Low Carbon Building Market Outlook:

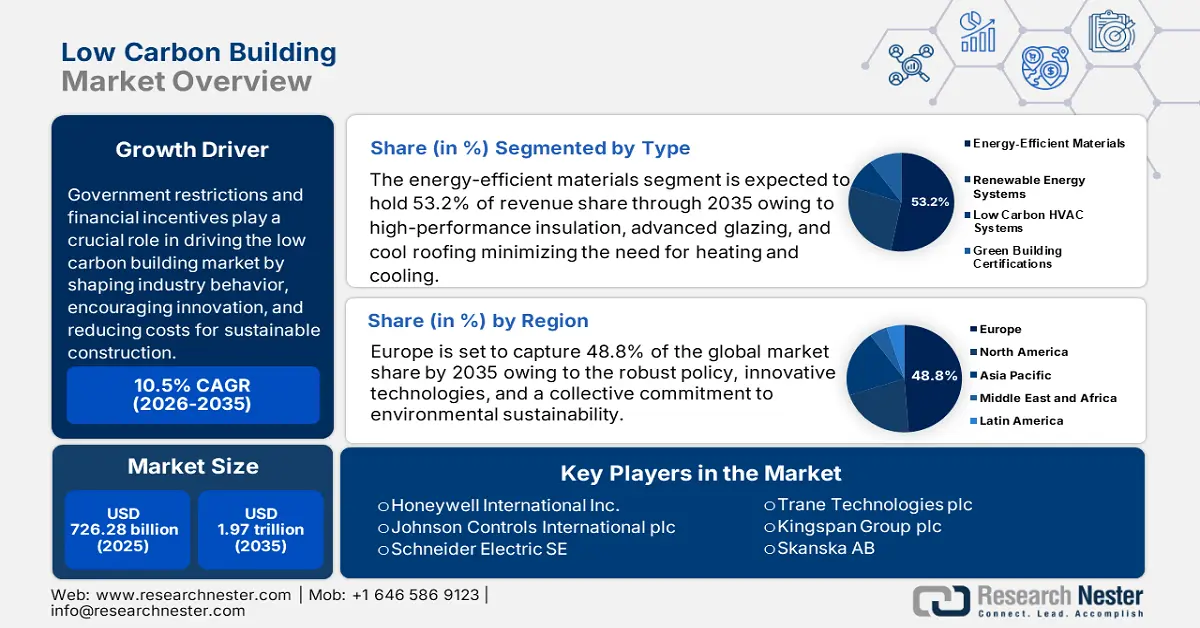

Low Carbon Building Market size was valued at USD 726.28 billion in 2025 and is expected to reach USD 1.97 trillion by 2035, registering around 10.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of low carbon building is evaluated at USD 794.91 billion.

Government restrictions and financial incentives play a crucial role in driving the low carbon building market by shaping industry behavior, encouraging innovation, and reducing costs for sustainable construction. Governments impose regulations to ensure buildings reduce carbon emissions. These may include building codes and energy efficiency standards such as LEED, BREEAM, and Passive House, mandating renewable energy use such as solar panels, forcing industries to adopt greener solutions, and banning high-carbon materials such as fossil-fuel-based heating. By enforcing stricter environmental standards, these regulations push developers and builders toward low carbon designs.

Further, governments offer financial support to make green buildings more attractive such as subsidies and tax credits, grants and funding, low-interest green financing for sustainable construction projects, and performance-based incentives where buildings exceeding efficiency targets get financial rewards. Tax credits in North America have significantly spurred the green building industry by making sustainable construction and retrofit more financially viable. For instance, homeowners in the U.S. can save up to USD 3,200 per year on taxes for energy-efficient upgrades. In addition to the energy efficiency credits, homeowners can take advantage of the modified and extended Residential Clean Energy credit, which provides a 30% income tax credit for clean energy equipment such as rooftop solar, wind energy, geothermal heat pumps, and battery storage through 2032, with a reduction to 22% in 2033 and 2034.

