Drug Testing Equipment Market Outlook:

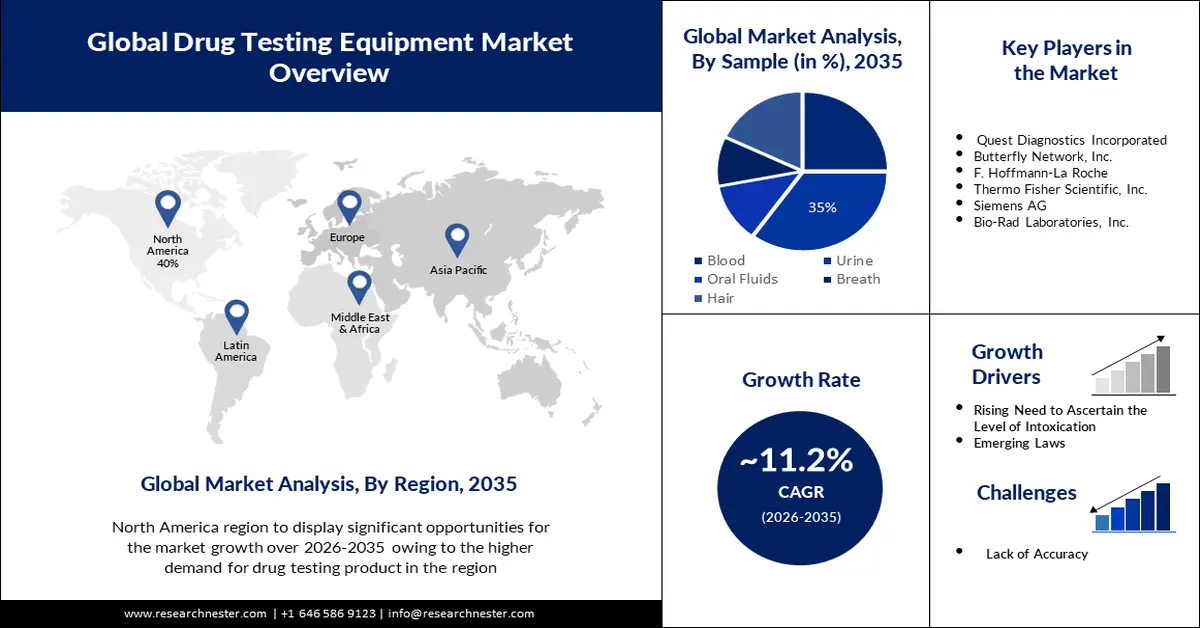

Drug Testing Equipment Market size was over USD 8.82 billion in 2025 and is poised to exceed USD 25.5 billion by 2035, growing at over 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of drug testing equipment is evaluated at USD 9.71 billion.

The growing usage of intoxicants and controlled substances and the rising misuse of prescribed medicines have emerged in the need to ascertain the level of intoxication in the body at any given point in time, which is elevating the market growth.

The increasing concern about the rising consumption of drugs by the young population which is leading to the mental crisis and surging crime rates in many countries of the world is thriving in the use of prevention tools such as drug testing. According to the National Center for Drug Abuse Statistics of 2023, youth drug abuse has now become a public health concern in America. In the year 2022, nearly 1-in-8 teenagers used prohibited drugs. Moreover, every year more than 1.16 million prisoners commit some drug-related offense and are arrested.

Key Drug Testing Equipment Market Insights Summary:

Regional Highlights:

