X-Ray Flat Panel Detectors Market Outlook:

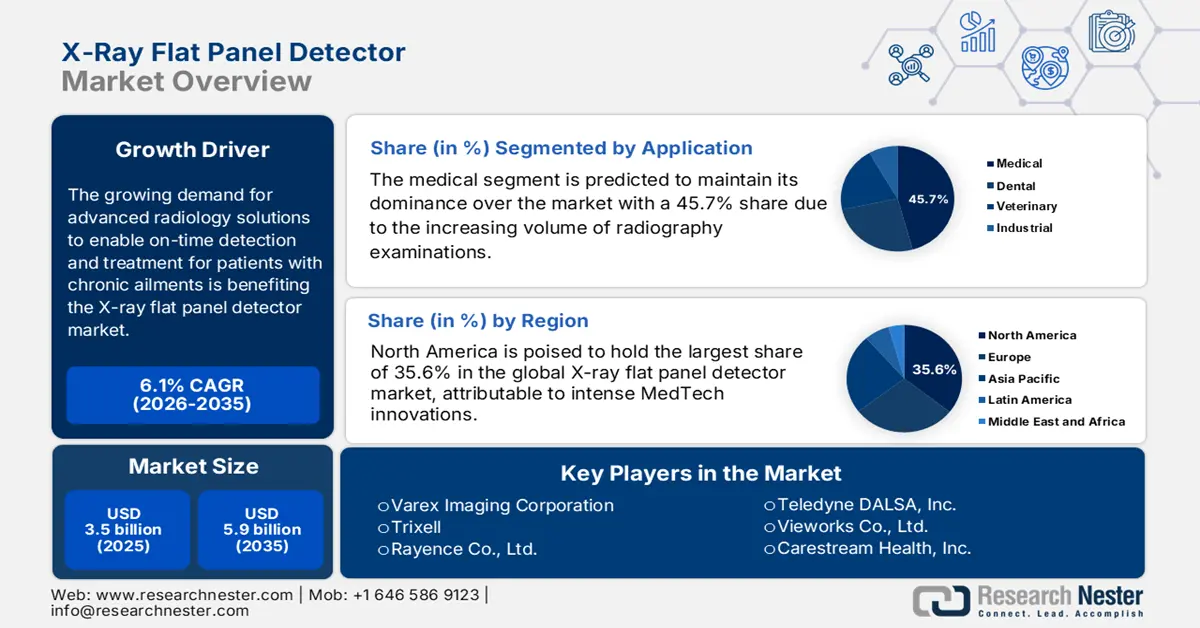

X-Ray Flat Panel Detectors Market size was over USD 3.5 billion in 2025 and is estimated to reach USD 5.9 billion by the end of 2035, expanding at a CAGR of 6.1% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of X-ray flat panel detectors is estimated at USD 3.7 billion.

The growing demand for advanced radiology solutions to enable on-time detection and treatment for patients with chronic ailments, such as osteoporosis, arthritis, and cardiovascular diseases (CVD), is benefiting the market. The demographic expansion can be testified by the 2025 International Journal of Basic & Clinical Pharmacology unveiled that more than 200 million people around the globe suffer from osteoporosis. Further, it also predicted the volume of the patient pool of osteoporotic fractures to increase by 300% by 2050. Besides, the rapidly aging populations worldwide are amplifying the epidemiology that requires regular imaging to manage their associated health conditions.

The supply chain of the market is primarily formed with the sourcing of specialized raw materials, such as amorphous selenium or silicon, gadolinium-based scintillators, and electronic components. As a result of the heavy concentration of suppliers for these components in Asia, the production of related tools and imaging services often becomes complex and expensive for both manufacturers and consumers. Testifying to the same, in a 2025 study, the NLM revealed that the estimated net cost burden of routine X-rays after performing a central venous catheter removal surgery was EUR 37,588.8, where the cost per assessment stood at EUR 38.2 for the same cohort. This explains the need for the development of more affordable and scalable options.

