Polymer Bearing Market Outlook:

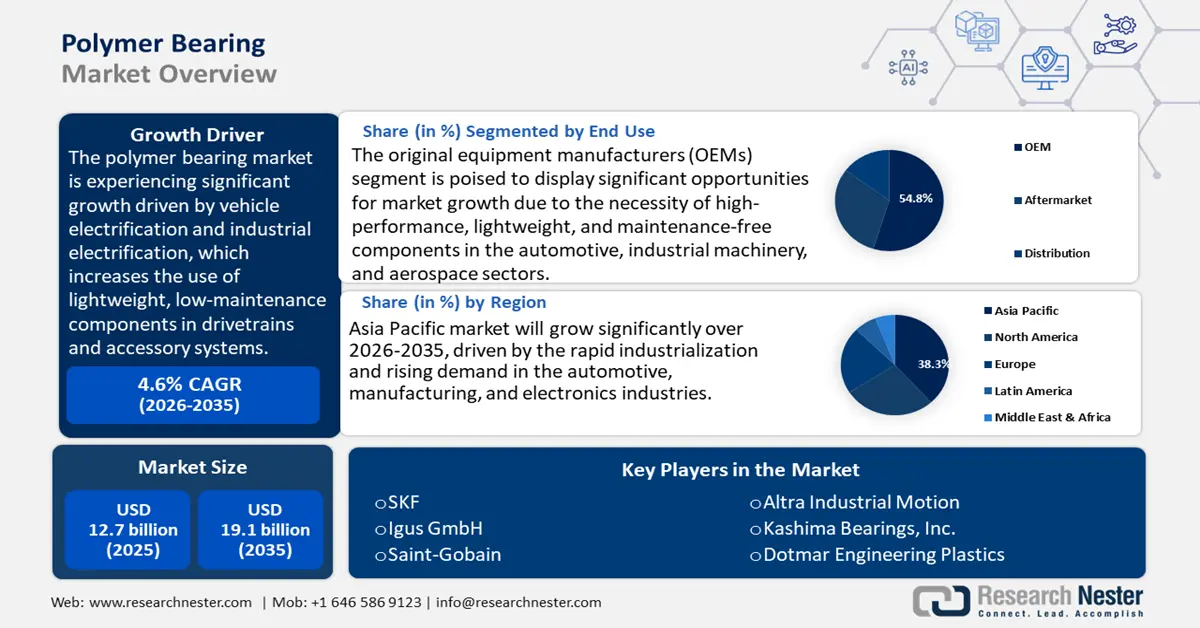

Polymer Bearing Market size was valued at USD 12.7 billion in 2025 and is projected to reach USD 19.1 billion by the end of 2035, rising at a CAGR of 4.6% during the forecast period, from 2026 to 2035. In 2026, the industry size of polymer bearing is assessed at USD 13.2 billion.

The polymer bearing market is expected to grow significantly over the projected years, primarily due to vehicle electrification and industrial electrification, which increases the use of lightweight, low-maintenance components in drivetrains and accessory systems. The plug-in and battery electric vehicle registrations are projected to grow to an estimated 18.7% share of light-duty vehicle sales in 2Q 2024. In addition, in 2023, the upstream resin and polymer industry providing engineered thermoplastics had an output worth about USD 109.7 billion. The broader material flows also reveal huge volumes of plastic generation (e.g., 35.7 million tons of plastics in U.S. municipal solid waste in 2018), reflecting a scale of feedstock availability and reuse flows that are relevant to polymer-component supply. Federal programs and funding also contribute to upstream materials development and circularity, such as Department of Energy efforts and National Laboratory projects that explore plastics upcycling and conversion solutions (upcoming awards in 2024-25) and the NSF-initiated specified sustainable-polymer requests (e.g., MFS-SPEED). Accelerating EV penetration, high output of the polymer industry, and focused investment in R&D to drive change that provides the measurable policy and demand foundation, thereby driving polymer bearing adoption in automotive and industrial markets.

