Ureteral Stents Market Outlook:

Ureteral Stents Market size was valued at USD 528.8 million in 2025 and is projected to reach USD 924.5 million by the end of 2035, rising at a CAGR of 6.5% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of the ureteral stents is estimated at USD 561.5 million.

There is an immense exposure for the worldwide ureteral stents market, which is fueled by the advancements in medical technology, the rising prevalence of urological disorders, and the increasing demand for minimally invasive procedures. In this regard, as of May 2024 NIH article there were an estimated 3.3 million women and 1.6 million men who experience chronic prostatitis or chronic pelvic pain syndrome. Meanwhile, the national public health surveys revealed that about 54% of women aged 20 and older report urinary incontinence, reflecting the presence of a reliable consumer base in this field.

Furthermore, with increasing adoption across hospitals and clinics worldwide, the market is expected to witness continuous evolution and growth. An article published by NIH in August 2023 evaluated the feasibility, safety, and cost-effectiveness of ureteral stent placement performed in an outpatient clinic setting and the traditional operating room approach. Analyzing 279 stent insertion encounters across 240 patients, the research demonstrated that clinic-based stenting is safe, with no increase in complications and pain when compared to the OR, hence making it suitable for standard market growth.

Key Ureteral Stents Market Insights Summary:

Regional Insights:

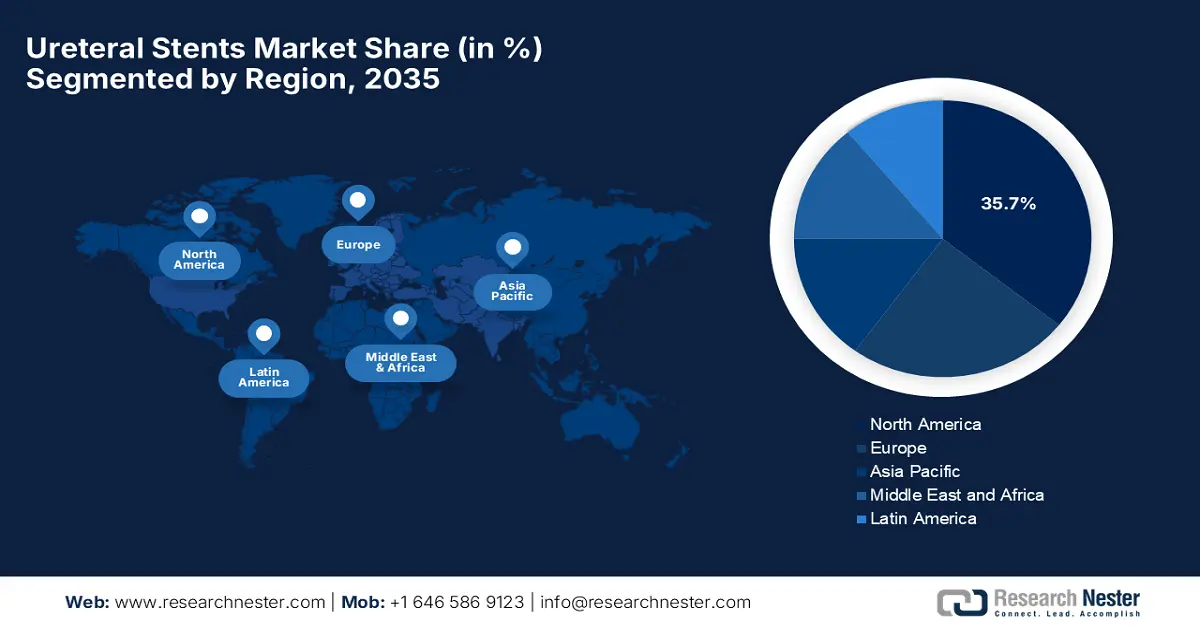

- North America is expected to command a 35.7% share of the ureteral stents market by 2035, supported by escalating medical technology advancements and rising healthcare expenditure owing to advancements in medical technology and rising healthcare investments.

- Asia Pacific is set to emerge as the fastest-growing region from 2026–2035, strengthening its position through surging urological procedure volumes and expanded healthcare access as a result of increasing

Segment Insights:

- The double pigtail stents segment is projected to secure a 58.8% share by 2035 in the ureteral stents market, anchored by its widespread procedural use and high efficiency in preventing stent migration impelled by its universal adoption and clinical effectiveness.

- The urolithiasis segment is forecast to account for a 52.6% share by 2035, maintaining its dominance in the field propelled by the rising global incidence of kidney stones.

