Water Recycle and Reuse Market Outlook:

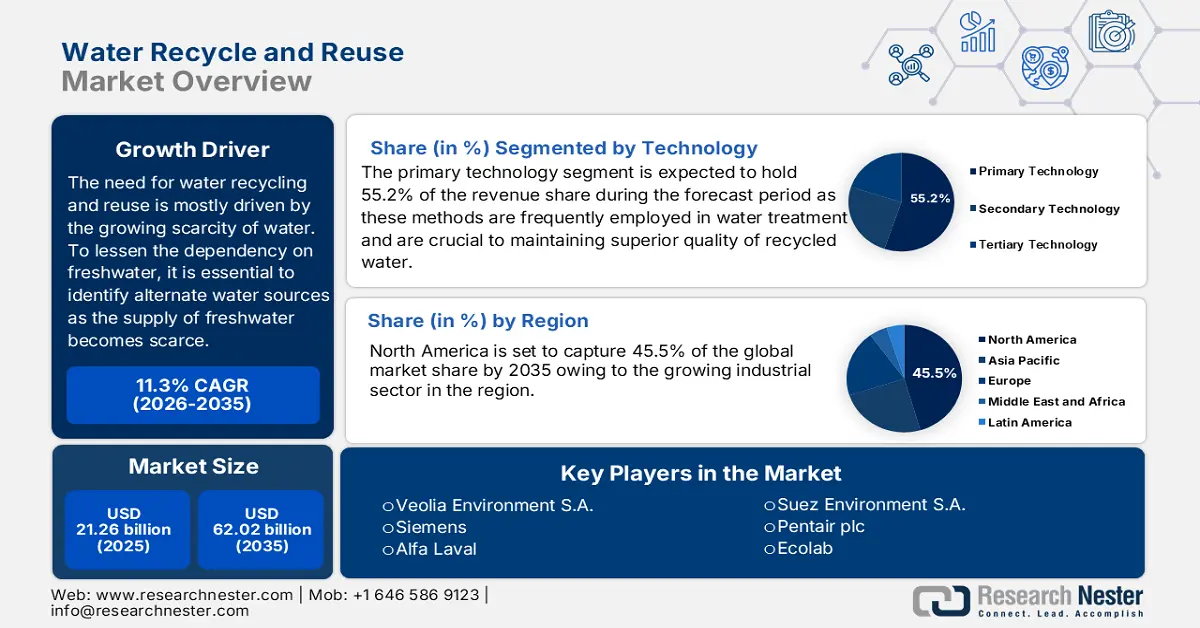

Water Recycle and Reuse Market size was valued at USD 21.26 billion in 2025 and is set to exceed USD 62.02 billion by 2035, expanding at over 11.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of water recycle and reuse is evaluated at USD 23.42 billion.

The need for water recycling and reuse is driven by the growing scarcity of water. For instance, approximately 4 billion people, or at least half of the world's population, struggle with water shortages at least once a year. A shift toward alternate water sources is observed to manage the dependency on freshwater. One sustainable way to treat and reuse water is to recycle and reuse it. Additionally, the water recycle and reuse market is positively influenced by the stringent government regulatory standards. Strict laws have been put in place in many nations and regions to encourage the usage of recycled water and to encourage water conservation. Water reuse goals, discharge restrictions, and incentives and subsidies to encourage the use of reclaimed water are a few examples of these rules.

Key Water Recycle and Reuse Market Insights Summary:

Regional Highlights:

