Turner Syndrome Drug Market Outlook:

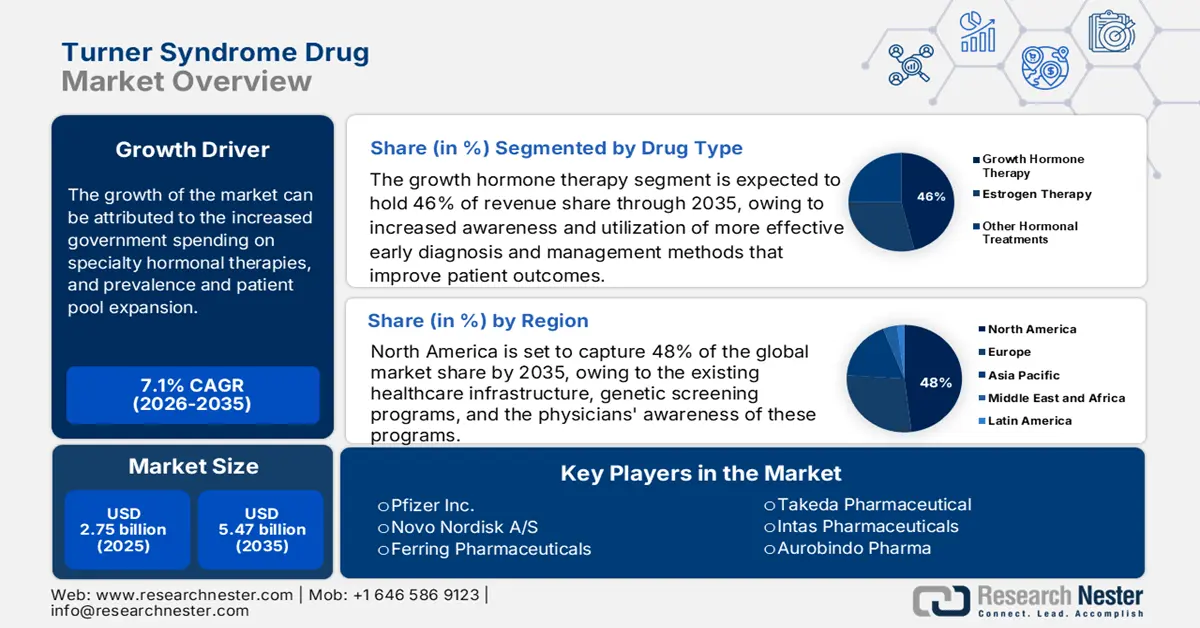

Turner Syndrome Drug Market size was valued at USD 2.75 billion in 2025 and is projected to reach USD 5.47 billion by the end of 2035, rising at a CAGR of 7.1% during the forecast period 2026-2035. In 2026, the industry size of turner syndrome drug is estimated at USD 2.95 billion.

Turner syndrome (TS) occurs at an incidence of about 1 of every 2,000 - 4,000 female live births worldwide, based on the NIH report in March 2025. These rising cases create a consistent demand for active pharmaceutical ingredients (APIs) and finished dosage forms of products for this patient population. The supply chain for these treatments is complex. Further, distribution of these products mainly depends on cold-chain logistics to maintain stability of the product from manufacturing sites to hospitals and other settings.

Resources with investment in research and development are funneled through registries, foundations, and federal agencies. The Turner Syndrome Society (TSSUS), working with UTHealth Houston, has implemented the Turner Syndrome Research Registry. This registry will enhance interventional and observational studies on individuals affected by this condition. Federal financial support is quite limited. There are currently no NIH extramural awards based solely in TS. From a trade perspective, the global movement of raw materials concentrates on recombinant DNA production inputs and hormonal synthesis intermediaries. The pharmaceutical export in the U.S. exceeded USD 100 billion, and the import reached USD 170 billion in 2023, as per the OEC data. Active Pharmaceutical Ingredients (APIs) are typically imported to supply the formulation plants. The finished hormonal drugs are then exported to Europe, the Americas, and parts of Asia.