Key Growth Trends:

- Escalating volumes of urological & related procedures

- Continued technical discoveries

Major Challenges:

- Stent-related complications

- Inadequate reimbursement

Key Players: BD (Becton, Dickinson and Company) (U.S.), Teleflex Incorporated (U.S.), Cook Medical (U.S.), Stryker Corporation (U.S.), Medtronic plc (Ireland), Karl Storz SE & Co. KG (Germany), Richard Wolf GmbH (Germany), Siemens Healthineers AG (Germany), Rocamed (Monaco), PnnMedical A/S (Denmark), Allium Medical (Israel), Taewoong Medical Co., Ltd. (South Korea), Cardinal Health (U.S.), B. Braun Melsungen AG (Germany), POLYMED Medical Devices (India).

Global Ureteral Stents Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 528.8 million

- 2026 Market Size: USD 561.5 million

- Projected Market Size: USD 924.5 million by 2035

- Growth Forecasts: 6.6%

Key Regional Dynamics:

- Largest Region: North America (35.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Australia, Brazil, United Arab Emirates, United Kingdom

Last updated on : 29 August, 2025

Ureteral Stents Market - Growth Drivers and Challenges

Growth Drivers

-

Escalating volumes of urological & related procedures: This is the direct driver for the ureteral stents market that includes procedures such as ureteroscopy, lithotripsy, and a growing volume of gynecological and colorectal surgeries. Testifying to this, the study by IKDRC revealed that from 2022 to 2024, Major Urology procedures showcased remarkable growth, with 242 cases in 2022, increasing to 376 in 2023. Likewise, minor urology had a steady rise from 2890 cases in 2022 to 3354 in 2023, which reflects variable procedure volumes across different urology specialties in a span of three years, hence denoting a positive market outlook.

Urological Surgeries at IKDRC-ITS (2022-2024)

|

Surgical Category |

2022 |

2023 |

2024 |

|

Major Urology |

242 |

376 |

339 |

|

Minor Urology |

2,890 |

3,354 |

2,955 |

|

Endo-Urology |

2,126 |

2,388 |

1,939 |

|

Laparoscopic Urology |

662 |

760 |

769 |

|

Pediatric Urology |

399 |

553 |

532 |

|

Kidney Transplant |

388 |

354 |

443 |

Source: IKDRC

-

Continued technical discoveries: The global pioneers involved in the market are readily making investments in R&D to address the notable drawbacks in traditional stents. In April 2024, the government of India declared that IIT Roorkee has partnered with UnivLabs Technologies Pvt. Ltd. to commercialize a new biodegradable ureteral stent technology. Developed by researchers from IIT Roorkee and UnivLabs, the stent is designed to degrade enzymatically, reducing biofilm formation and encrustation, thus suitable for market upliftment.

-

Rising aging demographics: Since the global population is rapidly aging, this is leading to a higher susceptibility to conditions such as urological cancers, benign prostatic hyperplasia (BPH), and related conditions that necessitate stenting. As per the October 2024 WHO article, 1 out of 6 people will be aged over 60 by the end of 2030, whereas by 2050, the aging demographics will surpass 2.1 billion. Therefore, this demographic trend is predicted to improve the volume of stent placements across different nations.

Kidney Stone Statistics and Recurrence Rates as of July 2025

|

Statistic |

Value |

|

Annual ER visits due to kidney stones |

Over 500,000 |

|

Lifetime risk of developing kidney stones |

1 in 10 people |

|

Prevalence in men |

11 in 100 men |

|

Prevalence in women |

9 in 100 women |

|

Chance of recurrence after the first stone |

About 1 in 2 (50% or more) |

Source: National Kidney Foundation

Comparison of Procedural Costs for Ureteral Stent Placement in Operating Room vs. Clinic (USD) 2023

|

Cost Category |

Operating Room |

Clinic |

|

Medical Supplies |

11,513.85 |

5,885.45 |

|

Rooming |

3,326.00 |

0 |

|

Anesthesia |

479.00 |

0 |

|

Pharmacy |

703.26 |

1,477.67 |

|

Laboratory |

58.30 |

72.60 |

|

Radiology |

269.50 |

429.97 |

|

Total Cost (Insertion) |

16,349.91 |

7,865.69 |

Source: NIH

Challenges

-

Stent-related complications: Despite the heightened demand, the ureteral stents market still faces risks in terms of complications such as encrustation, infection, migration, and patient discomfort. These complications can, in turn, create hesitation among consumers since they can cause additional medical interventions, including stent replacement or removal, which increases healthcare costs. Furthermore, the complicated nature of these stents is limiting wider adoption and patient compliance, hindering market expansion.

-

Inadequate reimbursement: The presence of inadequate reimbursements in the market causes a major challenge to capture the desired consumer base. Most of the healthcare systems and insurance providers have limited the reimbursements, which can make these advanced stents less accessible, particularly in emerging economies. Therefore, the existence of this financial barrier restricts market growth and limits the availability of stent technologies to a broader patient population.

