Blood Urea Nitrogen Diagnostics Market Outlook:

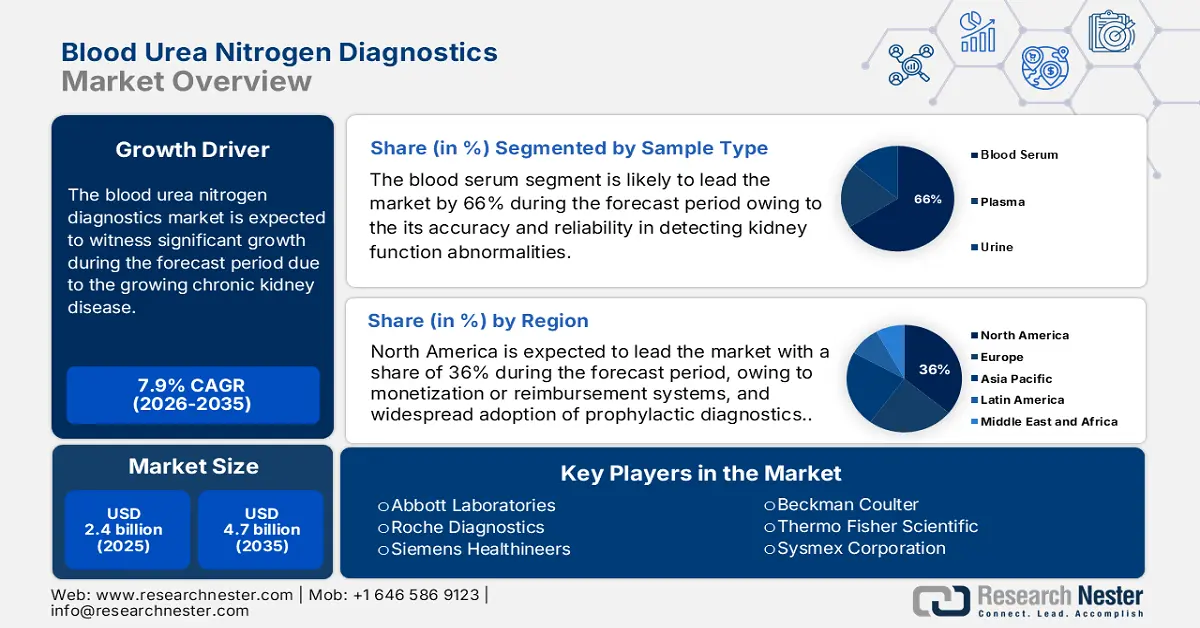

Blood Urea Nitrogen Diagnostics Market size was valued at USD 2.4 billion in 2025 and is projected to reach USD 4.7 billion by the end of 2035, rising at a CAGR of 7.9% during the forecast period 2026-2035. In 2026, the industry size of blood urea nitrogen diagnostics is estimated at USD 2.5 billion.

The global market is provided with impetus by the rising instances of chronic kidney disease in patients. As per a report by the NLM in March 2022, chronic kidney disease (CKD) is a public health problem with abnormalities in kidney structure or function that persist for at least a few months and affects over 10% of the population worldwide, or more than 800 million people. Kidney failure is reported by the CDC as being mainly caused by diabetes and hypertension. Blood urea nitrogen tests carried out through public health networks have been on the rise in the market lately due to the proliferating number of screening programs and preventative care initiatives being sponsored by the government.

The supply chain of the blood urea nitrogen diagnostics covers biochemical substrates, reagents, and disposable cartridges for analyzers. These are principally manufactured in North America, the APAC region, and Europe. As per a report by World Integrated Trade Solutions in October 2025, in 2023, India imported prepared enzymes (HS 350790) worth USD 137,709.3k (USD 137.7 million) and 19,184,800 kilograms, with purported imports from Germany to a tune of USD 7,923.2k. Some of the vital elements, such as colorimetric agents and urease enzymes, tend to be imported from India, Germany, and the U.S. The blood urea nitrogen diagnostics market is also bolstered by advancements in AI-integrated diagnostic platforms and enhancements in renal detection.

