Aerospace Coating Market Outlook:

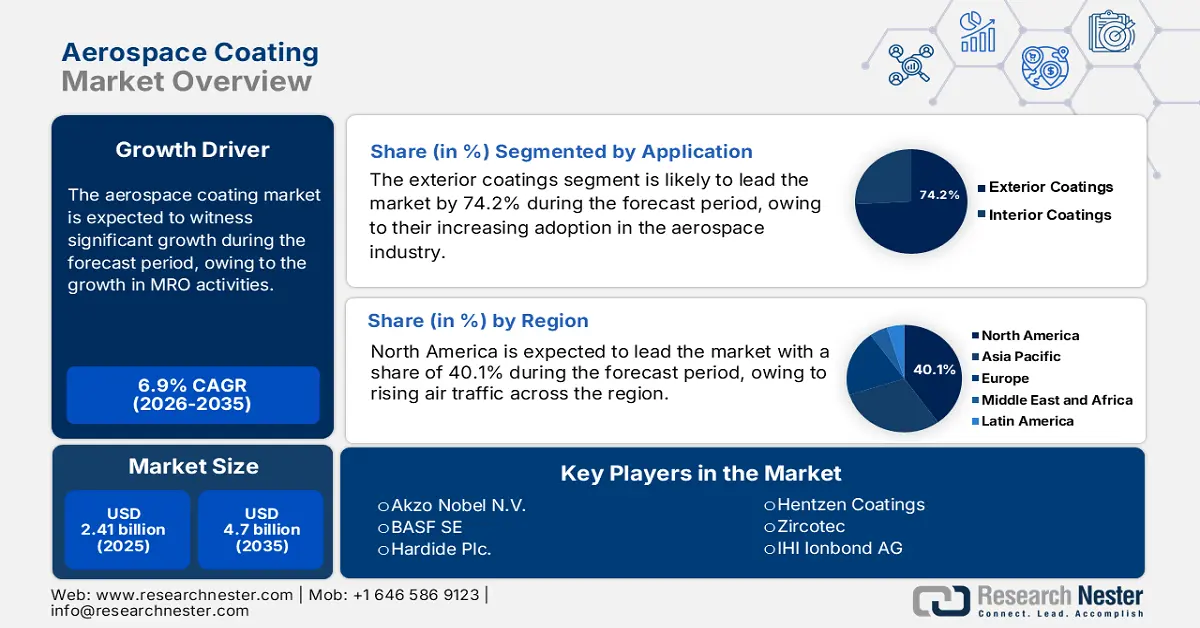

Aerospace Coating Market size was over USD 2.41 billion in 2025 and is anticipated to cross USD 4.7 billion by 2035, witnessing more than 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aerospace coating is assessed at USD 2.56 billion.

Aerospace coatings are rapidly gaining traction due to the modernization of aircraft fleets and the expansion of commercial flight services. Several companies are delivering enhanced commercial aircraft to meet the rising requirements of air travel. For instance, in January 2024, Airbus delivered 735 commercial aircraft to 87 customers across the world, marking an increase of 11% compared to the previous year. The surge in deliveries highlights airlines’ efforts to renew their fleets with energy-efficient models to align with the continually rising demand for air travel.

The advancements in aerospace coatings emphasize enhanced flight efficiency and extended maintenance capabilities. Companies are creating new coating compositions with upgraded resistance to corrosion and built-in self-repair capabilities to address the market requirement for lightweight premium coating materials. In addition, aerospace coating manufacturers are enhancing their production lines to fulfill the industry requirements. For instance, in February 2025, AkzoNobel introduced its new wood coating line, designed for environmental sustainability, better durability, and performance. Industry efforts to modernize fleets are supporting the state-of-the-art coating technologies developed by the companies.