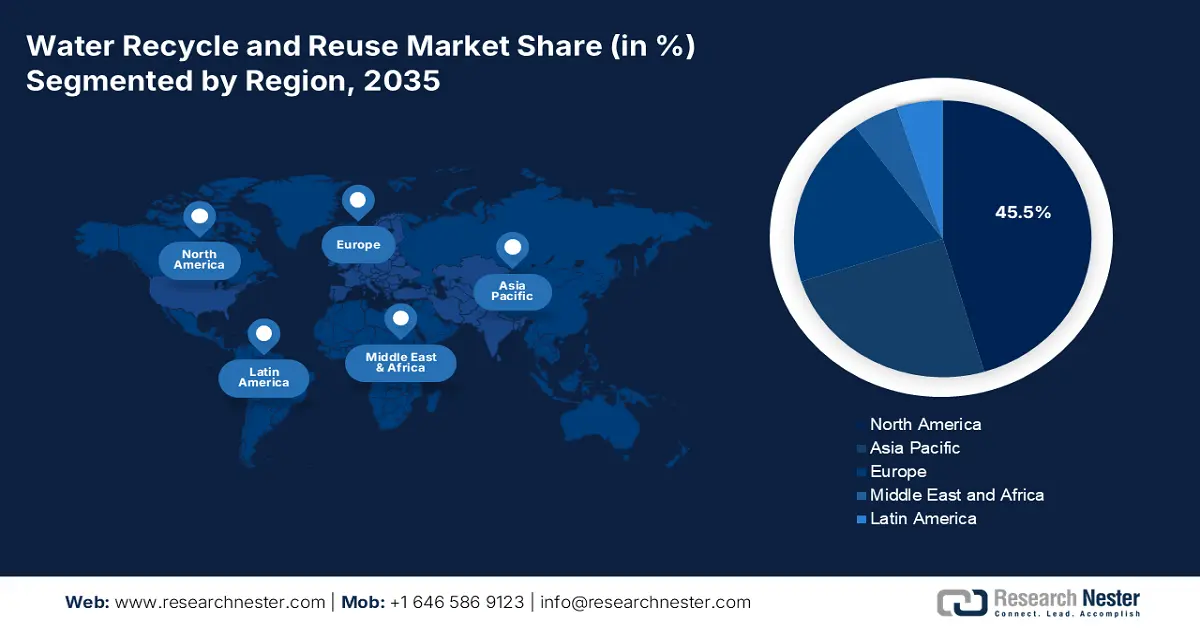

- North America commands a 45.5% share in the Water Recycle and Reuse Market, propelled by the growing industrial sector and increased focus on sustainability and water efficiency, ensuring significant growth by 2035.

- The Asia Pacific water recycle and reuse market is forecasted for stable growth through 2026–2035, attributed to population growth, urbanization, and industrialization placing pressure on freshwater resources.

Segment Insights:

- The Primary Technology segment is expected to hold around 55.2% share by 2035, driven by its critical role in improving recycled water quality.

- The Municipal segment of the Water Recycle and Reuse Market is projected to hold over 29.5% share by 2035, driven by advanced treatment technologies and growing reuse applications.

Key Growth Trends:

- Rising population growth and urbanization

- Decentralized water recycling solutions are receiving more attention

Major Challenges:

- Entry barrier due to high capital costs

- Safety and health issues

- Key Players: Veolia Environment S.A., Siemens, Alfa Laval, Hydraloop, Suez Environment S.A., Pentair plc, Ecolab, ABB ltd., and Evoqua.

Global Water Recycle and Reuse Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.26 billion

- 2026 Market Size: USD 23.42 billion

- Projected Market Size: USD 62.02 billion by 2035

- Growth Forecasts: 11.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, Canada

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Water Recycle and Reuse Market Growth Drivers and Challenges:

Growth Drivers

- Rising population growth and urbanization: The challenge of providing enough water resources to meet the rising demand is brought on by the growing world's population. Additionally, the number of people living in cities and urban areas is increasing at a rate never seen before due to urbanization. Water recycling and reuse have a lot of options due to this trend. For instance, between 2009 and 2050, the world's population is predicted to increase by 2.3 billion, with 80% of that growth occurring in emerging nations. The water availability for food production will be significantly impacted by the world's population growth.

- Decentralized water recycling solutions are receiving more attention: The growing emphasis on decentralized water recycling systems is a notable development in the water recycle and reuse sector. By enabling water to flow at or close to the point of use, these systems provide several advantages. This regional strategy lessens dependency on centralized infrastructure, offers tailored solutions for specific purposes, and gives more control over water quality and availability. Large medical centers are typically more expensive than decentralized systems.

As decentralized systems serve smaller areas and use less water, they can have financial benefits in the form of decreased operating and maintenance expenses. To lessen their carbon footprint, they are combined with renewable energy sources including solar or wind. Decentralized systems support environmentally beneficial and sustainable practices by using renewable energy for water treatment procedures. - Public understanding and support for recycling and reusing water: Initiatives to recycle and reuse water have gained more acceptance and support as a result of growing public awareness regarding pollution, water shortages, and the significance of sustainable water management. Businesses and governments are encouraged to invest in water recycling infrastructure due to the public's desire for eco-friendly activities. Customers are calling for more ecologically friendly goods and services in several industries, including water management. Businesses are encouraged to invest in water recycling infrastructure to match customer expectations and obtain a competitive edge, as this demand opens up new markets.

Challenges

- Entry barrier due to high capital costs: The high installation and maintenance costs pose a key water recycle and reuse market barrier. This is attributed to the need for sophisticated treatment technology and substantial infrastructure for transporting and storing recycled water. The total cost may also increase if recycled water needs further treatment to satisfy certain quality standards for its intended application.

- Safety and health issues: Owing to decisions about public water supply have a direct impact on sustainability, public health, environmental protection, and future growth, the public is cautious. People are therefore reluctant to adopt new technology and ways of supplying water, and they keep a careful eye on the strategies used by water management organizations. This is not an exception to the general public's mistrust of wastewater treatment technology because of the sociological concept of contagion.

Water Recycle and Reuse Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.3% |

|

Base Year Market Size (2025) |

USD 21.26 billion |

|

Forecast Year Market Size (2035) |

USD 62.02 billion |

|

Regional Scope |

|

Water Recycle and Reuse Market Segmentation:

Technology (Primary Technology, Secondary Technology, Tertiary Treatment)

In water recycle and reuse market, primary technology segment is projected to capture revenue share of around 55.2% by the end of 2035, as this is frequently employed in water treatment and is crucial to improving the quality of recycled water. Microfiltration is one of the primary methods of filtering water that separates trash, germs, and other big particles using microporous membranes. In contrast to other membrane systems, it functions in pore diameters ranging from 0.1 to 10 microns. For example, in March 2023, the next generation of advanced separation, brine concentration, and water reuse solutions was launched by Fluid Technology Solutions, Inc. (FTS) and Aquatech.

