Lyophilized Injectable Drugs Market Outlook:

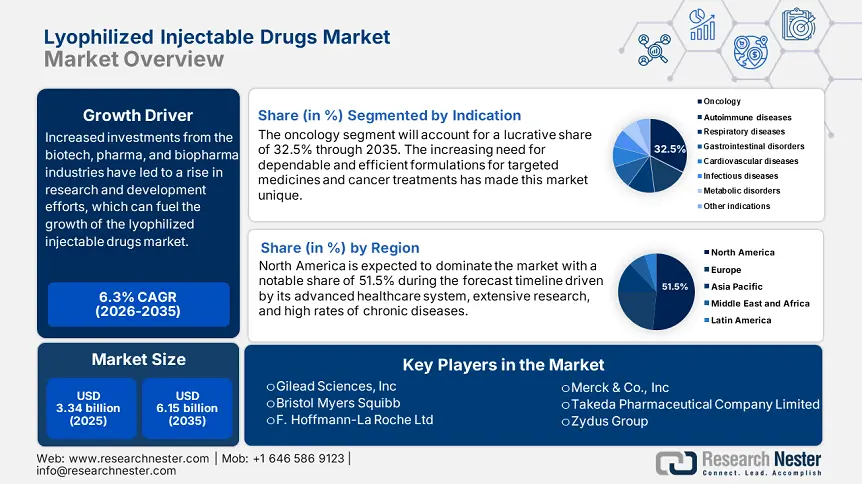

Lyophilized Injectable Drugs Market size was valued at USD 3.34 billion in 2025 and is likely to cross USD 6.15 billion by 2035, expanding at more than 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lyophilized injectable drugs is assessed at USD 3.53 billion.

The enhanced use of biosimilars represents the key growth opportunity in the lyophilized injectable drugs market. Furthermore, the strategic interest of the pharmaceutical industry in personalized medicine, typically involving sensitive and delicate drug molecules, requires the stability and precision provided by lyophilization. For instance, in February 2024, The FDA's annual report, Personalized Medicine: The Scope & Significance of Progress in 2023, detailed the advancements made by diagnostics and biopharmaceutical companies to commercialize novel tests and treatments. In addition, it revealed that 26 new tailored treatment approvals, 19 increased indications for already-approved personalized medications, and 12 diagnostic testing items with 17 important and expanded indications were examined.

Moreover, the increasing interest in cold chain logistics, developed with a purpose of ensuring guarantee for sensitive temperature biologics' integrity, justifies the value proposition of lyophilized products. For instance, in June 2024, Quantabio announced the launch of the eQo 1-Step ToughMix kit. It is bead-based, and available in eco-friendly format that is conveniently shipped, stored and set up at ambient temperature. The overlap of trends such as biosimilar uptake, patient-centric drug delivery, targeted therapy, and demanding cold chain protocols, all of them collectively ease the growth trajectory of the market.

Key Lyophilized Injectable Drugs Market Insights Summary:

Regional Highlights:

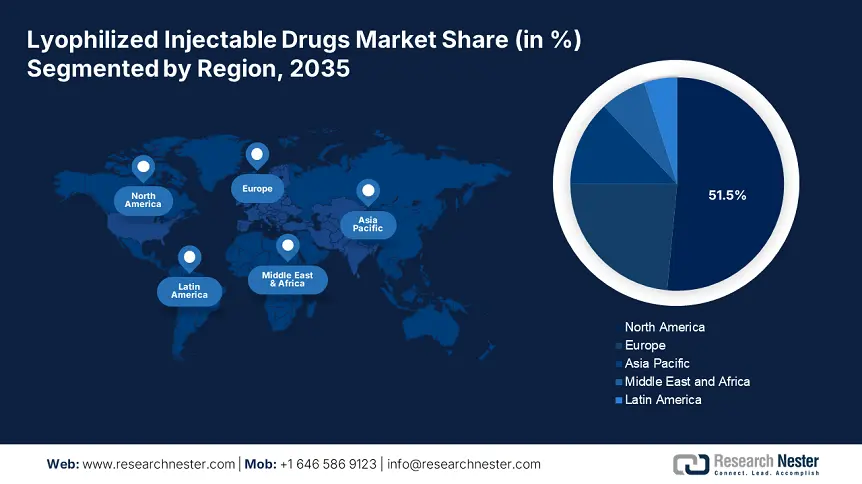

- North America dominates the Lyophilized Injectable Drugs Market with a 51.5% share, fueled by lucrative healthcare investments and availability of innovative drugs, supporting growth through 2035.