Sustainable Building Tax Credit (SBTC) Categories and Funding Amounts

|

Project Type |

Tax Credit Program Caps Per Calendar Year (in USD) |

Effective Year |

SBTC Qualification Requirement |

|

Energy Preserving Products |

2,900,000 |

2021 |

Products must meet Energy Star Certification or other specifications detailed in the application instructions and checklist |

|

New Residential Construction |

2,000,000 |

2022 |

The project must meet Build Green NM Gold or Emerald or LEED-H Gold or Platinum Certification |

|

New Commercial Construction |

1,000,000 |

2022 |

The project must meet the LEED Certification |

|

Manufactured Housing |

250,000 |

2022 |

The project must comply with the Energy Star Program |

|

Large Commercial Renovation |

1,000,000 |

2021 |

The project must be 50% better than ASHRAE Standard |

Source: EMNRD

Key Low Carbon Building Market Insights Summary:

Regional Highlights:

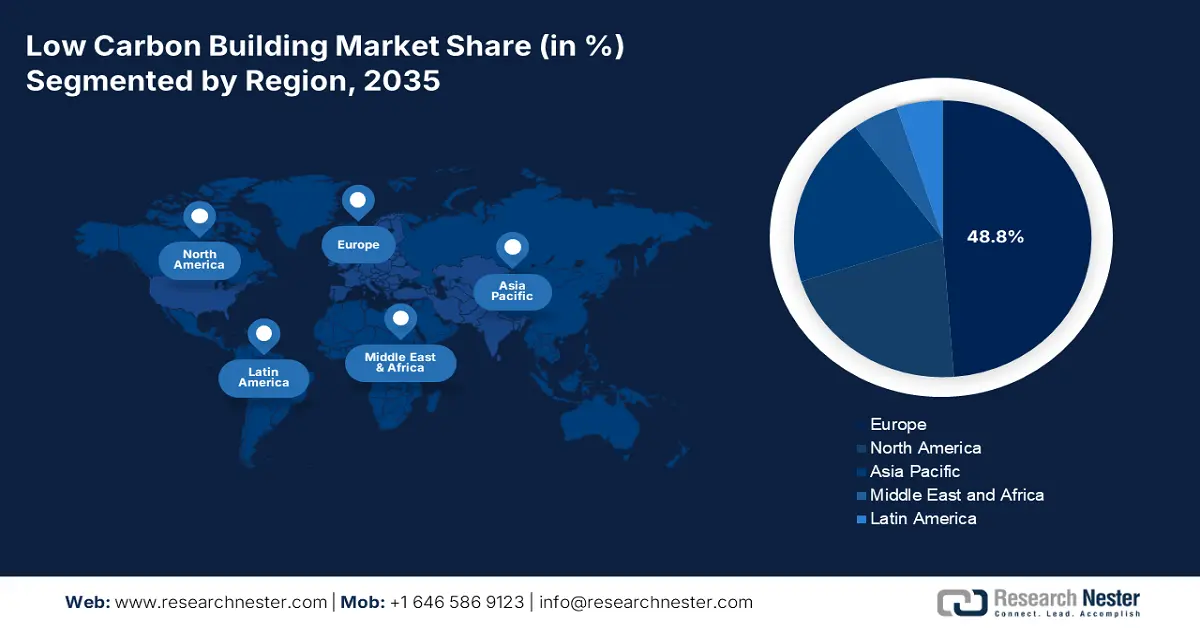

- Europe leads the Low Carbon Building Market with a 48.8% share, propelled by strong policy, sustainability goals, and innovative technologies, driving growth through 2035.

- North America's Low Carbon Building Market is set for significant growth by 2035, fueled by policy support, carbon-negative material innovation, and green building mandates.

Segment Insights:

- The energy-efficient materials segment is projected to achieve a 53.20% share from 2026 to 2035, driven by energy-efficient materials and increasing climate awareness.

Key Growth Trends:

- Advancements in construction technologies

- Rising awareness and concerns about climate change

Major Challenges:

- Financial and market barriers

- Supply chain limitations

- Key Players: Schneider Electric SE, Trane Technologies plc, Kingspan Group plc, Skanska AB, Lendlease Corporation Ltd, Aecon Group Inc..

Global Low Carbon Building Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 726.28 billion

- 2026 Market Size: USD 794.91 billion

- Projected Market Size: USD 1.97 trillion by 2035

- Growth Forecasts: 10.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (48.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, United Kingdom, France, China, United States

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 13 August, 2025

Low Carbon Building Market Growth Drivers and Challenges:

Growth Drivers

- Advancements in construction technologies: Reducing embodied carbon in materials with next-gen concrete innovations like carbon-capture concrete, geopolymer concrete, and bio-cement significantly lower CO2 emissions. Mass timers and alternative materials such as cross-laminated timers (CLT), hempcrete, and mycelium-based materials act as carbon sinks. Depending on the building design, a hybrid, mid-rise CLT commercial structure reduces global warming potential by 15-26%.