Key Blood Urea Nitrogen Diagnostics Market Insights Summary:

Regional Highlights:

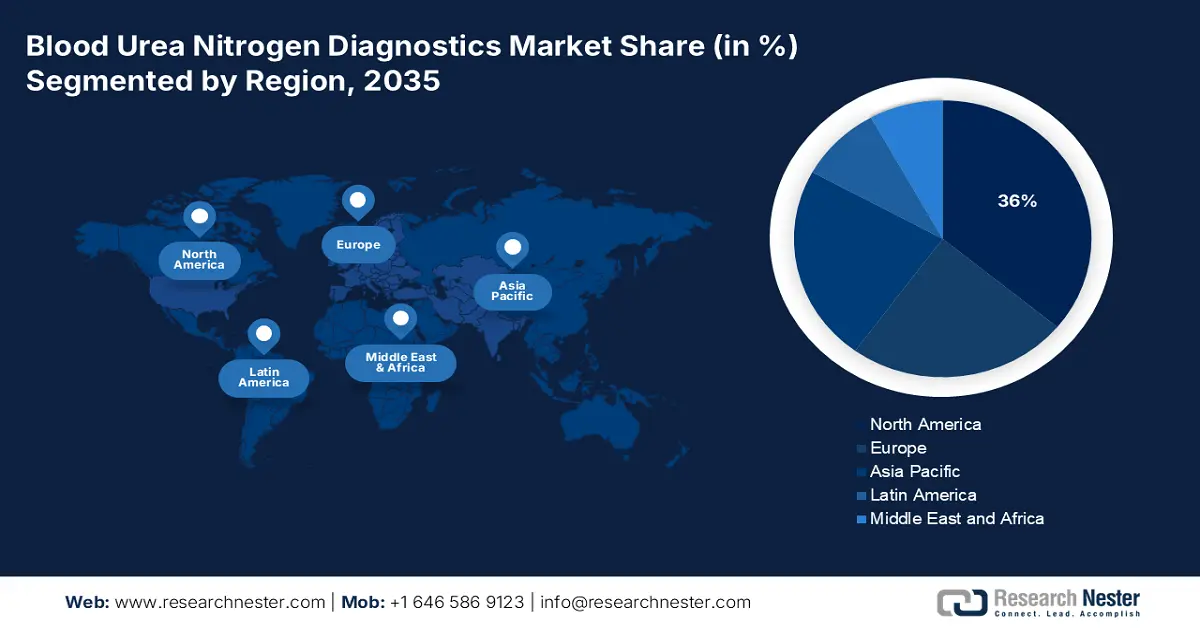

- North America is anticipated to reach a 36% share in the blood urea nitrogen diagnostics market by 2035, driven by an expanding patient pool, favorable reimbursement systems, and widespread adoption of prophylactic diagnostics.

- Asia Pacific is expected to emerge as the fastest growing region in the blood urea nitrogen diagnostics market by 2035, owing to rising healthcare investments, increasing chronic kidney disease incidence, and advanced diagnostic technologies.

Segment Insights:

- The blood serum segment is projected to hold the highest share of 66% in the sample type segment in the blood urea nitrogen diagnostics market within the forecast period, propelled by its accuracy and reliability in detecting kidney function abnormalities.

- The diagnostics sub-segment is expected to dominate the product type segment, driven by rising cases of chronic and acute kidney diseases and the need for early detection and monitoring.

Key Growth Trends:

- Rising chronic kidney disease Cases

- Increasing Prevalence of Diabetes and Hypertension

Major Challenges:

- Limited specificity of blood urea nitrogen tests

- High cost and accessibility issues in low-income regions

Key Players: Roche Diagnostics, Siemens Healthineers, Beckman Coulter, Thermo Fisher Scientific, Sysmex Corporation, Mindray Medical, Ortho Clinical Diagnostics, Randox Laboratories, Fujifilm Wako Pure Chemical, Bio-Rad Laboratories, Tosoh Corporation, Transasia Bio-Medicals, Seegene Inc., Horiba Medical.

Global Blood Urea Nitrogen Diagnostics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.5 billion

- 2026 Market Size: USD 17.8 billion

- Projected Market Size: USD 61.8 billion by 2035

- Growth Forecasts: 14.8% CAGR (2026-2035)

Key Regional Dynamics:

Largest Region: North America (36% share by 2035)

Fastest Growing Region: Asia Pacific

Dominating Countries: United States, Germany, Japan, France, Canada

Emerging Countries: India, China, Brazil, Mexico, South Korea

Last updated on : 13 October, 2025

Blood Urea Nitrogen Diagnostics Market - Growth Drivers and Challenges

Growth Drivers

- Rising chronic kidney disease Cases: The rise in chronic kidney disease (CKD) has become one of the prominent factors accounting for the expansion of the diagnostics for market. Blood urea nitrogen tests are useful in observing the functions of the kidney and the management of patients with diabetes and hypertension. As per a report by the NLM in September 2025, based on a recent GBD data study, between 95% of countries will witness an increased incidence of CKD in the years between 2022 and 2030. Such a change suggests an increased worldwide demand for accurate instruments to diagnose the condition at early stages.