Key Turner Syndrome Drug Market Insights Summary:

Regional Highlights:

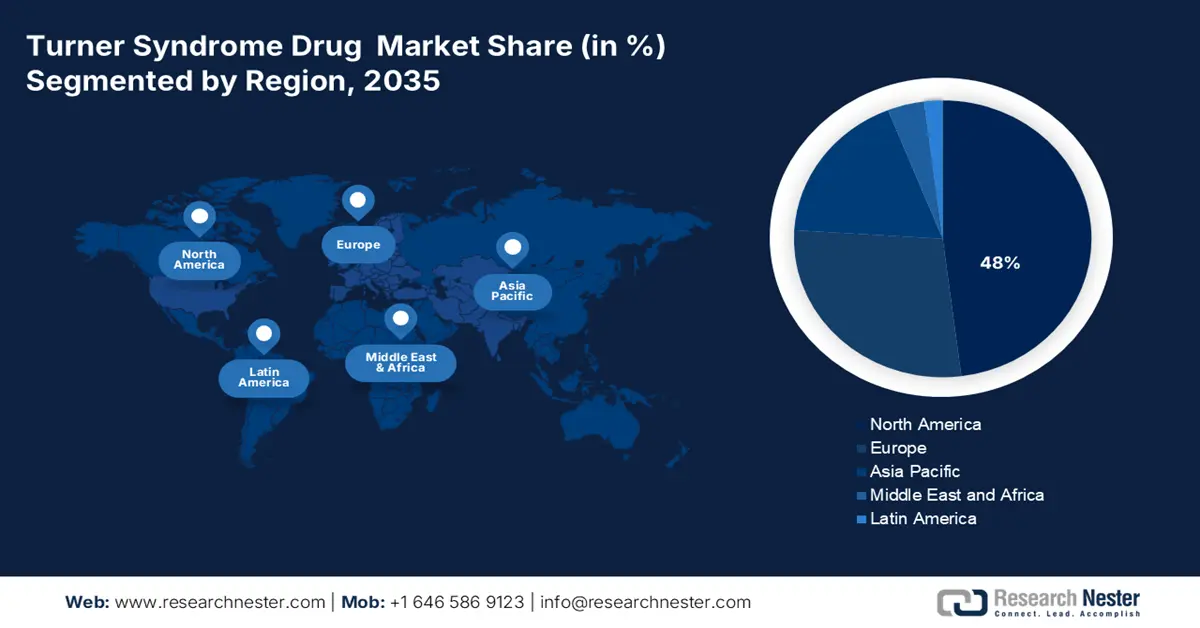

- The North America turner syndrome drug market is projected to dominate with a 48% share by 2035, supported by robust healthcare infrastructure, genetic screening programs, and heightened physician awareness promoting early diagnosis and treatment adherence.

- The Asia Pacific market is expected to register the fastest growth by 2035, driven by expanding healthcare infrastructure, increased disease awareness, government initiatives, and localized biosimilar growth hormone production.

Segment Insights:

- The growth hormone therapy segment in the turner syndrome drug market is projected to capture the largest share of 46% by 2035, driven by its proven effectiveness in promoting height and overall growth in individuals with Turner Syndrome.

- The injectable formulation subsegment is expected to hold the highest revenue share by 2035, fueled by its precision in dosing and higher absorption compared to oral or transdermal routes, making it the preferred delivery method for hormone therapies.

Key Growth Trends:

- Increased government spending on specialty hormonal therapies

- Government and payer assistance for orphan drugs

Major Challenges:

- Pricing Restraints and Government Price Caps

- Supply chain vulnerabilities and API sourcing risks

Key Players: Pfizer Inc., Novo Nordisk A/S, Eli Lilly and Company, Novartis AG, Merck KGaA, Sanofi S.A., Roche Holding AG, Teva Pharmaceutical Industries, Ferring Pharmaceuticals, Ipsen S.A., LG Chem Ltd., Dong-A ST (Part of Dong-A Socio Group), Sun Pharmaceutical Industries Ltd., Biocon Ltd., Takeda Pharmaceutical Company, Daiichi Sankyo Company, Ltd., JCR Pharmaceuticals Co., Ltd., CSL Limited, Aspen Pharmacare Holdings Ltd., Hovid Berhad

Global Turner Syndrome Drug Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.75 billion

- 2026 Market Size: USD 2.95 billion

- Projected Market Size: USD 5.47 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: nited States, Germany, Japan, Canada, United Kingdom

- Emerging Countries: India, South Korea, China, Australia, France

Last updated on : 6 October, 2025

Turner Syndrome Drug Market - Growth Drivers and Challenges

Growth Drivers

- Increased government spending on specialty hormonal therapies: Medicare's Part B and D spending continues to expand. The expansion is driven by coverage of biologics and hormone therapy. Drugs for Turner Syndrome are not specifically referenced within such coverage. Active pharmaceutical ingredients (APIs), developed principally via recombinant human growth hormone, are produced mainly in India or China and then formulated regionally. Supply disruptions have already limited hormone therapy access in Europe.