Key Aerospace Coating Market Insights Summary:

Regional Highlights:

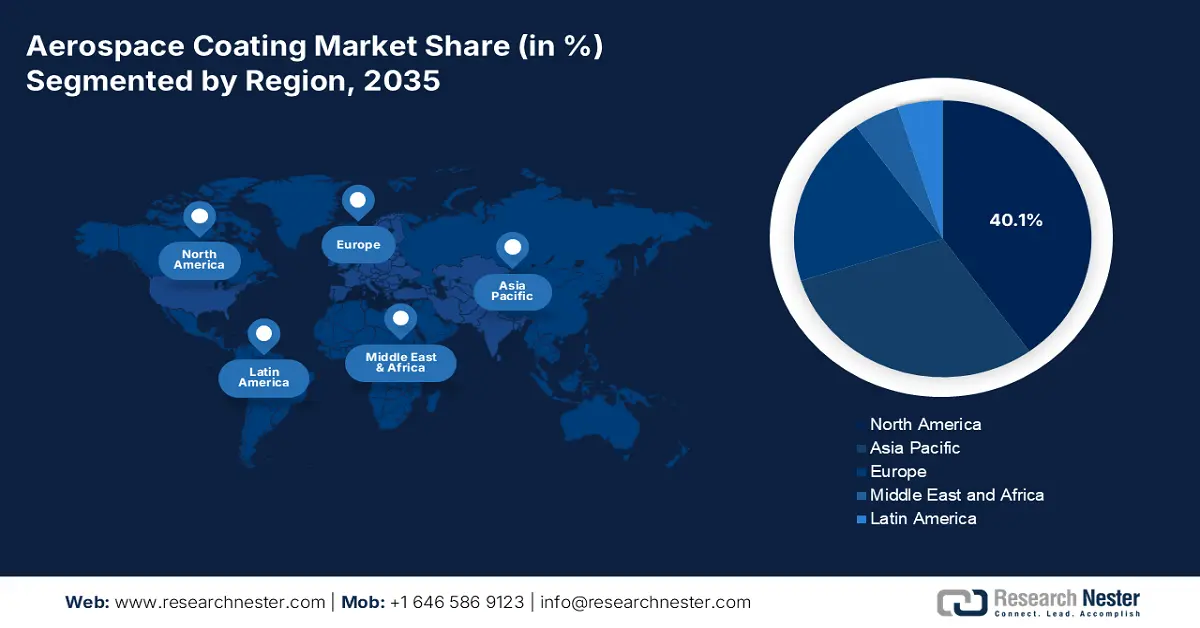

- North America dominates the Aerospace Coating Market with a 40.1% share, propelled by the rising air traffic across the region and the increasing demand for coatings due to fleet expansion and aircraft modernization, ensuring growth through 2026–2035.

Segment Insights:

- The Polyurethane segment is anticipated to exhibit strong CAGR growth from 2026 to 2035, driven by its ability to resist ultraviolet radiation and environmental degradation, ensuring long-term durability of aircraft exteriors.

- The exterior coatings segment is forecasted to secure a 74.2% share by 2035, propelled by innovations in nano-coatings and self-healing coatings enhancing aircraft durability.

Key Growth Trends:

- Development of high-performance thermal barrier coatings

- Growth in maintenance, repair, and overhaul activities

Major Challenges:

- Fluctuations in raw material prices

- Limited compatibility with new aircraft materials

Key Players: BASF SE, Hardide Plc., Henkel AG and Co. KgaA, and Hentzen Coatings.

Global Aerospace Coating Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.41 billion

- 2026 Market Size: USD 2.56 billion

- Projected Market Size: USD 4.7 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Aerospace Coating Market Growth Drivers and Challenges:

Growth Drivers

- Development of high-performance thermal barrier coatings: The utilization of advanced ceramic materials and new deposition techniques is resulting in the development of durable coatings that handle extreme temperature changes, thereby reducing maintenance costs and improving engine reliability. These advanced coatings reduce heat transfer, enabling higher operating engine temperatures to boost fuel efficiency together with performance metrics. The aerospace manufacturing industry is focusing on enhanced thermal barrier coatings (TBC) formulations to improve thermal insulation, oxidation resistance, and adhesion properties. The deposition techniques, including air plasma spraying and electron beam-physical vapor deposition, create lucrative opportunities for market growth.