- Increasing Prevalence of Diabetes and Hypertension: the worldwide increase in lifestyle diseases such as T2DM and hypertension is synergistically driving the growth of the blood urea nitrogen diagnostics market. Such diseases are among the most common causes of chronic kidney pathology. Blood urea nitrogen testing is, in general, a low-cost, easy-to-access diagnosis that can be applied in all hospital and outpatient settings. The International Diabetes Federation in 2025 estimated that the total population with diabetes is expected to increase from 853 million in to 2050 2025. Trends such as these are a clear indication of an increased demand for regular kidney assessment through BUN tests worldwide in the market.

- Expansion of point-of-care diagnostic technologies: Development of technology, particularly POC diagnostics, has generated novel avenues for and how BUN tests can be carried out in the market. The International Diabetes Federation 2025 estimated that approximately 589 million adults (20 to 79 years of age) will live with diabetes in 2025. Several portable analyzers, AI-integrated platforms, and less-fussy kits for blood urea nitrogen tests are coming up to conduct these tests six feet away from conventional labs in clinics, rural health centers, and the homes of patients. Decentralization of diagnostics thus makes kidney health screening easily accessible and urges screening for kidney health more often.

Chronic Kidney Disease (CKD) Stages and Albuminuria Categories (2024)

|

CKD Stage |

GFR (mL/min/1.73 m²) |

Description |

Albuminuria Category |

ACR (mg/g) |

ACR (mg/mmol) |

Description |

|

G1 |

≥ 90 |

Normal or high GFR with kidney damage (e.g., proteinuria or hematuria) |

A1 |

< 30 |

< 3.4 |

Normal to mildly increased albuminuria |

|

G2 |

60 to 89 |

Mildly decreased GFR |

A2 |

30 to 299 |

3.4 to 34 |

Moderately increased albuminuria |

|

G3a |

45 to 59 |

Mild to moderate decrease in GFR |

A3 |

≥ 300 |

> 34 |

Severely increased albuminuria |

|

G3b |

30 to 44 |

Moderate to severe decrease in GFR |

|

|

|

|

|

G4 |

15 to 29 |

Severe decrease in GFR |

|

|

|

|

|

G5 |

< 15 or dialysis |

Kidney failure or on dialysis |

|

|

|

|

Source: NLM

Kidney Disease: Improving Global Outcomes (KDIGO) Diagnostic Criteria for Acute Kidney Injury (AKI) (2023)

|

Criterion |

Rates |

|

Increase in Serum Creatinine |

≥ 0.3 mg/dL (≥ 26.5 μmol/L) within 48 hours |

|

Relative Increase in Serum Creatinine |

≥ 1.5 times the baseline value within the previous 7 days |

|

Decreased Urine Output |

< 0.5 mL/kg/h for at least 6 hours |

Source: NLM

Challenges

- Limited specificity of blood urea nitrogen tests: One of the major challenges the market faces is the lack of test specificity. Blood urea nitrogen levels may be altered by factors that are sometimes related to kidney function, such as dehydration, high-protein diets, or liver disorders, thereby causing incorrect or misleading interpretations. Thus, the blood urea nitrogen is not fully reliable as a single diagnostic tool and often requires further tests for an exact diagnosis. As health care professionals may prefer more specific biomarkers, this may hamper the growth or slow down the penetration of BUN testing into certain clinical settings. In this way, the limitation can directly hinder the blood urea nitrogen diagnostics market growth.

- High cost and accessibility issues in low-income regions: Advances in technology are not that much helpful for the blood urea nitrogen diagnostic market devices and reagents as far as cost is concerned, thereby limiting their existence in most of the low-income, rural areas. Limited health care infrastructure, coupled with shortages of trained personnel, acts as a constraint against prompt and accurate blood urea nitrogen testing in such regions. Consequently, many patients remain undiagnosed for kidney-related problems or receive treatment in a delayed manner. These accessibility challenges do not undergird market penetration in emerging economies, wherein low-cost, simplistic diagnostics are in the utmost demand.