- Prevalence and patient pool expansion: According to the Birth Defect Research for Children in 2025, the U.S, approximately 60,000 women have Turner Syndrome. As a result, there is a growing awareness of Turner Syndrome and diagnostic screening. AHRQ’s long-standing focus on quality improvement, the national recommendation to provide early-stage hormone therapy for hypogonadal children, will likely lessen downstream costs through improved growth outcomes and lessening hospitalizations. Although there are no Turner Syndrome-specific studies on early intervention. Analogous studies making the case for endocrine early intervention found 18% fewer hospital admissions.

- Government and payer assistance for orphan drugs: Substantial government spending through programs like Medicare and Medicaid is a primary driver. Incentives such as market exclusivity under the FDA's Orphan Drug Act speed up drug development for orphan diseases. For example, Medicare Part B expenditure on all drugs grew at 9.2% annually over the 2008-2021 period, part of which goes towards the specialized biologics such as growth hormones, based on the ASPE report in June 2023. Such financial support lowers developer risk and guarantees patient access. The shift is toward outcomes-based reimbursement schemes, where payers such as the CMS negotiate contracts based on real-world drug effectiveness, guaranteeing sustainable market expansion at a controlled cost.

Prevalence of Turner Syndrome Distribution Across 10-Year Age Groups

|

Age |

Population |

Total Number of cases |

Prevalence per 100000 persons |

Total number of incidence |

Incidence per 100000 persons |

|

0–9 |

2173716 |

257 |

11.82 |

43 |

1.91 |

|

10–19 |

2546817 |

590 |

23.17 |

46 |

1.75 |

|

20–29 |

3293140 |

605 |

18.37 |

15 |

0.46 |

|

30–39 |

3681152 |

386 |

10.49 |

10 |

0.27 |

|

40–49 |

4332041 |

177 |

4.09 |

4 |

0.09 |

|

50– |

10160086 |

39 |

0.38 |

7 |

0.07 |

Source: NLM October 2022

Challenges

- Pricing Restraints and Government Price Caps: The high cost of treatment greatly limits reimbursement and patient access. For instance, European states have national health agencies with strict price caps that limit drug pricing. It is important to note that Medicaid, while it may seem to have expanded access for Turner Syndrome patients under the expansion of Medicare Part D, covers only for eligible patients. Hence, access to the drug is still limited for low-income individuals with Turner Syndrome.

- Supply chain vulnerabilities and API sourcing risks: As per the World Health Organization (WHO), the reliance on imported APIs from India and China applies supply chain constraints that affect drug availability. Moreover, this can cause price instability. Emerging markets such as India and parts of Latin America have barriers to diagnosis and treatment infrastructure. Further, this hampers market access, although their patient prevalence is quite high.

Turner Syndrome Drug Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 2.75 billion |

|

Forecast Year Market Size (2035) |

USD 5.47 billion |

|

Regional Scope |

|

Turner Syndrome Drug Market Segmentation:

Drug Type Segment Analysis

The growth hormone therapy segment is predicted to capture the largest share at 46% in the turner syndrome drug market over the assessed period. Growth Hormone Therapy (GHT) has continually played an important role in the management of individuals with Turner Syndrome due to its effectiveness in both height promotion and overall growth in individuals with Turner Syndrome. The growth hormone accelerates the height of 5–8 cm at a dosage of 42–50 μg/kg/day, which has been approved to treat turner syndrome, as per the frontiers report in January 2023. High adoption rates of GHT can be attributed to the increased awareness and utilization of more effective early diagnosis and management methods that improve patient outcomes. The U.S. National Library of Medicine emphasizes the effectiveness of growth hormone treatment in patients with Turner Syndrome to reduce complications. The treatment's effectiveness in improving quality of life has caused its prevalence in the Turner Syndrome market.