Key X-Ray Flat Panel Detector Market Insights Summary:

Regional Insights:

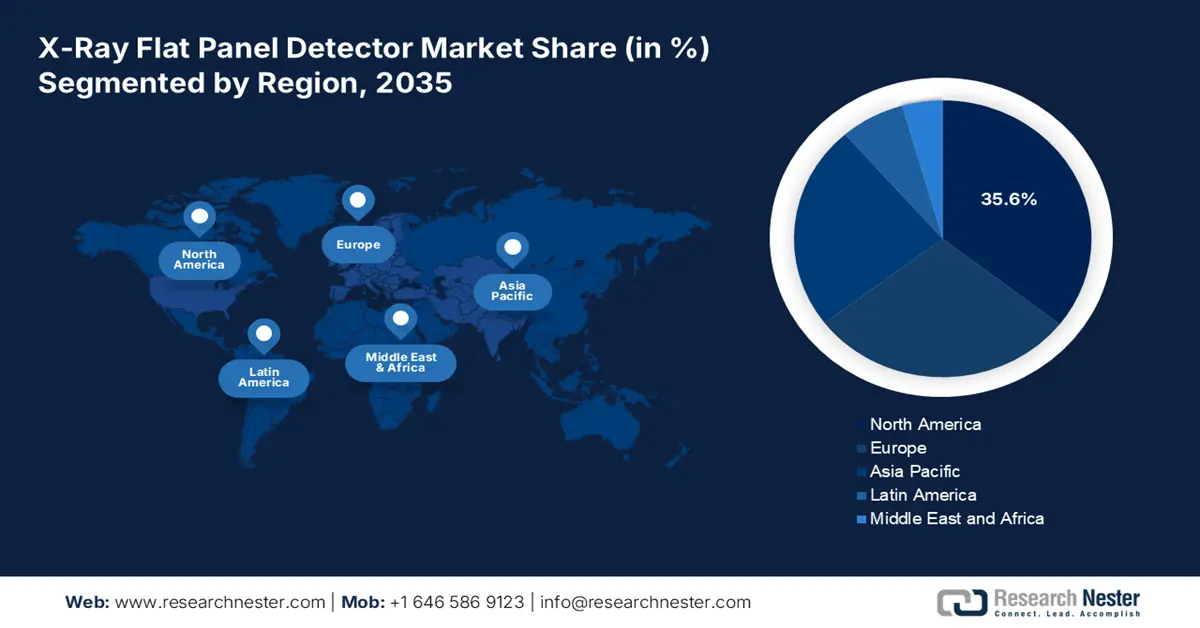

- North America is expected to hold a 35.6% share by 2035, owing to robust medical facilities, high imaging volumes, and intense MedTech innovation.

- Asia Pacific is anticipated to emerge as the fastest-growing region by 2035, impelled by rapid healthcare infrastructure development and expanding medical imaging needs.

Segment Insights:

- The medical segment is projected to account for 45.7% share by 2035, propelled by the increasing volume of radiography diagnostics, surgical guidance, and treatment procedures.

- Indirect FPDs are anticipated to hold a 65.3% revenue share by 2035, driven by their superior performance in general radiography.

Key Growth Trends:

- Rising awareness about radiation exposure

- Extension toward dental and veterinary applications

Major Challenges:

- High upfront cost of R&D and production

- Limitations in infrastructure and workforce

Key Players:Varex Imaging Corporation, Trixell, Rayence Co., Ltd., Teledyne DALSA, Inc., Vieworks Co., Ltd., Carestream Health, Inc., Samsung Medison, Agfa-Gevaert Group, PerkinElmer, Inc., Detection Technology Plc, iRay Technology, DRTECH, Smartray GmbH, COMET Group, Mediavision International.

Global X-Ray Flat Panel Detector Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.5 billion

- 2026 Market Size: USD 3.7 billion

- Projected Market Size: USD 5.9 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, France, Canada

- Emerging Countries: China, India, South Korea, Brazil, Australia

Last updated on : 5 September, 2025

X-Ray Flat Panel Detectors Market - Growth Drivers and Challenges

Growth Drivers

-

Rising awareness about radiation exposure: The growing concerns about patient and operator health impact from excessive absorption of strong photon particles are fostering momentum in the market. The commodities available in this sector require lower radiation doses compared to traditional imaging technologies, making them the most preferred choice for a wide range of medical and diagnostic settings. Besides, regulatory emphasis on minimizing radiation exposure also encourages healthcare providers to adopt safer imaging systems, where advanced flat panel detectors (FPDs) can improve patient compliance and repeatability of scans.

