Blood Screening Market Outlook:

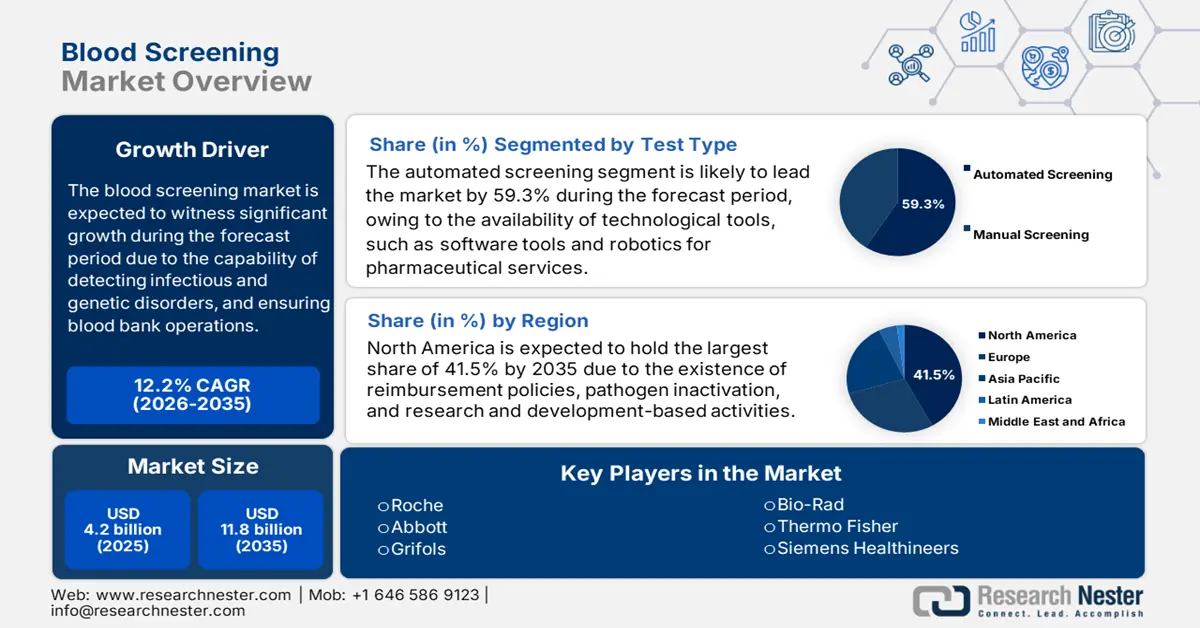

Blood Screening Market size was USD 4.2 billion in 2025 and is predicted to reach USD 11.8 billion by the end of 2035, increasing at a CAGR of 12.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of blood screening is assessed at USD 4.7 billion.

The international market readily encompasses services, products, and technologies to effectively detect genetic disorders, infectious diseases, such as Zika, hepatitis B/C, and HIV, and other contaminants. In addition, the market has also ensured compliance, transfusion safety, and suitable blood bank operations. According to an article published by the CDC in May 2024, parents with any disease have the ability to pass 50% of the gene-based disease to their children. Besides, if both parents are affected by diseases, then there is a 25% chance that their children will be affected. Therefore, blood screening allows early diagnosis to ensure timely management and interventions, thus suitable for the overall market’s growth.

Moreover, a surge in blood transfusion volumes, strict government policies, and technological innovation are also driving the market’s growth across different nations. As per an article published by NLM in June 2023, blood product transfusion takes place through intravenous tubing with filters, usually comprising 170 to 260 microns. The purpose is to successfully combat debris from being administered. Besides, blood components can be provided through different central venous access devices by considering certain sizes. This includes 20 to 22 gauge for routine and 16 to 18 gauge for rapid transfusions among adults, along with 22 to 25 gauge for pediatrics, thereby denoting a positive outlook for the market.

