Uveal Melanoma Market Outlook:

Uveal Melanoma Market size was valued at USD 1.9 billion in 2025 and is estimated to reach USD 3 billion by the end of 2035, expanding at a CAGR of 5.4% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of uveal melanoma is assessed at USD 2 billion.

The rising incidence and severity of intraocular malignant tumors (IMTs) are creating a surge in early diagnosis, treatment, and prevention, hence, fueling the uveal melanoma market. According to the 2024 NLM findings, this condition is considered the most prevalent IMT among adults, accounting for 79%-81% of ocular melanomas and 3%-5% of all melanomas. It also mentioned that iris melanoma was affecting approximately 1-9 individuals per million across the world during the same timeline. Further, the growing volume of geriatric residents is expanding the high-risk demography, where the global elderly population is estimated to surpass 1.4 billion by 2030.

This portrays the need for continuous research and development in the market to combat the worldwide epidemic. The supply chain of this sector consists of secure and reliable distribution of diagnostic tools, therapeutic devices, and pharmaceuticals, which largely depends on the sufficient resources of critical components, including APIs, radioactive isotopes, targeted biologics, and other raw materials. As a result, the expensive procurement and production in this category translates to higher payers’ pricing, fostering an economic barrier among both medical settings and patients. As evidence, in 2024, a study conducted by the American Academy of Ophthalmology unveiled that the per-procedure surgical costs of plaque brachytherapy stood at $4013, which is even higher than the enucleation method.

Key Uveal Melanoma Market Insights Summary:

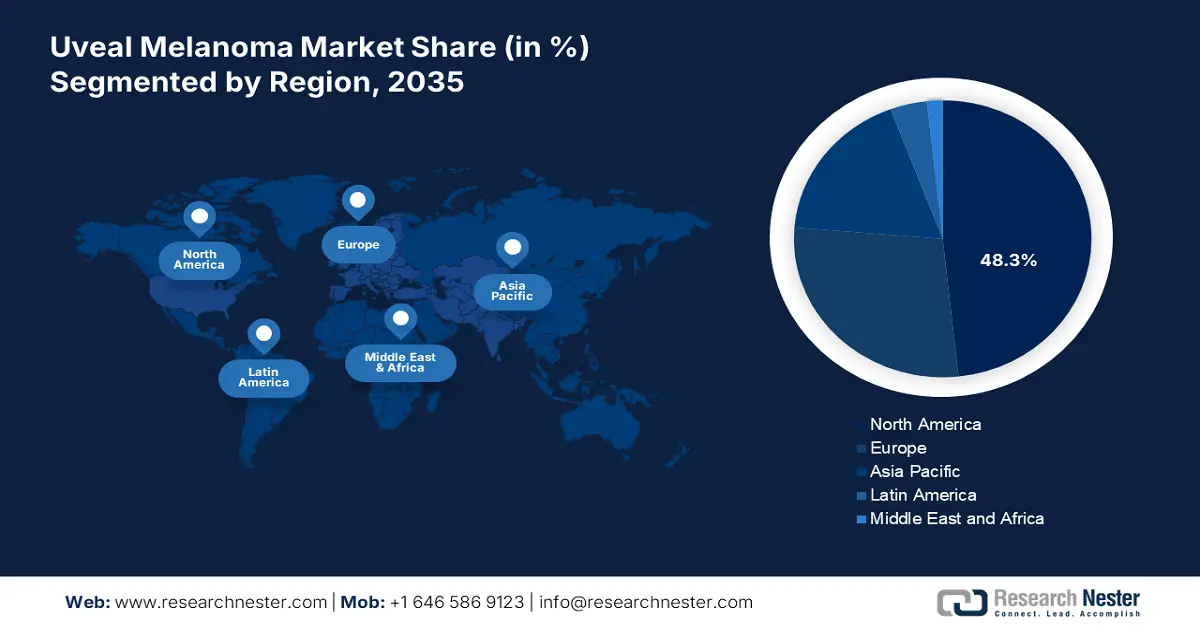

Regional Insights:

- By 2035, North America is anticipated to command a 48.3% share in the uveal melanoma market, bolstered by the advancement and commercialization of premium-priced novel therapeutics.

