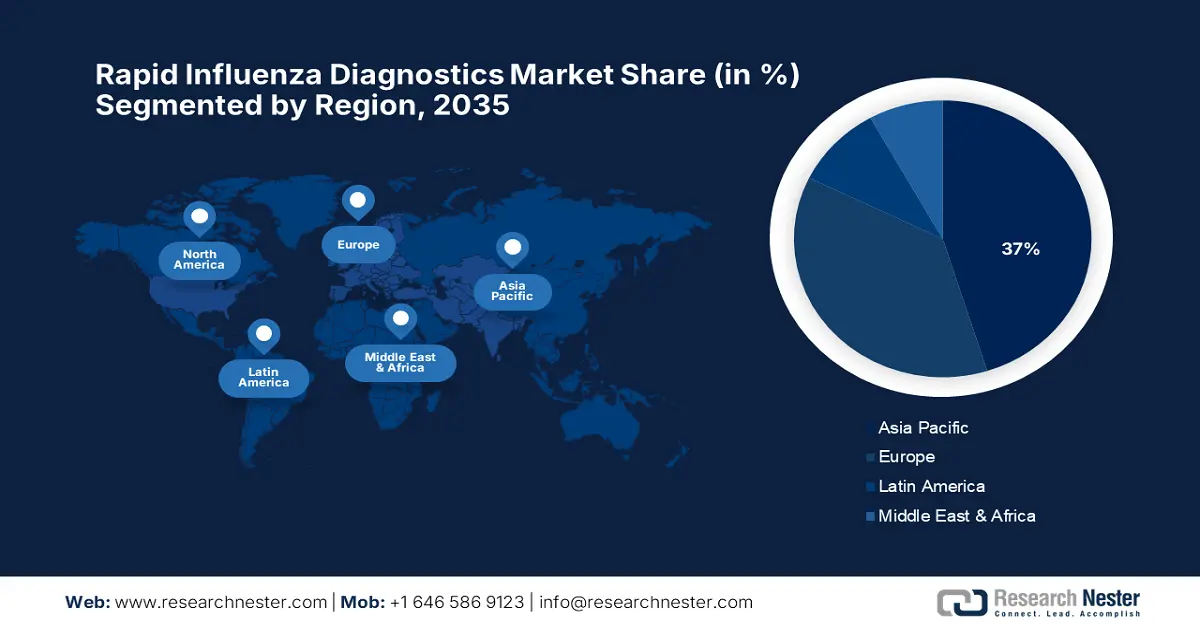

Regional Highlights:

- By 2035, North America is forecast to capture a 37% share of the rapid influenza diagnostics market, owing to its advanced healthcare infrastructure and strong emphasis on early disease detection.

- By 2035, Europe is projected to emerge as the fastest-growing region, underpinned by rising healthcare spending and accelerated adoption of advanced diagnostic technologies.

Segment Insights:

- By 2035, the lateral flow immunoassays subsegment is expected to command a 43% share in the rapid influenza diagnostics market, propelled by its rapid usability and superior sensitivity over traditional testing methods.

- By 2035, the nasal swab subsegment is set to secure the second-largest share, supported by its minimal discomfort, ease of handling, and high sensitivity in influenza virus detection.

Key Growth Trends:

- Ongoing research and development funding by public health agencies

- Increased demand for rapid and accurate influenza detection

Major Challenges:

- Regulatory compliance and quality assurance

- Supply chain disruptions and material sourcing

Key Players: Abbott Laboratories, F. Hoffmann-La Roche Ltd, Quidel Corporation, Thermo Fisher Scientific Inc., Becton, Dickinson and Company (BD), Meridian Bioscience Inc., DiaSorin S.p.A., Sekisui Diagnostics LLC, Siemens Healthineers AG, Danaher Corporation, Luminex Corporation, bioMérieux SA, Hologic Inc., Abbott Laboratories, Seegene Inc.

Global Rapid Influenza Diagnostics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.5 billion

- 2026 Market Size: USD 1.8 billion

- Projected Market Size: USD 2.9 billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 9 May, 2025

Rapid Influenza Diagnostics Market - Growth Drivers and Challenges

Growth Drivers

- Ongoing research and development funding by public health agencies: The government research organizations continue to invest in the development of new generations of rapid influenza diagnostics focused on sensitivity and quicker results. The focus is to achieve better accuracy in the diagnosis of diseases and to take into consideration a large number of strains of influenza. Funding supports the development of molecular assays and new technologies that meet regulatory standards, helping their quick use in clinical settings. The R&D initiatives support the innovation pipelines and further sustain the growth of the market.

