Wireless Power Transmission Market Outlook:

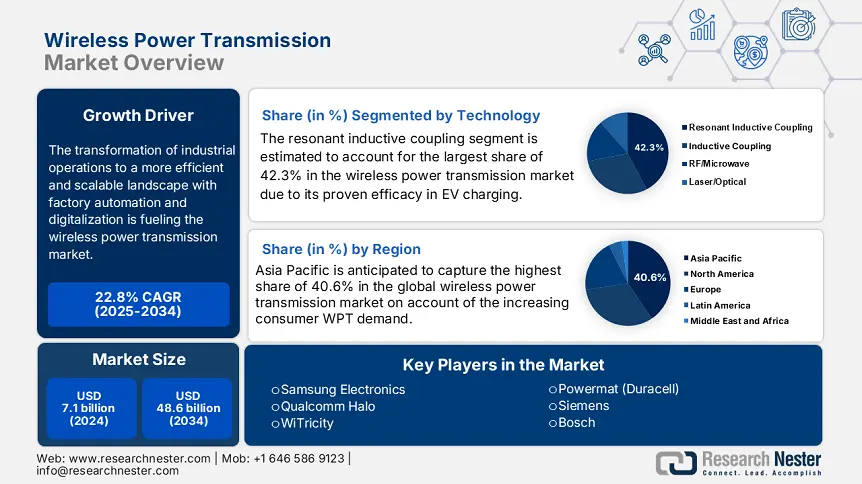

Wireless Power Transmission Market size was over USD 7.1 billion in 2024 and is estimated to reach USD 48.6 billion by the end of 2034, expanding at a CAGR of 22.8% during the forecast timeline, i.e., 2025-2034. In 2025, the industry size of wireless power transmission is estimated at USD 8.6 billion in 2025.

The transformation of industrial operations to a more efficient and scalable landscape with factory automation and digitalization is a major source of growing demand in the wireless power transmission (WPT) market. Testifying to the same, the International Trade Commission (ITC) revealed that the global trade value of commodities from this sector surpassed $5.5 billion in 2024. Another report from the Census Bureau highlighted that the U.S. alone recorded $2.1 billion and $920.4 million worth of imports and exports in wireless power transmission (WPT) modules, respectively. Besides, the manufacturers are cultivating new supply chains of essential components, including semiconductors, to avoid additional expenses on tariff duties and logistics.

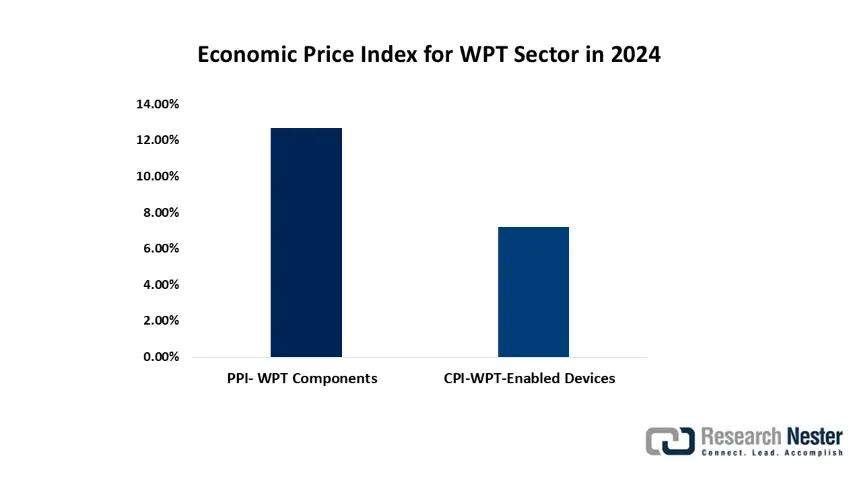

Currently, upon consideration of the consistent cost pressures throughout the value chain of the wireless power transmission market, the localization of production and integration of next-generation technologies is receiving immense priority. As evidence of the payers' pricing inflation, the Bureau of Labor Statistics (BLS) in the U.S. recorded a notable jump of 12.7% year-over-year (YoY) in the producer price index (PPI) for WPT components in 2024. Concurrently, it also underscored an annual rise of 7.2% in the consumer price index (CPI) for WPT-enabled devices. In response, 55% of manufacturing in this sector adopted automation in assembly lines that cut labor expenses by 30.4% in high-volume plants, according to the Organization for Economic Co-operation and Development (OECD).

