Specialty PACS Market Outlook:

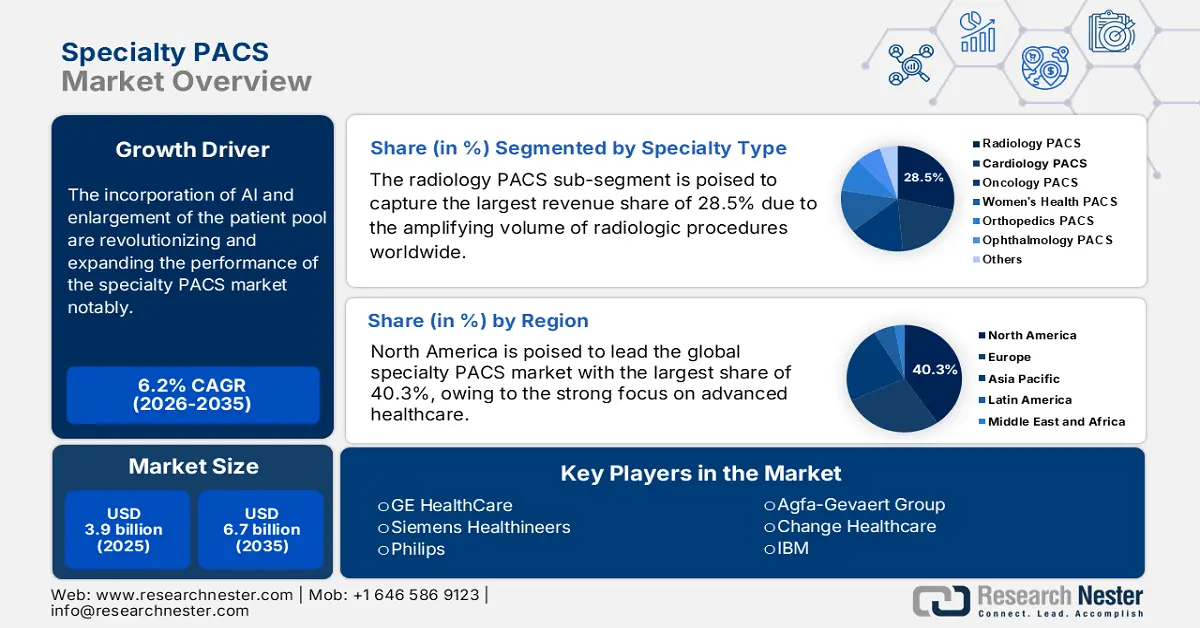

Specialty PACS Market size was over USD 3.9 billion in 2025 and is estimated to reach USD 6.7 billion by the end of 2035, expanding at a CAGR of 6.2% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of specialty PACS is estimated at USD 4.1 billion.

The market has a wide applicability in diagnosing cancer, cardiovascular diseases (CVD), and neurological disorders. Thus, the demography is continuously expanding with the increasing worldwide prevalence, incidence, and fatality of these ailments. Testifying to the same, the WHO unveiled that 20 million and 9.7 million new and death cases of cancer were recorded around the globe in 2022 alone, where 53.5 million people were alive within 5 years following a diagnosis. Besides, an NLM study predicted the occurrence and crude mortality of CVD to increase by 90.0% and 73.4, respectively, between 2025 and 2050 globally. These figures are evident indications of the growing demand in this sector.

Despite the amplifying surge, the heightening costs of diagnostic services, specifically radiology, are creating a risk of financial exhaustion for both patients and service providers. Moreover, the need for a well-trained workforce and specialized equipment makes these assessments expensive for the majority of consumers. Exemplifying the same, a 2023 NLM article unveiled that the unit cost of each CT and MRI scan was significantly higher, accounting for EUR 177.73 and EUR 180.60, respectively. Thus, the cost-effectiveness of commodities available in the market is attracting customers seeking affordable healthcare solutions. Such characteristics are also validated by several clinical studies, which help the sector earn greater engagement.