- Increased demand for rapid and accurate influenza detection: The need for rapid influenza diagnostic tests in healthcare facilities is increasing to detect influenza infections quickly and to distinguish them from other respiratory conditions. According to a CDC September 2024 report, a rapid influenza diagnostic test can provide results in less than 15 minutes. This timely detection helps manage patients efficiently and prevents the spread of infection in hospitals, clinics, and long-term care facilities. Preparedness and early intervention have become a priority, especially during flu seasons and other respiratory outbreaks, driving demand for fast and reliable diagnostic tools at the point of care, thus creating a positive impact in the market.

- Government initiatives enhancing testing capacity and outbreak management: The expansion of diagnostic testing capabilities by federal health agencies to strengthen the public health response is another growth driver for the market. Programs to improve rapid influenza diagnostic tests and molecular assays in urban and rural areas are prioritized for timely outbreak detection and management. Government investments help ensure that laboratories and healthcare providers use these diagnostics in daily treatment for better disease surveillance and control. Institutional support is an important factor in market growth and innovation.

Influenza Diagnostic Tests (2022)

|

Method |

Accuracy |

Comments |

|

Rapid antigen test |

Sensitivity: 40% to 80%, Specificity: High |

Detects influenza A/B antigens via lateral flow or immunofluorescent assay; results in 10 to 15 minutes; point-of-care use; multiplex tests detect SARS-CoV-2 too; analyser devices improve sensitivity. |

|

Rapid molecular assay |

Sensitivity: >95%, Specificity: >99% |

Detects viral RNA via nucleic acid amplification; results in 15 to 40 minutes; requires a small analyzer; some point-of-care multiplex tests detect SARS-CoV-2, influenza A/B, and RSV. |

|

Molecular assay (lab-based) |

Sensitivity: >95%, Specificity: >99% |

Detects viral RNA; 45 to 80 minutes (up to 4 to 6 hours); requires complex machinery, certified labs, and qualified staff; multiplex detects SARS-CoV-2, influenza A/B, subtypes, and other pathogens. |

|

Immunofluorescence assay |

Sensitivity: Moderate, Specificity: High |

Detects antigens via fluorescent staining; 1 to 4 hours; requires fluorescent microscope, certified labs, skilled personnel; sensitivity depends on sample prep; less commonly used. |

|

Virus culture |

Sensitivity: High, Specificity: High |

Isolation of viable virus in tissue culture; 1 to 10 days; requires qualified personnel and complex lab setup; shell-vial culture yields results in 1 to 3 days; standard culture takes 3 to 10 days. |

Source: NLM August 2022

Challenges

- Regulatory compliance and quality assurance: Rapid flu test suppliers face extremely demanding criteria concerning test accuracy, sensitivity, and specificity. Therefore, the manufacturers need to carry out rigorous testing and continued quality control, which slows down the pace of product development and thereby affects cost potential, thereby negatively impacting the market. Meeting the ever-changing FDA and CDC regulations is an expensive proposition, and maintaining consistency while limiting market entry and mass manufacture. Regulatory burden affects incumbents and entrants alike.

- Supply chain disruptions and material sourcing: Manufacturing of quick flu tests relies on a sophisticated global supply chain of raw materials, reagents, and specialized parts. Any disruption in the international supply chain, such as a delay in import-export logistics or a lack of some very important raw materials, can disrupt the continuity of production. Such problems act against the availability and timely delivery during the peak of flu season or in moments of an outbreak associations and so undermine the responsiveness of healthcare providers. Therefore, with such disruptions, the market is facing hindrances in its growth internationally.

Rapid Influenza Diagnostics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 2.9 billion |

|

Regional Scope |

|

Rapid Influenza Diagnostics Market Segmentation:

Product Type Segment Analysis

The lateral flow immunoassays subsegment in the market is expected to hold the highest market share of 43% within the forecast period in the product type segment due to its rapid, easy-to-use format and high sensitivity compared to traditional methods like the hemagglutinin (HA) test. As per a report by NLM in June 2023, technologies, such as the immunochromatographic strip, have been developed that can detect avian avulavirus 1 within 36 hours post-infection, showing the effectiveness of lateral flow assays in early and precise detection. Their adaptability and suitability for use with point-of-care testing only stimulate extensive application in clinical and field settings.

