Iron Ore Pellets Market Outlook:

Iron Ore Pellets Market size was over USD 58.72 billion in 2025 and is projected to reach USD 108.17 billion by 2035, growing at around 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of iron ore pellets is evaluated at USD 62.05 billion.

The iron ore pellets market is propelling due to the surging demand for steel production, particularly in emerging nations such as India and China. Steel demand and iron ore pellets are increasing as these regions prioritize industrialization, infrastructural development, and urbanization. For instance, in 2023, China's steel manufacturing capacity reached 1.173 billion tons, continuing its upward trend. This continues the upward trend in capacity and represents a 2% year-over-year increase from 2022. Also, from 1980 until 2024, India's steel production averaged 4134.40 thousand tons, peaking in March 2024 at 12700.00 thousand tons.

Steel is in high demand, particularly in developing nations where significant investments are made in railroads, energy projects, and highways. They also require alloy steel to grow their manufacturing sectors, especially for machinery and automobiles. Government programs to boost the economy also increase the need for steel by developing infrastructure and supporting local industries. The amount and forms of taxes, the amount and makeup of spending, and the amount and type of borrowing are all ways that governments affect the economy. The economy's usage of resources is influenced by governments both directly and indirectly.

Key Iron Ore Pellets Market Insights Summary:

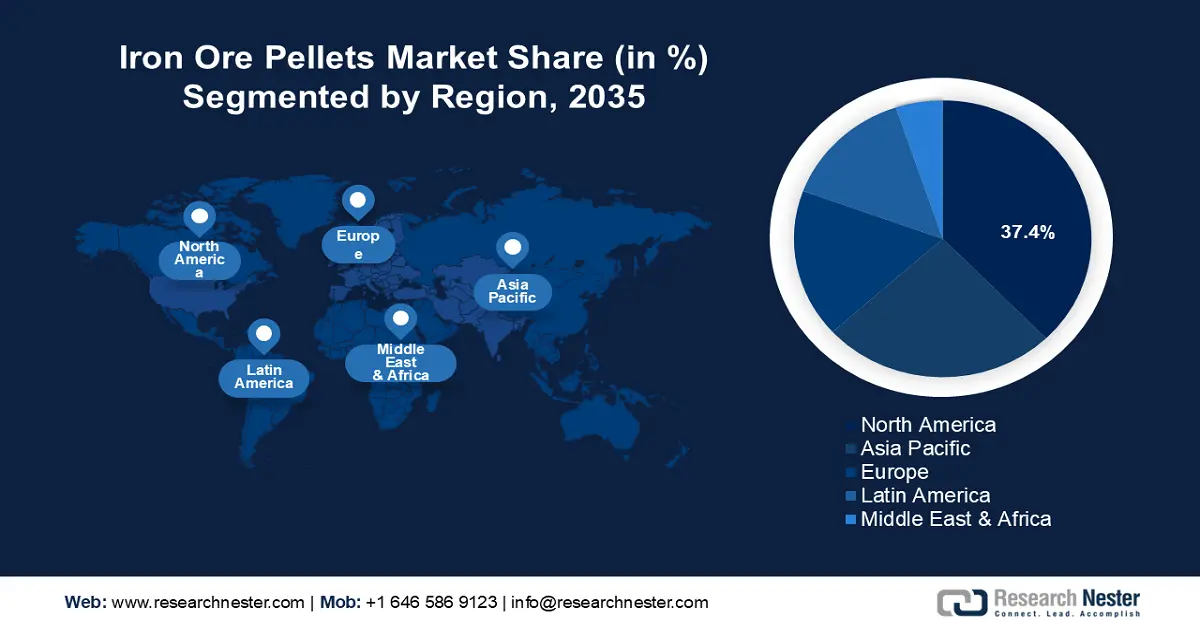

Regional Highlights:

- North America commands a 37.4% share in the iron ore pellets market, propelled by increased demand in construction through 2026–2035.

- Asia Pacific’s iron ore pellets market is poised for substantial growth by 2035, driven by rising crude steel production and investment in manufacturing sectors.

Segment Insights:

- The captive trade segment is predicted to hold over 61.7% market share by 2035, attributed to in-house pellet use by major steelmakers.

- The furnace grade pellets segment is projected for substantial growth from 2026-2035, due to the cost-effectiveness and wide use of blast furnace grade pellets in steelmaking.

Key Growth Trends:

- Increasing metal additive manufacturing

- Limited availability of high-grade lump ore

Major Challenges:

- Availability of alternatives

- Volatility in raw material prices

- Key Players: ArcelorMittal S.A., Bahrain Steel, Cleveland-Cliffs Inc., Ferrexpo PLC, JSW Group, LKAB, Metalloinvest MC LLC, Midrex Technologies, Inc., Rio Tinto Group, Samarco S.A.

Global Iron Ore Pellets Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 58.72 billion

- 2026 Market Size: USD 62.05 billion

- Projected Market Size: USD 108.17 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Canada, Brazil, Australia

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Iron Ore Pellets Market Growth Drivers and Challenges:

Growth Drivers

- Increasing metal additive manufacturing: Additive manufacturing (AM) has revolutionized the production of intricate components, particularly in the medical and aviation sectors. Its ability to create lighter parts, reduce resource consumption, and manufacture complex assemblies has led to rapid adoption. Among the various methods available, direct metal laser sintering and laser melting stand out as the leading techniques for producing metal components. These processes utilize a heat source to fuse powdered metal, enabling the creation of highly detailed and functional parts.

Notably, several companies are expanding their use of 3D printing to develop essential building materials and metals. A significant collaboration occurred in April 2024, when Materialise, a leader in metal 3D printing software and services, joined forces with Renishaw, an engineering technology firm, to enhance efficiency and productivity for businesses leveraging Renishaw's AM systems. Together, these advancements are driving innovation and capability in the additive manufacturing landscape. - Limited availability of high-grade lump ore: Reputable steel firms prefer to use iron ore pellets as blast furnace feed rather than lump ore since the pelletizing process generates less pollution than the sintering process used when utilizing lump ore. Technological developments in steelmaking have changed significantly due to tighter regulations governing sinter input due to related environmental concerns.

Consequently, the iron ore pelletizing process continues to experience numerous new advancements in the sector. Due to excessive mining activity, there is a shortage of lump ores of the right quality, which affects steelmakers and consumers. As a result, iron ore finds its ideal position in controlling the steel industry. Furthermore, due to their adaptability in forming the finished steel product, iron ore pellets have been used by various integrated and non-integrated steel makers. - Enhancements in logistics and transportation improvements: Lead times and expenses are greatly decreased when pellets are transported from production to steel mills using effective transport systems, such as upgraded rail networks and port infrastructure. To upgrade infrastructure and railway networks, governments are highly focusing on these developments. For instance, In June 2024, the government approved the development of a huge port in Vadhavan, Maharashtra, at an estimated cost of USD 9.14 billion. This project seeks to increase EXIM trade capacity and encourage public-private partnerships for infrastructure development. Also, The European Commission has chosen 134 transportation projects to receive EU funding totaling more than USD 7.40 billion from the Connecting Europe Facility (CEF), the EU's infrastructure investment mechanism.

Challenges

- Availability of alternatives: Using aluminum as a substitute for steel, primarily in automotive applications, is expected to reduce interest in steel, impacting the growth of the iron ore pellets market. Aluminum’s lightweight nature and strength are the primary reasons for its increased automobile use. This improves eco-friendliness and vehicle performance while assisting producers in adhering to the stringent criteria imposed by various regulatory organizations to ensure a safe and secure discharge.

- Volatility in raw material prices: Volatility of iron ore and associated raw material prices may impact the production costs and manufacturers' overall profitability. Unpredictably rising prices make it difficult for manufacturers to keep their prices competitive, which may cause consumers to seek more stable and predictable prices. Furthermore, these variations cause ambiguity in financial planning and budgeting, which hinders businesses' ability to make wise investment choices. This may impede the iron ore pellets market from expanding.

Iron Ore Pellets Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 58.72 billion |

|

Forecast Year Market Size (2035) |

USD 108.17 billion |

|

Regional Scope |

|

Iron Ore Pellets Market Segmentation:

Product (Blast Furnace Grade Pellets, Direct Reduced Grade Pellets)

Blast furnace grade pellets segment is expected to hold more than 56.6% iron ore pellets market share by 2035. Since it is more affordable than the conventional direct reduction grades (DR), the market is expanding. Because of their adaptable design and speedy transition to large-scale manufacturing, they are widely utilized in the steelmaking process. In the blast furnace phase of steel manufacture, these pellets serve as calibration lumps or sinter substitutes.

The direct reduced-grade pellets segment is anticipated to hold a substantial share during the projected period. DR is one remarkable natural material used in the production of steel. Steel made from direct reduced iron can be used for various purposes, such as drawing tools, fashioning bars, thin wire, plates, and consistent cylinders. Also, the DR-grade pellets industry is changing due to environmental concerns. To reduce their carbon footprint, producers are investing in more environmentally friendly technologies.