Moreover, optimizing the construction process in 3D printing and prefabrication reduces material waste, speeds up construction, and enhances efficiency. Modular construction uses factory-controlled environments to lower emissions and ensure sustainability. Most modular designs yield 2-22% emission reductions, with possible benefits varying by structural framing material and industrial location. - Rising awareness and concerns about climate change: As climate change becomes a pressing global issue, rising awareness and concerns are significantly driving the demand for low carbon building practices. Increased media coverage, scientific reports, and climate activism have made people more conscious of the environmental impact of buildings. Consumers and investors now prioritize sustainability, pushing developers to adopt eco-friendly construction methods. Climate risks such as extreme weather events such as floods, wildfires, and heatwaves are promoting cities to adopt climate-resilient, energy-efficient buildings. Green infrastructure that includes green roofs, rainwater harvesting, and passive cooling techniques is becoming a standard for urban development.

Additionally, many companies are adopting Environmental, Social, and Governance (ESG) policies, making sustainable buildings a priority for offices and retail spaces. Businesses are investing in carbon-neutral headquarters to align with global climate commitments. According to 75% of business leaders, ESG factors are either very important or relevant to their company's strategy. Initiatives for diversity, equity, and inclusion are essential, according to 9 out of 10 corporate leaders. In contrast to less than 1 in 5 investors in North America, nearly half of all European investors place a high priority on ESG. Climate-related data is included in the financial accounts of 54% of banks worldwide.

Challenges

- Financial and market barriers: Many consumers prioritize lower upfront costs over long-term energy savings, reducing demand for low carbon buildings. Lack of education on the benefits affects purchasing decisions. Carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, vary widely across regions, leading to uncertainty in cost projections. The lack of standardized carbon accounting methods makes it challenging for investors to compare low-carbon projects.

Addressing these financial and market barriers requires stronger policy support, innovative financing models, increased consumer awareness, and standardization in carbon pricing and valuation methods. Greater collaboration between governments, financial institutions, and the private sector can accelerate the transition toward a sustainable built environment. - Supply chain limitations: Many eco-friendly materials are not widely available and high demand with limited supply can lead to increased costs and project delays. Sourcing sustainable materials from distant locations increases transportation emissions. Local availability of green materials is often insufficient, reducing the overall carbon savings. Supply chain disruptions can cause delays, leading to increased costs and missed deadlines. Developers may hesitate to adopt low carbon materials if their availability is uncertain.

To overcome these challenges, investment in sustainable supply chains, local material production, and policy support is needed.

Low Carbon Building Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.5% |

|

Base Year Market Size (2025) |

USD 726.28 billion |

|

Forecast Year Market Size (2035) |

USD 1.97 trillion |

|

Regional Scope |

|

Low Carbon Building Market Segmentation:

Type (Energy-Efficient Materials, Renewable Energy Systems, Low Carbon HVAC Systems, Green Building Certifications)

In low carbon building market, energy-efficient materials segment is predicted to capture revenue share of over 53.2% by 2035. Energy-efficient materials like high-performance insulation, advanced glazing, and cool roofing minimize the need for heating and cooling, significantly reducing energy demand in buildings. Using sustainable materials such as recycled steel, bamboo, or low carbon concrete decreases embodied carbon emissions associated with material production, transportation, and installation. For instance, according to the American Institute of Steel Construction, structural steel produced in the U.S. contains approximately 93% recycled steel scrap on average. At the end of a building's life, 98% of all structural steel is recycled into new steel products, retaining all of its physical attributes. When steel goods reach the end of their useful life, 81% of them are recycled. This includes 85% of cars, 82% of appliances, 70% of containers, 72% of reinforcing bars, and 98% of structural steel. Steel is the most recycled resource in the world, with domestic mills recycling more than 70 million tons of scrap annually. Currently, structural steel contains 93% recycled content.

Additionally, some energy-efficient materials have a higher upfront cost, which reduces energy bills and maintenance costs, making buildings more economically sustainable in the long run. Further, as awareness of climate change grows, both investors and consumers prefer buildings with lower operational and embodied carbon, accelerating the adoption of energy-efficient materials.

