Cyclic Olefin Copolymer Market Outlook:

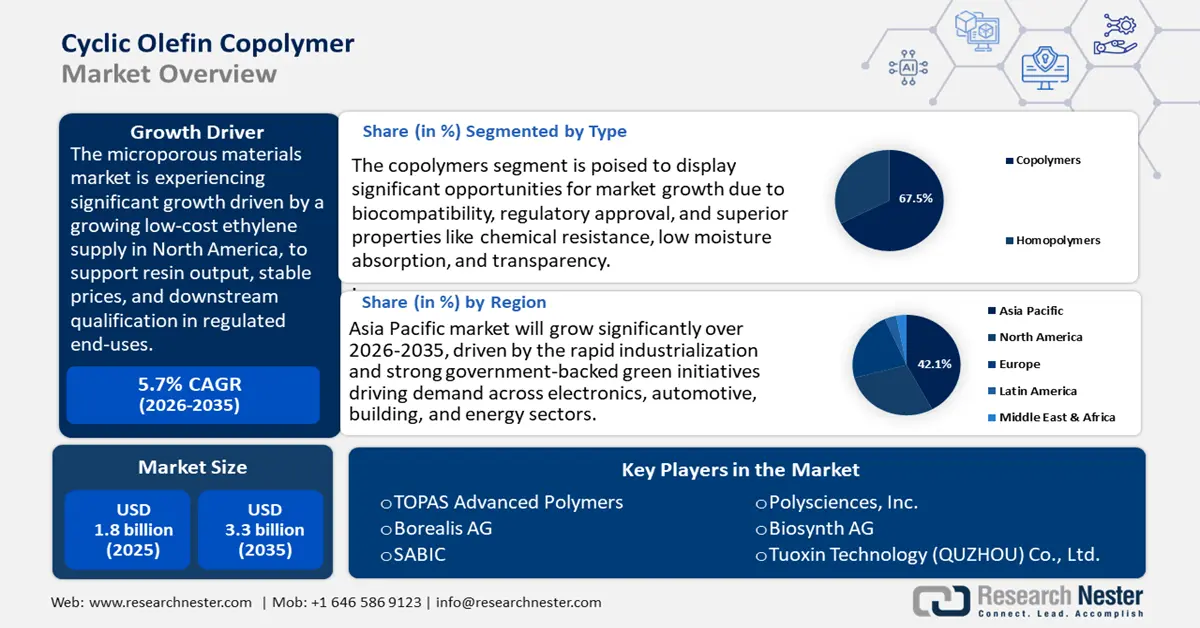

Cyclic Olefin Copolymer Market size was valued at USD 1.8 billion in 2025 and is projected to reach USD 3.3 billion by the end of 2035, rising at a CAGR of around 5.7% during the forecast period, from 2026 to 2035. In 2026, the industry size of cyclic olefin copolymer is estimated at USD 2.1 billion.

The cyclic olefin copolymer market is expected to expand significantly over the projected years, primarily driven by a growing low-cost ethylene supply in North America, to support resin output, stable prices, and downstream qualification in regulated end-uses, with U.S. ethane production and consumption at record levels. The U.S. Energy Information Administration (EIA) anticipates that ethane production and use will average approximately 2.8 million b/d in both 2024 and 2025, with net exports rising to 520,000 b/d in 2025, up 11% from 2023-2025. The BLS Producer Price Index of Plastics material and resin manufacturing (NAICS 325211) was at around 284.251 (Dec 1980=100) in July 2025, in the recent range and materially lower than 2022 levels, contributing to predictable sourcing and long-term contracts.