Wireless Power Transmission Market - Growth Drivers and Challenges

Growth Drivers

- Emergence of smart factories: As per an estimation of the OECD, more than 45.3% of smart factories worldwide are projected to adopt WPT for robotics by the end of 2030. This transition is delivering tangible efficiency gains, including 20.6% reductions in maintenance costs across automated production lines, and hence benefiting the wireless power transmission market. The commercial success in this field can further be exemplified by Siemens' successful implementation of wireless-powered assembly systems in Germany. which demonstrated the technology's potential in boosting productivity by 15.4% while eliminating cable constraints.

- Extensive R&D initiatives and investments: Government investments are accelerating innovation in the wireless power transmission market, with global R&D funding crossing $3.8 billion in 2024 alone. This is a result of cumulative efforts to accelerate the research, development, and deployment (RDD) of advanced technologies across the globe. For instance, the U.S. Department of Energy (DoE) allocated $1.6 billion in this category, which is followed by the Horizon Europe program committing $950.4 million. These substantial public allocations are driving breakthroughs in WPT efficiency and scalability, indicating the presence of strong confidence in progress and commercial expansion across multiple landscapes.

Key Technological Trends Reshaping the Market

Adoption Patterns by Industry

|

Industry |

Key Technology |

Adoption Rate (2024) |

Example |

Impact |

|

Automotive |

Resonant Coupling |

42.5% of new EV models |

BMW i5 (11 kW wireless charging) |

30.3% faster charging |

|

Healthcare |

RF WPT |

28.3% of implantable devices |

Wi-Charge (FDA-cleared) |

5x battery life extension |

|

Manufacturing |

AI-Optimized WPT |

35.3% of smart factories |

Siemens (AI energy routing) |

18.7% energy savings |

|

Consumer Tech |

GaN Semiconductors |

60.6% of Qi2.0 devices |

Apple MagSafe (GaN adoption) |

15.3% efficiency gain |

Sustainability Initiatives Reshaping the Market

Breakdown of Sustainability Benchmarks

|

Company |

Sustainability Initiatives |

Goals & Vision (2030) |

Impact on Business |

|

WiTricity |

100% renewable energy in operations (2023) |

Carbon-neutral manufacturing by 2025 |

40.5% lower emissions; 25.3% more partnerships |

|

Powermat |

75.7% renewable energy use (2023) |

100% clean energy by 2027 |

12,004 MT CO₂ reduction annually |

|

Siemens |

98.4% waste recycled (2024) |

Zero-landfill production by 2026 |

15.5% cost savings from circular economy |

|

Qualcomm |

50.4% renewable-powered R&D labs (2024) |

Net-zero supply chain by 2030 |

20.6% energy efficiency gain in WPT systems |

Challenges

- Cybersecurity risks in WPT networks: The growing number of cyber breach cases often results in significant financial and reputation losses in the market. As evidence, in 2024, a 55.4% surge in such attacks targeting EV charging and medical device networks was recorded by a report from the European Union Agency for Cybersecurity (ENISA). This vulnerability prompted upgrades in regulatory policies, including the 2025 Cyber Resilience Act in Europe, imposing mandatory WPT security standards. However, Qualcomm Halo addressed this problem by developing an AI-driven encryption system, which improved compliance by 25.3%.