Key Specialty PACS Market Insights Summary:

Regional Insights:

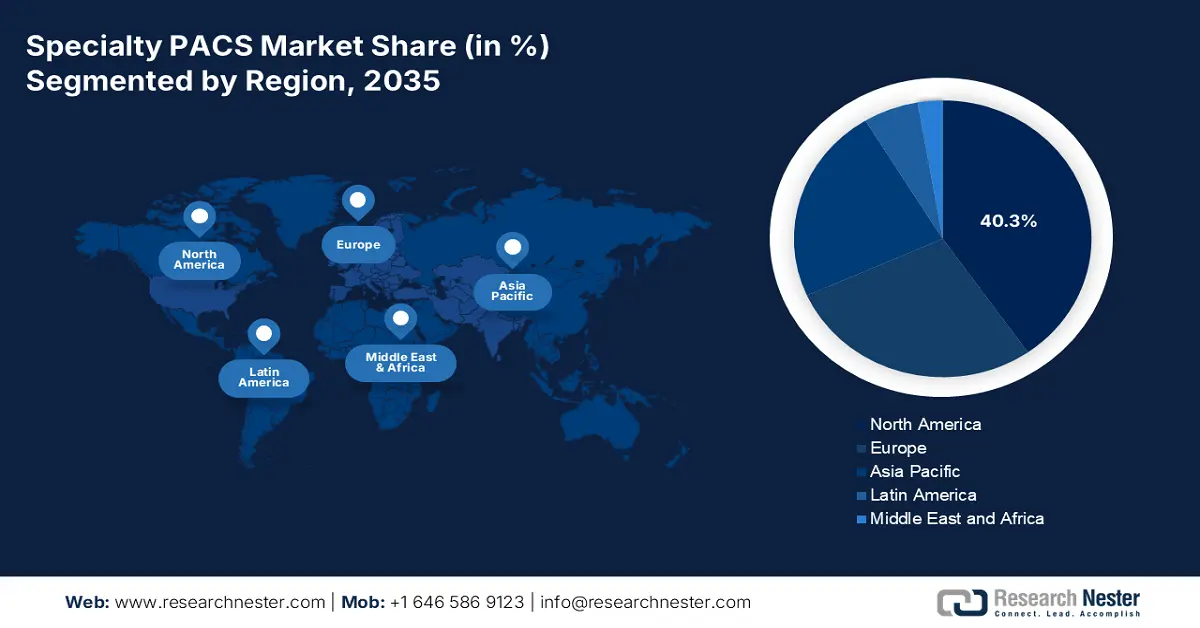

- By 2035, north america is projected to command a 40.3% share in the specialty pacs market, supported by the high volume of diagnostic imaging technologies.

- Asia Pacific is anticipated to grow at the fastest pace through 2035, underpinned by rapid healthcare infrastructure development.

Segment Insights:

- The radiology PACS segment is expected to secure a 28.5% share by 2035 in the specialty pacs market, impelled by the enlarging volume of diagnostic procedures.

- The web/cloud-based PACS segment is projected to hold a 58.6% share by 2035, sustained by scalability, lower upfront capital expenditure, and facilitation of remote diagnostics.

Key Growth Trends:

- Regulatory validation and standardization

- Growing need for workflow optimization

Major Challenges:

- Government-imposed pricing controls

- Data privacy and sovereignty laws

Key Players: Siemens Healthineers (Germany), Philips (Netherlands), Agfa-Gevaert Group (Belgium), Change Healthcare (Now Part of Oracle) (U.S.), IBM (U.S.), Mach7 Technologies (Australia), INFINITT Healthcare (South Korea), Hyland Software (U.S.), Visage Imaging (Australia), Sectra (Sweden), Novarad Corporation (U.S.), RamSoft, Inc. (Canada), Carestream Health (U.S.), eRAD, A Canon Medical Group Company (U.S.), Everlight Radiology (Australia), Medic Vision Imaging Solutions (Israel), Telerad Tech (India), RADPAIR (U.S.).

Global Specialty PACS Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.9 billion

- 2026 Market Size: USD 4.1 billion

- Projected Market Size: USD 6.7 billion by 2035

- Growth Forecasts: 6.2%

Key Regional Dynamics:

- Largest Region: North America (40.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Australia, Brazil, United Arab Emirates, United Kingdom

Last updated on : 28 August, 2025

Specialty PACS Market - Growth Drivers and Challenges

Growth Drivers

-

Regulatory validation and standardization: As more healthcare authorities are mandating long-term image archiving, data traceability, and standardized reporting, the market is expanding. The close compliance of the sector with stringent regulations, such as DICOM, CFR, NIST Guidelines, and HIPAA, makes it stand out in competition with other imaging modalities. Besides, the ongoing advances in technology are also supporting the market’s relevance with current data privacy trends, securing a greater cash inflow for this sector. For instance, in July 2024, medDream launched a new version of its SendToPACS desktop application, SendToPACS v3.0.0, which conveniently processes DICOM-compliant files through PACS systems.