Blood Urea Nitrogen Diagnostics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 2.4 billion |

|

Forecast Year Market Size (2035) |

USD 4.7 billion |

|

Regional Scope |

|

Blood Urea Nitrogen Diagnostics Market Segmentation:

Sample Type Segment Analysis

Blood serum holds the highest market share of 66% in the sample type segment in the blood urea nitrogen diagnostics market within the forecast period due to its accuracy and reliability in detecting kidney function abnormalities. Serum samples produce consistent results in measuring blood urea nitrogen levels; this was instrumental for diagnosing and monitoring renal diseases. According to the CDC May 2024 report, the rate of chronic kidney diseases is 11.8% in men and 14.4% in women in the U.S., thus bringing blood serum testing as one of the important tools for early diagnosis and management of chronic kidney diseases. Even though blood tests are preferred at the serum level during processing, the speed remains higher with minimal interference offered during sample collection from other sample types.

Product Type Segment Analysis

The diagnostics sub-segment dominates the product type segment in the blood urea nitrogen market since it generates demand for early detection and monitoring of renal disorders. The rise in the number of cases of chronic kidney disease (CKD) and acute kidney injury (AKI) has forced healthcare providers to depend on effective diagnostic procedures. As per the CDC May 2024 report, CKD is found to be common in people aged 65 years or older (34%) as compared to people aged 45 to 64 years (12%) and people aged 18 to 44 (6%), thereby accentuating further the need for diagnostic methods such as BUN testing for the minimization of the disease progression. The advances in diagnostic technologies have supplemented this segment's growth.

Application Segment Analysis

Kidney function testing in the application is the leading application driving the blood urea nitrogen diagnostics market. Blood urea nitrogen, or BUN level, determines the ability of the kidneys to filter out waste and is important for the early detection of kidney impairment or failure. According to the CDC’s May 2024 report, CKD is estimated to have been in more than 1 in 7 adults in the U.S.- approximately 35.5 million people or 14%, accentuating the increasing need for kidney function tests. Such early and periodic tests help keep the kidneys healthy and halt the progression of renal cases to end-stage, thus making this application paramount in the market.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Sub-segments |

|

Product Type |

|

|

End user |

|

|

Application |

|

|

Technology |

|

|

Sample Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Blood Urea Nitrogen Diagnostics Market - Regional Analysis

North America Market Insight

North America is anticipated to reach 36% of market share by 2035. Some of the principal drivers of this market are an expanding patient pool suffering from chronic kidney ailments, monetization or reimbursement systems, and widespread adoption of prophylactic diagnostics. Rising healthcare expenditure, incorporation of digital systems in diagnostics, Medicare, and Medicaid policy enhancements into basic care are a premium advantage to the region. As per a report by NIH in September 2024, in the U.S., there are more than 808,000 persons living with ESKD, or end-stage renal disease (ESRD), with 68% on dialysis and 32% with a kidney transplant.

The market in the U.S. is witnessing rapid expansion owing to the chronic diseases, and hence setting new federal priority health issues and supporting reimbursement schemes. Besides, medical agencies such as AMA and BIO support wider access to testing, promoting the use of AI-facilitated analyzers and interoperable systems. Together, such policy alterations and government injections keep the demand and growth curve strong for the industry. Additionally, as per a report by NIH in September 2024, a total of 27,332 kidney transplants were conducted across the U.S. in 2023. Continued advancements in point-of-care testing and integration of AI are expected to further enhance diagnostic accuracy and patient outcomes in the coming years.

Canada market is growing due to an increase in the incidence of chronic kidney disease and diabetes, as well as rising awareness about monitoring kidney function at very early stages. This is backed by rapidly advancing diagnostic technologies, a strong health infrastructure, and various governmental healthcare initiatives. As per a report by NLM in February 2023, chronic kidney disease (CKD) is one of the major health concerns affecting almost 4 million people in the country and 11% to 13% of the population globally. Government programs that encourage the early detection and treatment of kidney diseases actually drove the demand.

Medical Instruments Trade by Country in 2023

|

Country |

Export Value (USD) |

Import Value (USD) |

|

U.S. |

34.8 billion |

37.7 billion |

|

Mexico |

17.6 billion |

4.6 billion |

|

Costa Rica |

5.9 billion |

828 million |

|

Dominican Republic |

2.1 billion |

— |

|

Canada |

1.2 billion |

3.7 billion |

Source: OEC

Asia Pacific Market Insight

The Asia Pacific is the fastest-growing region in the blood urea nitrogen diagnostics market by 2035 due to factors such as rising healthcare investments, increasing chronic kidney disease incidence, and advanced diagnostic technologies. Several governments across the region have taken active steps to counter chronic kidney diseases, including programs on integrated diagnostics and screening for blood on a regular basis. As per a report by the Open Access Government in July 2025, an increase in the market can be attributed to the aging population of about 173.3 million by 2050, from 77.4 million in the last 5 years.