There is an evolving focus on developing and expanding the manufacturing capacities of the engineered polymer bearing market. This is in the form of investment in pilots and large-scale production, in addition to downstream assembly of components. The OECD 2025 report states that the regulation of international plastic waste and scrap trade has increased with a decline in international trade volumes by 8% of the international trade volumes by 2022. There is an emerging long-term trend of sustainable practices in OECD countries, the export of waste in a responsible way, and the guarantee that there are better recycling and management of waste products in the destination countries. The trend indicates an advance in safer and less environmentally unfriendly trade of plastic in the world. The UN Comtrade has recorded trade in plastics over many years, giving monthly and annual breakdowns. This trend reflects progress toward safer, more environmentally conscious global plastic trade. The UN Comtrade has tracked the plastics trade for decades, providing detailed monthly and annual records.

The concentration of Australia's plastic supply is evident in its $6.7 billion worth of plastic imports in 2023, a dependency that exposes the market to potential volatility from global supply chain disruptions. U.S. Trade Remedies Authority data indicate $78.3 million in subject imports and $529.2 million in non-subject imports of finished mechanical products, revealing significant import competition in the bearing assembly market. On the macro-inflation front, the consumer price index (CPI-U) increased 2.7% between July 2024 and July 2025, giving a macro-inflationary backdrop to purchaser-side cost pressures. Direct federal-government investment in R&D and regional grant schemes such as the EDA Sustainable Polymers Tech Hub, around USD 51 million granted in 2024, is expected to fund pilot lines, workforce, and pilot-scale manufacturing that reduce time-to-assembly of specialty polymer components.

Key Polymer Bearing Market Insights Summary:

Regional Highlights:

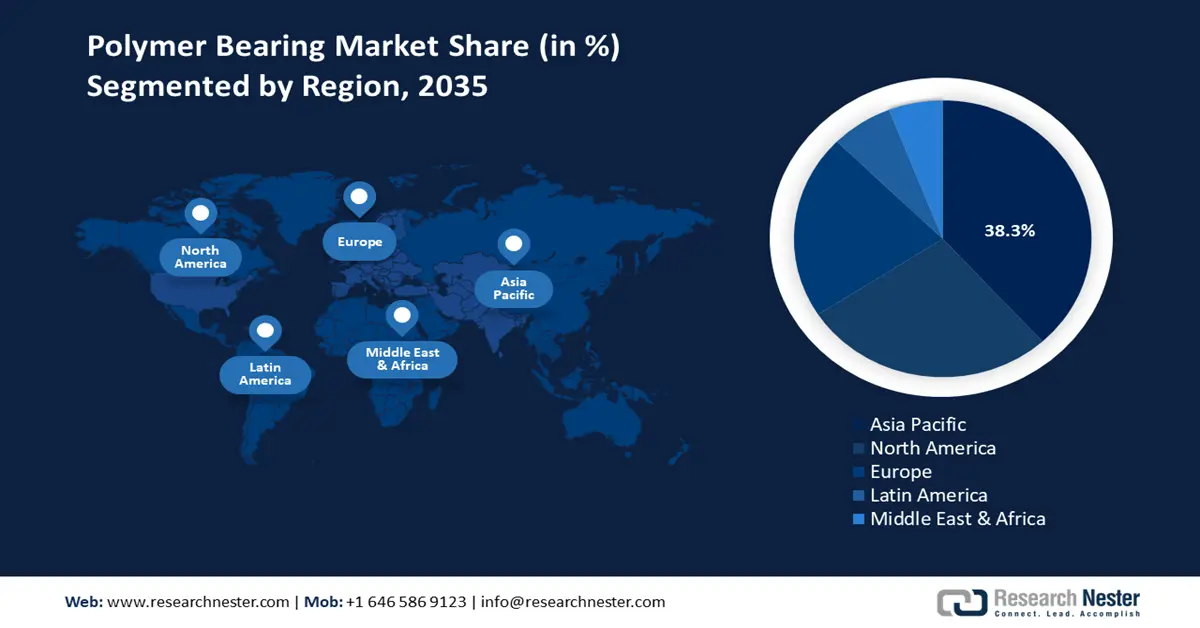

- The Asia Pacific polymer bearing market is forecast to hold the largest revenue share of 38.3% between 2026 and 2035, owing to rapid industrialization and surging demand across automotive, manufacturing, and electronics sectors.