-

Growing need for workflow optimization: The growing workload in healthcare facilities is becoming a burden both in finance and efficiency. This is fostering an urgent need for streamlined imaging workflows. Thus, by offering department-specific tools, templates, and reporting formats, the market is gaining momentum. Besides, its compatibility with existing HIS, RIS, and EHR systems promotes enhanced interoperability, making these instruments the most preferred choice. Testifying to the same, in May 2023, the NLM published a study on perceived benefits in using PACS at Charlotte Maxeke Johannesburg Academic Hospital, observing an 83% reduction and 65% improvement in hospital stays and clinicians’ efficiency.

-

Integration with next-generation technologies: The incorporation of AI and ML has revolutionized the performance of the market notably. Specifically, the ability of these advancements to elevate the quality of image interpretation and assist in clinical decision-making is gaining popularity among various healthcare settings. Evidencing the clinical advantages of this technological shift, in April 2025, the NLM published a study evaluating the outcomes of AI integration in PACS, which underscored a 93.2% improvement and 90% reduction in diagnostic accuracy and times. Moreover, the increasing penetration of automated data analysis into the healthcare industry is securing a prosperous future for this sector.

Historic Trends of Inflation in Payers’ Pricing for Traditional Imaging Methods

Observational Study on Cost Increase for MRI & CT Scans (2014-2019)

|

Metrics |

Details / Values |

|

Number of Outpatient Exams Analyzed |

9,725 (MRI and CT combined) |

|

Hospitals Involved |

2 major hospitals in Almaty |

|

Assessment Standards Used |

ACR compliance standards, RCR recommendations |

|

Total Cost of MRI & CT Scans in 2014 |

$22,537 |

|

Total Cost of MRI & CT Scans in 2019 |

$40,519 |

|

Total Cost of MRI & CT Scans Cost Increase (2014-2019) |

$17,982 |

Source: NLM

Workforce Statistics of Diagnostic Imaging, Creating Opportunities for the Market

Workforce Trends in Radiology Imaging in the U.S.

|

Aspect |

Statistic/Trend |

|

Number of active radiologists in the U.S. (2023) |

Approximately 37,482 practicing radiologists |

|

Radiologic technologists participating in the process of image generation (2022) |

An additional of over 250,000 |

|

The bulk of the workforce-older than 45 years and 55 years (2021) |

Ranged from 82% to 53% |

|

Radiology match rate (2025) |

97.4% of positions filled |

|

Imaging utilization projected increase by 2055 |

16.9% to 26.9% increase in imaging volume |

|

Projected radiologist shortage by 2055 |

Shortage of 3,116 radiologists expected |

|

Burnout rate among radiologists |

46% in private practice, 37.4% in academic settings |

Source: NLM, JACR, and MATCH

Challenges

-

Government-imposed pricing controls: As government and public payers are the primary purchasers of healthcare technology, their cost-effectiveness threshold often creates intense price negotiation and cost containment measures. Additionally, the procedural complexities and supply chain disruptions make it difficult for manufacturers to comply with the mandated reimbursement value. This ultimately shrinks the profit margins in the market, which requires rigorous R&D to enable workflow efficiency or diagnostic superiority over a premium price.

-

Data privacy and sovereignty laws: Cybersecurity threats are becoming a global concern for the MedTech industry, consequently imposing a critical barrier for the market. On the other hand, strict data protection laws, such as the General Data Protection Regulation (GDPR), restrict the scale of data transferring and storing, which hampers the commercial or enterprise-level operations in this sector. This is also increasing the cost and complexity of widespread deployment and ongoing service delivery, limiting the volume of adoption.

Specialty PACS Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 3.9 billion |

|

Forecast Year Market Size (2035) |

USD 6.7 billion |

|

Regional Scope |

|

Specialty PACS Market Segmentation:

Specialty Type Segment Analysis

The radiology PACS sub-segment is poised to maintain its dominance over the specialty type segment by capturing the largest revenue share of 28.5% by the end of 2035. The continuously enlarging volume of diagnostic procedures creates a critical need for PACS integration to enhance workflow efficiency across radiology departments. Evidencing the same, in June 2025, Duke University published a study that calculated the annual count of MRI scans performed worldwide to range between 100 million and 150 million. On the other hand, this epidemiology is highly attributable to the rising global incidence of chronic musculoskeletal diseases and cancers that require extensive imaging, hence benefiting the market.