Trade (Captive, Seaborne)

By the end of 2035, captive trade segment is predicted to capture around 61.7% iron ore pellets market share. Iron ore pellets are either transferred to neighboring clients for use in steel production or used internally. Most of the world's largest steel corporations, such as ArcelorMittal, which make a substantial contribution to the world's steel output, get their iron ore pellets from their production plants.

The seaborne trade segment is estimated to gain a significant iron ore pellets market share by 2035. The segment is expanding due to the increased demand for iron ore pellets from non-integrated steel producers. The extent of the seaborne trade is mostly determined by the price of iron ore pellets in different geographical areas.

Our in-depth analysis of the global iron ore pellets market includes the following segments:

|

Product |

|

|

Trade |

|

|

Balling Technology |

|

|

Application |

|

|

Steelmaking Technology |

|

|

Product Source |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Iron Ore Pellets Market Regional Analysis:

North America Market Statistics

North America in iron ore pellets market is expected to capture around 37.4% revenue share by the end of 2035. The market is growing due to the increased demand for iron pellets in the construction, aerospace, defense, and automotive industries. Also, the region's increasing production of electric vehicles (EVs) and the resurgence of aircraft manufacturing industries will contribute to the need for steel.

In the U.S., the growing steel production is influenced by the increasing need for more environmentally friendly manufacturing techniques. This shift is evident in the actions of 1,674 manufacturing facilities that launched over 3,400 pollution reduction initiatives in 2022, as reported by the U.S. Environmental Protection Agency. These initiatives aim to minimize the use of TRI chemicals and reduce waste, reflecting a commitment to sustainable practices in the industry. Only 5% of the trash produced by the manufacturing sector was discharged into the environment; the remainder was handled by recycling, energy recovery, and treatment.

Canada is increasingly investing in its industrial capacity and infrastructure, meeting the growing demands of the steel manufacturing industry. Also, the use of iron ore pellets in DRI manufacturing is further supported by Canada's dedication to green technologies and ecologically friendly production practices.

APAC Market Analysis

Asia Pacific will encounter huge growth in the iron ore pellets market during the forecast period. The existence of growing nations like China, India, and Vietnam, which have a sizable crude steel production industry and are seeing rising investment in the manufacturing sector along with other end-use industries, is responsible for the expansion of the regional iron ore pellets market.

To align with China's green and sustainable development goals, the iron ore pellets aid in lowering blast furnace energy consumption and greenhouse gas emissions. For instance, China declared in 2020 that it would aim to reach carbon neutrality by 2060 and reduce carbon dioxide levels by 2030. Furthermore, due to the increased cost-effectiveness and efficiency achieved through advancements in palletization technology, mining corporations in India have significantly ramped up their investments in the production of iron ore pellets.

In South Korea, iron ore pellet sales are rising due to the expanding infrastructure initiatives, resulting in increased steel demand. Negative government regulations of sintering operations are increasing the nation's iron ore pellets market worth. Several initiatives to lower emissions from the steel sector have been announced by the South Korean government. The country set a goal to reduce emissions by 2.3% below 2018 levels by 2030 as part of its updated 2030 Nationally Determined Contribution (NDC).

Key Iron Ore Pellets Market Players:

- ArcelorMittal S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bahrain Steel

- Cleveland-Cliffs Inc.

- Ferrexpo PLC

- JSW Group

- LKAB

- Metalloinvest MC LLC

- Midrex Technologies, Inc.

- Rio Tinto Group

The iron ore pellets market has been marked by fierce competition, with a few significant industry players controlling a sizeable portion. Multinational corporations that possess well-established iron ore mines and processing facilities control a major portion of the market, making it challenging for new competitors to enter. Major competitors compete mostly based on price and quality and concentrate on long-term agreements with steel manufacturers.

Recent Developments

- In September 2024, Vale and Midrex Technologies, Inc. agreed to collaborate on developing a technical solution for the use of iron ore briquettes in direct reduction plants. Executives from the two firms met at the Midrex Research & Technology Development Center and signed a Technical Cooperation Agreement, sharing a goal for steelmaking decarbonization.

- In January 2022, Bahrain Steel BSC, a top global producer and supplier of high-quality steel produced a record 12 million tons of iron-ore pellets in 2021. The Company's increased output contributes to the transition to carbon neutrality, which requires a major rise in the use of pellets for efficient, clean, and sustainable steel production globally.

- Report ID: 6807

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Iron Ore Pellets Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.