- The North American market is projected to expand at a substantial rate of 27.5% from 2026 to 2035, underpinned by advancements in lightweight and corrosion-resistant materials driven by growing EV and renewable energy adoption.

Segment Insights:

- The original equipment manufacturers (OEMs) segment is projected to account for a dominant 54.8% revenue share in the polymer bearing market by 2035, propelled by the growing demand for lightweight, maintenance-free, and high-performance components across automotive, industrial machinery, and aerospace sectors.

- The automotive application segment is anticipated to capture a notable 38.4% share by 2035, fueled by the expanding adoption of polymer bearings in electric vehicles, lightweight drivetrains, and actuator systems.

Key Growth Trends:

- Chemical recycling & feedstock security

- Process innovation -catalytic and energy efficiency

Major Challenges:

- Pricing pressures of international trade relationship

- Environmental compliance costs

Key Players: SKF (Sweden), Igus GmbH (Germany), Saint-Gobain (France), Altra Industrial Motion (USA), Kashima Bearings, Inc. (Japan), Dotmar Engineering Plastics (Australia), Waukesha Bearings (USA), ISB Industries (Italy), BNL Ltd. (UK), Samsung C&T Corporation (South Korea), Polymer Products Sdn Bhd (Malaysia).

Global Polymer Bearing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.7 billion

- 2026 Market Size: USD 13.2 billion

- Projected Market Size: USD 19.1 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.3% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, Mexico, Indonesia, Vietnam

Last updated on : 3 September, 2025

Polymer Bearing Market - Growth Drivers and Challenges

Growth Drivers

- Chemical recycling & feedstock security: Chemical recycling has become a potential solution to ensuring long-term polymer feedstock security, especially in Europe and North America. European Commission notes that the EU produces approximately 25.8 million tons of plastic waste annually, with less than 30% waste being recycled. The investments in large-scale chemical recycling are estimated to increase dramatically, with announced plants expected to total more than 8 billion euros by 2030. This expansion of capacity will increase the supply security of high-performance polymers like PEEK and PTFE, which are effectively used in polymer bearings. The recycling of feedstock increases supply chain resilience by countering a reliance on unstable petrochemicals, stabilizing prices, and supporting EU recycling targets of 55% plastics packaging recycling by 2030.

- Process innovation -catalytic and energy efficiency: Innovations in catalytic and electrochemical processes are changing the way chemicals are produced, which is directly linked to the availability of polymer resins used in bearings. According to the U.S. Department of Energy, new catalysts and process innovations used in the manufacture of chemicals may result in approximately 10 to 20% energy efficiency improvements on major processes, including the production of ethylene and propylene. Such developments contribute to a higher conversion yield and less energy consumption that resulting in high energy and CO2 emissions savings to the chemical industry. The chemical sector's implementation of such technologies is a crucial pathway to greater manufacturing energy efficiency and environmental gains. Enhanced catalysts not only usher in lower greenhouse gas emissions but also translate into lower per-unit costs of production, which enables polymer manufacturers to put forth competitive prices of polymers. To illustrate, DOE pilot upgrading projects realize up to 15% energy savings in industrial-scale pilots. Such energy savings benefits drive sustainable growth in polymer bearings by reducing input costs, enabling the supply chain security, and supporting corporate net-zero goals. The cost savings have made polymer bearings a viable option on high-volume applications such as automotive, EV, and aerospace auxiliary systems.

- Vertically integrated OEM & procurement standards: Such OEM procurement strategies are already influencing polymer-bearing demand, and these are bound to increase as compliance and sustainability standards are tightened. The U.S. EPA Chemical Data Reporting (CDR) Rule requires manufacturers and importers to report production volumes and chemical-use information on a four-year basis on chemicals in excess of 25,000 pounds per site. These requirements compel the polymer-carrying suppliers to have traceability and disclosure capacities. The reporting requirements also mean an increase in operational expenses satisfied under REACH and REACH Candidate List (now more than 240 very high concern substances) by OEMs in the EU. Utilizing compliance readiness and low-risk chemistries allows companies to have a better likelihood of long-term OEM contracts. In the automotive and medical-device procurement sectors, this trend is exceptionally high due in large part to the direct relationship between supplier selection and contract value and compliance assurance.