Deployment Model Segment Analysis

The web/cloud-based PACS deployment model is predicted to be the dominant sub-segment in the market over the assessed period, with a majority share of 58.6%. The scalability, lower upfront capital expenditure, and facilitation of remote diagnostics are the primary growth factors behind the leadership. This is further accelerated by the enactment of favorable government policies promoting telehealth and data interoperability. This is also influencing public payers to expand their reimbursement coverage for these medical devices, which is creating a lucrative business environment for cloud-based MedTech pioneers, cementing the segment’s position in this sector.

End user Segment Analysis

Hospitals are anticipated to acquire approximately 45.4% share in the market throughout the discussed timeframe. The comprehensive imaging needs across multiple departments and specialties that operate under these facilities make them the largest contributor to revenue generation in this sector. These institutions require robust data management and processing solutions that support high imaging volumes, advanced visualization tools, and seamless integration with hospital information systems (HIS) and electronic health records (EHR). Thus, specialty PACS are particularly vital in hospital settings for managing persistent workflows in cardiology, neurology, oncology, and orthopedics.

Our in-depth analysis of the specialty PACS market includes the following segments:

|

Segment |

Subsegments |

|

Specialty Type |

|

|

Component |

|

|

Deployment Model |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Specialty PACS Market - Regional Analysis

North America Market Insights

North America is poised to lead the global market during the analyzed tenure, while holding the largest share of 40.3%. High volume of diagnostic imaging technologies and strong focus on elderly care are collectively solidifying the region’s proprietorship in this field. Its well-established ecosystem of hospitals, specialty clinics, and research institutions that require tailored imaging solutions across various medical disciplines also creates a surge in this sector. Furthermore, regulatory push and the Federal government initiatives toward healthcare digitization, combined with the widespread use of EHR systems and AI-powered diagnostic tools, are consolidating the region’s position in this field.

The U.S. holds the highest share of the North America specialty PACS market on account of its high healthcare spending, early adoption of AI-assisted imaging modalities, and growing emphasis on subspecialty care. The country is also home to several global MedTech leaders, making it the hub of commercial operations in this category. Exemplifying the same, in November 2023, PaxeraHealth launched its groundbreaking AI-powered reading and generative AI technologies at RSNA23. Among this upgraded pipeline, PaxeraUltima 9th Gen made waves by enabling an option to navigate viewing and interpretation for radiologists.

Canada is growing steadily in the market in support of its universal healthcare system and massive government investments in digital health infrastructure. Such a beneficial inflow of capital can be evidenced by the allocation of $200 billion over 10 years from the government body of the country in February 2023 to improve health services through the modernization of the national medical system with standardized health data and digital tools. Besides, the shortage of adequate radiology workforce and equipment is also forcing the authorities of Canada to invest in this sector.

APAC Market Insights

Asia Pacific is expected to be the fastest-growing region in the global specialty PACS market by the end of 2035. Rapid development in healthcare infrastructure, an increase in imaging procedural volumes, and robust localization of medical device production are cumulatively escalating the pace of growth in this landscape. Particularly, in emerging economies, such as China, India, Japan, and South Korea, massive investments in healthcare digitalization are recorded, which display a greater business opportunity for this sector. Moreover, the growing burden of chronic disease mortality, combined with a rising middle-class population and government support for healthcare modernization, is accelerating the adoption of scalable, early detection tools, hence benefiting this field.

China is a key manufacturer and supplier of the Asia Pacific specialty PACS market, which is primarily fueled by its rapidly expanding healthcare industry and enlarging population. The government's ambitious goal to achieve complete healthcare digitization through the Healthy China 2030 initiative is also amplifying the volume of adoption in both public and private hospitals. Furthermore, the deepened penetration of AI in diagnostics and local PACS vendors is enhancing the scalability and accessibility of this sector, while fostering a great potential for the development of next-generation models.