- Asia Pacific is projected to grow at the fastest pace through 2026–2035 as improvements in healthcare infrastructure and rising rare-disease awareness accelerate adoption of advanced diagnostic and treatment technologies.

Segment Insights:

- By 2035, the immunotherapy/targeted therapy sub-segment in the uveal melanoma market is expected to secure a 45.4% share, propelled by the superior efficacy and premium pricing of novel biologic therapies.

- Melanoma of the choroid is set to capture an 85.3% share by 2035, underpinned by its high susceptibility to malignant transformation.

Key Growth Trends:

- Improved access and efficacy of diagnosis

- Increasing activities in research and development

Major Challenges:

- Economic limitations for patients and producers

- Diagnostic and infrastructural barriers

Key Players: Immunocore, Bristol Myers Squibb, Novartis AG, Pfizer Inc., Merck & Co., Inc., Aura Biosciences, IDEAYA Biosciences, Moderna, Inc., Iovance Biotherapeutics, F. Hoffmann-La Roche Ltd., Sanofi, CSL Limited, Samsung Biologics, Celltrion Inc., Sun Pharmaceutical, Biocon Limited, Hovid Berhad.

Global Uveal Melanoma Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size:USD 1.9 billion

- 2026 Market Size: USD 2 billion

- Projected Market Size: USD 3 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, Japan, France

- Emerging Countries: China, South Korea, India, Brazil, Australia

Last updated on : 29 August, 2025

Uveal Melanoma Market - Growth Drivers and Challenges

Growth Drivers

- Improved access and efficacy of diagnosis: The enhanced availability and accessibility of high-resolution imaging, genetic profiling, and molecular diagnostics support a greater volume of diagnosed patients. This ultimately expands the consumer base of the market. Moreover, the ability of these diagnostic technologies to deliver accurate results and tailored treatment suggestions reduces misdiagnosis and improves patient outcomes, enabling greater cash inflow in this sector. Evidencing the same, in 2024, an NLM study revealed that circulating tumor DNA (ctDNA) has the potential to deliver up to a 100% uveal melanoma (UM) detectability rate as a novel biomarker, in the presence of adequate assessment tools and methods.

- Increasing activities in research and development: The growing awareness about the importance of continuous R&D is attracting more public and private allocations for innovation in the market. This is encouraging both academic and biopharma pioneers to engage in rigorous research and exploration projects that help the sector expand its existing pipeline with new diagnostic and treatment options. Such activity can be exemplified by the launch of the Eye Cancer Artificial Intelligence Digital Bioresource (EYE-CAN-AID) initiative in March 2025. This cohort to improve early detection of rare eye cancers was empowered by the state-of-the-art, high-resolution digital pathology slide scanner, VENTANA DP 600, from Roche.

- Emergence of minimally invasive treatments: As patients and clinicians increasingly prefer therapies that preserve vision and reduce complications, the approach of minimally invasive treatment is gaining traction in the market. Currently, various clinical studies prove the enhanced efficacy of continuously evolving minimally invasive therapies. For instance, a 2023 NLM study unveiled that transarterial chemoembolization with drug-eluting beads (DEB-TACE) delivers greater objective response and disease control compared to the conventional TACE therapy, accounting for 52% and 63%, respectively. Moreover, such promising outcomes are creating new opportunities for this sector.