Challenges

- Pricing pressures of international trade relationship: As polymer bearing manufacturers in the polymer bearing market have a high exposure to petrochemical and engineering polymers trade fluctuations, price-related cost structures are directly affected by the key players. According to the UNCTAD "Key Statistics and Trends in Trade Policy 2023" report, tariffs and trade restrictions remain significant barriers for various sectors, with developing regions facing higher tariff restrictiveness, particularly in South Asia and Africa. Non-tariff measures and trade defense actions continue to add to trade costs, impacting raw material availability and pricing globally. These trade barriers collectively increase operational expenses and pricing pressures across raw material-dependent industries worldwide. Suppliers who import experience sudden increases in costs, making them less competent when participating in the international tender process. Smaller companies do not have the financial cushion to counter such shifts and therefore, they can either transfer increased costs to the customers or leave the polymer bearing markets, limiting the supply flexibility and profit margins at a global level.

- Environmental compliance costs: High costs associated with compliance in operations among polymer-bearing exporters. According to the EPA, a Premanufacture Notice (PMN) submission can cost up to an estimated 37,000 dollars per submission, and further testing and documentation may be required. This imposes a significant financial stress on SMEs, particularly on those that are initiating new bearing materials that are based on fluoropolymer or nylon. In addition to the direct filing costs, there is also the loss in time-to-market due to the compliance procedures that take months to complete, and this is a concern in dynamic industries like the automotive and aerospace industries. This regulatory burden can be costly to many SMEs, curtailing innovation and product diversification.

Polymer Bearing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 12.7 billion |

|

Forecast Year Market Size (2035) |

USD 19.1 billion |

|

Regional Scope |

|

Polymer Bearing Market Segmentation:

End use Segment Analysis

The original equipment manufacturers (OEMs) segment is expected to grow with the largest revenue share of 54.8% in the polymer bearing market during the projected years by 2035, owing to the necessity of high-performance, lightweight, and maintenance-free components in the sectors of automotive, industrial machinery, and aerospace. In the U.S. Bureau of Economic Analysis, the real GDP rose by 2.1% in 2022 largely due to an improvement in non-residential fixed investment. In this, equipment investment, which was mainly the information processing equipment, enhanced the economy, supporting the manufacturing and other related sectors. The report indicates that there is a growth ratio of GDP by 9.2% to USD 25.46 trillion in 2022. Electric vehicle drivetrains and actuators add additional demand, as OEMs use high-quality, low-friction bearings to increase efficiency and vehicle range, driving the long-term polymer bearing market.

The trend in the adoption of polymer bearings is driven by the Automotive OEMs and the Industrial Machinery OEMs, as they seek out lightweight, high-deep bearing products to support their products. Automotive OEMs have implemented polymer bearings in EV driveline and transmissions, actuation systems, and often find an enhancement in weight and vibration performance, along with increased service life. It is estimated that the global EV stock increased to more than 20 million in 2023, which in turn creates demand for polymer bearings. Industrial Machinery OEMs apply these bearings in robots, conveyor systems, and precision equipment, as low-friction self-lubricating bearings add a high level of efficiency. The combination of these sub-segments should lead to the contribution of quality revenue during the year 2035 towards OEM polymer bearing.

Application Segment Analysis

Automotive application is expected to rise with a significant polymer bearing market share of 38.4% from 2026 to 2035, driven by the rising use in electric vehicles (EVs), lightweight drivetrains, and actuator systems. The International Energy Agency’s Global EV Outlook 2023 reports that electric car sales exceeded 10 million worldwide in 2022 and are expected to reach 14 million in 2023, a 35% increase year-on-year. Polymer bearings can substitute metal, giving less friction and lubrication-free use, and saving weight in vehicles. To complement the growing polymer bearing demand of 1.2B by automotive OEMs, high-performance polymers are being specified in transmissions, steering, and suspension. The European targets of CO2 reduction also boost the pace of polymer integration in a way that lightweight applications can achieve the 55% target by 2030.

EV drivetrain bearings are essential in the lightweight, devoid of lubricant transmissions and electric motor assemblies since they have to support high rotational velocities and minimize transmission of power. The U.S. Department of Energy, through the National Renewable Energy Laboratory (NREL), projects that electric vehicle (EV) adoption in the U.S. could reach between 30 million and 42 million EVs on the road by 2030, which will mean a significant uptrend in the number of polymers bearing applications in drivetrain systems. Interior and actuator bearings, such as those used with seats, doors, and window regulator systems, respond well to low-friction, self-lubricating plastics, improving durability and limiting maintenance. These two sub-segments will contribute the larger portion of automotive polymer bearing revenue due to increased EV adoption and OEM demand for lightweight and high-performance polymer parts.

Material Segment Analysis

The PEEK segment in the polymer bearing market is likely to grow at a steady pace, with a revenue share of 31.7% during the projected years, driven by its superior chemical resistance, high mechanical strength, and thermal stability. Automobiles. In automotive applications, EV drivetrains, aerospace, and industry machinery, the use of carbon-fiber reinforced PEEK is gaining ground, allowing high-load, high-temperature situations. PEEK demand reportedly grew significantly over the past five years to 29,000 tons in 2022. The low friction and durability of PEEK will cut maintenance expenses, increasing the life of machinery. By 2035, PEEK is likely to hold a substantial share of the polymer bearing market, driven by its use in high-value sectors such as aerospace, automotive, and industrial applications where performance and strength are crucial.

Our in-depth analysis of the polymer bearing market includes the following segments:

|

Segment |

Sub- Segments |

|

Material |

|

|

Type

|

|

|

Application |

|

|

End-use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polymer Bearing Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific polymer bearing market is anticipated to dominate the polymer bearing market with the largest revenue share of 38.3% from 2026 to 2035, owing to rapid industrialization and rising demand in the automotive, manufacturing, and electronics industries. The countries, such as China, Japan, India, South Korea, and Australia, are major contributors to this growth. Government policies like the National Circular Economy Roadmap in India seek to counter the use of plastic and bring sustainability in the sphere of the chemical industry. Additionally, the enforcement of regional cooperation is supported by the Asia-Pacific Economic Cooperation (APEC) in an effort to enhance the sustainability of the chemical sector. These initiatives are anticipated to make the region a favorable environment where the polymer bearing market is set to experience wider growth.

By 2035, China’s polymer bearing market is predicted to lead the region, due to considerable investments in the areas of sustainable chemical technologies. By 2024, China will have reached a carbon intensity reduction of 12%, representing significant efforts toward the carbon neutrality target. By early 2025, renewable energy capacity exceeded coal with 1,482 GW, with renewables supplying 36% of the power generation. Although clean energy is rapidly growing, coal retains its leading role, and overall emissions of China are expected to reach between 14.5 and 15.5 GtCO2e by 2030 based on present policy. The government expenditures in China in Polymer Bearing chemical technologies in 2023 witnessed a massive growth, and millions of new companies followed on the sustainability of chemical processes. This transition is a component of the Chinese effort to pursue greater environmental sustainability as well as a more efficient industry. The nation attracts investment, especially in electric cars and electric battery technologies, as it also leads in advanced industries.

The polymer bearing market in India is also striding forward with efforts such as the Gallium Arsenide Enabling Technology Centre (GAETEC) in Hyderabad. Investment in semiconductors and technologies such as Gallium Arsenide has been high in India, with its capabilities geared toward the enhancement of the chemical industry. By 2023, there were over 2 million workers in the Indian chemical industry, and it had a valuation of approximately USD 220 billion, as the emphasis on green chemistry and sustainability practices was built into the majority of the companies. The industry is supporting sustainability through bio-based feedstocks, renewable energy use, and dispersion of circular economy ideas and state policies, including the National Chemical Policy and schemes like the Responsible Care. This transformation represents that India has invested in becoming one of the world's centers for sustainably producing chemicals. Moreover, the National Circular Economy Roadmap to Reduce Plastic Waste in India will assess economic and policy implications of shifting towards a circular economy with plastics through input from industry, governments, and community members.

North America Market Insights

The North American polymer bearing market is anticipated to grow at a notable rate of 27.5% over the forecast period from 2026 to 2035. The U.S. polymer bearing market is the primary growth-driving factor because the country boasts of robust industrial and automotive industries that emphasize lightweight, corrosion-resistant bearing elements. The trend continues as more electric vehicles (EVs) and renewable energy equipment are sought. The U.S. Department of Energy (DOE) has directed USD 78 million to build chemical manufacturing towards a decarbonized future via programs and efforts such as the RAPID institute program. These investments optimize manufacturing operations and minimize emissions, which will have a beneficial influence on the supply and demand. In addition, the Environmental Protection Agency (EPA) announced the winners of the 2021 Green Chemistry Challenge Awards, recognizing innovative green chemistry technologies that reduce or eliminate hazardous substances.

In 2021, these technologies contributed to advancing sustainability by reducing toxic chemical exposure, preventing pollution at its source, and promoting more sustainable products in the polymer bearing market. Over the 25 years of the program, more than 128 technologies have been awarded, collectively reducing the use or generation of hundreds of millions of pounds of hazardous chemicals annually. The North American supply chain is characterized by the expansion of domestic production with strategic import levels of specialty engineering polymers used in the manufacturing of polymer bearings. The strong capital expenditure environment is available to firms due to government tax incentives and programs encouraging research and development efforts in modern materials, as well as manufacturing processes, as reported by the American Chemistry Council (ACC).

The U.S. polymer bearing market is expected to lead the North America region with the largest share during the forecast years. The chemical industry in the United States is a major pillar of the economy, as it earns the country an estimated amount of money in the order of 633 billion a year, comprising about 25% of the U.S. GDP. It is a major pillar of the economy, supporting a wide range of sectors and providing over 554k skilled, high-paying jobs. In 2023, the United States held the world’s largest stock of foreign direct investment (FDI), totaling USD 5.4 trillion, with a 29% increase since 2018. The chemical industry alone accounted for USD 767 billion of this FDI stock, representing 34% of all foreign investment in U.S. manufacturing, which one can view as a sign of its competitiveness in the polymer bearing market. It is a broad environment that has a wide product variety, including plastics, resins, and special chemicals that are in a broad industry as automotive, construction, and packaging. It is interesting to note that the U.S. chemical industry is the second-largest exporter of global chemical products. It is a strong performance that characterizes the industry since it is a key player in the contribution of innovation and economic progress.

Canada’s polymer bearing market is likely to grow at a significant rate over the projected years by 2035. The chemical manufacturing sector is a key contributor to the Canadian economy. The entire polymer bearing market of the nation in this area earned its owners USD 72.7 billion in 2023. Of the total number of people employed, direct jobs availed by the industry are around 90,800, with 454,000 jobs getting support in related industries. Ontario, Quebec, and Alberta are some of the key provinces in this industry and have major chemical manufacturing plants. In the year 2023 alone, Ontario has been contributing towards the chemical manufacturing revenue as opposed to its individual amount of generating USD 29.8 billion. The industry is fueled by the trends in industrial chemicals, and its outlook is between 2-7% growth in shipments by 2023. Such advancements testify to the fact that Canada is an innovation- and sustainability-driven country regarding the chemical sector. The strong capital expenditure environment is available to firms due to government tax incentives and encouraging research and development efforts in modern materials as well as manufacturing processes in the polymer bearing market.

Europe Market Insights

The European polymer bearing market is likely to account for a notable share of 21.3% during the projected years, attributed to the growing demand for lightweight, corrosion, and low-maintenance solutions that could be used across a variety of industries, such as automotive, aerospace, and industrial machinery. European Union efforts to remain sustainable and innovative are reflected in such initiatives of the European Union as the European Green Deal, which insists on making Europe the first climate-neutral continent by 2050. This policy framework is contributing to investments in eco-friendly technologies and processing units, which makes it more successful in this polymer bearing market. The Horizon Europe program also devoted a considerable amount of funds to research and innovation in sustainable materials, including polymers, and thus inspired new developments in bearing technologies. In the UK, there has been a realization of the strategic role of Advanced Materials, such as Gallium Arsenide (GaAs), in the advancement of technology in the country.