Ureteral Stents Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 528.8 million |

|

Forecast Year Market Size (2035) |

USD 924.5 million |

|

Regional Scope |

|

Ureteral Stents Market Segmentation:

Product Type Segment Analysis

Double pigtail stents segment is projected to gain the largest revenue share of 58.8% in the market during the discussed time frame. Its universal adoption in procedures like ureteroscopy and its effectiveness in preventing migration positions this subtype at the forefront to generate revenue in this field. The study by GIE in June 2023 revealed that the use of double-pigtail plastic stents placed through lumen-apposing metal stents for draining walled-off necrosis reduces adverse events such as stent occlusion, hence a wider segment scope.

Application Segment Analysis

Urolithiasis segment is predicted to garner the largest revenue share of 52.6% in the market during the forecast period. The subtype’s dominance in this field is effectively propelled by the increasing burden of kidney stones among the worldwide population. As per an NIH article published in June 2023, this condition, called urolithiasis, creates a total USD 5 billion healthcare expenditure in the U.S. and is responsible for nearly 1 million emergency department visits on a yearly basis.

End-user Segment Analysis

Hospitals segment is expected to grow at a considerable rate with a share of 48.5% in the ureteral stents market during the discussed time frame. The capability of these healthcare settings to perform complex urological surgeries, emergency interventions for renal colic, and manage post-operative care positions it at the forefront of expansion in this field. Also, hospitals remain the central hub to perform both acute and chronic urological interventions, hence denoting a wider market scope.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Application |

|

|

End user |

|

|

Material |

|

|

Coating |

|

|

Length |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ureteral Stents Market - Regional Analysis

North America Market Insights

North America is expected to dominate the worldwide ureteral stents market, capturing the largest share of 35.7% by the end of 2035. The region's dominance in this field is attributed to the advancements in medical technology and rising healthcare investments. As evidence, the 2024 UDA report revealed that the Medicare FFS expenditures for key urologic conditions in patients aged above 65 totaled USD 2.8 billion in 2021. Besides, the urinary stone disease resulted in $1.1 billion, and benign prostatic hyperplasia $1.3 billion, hence further boosting the adoption of ureteral stents across the region.

The U.S. is reinforcing its leadership in the regional market owing to the increasing patient awareness and enhanced access to advanced healthcare facilities. In this regard Journal of Comparative Effectiveness Research in October 2022 analyzed the data from over 16,000 patients in the country, which found that encrusted stents, delayed removal, and certain demographic factors contributed to procedural complexity and cost escalation. Therefore, the study underscores the need for innovations like anti-encrustation stents or biodegradable stents, thereby encouraging more players to establish their footprint in this field.

There is a huge opportunity for the ureteral stents market in Canada since there is a constant rise in the cases of urinary tract disorders, increasing awareness of minimally invasive processes, and supportive regulatory frameworks. In February 2024, Health Canada reported that it had approved an amendment to the Class III medical device license for the Urosoft Ureteral Stent Set manufactured by Angiomed GmbH & Co. Besides, the stent is designed for the treatment of ureteral obstructions or strictures and for postoperative drainage, hence denoting a positive market outlook.

Medicare Reimbursement for Ureteral Stent Procedures 2021 (USD)

|

Procedure |

Reimbursement |

|

Stent Insertion |

2,807.32 |

|

Stent Removal |

1,634.89 |

Source: NIH

APAC Market Insights

Asia Pacific is considered to be the fastest-growing region in the market from 2026 to 2035. The region’s upliftment in this field is effectively catered to the increasing urological procedure volumes, expanding healthcare infrastructure, and greater awareness around kidney stone disease and ureteral obstructions. Besides, there has been a strong penetration of health insurance and government support for minimally invasive procedures, due to which countries across the region are increasingly adopting advanced stenting technologies.

China is also continuously growing in the Asia Pacific’s ureteral stents market, facilitated by its large population base and the government’s investment in expanding tertiary care hospitals. The study by NIH in December 2023 observed that over the last decade, private hospitals increased by 193.4% in the country, which is reshaping access to urological care. Besides, the increase in outpatient visits and surgical procedures has boosted demand for devices like ureteral stents, further boosting device adoption across the private healthcare landscape.

India is demonstrating notable growth in the ureteral stents market, supported by the improvements in public and private healthcare infrastructure, as well as the growing availability of urological specialists. In April 2025, the country’s Health Minister, Shri Jagat Prakash Nadda, inaugurated the new Centre for Nephrology and Urology at Symbiosis University Hospital & Research Centre in Pune, which is equipped with state-of-the-art dialysis, transplantation, and kidney stone management services, thereby providing opportunities for device suppliers to meet evolving clinical needs.