- Growth in maintenance, repair, and overhaul activities: The surge in the number of commercial flights and aging aircraft fleets is accelerating the adoption of Maintenance, Repair, and Overhaul (MRO) activities, fueling the demand for aerospace coatings. Various organizations are increasingly investing in the establishment of MRO facilities. For instance, in October 2024, Embraer announced its plans to invest in Morocco’s aerospace industry, with the establishment of a new MRO facility. This initiative aligns with Morocco’s strategy to attract aerospace investments, as evidenced by the presence of 147 aerospace plants producing components for major manufacturers like Boeing and Airbus.

Challenges

- Fluctuations in raw material prices: The aerospace coatings industry is highly dependent on raw materials such as resins, pigments, and solvents, and their prices fluctuate due to supply chain disruptions and crude oil price variations. These cost uncertainties are directly impacting production expenses, making it difficult for manufacturers to maintain stable pricing. Sudden price hikes can squeeze profit margins, forcing companies to either absorb the costs or pass them on to customers. In addition, supply shortages are delaying production schedules and disrupting aircraft manufacturing and maintenance operations.

- Limited compatibility with new aircraft materials: The increasing utilization of lightweight composite materials in modern aircraft, such as carbon fiber-reinforced polymers, poses adhesion challenges for traditional aerospace coatings. These materials require specially formulated coatings to ensure durability, resistance to environmental factors, and proper surface bonding. However, developing such coatings demands extensive research and testing, driving up research and development costs.

Aerospace Coating Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 2.41 billion |

|

Forecast Year Market Size (2035) |

USD 4.7 billion |

|

Regional Scope |

|

Aerospace Coating Market Segmentation:

Application (Exterior Coatings, Interior Coatings)

Exterior coatings segment is anticipated to capture aerospace coating market share of over 74.2% by 2035, owing to their increasing adoption in the aerospace industry for better durability and performance. Innovations such as nano-coatings and self-healing coatings provide superior resistance to environmental factors, thereby extending the lifespan of aircraft surfaces. For instance, in April 2023, PPG Industries introduced a portable aerospace sealant removal, mixing, and application kit, streamlining maintenance processes and ensuring consistent application quality. Such technological advancements significantly contribute to segmental growth by offering improved protection and maintenance efficiency.

Resin (Polyurethane, Epoxy)

The polyurethane segment in aerospace coating market is expected to witness steady growth, attributed to its ability to offer resistance to ultraviolet radiation. These coatings help protect aircraft exteriors from environmental degradation, ensuring long-term structural integrity and reducing the frequency of maintenance. Their resistance to harsh weather conditions, chemicals, and abrasion makes them a preferred choice for commercial and military aviation, contributing to the growing demand for polyurethane-based aerospace coatings.

Our in-depth analysis of the global aerospace coating market includes the following segments:

|

Resin |

|

|

Product |

|

|

End use |

|

|

Industry |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aerospace Coating Market Regional Analysis:

North America Market

North America in aerospace coating market is projected to hold more than 40.1% revenue share by 2035, owing to the rising air traffic across the region. Major airlines are investing in fleet expansion and aircraft modernization, requiring coatings for enhanced UV resistance, weather protection, and fuel efficiency benefits. Also, coatings with antimicrobial properties are gaining traction as airlines prioritize cabin hygiene and passenger safety.

The U.S. aerospace coating market is expected to experience significant growth, due to increasing investment in hypersonic aircraft and next-generation fighter jets, necessitating specialized coatings that can withstand extreme temperatures and high-speed friction. The U.S. Department of Defense and NASA are actively developing thermal-resistant coatings to protect these advanced aircraft. In November 2023, NASA conducted tests on Phenolic Impregnated Carbon Ablator (PICA), a thermal protection material developed at NASA's Ames Research Center, for use in hypersonic vehicles.