Key Blood Screening Market Insights Summary:

Regional Highlights:

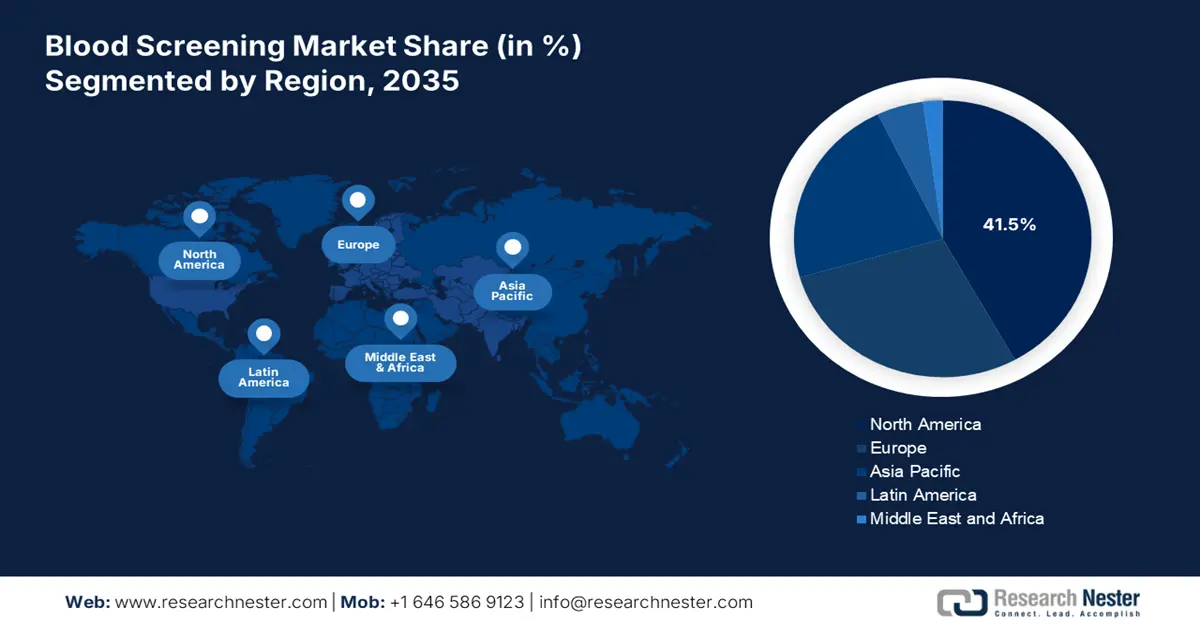

- By 2035, North America is set to command a 41.5% share in the blood screening market, underpinned by strict regulations, funding strength, and technological leadership.

- Asia Pacific is anticipated to secure a 22.1% share by 2035, supported by diversified regulations, pathogen variability, and cost sensitivity.

Segment Insights:

- The automated screening segment in the blood screening market is projected to hold a 59.3% share by 2035, spurred by software-enabled efficiency gains.

- The reagents and kits segment is expected to capture a 50.1% share by 2035, propelled by high recurring demand and diagnostic accuracy.

Key Growth Trends:

- Customized blood matching

- Blockchain for tracing blood

Major Challenges:

- Cost-effective gaps among patients

- Disruptions in the supply chain

Key Players: Roche Diagnostics (Switzerland), Abbott Laboratories (U.S.), Grifols (Spain), Bio-Rad Laboratories (U.S.), Thermo Fisher Scientific (U.S.), Siemens Healthineers (Germany), Becton Dickinson (BD) (U.S.), Ortho Clinical Diagnostics (U.S.), Hologic (U.S.), QuidelOrtho (U.S.), Danaher (U.S.), BioMérieux (France), TransAsia Bio-Medicals (India), SD Biosensor (South Korea), Werfen (Spain).

Global Blood Screening Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.2 billion

- 2026 Market Size: USD 4.7 billion

- Projected Market Size: USD 11.8 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 27 August, 2025

Blood Screening Market - Growth Drivers and Challenges

Growth Drivers

- Customized blood matching: It is considered to be essential because the existence of an incompatible blood type tends to trigger a critical immune response, which can potentially lead to death or hemolytic anemia, thereby driving the blood screening industry. In this regard, the June 2023 American Cancer Society article denoted that for blood group A, the A antigen, anti-B, along with Blood group O and A, effectively matches. Simultaneously, for blood group B, the B antigen, anti-A antibodies, and blood groups O and B are suitable, thereby suitable for the market’s continuous upliftment.