The supply chain of COC depends on the ethylene and specialty cyclic monomers (e.g., norbornene) with the help of U.S. cracker facilities and worldwide logistics. The atlas of facilities of EIA affirms a heavy Gulf Coast cracker footprint that enshrines domestic monomer availability. The trade statistics show that cross-border traffic involving the applicable tariff family, under the HS 390290 code (other polymers of propylene or other olefins, which is the category used by the majority of COC shipments), the United States imported approximately USD 143,061.75 million in 2023. On the export front, the United States was the biggest world exporter with a value of 628,490.84 million in 2023, then the European Union with 371.6 million. The broader U.S. plastics trade will also indicate a sustainable surplus of materials with FTA partners, which indicates its competitive domestic resin capacity to support COC formulations and off-the-shelf film/syringe components manufacture. To use in pricing comparison, the BLS PPI 325211 is usually monitored by buyers. When discussing market-facing costs, firms are more and more indexing to BLS import/export price indexes, which have been harmonized to Hs categories (expanded in 2025) and the PPI. On innovation spend, U.S. business R&D reached USD 892 billion in 2022, with an estimate of USD 940 billion in 2023, with manufacturing accounting for USD 372 billion.

Key Cyclic Olefin Copolymer Market Insights Summary:

Regional Highlights:

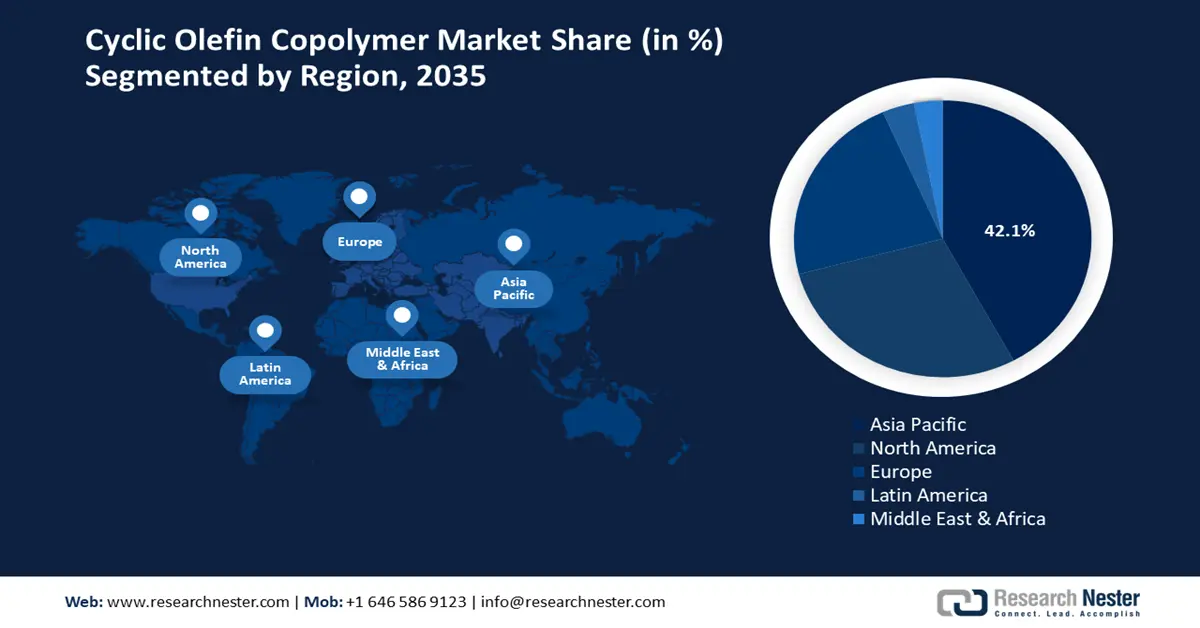

- Asia Pacific is projected to lead the cyclic olefin copolymer market with a 42.1% share during 2026–2035, driven by expanding applications in medical devices, electronics, and high-performance packaging supported by strong clean-technology and semiconductor investments.

- North America is expected to secure a 28.8% revenue share by 2035, owing to rising adoption of sustainable specialty polymers across healthcare and electronics sectors under federal decarbonization and green chemistry programs.

Segment Insights:

- The copolymers segment is projected to hold the largest 67.5% revenue share by 2035 in the cyclic olefin copolymer market, driven by its superior biocompatibility, purity, and compliance with global regulatory standards for medical and food-contact applications.

- The injection molding segment is expected to account for a 64.7% market share during 2026–2035, attributed to its precision, repeatability, and suitability for high-quality mass production of FDA- and ISO-compliant products.

Key Growth Trends:

- EU BPA food-contact ban

- Microplastics restriction (EU)

Major Challenges:

- Delayed chemical disaster safety standards (U.S.)

- Waste management/ reporting responsibilities

Key Players: TOPAS Advanced Polymers, Borealis AG, SABIC, Polysciences, Inc., Biosynth AG, Tuoxin Technology (QUZHOU) Co., Ltd., INEOS Group, Apex Techno Polymer Pvt. Ltd., Lotte Chemical

Global Cyclic Olefin Copolymer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.8 billion

- 2026 Market Size: USD 2.1 billion

- Projected Market Size: USD 3.3 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.1% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, France, United Kingdom, Australia

Last updated on : 5 September, 2025

Cyclic Olefin Copolymer Market - Growth Drivers and Challenges

Growth Drivers

- EU BPA food-contact ban: The European Commission drafted a ban on bisphenol A (BPA) in food-contact materials (FCMs) amid the 2023 reduction of the tolerable daily intake of BPA by the European Food Safety Authority (EFSA) by 120-fold (from 40 g/kg body weight down to 0.2 ng/kg). This tightening of regulations declares the absence of BPA in such merchandise as food packaging and beverage containers, and repeat-use dispensers, which are in the EU market. In the case of manufacturers, this compliance will mean replacement with polymers without BPA, and this creates a chance to use cyclic olefin copolymers (COCs) with clarity and other barrier properties, plus sterilization stability without BPA-based toxicological risks. The regulation may have a high demand in other resins like COC because the plastics packaging industry is worth over EU 370 billion in 2022, to be used in medicine and food delivery.

- Microplastics restriction (EU): The European Chemicals Agency (ECHA) has presently added the first restriction on manufactured microplastics, as mandated to intentionally add it to products in 2023 under REACH. The restriction has an impact on polymers expressed in product usage in industries, and categorically mandates phase bans, labels, and reporting on industrial, agricultural, and healthcare applications. Based on the impact assessment by ECHA, the rule will lead to a reduction of the emission of microplastics by approximately 500,000 tons of plastic in 20 years, and the compliance costs are estimated at 19 billion to 20 years for EU manufacturers and importers. Such regulation is driving the transition to higher stability polymers, lowered use of additives, and decreased chances of particle escape. Since COC is chemically resistant and more than other materials find use in thin-wall medical and optical processes, COC offers a less risky substitute material compatible with such developing limitations.

- Circularity targets & PCR demand: The Ellen MacArthur Foundation and UNEP’s 2023 Global Commitment Progress report highlights momentum in circular packaging. The proportion of post-consumer recycled (PCR) plastic packaging increased to 11.7% in 2022 (initialized by 10.0% in 2021), or to 26% in the global average, by 2025. Over 1,000 signatory companies, such as resin manufacturers, converting companies, and brand owners, are obliged to report on developments every 12 months, to align procurement with recycled and renewable-content requirements. In the case of specialty materials like COC, this translates to carbon inch and needs material in mono-patterns or multilayer geometries in films, diagnostic kits, and medical packaging that are easily separable. As governments also indicate a preference towards recyclable replenishment in procurement choice, the circularity drive is impacting the material specifications and may open billions in compliant demand for products under regulation in the regulated healthcare and consumer markets.

Challenges

- Delayed chemical disaster safety standards (U.S.): In March of 2025, the EPA halted the implementation of the revised Risk Management Program (RMP) rules that were to be attached so that stronger protection would be engaged in about 12,000 chemical facilities in the U.S. These are revisions which were completed in 2024, necessitating increased assessment of hazards, increased safer technologies and enhanced emergency planning. The lag has provided a lot of confusion in the minds of chemical producers, such as COC producers, who frequently decision can either invest on their part to ensure compliance or wait to see how long the delay can help them. The regulatory effects assessment by EPA revealed that the regulation would have incurred industry-wide compliance costs of USD 256.9 million (3% discount rate) and USD 296.9 million (7% discount rate) over 10 years. In the case of the COC suppliers, there is a lack of predictability in regulatory schedules to have time to invest in safer production infrastructure, and product launches are also delayed.