Historic Demographic Trends in the Uveal Melanoma Market Across Various Regions

Incidence Rates of UM Across Different Regions

|

Region/Country |

Incidence Rate (per million) |

Time Period |

|

U.S. |

5.2 |

1973-2013 |

|

Canada |

5.09 |

2011-2017 |

|

Republic of Korea |

0.42 |

1999-2011 |

|

New Zealand |

5.56 |

2000-2020 |

|

Australia |

7.6 |

1982-2014 |

|

Europe (Overall) |

3.1-5.8 |

1995-2002 |

|

Sweden |

5.6 |

1960-2009 |

|

Germany |

6.41 |

2009-2015 |

|

Poland |

6.67 |

2010-2017 |

|

UK |

10 |

1999-2010 |

Ongoing Clinical Trials Expanding the Territory of the Uveal Melanoma Market

Immunotherapy and T-cell Therapy Treatments for Metastatic UM under Trial (2025)

|

Treatment |

Phase |

Status/Notes |

|

Pembrolizumab (anti-PD-1) + Entinostat (HDAC inhibitor) |

II |

Completed; Benefits only a subset of patients |

|

Immunoembolization + Ipilimumab (anti-CTLA-4) + nivolumab (anti-PD-1) |

II |

Completed; Stable disease only (57%) |

|

Nivolumab (anti-PD1) Plus Relatlimab (anti-LAG-3) |

II |

Active, not recruiting; Objective response rate (ORR 7.7%) |

|

Sitravatinib (mTKI) and Tislelizumab (anti-PD-1) |

II |

Active, not recruiting |

|

Stereotactic Body Radiotherapy + Nivolumab (anti-PD1) + Relatlimab (anti-LAG-3) |

II |

Active, not recruiting |

|

Lenvatinib (mTKI) + Pembrolizumab (anti-PD1) |

II |

Active, not recruiting |

|

PHP + Ipilimumab (anti-CTLA-4) and Nivolumab (anti-PD-1) |

III |

Recruiting |

|

Cemiplimab (anti-PD1) + Ziv-Aflibercept (anti-VEGF) |

II |

Recruiting |

|

RP2 (oncolytic immunotherapy) + Nivolumab (anti-PD-1) |

II |

Recruiting |

|

Olaparib + Pembrolizumab (anti-PD-1) |

II |

Recruiting |

|

Tumour Infiltrating Lymphocytes |

II |

Recruiting |

|

Adjuvant Therapeutic: Tebentafusp (IMCgp100) |

III |

Recruiting |

Source: NLM

Challenges

- Economic limitations for patients and producers: Having a restrictive patient pool, the manufacturers in the market often hesitate to engage in full-fledged R&D cohorts and commercialization due to the uncertainty in return on investment (ROI). This ultimately shrinks the availability of advanced treatment and diagnostic solutions in this sector. Besides, the premium-pricing of products mostly fails to meet the cost-effectiveness threshold of insurance policies, impacting both the adoption rates and the margin of profitability.

- Diagnostic and infrastructural barriers: Many novel therapies available in the market, for both surgical and minimally invasive therapies, require specific and standardized diagnostic and procedural accommodations. However, the infrastructural limitations in budget-constrained healthcare settings, particularly in underserved regions, hinder the process of identifying eligible patients. This also puts an additional burden of investing in companion diagnostic development and deployment on manufacturers, who are willing to expand their business at a global scale.

Uveal Melanoma Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 1.9 billion |

|

Forecast Year Market Size (2035) |

USD 3 billion |

|

Regional Scope |

|

Uveal Melanoma Market Segmentation:

Treatment Segment Analysis

The immunotherapy/targeted therapy sub-segment is predicted to capture the highest share of 45.4% in the market over the assessed timeline. The dominance is primarily fueled by the unmatched efficacy and premium pricing of novel biologic drugs, contributing to greater revenue generation in this sector. Besides, a majority of healthcare authorities worldwide prioritize the therapeutic administration targeting genetic mutations of afflicted cells to avoid destruction of healthy tissues, which makes these therapies a less harsh and safer alternative option to surgeries and radiotherapies. Testifying to this trend, at the 2025 American Society of Clinical Oncology (ASCO) Annual Meeting, the team of oncology professionals showcased tolerability and potential clinical benefit from the first-in-human trial on DYP688 as a UM treatment.