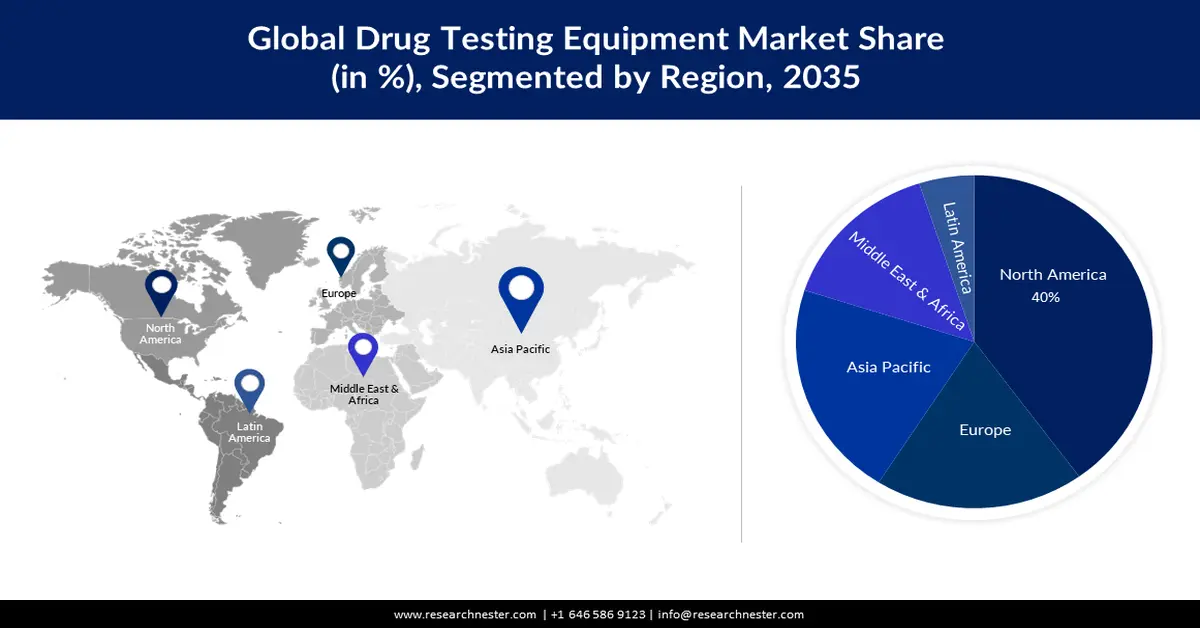

- The North America drug testing equipment market is forecast to secure nearly 40% share by 2035, reinforced by the strong presence of industry players promoting drug screening and the heightened concern over escalating drug abuse in the region.

- Asia Pacific is projected to expand at a 21% growth rate through 2035, supported by rising substance abuse cases, increasing drug-trafficking activities, and stringent regulatory frameworks across South-East Asian countries.

Segment Insights:

- The urine segment in the drug testing equipment market is anticipated to achieve about 35% share by 2035, bolstered by its widespread use as a cost-effective and non-invasive method for rapid detection of illegal drug consumption.

- The hair segment is expected to observe notable revenue growth by 2035, propelled by its rising adoption as a minimally invasive testing method offering an extended detection window of up to 90 days.

Key Growth Trends:

- Stringent Regulations of Sports Association

- Collaborations & Innovations in Testing Technology

Major Challenges:

- Emerging Policies & Ban on Testing of Drugs

- Lack of Accuracy in Many Cases

Key Players: Sandoz International GmbH, Quest Diagnostics Incorporated, Butterfly Network, Inc., F. Hoffmann-La Roche, Thermo Fisher Scientific, Inc., Siemens AG, Bio-Rad Laboratories, Inc., Cordant Health Solutions, Legacy Medical Services, LLC, Omega Laboratories, Inc., GE Healthcare.

Global Drug Testing Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.82 billion

- 2026 Market Size: USD 9.71 billion

- Projected Market Size: USD 25.5 billion by 2035

- Growth Forecasts: 11.2%

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Japan, Germany

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, United Arab Emirates

Last updated on : 20 November, 2025

Drug Testing Equipment Market - Growth Drivers and Challenges

Growth Drivers

-

Stringent Regulations of Sports Association – The adoption of several programs that are designed to detect the use of banned substances and strict drug testing for illegal drug abuse by athletes worldwide during the sports session is anticipated to propel the market growth. Sports organizations such as the International Olympic Committee (IOC), the International Sports Federation (ISF), and others have made drug testing mandatory for participants before participating in a sporting event.