The Canada aerospace coating market is expanding rapidly, attributed to the country’s extreme winter conditions, which necessitate advanced aerospace coatings for ice-phobic and anti-corrosion properties. In addition, prolonged exposure to moisture and fluctuating temperatures increases the risk of corrosion, which can weaken aircraft structures. Aerospace manufacturers are increasingly adopting coatings with superior hydrophobic and anti-corrosive properties to address these challenges.

Asia Pacific Market Analysis

The Asia Pacific aerospace coating market is experiencing significant growth due to growth in domestic aircraft manufacturing, driven by increasing defense budget allocations as well as rising commercial aviation demand. The countries in the region, such as India, China, and Japan, are actively developing their aircraft programs, such as China's C919 and India's HAL Tejas, which require advanced aerospace coatings for protection against extreme environmental conditions. The expansion of local manufacturing capabilities is bolstering the demand for high-performance coatings that enhance durability, corrosion resistance, and fuel efficiency.

The aerospace manufacturing sector in the region is continually adopting sustainable coating solutions owing to escalating environmental standards combined with sustainability demands. Advanced coatings such as water-based coating solutions together with low-VOC compounds are experiencing significant demand due to rising emissions regulations by the government. Companies are investing in research and development to create advanced coatings that meet both regulatory requirements and performance expectations, further driving market growth.

The aerospace coating market in China is witnessing significant growth due to the advancements in military aviation, including the development of next-generation fighter jets such as the J-20 and J-35, which are stimulating demand for specialized aerospace coatings. These coatings are essential for stealth capabilities, thermal resistance, and durability in extreme conditions. As China strengthens its defense sector, the need for specialized coatings that enhance radar absorption and corrosion resistance continues to grow, boosting the aerospace coating market.

The aerospace coating market in India is experiencing a rapid expansion, attributed to the increasing procurement of helicopters, unmanned aerial vehicles, and military aircraft in the defense industry. The strategic partnerships between local and international aerospace companies for advanced fighter jet programs and indigenous helicopter manufacturing are propelling the demand for high-performance coatings. These coatings play a crucial role in corrosion resistance, stealth capabilities, and thermal protection, supporting the operational readiness of the country’s defense fleet in diverse climatic conditions.

Key Aerospace Coating Market Players:

- Akzo Nobel N.V.

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Hardide Plc.

- Henkel AG & Co. KGaA

- Hentzen Coatings

- IHI Ionbond AG

- Mankiewicz Group

- The Sherwin-Williams Company

- Zircotec

The aerospace coating market is highly competitive, with key players focusing on innovation, strategic partnerships, and product advancements to strengthen their market presence. Companies such as PPG Industries, AkzoNobel, Sherwin-Williams, and Henkel are dominating the sector, offering specialized coatings for commercial, military, and space applications. Increasing investments in eco-friendly and high-performance coatings are driving competition, as firms develop low-VOC, lightweight, and durable solutions. Mergers, acquisitions, and collaborations with aerospace manufacturers are further intensifying the competitive landscape. Additionally, regional players and new entrants are expanding their footprint, leveraging advanced technologies to meet evolving industry demands and stringent environmental regulations. Here are some key players operating in the global market:

Recent Developments

- In December 2024, the Adani Group acquired Air Works, an aircraft maintenance company, for USD 54 million. This acquisition included over 900 maintenance experts, enhancing Adani's capabilities in the aerospace sector.

- In June 2023, Lufthansa Technik collaborated with ANSYS to develop AeroSHARK technology, utilizing advanced materials and nanocoatings to improve aircraft fuel efficiency and aerodynamics.

- Report ID: 7447

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aerospace Coating Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.