- Blockchain for tracing blood: The presence of regulatory uncertainty, ecosystem application, and combating scalability has augmented the blockchain integration in the healthcare industry, which is positively impacting the blood screening sector globally. According to a report published by the Journal of Network and Computer Applications in June 2023, the smartpool technique in blockchain minimizes 51% of attacks, which gradually augments security. Therefore, this is suitable for effectively managing blood screening-based devices, which, in turn, deliberately enhances the market’s exposure internationally.

- Increased telepathology integration: The provision of rapid, remote, and accurate pathology consultations and diagnoses, particularly in underserved locations, is uplifting telepathology adoption, which is positively impacting the blood screening market. Regarding this, a cross-sectional study was published by NLM in November 2023, wherein 388 participants were included. Overall, 80.3% were aware of telepathology, 88.1% were inclined towards its approval, and 89.9% considered an optimistic approach to its potentiality, thereby suitable for its integration during blood screening.

Adverse Transfusion Events Impact on the Market

Estimated Risk Per Unit of Red Blood Cells (RBCs)

|

Risks |

Transfusion Rate |

|

Febrile reaction |

1:60 |

|

Transfusion-based circulatory overload |

1:100 |

|

Allergic reaction |

1:250 |

|

TRALI |

1:12,000 |

|

Hepatitis C infection |

1:1,149,000 |

|

Human immunodeficiency virus infection |

1:1.467,000 |

|

Fatal hemolysis |

1:1,972,000 |

Sources: NLM, June 2023

HIV Incidences Driving the Market Demand

2023 International HIV Epidemic

|

Categories |

People Living With HIV |

People Acquiring HIV |

People Dying From HIV-Based Causes |

|

Adults (15+ years) |

38.6 million (34.9 to 43.1 million) |

1.2 million (950,000 to 1.5 million |

560,000 (430,000 to 730,000) |

|

Women (15+ years) |

20.5 million (18.5 to 22.9 million) |

520,000 (400,000 to 690,000) |

240,000 (180,000 to 320,000) |

|

Men (15+ years) |

18.1 million (16.2 to 20.3 million) |

660,000 (540,000 to 840,000) |

320,000 (250,000 to 420,000) |

|

Children (<15 years) |

1.4 million (1.1 to 1.7 million) |

120,000 (83,000 to 170,000) |

76,000 (53,000 to 110,000) |

|

Total |

39.9 million (36.1 to 44.6 million) |

1.3 million (1.0 to 1.7 million) |

630,000 (500,000 t0 820,000) |

Source: HIV Government, February 2025

Challenges

- Cost-effective gaps among patients: Out-of-pocket expenses in developing regions prevent the majority from accessing suitable blood screening, which has caused a hindrance in the market’s growth. However, manufacturers have implemented different strategies to combat this barrier through private and public collaborations, cross-subsidization, and the presence of ultra-low-cost tests. Besides, sustainability is still a challenging aspect due to which testing rates have gradually reduced overnight. On the contrary, a few countries are experimenting with advanced financing, which denotes a growth opportunity for the market globally.

- Disruptions in the supply chain: Manufacturers in the market experience increased vulnerabilities in the supply chain that threaten the international availability of the market. The overall industry depends on specialized suppliers, with the majority of NAT enzymes sourced from three Germany-based firms. This, however, has developed systemic risks due to which the NAT test production diminished. Besides, the COVID-19 impact revealed other weaknesses, such as delays in shipping and increased lead times for components, thus creating a negative impact on the market.

Blood Screening Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 4.2 billion |

|

Forecast Year Market Size (2035) |

USD 11.8 billion |

|

Regional Scope |

|

Blood Screening Market Segmentation:

Test Type Segment Analysis

Based on the test type, the automated screening segment in the blood screening market is projected to garner the highest share of 59.3% by the end of 2035. According to the January 2025 World Economic Forum report, the utilization of software tools by researchers assisted in reducing operational duration by 31%, which denotes a huge opportunity for the segment to effectively flourish in the market. In addition, autonomous robotic vehicles tend to deliver pharmaceuticals in hospitals and freeing up healthcare team members to focus on patients, thus suitable for enhancing the segment’s exposure.