- Waste management/ reporting responsibilities: The EPA study of Chemical Management Services (CMS) highlights the unseen costs of chemical procurement/handling/compliance and waste disposal requirements. The agency established that businesses use USD 1 to USD 3 in both management and disposal of every dollar they spend on chemicals acquired. In the case of specialty polymers such as COC, it implies that the high-performance resins can face procurement hiccups, where their waste streams or handling are perceived to be expensive. Small and mid-sized companies that do not have specific compliance teams find these indirect costs especially difficult. Although CMS programs have an opportunity to minimize the costs of the life cycle by partnering with suppliers to recycle and/or implement safe collection of the advanced polymers, most parts of areas do not have the infrastructure to handle the safe collection and recycling of advanced polymers. With sustainability reporting becoming obligatory under EU-based regulation, as well as within the U.S., suppliers unable to provide avenues towards circularity may lose bids to cheaper or easier-to-manage materials.

Cyclic Olefin Copolymer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 1.8 billion |

|

Forecast Year Market Size (2035) |

USD 3.3 billion |

|

Regional Scope |

|

Cyclic Olefin Copolymer Market Segmentation:

Type Segment Analysis

The copolymers segment in the cyclic olefin copolymer market is projected to grow at the largest revenue share of 67.5% over the forecast years, as it is considered to be biocompatible and pure by most well-known official regulatory bodies, and this aspect has predisposed more people towards its use as compared to the homopolymers. For example, TOPAS Cyclic Olefin Copolymer (COC) is a high-performance, transparent polymer with excellent mechanical strength, chemical resistance, and low moisture absorption. It offers customizable heat deflection temperatures up to 170°C and is suitable for applications in food packaging, medical devices, and optical components. The material is biocompatible, sterilizable, and compliant with global regulatory standards. Its versatility allows processing by injection molding, extrusion, and blow molding. The unparalleled expertise of COC is payment in its exceptionally clear, chemically insensitive, and regulatory aptitude, which has made it the resin of choice in high-performance medical, diagnostic, and food-contact technologies.

Prefilled syringes are gaining speed in use worldwide, with the WHO approximating more than 16 billion injections each year and recommending increased use of safe auto-disable syringes with COC, which has excellent break resistance and clarity that makes it a desirable choice of material. Such need is supported by the increase in biologics with smaller extractables in OC in glass. Similarly, diagnostic cartridges, which are essential components in PCR and microfluidic equipment, grew swiftly during the pandemic, with the FDA approving over 400 Emergency Use Authorizations (EUAs) of COVID-19 diagnostic tests. Regulatory acceptance reflects itself in these applications; with projections anchoring the market share of copolymers projected to drive one-third of the market by 2035, driven by increasing levels of reliance on healthcare.

Processing Technique Segment Analysis

Injection molding is anticipated to grow with a substantial cyclic olefin copolymer market share of 64.7% from 2026 to 2035, owing to its use in the processing of COC, particularly in controlled, high-precision uses. A NIST perspective document confirms that cyclic olefin copolymer (COC) lends itself to mass-production measures such as injection molding due to its ability to facilitate consistent quality and dimensional accuracy required in diagnostics, optics, and medical equipment. Such official recognition provides the preeminence of this technique as it allows repeatability, tolerance control, and the adaptability to sterilization, all of which are essential with FDA/ISO-compliant products. Thus, injection molding is the dominant mode of production, which is expected to reach about USD 480.6 billion by 2035.

Medical syringes/cartridges and labware devices are the leading segment within the injection molding. The global number of safe injection device demands is increasing, and the WHO projected more than 16 billion injections in a year, focusing on the notable utility of medical syringes and cartridges, where the chemical inertness and break resistance outperform glass. Meanwhile, Labware devices, including pipettes, microplates, and diagnostic cassettes-use of precision labware-is now increasing dramatically, especially in molecular testing and high-throughput screening. The FDA established Emergency Use Authorizations (EUAs) as a mechanism to expedite the availability of medical products, including diagnostic tests, during the COVID-19 public health emergency. The EUA process allowed rapid evaluation and authorization of tests to address urgent needs, increasing diagnostic capacity and improving labware quality. A combination of these sub-segments solidifies injection molding as the dominant segment and is predicted to occupy a significant share of the COC processing revenues by 2035.