Type Segment Analysis

Melanoma of the choroid is estimated to dominate the market till the end of 2035, with an 85.3% share. Being the most vascular layer of the uvea, this part of the eye is highly susceptible to malignant transformation, making it the most common site for tumor development. Evidencing this predominant occurrence, the 2025 NLM study unveiled that 90% of UM cases worldwide develop in the choroid. This is drawing and concentrating the focus of research institutions, public authorities, and biopharma leaders toward this category. Currently, advanced imaging technologies, such as OCT and fundus autofluorescence, are frequently utilized for early detection, while treatments including plaque brachytherapy, proton beam therapy, and enucleation are often tailored to this subtype.

End user Segment Analysis

Hospitals are poised to represent themselves as the leading end-user in the market, while accounting for a 55.7% share. This is majorly attributable to their access to advanced diagnostic equipment, specialized ophthalmologists, and comprehensive treatment facilities that are essential for managing complex ocular cancers. Thus, these service providers are typically recognized as the primary point of care for patients undergoing surgical procedures, radiation therapy, and systemic treatments. On the other hand, a notable proportion of hospitals accommodate research premises and government subsidies, which enable a boost in participation for clinical trials and the adoption of cutting-edge therapies.

Our in-depth analysis of the uveal melanoma market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Treatment |

|

|

Diagnosis |

|

|

Disease Stage |

|

|

End user |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Uveal Melanoma Market - Regional Analysis

North America Market Insights

North America is anticipated to hold the largest revenue share of 48.3% in the global uveal melanoma market during the analyzed tenure. This leadership is augmented by ongoing development and commercialization of premium-priced novel therapeutics, which is further complemented by a well-established advanced healthcare infrastructure. The presence of favorable regulatory and reimbursement frameworks also supports wide adoption in this sector. Testifying to such a lucrative environment, in October 2023, iOnctura attained FDA clearance for IND application of its first-in-class allosteric modulator of PI3Kδ, roginolisib, for solid and hematologic malignancies, including UM.

The U.S. augments the market with regional leadership, which is accomplished through relatively higher UM incidence rates compared to neighboring countries and strong healthcare infrastructure. The country remarkably pledges to its wide network of advanced diagnostic facilities, enabling seamless availability of specialized ocular oncology centers. Besides, the presence of globally renowned research institutions that are focused on developing innovative treatments is also deepening the penetration of innovation trends in this landscape. On the other hand, increasing awareness among healthcare professionals and patients facilitates early detection and improved management of uveal melanoma.

Canada also plays an important role in the consistent growth of the North America market. The country’s significance in this sector is primarily characterized by moderate incidence rates and a well-established healthcare system. Besides, proactive government initiatives to enhance patient access to specialized eye care centers and spread awareness about rare ocular cancers collectively contribute to the substantial expansion of this sector in Canada. Exemplifying such an influx of capital in this category, in March 2023, the government of Canada allocated up to $1.5 billion over three years to help increase access to, and affordability of, promising and effective drugs for rare diseases. Besides, in the same year, the funding for vision research in the country reached $26.2 million, drawing a 23% increase from 2019.

APAC Market Insights

Asia Pacific is predicted to emerge as the fastest-growing region in the global market by the end of 2035. The improving healthcare infrastructure, rising rare disease awareness, and increasing adoption of advanced diagnostic and treatment technologies are collectively propelling the pace of progress in this landscape. Despite having a lower incidence rate than in Western regions, the ongoing investments in ophthalmic oncology and improving access to specialized care are amplifying the sector’s expansion in APAC. Countries, including China, Japan, and South Korea, are currently engaged in extensive research activities and clinical trial participation, which contribute to the widespread availability of novel therapies in this sector.

China is establishing itself as a key landscape for the Asia Pacific market, which is primarily pledged to its large and diverse population. Besides, continuous centralization of the healthcare system and advances in diagnostic technology are leading to an increased volume of intervention. The country is also witnessing a growing focus on oncology research, which can be exemplified by the FDA approval for the new Aptamer Drug Conjugate (ApDC) developed by a team of researchers at the Hangzhou Institute of Medicine (HIM) under the Chinese Academy of Sciences in December 2024.