Product Segment Analysis

Based on the product, the reagents and kits segment in the blood screening market is projected to account for the second-largest share of 50.1% by the end of the forecast period. The segment’s development is highly attributed to its crucial role in high recurring demand, along with gaining diagnostic accuracy. The segment effectively includes rapid test components, NAT assay kits, and ELISA reagents. Besides, key players are making intense investments in multiple assays, which have successfully enabled simultaneous numerous pathogens, as well as process reduction time. In addition, scalability and cost-effectiveness also make reagents in emerging economies, thereby suitable for the overall segment.

Technology Segment Analysis

Based on the technology, the nucleic acid testing (NAT) segment in the blood screening market is expected to hold the third-largest share of 42.7% during the forecast timeline. The segment’s growth is highly propelled by improving diagnosis processes and advancing health and medical services. According to the June 2024 Molecular Aspects of Medicine report, with the NAT implementation, the clinical sensitivity is more or less 95% to 97%, 97% to 99% for clinical specificity, and less than equal to 5% of clinical errors, thus augmenting the market across different nations.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Test Type |

|

|

Product |

|

|

Technology |

|

|

End user |

|

|

Disease Screening |

|

|

Sample Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Blood Screening Market - Regional Analysis

North America Market Insights

North America in the blood screening industry is expected to be the dominant region, garnering the largest share of 41.5% by the end of 2035. The market’s growth in the region is highly propelled by the presence of strict regulations, funding dominance, and leadership in technological innovations. As per an article published by NLM in May 2024, newborn bloodshot screening has been readily implemented for successfully screening 400,000 newborns across 29 states in the U.S. Besides, an increase in population is also driving the market demand, with the U.S. comprising 335 million across 51 jurisdictions, thus suitable for the market’s growth.

The blood screening market in the U.S. is significantly growing, owing to the presence of Medicaid and Medicare coverage services, R&D activities in the private sector, and pathogen inactivation. As stated in the 2025 Medicaid Government report, almost half a million children between 1 to 5 years of age in the country possess blood lead levels more than 3.5 micrograms per deciliter. Therefore, it is crucial that children get enrolled in Medicaid programs to achieve suitable blood lead screening tests. Regardless of the coverage, children are poised to receive these tests between 12 months and 24 months, thereby denoting growth opportunity for the market.

The market in Canada is also growing due to provincial decentralization, the availability of public blood banks, and a focus on indigenous health. As per the April 2022 NLM article, Canadian Blood Services and Héma-Québec have readily extended their role in public health surveillance, and nearly 1 million blood samples can be made available in the country. In addition, with the presence of 90% repeated donors, there is a huge possibility of longitudinal sampling in Canada. Meanwhile, Héma-Québec has been evaluating more than 18,600 blood donations by collaborating with the government.

Hepatitis B Virus (HBV) and Hepatitis C Virus (HCV) Prevalence in North America

|

Countries/Components |

Mean Age |

Men (%) |

Number of Patients |

HIB |

HCV |

|

Canada |

57 |

61 |

164,085 |

8% (4 to 13) |

36% (22 to 50) |

|

U.S. |

57 |

62 |

866,810 |

3% (3 to 4) |

37% (34 to 39) |

Source: NLM, May 2022

APAC Market Insights

Asia Pacific in the blood screening market is considered to be the fastest-growing region, with a projected share of 22.1% during the forecast timeline. The market’s development in the country is highly fueled by the presence of diversified regulations, variability in pathogens, and cost sensitivity. Besides, the October 2024 NLM article denoted that WHO's External Quality Assurance Programme (EQAP) was implemented in Southeast Asia regions, leading to 100% concordance achievement among regional laboratories, which indicated increased testing standards. Therefore, with all these factors, the market is gradually growing in the region.

The market in China is gaining increased traction, owing to centralized funding, the presence of regional tech organizations, public and private collaborations, and the division between rural and urban areas. As per an article published by MedNexus in November 2023, the country has readily witnessed an increase in its healthcare spending for the past five years by 166%, thereby denoting a huge opportunity for strong private and public partnerships. As a result, hospital providers, physician groups, medical devices, and technical organizations collaborate with each other to uplift the market in the country.