- APAC’s lyophilized injectable drugs market is projected to experience rapid growth by 2035, driven by increasing pharmaceutical industry adoption and advanced formulation methods.

Segment Insights:

- The Oncology segment is expected to achieve 32.5% market share by 2035, driven by increasing instances of various cancers worldwide and improved drug accessibility.

Key Growth Trends:

- Rising use of orphan drugs

- Increasing geriatric population with chronic illness

Major Challenges:

- Complex formulation and manufacturing process

- Re-constitutional challenges

- Key Players: Sanofi, Aurobindo Pharmaceuticals, Merck & Co., Inc, Zydus Group, Vetter Pharma, Johnson & Johnson Services, Inc., and more.

Global Lyophilized Injectable Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.34 billion

- 2026 Market Size: USD 3.53 billion

- Projected Market Size: USD 6.15 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (51.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Lyophilized Injectable Drugs Market Growth Drivers and Challenges:

Growth Drivers

-

Rising use of orphan drugs: The extensive usage and reliability over orphan drugs in treating disorders and the efficacy delivered by its formulations in rendering better patient care is fueling demand for lyophilized injectable drugs market. For instance, in December 2024, The US FDA has designated MicuRx Pharmaceutical's anti-infection medication MRX-5 as an Orphan Drug Designation (ODD) for the treatment of infections caused by non-tuberculous mycobacteria (NTM). A new benzoxazole antibiotic called MRX-5 was also created to treat mycobacteria infections, especially those brought on by non-tuberculous Mycobacteria (NTM).

-

Increasing geriatric population with chronic illness: A remarkable growth stimulant in the market is the growing aging population clubbed with the surging cases of chronic illness amongst them. For instance, in May 2024, Research from NCOA showed that 78.7% of persons 60 and older had two or more conditions, and 94.9% have at least one. In addition, as per the reports of National Institute on Aging in January 2023, approximately 85% of older adults have at least one chronic health condition, and 60% have at least two chronic conditions.

Challenges

-

Complex formulation and manufacturing process: One of the primary challenges in the lyophilized injectable drugs market is the intrinsic formulation complexity. Stringent sterility during the process is imperative, as lyophilized products are very prone to contamination. In addition, manipulation of sensitive biologics and other innovative molecules involves specialized expertise and sophisticated machinery, adding to manufacturing and logistics costs. This delicate ballet of variables highlights the importance of rigorous quality control measures and extensive process validation to guarantee the manufacture of safe and effective lyophilized injectable pharmaceuticals.

-

Re-constitutional challenges: Problems that occur due to reconstitution is the main impediment to the extensive utilization in the lyophilized injectable drugs market. The requirement for accuracy and specificity of reconstitution, frequently demanding the use of specialized diluents and method, is a potential for error that can interfere with drug effectiveness and jeopardize patient safety. Differences in methods of reconstitution, as well as the requirement for training experts among healthcare professionals and patients, contribute to logistics complexities. In addition, the threat of particulate generation on reconstitution requires high-quality control and engineered reconstitution procedures.

Lyophilized Injectable Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 3.34 billion |

|

Forecast Year Market Size (2035) |

USD 6.15 billion |

|

Regional Scope |

|

Lyophilized Injectable Drugs Market Segmentation:

Indication (Autoimmune diseases, Respiratory diseases, Gastrointestinal disorders Oncology, Cardiovascular diseases, Infectious diseases, Metabolic disorders)

Oncology segment is set to hold more than 32.5% lyophilized injectable drugs market share by 2035, owing to the increasing instances of variety of cancers across the globe. Moreover, the lyophilized solutions facilitate the potential to deliver the efficacy in treatment and structure precise dosing for patients. For instance, in February 2024, Fresenius Kabi declared the launch of Cyclophosphamide for Injection, USP, a generic version of Cytoxan that can be used to treat a variety of cancer types. It is the most recent addition to Fresenius Kabi's extensive line of generic oncology injectables, which contribute to the accessibility and affordability of cancer treatments.

Drug Type (Anti-infectives, Anti-neoplastics, Anticoagulants Hormones, Antiarrhythmics)

Based on the drug type, the anti-infective segment is rightfully spearheading the lyophilized injectable drugs market. It is due to their unmatched attributes of being antimicrobial and antibiotic agents. For instance, in February 2024, The Spanish State Research Agency's call Publico Private Collaboration projects have awarded a total of USD 9,72,415.7 to Affirma Biotech, the University of Barcelona, and IS Global as part of a consortium for the study of novel immunomodulatory treatments for bacterial infections of undetermined severity. In addition, the company was awarded a USD 270,250 CDTI-NEOTEC grant to develop its antiviral therapy prospects to explore the field of novel broad-spectrum anti-infective medications.