China holds the Asia-Pacific blood urea nitrogen diagnostics market due to a huge patient population base, government programs targeted at kidney health, and rapid modernization of healthcare. As per a report by NLM in December 2024, incident hemodialysis patients have seen steadily rising numbers from 70,961 (52.2 per million population, pmp) to 156,645 (111.9 pmp) in 2022. With almost a two-fold increase, it shows an urgent requirement for some highly efficient mechanism to monitor kidney function, BUN diagnostics being one possibility. At the same time, the growing awareness due to educational programs and increasing insurance coverage are at the same time pull forces toward the early diagnosis and treatment of kidney diseases in China.

The market in India is expanding as nephrology-related ailments are fast gaining awareness, with growing access to health in rural areas and Government programs geared toward timely diagnosis and early treatment in cases of chronic diseases such as diabetes and hypertension. As per a report by NLM in April 2023, kidney disease weighty public health issue in India, has high morbidity and mortality rates and the Million Death Study estimated deaths from chronic kidney disease at 50% up. Also, cheaper diagnostic instruments are being made available increasingly for more widespread screening and monitoring in both urban and rural populations.

Europe Market Insight

The blood urea nitrogen diagnostics market in Europe is expected to grow steadily owing to an aging population, the increased suffering of chronic kidney diseases, and the broad implementation of universal healthcare systems under which testing for kidney function is considered a routine. As per a report by Bruegel in March 2025, by 2050, the working-age population would decrease or is projected to decrease further in 22 out of 27 countries in Europe, while the share of the 85+ age group would more than double in Europe as a whole by 2050. This demographic shift will increase the demand for regular kidney health checks.

UK market is growing due to the rising occurrences of diabetes and hypertension, drastic awareness programs for the promotion of early diagnostic screening, and the installation of advanced diagnostic systems in NHS facilities. As per a report by the Government of the UK in March 2025, from March 2024, the prevalence of type 2 diabetes among adults over 17 years of age in England was around 7.0%, an increase over the 6.8% from March 2023. Such an increase in chronic conditions raises demand for greater administration of kidney functioning tests, including those for BUN, so that complications might be averted.

The blood urea nitrogen diagnostics market in Germany has been bordering upon high healthcare spending, having a well-established industry for diagnostics and clinical attention to early renal disorder detection and its management through standardized blood-testing protocols. Under the country's healthcare infrastructure, further impetus is provided for the updating of diagnostic equipment, therefore including BUN testing. Further, government initiatives related to chronic disease management have led to increased monitoring of kidney function. This awareness among medical practitioners for early detection tends to build a growing demand for dependable and fast BUN diagnostic methods. The synergy of all these factors leads to the steady growth of the German market.

Key Blood Urea Nitrogen Diagnostics Market Players:

- Abbott Laboratories (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Roche Diagnostics (Switzerland)

- Siemens Healthineers (Germany)

- Beckman Coulter (U.S.)

- Thermo Fisher Scientific (U.S.)

- Sysmex Corporation (Japan)

- Mindray Medical (China)

- Ortho Clinical Diagnostics (U.S.)

- Randox Laboratories (UK)

- Fujifilm Wako Pure Chemical (Japan)

- Bio-Rad Laboratories (U.S. )

- Tosoh Corporation (Japan)

- Transasia Bio-Medicals (India)

- Seegene Inc. (South Korea)

- Horiba Medical (France)

The global market is moderately concentrated, and Abbott, Roche, and Siemens Healthineers dominate in sophisticated clinical diagnostics platforms. These companies continue to grow through R&D efforts and mergers and acquisitions. Asian producers like Sysmex, Mindray, and Tosoh are quickly growing on the back of demand for affordable and portable solutions in developing markets. Key strategies are AI-powered chemistry analyzers, connectivity with digital health platforms, and local manufacturing to comply with government procurement regulations and affordability requirements.

The top cohort of such key players includes:

Recent Developments

- In March 2025, CalciMedica shared their financial results with clinical and corporate updates with announcing about enrolling patients in the Phase 2 KOURAGE trial, which is testing Auxora, a drug designed to treat patients with acute kidney injury (AKI) and serious breathing problems.

- In October 2024, Guard Therapeutics announced that the first patient in Europe has been given the experimental drug RMC-035 as part of its ongoing Phase 2b POINTER study. The first patient was treated at University Hospital Carl Gustav Carus in Dresden, Germany, under the supervision of Professor Klaus Matschke.

- Report ID: 4147

- Published Date: Oct 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.