- Resistance toward advanced technologies: The economic barriers in the market are widening due to premium pricing. According to the World Trade Organization (WTO), till 2024, the cost of WPT systems was 30.4% higher than conventional wired alternatives. Concurrently, such a disparity hampered the penetration of this sector among small and medium enterprises (SMEs) having limited budgets. To bridge the gap, Powermat introduced a scalable resonant coupling technology to the consumer base of India, which already reduced costs by 25.4% in 2023, as per the Indian Ministry of Electronics.

Wireless Power Transmission Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

22.8% |

|

Base Year Market Size (2024) |

USD 7.1 billion |

|

Forecast Year Market Size (2034) |

USD 48.6 billion |

|

Regional Scope |

|

Wireless Power Transmission Market Segmentation:

Technology Segment Analysis

The resonant inductive coupling segment is estimated to account for the largest share of 42.3% in the wireless power transmission market over the discussed timeframe. Its cost-effectiveness and proven efficiency in electrification and automation are making the category a major source of revenue generation in this field. In addition, this commodity is becoming the primary focus of government R&D investments toward sustainability, which is enabling a stable cash inflow. According to the International Energy Agency (IEA), this subtype receives more than 75.5% of public funding for WPT development. Moreover, substantial capital influx and state-of-the-art performance are cumulatively positioning resonant inductive coupling as the foundation for next-generation power solutions.

Application Segment Analysis

The electric vehicle charging segment is poised to dominate the wireless power transmission market with a share of 38.5% during the analyzed period. Stringent regulations and initiatives to attain maximum sustainability are backing this leadership. Supporting this cohort, the European Commission (EC) mandated all new EVs in Europe to feature wireless charging by 2030 and banned the use of combustion engines by 2035. Additionally, the segment's predominant captivity over the revenue generation in this sector can be exemplified by a 2024 report from the IEA, highlighting 60.4% of WPT revenue, originating from the automotive industry. The same evaluation also projects 35.5% of EVs around the globe to adopt wireless charging by 2030.

Our in-depth analysis of the global wireless power transmission market includes the following segments:

|

Segments |

Subsegments |

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wireless Power Transmission Market - Regional Analysis

APAC Market Insights

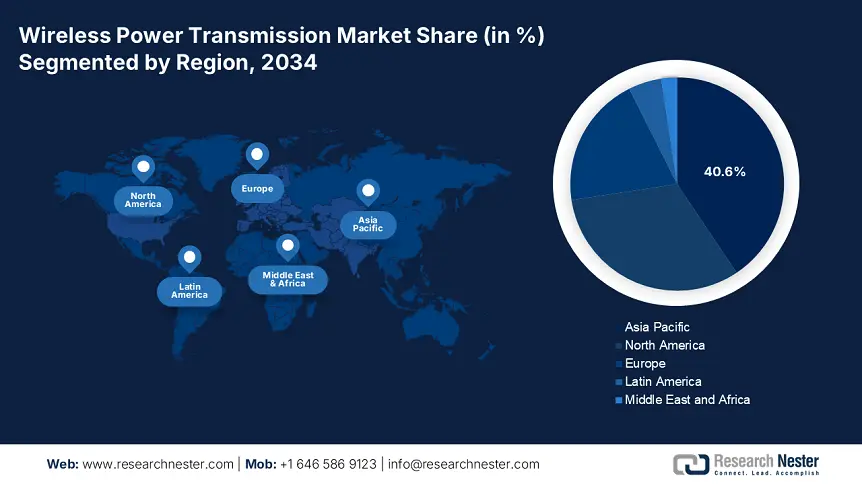

Asia Pacific is anticipated to capture the highest share of 40.6% in the global wireless power transmission market by the end of 2034. As the region accounts for 65.4% of worldwide consumer WPT demand, it secured the forefront position in this sector with a substantially growing demand. Specifically, the notable boom in the electronics and EV industries in China and South Korea is solidifying the leadership. APAC also dominates the global manufacturing, with 65.3% of WPT assembly plants concentrated in China, Vietnam, and South Korea, according to a report from the ITC. This is further backed by continuous government funding, where South Korea alone committed $2.6 billion to realize the 6G-WPT integration plan by 2030, as unveiled by the Ministry of Science and ICT (MSIT).