Application (Commercial, Residential, and Industrial)

Based on the application, the commercial segment in low carbon building market will likely hold a noteworthy share by the end of 2035. The commercial segments significantly drive the market by increasing demand for energy-efficient, sustainable, and environmentally friendly buildings. Energy-efficient technologies like smart HVAC, LED lighting, and solar panels reduce operating expenses. Lower utility bills and maintenance costs create a strong business case for sustainable investments.

Further, demand for eco-friendly office spaces and retail outlets is growing. Sustainable buildings improve brand reputation and attract premium tenants. Smart building solutions, energy management systems, and carbon-tracking software enhance sustainability. The adoption of modular construction, green roofs, and low carbon materials such as mass timber and recycled steel is increasing. Moreover, the expansion of green urban infrastructure fosters growth in low carbon commercial real estate. Public-private partnerships support large-scale sustainable projects.

Our in-depth analysis of the global low carbon building market includes the following segments:

|

Type |

|

|

Application |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Low Carbon Building Market Regional Analysis:

Europe Market Analysis

Europe low carbon building market is likely to account for revenue share of more than 48.8% by the end of 2035. Europe’s low carbon building market is on an upward trajectory, propelled by robust policy, innovative technologies, and a collective commitment to environmental sustainability. The EUs ambitious plan aims to achieve climate neutrality by 2050, emphasizing the decarbonization of various sectors, including construction. This initiative promotes the use of sustainable materials and energy-efficient building practices.

Germany is home to pioneering projects like the Heliotrope in Freiburg, designed to produce more energy than it consumes. Such innovations showcase the potential for carbon-neutral building designs and set benchmarks for future developments. Moreover, companies like Low Carbon are expanding their presence in Germany, developing large-scale renewable energy projects. In April 2024, Low Carbon announced plans to develop over 400 MW of solar capacity in the country, with the first project expected to begin construction in 2025.

The UK government has implemented several policies to promote low carbon buildings. Notably, the Future Homes Standard, set to take effect in 2025, mandates that new homes produce 75-80% less carbon emissions than current standards. Additionally, the government has pledged USD 3.5 billion for the Warm Homes Plan, aiming to upgrade the energy efficiency of existing housing stock.

North America Market Analysis

The North America in low carbon building market is expected to grow significantly during the projected period. The market is poised for significant expansion, driven by supportive policies, technological innovations, and a growing emphasis on sustainability in the construction industry.

The U.S. Department of Housing and Urban Development (HUD) has invested over USD 1 billion to modernize affordable housing, focusing on energy efficiency and climate resilience. Moreover, the industry is witnessing a surge in technological innovations aimed at reducing the carbon footprint of building materials. Companies are developing carbon-negative materials, such as alternatives to traditional cement, which significantly lower greenhouse gas emissions.

The Canada Green Buildings Strategy (CGBS), introduced in July 2024, aims to decarbonize buildings nationwide by 2050. Key components include modernizing the Energy Efficiency Act, phasing out oil heating systems in new constructions by 2028, and promoting the adoption of heat pumps. Additionally, the Pan-Canadian Framework on Clean Growth and Climate Change emphasizes carbon pollution pricing and the development of net-zero energy-ready building codes by 2030.

Key Low Carbon Building Market Players:

- Siemens AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.

- Johnson Controls International plc

- Schneider Electric SE

- Trane Technologies plc

- Kingspan Group plc

- Skanska AB

- Lendlease Corporation Ltd

- Aecon Group Inc.

Key players are reshaping the low carbon building market through innovation, sustainable practices, and regulatory compliance. Their efforts reduce carbon footprints and create long-term economic and environmental benefits. Many companies secure green bonds and Environmental, Social, and Governance (ESG) funding to support sustainable projects.

Recent Developments

- In December 2024, Aecon Group Inc. announced a collaboration with Lafarge and CarbiCrete to test low-carbon concrete and cement-free concrete blocks, marking a significant step toward increasing sustainability in the construction industry.

- In July 2023, Kingspan Group plc (Kingspan), the global leader in advanced insulation and innovative building solutions, announced the acquisition of Troldtekt A/S, a maker of sustainably manufactured wood-based acoustic boards.

- Report ID: 7242

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Low Carbon Building Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.