End use (Industrial, Agriculture, Residential, Commercial, Municipal)

By the end of 2035, municipal segment is set to hold water recycle and reuse market share of over 29.5%. By eliminating pollutants, bacteria, and impurities from wastewater and creating usable water that satisfies unused water requirements, treatment technologies play a significant part in the use and reuse of water. A range of physical, chemical, and biological procedures and processes are included in treatment technologies. Water recycling is now much more effective and efficient due to ongoing improvements in treatment techniques. Reverse osmosis and ultrafiltration are two membrane filtration innovations that have improved the removal of pollutants, salts, and minute particles from wastewater, which has helped the market as a whole.

Our in-depth analysis of the global water recycle and reuse market includes the following segments:

|

Technology |

|

|

Equipment |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Water Recycle and Reuse Market Regional Analysis:

North America Market Analysis

North America in water recycle and reuse market is predicted to hold more than 45.5% revenue share by 2035, owing to its growing industrial sector. Companies in this region are steadily becoming aware of how crucial sustainability and water efficiency are to cutting expenses, meeting legal requirements, and enhancing environmental performance. Reusing and recycling water is a smart way to improve water efficiency and lower freshwater use. For instance, the amount of recycled water generated in the U.S. is expected to rise 37% from 4.8 billion gallons per day to 6.6 billion gallons per day by 2027.

Growing water scarcity and the demand for sustainable water management solutions are driving growth in the U.S. for water recycle and reuse market. Increased industrialization and urbanization are fueling the need for water efficiency. The adoption of water recycling technologies is also encouraged by government incentives and strict environmental restrictions. Growing public and private sector investments in cutting-edge water treatment and reuse systems to guarantee a sustainable water supply are driving market expansion, along with growing awareness of water conservation and the advantages of recycling.

The water recycle and reuse market is well-established in Canada due to factors including strict environmental legislation, a strong emphasis on sustainability, and water stress in some areas. Struggle with water shortages and high-water demand have put in place water recycling and reuse programs for a range of uses, such as groundwater replenishment, industrial processes, landscape irrigation, and agriculture in the nation. The water recycle and reuse market in Canada has grown as a result of the implementation of cutting-edge water treatment technology and the existence of strong regulatory frameworks.

Asia Pacific Market Analysis

Asia Pacific water recycle and reuse market is expected to experience a stable CAGR during the forecast period due to the population's fast increase, urbanization, and industrialization. Freshwater resources are being strained by these factors, which is why businesses and governments are investing in sustainable water management techniques. Water recycling technology adoption is fueled by growing awareness of water shortage and its effects on the environment. The market is growing as a result of government policies and programs that encourage water conservation.

The aggressive plan by the government of India to address the problem of water scarcity is anticipated to boost water recycle and reuse market demand. For example, the Bawana water treatment plant in Delhi received approval from the Delhi government in May 2023 for a water recycling and reuse project. 2 million gallons can be recycled every day at the plant that is now under development.

In South Korea, the water recycle and reuse market is expanding as a result of growing urbanization and industrial sector water demands. The nation places a high priority on sustainable water management techniques due to its limited freshwater resources. Water recycling technologies are encouraged by government policies and programs to lessen the effects of water scarcity on the environment. Water treatment technological developments help the market grow, and growing public and industry awareness of water conservation encourages adoption.

Key Water Recycle and Reuse Market Players:

- Dow Corporate

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Veolia Environment S.A.

- Siemens

- Alfa Laval

- Hydraloop

- Suez Environment S.A.

- Pentair plc

- Ecolab

- ABB Ltd.

- Evoqua

The water recycle and reuse market has been significantly shaped by mergers and acquisitions. The major companies in this sector have been able to increase their offers and seize new business opportunities by diversifying their product lines and strengthening their market positions.

Here are some leading players in the water recycle and reuse market:

Recent Developments

- In November 2024, the U.S. Department of the Interior announced a USD 125 million investment in large-scale water recycling projects. The Department's new Large-Scale Water Recycling Program, which was started in 2023 with additional funding from the Bipartisan Infrastructure Law, is supported by these investments. By converting undesirable water sources into clean, dependable ones, the new program will help communities create local, drought-resistant water supplies and encourage conservation projects on a broader scale, with no cap on project size.

- In January 2023, Evoqua, a leader in mission-critical water treatment solutions and services, and Xylem Inc., a prominent global water technology company announced that they have reached a final agreement whereby Xylem will buy Evoqua in an all-stock transaction with an implied enterprise value of roughly USD 7.5 billion.

- Report ID: 6771

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Water Recycle and Reuse Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.