-

Extension toward dental and veterinary applications: Ongoing advances in different imaging modalities and product designs are extending the field of applications for the market. The additional use of FPDs beyond medical now includes dentistry and veterinary assessments. Thus, to capitalize on such an expansion in the consumer base, in March 2025, Detection Technology unveiled the first-of-its-kind X‑Panel 2520z FOM flat panel detector for elevated dental imaging. This compact 25 cm x 20 cm detector features advanced IGZO TFT technology that can deliver a larger field of view (FOV) and enhanced image quality compared to traditional a Si panels.

-

Integration of next-generation technologies: The shift from conventional radiography imaging is also followed by the digitization and automation of workflow. This is accelerating the penetration of the market into enhanced diagnostic capabilities on account of its growing compatibility with digital tools. Particularly, the incorporation of AI technology improves accuracy and reduces interpretation times, while making the whole process more synergistic and seamless. This cohort of innovation can be evidenced by the introduction of VUNO AI-powered chest X-ray imaging flat panel detectors, VXvue, by Vieworks in October 2024.

Pricing Trends Impacting the Overall Economic Value of the Market

Analysis on Cost per Assessment for Low-value Conventional Radiography/Fluoroscopy (2022)

|

Modality of Imaging |

Cost per Assessment (in USD) |

|

Overall Radiography/Fluoroscopy |

4.27-3,696.1 |

|

Routine postoperative or follow-up X-rays in orthopedics |

404.3 |

|

Routine use of chest X-ray |

226.4 |

|

Imaging in breast cancer |

122.0 |

|

Imaging outside guidelines in syncope patients |

1,035.5 |

|

Others |

324.5 |

Source: NLM

Overview of the Historic Trends in the Patient Pool Related to the Market

Comparative Analysis of U.S. and Global Medical Imaging Usage and Radiation Exposure (2014-2017)

|

Metric |

U.S. |

Worldwide |

U.S. Share of Global Total |

|

Total Imaging Procedures |

691 million |

4.2 billion |

16.50% |

|

CT Procedures |

74 million |

~411 million |

18% |

|

Conventional Radiology |

275 million |

~2.5 billion |

11% |

|

Interventional Radiology |

8.1 million |

~23.8 million |

34% |

|

Dental Radiography |

320 million |

~1.1 billion |

29% |

|

Nuclear Medicine |

13.5 million |

~39.7 million |

34% |

|

Collective Effective Dose |

717,000 person-sieverts |

~4.07 million person-sieverts |

17.60% |

|

Average Annual Individual Effective Dose |

2.2 mSv |

0.56 mSv |

~4× higher in the U.S. |

Source: NLM

Challenges

- High upfront cost of R&D and production: The process of developing a new FPD technology requires capital allocation for prolonged research cohorts. Besides, the requirement of highly specialized manufacturing facilities to enable full-fledged commercialization often creates economic barriers for small- and medium-sized producers. This further translates to higher payers’ pricing, pressuring both new and established players to achieve unreal sales volume to recoup investments, which is highly difficult for the market in price-sensitive regions.

- Limitations in infrastructure and workforce: The underserved landscapes also present a limited volume of adequate medical settings and trained professionals, which is essential to operate advanced tools from the market. This forces manufacturers to invest heavily in the cultivation of local commercial and infrastructural support, creating a risk of financial loss and a burden of budget overflow. It also discourages new entrants and patients from investing in this sector, shrinking engagement and adoption.

X-Ray Flat Panel Detectors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 3.5 billion |

|

Forecast Year Market Size (2035) |

USD 5.9 billion |

|

Regional Scope |

|

X-Ray Flat Panel Detectors Market Segmentation:

Application Segment Analysis

The medical segment is predicted to maintain its dominance over the market by capturing the highest share of 45.7% by 2035. The leadership is primarily attributable to the increasing volume of radiography diagnostics, surgical guidance, and treatment procedures. Evidencing the same, in 2024, the WHO unveiled that 3.6 billion imaging examinations are performed annually across the globe, 84% of which are conventional radiography and fluoroscopy (CR). Additionally, the amplifying high-risk population of cancer, cardiovascular conditions, and musculoskeletal disorders is creating a need for regular imaging assessments to enable early prevention and improve outcomes, solidifying the segment’s forefront position in this sector.