Drug Formulation Segment Analysis

The injectable formulation leading the segment and is poised to hold the highest revenue share in the turner syndrome drug market. As per the NLM study in August 2024, Somatropin is given in injectable form at 45 mcg/kg/day to 50 mcg/kg/day to treat Turner syndrome. Most importantly, injection is the delivery method of choice for hormone therapies important for conditions like GHT and estrogen replacement. Injectables provide the ability to be precise in dosing, as the absorption is much greater when compared to oral or transdermal routes.

End user Segment Analysis

Endocrinology centers are expected to dominate the market among end users by 2035 because of their expert focus on hormonal diseases and long-term patient care. These centers offer comprehensive care, including growth hormone therapy, estrogen replacement, and regular monitoring of metabolic and cardiovascular health. Their multidisciplinary technique ensures the early diagnosis and personalized treatment, which are crucial for the Turner syndrome patients. With growing awareness and referrals, endocrinology clinics are turning into the main centers for therapeutic intervention, fueling demand for sophisticated drug preparations and regular follow-up treatment.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegment |

|

Drug Type |

|

|

Distribution Channel |

|

|

End user |

|

|

Treatment Approach |

|

|

Drug Formulation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Turner Syndrome Drug Market - Regional Analysis

North America Market Insights

North America is expected to dominate the market with a share of 48% by the end of 2035. Strong regional performance in North America is a consequence of existing healthcare infrastructure, genetic screening programs, and the physicians' awareness of these programs. Innovations focused on creating a patient-centered experience are improving adherence rates. The universal health insurance structure, with provincial investment in rare disease therapies, has helped the market remain resilient. Increasing newborn screening and public awareness campaigns have increased the rates of early diagnosis and have positioned the region as a leader in the growth hormone therapy arena.

The turner syndrome drug market in the U.S. has excellent resources available in the federal and state health systems. Robust diagnostic rates and comprehensive insurance coverage mainly drive the market. A primary trend is the shift toward long-acting HGH formulations, which improve patient adherence and quality of life. The NPR data in February 2025 stated that NIH allocated USD 1.5 to medical research, including rare disease research. Growth factors fuelling Turner Syndrome include processes such as the increased rates of birth detection through non-invasive prenatal testing, and to a lesser extent, increased use of rhGH and estrogen replacement therapies.

Canada's turner syndrome drug market is driven by the publicly funded, province-led healthcare system, which results in regional variations in treatment access and reimbursement. The Government of Canada report in March 2023 states that an investment of 1.5 billion was allocated over three years to support the National Strategy for Drugs for Rare Diseases, which includes a Turner syndrome drug. International partners Innovative Medicines Canada and BioteCanada are currently working together to help ensure long-acting growth hormone treatments continue to remain a national healthcare coverage option. Also, notable trends include adoption among pediatric endocrinologists of the recently released after FDA EMA approvals, models for innovations and pilot programs for the entry of biosimilars.

Prevalence of Rare Disease and Turner Syndrome in the U.S. and Canada

|

Country |

Rare Disease |

Turner Syndrome |

|

U.S. |

30 million |

3.2 per 10,000 female live births |

|

Canada |

one in 2,000 people |

1 in 2500 females |

Source: FDA November 2024, Government of Canada January 2023, NLM June 2025, NORD 2025

APAC Market Insights

Asia Pacific is poised to register the highest pace of growth in the turner syndrome drug market by the end of 2035. The expansion is driven by rapid healthcare infrastructure development, increasing disease awareness, and growing government initiatives. A significant trend is the localization of biosimilar growth hormone production, particularly in India and South Korea, which enhances affordability and access. Furthermore, governments are progressively implementing national rare disease policies, as seen with India's National Policy for Rare Diseases, which aims to boost domestic manufacturing and provide financial support. Government spending on OOP and health care access are likely considered crucial in offering patient access to their prescription hormone medications.