Sample Type Segment Analysis

The nasal swab subsegment in the market is expected to hold the second-highest share during the forecast period in the sample type segment due to ease of handling, minimal discomfort, and high sensitivity for the identification of influenza viruses. According to the April 2023 NLM article, nasal swab sensitivity was more than 97.7% for low and moderate Ct values. Nasal swabs are very popular in clinical and point-of-care laboratories owing to the fact that they provide the sample quickly without needing any special training. Growing use of rapid tests based on nasal swabs also supports effective screening and early detection, leading to strong demand for this segment.

End user Segment Analysis

Hospitals are expected to hold the third-highest market share in the end user subsegment during the forecast period in the market, as they are the most crucial in treating and containing influenza outbreaks, and providing full patient care. Rapid tests are required by hospitals to accelerate the detection of influenza infections, make the correct treatment choices, and prevent nosocomial spread. Additionally, hospital investments in more sophisticated diagnostic facilities and equipment encourage the utilization of rapid influenza diagnostics, further solidifying their role as the strongest end-user market segment.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Technology |

|

|

End user |

|

|

Distribution Channel |

|

|

Sample Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rapid Influenza Diagnostics Market - Regional Analysis

North America Market Insight

The market in North America is expected to hold the highest market share of 37% during the forecast period, owing to advanced healthcare infrastructure and increased awareness for early disease detection. According to the America Hospital Association 2025 report, the U.S. market is being supported by a large healthcare network with 6,093 hospitals, thereby enabling the interface of rapid diagnostics. Out of these, 5,112 are community hospitals, thus making testing infrastructure highly available at the regional level. Having rapid influenza diagnostic tests in place across a wide network of hospitals ensures they can be efficiently scaled and quickly deployed in both urban and rural settings.

The market in the U.S. is growing due to government initiatives for influenza control and key diagnostic companies playing principal roles in it. According to the 2025 America Hospital Association report, the market within the U.S. is strongly supported by an extensive healthcare infrastructure, which includes 920 state and local government community hospitals, enhancing access to diagnostic services within public systems. The nation's hospitals accommodate high patient volumes-especially during the peak flu season, with 913,136 staffed beds in all. Therefore, there is an increasing demand for rapid influenza diagnostic tests, supported by the flexibility and preparedness of the healthcare system in the country.

The rapid influenza diagnostics market in Canada is growing due to increasing population aging and demand for point-of-care testing during flu seasons. As per a report by the Government of Canada published in July 2024, with the recent record USD 200 billion investment in health care for more than 10 years, the country demonstrates its clear commitment to promoting patient health and improving accessibility. By extending Canada Health Act deductions to include diagnostic services, the country emphasizes the need for equitable and free access to essential testing. This policy now encourages provinces to strengthen public diagnostic infrastructure, supporting the broader adoption of rapid influenza diagnostics.

Europe Market Insight

The rapid influenza diagnostics market of Europe is expected to hold the fastest-growing market within the forecast period due to the rise in healthcare spending and the increasing use of more advanced technologies for diagnostics. Besides, all countries in the region recorded a higher healthcare spending per inhabitant in 2022, supporting growth in diagnostic services. As per a report by Eurostat published in November 2025, Latvia, Romania, and Lithuania have seen the maximum increases in healthcare expenditure, with increases of 140.5%, 125.6%, and 123.1%. In Bulgaria and Czechia, the expenditures more than doubled, pushing the markets further. Sweden had the least increase of about 13.8%, thus providing consistent support to diagnostic advances.

The rapid influenza diagnostics market in the UK is expected to be the fastest-growing market within the forecast period due to public health surveillance upgrades and increased focus on diagnostic testing. Gradual increases in awareness among doctors and patients alike have led to higher demand for faster, more precise influenza diagnostics. In addition, investments in healthcare infrastructure, along with the integration of point-of-care testing in clinical settings, support the widespread adoption of rapid diagnostic technology. Further growth results from efforts to reduce hospital burdens during acute winter periods and improve patient outcomes.

The rapid influenza diagnostics market in Germany is growing due to support from the government for managing infectious diseases, and a strong healthcare infrastructure leads to the growth. As per a report by Eurostat in November 2025, the healthcare spending in Germany was highest among the EU countries, standing at an estimated €489 billion in 2022. This high expenditure allows hospitals and clinics all over the nation to adopt state-of-the-art diagnostic technologies. Additionally, the growing public awareness and focus on early diagnosis consequently create a higher demand for rapid testing.