China is augmenting the wireless power transmission market with regional dominance. Testifying to this leadership, the Ministry of Industry and Information Technology (MIIT) revealed that the country accounts for 60.4% of global EV-WPT deployments and is targeting the construction of 800,006 wireless charging spots by 2030. The increased WPT spending is also evidently signifying the nation's accelerated progress in this sector. In this regard, the China Academy of Information and Communications Technology (CAICT) reported that the government expenditure on this category grew at a 35.4% CAGR from 2019 to 2024, reaching $8.9 billion. Besides, in 2024, China gained traction in technology integration with Huawei's $2.6 billion funding in 6G-WPT research, according to a 2024 report from the MSIT.

India is presenting itself as a lucrative opportunity for global expansion for key players in the wireless power transmission market. With more than 500,004 businesses adopting WPT solutions in 2023 alone, the country stands strong in this category, as per the Ministry of Electronics and Information Technology (MeitY). The rapidly developing public infrastructure is also empowering this cohort to gain sustainability. Following the same pathway, Tata Power expanded its WPT ecosystem with $500.6 million funding from the MeitY's scheme. Such investments also make India an attractive alternative for WPT component sourcing by diversifying supply chains traditionally concentrated in China.

Government Investments & Policies

|

Country |

Initiative / Policy |

Budget / Funding (Million) |

Key Focus Area |

|

Australia |

National Electric Vehicle Strategy |

~$170.4 (2023) |

EV wireless charging infrastructure |

|

Indonesia |

National Smart Mobility Initiative |

~$80.6 (2024) |

Public transport WPT solutions |

|

Malaysia |

MyHIJAU WPT Adoption Scheme |

~$65.3 (2023) |

Consumer electronics & EVs |

North America Market Insights

North America is poised to exhibit a notable CAGR in the global wireless power transmission market throughout the discussed period. The continuous public investments and increasing defense applications are propelling demand in this sector. As evidence, in 2025, the Department of Defense (DoD) dedicated $1.8 billion to WPT applications with a focus on drone and satellite power beaming systems. The region's position is further consolidated by rapid industrial WPT adoption, under the support of DoE-funded infrastructure projects. Besides, the development of safety certifications is projected to reduce compliance costs in this category by 20.5% by 2026, as per the National Institute of Standards and Technology (NIST).

The U.S. leads the regional wireless power transmission market with 85.4% revenue share on account of government initiatives and upgrades in sustainability regulations. As evidence, in 2023, the Federal Communications Commission (FCC) released the 6 GHz spectrum scheme to amplify IoT integration in industrial operations, reflecting the country's acceptance of technological advancements. The $42.4 billion Broadband Equity Act by the National Telecommunications and Information Administration (NTIA) further expanded WPT penetration in the enhancement of rural connectivity. Moreover, the field of applications in defense is also widening through contracts.

Canada is establishing a strong emphasis on the wireless power transmission market. Provincial investments in scalable and sustainable technologies to empower various industries are enabling a strong capital influx in this sector. For instance, in 2024, Innovation, Science and Economic Development Canada (ISED) allocated $360.7 million as a Green Tech Fund. On the other hand, in 2023, the Canadian Radio-television and Telecommunications Commission (CRTC) made nationwide cultivation of charging infrastructure mandatory for full-fledged use of EVs. As evidence, Ontario sanctioned a $120.4 million grant to deploy resonant charging pilots, targeting 30.3% EV penetration by 2030.

Europe Market Insights

The Europe wireless power transmission market is fostering attractive avenues by implementing stringent environmental regulations and making substantial funding commitments. The tightening emissions norms are accelerating wireless EV charging infrastructure development, particularly for public transport systems. For instance, in 2023, France allocated €1.5 billion of its ICT budget to WPT initiatives. On the other hand, the governing authorities in Europe invested €2.7 billion in GaN RF technology between 2023 and 2030. These allocations, combined with the Cyber Resilience Act's security standards, position Europe as a leader in regulated, sustainable WPT solutions.