Japan's market is characterized by advanced healthcare and strong government support. The Ministry of Health, Labour and Welfare (MHLW) designates treatments for rare diseases like Turner Syndrome for priority review and premium pricing. According to the NLM study in April 2025, nearly 2,589 projects were awarded medical research and development by investing an amount of USD 159.7 billion in 2022, which includes research in turner syndrome. This drives the technology development of energy replacement growth hormones. Japan has a sophisticated healthcare system that facilitates earlier diagnosis and broad access for patients.

China is the largest turner syndrome drug market in APAC due to its population size. The National Medical Products Administration (NMPA) has accelerated the approval process for innovative drugs, including growth hormones. As per the Mednexus report in May 2021, 1 in 2000 female live births have turner syndrome in 2021. The Government had a determined emphasis on rare disease drug approval programs and post-marketing surveillance programs. The urban cities in China have higher rates of diagnosis in females compared to rural counties. Private-public perspective strategies and clinical trials also expand the market potential.

Europe Market Insights

The Europe turner syndrome drug market is estimated to garner a notable industry value from 2026 to 2035. Their public health systems emphasize rare disease treatment. Evidence suggests that increasing patient access to treatments, fast-track approval mechanisms are available for innovative Turner Syndrome treatment pathways under the European Medicines Agency. The patient-centric model of care, telehealth, and home delivery receive on market adherence with the role of the health care provider, and investment into rare disease research has increased through European Union policies.

Germany is also one of Europe's largest turner Syndrome drug markets. The market is driven by its favorable regulatory environment and high treatment adoption rates. The NLM study in June 2025 states that 1 in 2000 to 1 in 2500 live female births have Turner syndrome. The Federal Ministry of Health also supports significant research activity and reimbursement initiatives that facilitate access of recombinant human growth hormones. The German statutory health insurance (GKV) offers substantial coverage for the treatment costs with early diagnosis initiatives. In Germany, the aging population with Turner Syndrome-related complications will continue to fuel increased demand for treatments.

The Turner syndrome drugs market in the UK is guided by the National Institute for Health and Care Excellence (NICE), which has established clear guidelines for growth hormone therapy in Turner Syndrome. According to the Government of the UK data in February 2025, nearly 3.5 million people live with a rare condition, and £14 million is funded by MRC and NIHR for the Rare Disease Research UK platform. The market demand for growth hormone therapies and supportive hormonal treatments is increasing due to expanded newborn screening programmes. In NHS drug therapies for Turner Syndrome, the NHS invests heavily in rare disease management, including Turner Syndrome.

Key Turner Syndrome Drug Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novo Nordisk A/S

- Eli Lilly and Company

- Novartis AG

- Merck KGaA

- Sanofi S.A.

- Roche Holding AG

- Teva Pharmaceutical Industries

- Ferring Pharmaceuticals

- Ipsen S.A.

- LG Chem Ltd.

- Dong-A ST (Part of Dong-A Socio Group)

- Sun Pharmaceutical Industries Ltd.

- Biocon Ltd.

- Takeda Pharmaceutical Company

- Daiichi Sankyo Company, Ltd.

- JCR Pharmaceuticals Co., Ltd.

- CSL Limited

- Aspen Pharmacare Holdings Ltd.

- Hovid Berhad

The turner syndrome drug market is extremely competitive. Pfizer and Novo Nordisk are strong leaders in that segment through their recombinant human growth hormone therapies. A number of companies are expanding biosimilar portfolios as a strategic initiative, which may involve some manner of treatment for Turner syndrome. Education and product innovation/research and development, as either a long-acting formulation or combination product, will be important strategic initiatives in this category. Likewise, when the treatment is affordable, they can improve patient access through programs. All the companies collaborate with other healthcare providers and government bodies to create reimbursement procedures.

Below is the list of some prominent players operating in the market:

Recent Developments

- In July 2025, Ascendis Pharma has plans to initiate a basket trial for ISS, SHOX deficiency, Turner syndrome, and SGA, as well as a combination therapy trial in achondroplasia and hypochondroplasia in Q4 2025.

- In May 2025, BioMarin Pharmaceutical Inc. announced the investigation of VOXZOGO as the potential treatment option for girls with Turner syndrome, with a Phase 2 prospective, single-center, open-label clinical study showing a promising increase in annualized growth velocity (AGV) at 6 months compared to baseline.”

- Report ID: 2640

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Turner Syndrome Drug Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.