Our in-depth analysis of the global lyophilized injectable drugs market includes the following segments:

|

Drug Type |

|

|

Indication |

|

|

Type of Delivery |

|

|

Packaging |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lyophilized Injectable Drugs Market Regional Analysis:

North America Market Statistics

North America in lyophilized injectable drugs market is set to dominate over 51.5% revenue share by 2035, characterized by the lucrative investments in healthcare infrastructure in emerging nations within the region. Moreover, innovative drugs are becoming more widely available, meeting unmet medical requirements, and driving market expansion. Furthermore, the focus of authorities on improving healthcare facilities and distribution systems is likely to unfold remunerative growth. In addition, the region places greater dedication in emerging economies towards better patient care and healthcare advancement.

The landscape in the U.S. lyophilized injectable drugs market will witness a lucrative growth opportunities during the stipulated timeframe owing to the expansion in manufacturing capacities of the company. For instance, in February 2025, at a press conference in Washington, D.C., Eli Lilly and Company revealed plans to construct four new pharmaceutical manufacturing facilities in the US in order to increase its domestic medicine production across therapeutic categories. Since 2020, the corporation has committed to more than USD 50 billion in capital growth in the country.

In Canada the growth in the lyophilized injectable drugs market is developing rapidly owing to the continuous innovations and discoveries in development of the novel drugs to treat chronic illness. For instance, in January 2024., Revive Therapeutics Ltd. announced that it has finished the formulation development work of its next-generation lyophilized formulation of Bucillamine at the University of Waterloo. The therapeutic potential of bucillamine for the treatment of public health medical emergencies and medical countermeasure occurrences and attacks was unlocked by this development.

Asia Pacific Market Analysis

The Asia Pacific lyophilized injectable drugs market is revolutionizing at a rapid pace owing to the expanding use in the pharmaceutical industry. Specialized formulation methods, such as lyophilization, are necessary for biologics to increase stability and extend shelf life, which is a key driver of market expansion in the region. Furthermore, the move toward individualized medicine guaranteeing stability and efficacy in medication therapy is gaining traction, as the healthcare sector increasingly embraces individualized treatment approaches.

In India, the lyophilized injectable drugs market is developing at a fast pace attributed to the healthcare infrastructure development including facilities to promote the drug discoveries and advancement in treatment using state-of-the-art technology. For instance, in January 2025, Akums launched the state-of-the-art manufacturing facility for Lyophilized products. This factory uses cutting-edge technology and innovative procedures to create premium lyophilized (freeze-dried) products for a range of medicinal uses.

In China, the lyophilized injectable drugs market is witnessing substantial growth owing to the strategic investments by pharmaceutical giants aiming for the treatment efficacy and fostering in-house reliance for the therapeutic drugs. For instance, in March 2024, Novo Nordisk revealed plans to invest USD 556 million in an expansion project for sterile preparations at its Tianjin, China, site. To increase sterility and satisfy the growing demand for Novo's treatments, the new facility used the isolator technology. This project is anticipated to be finished by 2027, and increase the company's production capacity while promoting regional medication manufacture.

Key Lyophilized Injectable Drugs Market Players:

- Gilead Sciences, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bristol Myers Squibb

- F. Hoffmann-La Roche Ltd

- Cipla Limited

- Novo Nordisk A/S

- SFresenius SE & Co. KGaA (Fresenius Kabi)

- Sanofi

- Aurobindo Pharmaceuticals

- Merck & Co., Inc

- Zydus Group

- Vetter Pharma

- Johnson & Johnson Services, Inc

The presence of prominent players in the lyophilized injectable drugs market is transforming the landscape with their strategies to expand their portfolios and introduce the market with innovations, breakthroughs, and effectiveness. For instance, in February 2023, Thermo Fisher Scientific's Applied Biosystems division unveiled the TaqMan 2.5X Lyo-Ready 1-step qPCR Master Mix, which features an excipient, optimized, ready-to-use formulation for a lyophilization process.

Here's the list of some key players:

Recent Developments

- In March 2025, CARBOGEN AMCIS reported that its state-of-the-art sterile drug product manufacturing facility in Saint-Beauzire, France, successfully passed the first inspection by the French regulatory body, ANSM (Agence nationale de sécurité du médicament et des produits de santé).

- In August 2022, Accord Healthcare, Inc. introduced carmustine to its lineup of chemotherapy medications. It has been authorized to treat blood malignancies and several forms of brain tumors.

- Report ID: 7466

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lyophilized Injectable Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.