-

Collaborations & Innovations in Testing Technology – The tangible benefits of collaborations include reduced medical errors, medication errors, and redundant tests, as well as innovative brainstorming, faster patient throughput, and improved provider satisfaction that come with a democratized and collegial care process. Intoximeters, Inc. with Abbott Healthcare Private Limited agreed to market SoToxa Mobile Test System of Abbott together with Alco-Sensor brand breath alcohol-testing products of Intoximeters. SoToxa is a handheld oral fluid testing solution that will be used to detect drug use.

-

Emerging Laws – As per the Biden-Harris Administration’s Unity Agenda, around USD 3.8 billion has been invested through the American Rescue Plan by the administration to address the mental health crisis and drug overdose plague in the United States.

Challenges

-

Emerging Policies & Ban on Testing of Drugs - Drug testing in some places (particularly the workplace) is regarded as a violation of employee privacy, which is expected to impede market growth. The drug consumption ban in certain areas, as well as accuracy issues, are expected to pose challenges to the drug screening market.

-

Lack of Accuracy in Many Cases

-

Slower Penetration Due to Privacy Concerns

Drug Testing Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 8.82 billion |

|

Forecast Year Market Size (2035) |

USD 25.5 billion |

|

Regional Scope |

|

Drug Testing Equipment Market Segmentation:

Sample (Blood, Urine, Oral Fluids, Breath, Hair)

The urine segment in the drug testing equipment market is expected to garner the largest revenue share of 35% by the year 2035 due to the growing use and trade of illegal and banned drugs such as opioids. Urine drug tests are majorly used to detect the positivity of substance abuse which is a cost-effective and non-invasive method that aids in the rapid detection of drug intake.

Moreover, the hair segment is further foreseen to witness to bring in notable revenue owing to its rapid adoption as is the least invasive method and this testing provides an extended detection window of about 90 days.

End User (Personal Users, Hospitals, Workplace & Schools, Criminal Justice Systems and Law Enforcement Agencies, Drug Testing Laboratories, Drug Treatment Centers, and Pain Management Centers)

Drug testing equipment market from the workplace & school segment will hold a significant growth rate in the upcoming years. With the changing organizational policies and the growing percentage of jobs requiring background verification for accessing workplace employment eligibility, the adoption of pre-employment drug tests is increasing. This will lead the segment to rise.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Sample |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Drug Testing Equipment Market - Regional Analysis

North American Market Forecast

North America industry is anticipated to account for largest revenue share of 40% by 2035, The existence of giant players in the industry encouraging drug screening in the region with the increasing concern of augmenting drug abuse in countries such as the United States and the growing implementation of strict norms to vigorously tackle the drug problem. As per recent data from 2023, Americans constitute 12% of global drug users.

APAC Market Statistics

The Asia Pacific drug testing equipment market is estimated to register a growth rate of 21% through 2035. The growing use of substance abuse in the region and the rising prevalence of drug trafficking and the adoption of concealment methods and cross-border operations in South-East Asia specifically in Myanmar, Thailand, and Vietnam is leading to the stringent regulatory frameworks which is resulting in the expansion of drug testing equipment demand.

Drug Testing Equipment Market Players:

- Sandoz International GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Quest Diagnostics Incorporated

- Butterfly Network, Inc.

- F. Hoffmann-La Roche

- Thermo Fisher Scientific, Inc.

- Siemens AG

- Bio-Rad Laboratories, Inc.

- Cordant Health Solutions

- Legacy Medical Services, LLC

- Omega Laboratories, Inc.

- GE Healthcare

Recent Developments

- Sandoz International GmbH announced the acquisition of the cephalosporin antibiotics business of GSK, to expand its portfolio in manufacturing drugs and medicines.

- Quest Diagnostics Incorporated partnered with Select Health of South Carolina Inc. to expand the lateral’s laboratory network for its dual eligible enrollees of Medicaid and Medicare-Medicaid.

- Butterfly Network, Inc. launched an augmented-reality capability to remotely guide Butterfly iQ ultrasound scanners.

- Report ID: 3821

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Drug Testing Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.