Application Segment Analysis

The medical and healthcare segment in the cyclic olefin copolymer market is likely to grow at a steady pace over the projected years by 2035, attributed to its clear approval in regulated use. The FDA’s final guidance on ISO 10993-1 emphasizes using this standard within a risk management process to evaluate the biocompatibility of medical device materials like such as polymers, COC. It supports ensuring safety for clinical contact by guiding risk assessment, testing, and documentation requirements in device submissions. The guidance helps sponsors address potential biological risks systematically for regulatory approval. Together with COC testing biocompatibility through its USP Class VI and the ISO 10993 (e.g., as in TOPAS FDA submissions), the capacity of the material to address stringent biocompatibility criteria supports its status as a leading material in medical devices.

Our in-depth analysis of the cyclic olefin copolymer market includes the following segments:

| Segment | Sub-Segment |

|

Type |

|

|

Product Format |

|

|

Processing Technique |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cyclic Olefin Copolymer Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is expected to dominate the global cyclic olefin copolymer market with the largest revenue share of 42.1% from 2026 to 2035, attributed to the increased applications in the medical device, electronics, and high-performance packaging. In addition, strong policy regimes have strengthened the region with strong investments in semiconductor and manufacturing, healthcare infrastructures, as well as the manufacture of clean chemicals. The strategies, like Japan’s Green Growth Strategy, goal of breaking the carbon halal by 2050 through a focus on clean technologies such as hydrogen and energy-efficient digital solutions, funded in part by a 2-trillion-yen Green Innovation Fund, to support the ongoing leadership in global trade uncertainties. In addition, South Korea is expected to expand its support package to boost the semiconductor business to 33 trillion won (approximately 23 billion dollars) in 2025, to prioritize low-cost lending, subsidies, and R&D.

Additionally, the Modern Manufacturing Initiative provides businesses with co-funding grants to a maximum amount of 20 million AED to align with domestic and international value chains in priority areas, which include medical products, critical minerals, and clean energy, to enhance innovation, manufacturing ability, and export volume. Further, the Asia Pacific electronic market, characterized by associations such as JEITA and SEAJ, remains a dominant force that consumes the polymer in areas such as optical clarity and thermal stability of semiconductor package-sourced materials. Asia Pacific is likely to continue to contend as the biggest producer of global COC demand by 2035, owing to the growth of the population and government-sponsored research into sustainable materials.

China’s cyclic olefin copolymer market stands as the largest country of cyclic olefin copolymer in the Asia Pacific, due to the modernization of the healthcare industry as well as the use of renewable energy sources as well and the booming olefin industry, coming up with the semiconductor industry. With over 44% of worldwide chemical production and a leading position in basic chemicals, China is still the world's top manufacturer of chemicals as of 2022. The country leads in capital investment, responsible for approximately 46% of global investment in chemicals, and is advancing in specialty and fine chemicals driven by innovation and government policies. The Made in China 2025 and the 14th Five-year Program on New Materials have clear provisions of high-performance polymers, especially in the field of medical technology, optics, and electronic casework. Additionally, in order to achieve the country's carbon-neutrality goals by 2060, the Ministry of Industry and Information Technology (MIIT) has put in place incentive programs pertaining to green and specialty chemicals. Such programs generate positive special spaces to expand COC, especially in the medical packaging, diagnostics, and semiconductor 5G materials, with China serving as a pillar of the growth of regional demands until 2035.

The cyclic olefin copolymer market in India is projected to grow with the fastest CAGR over the forecast years, due to growth in healthcare access, the production of pharmaceuticals, and the establishment of the chemical industry with the support of the government. With an approximate growth in the domestic and global markets, the Indian chemical sector contributes approximately 7% to the country's GDP, and with a valuation record of USD 178 billion in 2019 and USD 304 billion by 2025, the country's chemical industry takes action among the progressing market growth. Government programs, such as Make in India and Atmanirbhar Bharat, are likely to spur the industry towards further growth due to hefty investments and growing specialty chemical niches. The position of India over the rest of the world in the changing global supply chains is made possible by its strategic location, competitive cost, and attention to sustainability. PLI Scheme on Specialty Chemicals targets the domestic production of high-value materials and demand production of advanced polymers, and the production of COC in medical packaging, electronics.