The blood screening market in India is also growing due to a surge in the HBV burden, the existence of a decentralized system, and diagnostic feasibility and validations. As stated in the January 2024 NLM article, a clinical study was conducted on 416 urban slum people to successfully validate haemoglobin between the non-invasive EzeCheck and invasive haematology analyzer. The invasive device demonstrated 91.5% results, with a 1.5% difference, and the non-invasive displayed 43.5%, with the absence of any difference. Therefore, bulk screening in communities and schools with the non-invasive device is useful for identifying anaemic people and ensuring early diagnosis.

Microscopes 2023 Import and Export in the Asia Pacific

|

Countries |

Import |

Export |

|

China |

USD 359 million |

USD 487 million |

|

Japan |

USD 209 million |

USD 439 million |

|

Singapore |

USD 79.9 million |

USD 249 million |

|

South Korea |

USD 74.7 million |

- |

|

India |

USD 70.7 million |

- |

Source: OEC, July 2025

Europe Market Insights

Europe in the blood screening market is expected to account for a considerable share of 28.3% during the projected timeline. The market’s growth in the region is subject to harmonization in administration, cross-border partnerships, and a surge in the aging population. According to a report published by the Joint United Kingdom (UK) Blood Transfusion and Tissue Transplantation Services Professional Advisory Committee in March 2024, the Commission Directive 2002/98/EC of the Europe-based Parliament has set standards for safety and quality processing, testing, collection, distribution, and storage of blood components and human blood by amending the Directive 2001/83/EC, thus suitable for market’s upliftment.

The market in Germany is steadily growing, driven by the integration of automation, increased medical and healthcare spending, and a focus on allogeneic transplant. As stated in an article published by eBioMedicine in December 2024, there is a presence of 8% to 10% of intracranial lesion cases, requiring blood-based brain biomarkers. In addition, a clinical study was conducted in 16 emergency departments, wherein a 10 ml blood sample was collected, and the testing was performed utilizing VIDAS 3 in automatic pipetting mode. The analytical measuring interval (AMI) of the VIDAS TBI assay ranged between 10.0 pg/ml and 320.0 pg/ml, thus denoting the importance of blood tests before conducting any procedures.

The blood screening sector in the UK is also gaining increased traction due to genomic screening, public health prioritization, and post-Brexit self-sufficiency. According to the April 2025 NLM article, a workforce-based survey analysis was conducted on 2,814 individuals, of which 31.3% of responders have been delivering genomic services. Besides, 75.9% and 85.7% stated the demand for genomics training and education. In addition, the survey was conducted in the country, comprising 10% oncologists, demanding genomic medication integration in clinical practice, thereby suitable for enhancing the market’s exposure in the country.

Key Blood Screening Market Players:

- Roche Diagnostics (Switzerland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories (U.S.)

- Grifols (Spain)

- Bio-Rad Laboratories (U.S.)

- Thermo Fisher Scientific (U.S.)

- Siemens Healthineers (Germany)

- Becton Dickinson (BD) (U.S.)

- Ortho Clinical Diagnostics (U.S.)

- Hologic (U.S.)

- QuidelOrtho (U.S.)

- Danaher (U.S.)

- BioMérieux (France)

- TransAsia Bio-Medicals (India)

- SD Biosensor (South Korea)

- Werfen (Spain)

The global market is extremely dominated by key players, including Grifols, Abbott, and Roche, all of which jointly account for a generous global share, through NAT automation and leadership. Besides, AI-powered investments, emerging economies, and pathogen inactivation technology are a few strategies that are readily adopted by all these organizations. Through effective investments, Roche successfully reduced false positives, followed by Abbott offering NAT test services in India, with the pathogen inactivation by Grifols, there has been capturing of the majority of the Europe-based plasma market, thus suitable for the overall market’s growth.

Here is a list of key players operating in the global market:

Recent Developments

- In December 2024, BD and Babson Diagnostics declared the expansion of testing technologies, along with fingertip blood collection for usability by healthcare systems and provider networks in the U.S.

- In July 2024, Truvian Health raised USD 74 million in capital by introducing blood tests through the U.S. FDA approval of its blood testing platform, and ensuring simple, accurate, and comprehensive services.

- Report ID: 4480

- Published Date: Aug 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Blood Screening Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.