Europe Market Insights

Europe is gaining traction in the market, effectively driven by the implementation of mutually beneficial collaborations, technological advancements, and strong healthcare infrastructure. In February 2025, Micro-Tech finalized the acquisition of a 51% stake in Creo Medical S.L.U. (CME), which is a key European distributor specializing in urology, gastroenterology, and single-use endoscopic devices. This move enhances Micro-Tech’s access to nearly 5,000 healthcare institutions across Western Europe and is expected to support wider distribution of its endoscopic and urological products, including ureteral stents, hence an optimistic market opportunity.

Germany is the key player in Europe’s ureteral stents market, which is extensively supported by the strong healthcare infrastructure and a high volume of urological procedures. The country is also home to key industry players, wherein the pioneer Medi-Globe Group in April 2022 reported that its flagship product, called Magnetic Black-Star, has been proven superior to conventional stents in a systematic review of worldwide studies. The review, published in the Irish Journal of Medical Science, concluded that the Magnetic Black-Star results in less pain during stent removal and leads to cost savings compared to traditional ureteral stents.

U.K. market is poised for exceptional growth, which is characterized by high adoption rates of advanced medical technologies and stringent regulatory standards guided by the National Institute for Health and Care Excellence (NICE). In July 2022, the University of Southampton, with a key emphasis on improving care for patients with urinary stents, launched a £1.3 million clinical trial funded by the National Institute for Health and Care Research (NIHR). Besides, the project aims to test a newly designed ureteral stent that could significantly reduce the common issues of stent failure and discomfort experienced by patients.

Historic Urology Health Statistics in the UK (2017-2019)

|

Category |

Statistic |

|

General Urology |

1 in 2 people will be diagnosed with a urology condition in their lifetime |

|

Urology Cancers (UK) |

Over 78,000 new cases are diagnosed annually |

|

Prostate Cancer |

- 27% of all new cancers in UK males |

|

- 1 in 8 males are diagnosed in their lifetime |

|

|

- 1 in 4 Black males are diagnosed in their lifetime |

|

|

- Over 12,000 deaths annually (2017-2019) |

|

|

Prostate Conditions |

40% of men over 60 have lower urinary tract symptoms |

|

Acute prostatitis affects 1 in 10,000 UK men |

|

|

Bladder Cancer |

Over 10,000 new cases annually |

|

1 in 130 females are diagnosed in their lifetime |

|

|

1 in 55 males are diagnosed in their lifetime |

|

|

49% of bladder cancer cases are preventable |

|

|

Urinary Incontinence |

13% of women and 5% of men will experience it |

|

Urinary Tract Infections (UTIs) |

50-60% of UK women will experience at least 1 UTI |

|

20% of women experience recurrent UTIs |

|

|

UTIs in men are often linked to urinary obstruction |

|

|

Kidney Disease & Stones |

Kidney stones affect 3 in 20 males and 2 in 20 females |

|

1 in 8 people has chronic kidney disease |

|

|

4,709 people die of kidney cancer annually |

Source: Urology Foundation

Key Ureteral Stents Market Players:

- Boston Scientific Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BD (Becton, Dickinson and Company) (U.S.)

- Teleflex Incorporated (U.S.)

- Cook Medical (U.S.)

- Stryker Corporation (U.S.)

- Medtronic plc (Ireland)

- Karl Storz SE & Co. KG (Germany)

- Richard Wolf GmbH (Germany)

- Siemens Healthineers AG (Germany)

- Rocamed (Monaco)

- PnnMedical A/S (Denmark)

- Allium Medical (Israel)

- Taewoong Medical Co., Ltd. (South Korea)

- Cardinal Health (U.S.)

- B. Braun Melsungen AG (Germany)

- POLYMED Medical Devices (India)

The global ureteral stents market is extremely consolidated, wherein the top five players captured the majority revenue share. Research & development into advanced materials such as biodegradable polymers, hydrogel coatings, and metal alloys is one of the primary strategies implemented by pioneers to enhance market development. Besides, the firms are also focusing on portfolio diversification, thereby offering stents for oncology, pediatrics, along with devices such as stent placement systems and extraction tools to create procedural solutions, hence indicating a positive market outlook.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In January 2025, JiffyStent reported that it has rebranded as Akeeko Medical, which aligns with the upcoming launch of its Akeeko Stent Inserter, especially designed to enable ureteric stent placement in emergency departments or clinics using only local anesthesia.

- In December 2024, University Hospitals announced that its RELIEF ureteral stent is accepted by the U.S. FDA as the first and only stent designed to prevent vesicoureteral reflux. And comes in a unique suture-based design.

- Report ID: 8031

- Published Date: Aug 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ureteral Stents Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.