Moreover, the National Policy on Electronics (NPE) highlights the domestic semiconductor packaging and optical materials that can use COC. India stands to experience the highest outlook of COC demand growth rates in the Asia Pacific by the year 2035, due to its increased level of R&D expenditures and a policy direction towards sustainable chemicals.

North America Market Insights

The North American cyclic olefin copolymer market is anticipated to grow with a substantial revenue share of 28.8% over the forecast years, primarily driven by a robust demand in the healthcare, electronics, and telecommunication industries in line with the federal sustainability plans in the region. The American Chemistry Council (ACC) reported that the North American chemical industry, including specialty polymers like cyclic olefin copolymer (COC), recorded shipments worth over USD 639 billion in 2022. This accounts for nearly 12% of the world's total chemical production by value. The industry supports more than half a million jobs, with considerable capital investments exceeding USD 26 billion in 2022 to expand capacity and promote sustainable manufacturing. The policies governing the environment also contribute: hundreds of millions of pounds of harmful chemicals are avoided every year by the Green Chemistry Challenge Program at the U.S. Environmental Protection Agency, and this is affecting the resin innovation toward more sustainable chemistries. Occupational Safety and Health Administration programs enforce worker safety and provide training grants totalling $11.79 million in FY 2022 to reinforce chemical-plant compliance. Together with energy-efficiency initiatives due to decarbonization initiatives by the Department of Energy for industrial sectors, North America can enjoy a consistent growth in developed polymer applications at a steady rate by 2035.

The U.S. cyclic olefin copolymer market is expected to lead the North American region during the projected years, owing to increased government expenditure and industrial policy in the country, which has propelled demand in advanced polymers, including the use of COC in optics, medical equipment, and telecom parts. Energy-intensive sectors like chemicals are explicitly funded through the $6.3 billion Industrial Demonstrations Program (2023) by the Department of Energy, which enables the manufacture to run more efficiently and produce reduced emissions. Simultaneously, the CHIPS and Science Act, which was designed by the National Institute of Standards and Technology (NIST), is informed by the provision of $50 billion for semiconductor manufacturing and packaging needs, creating the downstream requirement of low dielectric and optically clear polymers in chip carriers and photonics. The Safer Adoption of Chemicals is done under the Environmental Protection Programme’s Green Chemistry, which also encourages safer chemical use with award-winning technologies, reducing the hazardous use of chemicals by hundreds of millions of pounds per year. The U.S. remains committed to making exports of the polymer innovation in the world, with more than 639 billion shipments of chemicals in 2022 as a result of a combination of federal incentives and industrial capacity.

The cyclic olefin copolymer market in Canada is poised to grow remarkably within the region, owing to federally funded sustainability and innovation investments with advanced materials and clean manufacturing. In Budget 2023, the Canadian government has proposed a Clean Technology Manufacturing Investment Tax Credit, a 30% credit of investment in new machines and equipment that reimburses investments in local production of critical materials (e.g., polymers that are used in packaging, medical, electronics, etc.). The tax credit applies to property the taxpayer acquires between January 1, 2024, and the end of 2034, with a transition planned to start in 2032. Similarly, Net Zero Accelerator, which is being financed through the Strategic Innovation Fund, takes bids of CAD 8 billion of initiatives that optimize emissions in the industrial supply chain, which chemical and polymer manufacturers will also qualify for.

A refundable 30% Clean Technology Manufacturing Investment Tax Credit was introduced in the 2023 Canadian federal budget to promote domestic manufacture of clean technologies, such as polymers used in packaging purposes, as well as healthcare, and electronic sectors. It is also investing billions in clean electricity, critical minerals, and infrastructure to create a competitive, long-term clean economy. With these policies and the continued rise of demand in healthcare and inequalities with the North American electronic value chains, these measures are projected to raise the Canadian specialty polymer markets in a gradual way, until 2035, in terms of competitiveness in the production of advanced materials.