South Korea is playing an increasingly important role as a supplier of biologics in the Asia Pacific market. Despite the low UM incidence rate, the nation benefits from a highly advanced healthcare system with widespread access to cutting-edge diagnostic technologies and specialized ophthalmic care. The country’s strong emphasis on medical research and API manufacturing is cumulatively fostering notable development and adoption in this category. Moreover, the growing awareness among healthcare providers and patients is also enhancing early detection rates in this sector.

Europe Market Insights

Europe is poised to maintain consistency in revenue generation in the global uveal melanoma market between 2026 and 2035, while acquiring the second-largest shareholder’s position. Being the most prevalent region of UM in the world, the landscape is growing steadily with a sustainable consumer base. Nations such as the United Kingdom, Germany, Sweden, and Poland report some of the highest incidence rates globally, which captures the surge in this category within Europe. The region also benefits from a strong clinical research ecosystem, government support for rare disease management, and widespread access to specialized ocular oncology centers.

The UK is a key contributor to the Europe uveal melanoma market, backed by a relatively higher incidence of eye cancer, which is expected to increase by 50% between the timeline between 2023-2025 and 2038-2040. Such an expanding demography is further complemented by the nationwide deployment of advanced diagnostic facilities and specialized ocular oncology centers. Furthermore, the country’s strong clinical research environment supports the continuous development in this sector. This can be evidenced by the discovery of novel targets, CDS1 and CDS2, that contain remarkable therapeutic value for metastatic eye melanoma. This was achieved by the team of researchers at the Sanger Institute in July 2025.

Germany holds a strong position in the Europe uveal melanoma market, with an extensive network of specialized eye cancer centers and cutting-edge diagnostic facilities. The country is also home to several MedTech and biopharma pioneers, who attract greater cash inflow in this landscape through their exceptional work in clinical research and innovation. Particularly, the ongoing development of targeted therapies and personalized treatment approaches is creating a progressive atmosphere for this sector. Moreover, government support for rare diseases and strong collaboration between academic institutions and pharmaceutical companies solidify a secure position for Germany.

Key Uveal Melanoma Market Players:

- Immunocore

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bristol Myers Squibb

- Novartis AG

- Pfizer Inc.

- Merck & Co., Inc.

- Aura Biosciences

- IDEAYA Biosciences

- Moderna, Inc.

- Iovance Biotherapeutics

- F. Hoffmann-La Roche Ltd.

- Sanofi

- CSL Limited

- Samsung Biologics

- Celltrion Inc.

- Sun Pharmaceutical

- Biocon Limited

- Hovid Berhad

The commercial dynamics of the uveal melanoma market are controlled by a consortium of established pharma companies and emerging biotech firms. These pioneers are increasingly investing in extensive R&D to expand their pipeline and commercial operations toward precision ophthalmic oncology. As evidence, in December 2024, iOnctura achieved a new clinical milestone in establishing roginolisib as a first-line asset for treating uveal melanoma. The phase I DIONE-01 study showcased a 2x rise in overall survival among patients.

Such key players are:

Recent Developments

- In March 2025, IDEAYA attained FDA approval for Breakthrough Therapy designation (BTD) for the use of darovasertib monotherapy in treating neoadjuvant uveal melanoma (UM). The potential first-in-class protein kinase C (PKC) inhibitor is suitable for adult patients with primary UM for whom enucleation has been recommended.

- In December 2024, Immunocore, in collaboration with EORTC, announced the enrolment of the first patient onto the only active Phase 3 adjuvant trial in uveal melanoma. This commencement aimed to investigate the safety and efficacy of tebentafusp as an adjuvant treatment for UM.

- Report ID: 8032

- Published Date: Aug 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Uveal Melanoma Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.