The GaAs is also mentioned in the National Semiconductor Strategy, published in May 2023, as an important material to produce components in radio frequency, lasers, sensors, or satellite applications. Global revenue in the semiconductor sector was USD 601.7 billion in 2022, representing a 100.6% increase from 2012, and is expected to grow at an aggregate annual growth rate of 6% to 8% by 2030. Germany has been a leader in the field of incorporating sustainability in the German chemical industry. In 2025, Germany earmarked nearly 3 billion US dollars to subsidize 15 industrial companies through climate protection contracts. These contracts aim to help industries reduce carbon emissions by covering additional costs for decarbonizing production processes over 15 years. The funding targets sectors including glass, ceramics, paper, pulp, and chemicals to cut about 17 million tons of CO2 emissions. This effort is in line with Germany realizing the goal of being climate-free by the year 2045, and to this end falls into the domain of such industries as chemicals used in such areas as polymer bearing.

Key Polymer Bearing Market Players:

- SKF (Sweden)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Igus GmbH (Germany)

- Saint-Gobain (France)

- Altra Industrial Motion (USA)

- Kashima Bearings, Inc. (Japan)

- Dotmar Engineering Plastics (Australia)

- Waukesha Bearings (USA)

- ISB Industries (Italy)

- BNL Ltd. (UK)

- Samsung C&T Corporation (South Korea)

- Polymer Products Sdn Bhd (Malaysia)

The polymer bearing market is well-competitive, divided into powerful Japanese, European, and American chemicals companies and manufacturers. Japan has a dominant share with NSK Ltd., NTN Corporation, OILES Corporation, and TOK, Inc. dominating the precision engineering and innovation polymer bearing market share, with more than 23% share. The companies deal with advanced polymer composites and high-performance bearings that serve the automotive and industrial areas. Innovative European bearing companies such as SKF and Igus have extensive sustainable bearing materials and distribution networks worldwide. U.S. businesses with a focus on R&D and achieve growth through acquiring strategic companies. New entrants in the polymer bearing market are Australian firms, South Korean firms, and Malaysian firms that offer niche-based polymer solutions. All these together push the technological superiority and the penetration in the region to satisfy the polymer bearing market growth globally.

Top Global Polymer Bearing Manufacturers in the Polymer Bearing Market:

Recent Developments

- In April 2025, HP announced significant developments in the set of additive manufacturing technologies applicable to polymer bearings. In their new 3D printing procedures, there is integrated laser surface texturing, which has significantly augmented the lifetime and wear resistance of polymeric bearings by 25 %. The innovation leads to greater levels of efficiency in production and durability in parts. The technology that HP uses is capable of prototyping and lightweight manufacturing at a faster pace, thus making it a great fit in challenging industries such as the automotive and aerospace industries. Multi Jet Fusion (MJF) technology can be used to create very detailed designs and customization, as well as offer a greater ability to reduce time to polymer bearing market, as it does not require as much conventional tooling. Such inventions have a tremendous influence on the scalability and sustainability of manufacturing the polymer bearings, one that gears the production toward future developments.

- In October 2024, Igus GmbH introduced iglidur JPF, a brand-new PTFE-free, lubrication-free plain bearing material. This material is as wear and performance-resistant as conventional PTFE bearing, with the added benefits of not using environmentally unsafe PFAS compounds. Developed as an active measure to the foreseeable PFAS ban in Europe, which is currently expected in 2026, igus has invested immensely in research and development to offer eco-friendly alternatives. Proving comparable friction and durability to existing products, in-house laboratory testing of iglidur JPF at igus proved it to be an effective, environmentally friendly alternative to traditional polymer bearings.

- Report ID: 8043

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polymer Bearing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.