Germany is poised to dominate the Europe wireless power transmission market with a 35.4% revenue share by 2034. The country is pledged to its persistent automotive and industrial leadership. The €3.5 billion investment in dynamic EV charging by BMW and Volkswagen is evidence of this growth factor, which is further complemented by €1.9 billion grant from the government for WPT R&D. On the other hand, the thriving industrial WPT adoption is accelerated by ongoing innovations, such as 18.5% reduction in energy waste from the use of Siemens' AI-optimized systems in smart factories. Besides, these efforts are amplified by €500.3 million in GaN semiconductor grants as per the region's Digital Strategy.

The UK is utilizing its ambitious goal for sustainability to acquire a strong position in the regional wireless power transmission market. This can be testified by its allocation of 9.6% of its national ICT budget, totaling £850.4 million, to WPT initiatives in 2024. The presence of such a steady capital influx reflects the nation's focus on developing new wireless power technologies as a pivotal part of its digitalization strategy. Moreover, government initiatives supporting the integration of next-generation charging solutions for regular transportation mediums are propelling adoption in this sector.

Country-wise Government Provinces

|

Country |

Initiative / Policy |

Budget / Funding (Million) |

Key Focus Area |

|

Spain |

MovES (Electric Mobility Plan) |

~$220.4 (2023) |

EV wireless charging infrastructure |

|

Italy |

Industria 4.0 WPT Tax Credits |

~$88.4 (2024) |

Industrial automation |

|

Russia |

Rosnano GaN Semiconductor Fund |

~$33.7 (2023) |

Domestic WPT component production |

Key Wireless Power Transmission Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

Current dynamics in the wireless power transmission market feature a distinct competitive environment, with U.S. firms, such as WiTricity and Qualcomm, leading in EV charging and semiconductor technologies. On the other hand, manufacturers in APAC, including TDK and Samsung, are concentrating their focus on the consumer electronics segment. For instance, Samsung captured 7.4% of the consumer market through dual-standard adoption of Qi + AirFuel. Simultaneously, key players in Europe are maintaining their forefront position in industrial applications with innovation in GaN solutions.

Here is a list of key players operating in the global market:

|

Company |

Country |

Market Share (2024) |

|

WiTricity |

U.S. |

18.1% |

|

Qualcomm Halo |

U.S. |

15.4% |

|

Powermat (Duracell) |

Israel |

12.3% |

|

Siemens |

Germany |

10.3% |

|

Samsung Electronics |

South Korea |

7.1% |

|

Bosch |

Germany |

xx% |

|

Fulton Innovation |

U.S. |

xx% |

|

NXP Semiconductors |

Netherlands |

xx% |

|

MediaTek |

Taiwan |

xx% |

|

Energous Corporation |

U.S. |

xx% |

|

Tata Power (India) |

India |

xx% |

|

Green Packet |

Malaysia |

xx% |

|

CapTech (Australia) |

Australia |

xx% |

Below are the areas covered for each company in the wireless power transmission market:

Recent Developments

- In March 2024, WiTricity launched its Halo EV Charging System, featuring 11 kW wireless charging with 92.3% efficiency and compatibility with BMW and Toyota models. The system has been deployed in 12 U.S. cities through a $50.2 million DoE grant, driving a 30.1% revenue surge for WiTricity in the 1st quarter of 2024.

- In February 2024, Samsung introduced its Qi2.0-compatible wireless charger, featuring 15W fast charging with GaN semiconductor technology that reduces heat loss by 20.2%. The product sold 1 million units in 1st quarter of 2024, capturing 25.3% of the consumer WPT market.

- Report ID: 314

- Published Date: Jul 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wireless Power Transmission Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert