Anesthesia Monitoring Devices Market Outlook:

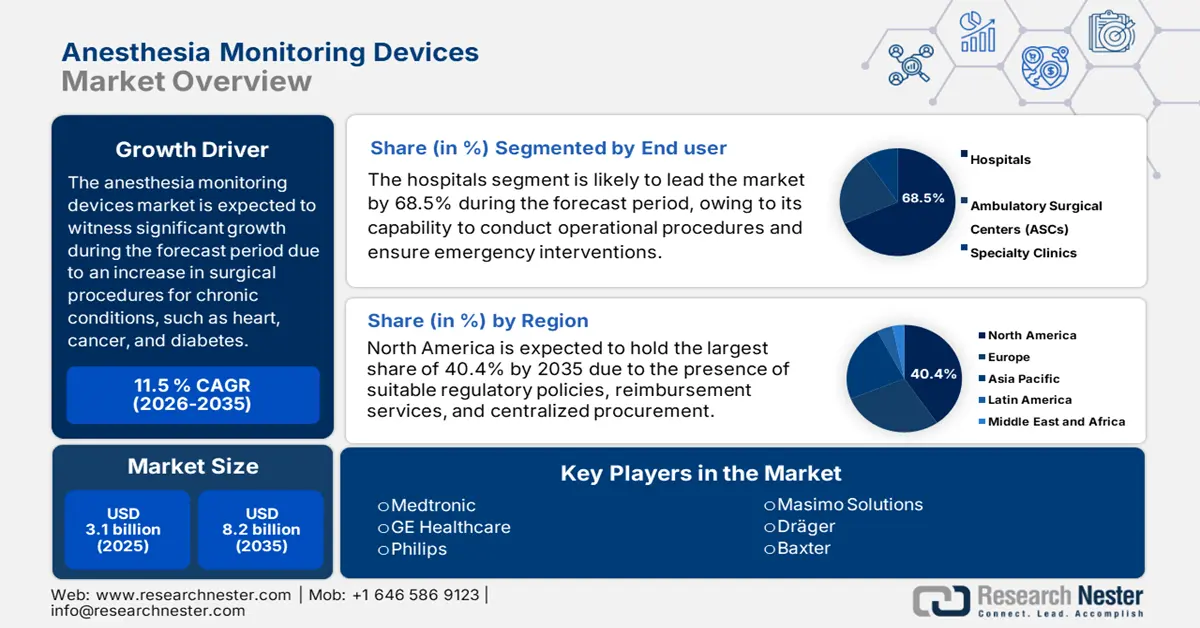

Anesthesia Monitoring Devices Market size was USD 3.1 billion in 2025 and is projected to reach USD 8.2 billion by the end of 2035, increasing at a CAGR of 11.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of anesthesia monitoring devices is evaluated at USD 3.4 billion.

The international market is currently witnessing significant growth, which is highly attributed to key factors, including a rise in surgical volume, the aging population, and an increase in chronic diseases, requiring surgical intervention. According to an article published by NLM in January 2024, approximately 523 million people suffer from heart disease and stroke, leading to an estimated 19 million deaths. Likewise, almost 600,000 deaths occur across different nations, owing to cancer, while 37 million people are affected with diabetes, therefore, enhancing the global demand for the market.

Moreover, the existence of strict administrative policies, technological innovation, and expansion in healthcare infrastructure are also positively impacting the market internationally. As stated in the October 2022 NLM article, almost 80% of patient data are currently stored in semi-structured and unstructured formats, from which required data and information are gathered for medical purposes. Besides, the gene sequencing process has extended to 200 terabytes for more than 1,700 patient data, through which researchers are able to access and analyze. Meanwhile, big streaming processing systems are also suitable for healthcare systems, thus proliferating the market’s growth.

Key Anesthesia Monitoring Devices Market Insights Summary:

Regional Highlights:

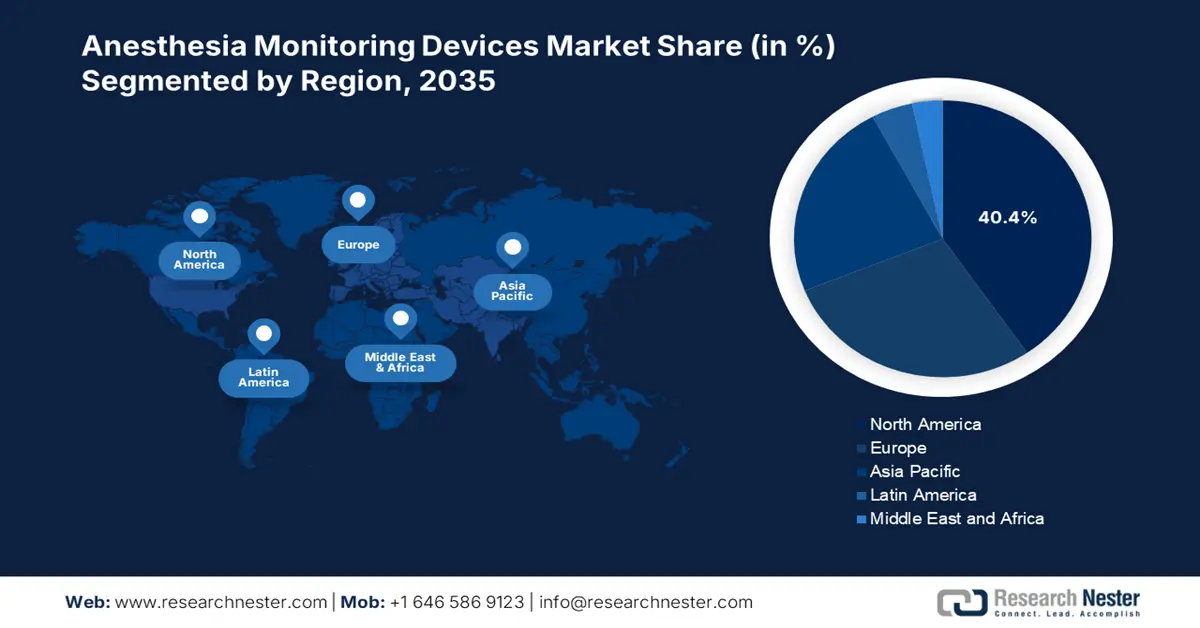

- North America is poised to secure a 40.4% share of the anesthesia monitoring devices market, underpinned by harmonized regulations, rising surgical procedures, and strong reimbursement-driven integration.

- Asia Pacific is set to register the fastest expansion, stimulated by diverse market maturity, advancing healthcare infrastructure, and strengthened government-led procurement.

Segment Insights:

- The hospitals segment in the anesthesia monitoring devices market is expected to capture 68.5% of the share, upheld by its central role in delivering complex surgical, emergency, and critical care supported by advanced monitoring systems.

- The integrated workstations segment is anticipated to hold the second-largest share, encouraged by its capacity to elevate communication, optimize patient outcomes, and streamline data-driven workflow efficiency.

Key Growth Trends:

- Expansion in minimally invasive surgery

- Increased focus on valuable health and medical services

Major Challenges:

- Budget constraints in public health systems

- Reimbursement and cost-effective obstacles

Key Players: Medtronic plc (Ireland), GE Healthcare (U.S.), Philips Healthcare (Netherlands), Masimo Corporation (U.S.), Drägerwerk AG (Germany), Hillrom (Baxter) (U.S.), Mindray Medical (China), Siemens Healthineers (Germany), Contec Medical Systems (China), Spacelabs Healthcare (U.S.), Schiller AG (Switzerland), BPL Medical Technologies (India), Edan Instruments (China), Larsen & Toubro (India), Becton, Dickinson (BD) (U.S.)

Global Anesthesia Monitoring Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.1 billion

- 2026 Market Size: USD 3.4 billion

- Projected Market Size: USD 8.2 billion by 2035

- Growth Forecasts: 11.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 29 August, 2025

Anesthesia Monitoring Devices Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in minimally invasive surgery: This particular surgery has gained immense importance, since surgeries provide the liberty to utilize numerous approaches to successfully operate, which is a huge opportunity for the anesthesia monitoring devices sector growth. Based on this, the September 2022 NLM article noted that a clinical study was conducted on 9.8 million inpatient operating procedures, of which 11.1% were MIS. In addition, there were a total of 10.6, 10.6, and 10.7 million ambulatory procedures for which MIS displayed an increase in the trend by 16.95, 17.4%, and 18.0%, thereby suitable for fueling the market’s demand.

- Increased focus on valuable health and medical services: These are essential to provide enhanced life quality, extended life, and promote well-being, thus suitable for uplifting the anesthesia monitoring devices market internationally. As per an article published by NLM in February 2025, CMS introduced healthcare provider, P4P, which has increased the revenue percentage based on which health and medical providers can earn from aiding Medicare patients to almost 10%, which has currently been modified into 9%, thus bolstering the market’s growth across different nations.

- Remote monitoring implementation: With the artificial intelligence integration, there is a huge possibility of remotely monitoring patients, thereby denoting a huge growth driver for the anesthesia monitoring devices industry globally. In this regard, the February 2025 NLM article indicated that the aspect of automation in process-based tasks tends to eliminate anesthesiologists and, intraoperatively, minor surgeries might not need one in the room 100% of the time. However, there is a 5% chance of patients dying, due to which strict and standard policies need to be formulated to manufacture suitable monitoring devices.

2023 Global Healthcare Expenditure Across Different Countries

|

Countries/ Years |

2023 (%) |

|

U.S. |

16.5 |

|

France |

11.9 |

|

Germany |

11.8 |

|

Switzerland |

11.7 |

|

New Zealand |

11.3 |

|

Canada |

11.2 |

|

Sweden, UK |

10.9 |

|

Netherlands |

10.1 |

|

Australia |

9.8 |

Source: Commonwealth Fund Organization, September 2024

2022 Cancer Cases Driving the Market

|

Countries |

Both Males and Females |

Age-Standardized Rates (ASR) |

|

China |

4,824,703 |

196.9% |

|

U.S. |

2,380,189 |

367.0% |

|

India |

1,413,316 |

98.5% |

|

Japan |

1,005,157 |

267.1% |

|

Russia |

635,560 |

248.1% |

|

Brazil |

627,193 |

214.4% |

|

Germany |

605,805 |

274.2% |

|

France (Metropolitan) |

483,568 |

339.0% |

|

UK |

454,954 |

307.8% |

|

Italy |

436,242 |

284.5% |

|

Indonesia |

408,661 |

136.9% |

|

Canada |

292,098 |

345.9% |

Source: World Cancer Research Fund

Challenges

- Budget constraints in public health systems: The entry in the anesthesia monitoring devices market is futile, despite the presence of a suitable reimbursement pricing strategy and regulatory approval. Besides, health systems and public hospitals effectively operate under the fixed yearly capital equipment budgets, which are negatively impacting the overall market growth. Meanwhile, a sole anesthesia workstation has the capability to demonstrate an effective portion of the budget, which results in a long-lasting and lengthy sales cycle, thus not suitable for the market’s growth.

- Reimbursement and cost-effective obstacles: The aspect of achieving reimbursement is another daunting challenge beyond the regulatory approval in the market. Payers are no longer accepting only clinical efficiency, but are also demanding strong health-based economic data to ensure that devices lower the overall care expenses. Besides, it is mandatory for manufacturers to invest in prolonged and expensive result-specific studies to demonstrate that devices can diminish complications, lower hospital accommodation, and optimize surgical throughput.

Anesthesia Monitoring Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.5% |

|

Base Year Market Size (2025) |

USD 3.1 billion |

|

Forecast Year Market Size (2035) |

USD 8.2 billion |

|

Regional Scope |

|

Anesthesia Monitoring Devices Market Segmentation:

End user Segment Analysis

Based on the end user, the hospitals segment in the anesthesia monitoring devices market is anticipated to garner the largest share of 68.5% by the end of 2035. The segment’s upliftment is highly attributed to its pivotal role as the ultimate facility for conducting complicated surgical procedures, emergency interventions, and severe care, which demand the highest and accurate monitoring capabilities. Besides, a surge in the patient volume, along with the presence of strict regulatory mandates, has necessitated continuous investment in innovative and integrated workstations, as well as standalone monitors, thus effectively uplifting the segment across different nations.

Product Segment Analysis

Based on the product, the integrated workstations segment in the anesthesia monitoring devices market is expected to hold the second-largest share by the end of the projected timeline. The segment’s growth is highly driven by its significance to enhance communication, optimize patient outcomes, and streamline workflows by ensuring real-time accessibility to patient data. As per an article published by NLM in March 2023, there have been improvements in healthcare globally, owing to the existence of USD 1 trillion to cater to clinical productivity, simplify administrative processes, apply Industry 4.0 technologies, and transform the delivery system.

Application Segment Analysis

Based on the application, the cardiac surgery segment in the anesthesia monitoring devices industry is predicted to grab the third-largest share during the forecast timeline. The segment’s development is effectively fueled by the anesthesia application to control pain, maintain stability in vital functions, including oxygen and blood pressure levels. According to an article published by the Heart Surgery Forum in 2025, there has been an increase in surgeons to 127, denoting a 13% surge as of 2022, while the average surgeon caseload, pertaining to cardiothoracic is projected t increase by 45% by the end of 2075, thereby enhancing the market’s demand globally.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Product |

|

|

Application |

|

|

Type |

|

|

Technology |

|

|

Acuity Level |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anesthesia Monitoring Devices Market - Regional Analysis

North America Market Insights

North America in the anesthesia monitoring devices industry is expected to be the dominating region by garnering the highest share of 40.4% by the end of 2035. The market’s growth in the region is highly attributed to harmonized regulations, an increase in surgical volume, reimbursement-based integration, litigation environment, centralized procurement, and a focus on cost-control. Besides, as per the February 2025 NLM article, the existence of the American Society of Anesthesiologists has resulted in 0.7% of sensitivity, which is followed by 0.6% of specificity, and 0.7% of operative aspect, thus suitable for the market’s upliftment.

The anesthesia monitoring devices market in the U.S. is growing significantly, owing to administrative policies, investments by hospitals in technologies, a strict regulatory environment, and the increased medical malpractice litigation. According to the January 2022 Research America Organization data report, the federal government in the country initiated investments in terms of health and medical R&D, which increased to USD 9.8 billion between 2019 and 2020 from USD 21.4 billion over the past ten years. This, in turn, is suitable for uplifting the market in the country, with exposure to advanced technologies required for monitoring.

The market in Canada is also growing due to the existence of the single-payer and provincially-managed healthcare system, evidence-specific procurement, system-level efficiency, and governmental funding. As stated in the 2025 Canada-based Anesthesiologists’ Society article, the Canada Anesthesiologists' Society Research Grants Program, since its initiation, has administered funds to support domestic researchers, and currently manages over USD 200,000 yearly to ensure suitable research and training for anesthesia in the country.

APAC Market Insights

Asia Pacific in the anesthesia monitoring devices market is projected to emerge as the fastest-growing region during the forecast timeline. The market’s development in the region is propelled by the aspect of heterogeneous market maturity, a boom in the healthcare infrastructure, centralized government procurement, domestic advancements, and dual-based market structure. As per an article published by OECD in 2022, the overall spending across lower-middle and low-income countries was valued at USD 285 per person over the past 6 years, in comparison to USD 822 and USD 3,891 for upper-middle income and high-income countries, thus contributing towards the market growth.

The market in China is gaining increased traction, owing to modernized plans for hospitals, localized manufacturing, sourcing of thermometers and their accessories, and generous contributions by domestic organizations. As per the May 2023 NLM article, the country comprises overall 1,030,935 healthcare centers, including 36,570 hospitals and 977,790 primary clinics. In addition, there are 3,275 tertiary hospitals, along with 10,848 secondary hospitals, and 36,169 community health service centers in urban locations and 34,943 township health facilities in rural areas. Therefore, with an increase in different hospitals, there is a huge growth opportunity for the market in the country.

The market in India is also developing due to the provision of government-based investments, particularly in public health systems, and the formation of administrative bodies, such as Ayushman Bharat. According to the August 2025 Invest in India data report, the country’s healthcare industry has been valued at USD 4 billion as of 2023, based on vaccine and biotech aspects. Additionally, 25% of healthcare innovation has doubled, resulting in USD 7 billion in the same year, in comparison to USD 3 billion over the past 5 years, thereby denoting an optimistic outlook for advancements in the market.

2023 Thermometers and Accessories Export and Import in Asia

|

Countries |

Exports |

Imports |

|

China |

USD 241 million |

USD 156 million |

|

Japan |

USD 123 million |

USD 52 million |

|

Singapore |

USD 85.3 million |

USD 34.4 million |

|

Thailand |

USD 40.4 million |

USD 46.5 million |

|

Malaysia |

USD 24 million |

USD 22.6 million |

|

India |

USD 19 million |

USD 26.1 million |

|

South Korea |

USD 17.9 million |

USD 43.6 million |

|

Hong Kong |

USD 13 million |

USD 72.6 million |

Source: OEC, July 2025

Europe Market Insights

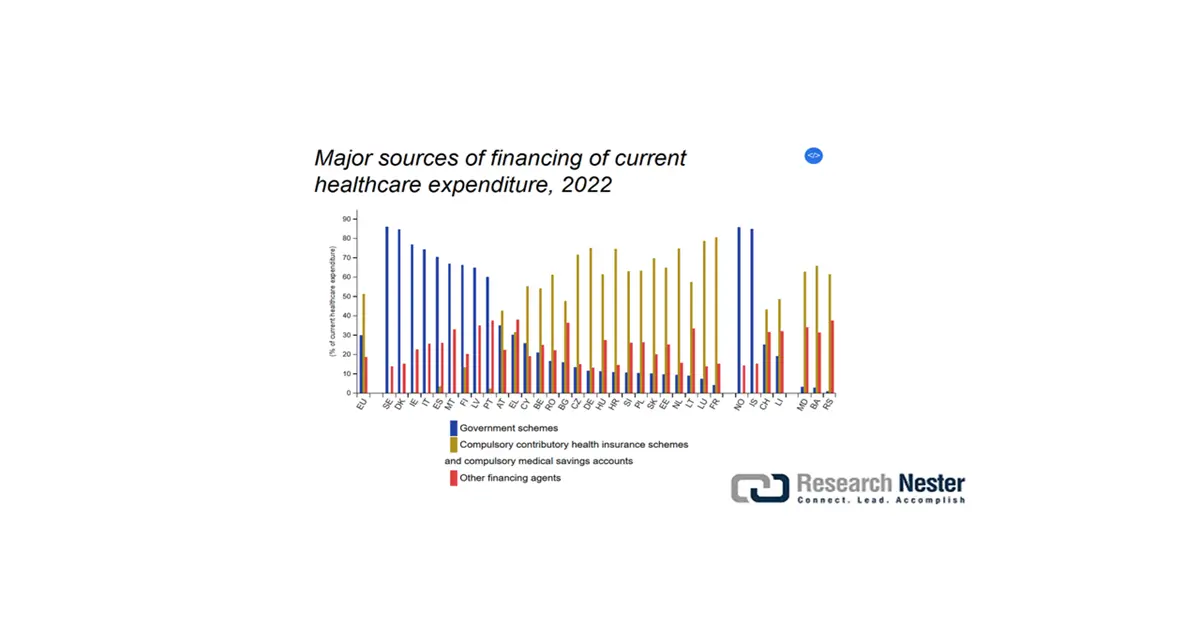

Europe in the anesthesia monitoring devices market is expected to account for a considerable share by the end of the projected period. The market’s upliftment in the region is highly driven by the presence of unified regulatory frameworks, centralized procurement tendering, reimbursement policies for diagnosis, decentralized hospital investment, and the existence of compulsory health technology assessment (HTA). According to the November 2024 Eurostat data report, the present healthcare spending in the overall region accounts for 51.3%, which has been successfully financed by mandatory schemes. In addition, 51.9% has been allocated for rehabilitative care, 17.8% for medical goods, and 30.3% for overall functionality.

Source: Eurostat, November 2024

The anesthesia monitoring devices market in Germany is growing steadily, owing to standard reimbursement policies, optimizing operational efficiency, integrating anesthesia workstations, decentralized hospital structure, and introducing premium devices. For instance, in August 2023, PAION AG, a country-based organization, effectively declared that its Byfavo has been unveiled and is currently commercialized in the Netherlands for its utilization in general anesthesia. Besides, this particular compound is safe for implementation and permits patient recovery, thereby suitable for boosting the market in the country.

The anesthesia monitoring devices market in France is also growing due to the presence of robust centralized planning, along with state involvement, generous budget allocation, and compulsory assessment by the French National Authority for Health (HAS). As stated in the 2025 Commonwealth Fund Organization report, the regional government has successfully set the overall health insurance to cater to 2.7% of gross domestic product (GDP), further displaying a €4.6 billion surge in the health budget. This has been suitable to uplift the healthcare system in the country and enhance the delivery, along with care services, thereby suitable for the market.

Key Anesthesia Monitoring Devices Market Players:

- Medtronic plc (Ireland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE Healthcare (U.S.)

- Philips Healthcare (Netherlands)

- Masimo Corporation (U.S.)

- Drägerwerk AG (Germany)

- Hillrom (Baxter) (U.S.)

- Mindray Medical (China)

- Siemens Healthineers (Germany)

- Contec Medical Systems (China)

- Spacelabs Healthcare (U.S.)

- Schiller AG (Switzerland)

- BPL Medical Technologies (India)

- Edan Instruments (China)

- Larsen & Toubro (India)

- Becton, Dickinson (BD) (U.S.)

The worldwide market is extremely consolidated, with key players garnering a generous amount of share in the market. Besides, the competitive landscape has been redefined by technological advancement, tactical acquisitions, and intense focus on integration. Meanwhile, prominent organizations, such as Philips, GE Healthcare, and Medtronic, have pursued certain strategies, including completely integrated AI-based operating rooms that effortlessly connect monitoring devices with anesthesia machines and EHRs to provide data-based clinical decisions, thereby suitable for boosting the overall market globally.

Here is a list of key players operating in the global market:

Recent Developments

- In October 2024, Senzime AB announced the launch of its cutting-edge TetraGraph system to effectively redefine the quantitative monitoring and optimize patient safety with smart monitoring capabilities.

- In September 2024, BD declared that it has successfully acquired Edwards Lifesciences' Critical Care product group to rename itself as BD Advanced Patient Monitoring, and effectively extend its smart connected care solutions.

- Report ID: 8033

- Published Date: Aug 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.