Healthcare Expenditure for the Rapid Influenza Diagnostics Market for Europe

|

Country |

Government Schemes |

Compulsory Schemes & Saving Accounts |

Other Financing Agents |

Curative & Rehabilitative Care |

Medical Goods (Non-specified) |

Other Functions (Including Unknown) |

Hospitals |

|

EU (¹²) |

30.0 |

51.3 |

18.7 |

51.9 |

17.8 |

30.3 |

36.4 |

|

Belgium |

21.0 |

54.1 |

24.9 |

54.2 |

12.8 |

33.0 |

39.0 |

|

Bulgaria |

15.9 |

47.6 |

36.5 |

51.5 |

33.0 |

15.5 |

36.7 |

|

Denmark |

84.6 |

0.0 |

15.4 |

59.4 |

10.4 |

30.1 |

44.9 |

|

Germany |

11.7 |

75.0 |

13.3 |

51.8 |

17.8 |

30.3 |

26.9 |

|

Ireland |

76.8 |

0.6 |

22.7 |

56.6 |

11.3 |

32.0 |

38.2 |

|

Greece |

30.2 |

31.7 |

38.1 |

58.4 |

12.9 |

28.7 |

45.3 |

|

Spain |

70.3 |

3.7 |

26.0 |

57.6 |

21.4 |

21.0 |

46.0 |

|

France |

4.3 |

80.4 |

15.3 |

51.7 |

19.1 |

29.2 |

38.9 |

|

Italy |

74.3 |

0.0 |

25.6 |

53.4 |

20.2 |

26.5 |

43.5 |

Source: Eurostat, November 2024

Asia Pacific Market Insight

The rapid influenza diagnostics market in the Asia Pacific is expected to grow steadily over the forecast period, driven by increasing awareness of influenza outbreaks, with growing access to diagnostic tools. Additionally, investments in healthcare infrastructure and government initiatives against infectious diseases provide additional market growth opportunities. Furthermore, the increased incidence of respiratory infections in a large patient population demands more timely and accurate testing for influenza. Better healthcare delivery, particularly in rural and underserved areas, also promotes the progress of rapid diagnostic technologies on a steady basis across the region.

The rapid influenza diagnostics market in China is growing due to expanding healthcare reforms and frequent outbreaks of respiratory infections. As per a report by NLM May 2025, the China National Influenza Center demonstrated a study that the average nucleic acid testing positive rate for influenza virus (IFV) among influenza and related illness (ILI) cases in Fujian Province during the last 10 years was 14.7%, further reinforcing the pressing need for accurate and timely diagnostic tools. This translates to the need for efficient, rapid influenza diagnostics in the effective management and control of flu outbreak situations. Added government support and improved health care access continue to be the incentives behind market growth.

The influenza diagnostics market in India is growing due to the large population base, growing disease burden, and the improvement of rural health centers walk along. The early detection and curing of diseases have gained erroneous glories in the public, as further stimulation is lent to investments in public healthcare programs. Government-level operation in strengthening disease surveillance and enhancing the potential to access diagnostic services considerably increases demand for rapid testing technologies. An increased presence of domestic diagnostic manufacturers further improves the affordability and availability of rapid influenza testing in both urban as well as rural areas.

Key Rapid Influenza Diagnostics Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- F. Hoffmann-La Roche Ltd

- Quidel Corporation

- Thermo Fisher Scientific Inc.

- Becton, Dickinson and Company (BD)

- Meridian Bioscience Inc.

- DiaSorin S.p.A.

- Sekisui Diagnostics LLC

- Siemens Healthineers AG

- Danaher Corporation

- Luminex Corporation

- bioMérieux SA

- Hologic Inc.

- Abbott Laboratories

- Seegene Inc.

As the rapid influenza diagnostics market is growing steadily, the main competitors, such as Abbott Laboratories, F. Hoffmann-La Roche Ltd, and Quidel Corporation, are focusing on innovation and product development. Besides, Abbott’s ID NOW Influenza A & B 2 test provides quick results at the point of care to meet the demand for rapid diagnosis, which is positively impacting the overall market globally. Moreover, as companies compete to improve accuracy, speed, and accessibility, they are adjusting to the growing global demand, which further denotes a huge growth opportunity for the market across different nations.

Here is a list of key players operating in the global market:

Recent Developments

- In June 2025, Abingdon Health plc has partnered with Okos Diagnostics to co-develop, manufacture, and commercialize lateral flow test kits for avian flu (H5N1), targeting both bovine health and human applications.

- In September 2024, Roche launches the first test to use its breakthrough TAGS technology for high throughput, and simultaneous ensure the detection of 12 respiratory viruses.

- Report ID: 5310

- Published Date: May 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rapid Influenza Diagnostics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.