India is emerging as a regional hub of innovation and expansion for the specialty PACS market. Such progress is highly attributable to the increasing public investments in healthcare infrastructure and rapid digitalization. Testifying to the same, in December 2023, the nation’s central government dedicated Rs. 2,516 crores to the computerization of 63 thousand functional PACS systems. Further, the authorities also allocated significant funds for complete reinforcement in tertiary hospitals, diagnostic centers, and specialty, which are propelling the adoption of PACS solutions.

Key Growth Factors for the Specialty PACS Market

|

Country |

Growth Factor |

Timeline |

|

China |

CNY 413 billion worth of Digital Health Industry |

2024 |

|

Australia |

$107.2 million allocation to modernize the healthcare system |

2022-2023 |

|

Japan |

Launch of the Medical Digital Transformation (DX) Promotion Plan |

2022 |

Source: NLM, Australian Government, and ITA

Europe Market Insights

Europe augments a strong significance in the global specialty PACS market, which is steadily growing with advancements in healthcare infrastructure, high adoption of advanced imaging technologies, and the aging population. Germany, the U.K., and France are the leading landscapes in this category, where the magnifying volume of the patient pool and ongoing MedTech innovations are cultivating a favorable atmosphere for this merchandise. The region further benefits from strict regulatory standards and robust health IT frameworks that help promote and maintain high efficiency and accuracy in interoperability and data security. Besides, amplifying capital influx in AI deployment, cloud-based imaging, and cross-border health data exchange are propelling the adoption of PACS in Europe.

The UK is propagating the specialty PACS market with continuous advances in the healthcare system and ongoing allocations to digital transformation. Evidencing the same, in April 2025, the governing body of the country, in collaboration with the Wellcome Trust, invested up to £600 million to create a new health data research service. This funding was intended to establish a secure single access point to national-scale data sets for researchers. The NHS is also actively participating in this cohort by providing extensive financial backing for accessibility enhancement of advanced diagnostic platforms.

Germany is one of the leading pioneers in the Europe specialty PACS market. Its highly developed healthcare infrastructure and strong focus on medical technology innovation are the foundational growth factors of the country in this sector. Besides, the widening network of public hospitals and private clinics is prompting maximum PACS deployment in cardiology, oncology, and orthopedics departments to enable precise diagnostics and efficient management of patients. The country’s stringent regulatory environment also ensures high standards for data security and interoperability, consolidating a strong reputation for Germany in this category.

Country-wise Volume of Radiologic Procedures (2022)

|

Country |

Modality |

Count of Scans Performed (Million) |

|

Germany |

MRI |

13.0 |

|

France |

CT |

15.2 |

|

Spain |

CT |

6.8 |

Source: eurostat

Key Specialty PACS Market Players:

- GE HealthCare (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens Healthineers (Germany)

- Philips (Netherlands)

- Agfa-Gevaert Group (Belgium)

- Change Healthcare (Now Part of Oracle) (U.S.)

- IBM (U.S.)

- Mach7 Technologies (Australia)

- INFINITT Healthcare (South Korea)

- Hyland Software (U.S.)

- Visage Imaging (Australia)

- Sectra (Sweden)

- Novarad Corporation (U.S.)

- RamSoft, Inc. (Canada)

- Carestream Health (U.S.)

- eRAD, A Canon Medical Group Company (U.S.)

- Everlight Radiology (Australia)

- Medic Vision Imaging Solutions (Israel)

- Telerad Tech (India)

- RADPAIR (U.S.)

The competitive landscape of the specialty PACS market marks an intense rivalry among global MedTech leaders and niche players. Despite the differences in operational strategies, these pioneers are mostly striving to offer innovative and tailored solutions for specific consumer bases that ensure optimum revenue generation. Their resources and efforts are also dedicated to cultivating an AI-backed, affordable, and highly efficient pipeline to meet the evolving requirements and maintain market relevance in this category.

Such key players are:

Recent Developments

- In June 2024, RADPAIR partnered with NewVue to enhance radiologists' well-being and job satisfaction while improving workflow and report quality. The company utilized this collaboration to integrate its advanced AI diagnostic reporting capabilities into NewVue's workflow orchestrator to create a cloud-native solution.

- In November 2023, Philips expanded its enterprise imaging portfolio and AI-enabled solutions by launching HealthSuite Imaging at #RSNA23. This is a next-generation cloud-based PACS enabling radiologists and clinicians to adopt new capabilities faster, help improve operational efficiency, and enhance patient care.

- Report ID: 8025

- Published Date: Aug 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Specialty PACS Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.