Europe Market Insights

The cyclic olefin copolymer market in Europe is likely to witness an upward trend during the projected years by 2023, due to the regulatory focus on sustainability, new applications of medicine, and the innovation of semiconductor packaging in the European market. In the case of the European chemical industry, it produced Euro 655 billion in 2022 of global chemical sales, describing how heavy the industry is within the global polymer supply chains. COC is required due to the growing life sciences market in the region, where first derivatives such as high-purity, clear polymers are required for diagnostic equipment and the packaging of sterile barriers. Large funding streams directly specified towards sustainable chemistry and advanced materials are found across EU-wide initiatives like Horizon Europe, which allocates up to 93.5 billion (2021-2027) to research and invention. In the same way, direct growth seen in the investments of the European Green Deal in the chemical sector boosted the necessity of using specialty polymers in industrial use with low-emission processes.

Using the funds available through UKRI of the Smart Sustainable Plastic Packaging (SSPP) challenge, which cost £60 million, unlocked more than £274 million in total investment on sustainable materials, including uses of COC in medical packaging. Germany’s Klimaschutzverträge (Carbon Contracts for Difference) initiative has awarded its first contracts to 15 industrial companies with a maximum funding volume of around €2.8 billion. These projects aim to decarbonize production processes, potentially saving up to 17 million tons of CO2 equivalents over the next 15 years. The program provides long-term planning security by offsetting additional costs and price risks for climate-friendly production, with a second bidding round planned to allocate a low double-digit billion euros to the development of clean polymer capabilities to enable new, high-performance uses, such as COC.

Key Cyclic Olefin Copolymer Market Players:

- TOPAS Advanced Polymers

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Borealis AG

- SABIC

- Polysciences, Inc.

- Biosynth AG

- Tuoxin Technology (QUZHOU) Co., Ltd.

- INEOS Group

- Apex Techno Polymer Pvt. Ltd.

- Lotte Chemical

The cyclic olefin copolymer market is highly consolidated, with the advanced technologies and market share under the control of the Japanese corporations, including Mitsui Chemicals, Polyplastics, Zeon Corporation, and Sumitomo Chemical. There are other European players, such as Borealis and SABIC, which are also dominant. U.S. presence is expected to be symbolized by the presence of such companies as Polysciences that focus on specialty polymers. Members of emerging Indian and South Korean players are growing by means of innovation and capacity additions. The strategic approaches of these players are capacity expansions, diversification of their product line, as well as investments in high-performance sustainable polymers. R&D activities center upon enhancing optical characteristics, chemical resistance, and biocompatibility to address the increasing demand in the pharmaceuticals, electronics, and automobile industries globally.

Top Global Cyclic Olefin Copolymer Manufacturers

Recent Developments

- In March 2025, Zeon Corporation completed the construction of its Cyclo Olefin Polymer (COP) recycling facility in its Takaoka plant in Japan. The new facility allows a high-quality recycled COP resin in terms of optical properties, which is applicable in the production of display films and in precision optical equipment. This innovation represents a significant step forward progressive development of the circular economy of specialty polymers, in terms of minimizing environmental footprint, as well as in terms of stability in supply. As the use of COP spreads to electronics and quality health care, the investment Zeon makes in technology will be able to back its competitiveness across the globe and provide the company with a top position in producing the COP most efficiently and sustainably possible.

- In January 2025, Mitsubishi Gas Chemical (MGC) announced the nomination of its OXYCAPT multilayer COP vial at Pharmapack 2025 in Paris and won the Packaging Innovation Award. The award was given due to the use of OXYCAPT by the company in storing drugs in cryogenic conditions and the use of advanced biopharmaceutical packaging where oxygen and UV barrier functionality is paramount. This awareness reflects the increasing significance of COP in pharmaceutical commercial uses in terms of increased demand for high-purity, lightweight packaging and break-resistant packaging. The innovation further reinforces MGC’s leadership in the healthcare-focused COP market.

- Report ID: 8064

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cyclic Olefin Copolymer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.