Product Segment Analysis

Indirect FPDs are estimated to hold the largest revenue share of 65.3% in the market over the assessed timeline. The superior performance of this subtype in general radiography, which constitutes the highest volume of X-ray procedures globally, is the foundational pillar of this dominance. Their advantages further include high durability, lower cost compared to direct counterparts, and high efficiency at the typical X-ray energies used in medical diagnostics, making the indirect detectors the gold standard for all service providers and medical settings.

End user Segment Analysis

Hospitals are poised to remain the leading end-users in the market with a 50.6% share throughout the analyzed timeframe. This is largely fueled by their high patient volumes, comprehensive pricing for diagnostic services, and government efforts on infrastructure modernization. Moreover, the ability of these facilities to perform a wide range of radiographic procedures, including emergency, surgical, and inpatient diagnostics, where FPD systems are crucial to deliver speed, image clarity, and lower radiation exposure. Ultimately, the push for improvement in workflow efficiency, diagnostic accuracy, and patient outcomes is positioning hospitals at the forefront of this sector.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Imaging Type |

|

|

Type |

|

|

Application |

|

|

Panel Size |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

X-Ray Flat Panel Detectors Market - Regional Analysis

North America Market Insights

North America is poised to hold the largest share of 35.6% in the global X-ray flat panel detectors market by the end of 2035. The robust medical facilities, high imaging volumes, and intense MedTech innovation are the major growth drivers behind the region’s leadership in this sector. The strong presence of globally leading medical device innovators, substantial R&D investment, and supportive regulatory frameworks further testify to the lucrative and progressive characteristics of this landscape. Moreover, the rising demand for portable and point-of-care imaging systems is fueling a greater surge in this sector.

In the U.S., more than 10 million people were suffering from osteoporosis till 2025, and an additional 44 million individuals with low bone density were identified as a high-risk population for this ailment. Further estimation indicates that this medical condition is poised to impose a burden of $57 billion in healthcare costs across the country by 2030. This proves the continuous rise in need for scalable, reliable, and high-performance FPD systems, which ultimately fuels the X-ray flat panel detectors market.

Canada plays a supportive yet prominent role in the North America X-ray flat panel detectors market on account of the ongoing public investments in healthcare modernization and imaging accessibility enhancement. The country is also witnessing a considerable increase in the adoption of digital radiography in both public and private healthcare facilities that are seeking solutions to streamline and enhance diagnostic workflow. Moreover, government efforts to reduce waiting time for diagnostic imaging, particularly in rural and underserved territories, are benefiting this sector.

APAC Market Insights

Asia Pacific is expected to become the fastest-growing region in the global X-ray flat panel detectors market during the discussed tenure. The rapid infrastructural development in healthcare, expanding medical imaging needs, and government efforts to spread awareness about early disease diagnosis are collectively escalating the region’s pace of progress in this sector. The ongoing surge in digital radiography to manage large patient volumes and government-led healthcare reforms. Further, in support of the demographic expansion, a 2025 publication from the International Journal of Basic & Clinical Pharmacology predicted 50% of global osteoporotic fractures to occur in Asia by 2050. Besides, an NLM study estimated crude mortality of CVD in Asia to rise by 91.2% between 2025 and 2050.

China acts as a growth engine for the Asia Pacific X-ray flat panel detectors market, which is supported by its rapidly expanding patient demography. This is further complemented by the government-backed efforts to centralize the national healthcare system with an aim to make medical services equally accessible to every citizen. This is ultimately fostering a favorable business atmosphere and a reliable distribution channel for this merchandise in China. Moreover, with a large and aging population, the country prompts widespread adoption of FPD-based digital radiography systems.

India is also emerging as a lucrative landscape for the X-ray flat panel detectors market on account of the improving healthcare access, expanding network of diagnostic facilities, and government efforts to modernize medical infrastructure. The increasing mortality of chronic diseases and a large rural population are pushing public authorities to cultivate portable and affordable digital radiography solutions, securing a stable consumer base for this sector. Additionally, private medical service providers in India are increasingly adopting FPD-enabled X-ray systems to maintain market relevance.

Diverse Opportunities for the X-Ray FPD Market

|

Country |

Opportunity |

Key Notes |

Year |

|

India |

Expanding Diagnostic Industry |

Soft Radiology (including X-ray and ultrasound) induced a USD 3.5 billion industry value |

2024 |

|

China |

Increasing demand for chest X-rays |

The CVD-afflicted population surpassed 330 million |

2023 |

|

Australia |

National-level digital health transformation |

USD 5.5 billion Digital Budget allocation |

2025 |

Source: ASSOCHAM, NLM, and Australian Government

Europe Market Insights

Europe is predicted to acquire the second-largest share in the global X-ray flat panel detectors market over the timeline between 2026 and 2035. The position is consolidated in support of its well-established MedTech industry, high imaging procedure volumes, and strong regulatory focus on patient safety and imaging quality. The increasing expenditure on associated chronic ailments is also enabling a steady cash inflow in this sector. Evidencing the same, in 2025, the International Journal of Basic & Clinical Pharmacology estimated the annual healthcare costs linked to osteoporosis in Europe to increase from €37 billion to €76.7 billion by 2050. This showcases the urgent requirement for early detection and prevention, hence fueling demand in this field.

The UK is a key contributor to ongoing innovation in the Europe X-ray flat panel detectors market, which is empowered by the presence of globally leading MedTech pioneers. Exemplifying the same, in February 2022, Spectrum Logic expanded its pipeline of large area, super-fast FPD by launching 3131HS in the country. The dynamic X-ray detector is designed for a wide range of clinical applications, including Cone Beam Computed Tomography (CBCT) and fluoroscopy. Furthermore, the strong push toward digital transformation within the National Health Service (NHS) coverage is acting as both the expansion propeller and financial cushion for this sector.

Germany is one of the most important landscapes for the Europe X-ray flat panel detectors market. The country’s forefront position is majorly supported by high diagnostic imaging volumes and strong emphasis on medical device innovation. The well-distributed network of hospitals and diagnostic centers is also fueling demand in this field by continuously upgrading to digital radiography systems for improved efficiency and image quality. Currently, the low-dose, high-resolution imaging solutions are gaining traction in Germany under this category, prompting both domestic and foreign companies to invest more in innovation.

Factor Creating Opportunities for the X-Ray FPD Market

|

Country |

Metrics |

Key Notes |

Year |

|

Germany |

Expanded Reimbursement Coverage |

98 % of the general population have statutory or private full-cover health insurance |

2024 |

|

UK |

Frequency of radiology examinations |

1.6 million (the most common) X-rays were performed |

2023 |

|

France |

Greatest availability of technical resources in hospitals |

124.9 day care places per 100,000 inhabitants |

2022 |

Source: BFS, NHS, and Eurostat

Key X-Ray Flat Panel Detectors Market Players:

- Varex Imaging Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Trixell

- Rayence Co., Ltd.

- Teledyne DALSA, Inc.

- Vieworks Co., Ltd.

- Carestream Health, Inc.

- Samsung Medison

- Agfa-Gevaert Group

- PerkinElmer, Inc.

- Detection Technology Plc

- iRay Technology

- DRTECH

- Smartray GmbH

- COMET Group

- Mediavision International

Recent Developments

- In April 2025, Detection Technology launched the latest innovation, the X-Panel 43108a FQI, under its TFT flat panel detector (FPD) portfolio. This set a new standard as the world’s largest dynamic flat panel digital detector array (DDA), offering unparalleled performance for versatile industrial imaging applications.

- In October 2024, Agfa expanded its Dura-line family of robust, reliable, and cost-effective wireless Digital Radiography (DR) flat panel detectors pipeline by launching the glass-free and high-resolution Dura-line XF+ range, which comes in three sizes. These detectors deliver exquisite image quality, low weight, and high durability.

- Report ID: 8063

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

X-Ray Flat Panel Detector Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.